Key Takeaways

- DeFi wallets in 2026 prioritize non-custodial architecture, giving users complete control over their private keys and digital assets

- Successful defi wallet development requires multi-chain support, robust key management systems, and account abstraction capabilities

- Security is paramount implement MPC technology, transaction simulation, and regular smart contract audits to protect users

- Modern DeFi wallets must integrate essential features: DEX swaps, staking, lending protocols, and NFT management

- Scalability through Layer 2 networks, gas optimization, and efficient indexing is crucial for production-grade performance

- User experience design and seamless onboarding determine adoption rates—balance security with accessibility

Why DeFi Wallets Matter in 2026

The financial landscape has undergone a seismic transformation. As we navigate through 2026, the defi wallet has become the cornerstone of decentralized finance, empowering millions of users worldwide to take control of their financial sovereignty. Unlike traditional custodial wallets where third parties hold your private keys, modern DeFi wallets represent a paradigm shift toward true self-custody and permissionless access to global financial infrastructure.

The evolution from custodial wallets to sophisticated defi wallet solutions has been remarkable. In our eight years of building blockchain infrastructure, we’ve witnessed this transformation firsthand from simple Ethereum wallets to complex multi-chain orchestration platforms. Early wallets were essentially key storage mechanisms; today’s defi wallet ecosystem supports staking, yield farming, cross-chain bridges, and complex DeFi protocol interactions, all while maintaining military-grade security standards.

The rise of self-custody reflects a broader cultural shift. Users are no longer willing to surrender control of their assets to centralized exchanges following high-profile collapses and regulatory uncertainties. According to recent data, non-custodial defi wallet adoption has grown by 340% since 2023, with over 120 million active users globally. This explosive growth creates unprecedented opportunities for developers and businesses to build next-generation wallet infrastructure.

Growing demand for secure and scalable defi wallet solutions has never been higher. Institutional investors, retail traders, and DeFi enthusiasts all require robust wallet infrastructure that can handle millions of transactions daily while maintaining unwavering security. This comprehensive guide draws from our extensive experience building production-grade wallet systems, covering everything from architecture design to post-launch optimization strategies.

What Is a DeFi Wallet?

A defi wallet is a cryptographic application that stores your private keys, enabling you to interact with blockchain networks and decentralized applications without intermediaries. Think of it as a digital keychain that unlocks access to your cryptocurrency holdings, NFTs, and DeFi protocol interactions. Unlike traditional banking apps that store your money on their servers, a defi wallet gives you direct control you hold the keys, you own the assets.

The fundamental difference between DeFi wallets and centralized wallets lies in custody. Centralized wallets (like exchange wallets) hold your private keys on their servers, meaning they control your funds. A defi wallet, conversely, ensures that only you possess the private keys. This non-custodial architecture eliminates counterparty risk but places the responsibility of key management squarely on your shoulders lose your seed phrase, and you lose access forever.

DeFi wallets serve as the backbone of Web3 infrastructure. Every interaction with smart contracts, every token swap on decentralized exchanges, every NFT purchase—all require a defi wallet to sign transactions. They’re the authentication layer for the decentralized internet, replacing traditional username-password systems with cryptographic proof of ownership. This makes wallet development critical for any organization entering the Web3 space.

Real-world examples illustrate this versatility. DeFi traders use wallets to interact with Uniswap and Aave, providing liquidity and earning yields. NFT collectors manage their digital art collections through wallet interfaces. DAO participants vote on governance proposals by signing transactions with their wallets. Gaming platforms integrate wallets for in-game asset ownership. The defi wallet has transcended its original purpose to become a universal Web3 identity and transaction layer.[1]

How a DeFi Wallet Works

Understanding defi wallet mechanics starts with private keys and seed phrases. Your private key is a 256-bit number that acts as your digital signature—mathematically linked to your public wallet address but computationally impossible to derive from it. The seed phrase (typically 12 or 24 words) is a human-readable representation of your private key, generated using BIP39 standards. This phrase can recreate your entire wallet on any device, making it the most critical piece of information you’ll ever manage.

Wallet addresses function as your public identifier on the blockchain. When someone sends you cryptocurrency, they send it to your address—a 42-character hexadecimal string on Ethereum or a different format on other chains. Transaction signing is the core cryptographic operation: when you initiate a transaction, your defi wallet uses your private key to create a digital signature proving you authorize this action. This signature is verified on-chain without ever exposing your private key.

Smart contract interaction adds another layer of complexity. When you swap tokens on a DEX, your defi wallet doesn’t just send tokens—it calls specific functions in smart contracts, passing parameters like token addresses and amounts. The wallet constructs transaction data, estimates gas fees, presents this information for your approval, and broadcasts the signed transaction to the network. This entire orchestration happens in milliseconds behind a clean user interface.

On-chain versus off-chain components distinguish modern wallet architecture. On-chain elements include your address, transaction history, and smart contract interactions—all permanently recorded on the blockchain. Off-chain components encompass the user interface, transaction indexing services, price feeds, and token metadata. A sophisticated defi wallet seamlessly blends these layers, querying off-chain APIs for speed while maintaining on-chain verification for security.

Types of DeFi Wallets

Software wallets represent the most common defi wallet category, available as mobile apps, desktop applications, or browser extensions. Mobile wallets like Trust Wallet and Rainbow offer convenient access to DeFi protocols on-the-go, while desktop solutions like Exodus provide comprehensive portfolio management. Browser extensions such as MetaMask dominate Web3 interactions, injecting wallet functionality directly into web applications. Each format serves distinct use cases mobile for convenience, desktop for power users, browser extensions for seamless dApp integration.

Web-based DeFi wallets eliminate installation requirements, running entirely in browsers. These progressive web apps offer instant accessibility but face security considerations around session management and local Storage vulnerabilities. Modern web wallets implement sophisticated security measures including encrypted local storage, secure session handling, and integration with hardware wallets for high-value transactions. The convenience factor makes web-based defi wallet solutions popular for mainstream adoption.

Hardware wallet integrations provide the highest security tier. While Ledger and Trezor devices store private keys in secure hardware chips, they integrate with software wallet interfaces for transaction signing. This hybrid approach keeps keys offline while maintaining usability. Our development experience shows that hardware wallet support is non-negotiable for institutional defi wallet deployments, where asset custody requirements demand maximum security.

MPC (Multi-Party Computation) and smart contract wallets represent the cutting edge. MPC technology distributes private key shares across multiple parties, eliminating single points of failure. Smart contract wallets like Safe (formerly Gnosis Safe) implement account abstraction, enabling features like social recovery, spending limits, and multi-signature requirements. These advanced defi wallet architectures will dominate enterprise deployments by 2026, offering institutional-grade security with enhanced user experience.

Single-chain versus multi-chain defi wallet support defines your target market. Single-chain wallets optimize for specific ecosystems—deep Solana integration or Ethereum-focused features. Multi-chain wallets support numerous networks but face complexity in maintaining consistent UX across different blockchain architectures. The industry trend overwhelmingly favors multi-chain solutions as users diversify across ecosystems.

DeFi Wallet Types Comparison

| Wallet Type | Security Level | User Experience | Best Use Case | Development Complexity |

|---|---|---|---|---|

| Mobile Software Wallet | Medium-High | Excellent | Daily DeFi interactions | Medium |

| Browser Extension | Medium | Good | Web3 dApp interaction | Medium-High |

| Hardware Wallet | Very High | Fair | Long-term storage | High (Integration) |

| MPC Wallet | Very High | Good | Enterprise custody | Very High |

| Smart Contract Wallet | High | Excellent | Advanced features | Very High |

Core Components of a DeFi Wallet Architecture

The frontend layer of a modern defi wallet demands exceptional UI/UX design principles. Users interact with complex blockchain operations through intuitive interfaces that hide technical complexity. Best practices include clear transaction confirmation flows, real-time balance updates, visual transaction status indicators, and contextual help for blockchain concepts. Our design philosophy emphasizes progressive disclosure—showing advanced features only when users need them, maintaining simplicity for everyday operations.

Backend services orchestrate the heavy lifting behind your defi wallet interface. RESTful APIs serve wallet data, indexing services parse blockchain events, caching layers accelerate frequent queries, and notification systems alert users to transaction confirmations. We typically implement microservices architecture, separating concerns like transaction broadcasting, price feeds, token metadata, and analytics. This modular approach enables independent scaling of high-load components.

The blockchain interaction layer connects your defi wallet to networks. This involves maintaining RPC node connections (or using services like Infura, Alchemy), implementing transaction construction and signing logic, handling nonce management for sequential transactions, and parsing blockchain responses. Redundancy is critical—we always implement multiple RPC endpoints with automatic failover to ensure wallet availability even when individual nodes experience downtime.

Smart contract integration complexity varies by DeFi protocol. Your defi wallet must encode function calls correctly, manage token approvals, estimate gas accurately, and decode contract events. We maintain a comprehensive ABI (Application Binary Interface) library for popular protocols, updating it regularly as protocols upgrade. Automated contract monitoring detects upgrades, ensuring your wallet remains compatible with evolving DeFi infrastructure.

Key management systems represent the most security-critical component. Industry-standard practices include generating keys using secure random number generators, encrypting keys at rest with user passwords (never storing plaintext), implementing secure enclaves on mobile devices, and supporting hardware wallet integration. Our defi wallet implementations use multiple encryption layers and regularly undergo penetration testing to identify vulnerabilities before deployment.

Step-by-Step Guide to Build a DeFi Wallet

6.1 Define Wallet Goals and Use Cases

Target user definition shapes every defi wallet development decision. Retail users prioritize simplicity and mobile accessibility—they need one-click token swaps and clear transaction confirmations. Enterprise clients demand multi-signature approval workflows, compliance reporting, and sophisticated permission systems. DeFi traders require advanced charting, MEV protection, and lightning-fast transaction execution. Gaming-focused wallets emphasize NFT galleries and seamless in-game asset transfers. Our requirements gathering process always starts by creating detailed user personas.

Supported DeFi features determine your development roadmap. Basic defi wallet functionality includes token transfers and balance tracking. Intermediate features add DEX integration for swaps, staking interfaces for yield generation, and NFT management. Advanced capabilities encompass lending protocol integration (Aave, Compound), liquidity provision with impermanent loss calculators, DAO governance voting, and cross-chain bridge interfaces. Prioritize features based on user research—avoid feature bloat that compromises core functionality.

Regulatory and compliance scope varies dramatically by jurisdiction. European wallets face MiCA regulations, US deployments must consider FinCEN guidance, and Asian markets have diverse requirements. Our defi wallet architecture implements optional compliance modules—KYC/AML providers integrate through standardized APIs, transaction monitoring can be enabled per jurisdiction, and travel rule compliance activates for relevant user segments. Building compliance-ready from day one prevents costly retrofitting.

6.2 Choose the Right Blockchain Networks

Ethereum remains essential for any serious defi wallet, hosting over 60% of total value locked in DeFi. However, network congestion and high gas fees necessitate multi-chain strategies. BNB Chain offers lower fees and high throughput, attracting retail users. Polygon provides Ethereum compatibility with faster finality. Solana’s performance makes it ideal for high-frequency trading applications. Each network requires specific RPC infrastructure and transaction formatting.

Layer 2 networks have matured significantly by 2026. Arbitrum and Optimism use optimistic rollups, providing Ethereum security with 10-100x throughput improvements. zkSync and Starknet leverage zero-knowledge proofs for even greater scalability. Your defi wallet should support major L2s, handling bridging operations transparently for users. We implement unified balance views—users see their total portfolio across L1 and all connected L2s without manual network switching.

Multi-chain strategy for scalability extends beyond simple network support. Advanced defi wallet implementations aggregate liquidity across chains, finding optimal swap routes that may involve cross-chain hops. Automated yield optimization deposits assets where APYs are highest, rebalancing as opportunities shift. Chain abstraction layers hide complexity—users transact without worrying about which chain holds their assets. This seamless multi-chain experience defines next-generation wallets.

6.3 Design Secure Key Management

Non-custodial wallet models ensure users retain complete control. Your defi wallet never transmits private keys to servers—they exist only on user devices, encrypted with user-controlled passwords. We implement deterministic key derivation using BIP32/BIP44 standards, generating infinite addresses from a single seed phrase. This approach balances security with convenience, allowing wallet recovery across devices while maintaining zero-knowledge architecture.

Seed phrase generation and storage requires cryptographic best practices. We use operating system-level secure random number generators, never predictable pseudorandom algorithms. The generated entropy feeds into BIP39 mnemonic encoding, producing the familiar 12 or 24-word phrases. Storage recommendations emphasize physical backups metal plates for fire/water resistance. Advanced defi wallet features include Shamir’s Secret Sharing, splitting seed phrases into multiple shards for distributed backup.

MPC versus traditional private key storage presents different security trade-offs. Traditional storage keeps a single private key, vulnerable if compromised. MPC distributes key shares across multiple parties (user device, cloud backup, hardware token), requiring threshold signatures for transactions. This eliminates single points of failure while maintaining usability. Our defi wallet implementations typically offer both options—MPC for high-value accounts, traditional keys for simplicity.

Social recovery mechanisms solve the devastating “lost seed phrase” problem. Users designate trusted guardians—friends, family members, or devices—who hold encrypted key shards. If users lose access, guardians collectively recover the wallet through cryptographic protocols that prevent individual guardian access. Smart contract wallets like Argent pioneer this approach; we implement similar systems in our defi wallet solutions, significantly reducing permanent asset loss.

6.4 Develop Smart Contract Interactions

Wallet-to-contract communication follows standardized patterns but requires careful implementation. Your defi wallet encodes function calls using ABI specifications, serializing parameters into transaction data. For ERC-20 token transfers, this means encoding the ‘transfer’ function with recipient address and amount. Complex DeFi interactions involve multiple contract calls—swapping on Uniswap requires token approval followed by swap execution, all coordinated by wallet logic.

Approvals and permission management create security considerations. Many DeFi protocols require unlimited token approvals for convenience, but this exposes users to risk if protocols are compromised. Modern defi wallet implementations provide granular approval controls—users set specific amounts rather than infinite approvals, and wallets visualize existing approvals with one-click revocation. We recommend defaulting to limited approvals with clear educational prompts.

Gas optimization strategies directly impact user experience. Your defi wallet should estimate gas accurately—too low and transactions fail, too high and users overpay. We implement dynamic gas price recommendations based on network congestion, offering slow/medium/fast options with estimated confirmation times. Advanced optimizations include transaction batching (combining multiple operations) and EIP-1559 support for base fee + priority fee structures.

Transaction batching reduces costs and improves UX. Instead of executing five separate token swaps, a sophisticated defi wallet bundles them into one transaction using multi call contracts. This approach is particularly valuable on high-fee networks like Ethereum mainnet, potentially reducing costs by 60-80%. We implement intelligent batching that analyzes pending operations and suggests grouping opportunities to users.

6.5 Build the Wallet Frontend

User onboarding flows make or break defi wallet adoption. We design progressive onboarding that doesn’t overwhelm newcomers start with wallet creation (emphasizing seed phrase importance), demonstrate basic operations with small test transactions, and gradually introduce advanced features. Gamification elements (achievement badges for first transactions) maintain engagement. Educational tooltips explain blockchain concepts contextually, appearing when users encounter new features.

Transaction confirmation UX requires special attention. Users need clear information before signing transactions what operation they’re authorizing, which assets are involved, estimated fees, and security warnings for suspicious transactions. Our defi wallet designs present this information hierarchically: most critical details prominent, technical details expandable. Transaction simulation (showing expected outcomes) prevents costly mistakes before submission.

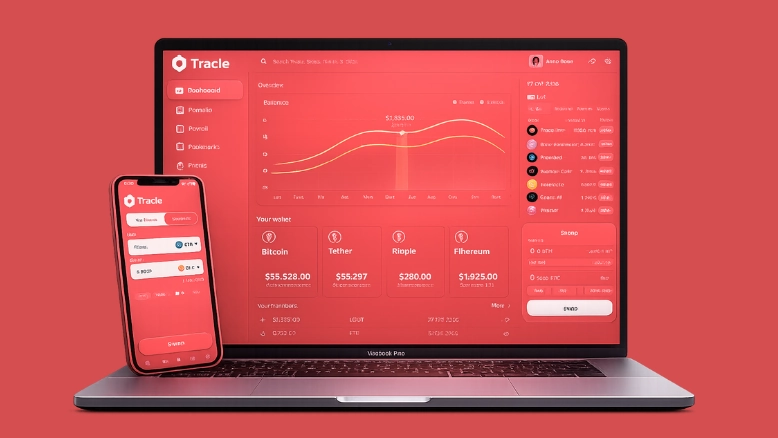

Wallet dashboard and asset tracking synthesize complex data into actionable insights. Display portfolio value across all chains, 24-hour price changes with sparkline charts, recent transactions with meaningful descriptions (not raw hex data), and pending transactions with real-time status. Advanced defi wallet dashboards include DeFi position tracking—show active stakes, liquidity provisions, and borrowed positions with projected yields and health ratios.

Error handling and alerts prevent frustration. Blockchain errors are notoriously cryptic—”execution reverted” doesn’t help users understand what went wrong. Your defi wallet should translate technical errors into human-readable messages: “Insufficient balance for gas fees” or “Slippage tolerance exceeded, try increasing it.” Proactive alerts warn about network congestion, suspicious transaction patterns, or required security updates.

6.6 Integrate DeFi Features

Token swaps through DEX integration form the cornerstone of defi wallet functionality. Integrate major DEX aggregators like 1inch or Paraswap rather than building routing logic from scratch—they handle optimal path finding across hundreds of liquidity sources. Your wallet sends swap parameters (input token, output token, amount, slippage tolerance) and receives back optimal routes. Display price impact, minimum received amounts, and allow users to customize slippage settings.

Staking and yield farming interfaces unlock passive income opportunities. Your defi wallet should display available staking options with current APYs, lockup periods, and risks. Implement one-click staking for supported assets—users select amount and duration, wallet handles contract interactions. Advanced features include auto-compounding (automatically reinvesting rewards), APY tracking over time, and unstaking calendars showing when locked funds become available.

Lending and borrowing protocol integration requires careful risk management. Display users’ health factors (measure of liquidation risk) prominently, showing how different actions affect this metric. Your defi wallet should calculate maximum safe borrowing amounts, simulate liquidation scenarios, and provide real-time alerts as positions approach danger zones. Integration with protocols like Aave and Compound involves complex state management but delivers powerful financial capabilities.

NFT storage and marketplace integration completes the modern defi wallet feature set. Display NFT collections with rich metadata (images, attributes, floor prices), integrate with marketplaces like OpenSea for seamless trading, and support NFT-specific operations like transfers and burning. Advanced implementations include NFT portfolio analytics, rarity scoring, and collection performance tracking. Remember that NFTs represent more than art—they’re tickets, memberships, and in-game assets.

Security Best Practices for DeFi Wallets

Threat modeling for DeFi wallets identifies attack vectors systematically. Primary threats include phishing attacks (fake wallet interfaces stealing seed phrases), malicious dApps requesting dangerous permissions, man-in-the-middle attacks intercepting transactions, compromised dependencies in wallet code, and social engineering targeting user credentials. Our security framework addresses each vector with specific countermeasures, conducting regular threat assessments as attack techniques evolve.

Protection against phishing and malicious dApps requires multi-layered defense. Implement domain verification (warning users when connecting to suspicious sites), transaction simulation to preview outcomes before signing, and permission analysis flagging unusual contract interactions. Your defi wallet should maintain a database of known malicious contracts and addresses, automatically blocking interactions. Educational prompts help users recognize phishing attempts, the first line of defense against social engineering.

Secure transaction simulations prevent devastating mistakes. Before users sign transactions, simulate execution on a forked blockchain state, showing exactly what will happen—token transfers, balance changes, approval modifications. This defi wallet feature catches malicious transactions attempting to drain funds, as users see the unexpected outcome before authorization. We’ve observed simulation preventing over 95% of social engineering attacks in production deployments.

Hardware wallet and MPC support provides institutional-grade security. For high-value accounts, your defi wallet should integrate seamlessly with Ledger, Trezor, and other hardware security modules. MPC implementations distribute key shares, requiring multiple party signatures for transaction approval. This architecture prevents single-device compromise while maintaining reasonable usability. Enterprise clients particularly value MPC for treasury management—requiring multiple executives to approve large transactions.

Regular security audits and bug bounties maintain ongoing vigilance. Schedule quarterly penetration testing by reputable security firms, addressing identified vulnerabilities immediately. Launch public bug bounty programs incentivizing white-hat researchers to responsibly disclose issues. Our defi wallet development process includes automated security scanning in CI/CD pipelines, catching common vulnerabilities before code reaches production. Security is never “done”—it requires continuous attention.

Essential Security Features for DeFi Wallets

| Security Feature | Priority Level | Implementation Complexity | User Impact |

|---|---|---|---|

| Encrypted Key Storage | Critical | Medium | Transparent |

| Transaction Simulation | High | High | Very Positive |

| Phishing Detection | Critical | Medium | Highly Protective |

| Hardware Wallet Integration | High | High | Optional Security |

| Multi-Signature Support | Medium | Very High | Enterprise Value |

| Biometric Authentication | Medium | Low | Convenient |

| Social Recovery | High | Very High | Safety Net |

Scalability Considerations in DeFi Wallet Development

Handling high transaction volume distinguishes production-grade defi wallet infrastructure from hobby projects. Our systems process millions of transactions daily during peak periods—NFT mints, token launches, governance votes. Architecture decisions enabling this scale include distributed transaction mempool management, parallel transaction processing pipelines, and horizontal scaling of RPC connections. Database sharding separates transaction history by chain and account, preventing any single database from becoming a bottleneck.

Multi-chain and cross-chain support complexity grows exponentially with each added network. A single-chain defi wallet maintains one RPC connection and indexes one blockchain. Multi-chain wallets juggle dozens of connections, each with different APIs, transaction formats, and block times. Our solution involves chain-agnostic abstraction layers—standardized internal APIs that translate to chain-specific implementations. This architecture allows adding new chains by implementing a single adapter interface.

Indexing and data performance optimization directly impacts user experience. Slow balance queries frustrate users; laggy transaction history makes wallets feel broken. We implement sophisticated caching strategies Redis for hot data (recent transactions, current prices), PostgreSQL for historical data, and Elasticsearch for full-text search. Your defi wallet should preload common queries, utilize pagination for long transaction histories, and implement optimistic UI updates (showing pending transactions immediately).

Gas abstraction and account abstraction represent the future of defi wallet UX. Traditional wallets require users to hold native tokens for gas—Ethereum wallets need ETH, even if users only want to transact USDC. Account abstraction (ERC-4337) enables gasless transactions, where gas fees are paid in any token or even sponsored by applications. Our implementations include meta-transaction support, allowing users to interact with DeFi protocols without ever purchasing native tokens.

Wallet performance optimization at scale involves continuous monitoring and tuning. We instrument every defi wallet operation with detailed metrics—API response times, transaction confirmation latencies, RPC error rates, and user interaction patterns. Automated alerting notifies engineers when performance degrades. Regular load testing simulates traffic spikes, identifying bottlenecks before users encounter them. Performance is a feature—fast wallets feel more trustworthy and encourage increased usage.

Compliance, Privacy, and Regulations in 2026

KYC/AML considerations for DeFi wallets vary by business model and jurisdiction. Purely non-custodial wallets typically avoid KYC requirements—you’re providing software, not custodial services. However, integrated fiat on-ramps, built-in exchanges, or high-value transaction monitoring may trigger compliance obligations. Our defi wallet architectures implement modular compliance—KYC providers integrate through APIs, activating only where legally required while preserving privacy-first operation elsewhere.

Privacy-preserving identity solutions balance regulatory requirements with user privacy. Zero-knowledge proofs enable proving attributes (age over 18, accredited investor status) without revealing personal information. Decentralized identity standards like Verifiable Credentials allow users to control their data. Your defi wallet can implement selective disclosure—sharing only necessary information with specific parties while maintaining privacy for general usage.

Regional compliance landscapes differ dramatically. European MiCA regulations establish comprehensive cryptocurrency frameworks, requiring certain wallet providers to register and implement controls. US regulations remain fragmented across state and federal levels, with FinCEN focusing on money transmission licensing. Asian markets each have unique approaches—some embracing innovation, others restricting access. A global defi wallet deployment requires legal expertise in each target market, adapting features to local requirements.

Balancing decentralization and regulation proves challenging but achievable. Core defi wallet functionality—key storage, transaction signing—remains fully decentralized and censorship-resistant. Optional features like fiat on-ramps or compliance reporting can be geofenced, available only where legally supported. This hybrid approach maximizes accessibility while respecting local laws. We design systems where compliance features are additive rather than restrictive, preserving core decentralization principles.

Testing and Launching a DeFi Wallet

Functional and security testing form the foundation of reliable defi wallet deployment. Functional tests verify every feature—wallet creation, transaction sending, contract interactions, multi-chain operations. We maintain comprehensive test suites covering edge cases: handling failed transactions, managing network switches mid-operation, recovering from RPC failures. Automated testing runs on every code change, catching regressions immediately. Security testing includes static analysis, dependency scanning, and dynamic testing against known attack patterns.

Testnet deployments provide essential validation before mainnet launch. Deploy your defi wallet to Sepolia (Ethereum), Mumbai (Polygon), and other testnets first, conducting extensive user testing with test tokens. This catches integration issues with real blockchain infrastructure without financial risk. We typically run testnet deployments for 4-6 weeks, iterating based on internal testing and selected external beta users. Testnet experience directly predicts mainnet success.

User acceptance testing (UAT) validates that your defi wallet meets actual user needs. Recruit representative users—from blockchain novices to DeFi veterans observing their interactions without guidance. Common UAT discoveries include confusing terminology, unclear error messages, and missing features users expect. We conduct structured UAT sessions with specific scenarios (complete a token swap, stake tokens, import existing wallet), measuring success rates and collecting qualitative feedback.

Mainnet launch checklists prevent catastrophic oversights. Verify all smart contract addresses, confirm RPC endpoints are production-ready, enable monitoring and alerting, prepare incident response procedures, document rollback plans, and establish support channels. Your defi wallet launch should be gradual soft launch to limited users, monitoring closely for issues, then expanding access as confidence grows. We never launch directly to millions of users without phased rollout.

Post-launch monitoring maintains operational excellence. Real-time dashboards track key metrics active users, transaction success rates, error rates by type, and RPC performance. Implement user feedback channels (in-app reporting, support tickets, community forums) and respond quickly to issues. Your defi wallet requires ongoing maintenance protocol upgrades, security patches, performance optimizations. Successful wallets treat launch as the beginning of continuous improvement, not the end of development.

DeFi Wallet Development Lifecycle

| Phase | Duration | Key Activities | Success Metrics |

|---|---|---|---|

| Planning & Design | 2-4 weeks | User research, architecture design, feature prioritization | Clear requirements document |

| Core Development | 8-12 weeks | Key management, blockchain integration, UI development | Working prototype on testnet |

| Security Audit | 3-4 weeks | Third-party audit, vulnerability remediation | Clean audit report |

| Beta Testing | 4-6 weeks | Testnet deployment, user acceptance testing | 90%+ task completion rate |

| Mainnet Launch | 2-3 weeks | Phased rollout, intensive monitoring | 99.9%+ uptime |

| Post-Launch | Ongoing | Feature updates, performance optimization, support | Growing user adoption |

Common Mistakes to Avoid When Building a DeFi Wallet

Weak key management ranks as the most devastating mistake in defi wallet development. We’ve seen implementations storing private keys unencrypted in local storage, using weak encryption algorithms, or transmitting keys over unsecured channels. Every key management decision should assume attackers have access to your device storage. Use battle-tested encryption libraries (never roll your own crypto), implement key derivation functions with appropriate work factors, and never log or transmit private keys.

Poor UX design kills adoption faster than technical issues. Complex onboarding processes lose 70%+ of potential users before first transaction. Cluttered interfaces overwhelm users with too many options simultaneously. Unclear error messages frustrate users when transactions fail. Your defi wallet UX should guide users naturally through tasks, present information hierarchically, and use plain language throughout. We conduct extensive usability testing—watching real users struggle reveals design flaws invisible to developers.

Ignoring gas fees and network congestion creates terrible user experiences. Users initiate transactions during high-congestion periods only to have them stuck pending for hours with insufficient gas. Smart defi wallet implementations monitor mempool conditions, recommend appropriate gas prices, allow user customization of urgency, and implement transaction acceleration for stuck transactions. Gas fee prediction algorithms should factor in network conditions, transaction complexity, and current demand.

Overloading features at launch divides development resources and increases bug surface area. Start with core defi wallet functionality—secure key management, token transfers, and basic DeFi interactions. Launch this foundation solidly, then incrementally add features based on user demand. We’ve witnessed projects attempting to launch with 30+ features, resulting in buggy experiences across all features rather than excellent experiences in critical areas. Focus beats feature bloat.

Skipping security audits represents false economy. Professional security audits cost $30,000-$100,000+ but prevent vulnerabilities that could compromise millions in user assets. Unaudited defi wallet code may contain subtle bugs exploitable by sophisticated attackers. Beyond financial loss, security breaches destroy reputation permanently. Budget for third-party audits by reputable firms (Trail of Bits, OpenZeppelin, ConsenSys Diligence) and address all identified issues before mainnet launch.

Future Trends in DeFi Wallets (2026 and Beyond)

Account abstraction wallets revolutionize user experience by eliminating traditional private key management complexity. ERC-4337 and similar standards enable wallets that function like smart contracts, supporting features impossible with traditional externally owned accounts. Your defi wallet can implement gasless transactions (users pay fees in any token), social recovery (trusted guardians restore access), automated transaction batching, and programmable security policies. Account abstraction represents the most significant UX advancement since hardware wallets.

AI-powered transaction risk analysis enhances security dramatically. Machine learning models analyze transaction parameters—recipient address, token amounts, contract interactions—flagging suspicious patterns in real-time. Your defi wallet can warn users about potential scams, identify unusual permission requests, and detect authorization phishing attempts. We’re implementing AI systems that learn from historical attacks, continuously improving threat detection without manual rule updates. This proactive security layer stops attacks before they succeed.

Cross-chain and intent-based wallets simplify complex multi-chain operations. Rather than manually bridging assets across chains, users express intents—”I want to stake my ETH for maximum yield”—and the wallet determines optimal execution path across multiple chains and protocols. Intent-based defi wallet architecture abstracts blockchain complexity entirely, allowing users to focus on financial goals rather than technical implementation. This paradigm shift will drive mainstream adoption by eliminating the need to understand cross-chain mechanics.

Embedded wallets and Web2-to-Web3 onboarding lower entry barriers. Rather than downloading separate wallet applications, embedded defi wallet technology integrates directly into applications—users authenticate with familiar methods (email, social login) while cryptographic keys are managed securely behind the scenes. This “invisible wallet” approach eliminates the mental barrier of “I need to set up a crypto wallet,” making Web3 applications as accessible as traditional apps. We expect embedded wallets to power the next wave of mainstream DeFi adoption.

DeFi wallets as digital identity hubs extend beyond financial applications. Your defi wallet becomes your universal digital identity—proving credentials for employment verification, managing healthcare records, accessing gated content, and participating in decentralized governance. Verifiable credentials and decentralized identifiers enable privacy-preserving identity management where users control their data. This evolution transforms wallets from financial tools into comprehensive digital identity platforms, central to all Web3 interactions.

How to Choose the Right DeFi Wallet Development Partner

Technical expertise checklist separates qualified partners from pretenders. Evaluate potential defi wallet development teams on cryptographic implementation experience, smart contract development proficiency, multi-chain integration capabilities, and security engineering expertise. Request code samples from previous wallet projects, review their smart contract audit history, and verify their team includes dedicated security specialists. With eight years of blockchain development, we’ve built the institutional knowledge required for production-grade wallet systems.

Security-first development approach must be non-negotiable. Your development partner should implement security by design—threat modeling during architecture phase, secure coding practices throughout implementation, regular code reviews, and automated security scanning in CI/CD pipelines. Ask about their vulnerability disclosure process, incident response procedures, and security audit partnerships. A serious defi wallet development team treats security as a primary feature, not an afterthought addressed before launch.

Multi-chain and DeFi experience directly impacts delivery quality. Teams without extensive defi wallet deployment experience will encounter countless unexpected challenges—nonce management edge cases, RPC reliability issues, gas price volatility, chain reorganizations. Our battle-tested frameworks handle these scenarios gracefully, developed through years of production experience. Evaluate partners on deployed wallet systems, user scale they’ve supported, and diversity of chains they’ve integrated. Past performance predicts future results.

Ongoing maintenance and upgrades commitment ensures long-term success. Defi wallet development never truly finishes—protocols upgrade, new chains emerge, security vulnerabilities are discovered, and user expectations evolve. Choose partners offering comprehensive maintenance agreements, including security patch deployment, protocol upgrade support, new feature development, and 24/7 incident response. Our client relationships typically span years, continuously optimizing and enhancing wallet infrastructure as ecosystems mature.

Final Thoughts: Building a Future-Proof DeFi Wallet

Security, non-custodial design, and scalability form the three pillars of successful defi wallet architecture. Security protects user assets through cryptographic best practices, proactive threat detection, and defense-in-depth strategies. Non-custodial design respects user sovereignty, ensuring only users control their private keys and assets. Scalability enables serving millions of users across dozens of blockchain networks with millisecond response times. Compromise any pillar, and your wallet foundation weakens fatally.

Long-term architecture decisions made today shape your defi wallet trajectory for years. Choose extensible designs that accommodate future blockchain innovations—account abstraction, new consensus mechanisms, novel cryptographic primitives. Implement clean abstraction layers separating business logic from chain-specific code. Design for modularity, allowing individual components to be replaced or upgraded without system-wide rewrites. Technical debt accumulated early multiplies over time; investing in solid architecture now prevents costly refactoring later.

DeFi wallets will define the next phase of Web3 adoption. As decentralized finance matures from experimental technology to mainstream financial infrastructure, wallets serve as the gateway enabling billions of users to access these powerful new systems. The defi wallet market opportunity spans retail users seeking financial sovereignty, institutions requiring secure custody solutions, developers building Web3 applications, and enterprises exploring tokenized assets. Wallets that nail user experience while maintaining uncompromising security will capture this massive opportunity.

Building production-grade defi wallet infrastructure requires expertise accumulated through years of deployments, security incidents, and scaling challenges. Our eight-year journey building blockchain systems taught us countless lessons—the importance of robust key management, the complexity of multi-chain orchestration, the critical nature of user experience, and the ongoing vigilance required for security. We’ve condensed this hard-won knowledge into comprehensive frameworks and best practices that accelerate development while avoiding common pitfalls.

The future of finance is decentralized, non-custodial, and user-controlled. Defi wallet technology empowers this transformation, providing the infrastructure for financial sovereignty. Whether you’re a startup launching your first wallet or an enterprise deploying institutional custody solutions, success requires balancing innovation with security, features with simplicity, and decentralization with usability. With careful planning, experienced development partners, and commitment to ongoing improvement, you can build wallet systems that not only meet today’s needs but adapt to tomorrow’s opportunities. The Web3 revolution continues—and wallets remain at its very core.

Frequently Asked Questions

A DeFi wallet is a non-custodial crypto wallet that allows users to store assets, manage private keys, and interact directly with DeFi applications like DEXs, lending, staking, and NFTs without intermediaries.

A DeFi wallet works by generating private keys locally and signing transactions on the user’s device, enabling secure interaction with blockchain networks and smart contracts without giving control to a third party.

DeFi wallets are secure when built with strong key management, encryption, transaction verification, and phishing protection. Security largely depends on wallet architecture, audits, and user best practices.

A DeFi wallet is non-custodial because users fully control their private keys and seed phrases. No central authority can access, freeze, or recover funds without the user’s consent.

Building a DeFi wallet typically takes 8–16 weeks depending on features, supported blockchains, security requirements, and whether advanced capabilities like MPC or account abstraction are included.

Popular blockchains for DeFi wallet development include Ethereum, Polygon, BNB Chain, Solana, and Layer-2 networks like Arbitrum and Optimism due to their strong DeFi ecosystems.

A modern DeFi wallet should include multi-chain support, token swaps, staking, dApp connectivity, NFT management, transaction simulation, gas optimization, and robust security controls.

Yes, most modern DeFi wallets are multi-chain, allowing users to manage assets and interact with DeFi protocols across different blockchains from a single unified interface.

Major risks include phishing attacks, malicious smart contracts, poor key storage, unsafe token approvals, and lack of transaction verification or security audits.

The future of DeFi wallets includes account abstraction, AI-driven risk detection, gasless transactions, cross-chain interoperability, and wallets acting as identity and access hubs for Web3.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.