Key Takeaways

Imagine a world where anyone with a smartphone and an internet connection can save money, send payments, borrow funds, and invest in opportunities that were once reserved for people with bank accounts. That world is no longer imaginary. It is being built right now through decentralized finance, commonly known as DeFi.

DeFi adoption in emerging markets is rapidly reshaping how billions of people across Africa, Southeast Asia, Latin America, and South Asia interact with money. For decades, millions of individuals in these regions have lived outside the traditional banking system. They had no access to loans, savings accounts, insurance, or affordable remittance services. Today, DeFi is changing that story by offering open, transparent, and permissionless financial tools powered by blockchain technology.

But what exactly does DeFi adoption in emerging markets look like? Why are these regions embracing decentralized finance faster than many developed nations? And what does this mean for startups, businesses, and everyday people trying to participate in the global economy?

This comprehensive guide answers all of those questions and more. Whether you are a beginner trying to understand decentralized finance, a fintech founder exploring new opportunities, or an enterprise looking to expand into high growth regions, this article will give you the clarity and insight you need.

What Is DeFi Adoption in Emerging Markets?

To understand DeFi adoption in emerging markets, let us first break down the two key terms in simple language.

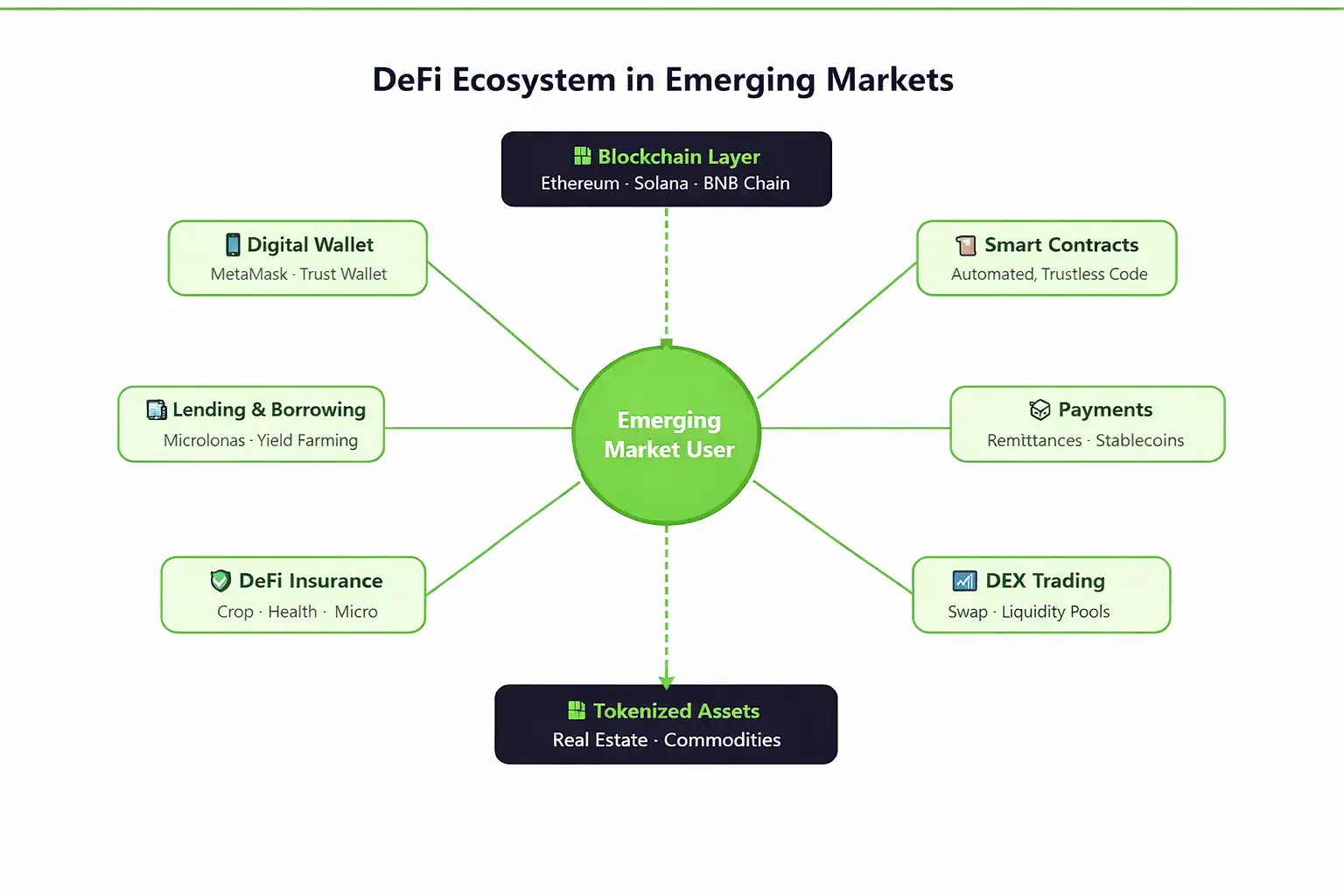

DeFi (Decentralized Finance) refers to a collection of financial services built on blockchain networks that operate without banks, brokers, or any central authority. Think of it like replacing a traditional bank with an open, transparent digital system that anyone can use at any time. These services include lending, borrowing, saving, trading, insurance, and payments, all managed by code called smart contracts rather than human intermediaries.

Emerging markets are countries with developing economies that are growing quickly but still face gaps in infrastructure, financial services, and institutional reach. Examples include nations in Sub Saharan Africa, South and Southeast Asia, Latin America, and parts of the Middle East.

Simple Analogy: Think of traditional banks as closed shops with strict entry rules: you need documents, a minimum balance, and a nearby branch. DeFi is like an open digital marketplace that never closes, has no entry requirements, and is accessible to anyone with an internet connection.

When we talk about DeFi adoption in emerging markets, we are describing how people, businesses, and governments in developing countries are embracing these decentralized financial tools to solve real problems like lack of banking access, expensive remittances, currency devaluation, and limited credit availability.

The DeFi Ecosystem in Emerging Markets: Visual Overview

Why Emerging Markets Are the Ideal Ground for DeFi Growth

One of the most frequently asked questions is: why are emerging markets adopting DeFi faster than wealthy nations? The answer lies in the unique challenges and conditions found in these economies.

Large Unbanked Population

According to the World Bank, over 1.4 billion adults globally have no bank account. DeFi provides an alternative using just a smartphone.

High Mobile Penetration

500M+ mobile connections in Africa alone. DeFi apps run on basic smartphones.

Expensive Remittances

Traditional services charge 6% to 9%. DeFi cuts fees to under 1%.

Unstable Local Currencies

Citizens in Nigeria, Argentina, and Turkey use stablecoins to protect savings from inflation.

Young & Tech Savvy

Youngest populations in the world are natural early adopters of blockchain technology.

Growing Internet Access

Dropping smartphone costs and cheaper data expand the foundation for DeFi platforms.

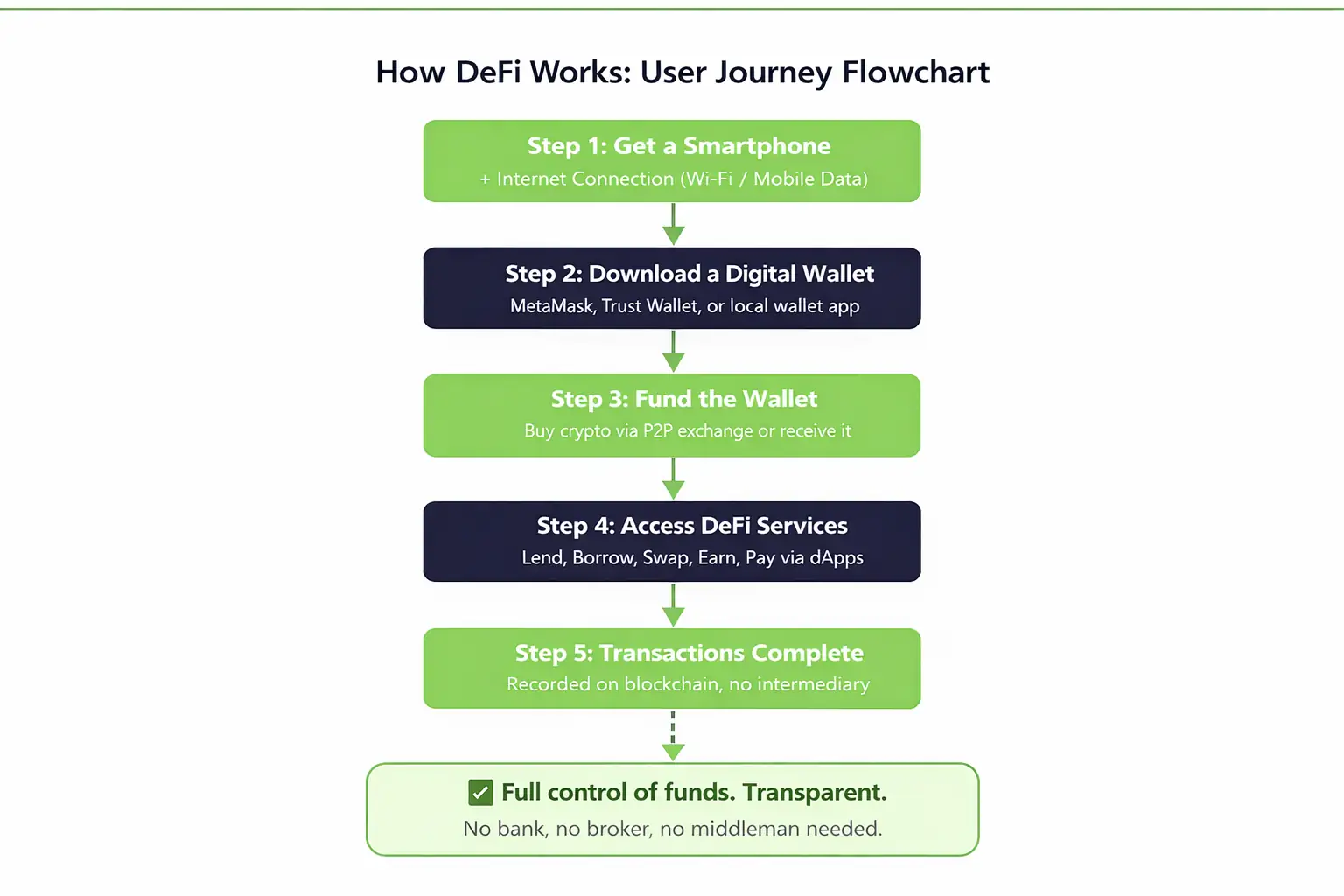

How DeFi Works in Emerging Markets: Step by Step Flowchart

If you are new to the world of decentralized finance, the technology behind it can seem complex. But the actual user experience is becoming increasingly simple. Here is how DeFi typically works for someone in an emerging market.

Real World Example: A farmer in rural Kenya can receive payment from a buyer in Lagos through a stablecoin transfer that settles in under 60 seconds. The farmer then uses the same DeFi platform to earn interest on the received funds. No bank visit, no paperwork, and no high fees.

Key Drivers Accelerating DeFi Adoption in Emerging Markets

Several powerful forces are pushing DeFi adoption forward in developing economies. Understanding these drivers helps explain why this trend is accelerating year after year.

Popular DeFi Use Cases in Emerging Markets

DeFi is not just a theoretical concept. It is already being used in practical, life changing ways across developing countries. Here are the most impactful use cases.

Cross Border Remittances

Migrant workers sending money home represent one of the largest financial flows into emerging economies. DeFi platforms allow these transfers to happen almost instantly, with fees that are a fraction of what traditional services charge. For example, a Filipino worker in Dubai can send stablecoins to family in Manila in minutes, compared to days through a conventional bank.

Savings and Yield Earning

DeFi lending protocols allow users to deposit their crypto assets and earn interest, often at rates significantly higher than traditional bank savings accounts. For individuals in countries where bank interest rates barely keep up with inflation, DeFi savings protocols offer a meaningful alternative.

Microloans for Small Businesses

Access to credit is one of the biggest challenges for small business owners in emerging economies. DeFi lending platforms enable micro borrowing without the need for a traditional credit score. Protocols built on the Ethereum DeFi ecosystem use collateral based smart contracts to facilitate trust between lenders and borrowers who may never meet.

Stablecoin Payments

In countries experiencing severe inflation, stablecoins serve as a practical medium of exchange. Small businesses in Nigeria, Argentina, and Turkey are increasingly accepting stablecoin payments because they maintain a stable value compared to volatile local currencies.

Decentralized Insurance

Farmers and small scale entrepreneurs in developing regions face significant risks from weather events, crop failures, and health emergencies. DeFi insurance protocols offer affordable, automated coverage through smart contracts that pay out claims without the delays and paperwork of traditional insurance companies.

Tokenized Assets and Real Estate

DeFi makes it possible to divide ownership of expensive assets like real estate into smaller digital tokens. This allows individuals with limited capital to invest in property or other assets that would otherwise be out of reach.

Traditional Finance vs. DeFi in Emerging Markets

| Feature | Traditional Finance | DeFi (Decentralized Finance) |

|---|---|---|

| Access Requirement | Bank account, ID, minimum balance | Smartphone and internet connection |

| Availability | Business hours, limited branches | 24/7 access from anywhere in the world |

| Remittance Fees | 6% to 9% average per transfer | Below 1% in most cases |

| Loan Approval | Weeks of paperwork and credit checks | Instant, powered by smart contracts |

| Transparency | Limited visibility into operations | All transactions on public blockchain |

| Intermediaries | Banks, brokers, payment processors | None (peer to peer via smart contracts) |

| Currency Stability | Dependent on local currency | Stablecoins pegged to USD or EUR |

| Savings Interest | Often below inflation in developing nations | Higher yields through DeFi protocols |

| Geographic Reach | Limited to branch or ATM locations | Global, borderless access |

| Onboarding Speed | Days to weeks | Minutes |

Financial Inclusion and the Unbanked: DeFi’s Biggest Promise

Financial inclusion is not just an economic goal. It is a fundamental enabler of social progress, education, healthcare access, and poverty reduction. When people have access to financial services, they can save for emergencies, invest in their children’s education, grow their businesses, and plan for the future.

Decentralized finance is uniquely positioned to advance financial inclusion because it removes the very barriers that have kept billions of people out of the traditional banking system. There are no requirements for government issued identification in many protocols. There are no minimum balance requirements. There is no need to travel to a physical bank branch.

Key Insight: In Sub Saharan Africa, less than 50% of adults have access to formal financial services. Yet mobile money platforms like M Pesa have already demonstrated that technology can bridge this gap. DeFi takes this concept further by offering a full suite of financial services, not just payments, through decentralized blockchain infrastructure.

For women in rural areas, microentrepreneurs in urban slums, and migrant workers living far from their families, DeFi offers a financial lifeline that traditional banks have never provided. This is why financial inclusion through DeFi is not just a trend. It is a transformation with lasting impact.

Benefits and Advantages of DeFi for Emerging Economies

No Gatekeepers

Anyone with internet access can participate. No application, no approval, no minimum income.

Lower Costs

Removing intermediaries dramatically reduces fees for payments, loans, and transfers.

Speed

Transactions that take days in the traditional system complete in seconds on blockchain.

Transparency

Every transaction is verifiable on a public ledger, reducing corruption and building trust.

Programmable Finance

Smart contracts automate loans, insurance, and interest, reducing human error.

Inflation Shield

Stablecoins protect purchasing power in volatile local economies.

Composability

DeFi protocols combine like building blocks for innovative new products.

Global Access

Users in emerging markets join global investment opportunities previously restricted.

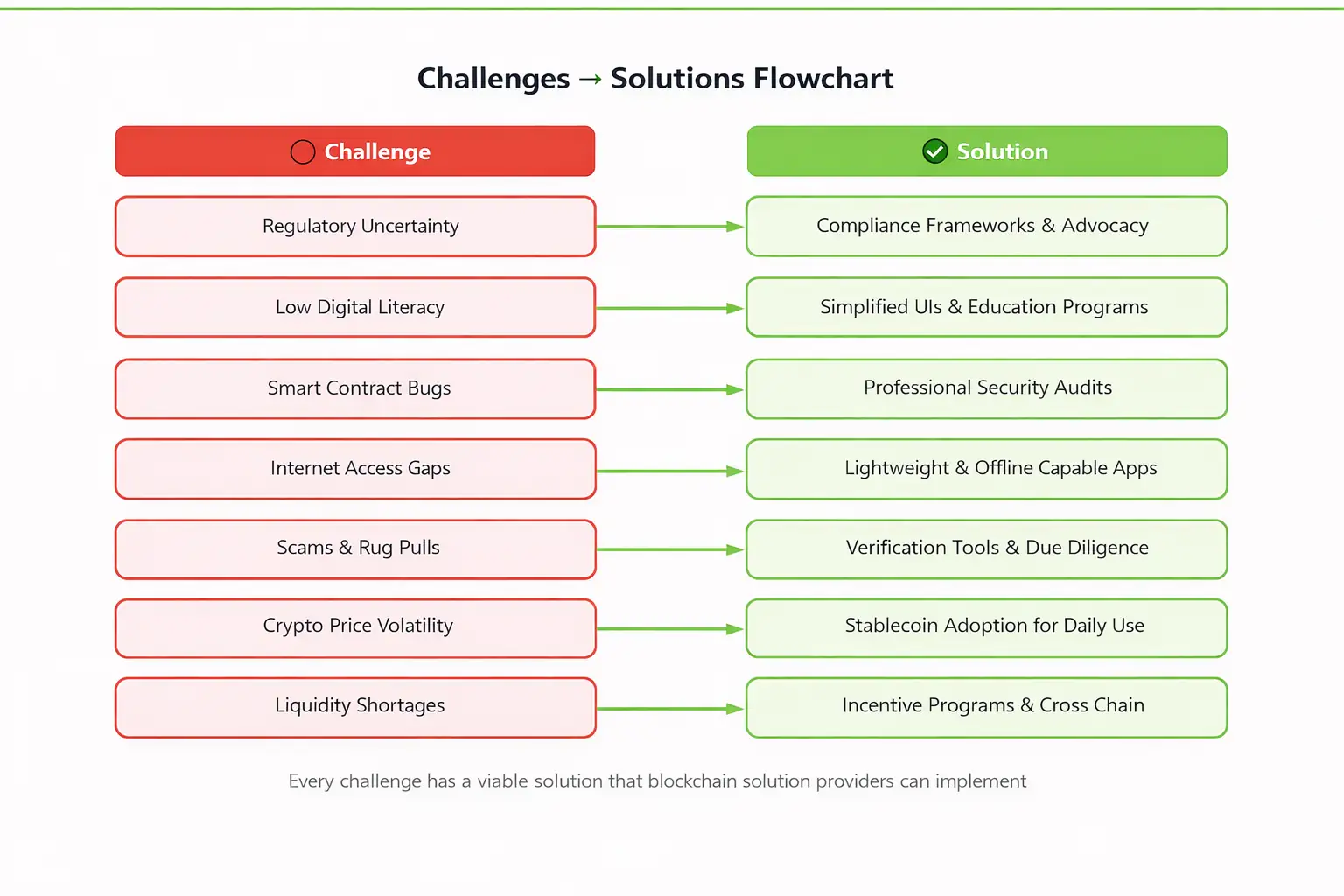

Challenges and Risks of DeFi Adoption in Emerging Markets

While the potential of DeFi is enormous, it would be incomplete to discuss adoption without acknowledging the real challenges and risks that exist.

Regulatory Uncertainty

Most emerging market governments are still figuring out how to regulate DeFi. Some have embraced crypto with progressive frameworks, while others have imposed strict bans or restrictions. This uncertainty creates confusion for users and businesses alike.

Limited Digital Literacy

Using DeFi platforms requires a basic understanding of digital wallets, private keys, and blockchain transactions. For populations with low digital literacy, the learning curve can be steep without proper education and user friendly interfaces.

Smart Contract Vulnerabilities

Smart contracts are only as secure as the code behind them. Poorly written or unaudited contracts can be exploited by hackers, leading to financial losses for users. Security audits and robust testing are essential.

Internet Connectivity Gaps

While mobile phone penetration is rising, reliable internet access remains inconsistent in many rural areas of developing countries. DeFi requires a stable connection to function properly.

Scams and Fraudulent Projects

The open nature of DeFi means anyone can launch a protocol, including bad actors. Users in emerging markets may be particularly vulnerable to scams if they lack the tools to evaluate project legitimacy.

Price Volatility

While stablecoins offer a solution, many DeFi assets remain highly volatile. New users unfamiliar with crypto markets can face significant losses if they invest without understanding the risks.

Liquidity Constraints

Some DeFi protocols serving emerging markets suffer from low liquidity, which can result in poor trade execution, high slippage, and limited access to funds.

DeFi Challenges vs. Solutions: Visual Flowchart

The Regulatory Landscape for DeFi in Developing Countries

Regulation is one of the most important factors that will shape the future of DeFi adoption in emerging markets. The current landscape is highly varied, with different countries taking very different approaches.

🟢 Progressive Frameworks

Singapore, UAE (Dubai), and parts of South America are building clear regulatory frameworks that encourage innovation while protecting consumers. These jurisdictions recognize the economic potential of blockchain technology.

🟡 Cautious Regulation

India, Brazil, and several Southeast Asian nations are taking a measured approach. They are studying DeFi before introducing comprehensive regulation while allowing certain activities.

🔴 Restrictive Policies

Some countries have imposed outright bans or severe restrictions. However, analytics show peer to peer crypto adoption continues to grow even in restrictive environments, driven by economic necessity.

Key Insight: The most successful regulatory approaches in emerging markets tend to balance consumer protection with innovation. Countries that create clear, fair rules for DeFi are attracting talent, investment, and business growth in the blockchain sector.

The Role of Blockchain Infrastructure and Web3 Platforms

DeFi does not exist in isolation. It is built on top of blockchain infrastructure, and its growth depends heavily on the quality and accessibility of that underlying technology. This is where Web3 platforms and blockchain solution providers play a crucial role.

Web3 in emerging markets is about more than just financial tools. It encompasses the entire decentralized internet ecosystem, including digital identity systems, decentralized storage, and governance platforms. For DeFi to thrive, it needs robust blockchain networks that can handle high transaction volumes at low costs.

Layer 1 blockchains like Ethereum, Solana, and BNB Chain provide the foundation. Layer 2 solutions and sidechains help reduce transaction costs and improve speed, which is particularly important for users in emerging markets who are sending small value transactions.

Blockchain solution providers like Nadcab Labs play an important role in this ecosystem. By helping startups, enterprises, and governments design, develop, and deploy DeFi platforms, token systems, and smart contract solutions, companies like Nadcab Labs make it possible for organizations to participate in the decentralized economy with confidence. Their expertise in building secure, scalable blockchain solutions ensures that DeFi applications are not only functional but also reliable and trustworthy for end users.

Business and Enterprise Relevance of DeFi in Emerging Markets

DeFi is not only a tool for individual consumers. It holds significant value for businesses and enterprises operating in or serving emerging markets.

Fintech Startups

Building DeFi powered products for micro lending, insurance, payments, and wealth management tailored for developing markets.

Enterprises

Exploring DeFi for supply chain financing, cross border trade settlements, and treasury management using smart contracts.

Financial Institutions

Integrating DeFi concepts to offer crypto savings, tokenized lending, and blockchain based services to underserved populations.

Governments & NGOs

Using blockchain to improve aid distribution, government payments, and financial record keeping with full transparency.

Industry Insight: Enterprises looking to build DeFi solutions for emerging markets often partner with experienced blockchain development companies. Nadcab Labs provides end to end blockchain development, smart contract auditing, token creation, and dApp development services, enabling businesses to launch DeFi products with professional grade security and performance.

The Future Outlook of DeFi Adoption in Emerging Markets

The trajectory of DeFi adoption in emerging markets points firmly upward. Several trends suggest that the next few years will see even faster growth and deeper integration of decentralized finance into everyday life.

Build the Future of DeFi with Nadcab Labs

Are you a startup, fintech company, or enterprise looking to build secure, scalable DeFi solutions for emerging markets?

Nadcab Labs is a trusted global blockchain development company specializing in DeFi platform development, smart contract engineering, token creation, dApp development, and Web3 consulting. Our experienced team helps organizations turn innovative ideas into production ready decentralized finance applications.

Conclusion

DeFi adoption in emerging markets is not a distant possibility. It is a present reality that is already transforming how millions of people save, send, borrow, and invest money. From stablecoin payments in Nigeria to micro lending in the Philippines and yield earning in Brazil, decentralized finance is solving problems that traditional banking has ignored for decades.

The combination of large unbanked populations, rising mobile connectivity, young tech savvy demographics, and growing regulatory clarity makes emerging markets the most exciting frontier for DeFi growth. While challenges like regulatory uncertainty, digital literacy gaps, and security risks remain, the momentum is undeniable.

For businesses, startups, and enterprises, the opportunity to participate in this transformation is immense. Building DeFi solutions tailored for emerging market needs, with a focus on accessibility, security, and user experience, will define the next generation of global financial services.

As the world moves toward a more open and inclusive financial future, DeFi adoption in emerging markets will continue to lead the way, powered by blockchain innovation, Web3 infrastructure, and the determination of billions of people seeking better financial tools for their lives.

Frequently Asked Questions

Most DeFi platforms require you to hold some cryptocurrency to interact with their services. However, many platforms now allow you to purchase crypto directly within the app using local payment methods, making it easier to get started even if you have never owned crypto before.

Tax treatment of DeFi earnings varies by country. Some nations like India tax crypto gains, while others are still developing their tax frameworks. It is advisable to consult a local tax professional to understand your obligations when earning through DeFi protocols.

If you lose your private key or recovery phrase, you may permanently lose access to your wallet and funds. This is why it is critical to store your recovery phrase securely offline. Unlike banks, DeFi has no central authority that can reset your password.

Mobile money services like M Pesa are operated by centralized companies and offer basic payment and transfer features. DeFi operates on decentralized blockchains and offers a broader range of services including lending, borrowing, trading, and yield earning, all without a central operator.

Yes. Decentralized insurance protocols use weather data and smart contracts to offer parametric insurance for farmers. If certain weather conditions are met (like drought or excessive rainfall), payouts are triggered automatically without the farmer needing to file a claim.

Safety depends on the protocol’s security audits, track record, and the amount of total value locked. It is generally recommended to diversify across multiple platforms, use well audited protocols, and never invest more than you can afford to lose.

While understanding the basics is helpful, you do not need to be a blockchain developer. Professional blockchain development companies like Nadcab Labs provide end to end services that handle the technical complexity, allowing you to focus on your business strategy and user experience.

DAOs allow DeFi protocol users to participate in governance decisions such as fee structures, protocol upgrades, and fund allocation. This community driven model is particularly appealing in emerging markets where users want greater control over the financial platforms they use.

Absolutely. DeFi and stablecoins enable businesses to settle international trade payments quickly and affordably, bypassing the slow and expensive correspondent banking system that typically handles cross border B2B transactions.

CBDCs could complement DeFi by providing a regulated digital currency that bridges the gap between traditional finance and decentralized protocols. In countries where CBDCs are launched, users may find it easier to move between government backed digital money and DeFi platforms.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.