Key Takeaways

- Bitcoin ETFs allow investors to access Bitcoin without handling wallets or private keys.

- They offer regulated, secure, and liquid exposure to digital assets.

- ETFs provide diversification opportunities beyond direct Bitcoin ownership.

- Top ETFs for 2026 include BITO, GBTC, XBTF, BITA, BTCW, FBTC, and ARKB.

- Choosing the right ETF requires assessing fund type, fees, liquidity, and compliance.

- Crypto ETFs reflect the growing maturity and transparency of the crypto exchange market.

What is a Bitcoin Exchange-Traded Fund (ETF)?

A Bitcoin Exchange-Traded Fund (ETF) is a regulated financial product that allows investors to gain exposure to Bitcoin without directly buying or storing the cryptocurrency. Instead of purchasing Bitcoin from cryptocurrency exchanges or managing digital wallets, investors buy shares of a fund that tracks Bitcoin’s price.

These ETF shares are traded on traditional stock exchanges, just like shares of companies. This structure makes crypto ETFs an attractive option for people who want to participate in the crypto market while staying within familiar financial systems.

Unlike direct Bitcoin purchases through Bitcoin exchanges, ETFs remove the complexity of private keys, wallets, and blockchain transactions. This simplicity is one of the main reasons crypto ETFs are gaining popularity among both new and traditional investors.

How Does a Bitcoin ETF Work?

A Bitcoin ETF works by holding Bitcoin (or Bitcoin futures) on behalf of investors. Each ETF share represents a portion of that holding. When Bitcoin’s price moves, the value of the ETF share moves accordingly.

Because ETFs are traded on regulated exchanges, they offer a more structured alternative to buying Bitcoin through crypto trading platforms or browsing a crypto exchange list to find a suitable provider. Investors can buy or sell ETF shares during market hours using standard brokerage accounts.

This model bridges the gap between traditional finance and digital assets, making crypto ETFs one of the most accessible entry points into Bitcoin investing.

Bitcoin ETFs vs Buying Bitcoin Directly

When comparing Bitcoin ETFs with buying Bitcoin directly from cryptocurrency exchanges, the difference lies in ownership, responsibility, and risk management.

Buying Bitcoin directly requires choosing from various bitcoin exchanges, managing wallets, securing private keys, and understanding blockchain transactions. In contrast, Bitcoin ETFs handle custody, storage, and compliance on behalf of the investor.

For investors who value simplicity and regulatory oversight, ETFs offer a smoother experience, especially compared to navigating multiple crypto trading platforms with varying fee structures and security standards.

Why Invest in a Bitcoin ETF Instead of Direct Bitcoin?

Ease of Access

Bitcoin ETFs are traded on traditional stock exchanges, making them accessible through standard brokerage accounts. Investors don’t need to evaluate which is the best crypto app for trading or worry about wallet compatibility.

Regulated Environment

Unlike some crypto platforms, ETFs operate within a regulated crypto exchange framework. Regulatory oversight improves transparency, reporting, and investor protection, which is especially important for risk-averse users.

Improved Security

While many exchanges promote themselves as a secure crypto exchange, ETFs reduce individual security responsibilities. Custody is handled by professional institutions, lowering the risk of hacks or key loss.

Diversification Opportunities

Some crypto ETFs include Bitcoin futures or blockchain-related assets, offering diversification that isn’t available when buying Bitcoin directly.

Liquidity and Tax Simplicity

ETFs generally provide high liquidity, allowing easy buying and selling without major price slippage. Additionally, tax reporting is often simpler compared to tracking transactions across multiple bitcoin exchanges.

| ETF | Type | Key Highlights | Liquidity |

|---|---|---|---|

| ProShares (BITO) | Futures-Based | First U.S. Bitcoin ETF High Trading Volume |

High |

| Grayscale (GBTC) | Bitcoin Trust | Large Bitcoin Holdings Institutional Favorite |

Medium |

| VanEck (XBTF) | Futures-Based | Tax-Efficient Futures Strategy |

Medium |

| Invesco (BITA) | Futures-Based | Institutional Focus Risk Managed Fund |

Medium |

| WisdomTree (BTCW) | Spot-Based | Low Cost Direct Bitcoin Exposure |

High |

| Fidelity (FBTC) | Spot-Based | Fidelity Security Trusted Custody |

High |

| ARK Invest (ARKB) | Futures-Based | Innovation-Driven High Growth Potential |

Medium |

Which Is the Best Bitcoin Trading Platform?

For investors who prefer direct ownership or want to explore trading alongside ETFs, choosing from the best crypto exchanges is an important step. The ideal platform depends on fees, usability, and security.

Coinbase

Coinbase is widely considered the best crypto exchange for beginners. Its clean interface, strong compliance standards, and educational tools make it ideal for users new to Bitcoin investing.

Binance

Binance is one of the most popular crypto trading platforms globally. It offers advanced trading tools, a large asset selection, and competitive fees, appealing to experienced traders and those seeking the lowest fee crypto exchange.

Kraken

Kraken is known for robust security and transparent pricing. It’s often preferred by users who prioritize safety while still accessing advanced features.

Gemini

Gemini focuses heavily on compliance and regulation, making it a strong choice for investors looking for a regulated crypto exchange with a conservative approach to crypto trading.

eToro

eToro stands out for its social trading features, allowing users to copy trades from experienced investors. This makes it appealing to users exploring Bitcoin without deep technical knowledge.

7 Best Bitcoin ETFs to Consider in 2026

As institutional adoption of digital assets continues to mature, crypto ETFs have become a core instrument for professional and long-term investors seeking regulated Bitcoin exposure. This trend mirrors the ongoing crypto exchange market growth, with more players entering the space, better liquidity, and clearer regulations shaping the industry. By 2026, the market for the best crypto exchange traded fundss is expected to be more competitive, transparent, and liquidity-driven than ever before. Below is a curated list of Bitcoin ETFs that stand out based on structure, liquidity, regulatory alignment, and institutional credibility.

1. ProShares Bitcoin Strategy ETF (BITO)

BITO remains one of the most established Bitcoin-related ETFs, primarily based on CME Bitcoin futures contracts. Its early-mover advantage has resulted in strong liquidity and consistent trading volume, making it a preferred choice among institutional traders.

While futures-based exposure can introduce tracking differences during volatile periods, BITO’s deep market participation and strong regulatory compliance keep it relevant in the crypto ETFs ecosystem. For investors prioritizing liquidity and active trading, BITO continues to be one of the best crypto ETFs available.

2. Grayscale Bitcoin Trust (GBTC)

GBTC has long been a dominant player in institutional Bitcoin exposure. Unlike traditional ETFs, it originated as a trust, but ongoing structural improvements and regulatory alignment have strengthened its position.

GBTC offers large-scale Bitcoin holdings, making it attractive for investors seeking substantial exposure. However, investors should closely evaluate management fees and NAV premiums or discounts. Despite this, GBTC remains a key benchmark when analyzing best crypto ETFs for long-term Bitcoin allocation.

3. VanEck Bitcoin Strategy ETF (XBTF)

XBTF stands out for its tax-efficient structure and strategic futures exposure. VanEck’s reputation in traditional asset management adds credibility, especially for investors transitioning from conventional ETFs into crypto ETFs.

This fund is particularly appealing to sophisticated investors who understand futures roll costs and are seeking regulated Bitcoin exposure without direct custody risks. XBTF’s disciplined approach places it firmly among the best crypto ETFs for advanced portfolio construction.

4. Invesco Bitcoin Strategy ETF (BITA)

BITA leverages Invesco’s global ETF expertise to offer a futures-based Bitcoin strategy with a focus on institutional-grade risk management. Its design emphasizes consistency, transparency, and regulatory clarity.

Although it may not always match spot Bitcoin performance precisely, BITA is optimized for investors who prioritize compliance and systematic exposure. In diversified portfolios, BITA serves as a stabilizing component within the broader crypto ETFs category.

5. WisdomTree Bitcoin ETF (BTCW)

WisdomTree has positioned BTCW as a cost-conscious and structurally efficient Bitcoin ETF. Known for innovative ETF products, WisdomTree focuses on minimizing operational inefficiencies that often affect futures-based funds.

BTCW appeals to investors seeking long-term exposure with controlled expenses, making it a strong contender among the best crypto ETFs. Its emphasis on transparency and risk-adjusted performance aligns well with institutional investment standards.

6. Fidelity Bitcoin ETF (FBTC)

FBTC benefits significantly from Fidelity’s deep involvement in digital asset custody and institutional crypto services. This ETF is designed for investors who demand robust infrastructure, secure asset handling, and regulatory assurance.

Fidelity’s strong compliance framework and operational maturity make FBTC one of the most trusted crypto ETFs in the market. For risk-aware investors prioritizing institutional-grade security, FBTC ranks high among the best crypto ETFs to consider in 2026.

7. ARK Invest Bitcoin ETF (ARKB)

ARKB reflects ARK Invest’s high-conviction approach toward disruptive innovation. Unlike traditional asset managers, ARK integrates Bitcoin into a broader thesis on technological transformation and decentralized finance.

ARKB may experience higher volatility, but it offers asymmetric upside potential for investors with a higher risk tolerance. For those aligning Bitcoin exposure with innovation-driven strategies, ARKB remains one of the more dynamic options within the crypto ETFs landscape.

Build a Future-Ready Crypto Exchange for the ETF-Driven Market

Build a Secure, Scalable Crypto Exchange for Modern Investors

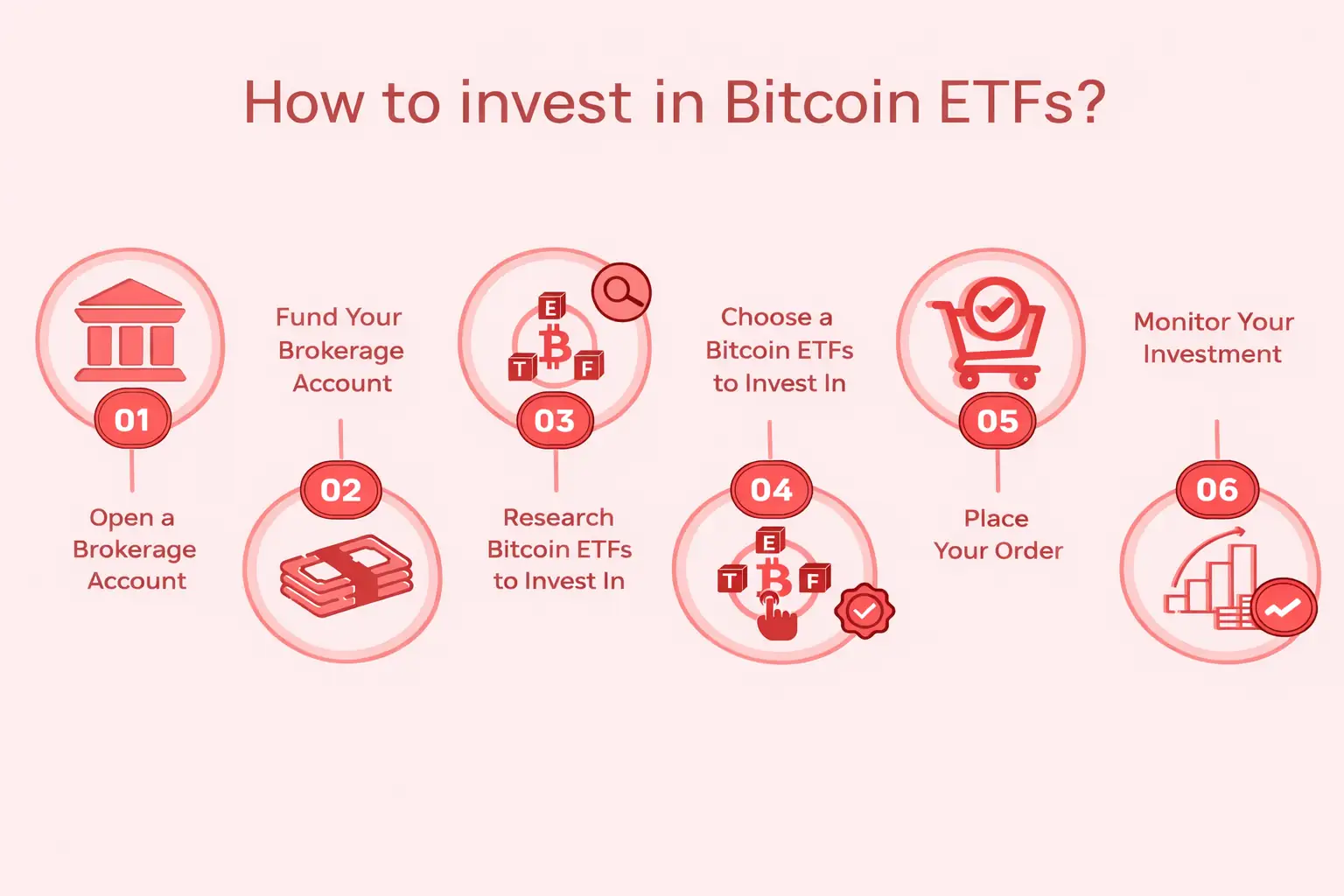

How to Choose the Best Bitcoin ETF

Choosing the right Bitcoin ETF requires the same mindset as selecting the best crypto exchange for beginners or the lowest fee crypto exchange clarity on goals and costs.

1. Fund Type: Futures vs Spot

- Spot ETFs- Directly track Bitcoin price

- Futures ETFs- Track Bitcoin futures contracts

Beginners usually prefer spot-based exposure for simplicity.

2. Expense Ratio

Lower fees mean better long-term returns. This mirrors how traders compare fees on bitcoin exchanges or look for the lowest fee crypto exchange.

3. Liquidity & Trading Volume

High trading volume ensures smooth buying and selling, similar to choosing the best crypto app for trading with fast execution.

4. Regulatory Compliance

Always prefer ETFs backed by strong regulatory oversight. This aligns with the user intent behind searches like secure crypto exchange and regulated crypto exchange.

Benefits of Investing in a Bitcoin ETF

Investing in crypto ETFs has become a popular choice for people who want exposure to Bitcoin without directly dealing with wallets, private keys, or complex Bitcoin exchanges. For many investors, especially beginners, Bitcoin ETFs bridge the gap between traditional finance and cryptocurrency investing.

Ease of Access

One of the biggest advantages of crypto ETFs is accessibility. Unlike buying Bitcoin through crypto trading platforms, ETFs are traded on traditional stock exchanges. Investors can buy or sell ETF shares using the same brokerage account they already use for stocks or mutual funds.

This eliminates the need to sign up on multiple crypto trading platforms or search through a long crypto exchange list just to get started.

Regulated Environment

Bitcoin ETFs operate within a regulated financial framework. Compared to unregulated or offshore platforms, ETFs provide a safer entry point. This is especially important for users searching for a regulated crypto exchange or a secure crypto exchange, as ETFs follow compliance standards, audits, and reporting requirements.

Diversification

Some crypto ETFs don’t just hold Bitcoin directly; they may include futures contracts or related blockchain assets. This provides built-in diversification, which is difficult to achieve when buying Bitcoin directly through Bitcoin exchanges.

Liquidity

ETFs usually offer high liquidity, meaning investors can enter or exit positions easily. Unlike some crypto platforms where liquidity varies, ETFs reduce the risk of price slippage an important factor when comparing the best crypto exchanges or doing a crypto exchange comparison.

Tax Efficiency

In many regions, ETFs simplify tax reporting compared to direct crypto trading. Investors who prefer traditional reporting structures often choose ETFs over navigating taxes across multiple crypto trading platforms.

Risks and Considerations of Bitcoin ETFs

While crypto ETFs offer convenience, they are not risk-free. A balanced understanding is essential, especially for investors transitioning from beginner to intermediate level.

Price Volatility

Bitcoin ETFs still track Bitcoin’s price, which means volatility remains. Even if you avoid the risks of a poorly secured exchange, market swings can still impact ETF value.

Management & Expense Fees

Unlike holding Bitcoin directly, ETFs charge management fees. When comparing ETFs, this is similar to checking a crypto exchange fee comparison before choosing a platform.

Tracking Error

Some ETFs may not perfectly match Bitcoin’s spot price, especially futures-based funds. This tracking gap can impact returns over time.

Market Liquidity Risks

Although ETFs are liquid, extreme market conditions can affect pricing similar to issues seen on even the best crypto exchanges during high volatility periods.

Frequently Asked Questions

A Bitcoin Exchange-Traded Fund (ETF) is a regulated financial product that lets investors gain exposure to Bitcoin without buying or storing the cryptocurrency directly. Instead of using crypto trading platforms or managing digital wallets, investors purchase shares of a fund that tracks Bitcoin’s price. Each ETF share represents a portion of Bitcoin or Bitcoin futures held by the fund, and its value moves with Bitcoin’s market price. ETFs are traded on traditional stock exchanges, allowing investors to buy or sell shares through standard brokerage accounts. This structure makes Bitcoin ETFs an accessible and regulated way to invest in Bitcoin while avoiding the complexity of private keys, wallets, and blockchain transactions.

When comparing Bitcoin ETFs with buying Bitcoin directly, the key differences are in ownership, responsibility, and risk management. Buying Bitcoin directly requires managing wallets, securing private keys, and navigating cryptocurrency exchanges. In contrast, Bitcoin ETFs handle custody, storage, and regulatory compliance on behalf of investors. ETFs offer a simpler and more regulated approach, providing a safer and more convenient way to invest in Bitcoin. For those who value ease of access, professional oversight, and reduced security risks, Bitcoin ETFs are generally a better choice than directly purchasing Bitcoin from crypto trading platforms.

By 2026, some of the best crypto ETFs are expected to dominate the market due to strong liquidity, regulatory compliance, and institutional credibility. Notable options include ProShares Bitcoin Strategy ETF (BITO), Grayscale Bitcoin Trust (GBTC), VanEck Bitcoin Strategy ETF (XBTF), Invesco Bitcoin Strategy ETF (BITA), WisdomTree Bitcoin ETF (BTCW), Fidelity Bitcoin ETF (FBTC), and ARK Invest Bitcoin ETF (ARKB). These ETFs reflect the growth of the crypto exchange market and offer investors regulated exposure to Bitcoin through a structured and accessible platform. Each ETF has unique features such as futures-based strategies, cost-efficiency, or innovation-driven upside potential, catering to both beginner and institutional investors.

Choosing the best Bitcoin ETF requires evaluating several factors. Investors should consider the fund type, such as spot ETFs that track Bitcoin’s price directly or futures ETFs that track Bitcoin futures contracts. The expense ratio is important because lower fees maximize long-term returns, similar to selecting the lowest fee crypto exchange. Liquidity and trading volume ensure smooth buying and selling, and strong regulatory compliance provides investor protection, similar to a secure crypto exchange. By analyzing these factors, investors can select a Bitcoin ETF that aligns with their goals, risk tolerance, and portfolio strategy.

Bitcoin ETFs are generally considered safer than buying Bitcoin directly because they operate within regulated financial frameworks. Professional institutions manage custody and storage, reducing risks such as hacks, lost private keys, or platform security breaches. ETFs also provide transparent reporting, oversight, and compliance, similar to a regulated crypto exchange. However, they are not risk-free, as investors are still exposed to Bitcoin’s price volatility, potential management fees, and tracking errors that can occur in futures-based ETFs. Overall, ETFs offer a more secure and convenient way to gain Bitcoin exposure compared to direct purchases on crypto trading platforms.

Yes, Bitcoin ETFs are traded on traditional stock exchanges, which means investors can purchase them through most standard brokerage accounts. This makes Bitcoin ETFs highly accessible, eliminating the need to register on multiple crypto trading platforms or manage private wallets. Investing via brokerage accounts also simplifies tax reporting and provides exposure to Bitcoin within a regulated framework, making ETFs a convenient option for both beginners and experienced investors seeking a regulated crypto investment.

The main benefits of investing in Bitcoin ETFs over crypto exchanges include ease of access, regulatory oversight, improved security, diversification, liquidity, and tax simplicity. ETFs are bought and sold through brokerage accounts, eliminating the need for multiple crypto trading platforms. They operate under regulated frameworks, providing protection similar to secure crypto exchanges. Custody and storage are handled by professional institutions, reducing personal security risks. Some ETFs include futures or blockchain-related assets, allowing built-in diversification. ETFs typically offer high liquidity and simpler tax reporting compared to direct Bitcoin purchases, making them an ideal investment choice for many users.

Bitcoin ETFs are a bridge between traditional finance and cryptocurrency investing, reflecting the ongoing crypto exchange market growth. Their popularity indicates higher institutional adoption, improved liquidity, and more regulated investment options. As more professional investors enter the space, ETFs help standardize Bitcoin investing within traditional financial systems, showing that the crypto market is becoming more competitive, transparent, and accessible. The rise of Bitcoin ETFs highlights how digital assets are integrating with established financial markets, offering both convenience and regulatory assurance.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.