Key Takeaways

- The crypto tax software market grew from $4.21 billion in 2024 to $5.06 billion in 2025, with a compound annual growth rate of 20.1 percent, and is projected to reach $10.41 billion by 2029.

[1] - Global cryptocurrency owners increased by 13 percent in 2024, rising from 583 million in January to 659 million in December, according to Crypto.com’s annual report

- Starting January 1, 2025, the IRS requires brokers who facilitate digital asset trades to issue a Form 1099-DA for all transactions, making crypto tax software more important than ever for accurate reporting.

[2] - CoinLedger is trusted by more than 700,000 investors around the world and offers pricing plans ranging from $49 for up to 100 transactions to $199 for up to 3,000 transactions.

[3] - Koinly supports tax filing for more than 20 countries and claims to generate tax forms in less than 20 minutes after syncing and importing crypto transactions.

[4] - CoinTracker integrates with over 500 exchanges and wallets and is the official crypto tax partner for both TurboTax and H&R Block

- The IRS treats cryptocurrency like property, similar to stocks or real estate, and short-term crypto gains held less than one year are taxed as ordinary income at rates between 10 to 37 percent

If you have been buying, selling, or trading cryptocurrency, there is one thing you cannot avoid: taxes. As more people around the world enter the crypto market, governments and tax authorities are paying close attention to how digital assets are reported. The problem is that tracking hundreds or even thousands of transactions across multiple wallets and exchanges can feel impossible when done by hand. This is exactly where crypto tax software comes in.

Whether you are a casual investor who bought some Bitcoin a while back or a daily trader moving tokens across decentralized platforms, the right cryptocurrency tax software can save you hours of work and help you avoid costly mistakes on your tax return. In this guide, we will walk you through everything you need to know about how these tools work, which ones are worth your time, what features to look for, and how to stay on the right side of tax law.

What Is Crypto Tax Software and Why Does It Matter?

Crypto tax software is a type of tool that connects to your cryptocurrency exchanges, wallets, and blockchain accounts to automatically pull your transaction data. It then organizes that data, calculates your capital gains and losses, and generates the tax forms you need to file with tax authorities like the IRS in the United States.

Think of it like this: every time you sell a cryptocurrency, swap one token for another, earn staking rewards, receive an airdrop, or get paid in crypto, that is a taxable event. Now imagine doing that across five different exchanges and a handful of wallets over an entire year. The number of transactions can pile up fast, and keeping track of every purchase price, sale price, and holding period manually would take a very long time. That is why many traders rely on crypto token platforms that automatically pull transaction history, calculate gains and losses, and organize everything into tax-ready reports.

A good crypto tax calculator automates all of this. It pulls your transaction history, applies the correct tax method (like FIFO or LIFO), and produces forms like IRS Form 8949 and Schedule D that you or your accountant can use during tax season. Many of these tools also connect directly with popular tax filing platforms like TurboTax, TaxAct, and H&R Block.

The reason this matters more now than ever is that the IRS and other global tax authorities are tightening their rules. As of January 2025, brokers who facilitate digital asset trades in the US must issue a new form called 1099-DA for all transactions. This means the IRS will now receive direct reports on your crypto sales, making it harder to skip or underreport your crypto income.

How Big Is the Crypto Tax Software Market?

The crypto tax software market is growing rapidly. According to The Business Research Company, the market grew from $4.21 billion in 2024 to $5.06 billion in 2025, with a compound annual growth rate of 20.1 percent. It is projected to reach $10.41 billion by 2029, growing at a rate of 19.8 percent per year.

This growth is being driven by several factors. First, the number of cryptocurrency users worldwide keeps rising. Crypto.com’s annual report showed that global cryptocurrency owners increased by 13 percent in 2024, going from 583 million in January to 659 million by December. That is a huge number of people who may need help with their crypto taxes. In the United States alone, approximately 30 percent of American adults, or 70.4 million people, now own cryptocurrency, according to Security.org’s 2026 adoption report.

Second, the complexity of crypto transactions is increasing. People are not just buying and selling Bitcoin anymore. They are earning yield through DeFi protocols, collecting NFTs, staking tokens, participating in liquidity pools, and trading across multiple blockchain networks. Each of these activities creates a taxable event, and manually tracking them is nearly impossible without proper tools.

Third, governments are enforcing stricter compliance standards. The introduction of Form 1099-DA in the US, the implementation of MiCA regulations in Europe, and similar moves in countries like India, Japan, and Australia are all pushing individuals and businesses toward automated tax solutions.

Recommended Reading:

How Does Cryptocurrency Get Taxed?

Before we look at the best tools, it is important to understand how crypto taxes actually work. The IRS treats cryptocurrency like property, not currency. This means that when you sell, trade, or dispose of a digital asset, you may owe capital gains tax, just like you would if you sold a stock or a piece of real estate.

Here is a simple breakdown of the main taxable events in crypto:

1. Selling Crypto for Fiat Currency

When you sell Bitcoin, Ethereum, or any other cryptocurrency for US dollars (or any other fiat currency), you realize a capital gain or loss. If the selling price is higher than what you originally paid, you owe capital gains tax. If it is lower, you have a capital loss that can offset other gains.

2. Trading One Crypto for Another

Swapping Ethereum for Solana, for example, is a taxable event. The IRS considers this a disposal of the first asset, meaning you need to calculate the gain or loss based on the original cost of the asset you gave up.

3. Earning Crypto as Income

If you receive cryptocurrency as payment for work, through mining, staking rewards, or airdrops, the fair market value at the time you received it counts as ordinary income. This applies to freelancers, miners, and anyone who earns crypto through their efforts.

4. Using Crypto to Buy Goods or Services

Spending Bitcoin at a store or paying for a service with crypto is also a taxable event. You need to calculate the gain or loss based on the difference between the price you paid for the crypto and the value of the goods or services you received.

5. DeFi and NFT Activities

Earning yield through decentralized finance protocols, providing liquidity, and selling NFTs all create taxable events. These are some of the most complex transactions to track, which is why crypto tax reporting software has become so valuable.

The tax rate depends on how long you held the asset. Short-term gains (held less than one year) are taxed as ordinary income at rates between 10 and 37 percent. Long-term gains (held more than one year) get lower rates of 0, 15, or 20 percent, depending on your income bracket.

New IRS Rules You Should Know About

The IRS has been slowly tightening its approach to cryptocurrency taxation, and some major changes have already taken effect. Here is what you need to be aware of:

1. Form 1099-DA Is Now Live

Starting January 1, 2025, brokers who facilitate digital asset trades for US customers must issue Form 1099-DA for all transactions. This includes centralized exchanges like Coinbase and Gemini, payment processors, hosted wallet providers, and certain stablecoin issuers. The form reports gross proceeds from your crypto sales directly to the IRS. For 2025 transactions, only gross proceeds are required. Cost basis reporting will begin for covered assets starting in 2026.

2. Per-Wallet Cost Basis Tracking

Revenue Procedure 2024-28 introduced a major shift: starting in 2025, your cost basis, holding periods, and tax lot identification must be tracked wallet by wallet or account by account. Each wallet now functions as its own accounting record. You can no longer use a universal method that pools all your assets together across different wallets. This makes having a good crypto tax software even more important because managing separate basis tracking across multiple wallets manually would be extremely difficult.

3. Digital Asset Question on Tax Returns

The IRS now asks all taxpayers on Form 1040 whether they engaged in digital asset transactions during the year. Checking “No” when the answer is “Yes” can lead to audits and penalties. This question applies even if you just received crypto as a gift or from an airdrop.

4. Staking and Mining Income

The IRS considers staking rewards and mining income as taxable upon receipt. Businesses involved in mining must report earnings as self-employment income and pay additional payroll taxes. The fair market value of staking rewards must be reported at the time you receive them, even if you do not sell immediately.

Features to Look for in the Best Crypto Tax Software

Not all crypto tax software is created equal. When choosing a platform, you want to make sure it handles your specific needs. Here are the most important features to consider:

1. Exchange and Wallet Integrations

The more exchanges and wallets a platform supports, the easier your life will be. Look for software that connects with your specific exchanges through API integrations rather than requiring manual CSV file uploads. Manual imports can be time-consuming and increase the chance of errors. The best platforms support hundreds of exchanges and dozens of blockchain networks.

2. DeFi and NFT Support

If you are involved in decentralized finance or have bought and sold NFTs, make sure your chosen platform can handle these transaction types. Not all tools support complex DeFi interactions like yield farming, liquidity providing, or token swaps across decentralized protocols.

3. Tax Method Options

Different countries and situations may require different accounting methods. Common methods include FIFO (First In, First Out), LIFO (Last In, First Out), and HIFO (Highest In, First Out). Your crypto tax calculator should let you switch between these methods so you can see which one gives you the lowest tax bill.

4. Tax Form Generation

The software should automatically generate the forms you need. For US taxpayers, this typically includes IRS Form 8949 and Schedule D. Many platforms also export files that are compatible with TurboTax, TaxAct, H&R Block, and TaxSlayer.

5. Tax Loss Harvesting

Some platforms include tools that identify opportunities to sell underperforming assets before the end of the year to offset your gains. This strategy, known as tax loss harvesting, can significantly reduce your tax bill when used properly.

6. Per-Wallet Tracking

With the new IRS rules requiring per-wallet cost basis tracking from 2025 onward, your software needs to support this. Platforms like CoinTracker and CoinLedger have already restructured their systems to comply with this requirement.

7. Multi-Country Support

If you are not based in the US, you still need crypto tax tools that support your local tax laws. Platforms like Koinly offer support for over 20 countries, making them a strong choice for international users.

8. Error Reconciliation

Crypto data is messy. Transfers between wallets, missing cost basis information, and duplicate transactions are common problems. Good crypto tax reporting software will flag these issues and help you fix them before you file.

Top Crypto Tax Software Platforms Compared

| Platform | Starting Price | Key Features |

|---|---|---|

| CoinLedger | $49 for up to 100 transactions | DeFi and NFT support, tax loss harvesting report, expert review option, TurboTax and H&R Block integration |

| Koinly | $49 for up to 100 transactions | Support for 20+ countries, fast report generation, error reconciliation, DeFi, and margin trading support |

| CoinTracker | Free portfolio tracking, paid plans from $49 | 500+ exchange integrations, official TurboTax and H&R Block partner, per-wallet cost basis, real-time portfolio tracking |

| ZenLedger | Free plan available, paid plans vary | 400+ integrations across all plans, DeFi and NFT support, 24/7 premium support, including phone |

| TokenTax | $65 for basic plan | In-house accounting team, full-service filing option at $3,499, enterprise plans, international gain/loss reports |

| TaxBit | Free for individual investors | Enterprise and regulator-focused, DeFi and NFT support, email and chat support |

| CoinTracking | Free for up to 200 transactions | Detailed analytics, customizable data views, popular among accountants, work in 25+ countries |

A Closer Look at the Best Crypto Tax Software

Let us go a bit deeper into some of the most popular crypto tax software for traders, so you can better understand which tool fits your situation.

1. CoinLedger

Previously known as CryptoTrader.Tax, CoinLedger has built a strong reputation since its founding in 2018. The platform is trusted by more than 700,000 investors worldwide and focuses heavily on being easy to use, even for people who are not tech-savvy. You can import your wallets and transactions in just a few minutes, and the platform will automatically classify most transactions for you.

CoinLedger stands out for its live chat support available to all users, including those on the free plan. It also offers an “Expert Review” feature where a team member will review your tax report for errors. Pricing starts at $49 for up to 100 transactions and goes up to $199 for up to 3,000 transactions. The platform integrates with TurboTax, TaxAct, H&R Block, and TaxSlayer.

2. Koinly

Koinly is one of the most popular choices for international users. It supports tax filing in over 20 countries, including the US, UK, Canada, Australia, and Japan. The platform claims it can generate tax reports in less than 20 minutes after you sync your accounts. Koinly has strong DeFi support, handling yield farming, liquidity pools, margin trading, and NFT transactions.

One thing that sets Koinly apart is the amount of self-help content it provides: over 50 help guides and nearly 200 YouTube videos to walk users through common issues. Pricing is similar to CoinLedger, with plans starting at $49 for up to 100 transactions and $279 for more than 3,000 transactions.

3. CoinTracker

CoinTracker is the official crypto tax partner for both TurboTax and H&R Block, which speaks to the trust major tax platforms place in this tool. The platform integrates with over 500 exchanges and wallets and offers real-time portfolio tracking alongside tax reporting. CoinTracker was one of the first platforms to restructure its technology around the new IRS per-wallet cost basis tracking rules introduced in 2025.

Free portfolio tracking is available, with paid tax plans starting at $49. CoinTracker is a strong pick for US-based traders who want their best crypto tax software to work hand-in-hand with their existing tax filing workflow.

4. TokenTax

TokenTax is unique because it is not just a software tool but also a full-service accounting firm. For users who want someone else to handle their taxes entirely, TokenTax offers a “Done For You” plan at $3,499, where an in-house accounting expert will file your taxes from start to finish. This makes it a strong option for high-net-worth individuals or people with very complex crypto portfolios.

The basic plan starts at $65, and the platform supports spot trading, staking, yield farming, derivatives, and international reporting. Customer support is available at every pricing level.

Recommended Reading:

Utility Tokens vs Security Tokens: Key Differences, Regulations, and Use Cases

Free vs Paid Crypto Tax Software: What Is the Difference?

Most of the top crypto tax software platforms offer a free tier, but there are important limits to understand. On the free plan, you can usually import your exchanges and wallets, see a summary of your portfolio, and sometimes view your capital gains and losses. However, downloading actual tax reports and forms almost always requires a paid plan.

For example, CoinTracker’s free plan includes portfolio tracking and a general tax summary. Koinly’s free plan lets you see your gains and losses, but will not let you download tax forms. CoinLedger offers free portfolio tracking with the ability to view net gains and losses before you pay. CoinTracking’s free plan supports up to 200 transactions but locks many features behind higher-priced plans.

If you only made a handful of trades during the year, a free plan might give you enough information to file your taxes manually. But if you are an active trader with hundreds or thousands of transactions across multiple platforms, a paid plan is almost always worth the cost. The time you save and the errors you avoid can easily make up for the $49 to $199 price tag.

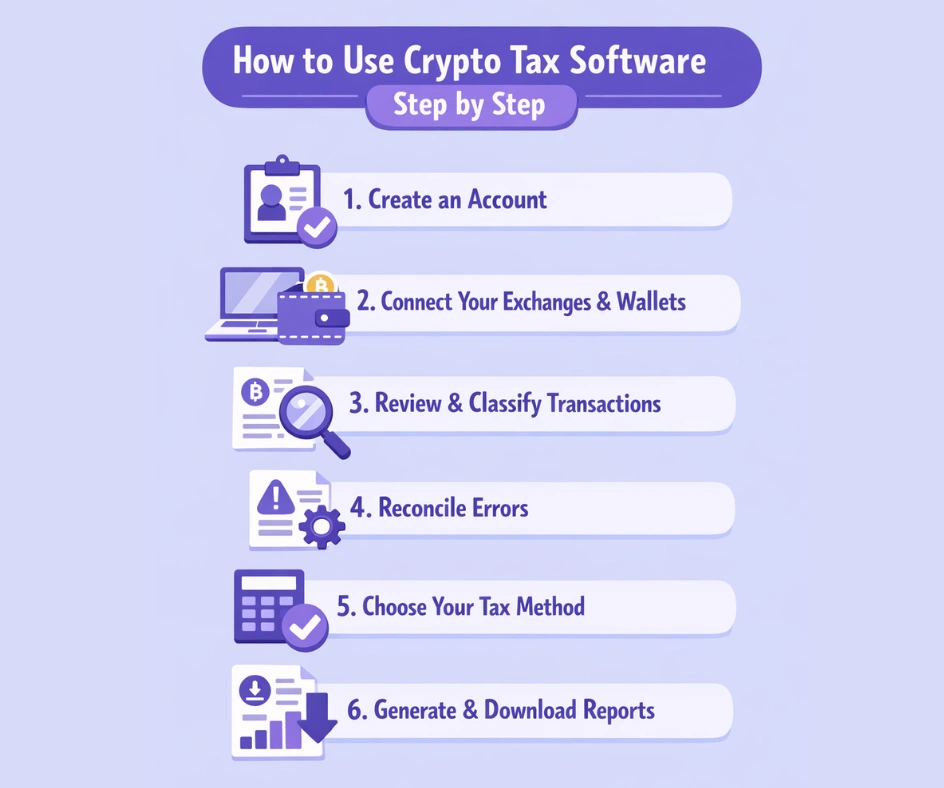

How to Use Crypto Tax Software Step by Step

If you have never used cryptocurrency tax software before, the process is actually quite straightforward. Here is a simple step-by-step guide:

1. Create an Account

Sign up for your chosen platform. Most offer a free tier that lets you get started without entering payment details.

2. Connect Your Exchanges and Wallets

Use API keys or read-only connections to link your cryptocurrency exchanges. You can also import data from blockchain wallets by entering your public wallet address. Some platforms support direct connections to DeFi protocols as well.

3. Review and Classify Transactions

The software will automatically pull your transaction history and try to classify each one (buy, sell, trade, income, transfer, etc.). Review the classifications and fix any that are incorrect. Pay special attention to transfers between your own wallets, as the software sometimes mistakes these for sales.

4. Reconcile Errors

Most platforms will flag missing cost basis information, unmatched transactions, or other issues. Fix these before generating your report. This step is important because unresolved errors can lead to inaccurate tax calculations.

5. Choose Your Tax Method

Select the accounting method you want to use (FIFO, LIFO, HIFO, or Specific Identification). Some tools let you preview the tax amount under each method so you can choose the one that minimizes your bill.

6. Generate and Download Reports

Once everything is reviewed, generate your tax report. Download Form 8949, Schedule D, or the export file for your preferred tax filing platform. Upload the data to TurboTax, H&R Block, or hand it to your accountant.

Tax Methods Used by Crypto Tax Software

| Tax Method | How It Works | Best For |

|---|---|---|

| FIFO (First In, First Out) | Sells the oldest purchased units first | Long-term holders looking to maximize long-term capital gains rates |

| LIFO (Last In, First Out) | Sells the most recently purchased units first | Traders who bought at higher prices recently and want to reduce taxable gains |

| HIFO (Highest In, First Out) | Sells the units with the highest cost basis first | Active traders looking to minimize capital gains tax |

| Specific Identification | You choose exactly which units to sell | Experienced traders who want full control over their tax outcomes |

| Average Cost Basis | Uses the average purchase price of all units | Users in countries like Canada, where ACB is the required method |

Tax Loss Harvesting: How Crypto Tax Software Saves You Money

One of the most valuable features offered by many crypto tax software tools is tax loss harvesting. This is a strategy where you sell cryptocurrency that has dropped in value to realize a loss, which can then be used to offset your capital gains from other profitable trades.

For example, if you made $5,000 in gains from selling Bitcoin but you also hold some altcoins that have dropped by $3,000, you could sell those altcoins before the end of the year to offset your gains. Instead of paying tax on $5,000, you would only owe taxes on $2,000 of net gains.

Unlike the stock market, cryptocurrency currently does not have a “wash sale” rule in the US (though this could change in the future). This means you can sell a crypto asset at a loss and buy it back immediately without waiting 30 days, which is required for stocks. Several of the best crypto tax software platforms include dashboards that show you unrealized losses in your portfolio, making it easy to identify harvesting opportunities before the tax year ends.

Common Mistakes Traders Make with Crypto Taxes

Even with the help of crypto tax software, there are some common mistakes that traders should watch out for:

1. Not Reporting All Transactions

Many traders forget about smaller transactions, airdrops, or tokens received through promotions. Every crypto transaction, no matter how small, may be a taxable event. With the IRS now receiving Form 1099-DA from brokers, any unreported transactions could trigger an audit.

2. Confusing Transfers with Sales

Moving crypto from one wallet to another or from an exchange to a cold storage wallet is not a taxable event. However, if your software incorrectly labels these as sales, it could inflate your gains. Always review your classified transactions before filing.

3. Ignoring DeFi and Staking Income

Many traders focus on their exchange trades but forget to report staking rewards, liquidity provider fees, or yield farming income. The IRS treats all of these as taxable income upon receipt.

4. Using the Wrong Accounting Method

Once you choose an accounting method (like FIFO or LIFO) for a particular tax year, you should be consistent. Switching methods from year to year without proper justification can raise red flags with the IRS.

5. Not Keeping Records

Even if you use crypto tax software, you should maintain your own records. Exchange platforms can shut down, APIs can break, and CSV files can get lost. Having backup records of all your transactions protects you in case of an audit.

Recommended Reading:

Global Crypto Compliance in 2026: Rules, Risks, and Real-World Enforcement

International Crypto Tax Rules: A Quick Overview

While we have focused heavily on IRS rules, crypto taxation is a global issue. Here is a quick look at how some other countries approach it:

In the United Kingdom, cryptocurrency is subject to Capital Gains Tax. You pay tax when you sell, swap, or give away crypto (unless it is to your spouse or civil partner). There is a tax-free allowance, and gains above that are taxed at 10 or 20 percent, depending on your income.

In Australia, the Australian Taxation Office (ATO) treats crypto as property and taxes capital gains similarly to other investments. If you hold crypto for more than 12 months, you get a 50 percent discount on your capital gains.

In India, crypto gains are taxed at a flat 30 percent, with an additional 1 percent TDS (Tax Deducted at Source) on each transaction. This is one of the highest crypto tax rates in the world.

In Germany, if you hold crypto for more than one year before selling, the gains are completely tax-free. However, if you sell within one year, gains above 600 euros are taxed at your regular income tax rate.

In Canada, only 50 percent of your capital gains from crypto are taxable, and you must use the Adjusted Cost Basis (ACB) method for calculating gains.

The development of crypto tax software that works across multiple countries has been a game-changer for international traders. Platforms like Koinly and CoinTracking support users in 20 to 25 countries, automatically adjusting their reports to local tax rules.

The Role of AI in Modern Crypto Tax Software

Artificial intelligence is starting to play a bigger role in how crypto tax software works. In February 2025, CPAI, a US-based AI-powered platform for crypto tax reconciliation, preparation, and filing, launched its multi-phase AI-powered crypto tax roadmap. This type of development shows where the industry is heading.

AI can help in several ways. First, it can automatically classify complex transactions. When you interact with a smart contract on a DeFi platform, the transaction data on the blockchain can be confusing even for experienced accountants. AI algorithms can analyze these on-chain transactions and determine whether they represent a swap, a liquidity provision event, a yield reward, or something else entirely.

Second, AI can improve error detection. Instead of just flagging missing data, AI-powered tools can suggest corrections based on patterns in your transaction history. If a transfer between your own wallets is mistakenly classified as a sale, the AI can recognize the pattern and suggest reclassifying it.

Third, AI can assist with tax optimization. By analyzing your portfolio in real-time, AI tools can suggest the best times to sell for tax purposes, identify harvesting opportunities, and even project your tax liability for the current year based on your trading activity so far.

The development of these AI-powered features is one of the key trends driving the growth of the cryptocurrency tax software market, and it is something that traders should keep an eye on when choosing their next tax tool.

Blockchain Solutions That Power Crypto Compliance Platforms

The following projects show how blockchain technology is already being used to build financial platforms, exchange systems, and crypto infrastructure. Each one reflects the same kind of technical development that supports tools like crypto tax software, from transaction tracking and wallet integration to multi-chain support and automated reporting.

💱

Tarality: Comprehensive Cryptocurrency Platform

Built a full-featured cryptocurrency platform offering buy/sell, borrowing, fixed deposits, and multiple trading modes. The platform integrates INR trading pairs, a referral system, and withdrawal tools, demonstrating how blockchain infrastructure handles complex financial transactions that require proper tax tracking and reporting.

🔄

Rubic: Decentralized Multi-Chain Exchange

Created a decentralized exchange aggregating over 200 DEXs across 80+ blockchain networks. The platform enables cross-chain swaps, smart routing for best rates, and MetaMask integration. This kind of multi-chain trading activity is exactly what makes crypto tax software necessary for accurate reporting.

Build Your Blockchain Platform with Confidence:

We bring deep blockchain expertise to cryptocurrency platform development. Our team handles everything from smart contract creation to multi-chain wallet integration, making sure your platform is built for performance, compliance, and great user experience. Whether you need a DeFi platform, trading system, or custom blockchain solution, we deliver results.

Conclusion

Cryptocurrency is no longer a niche investment. With over 659 million crypto owners globally and tightening tax regulations in every major market, the need for proper tax reporting has never been greater. Whether you are a casual holder or a full-time trader, ignoring your crypto tax obligations is no longer an option, especially now that the IRS is receiving direct transaction reports through Form 1099-DA.

The good news is that crypto tax software makes this process much easier than it used to be. Tools like CoinLedger, Koinly, CoinTracker, and TokenTax can pull your transaction data from hundreds of exchanges and wallets, calculate your gains and losses using the correct tax method, and generate the exact forms you need to file. Many of them also include features like tax loss harvesting, DeFi and NFT tracking, and per-wallet cost basis support that keep you compliant with the latest IRS rules.

The key is to choose a platform that matches your trading volume, supports the exchanges and wallets you use, and works with the tax filing software you prefer. Do not wait until April to start thinking about this. The earlier you set up your crypto tax software, the easier tax season will be. And if your portfolio is complex enough, consider consulting with a crypto-savvy tax professional to make sure nothing falls through the cracks.

Frequently Asked Questions

Crypto tax software connects to your exchanges and wallets, pulls your transaction history, calculates your capital gains and losses, and generates the tax forms you need to file with authorities like the IRS. It automates the process that would otherwise take hours to do manually.

If you made more than a handful of trades during the year, yes. The time savings alone are worth the $49 to $199 that most platforms charge. Plus, accurate reporting helps you avoid penalties and may even reduce your tax bill through proper loss tracking.

CoinLedger and Koinly are both excellent choices for beginners. CoinLedger is known for its simple interface and live chat support, while Koinly offers helpful guides and videos to walk you through the process.

If you only bought and held Bitcoin without selling, you do not owe capital gains tax yet. However, if you sold, traded, or earned Bitcoin as income at any point during the year, you should use crypto tax software to make sure everything is reported correctly.

Most major platforms like Koinly, CoinLedger, and CoinTracker support DeFi transactions, including staking, yield farming, and liquidity providing. However, the level of support varies, so check whether your specific DeFi protocols are covered before choosing a platform.

Failing to report crypto transactions can result in penalties, interest on unpaid taxes, and potential audits. With the IRS now receiving Form 1099-DA from brokers, unreported transactions are more likely to be caught than ever before.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.