Key Takeaways

- Modern crypto exchanges handle daily trading volumes exceeding $100 billion with platforms like Binance and Coinbase processing millions of orders per second, requiring robust technology stacks that prioritize speed, security, and scalability to maintain user trust and prevent financial losses.

- Exchange architecture consists of eight critical layers: frontend (web/mobile apps), trading engine (order matching), wallet module (custody), liquidity layer (market depth), admin dashboard (compliance), APIs (integrations), security infrastructure, and DevOps systems, all built on modular microservices architecture for independent scaling and updates.

- The order matching engine represents the heart of centralized exchanges and demands high-performance languages like C++, Go, Rust, or Java to minimize latency and maximize throughput, often utilizing event-queue systems like Kafka or RabbitMQ for asynchronous market event processing.

- Database strategy requires a multi-tiered approach combining PostgreSQL or MySQL for transactional ledger data, MongoDB or Cassandra for flexible market data, Redis for in-memory caching of hot data like order books, and Amazon S3 or IPFS for document storage.

- Frontend technologies leverage React.js or Next.js for web platforms and React Native or Flutter for mobile apps, incorporating WebSocket connections for real-time order book updates and TradingView or D3.js libraries for professional-grade charting capabilities.

- Blockchain integration requires running full or light nodes for various networks, implementing hot wallets for immediate transactions with multi-signature security, maintaining cold wallets for majority fund storage, and often partnering with custodial providers like Fireblocks or BitGo for enterprise-grade key management.

- Security implementation must include multi-layered protection with SSL/TLS encryption for data in transit, AES-256 for data at rest, multi-factor authentication, anti-DDoS protection via WAFs and Cloudflare, and KYC/AML compliance through providers like Sumsub, Jumio, or blockchain analysis tools like Chainalysis.

- Real-time communication architecture relies on REST APIs for standard operations, WebSocket APIs for live data streaming, gRPC for efficient microservice communication, and integration with oracles like Chainlink for external data feeds and blockchain indexing protocols like The Graph for historical queries.

- DevOps infrastructure utilizes cloud providers (AWS, GCP, Azure), Docker containerization, Kubernetes orchestration for scaling and self-healing, CI/CD pipelines through Jenkins or GitLab, and comprehensive monitoring via ELK Stack, Prometheus, or Grafana with multi-region deployment for disaster recovery.

- Future exchange architectures are evolving toward Web3-native hybrid models combining on-chain and off-chain components, Layer 2 scaling solutions for reduced gas costs, decentralized oracles for trustless data feeds, advanced blockchain indexing, and privacy-preserving technologies like zero-knowledge proofs and mixnets.

In 2025, the total daily trading volume across cryptocurrency exchanges regularly exceeded $100 billion, and high-performance platforms like Binance and Coinbase handle millions of orders per second during peak market activity. In such a high-stakes, real-time environment, the technology stack of a crypto exchange isn’t just plumbing; it’s the foundation that determines speed, security, scalability, and ultimately, user trust.

A poorly architected system can lead to downtime, security breaches, or unresponsive trading, all of which erode user confidence and can result in significant financial losses. Conversely, a robust technology stack enables seamless execution, real-time data, and compliance in a highly regulated and rapidly evolving market.

Let’s explore the key components of this stack, and why every modern crypto exchange, centralized (CEX), decentralized (DEX), or hybrid, builds on a modular, scalable, and secure architecture.

High-Level Architecture- Layers That Power an Exchange

A modern crypto exchange is not a monolith; it’s an ecosystem composed of multiple interacting layers. According to industry experts, the architecture typically includes:

- Frontend– Web and mobile apps used by traders

- Trading Engine– Core system that matches orders

- Wallet Module– For deposit, withdrawal, and custody

- Liquidity Layer– To provide or aggregate liquidity

- Admin Dashboard– For compliance, monitoring, and operations

- APIs & Integration– For external services (fiat on-ramps, KYC, market data)

- Security & Compliance– Encryption, KYC/AML, audits, etc.

- DevOps & Infrastructure– To support continuous deployment, scaling, and resilience

Modular architecture (often microservices-based) is key, letting components scale, update, or fail independently.

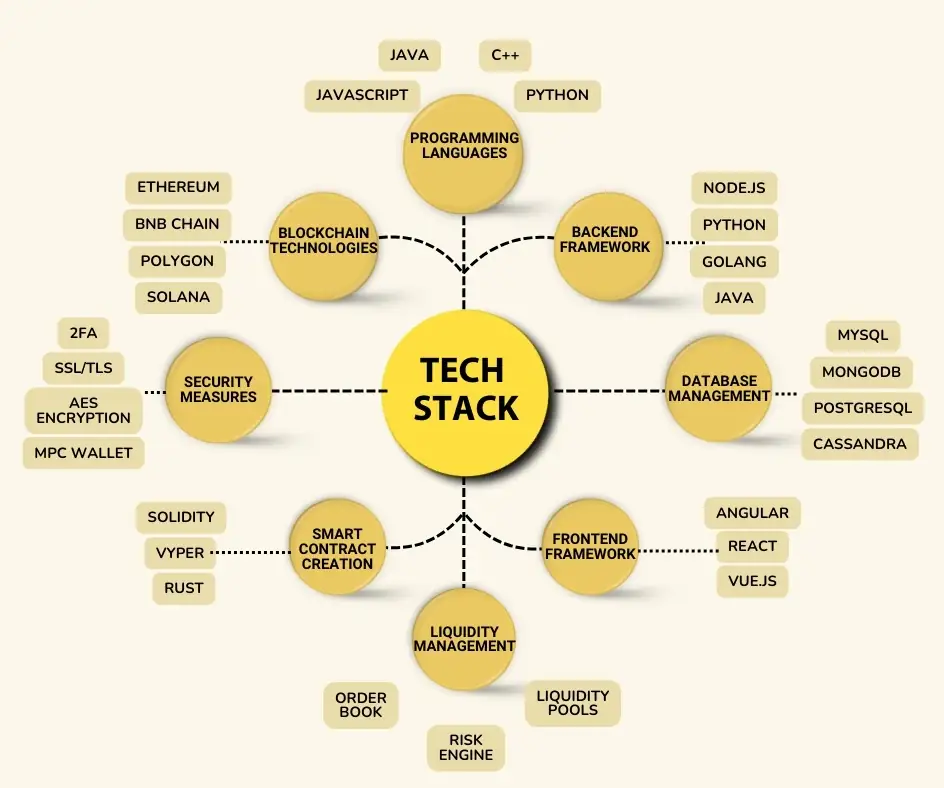

Frontend Technologies- What the User Sees

The frontend is where your users interact, trading dashboards, charts, order forms, wallets, and admin panels. The tech choices here need to support real-time data, intuitive UX, and cross-platform compatibility.

- Frameworks– Modern exchanges often use React.js or Next.js for web, thanks to component-based UIs, fast rendering, and SEO capabilities.

- Styling– Tailwind CSS or SCSS helps maintain a lightweight, customizable UI.

- State management & real-time updates– Redux (or Context API) + WebSockets for live order book, trade history, and chart updates.

- Mobile– Cross-platform frameworks like React Native or Flutter enable building both iOS and Android apps from a shared codebase.

- Charts– For trading charts, libraries like TradingView, D3.js, or Chart.js are commonly used.

Backend & Core Logic

1. Programming Languages & Frameworks

Choosing the right backend language is crucial. Popular choices include:

- Node.js (JavaScript/TypeScript)– Great for real-time, event-driven workloads.

- Go (Golang)– Efficient concurrency model (goroutines) makes it ideal for handling high-throughput matching engines.

- Python (Django / FastAPI / Flask)– Used for business logic, automation, analytics, and integrations.

- Rust– Gaining traction for performance-sensitive components like the matching engine, memory-safe, and low latency.

- Java / Kotlin (Spring Boot / Ktor)– Enterprise-grade, reliable, and thread-safe, often used for critical services.

2. Matching Engine

At the heart of any centralized exchange is the order matching engine, it pairs buy and sell orders in real-time. To minimize latency and maximize throughput, this is often written in-

- C++, Go, Rust, or Java, languages that offer low-level control, high performance, and concurrency.

- Internal messaging/event-queue systems Kafka, RabbitMQ, or Redis Streams help in managing market events and asynchronous processing.

3. Databases & Storage

A modern exchange handles varied data types:

- Relational DBs– PostgreSQL or MySQL for ledger data, user info, KYC, trades, orders.

- NoSQL– MongoDB or Cassandra for more flexible data, such as session logs, non-relational market data.

- In-memory stores/cache– Redis is used to store hot data (e.g., order book snapshots, sessions) to reduce latency.

- File storage– For storing large assets or user-uploaded KYC docs, Amazon S3 or IPFS (for decentralized assets) are widely used.

Launch Your High-Performance Crypto Exchange Now

Partner with Nadcab Labs to develop a high-performance crypto exchange.

Blockchain Integration & Wallet Management

One of the defining features of a crypto exchange is its integration with one or more blockchain networks.

- Nodes– Exchanges often run full or light nodes for various blockchains (e.g., Bitcoin Core, Geth for Ethereum) to interact with the underlying networks.

- Blockchain libraries– Web3.js, Ethers.js, or similar for Ethereum-based interactions.

- Smart Contracts– If the exchange supports on-chain order books (as in hybrid or DEX models), you need smart contracts (e.g., in Solidity, Vyper) maintained via frameworks like Truffle or Hardhat.

- Wallet architecture– Hot and cold wallets play a major role in user fund safety especially for first-time buyers who want to know how to buy Bitcoin.

- Hot wallets– Online wallets for immediate deposits/withdrawals; require high security and multi-signature setups.

- Cold wallets– Offline storage for the majority of funds to minimize risk.

- Custody solutions– Many exchanges integrate with custodial providers (like Fireblocks, BitGo) for secure key management.

APIs, Data Feeds & Real-Time Communication

- REST API– For standard operations, account management, trading operations, and fiat deposit/withdrawal.

- WebSocket API– For real-time streaming of order books, trades, and price updates, crucial for a live trading interface.

- gRPC / internal APIs– Microservices architecture often uses gRPC for efficient inter-service communication.

- Market data / Oracles– To fetch real-world data (e.g., price feeds), exchanges sometimes integrate oracles like Chainlink.

- Blockchain indexing– For efficient querying of historical or on-chain data, many platforms use The Graph, a decentralized protocol for indexing blockchain data.

Security, Compliance & Trust

Security is non-negotiable in crypto. A modern exchange’s tech stack must bake in strong, multi-layered protection:

- Encryption

- SSL / TLS for data in transit.

- AES-256 (or equivalent) for data at rest.

- Authentication

- Multi-factor authentication (2FA), biometrics, and IP whitelisting.

- JWT (JSON Web Tokens) for session management.

- Anti-DDoS & firewalls– Use WAFs (Web Application Firewalls), services like Cloudflare, and rate limiting to protect against attacks.

- Wallet security

- Multi-signature (multi-sig) wallets.

- Withdrawal whitelists, transaction limits.

- KYC / AML compliance

- Integration with providers like Sumsub, Jumio, Trulioo, and Onfido.

- Blockchain risk analysis tools (e.g., Chainalysis, TRM Labs) for transaction monitoring.

- Audits & testing

- Regular security audits (smart contract, infrastructure).

- Bug bounty programs to crowdsource vulnerability detection.

Admin Layer & Analytics

Behind the scenes, administrators and compliance teams need to monitor, manage, and intervene:

- Admin dashboard:

- User management (KYC status, bans)

- Trade monitoring, suspicious activity alerts

- Fee, commission, and profit configuration

- Analytics & Reporting:

- Real-time dashboards (trades, volume, liquidity, P&L)

- Tools like Mixpanel, Google Analytics, or self-built BI systems.

- Logging & Monitoring

- Use ELK Stack (Elasticsearch, Logstash, Kibana), Graylog, or similar for logs.

- Monitoring & alerting with Prometheus, Grafana, or Datadog.

DevOps, Infrastructure & Deployment

To support global trading, high concurrency, and zero downtime, exchanges rely heavily on modern infrastructure:

- Cloud providers– AWS, Google Cloud Platform (GCP), Microsoft Azure.

- Containerization– Docker packages services into portable containers.

- Orchestration– Kubernetes (or alternatives) to scale microservices, manage rolling updates, and self-heal.

- CI/CD pipelines– Using Jenkins, GitLab CI/CD, GitHub Actions for continuous integration and deployment.

- Backup & Disaster Recovery

- Regular database backups, snapshotting

- Multi-zone / multi-region deployment to ensure resilience

Example Real-World Systems

To illustrate how these components come together, here are a couple of practical examples:

- Uniswap (DEX)– A fully decentralized exchange built on Ethereum using automated market maker (AMM) architecture via smart contracts in Solidity.

- Centralized Exchange (CEX)– A platform built with React frontend, Node.js / Go backend, PostgreSQL for ledgers, Redis for caching, Docker + Kubernetes for infrastructure, and KYC/AML via third-party providers.

Challenges & Trade-Offs

Even the best stack comes with trade-offs.

- Latency vs. Complexity– Ultra-low latency systems (e.g., matching engine in Rust) may be harder to develop and maintain than simpler ones.

- Cost vs. Compliance– Running full blockchain nodes, multi-region infrastructure, and KYC services can be very expensive, especially for startups.

- Scalability vs. Security– Microservices and cloud-native deployments scale well, but they increase the attack surface if not architected securely.

- Technical Debt– Using many modern technologies (Go, Rust, Kubernetes) requires skilled developers. Poorly managed, this can lead to maintainability issues.

Future Trends in Exchange Tech Stack

Looking ahead, several trends are shaping how exchanges are built-

- Web3-native exchanges– Hybrid models combining on-chain order books + off-chain order matching.

- Layer 2 Adoption– Integrating scaling solutions (Optimistic / ZK rollups) to enable cheap, fast trades and lower gas costs.

- Decentralized Oracles– Greater use of decentralized oracle networks like Chainlink to feed external data in a trustless way.

- Blockchain Indexing Protocols– Increasing use of The Graph for building performant, queryable subgraphs.

- Privacy Tech– Use of mixnets (e.g., Nym) or zero-knowledge proofs to anonymize user data or transaction metadata.

Conclusion

Building a modern cryptocurrency exchange is a deeply technical endeavor, demanding a carefully orchestrated technology stack that balances performance, security, scalability, and regulatory compliance. From real-time order matching engines in Rust or Go, to robust frontends in React or Flutter, to secure wallet integrations and cloud-native infrastructure, each layer plays a crucial role in delivering a seamless, trustworthy trading experience.

As the cryptocurrency market continues to evolve, future exchange architectures are also likely to incorporate Web3-native components, decentralized oracles, and more privacy-preserving technologies, ensuring the stack remains future-proof and resilient.

Frequently Asked Questions

Crypto exchanges typically use Rust, Go, or C++ for high-speed matching engines, while Node.js, Python, Java, and Kotlin handle APIs, business logic, and integrations. This mix offers both ultra-low latency and flexible development.

Trading UIs are built using React.js or Next.js with WebSockets for live updates. Tailwind CSS shapes clean layouts, and TradingView or Chart.js delivers real-time charts, creating a fast, responsive trading experience.

The matching engine compares buy and sell orders in real time and executes trades using price-time priority. Built in high-performance languages like Rust or C++, it processes millions of operations per second, ensuring smooth trading even during high market volatility.

PostgreSQL stores structured data like balances and orders, Redis handles real-time caching for speed, and MongoDB/Cassandra manage flexible logs. For large files like KYC documents, exchanges use S3 or IPFS. This database mix ensures accuracy, speed, and scalability.

Exchanges run their own blockchain nodes—such as Bitcoin Core or Ethereum Geth—to verify deposits, process withdrawals, and read on-chain data. Libraries like Web3.js or Ethers.js enable smooth interaction, ensuring accurate wallet balances and fast asset movement.

Hot wallets support fast, online withdrawals and deposits, while cold wallets keep most funds securely offline. Combined with multi-sig, whitelisting, and custody services like Fireblocks, this hybrid setup protects user assets while maintaining platform speed.

REST APIs handle user actions, WebSocket APIs stream real-time market data, and gRPC enables fast communication between microservices. Exchanges also use Chainlink oracles for pricing and The Graph for blockchain indexing to deliver accurate, reliable data.

Exchanges rely on SSL/TLS, AES-256 encryption, 2FA, WAFs, rate limiting, multi-sig wallets, and IP whitelisting. They also integrate KYC/AML tools like Sumsub and Chainalysis and perform regular security audits to keep user funds and data safe from threats.

Challenges include achieving ultra-low latency, meeting strict compliance rules, securing wallets, running multiple blockchain nodes, and scaling microservices. Skilled developers for Rust, Go, Kubernetes, and security are essential to keep the platform fast, secure, and resilient.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.