Key Takeaways

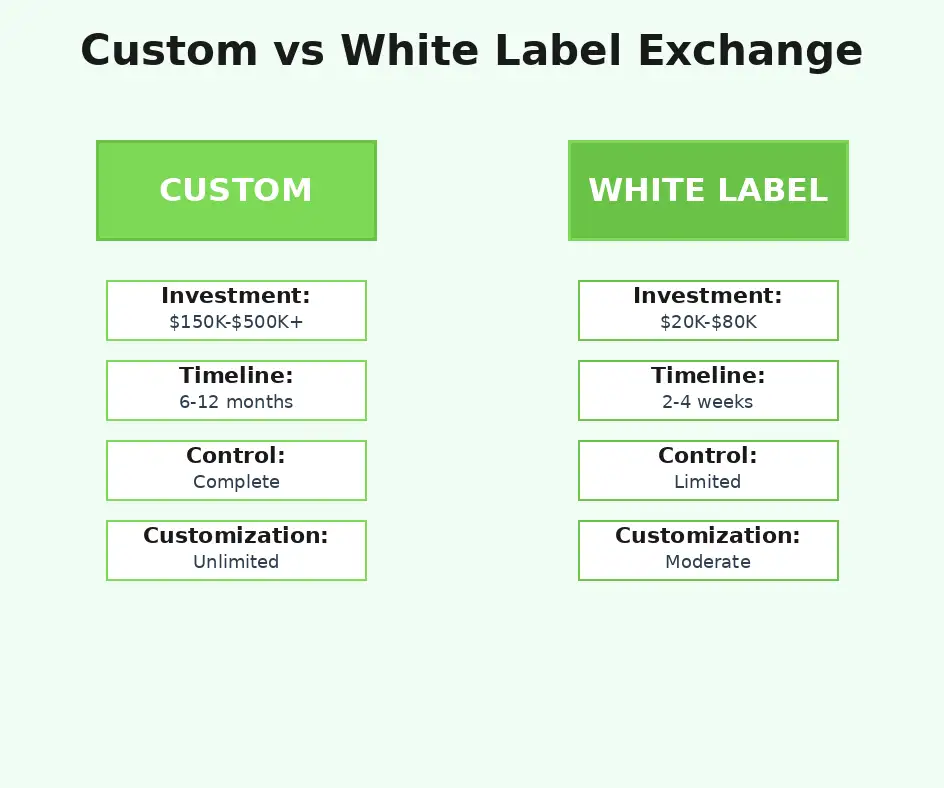

- Investment and Timeline: Custom crypto exchange platforms require $150,000-$500,000 and 6-12 months, while white label crypto exchange solutions start at $20,000-$80,000 with 2-4 week deployment, making each suitable for different business stages and capital availability.

- Customization Depth: Custom exchange platforms offer unlimited modification possibilities including unique trading mechanisms and proprietary features, whereas white label exchange platforms provide branding flexibility with standardized core functionality.

- Scalability Considerations: Custom crypto exchange infrastructure scales according to specific business requirements with optimized architecture, while ready made crypto exchange solutions offer adequate scaling for most small to medium operations with potential limitations at enterprise volumes.

- Security Architecture: Both secure crypto exchange options incorporate industry-standard protections, but custom platforms enable tailored security implementations and complete vulnerability management control, critical for high-volume trading environments.

- Operational Control: Custom exchange vs white label exchange decision hinges on control requirements, where custom solutions eliminate provider dependencies and licensing fees while white label platforms reduce technical overhead and maintenance responsibilities.

- Market Entry Strategy: White label crypto exchange platforms accelerate market validation for startups and new crypto trading businesses, while custom exchange platforms serve enterprises requiring differentiation, regulatory specificity, or unique competitive positioning.

- Long-Term Economics: Total cost analysis reveals custom platforms have higher initial expenditure but lower ongoing costs without licensing fees, contrasted with white label solutions featuring lower barriers but continuous subscription or revenue-sharing obligations.

- Technical Requirements: Operating a custom crypto exchange demands specialized teams including blockchain developers and security experts, while white label exchange platforms minimize technical barriers with managed infrastructure and provider support.

- Regulatory Flexibility: Custom cryptocurrency exchange platforms enable jurisdiction-specific compliance implementations and regulatory adaptability, essential for businesses operating across multiple markets with varying legal requirements.

- Transition Planning: Starting with a white label solution and migrating to a custom platform later is feasible but complex, requiring early planning for data portability and user migration to minimize business disruption.

The cryptocurrency industry continues its explosive growth trajectory, attracting entrepreneurs and enterprises eager to capitalize on digital asset trading opportunities. At the center of this ecosystem lies a critical business decision that shapes every aspect of operations, profitability, and competitive positioning. Whether you’re launching a new venture or expanding an existing financial services portfolio, selecting between a custom exchange vs white label crypto exchange represents one of the most consequential choices you’ll make.

This comprehensive guide examines both approaches in depth, analyzing investment requirements, technical considerations, scalability factors, and strategic implications. We’ll explore how custom crypto exchange platforms and white label crypto exchange solutions differ fundamentally in architecture, capabilities, and long-term business impact. By understanding the nuances of each cryptocurrency exchange platform type, you’ll be equipped to make an informed decision aligned with your business objectives, capital resources, and market ambitions.

Custom Crypto Exchange vs White Label Crypto Exchange

The decision between custom and white label approaches extends far beyond simple cost comparisons. Each crypto exchange platform type embodies distinct philosophies regarding control, flexibility, and market positioning. Understanding these fundamental differences helps businesses align their platform choice with strategic priorities and operational capabilities.

What Is a Crypto Exchange Platform?

A crypto exchange platform serves as the technological infrastructure enabling buyers and sellers to trade digital assets. These platforms facilitate price discovery, order matching, transaction settlement, and asset custody. Modern cryptocurrency exchange platforms integrate complex components including trading engines capable of processing thousands of transactions per second, wallet systems managing diverse blockchain protocols, liquidity management mechanisms, KYC/AML compliance systems, and user interfaces supporting various trading strategies.

The architecture must balance competing demands for speed, security, regulatory compliance, and user experience. Whether operating as a centralized crypto exchange with custodial control or a decentralized crypto exchange emphasizing user sovereignty, the platform’s technical foundation determines operational capabilities and competitive advantages. Partnering with experienced crypto exchange professionals ensures your platform incorporates industry best practices from inception.

Role of a Cryptocurrency Exchange Platform in Crypto Trading Business

Beyond technical transaction processing, crypto exchange platforms function as complete business ecosystems. They establish trust frameworks through security implementations, create revenue streams via trading fees and premium services, enable regulatory compliance through integrated monitoring systems, and build network effects by connecting traders with liquidity providers. The platform choice directly impacts user acquisition costs, operational margins, and scaling economics.

Successful crypto trading businesses recognize their exchange platform as a strategic asset rather than a commodity tool. Platform capabilities determine which market segments you can serve, how quickly you can respond to competitive threats, and whether you can expand into new jurisdictions or asset classes. This strategic significance makes the custom exchange vs white label exchange decision pivotal for long-term business trajectory.

Understanding a Custom Crypto Exchange

A custom crypto exchange represents a purpose-built solution engineered specifically for your business requirements. Every component, from the matching engine algorithm to the user interface design, is crafted to align with your strategic vision. This approach provides maximum flexibility and differentiation potential, though it requires substantial investment in technical expertise, time, and capital.

Custom exchange platform creation involves multiple specialized teams working collaboratively over extended timelines. Blockchain architects design the infrastructure, security specialists implement protective measures, frontend developers craft user experiences, and compliance experts integrate regulatory requirements. The process resembles constructing a building from architectural plans rather than purchasing a turnkey property. This investment creates a platform that truly reflects your business identity and operational priorities.

Key Features of a Custom Exchange Platform

Custom crypto exchange platforms distinguish themselves through tailored feature sets addressing specific market opportunities. These include proprietary trading algorithms optimized for your target user base, unique order types unavailable on competing platforms, integrated liquidity sourcing from specific providers, custom risk management systems reflecting your risk tolerance, specialized compliance workflows for target jurisdictions, and innovative user interfaces incorporating usability research specific to your demographic.

The flexibility extends to technical architecture decisions such as programming languages, database technologies, blockchain integration methods, and hosting infrastructure. This allows optimization for specific performance characteristics like ultra-low latency for high-frequency traders, maximum security for institutional clients, or mobile-first experiences for retail markets. Each technical decision can be made strategically rather than accepting vendor defaults.

Custom Exchange Scalability and Control

Perhaps the most compelling advantage of custom crypto exchange platforms lies in absolute scalability control. As transaction volumes grow, you determine precisely how to enhance capacity, whether through vertical scaling adding more powerful servers, horizontal scaling distributing load across multiple systems, or architectural refinements improving efficiency. There are no vendor limitations constraining your growth trajectory.

Complete control extends beyond technical scaling to business operations. You own all intellectual property, maintain all customer data sovereignty, set your own upgrade schedules, and avoid perpetual licensing relationships. This independence proves invaluable when market conditions demand rapid pivots or when expansion into new territories requires significant platform modifications. The custom exchange platform becomes a strategic asset appreciating in value as your business grows.

Understanding a White Label Crypto Exchange

A white label crypto exchange offers an alternative path through pre-built technology that can be branded and deployed rapidly. Established technology providers have invested years creating robust platforms, then license these solutions to multiple clients who customize branding and configure features within defined parameters. This approach dramatically reduces time to market and initial capital requirements.

The white label model parallels franchising in traditional business. The provider supplies proven infrastructure, ongoing maintenance, security updates, and technical support, while you focus on brand building, market positioning, customer acquisition, and regulatory relationships. For many crypto trading businesses, especially those without deep technical resources, this division of responsibilities represents an optimal starting point. Understanding white label solutions helps businesses evaluate if this approach matches their capabilities.

How a White Label Exchange Platform Works

White label exchange platforms operate through a software-as-a-service model where the provider maintains core infrastructure while clients access customization dashboards. The process begins with provider selection based on feature requirements, followed by branding customization including logos, color schemes, and domain configuration. Next comes feature activation where you enable specific trading pairs, payment methods, and user verification levels according to your target market.

The provider handles technical maintenance including security patches, performance optimization, server management, and compliance with blockchain protocol updates. Your team concentrates on business operations such as marketing campaigns, customer support, liquidity partnerships, and regulatory filings. This arrangement allows rapid market entry without building internal technical capabilities, though it creates ongoing dependencies on provider performance and policies.

Ready Made Crypto Exchange for Faster Market Entry

The compelling advantage of ready made crypto exchange solutions lies in compressed timelines from concept to operational launch. Where custom crypto exchange platforms require 6-12 months minimum, white label solutions can be live within weeks. This speed proves critical when capitalizing on market opportunities, responding to regulatory changes, or testing business hypotheses before committing substantial capital.

Rapid deployment enables iterative business model validation. You can launch with minimal features, gauge market response, refine your value proposition, then expand gradually. This approach reduces financial risk compared to investing heavily in custom platforms before proving market fit. For startups and entrepreneurs, the ability to generate revenue quickly while learning about customer preferences makes ready made solutions strategically attractive.

Important Principle: Platform selection should align with current capabilities and near-term objectives rather than aspirational future states. Start where you are, then evolve as resources and requirements grow.

Difference Between Custom and White Label Crypto Exchange

The distinctions between custom exchange platform and white label exchange platform approaches manifest across multiple dimensions. These differences compound over time, making the initial choice increasingly consequential as your crypto exchange business matures. Examining specific comparison points reveals how each model serves different strategic priorities.

| Comparison Factor | Custom Crypto Exchange | White Label Crypto Exchange |

|---|---|---|

| Timeline to Launch | 6-12 months minimum, extending to 18+ months for complex features | 2-4 weeks for basic deployment, 4-8 weeks with advanced configuration |

| Initial Investment | $150,000-$500,000+ depending on feature complexity and team location | $20,000-$80,000 for setup, licensing, and initial customization |

| Ongoing Costs | Infrastructure ($2,000-$10,000/month), maintenance teams, security audits | Licensing fees ($3,000-$15,000/month) or revenue sharing (2-10%) |

| Customization Depth | Unlimited – every aspect modifiable from core algorithms to UI details | Limited to provider parameters – branding, features, and configuration options |

| Technical Control | Complete ownership of codebase, infrastructure, and architectural decisions | Dependent on provider infrastructure, update schedules, and policy changes |

| Scaling Flexibility | Optimized for specific growth patterns with custom architectural refinements | Provider-determined scaling with potential volume-based pricing tiers |

| Security Implementation | Tailored security architecture with vendor selection control | Provider-implemented security following industry standards |

| Technical Expertise Required | Extensive – requires specialized blockchain developers, DevOps, security teams | Minimal – basic technical understanding sufficient with provider support |

Custom Exchange vs White Label Exchange Cost Comparison

Cost analysis extends beyond simple price comparisons to encompass total economic impact over a crypto exchange business lifecycle. Custom exchange platform investments concentrate heavily upfront with lower ongoing obligations, while white label crypto exchange platforms feature lower entry barriers but perpetual commitments. Understanding these economic patterns helps businesses make financially sound decisions aligned with their capital structure and growth projections.

Initial Investment and Operational Expenses

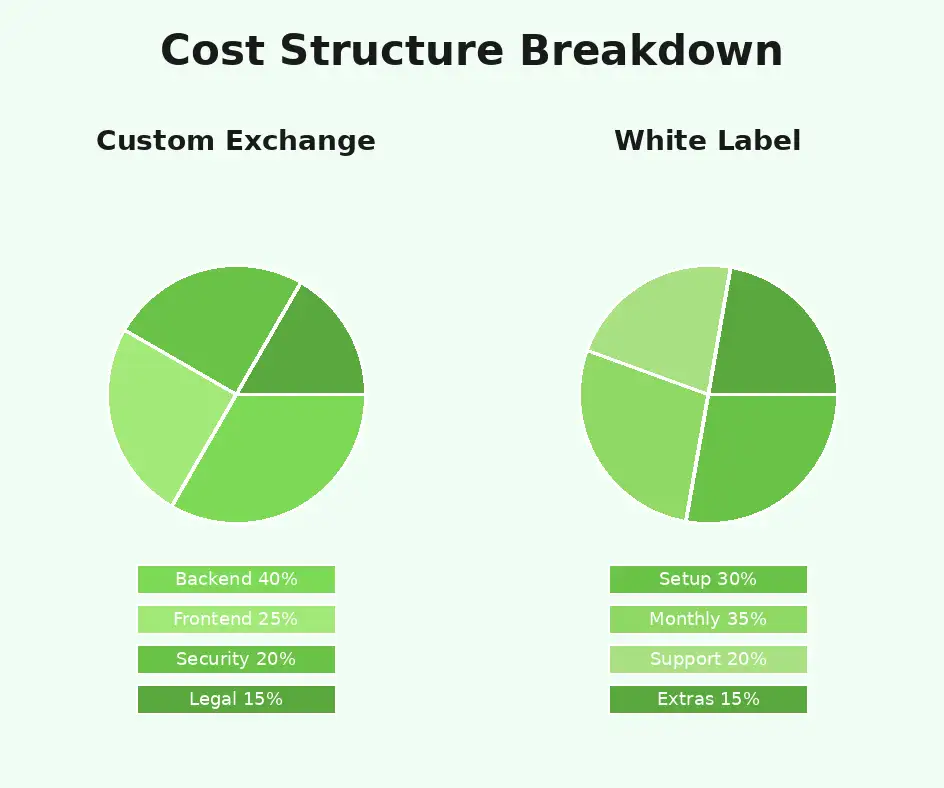

Custom crypto exchange platform creation demands significant upfront capital allocation across multiple expense categories. Planning and architecture phases consume $30,000-$60,000 as teams map business requirements to technical specifications. Backend infrastructure including matching engines, wallet systems, and database architecture represents $80,000-$200,000. Frontend user interfaces for web and mobile platforms add $40,000-$100,000. Security implementations including penetration testing and audit remediation cost $25,000-$75,000. Regulatory compliance integration and legal consultation require $20,000-$65,000.

White label crypto exchange platforms restructure these economics dramatically. Initial licensing and setup fees range from $15,000-$50,000, customization and branding services add $5,000-$20,000, and initial compliance configuration costs $3,000-$10,000. Monthly operational expenses include platform licensing at $3,000-$15,000, infrastructure hosting through provider tiers at $1,000-$5,000, and support packages at $500-$2,000. Revenue sharing arrangements typically extract 2-10% of trading fees instead of or in addition to fixed monthly costs.

Custom vs White Label Crypto Exchange Flexibility

Flexibility differences between custom exchange vs white label exchange platforms become increasingly significant as businesses mature and market conditions evolve. The ability to respond to competitive threats, regulatory changes, and emerging opportunities often determines long-term success in dynamic cryptocurrency markets. Each approach enables different types of adaptation and strategic pivots.

Platform Customization Options

Custom exchange platforms enable unlimited modification possibilities. Businesses can implement novel trading mechanisms like unique auction formats, create proprietary risk management algorithms, integrate with specific blockchain protocols before mainstream adoption, build custom APIs for institutional clients, and develop specialized order types targeting niche trading strategies. This flexibility allows differentiation through innovative features unavailable on competing platforms.

White label exchange platforms constrain customization to provider-defined parameters. Typical modification options include color scheme and logo adjustments, trading pair activation and deactivation, fee structure configuration within allowed ranges, payment gateway selection from supported providers, and user verification level settings. More extensive changes like altering matching engine logic, implementing custom order types, or integrating novel blockchain protocols generally require provider cooperation and may incur substantial additional costs or prove impossible within the platform architecture.

Branding and User Experience Control

Brand differentiation capabilities vary significantly between approaches. Custom crypto exchange platforms allow complete user experience design reflecting brand identity precisely. Every interaction point, from account registration flows to advanced trading interfaces, can embody your brand values and aesthetic preferences. This comprehensive control enables premium positioning strategies and targeted experiences for specific demographics.

White label platforms provide surface-level branding within standardized frameworks. While logos, colors, and domain names create visual distinctiveness, underlying user journeys remain consistent with provider templates. This standardization ensures proven usability but limits differentiation. Multiple exchanges built on the same white label platform may feel similar despite different branding, potentially weakening competitive positioning in crowded markets.

Security and Performance in Crypto Exchange Platforms

Security and performance represent non-negotiable requirements for any cryptocurrency exchange platform. User trust, regulatory compliance, and operational viability all depend on robust protections and reliable performance under varying load conditions. Both custom and white label approaches can deliver secure crypto exchange capabilities, but implementation philosophies and control mechanisms differ substantially.

Secure Crypto Exchange Features

Modern crypto exchange platforms must incorporate multiple security layers protecting against diverse threat vectors. Essential crypto exchange features include two-factor authentication with support for hardware tokens, cold wallet storage for the majority of user assets, hot wallet monitoring with automated anomaly detection, DDoS protection at network and application layers, encryption for data in transit and at rest, regular security audits by independent firms, bug bounty programs incentivizing responsible disclosure, withdrawal whitelist capabilities for users, and comprehensive activity logging for forensic analysis.

Custom crypto exchange platforms enable security architectures tailored to specific risk profiles. High-value institutional platforms might implement additional security measures like multi-signature approval workflows, hardware security modules for key management, geographic distribution of cold storage, dedicated security operations centers, and custom threat intelligence integration. These enhancements address specific vulnerabilities relevant to target markets. Detailed guidance on building secure platforms proves invaluable when designing custom solutions.

Scalable Crypto Exchange Platform Requirements

Scalability encompasses both technical performance and business flexibility. A scalable crypto exchange platform must handle transaction volume growth, support expanding asset variety, accommodate new features without architectural constraints, and maintain performance under stress conditions. Technical scalability involves database optimization, caching strategies, load balancing, microservices architecture, and efficient matching engine algorithms.

Custom platforms allow scalability optimization for anticipated growth patterns. If your crypto trading platform expects high-frequency trading dominance, you can architect for ultra-low latency. If institutional block trades will drive volume, you can optimize for large order processing. White label platforms provide general-purpose scalability adequate for typical growth trajectories but may require provider cooperation for exceptional scaling needs or specialized performance requirements.

Choosing the Right Crypto Exchange Platform for Your Business

Platform selection should emerge from systematic analysis of business objectives, resource availability, market positioning, and growth trajectory rather than arbitrary preferences. The optimal choice for one crypto exchange business may prove suboptimal for another despite similar surface characteristics. Understanding how various business factors interact with platform capabilities guides decision-making toward sustainable competitive advantages.

Crypto Exchange for Startups

Startup ventures face unique constraints balancing ambition with limited resources. Capital preservation, rapid market testing, and iterative learning cycles characterize successful startup methodologies. These operational realities often favor specific platform approaches that align with startup economics and validation requirements before substantial capital commitment.

White Label Exchange Benefits for New Crypto Businesses

White label crypto exchange platforms offer compelling advantages for startups navigating early-stage uncertainties. The dramatically reduced initial investment preserves capital for marketing, customer acquisition, and operational reserves. Quick deployment enables revenue generation within weeks rather than months, creating cash flow while validating business hypotheses. Technical complexity reduction allows founders to focus on market positioning and customer relationships rather than infrastructure management.

The ready made crypto exchange approach provides proven technology reducing technical risk substantially. Established white label providers have refined their platforms through multiple client implementations, resolving common issues and optimizing performance. This maturity level would take years to achieve with custom platforms. For startups without experienced blockchain teams, leveraging this proven infrastructure makes strategic sense. Resources explaining exchange fundamentals help founders understand platform capabilities regardless of chosen approach.

Crypto Exchange for Enterprises

Enterprise organizations entering cryptocurrency markets bring different capabilities and face distinct challenges. Established enterprises typically possess substantial capital resources, experienced technical teams, and sophisticated compliance frameworks. Their platform requirements emphasize regulatory flexibility, integration with existing systems, and differentiation supporting premium market positioning.

Advantages of a Custom Crypto Exchange Platform

Enterprises benefit substantially from custom exchange platforms enabling strategic differentiation. Large organizations can implement unique value propositions reflecting their market expertise. Financial institutions might integrate advanced risk management aligned with their existing frameworks. Technology companies could incorporate novel features leveraging their technical capabilities. Complete control over user data management and regulatory compliance proves essential for organizations in heavily regulated industries.

Custom platforms allow seamless integration with enterprise systems including existing customer databases, compliance platforms, risk management tools, and reporting infrastructure. This integration creates operational efficiencies impossible with standalone white label solutions. Additionally, enterprises can leverage their technical expertise to optimize performance for specific use cases, whether serving institutional traders requiring microsecond execution or retail customers prioritizing mobile experiences.

Which Crypto Exchange Platform Is Better?

The question of which cryptocurrency exchange platform proves superior lacks a universal answer. Context determines optimal choices. A well-capitalized enterprise with technical resources pursuing differentiated positioning should likely choose custom platforms. A bootstrapped startup testing market hypotheses should probably select white label solutions. Between these extremes lie numerous scenarios where trade-offs require careful consideration.

Custom Exchange or White Label Exchange for Long-Term Growth

Long-term growth trajectories influence platform decisions significantly. Businesses planning aggressive expansion, product diversification, or multi-jurisdictional operations benefit from custom platform flexibility. The ability to modify architecture, implement jurisdiction-specific features, and optimize for different market segments without provider constraints supports ambitious growth strategies. Custom platforms become increasingly valuable as operations scale and competitive differentiation intensifies.

Conversely, businesses focusing on specific niche markets with limited expansion plans may find white label platforms adequate indefinitely. If your crypto trading platform serves a particular demographic with standard requirements, provider updates may sufficiently address evolving needs. The key consideration involves whether your growth vision requires capabilities beyond white label provider roadmaps. Understanding your strategic trajectory helps determine which platform approach aligns with long-term objectives.

Risk Consideration: Platform migration from white label to custom involves significant technical complexity and business disruption. Factor in migration costs and timing when making initial platform decisions to avoid expensive future transitions.

Business Factors That Influence Exchange Platform Selection

Beyond technical and financial considerations, various business factors should inform platform decisions. Market positioning, competitive landscape, regulatory environment, and operational capabilities all interact to determine which cryptocurrency exchange platform best serves your objectives. Systematic evaluation of these factors reduces decision risk and improves strategic alignment.

Crypto Trading Business Model Considerations

Your business model fundamentally shapes platform requirements. Different revenue strategies, customer segments, and value propositions demand varying platform capabilities. A deep discount broker targeting retail traders has different needs than a premium platform serving institutions. Understanding your business model clarifies which platform features constitute core requirements versus optional enhancements.

Liquidity, Fees, and User Base Strategy

Liquidity provisioning strategy significantly impacts platform choice. If you plan to source liquidity through specific providers or implement innovative market making approaches, custom platforms offer necessary integration flexibility. White label solutions typically support mainstream liquidity providers but may constrain novel approaches. Fee structure creativity also varies, with custom platforms enabling complex fee models including maker-taker differentials, volume-based tiers, subscription models, or token-based discounts tailored precisely to your strategy.

User acquisition and retention strategies interact with platform capabilities. If your crypto exchange business relies on viral referral programs, affiliate networks, or gamification elements, verify your chosen platform can accommodate these features. Custom platforms allow unlimited implementation creativity, while white label solutions provide standard marketing tools that may suffice for conventional strategies but limit innovation. Real-world examples like successful exchange implementations demonstrate how platform choices enable different business models.

| Business Model Type | Platform Requirements | Recommended Approach |

|---|---|---|

| Retail Trading Platform | User-friendly interfaces, mobile apps, educational content integration, simple order types | White label initially, custom for differentiation at scale |

| Institutional Trading | Advanced order types, API trading, compliance reporting, high performance, custom integrations | Custom platform for required features and performance |

| Niche Asset Focus | Specific blockchain integrations, specialized trading pairs, targeted user experiences | Custom if assets unsupported by white label providers |

| Regional Specialist | Local payment methods, regional compliance, language support, cultural customization | White label if provider supports region, custom otherwise |

| DeFi Integration | Smart contract integration, wallet connectivity, decentralized features, cross-chain capabilities | Custom platform for novel DeFi integrations |

| Enterprise Financial Service | System integration, regulatory reporting, risk management, audit trails, brand alignment | Custom platform for integration and compliance needs |

Centralized Crypto Exchange vs Decentralized Crypto Exchange

The fundamental architecture decision between centralized and decentralized models influences platform selection significantly. Centralized crypto exchange platforms maintain custodial control of user assets, enabling faster transactions and familiar user experiences but requiring robust security and regulatory compliance. Decentralized crypto exchange platforms prioritize user sovereignty through self-custody, implementing trades via smart contracts without central authorities.

Platform Choice Based on Market Demand

Market research should guide architectural decisions. Different user segments prefer different exchange models. Retail traders often favor centralized exchanges for simplicity and customer support. Privacy-conscious users and cryptocurrency purists prefer decentralized alternatives. Institutional clients typically require centralized platforms with robust compliance and reporting capabilities. Understanding your target market’s preferences prevents misalignment between platform architecture and user expectations.

Custom platforms enable hybrid approaches combining centralized efficiency with decentralized transparency. You might implement centralized order matching for performance while using blockchain settlement for transparency. White label providers typically offer either centralized or decentralized solutions, with hybrid implementations rare and expensive. If your crypto trading platform vision involves architectural innovation, custom paths become necessary regardless of other factors.

Final Comparison – Custom Exchange vs White Label Exchange

Synthesizing the extensive analysis requires examining pros, cons, and appropriate use cases for each approach. This comprehensive comparison enables pattern matching between your specific situation and the characteristics favoring each platform type. No universal recommendation exists, but clear patterns emerge regarding which businesses benefit most from custom exchange vs white label exchange decisions.

Pros and Cons of Custom Crypto Exchange

Custom cryptocurrency exchange platform advantages include complete feature customization enabling unique competitive positioning, unlimited scalability with architecture optimized for your growth patterns, total technical control eliminating provider dependencies, intellectual property ownership with no ongoing licensing fees, security architecture tailored to specific risk profiles, regulatory implementation flexibility for multiple jurisdictions, and integration capabilities with any third-party system or service. These advantages compound over time as your crypto exchange business grows and market positioning solidifies.

Custom platform disadvantages involve substantial upfront capital requirements straining startup budgets, extended timelines delaying revenue generation by 6-12 months, significant technical expertise requirements for teams including specialized blockchain developers, ongoing maintenance responsibilities requiring dedicated resources, complete accountability for security vulnerabilities and technical failures, and regulatory compliance burden without provider guidance. These disadvantages prove particularly challenging for organizations lacking technical capabilities or operating with limited capital.

| Custom Exchange Advantages | Custom Exchange Disadvantages |

|---|---|

| Unlimited feature customization and innovation potential | High upfront costs ($150,000-$500,000+) |

| Complete control over technology stack and architecture | Long timelines (6-12 months minimum) |

| Ownership of intellectual property and codebase | Requires specialized technical expertise |

| Optimized scalability for specific growth patterns | Ongoing maintenance and update responsibilities |

| No ongoing licensing fees or provider dependencies | Full accountability for security and compliance |

| Flexible regulatory compliance for multiple jurisdictions | Higher operational overhead with dedicated teams |

| Unique competitive differentiation opportunities | Significant technical risk if team lacks experience |

When a Custom Exchange Platform Makes Sense

Custom crypto exchange platforms prove optimal for well-capitalized enterprises with clear differentiation strategies, businesses requiring unique features unavailable in white label solutions, organizations operating across multiple regulatory jurisdictions with varying requirements, companies with existing technical teams capable of managing complex infrastructure, platforms targeting institutional clients demanding customized solutions, businesses planning aggressive multi-year growth requiring architectural flexibility, and ventures where intellectual property ownership provides strategic competitive advantages.

Additionally, custom platforms make sense when your crypto trading platform vision involves technological innovation impossible within white label constraints, when integration with existing enterprise systems justifies custom work, when brand positioning emphasizes technological sophistication and uniqueness, or when long-term total cost of ownership analysis favors upfront investment over perpetual licensing arrangements. These scenarios share common threads of sufficient resources, clear differentiation needs, and strategic timeframes justifying substantial initial investments.

Pros and Cons of White Label Crypto Exchange

White label exchange platform advantages include dramatically lower initial investment enabling startup participation, rapid deployment allowing revenue generation within weeks, proven technology reducing technical risk through battle-tested infrastructure, minimal technical expertise requirements allowing focus on business operations, managed security and compliance with provider responsibility, regular updates and improvements without additional cost, provider technical support reducing operational burden, and established liquidity partnerships often included in packages. These advantages prove particularly valuable for resource-constrained businesses and rapid market testing scenarios.

White label disadvantages encompass limited customization constraining differentiation potential, ongoing licensing fees or revenue sharing reducing long-term profitability, provider dependency creating business continuity risks, standardized features limiting competitive positioning, scaling constraints based on provider infrastructure capabilities, branding limitations with underlying similarity to other clients, and potential feature gaps if provider roadmap diverges from your needs. These disadvantages become more significant as businesses mature and competitive differentiation intensifies.

When a Ready Made Crypto Exchange Is the Right Choice

Ready made crypto exchange platforms excel for startups with limited capital requiring fast market entry, businesses testing market hypotheses before substantial investment, organizations without technical expertise or resources for custom projects, regional specialists where white label providers offer local payment and compliance support, niche markets where standardized features adequately serve user needs, ventures prioritizing speed to revenue over long-term differentiation, and temporary solutions bridging gaps while planning eventual custom migration.

White label solutions also suit established businesses entering cryptocurrency as adjacencies rather than core offerings, organizations valuing operational simplicity over technical control, markets with intense competition where speed matters more than uniqueness, and situations where provider feature sets align closely with business requirements. The key consideration involves whether white label limitations constrain your essential business strategy or merely reduce optional differentiation opportunities.

Final Thoughts on Crypto Exchange Platform Selection

The custom exchange vs white label crypto exchange decision represents a pivotal strategic choice shaping your crypto exchange business trajectory. Neither approach proves universally superior. Success depends on thoughtful alignment between platform capabilities, business objectives, available resources, and market positioning. Organizations making informed decisions based on realistic self-assessment and clear strategic vision position themselves for sustainable competitive advantage regardless of chosen path.

Best Exchange Platform for Crypto Startup and Enterprises

Startups generally benefit from white label crypto exchange platforms enabling rapid validation with preserved capital. The ability to test business models, iterate based on market feedback, and generate revenue quickly outweighs customization limitations for most early-stage ventures. However, startups with substantial venture funding, experienced technical teams, and clear differentiation strategies may justify custom platforms from inception if their competitive advantage depends on unique technological capabilities.

Enterprises typically find custom crypto exchange platforms more aligned with their capabilities and requirements. Established organizations possess capital resources for significant upfront investment, technical expertise to manage complex infrastructure, and strategic timeframes justifying extended planning. Their market positioning often emphasizes trust, sophistication, and unique value propositions best served through differentiated platforms. Additionally, enterprises operating across multiple markets benefit from custom regulatory flexibility impossible with standardized solutions.

Making the Right Decision for a Secure and Scalable Crypto Exchange

Decision frameworks should incorporate multiple perspectives including financial capacity assessment examining available capital and acceptable risk levels, technical capability evaluation determining your ability to manage custom infrastructure, timeline sensitivity understanding how quickly you need market presence, differentiation requirements identifying whether your strategy demands unique features, regulatory environment analyzing compliance complexity in target markets, growth projections estimating scaling needs over 3-5 years, and competitive landscape evaluating whether standardization or customization offers advantages.

Launch the Right Crypto Exchange Platform for Your Business

Whether you choose a custom exchange or a white-label platform, our crypto exchange experts help you build a secure, scalable, and business-ready trading platform tailored to your goals.

Launch Your Exchange Now

Both custom exchange platform and white label exchange platform approaches can deliver secure, scalable cryptocurrency exchange platforms when implemented competently. The distinction lies in control, flexibility, and strategic alignment rather than absolute quality differences. Many successful crypto trading businesses have launched with white label solutions before migrating to custom platforms as resources and requirements evolved. This staged approach balances speed and cost efficiency with long-term strategic positioning. The critical success factor involves honest assessment of current capabilities and near-term objectives rather than aspirational future states.

Strategic Recommendation: Begin by clearly defining your core business strategy, competitive positioning, and non-negotiable requirements. Then evaluate which platform approach enables those essentials rather than choosing platforms first and adapting strategies second. Let business objectives drive technical decisions, not the reverse.

The cryptocurrency exchange industry rewards both approaches when properly executed. Success stems from strategic clarity, realistic resource assessment, and disciplined execution rather than platform type alone. Whether you select a custom crypto exchange for maximum control and differentiation or a white label crypto exchange for speed and efficiency, commitment to security, user experience, regulatory compliance, and continuous improvement determines ultimate outcomes. Your platform provides the foundation, but your team’s expertise, market understanding, and operational excellence build the successful crypto exchange business.

As you move forward with your platform selection, remember that the cryptocurrency landscape continues evolving rapidly. Technologies improve, regulations develop, and user expectations shift. Choose platforms offering adaptability appropriate to your business model, whether through complete custom control or responsive white label providers committed to continuous enhancement. The right cryptocurrency exchange platform combined with strong execution creates sustainable competitive advantages in this dynamic, opportunity-rich industry.

Frequently Asked Questions

The fundamental difference lies in creation approach and customization depth. A custom crypto exchange is built from scratch according to specific business requirements, offering complete control over features, design, and infrastructure. A white label crypto exchange is a pre-built, ready-made solution that can be rebranded and deployed quickly with limited customization options. Custom exchanges require more time and investment but provide unique competitive advantages, while white label solutions offer faster market entry at lower initial costs.

A custom crypto exchange typically requires an investment ranging from $150,000 to $500,000 or more, depending on features and complexity, with timelines extending 6-12 months. White label crypto exchange platforms start around $20,000 to $80,000, with deployment possible within 2-4 weeks. The total cost of ownership differs significantly, as custom platforms may have higher upfront costs but lower ongoing licensing fees, while white label solutions have lower entry barriers but continuous subscription or revenue-sharing arrangements with providers.

White label crypto exchange platforms are generally more suitable for startups due to lower capital requirements, faster time to market, and reduced technical complexity. They allow new crypto businesses to validate their market hypothesis without massive upfront investment. However, startups with substantial funding, unique value propositions, or plans to operate in highly regulated markets may benefit from custom exchange platforms that offer differentiation and complete regulatory control from day one.

Yes, white label exchange platforms offer branding customization including logo, color schemes, domain name, and user interface elements. However, customization depth is limited compared to custom solutions. Most white label providers allow frontend modifications, trading pair configurations, and fee structure adjustments, but core functionality, architecture, and advanced features remain standardized. For businesses requiring unique trading mechanisms, specialized compliance features, or innovative user experiences, a custom crypto exchange provides necessary flexibility.

A white label crypto exchange can be deployed within 2-4 weeks after provider selection and initial configuration. This includes branding setup, basic compliance configuration, and payment gateway integration. A custom crypto exchange requires 6-12 months minimum, encompassing planning, design, backend infrastructure creation, security implementation, testing phases, and regulatory compliance setup. The timeline for custom platforms extends further when incorporating advanced features like margin trading, derivatives, or complex liquidity solutions.

Reputable white label exchange platforms incorporate enterprise-grade security features including two-factor authentication, cold wallet storage, DDoS protection, and encryption protocols. However, security ultimately depends on the provider’s infrastructure quality and ongoing maintenance. Custom crypto exchanges allow businesses to implement tailored security architectures, choose specific security vendors, and maintain complete control over vulnerability management. For businesses handling high transaction volumes or operating in security-sensitive jurisdictions, custom solutions may offer superior risk management capabilities.

White label crypto exchange platforms typically involve monthly licensing fees ($3,000-$15,000), revenue sharing arrangements (2-10% of trading fees), or annual subscriptions. Additional costs include payment gateway fees, liquidity provider fees, and optional feature upgrades. Custom crypto exchange platforms have different cost structures including server infrastructure ($2,000-$10,000 monthly), maintenance and updates, security audits, compliance personnel, and technical support teams. While custom solutions eliminate licensing fees, they require ongoing technical investment.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.