Key Takeaways – ICO Fundraising

- ICOs democratize capital: Anyone worldwide can participate in early-stage fundraising, bypassing traditional financial barriers.

- Blockchain ensures transparency and trust: Digital contracts and immutable ledgers protect investors and automate operations.

- Tokenomics drives success: Utility, security, and asset-backed tokens align incentives between creators and participants.

- Community engagement is critical: Active early supporters become advocates, fueling adoption and ecosystem growth.

- Regulatory compliance matters: Navigating KYC, AML, and securities laws is essential for legitimacy and long-term sustainability.

- Due diligence is essential: Investors must research teams, technology, market fit, and token utility before participation.

- ICOs accelerate innovation: Startups can retain control, raise funds rapidly, and access global markets, fostering technological and financial inclusion.

- Risks coexist with opportunities: Fraud, technical failures, and market volatility require careful planning and mitigation strategies.

From our extensive experience in the blockchain ecosystem, we’ve observed that successful ICO projects share common characteristics: clear value propositions, transparent communication, robust technological foundations, and realistic roadmaps. The ICO cryptocurrency market has matured significantly, with investors becoming increasingly sophisticated in their evaluation criteria.

The Evolution of Fundraising in the Blockchain Era

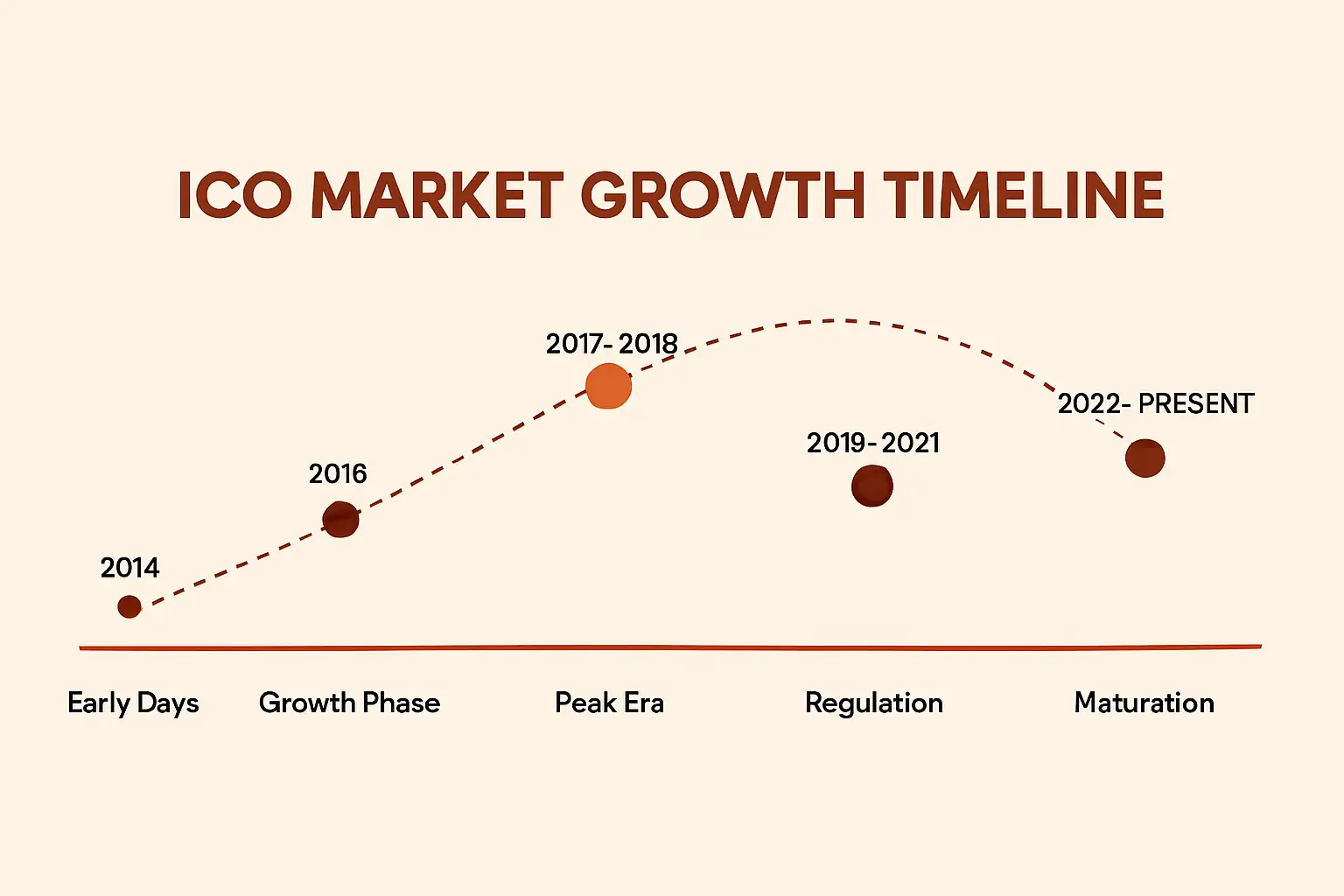

Traditional fundraising methods have long been the cornerstone of business solutions, but they come with inherent limitations that blockchain technology addresses systematically. The evolution from venture capital rounds and bank loans to crypto fundraising represents more than a technological shift—it embodies a philosophical transformation in how we conceptualize value creation and distribution. Throughout our eight-year journey in this space, we’ve documented the remarkable progression from early ICO projects that raised modest amounts to billion-dollar coin offerings that captured global attention.

The blockchain era introduced several revolutionary concepts to fundraising: borderless transactions, programmable money, transparent fund allocation, and community-driven governance. These innovations have enabled entrepreneurs from developing nations to access global capital markets, leveling the playing field in ways previously unimaginable. The upcoming ICO landscape continues to evolve, with new mechanisms like Security Token Offerings (STOs) and Initial Exchange Offerings (IEOs) building upon the foundational ICO model while addressing some of its shortcomings.

What is an Initial Coin Offering and How it Work?

An Initial Coin Offering represents a fundraising mechanism where new projects sell their underlying crypto tokens to early backers in exchange for established cryptocurrencies or fiat currency. The process begins with project founders identifying a problem that blockchain technology can solve, developing an ICO solution architecture, and creating a detailed whitepaper that outlines the project’s vision, technical specifications, tokenomics, and roadmap. This document serves as the foundation for attracting potential investors and establishing credibility within the crypto fundraising community.

The operational mechanics of an ICO coin offering involve several critical phases. During the pre-ICO phase, projects often conduct private sales to strategic investors and early supporters, typically offering tokens at discounted rates. This phase helps validate market interest and secure initial funding for marketing and solution efforts. The public ICO phase then opens token sales to a broader audience, usually setting specific fundraising targets with minimum and maximum caps. Digital contracts deployed on blockchain platforms automate the token distribution process, ensuring transparency and reducing the potential for fraud.

ICO Process Flow

Phase 1: Ideation

Concept solutions, team formation, and whitepaper creation

Phase 2: Pre-Sale

Private rounds, early investor engagement, and initial funding

Phase 3: Public ICO

Open token sale, marketing campaigns, and community building

Phase 4: Post-ICO

Exchange listings, product solutions, and roadmap execution

Key Components of a Successful ICO

Through our extensive work with numerous ICO projects over the years, we’ve identified several critical components that distinguish successful offerings from those that fail to meet their objectives. The whitepaper stands as perhaps the most crucial element—this comprehensive document must articulate the project’s purpose, technical architecture, token utility, distribution model, and long-term vision with clarity and precision. A well-crafted whitepaper demonstrates the team’s expertise while providing potential investors with the information necessary to make informed decisions about participation in the coin offering ICO.

Key Components of a Successful ICO

| Component | Description | Importance Level |

|---|---|---|

| Whitepaper | Comprehensive project documentation covering technical and business aspects | Critical |

| Experienced Team | Founders and advisors with proven track records in blockchain and relevant industries | Critical |

| Token Economics | Clear utility, distribution model, and value proposition for the ICO token | High |

| Digital Contracts | Audited, secure code governing token distribution and project operations | High |

| Marketing Strategy | Comprehensive outreach plan to build community and attract investors | Medium |

| Legal Compliance | Adherence to relevant regulations and jurisdictional requirements | Critical |

The team behind an ICO cryptocurrency project represents another cornerstone of success. Investors scrutinize the backgrounds, achievements, and reputations of founders and advisors, seeking evidence of relevant expertise and past accomplishments. A team combining blockchain developers, industry specialists, marketing professionals, and legal advisors signals to potential participants that the project possesses the multidisciplinary capabilities necessary for successful execution. Our experience has shown that transparency regarding team members—including LinkedIn profiles, past projects, and public track records—significantly enhances credibility and trust.

Role of Blockchain Technology in ICO Fundraising

Blockchain technology serves as the foundational infrastructure enabling ICO fundraising to function with unprecedented efficiency, transparency, and security. The distributed ledger architecture ensures that all transactions related to the ICO initial coin offering are recorded immutably and can be verified by anyone, creating an environment of trust that traditional fundraising mechanisms struggle to replicate. Digital contracts—self-executing code deployed on blockchain platforms—automate critical functions such as token distribution, fund allocation, and vesting schedules, eliminating the need for intermediaries and reducing the potential for human error or manipulation.

The programmability inherent in blockchain platforms like Ethereum has enabled ICOs projects to implement sophisticated tokenomics models that align incentives between various stakeholders. Through our years of experience implementing blockchain solutions for fundraising clients, we’ve witnessed how features like automatic token burns, staking mechanisms, and governance rights can be encoded directly into Digital contracts, creating self-sustaining ecosystems that operate according to predetermined rules. This technological foundation has been instrumental in establishing the ICO crypto market as a legitimate alternative to traditional capital-raising methods.

Types of Tokens Issued in ICOs

The diversity of token types issued through ICOs coin offerings reflects the varied purposes and use cases that blockchain projects serve. Understanding these distinctions is essential for both project creators designing their tokenomics and investors evaluating participation opportunities. Utility tokens, the most common type in ICO cryptocurrency offerings, grant holders access to specific products or services within the project’s ecosystem. These tokens function as internal currencies or access keys, deriving their value from the utility they provide rather than representing ownership stakes in the issuing entity.

Types of Tokens Issued in ICOs

| Token Type | Primary Function | Regulatory Consideration | Example Use Case |

|---|---|---|---|

| Utility Tokens | Provide access to products or services within an ecosystem | Generally less regulated if not investment contracts | Platform access, transaction fees, governance voting |

| Security Tokens | Represent ownership or equity stakes in assets or companies | Subject to securities regulations in most jurisdictions | Equity shares, profit sharing, dividend rights |

| Payment Tokens | Function as cryptocurrencies for transactions | Varies by jurisdiction; may be treated as currency or property | Medium of exchange, store of value |

| Asset-Backed Tokens | Represent ownership of physical or digital assets | Depends on underlying asset classification | Real estate, commodities, precious metals |

Security tokens represent another significant category, offering ownership rights, profit-sharing arrangements, or equity stakes in the project or its parent company. These tokens are subject to securities regulations in most jurisdictions, requiring compliance with extensive legal frameworks. Our advisory work has demonstrated that while security tokens involve more complex regulatory navigation, they can provide investors with traditional investment protections while leveraging blockchain technology’s efficiency and transparency advantages. The coin market cap ICO landscape increasingly includes hybrid models that combine elements of multiple token types, reflecting the sophistication and maturation of the industry.

ICO vs Traditional Fundraising Methods

The comparison between ICOs fundraising and traditional capital-raising mechanisms reveals fundamental differences in accessibility, speed, regulatory burden, and investor demographics. Traditional fundraising methods—including venture capital, angel investing, bank loans, and public offerings—have established frameworks with well-defined processes, regulatory oversight, and institutional support. However, these conventional approaches often exclude entrepreneurs from developing markets, impose significant costs and time requirements, and limit participation to accredited or institutional investors.

ICO vs Traditional Fundraising Methods

| Aspect | ICO Fundraising | Traditional Fundraising |

|---|---|---|

| Accessibility | Global participation with minimal barriers; open to retail investors | Limited to accredited investors, institutions, or specific geographies |

| Timeline | Weeks to months from conception to funding | Months to years for substantial capital raises |

| Cost Structure | Lower overhead, primarily marketing and technical solutions | Significant legal, banking, and intermediary fees |

| Regulatory Framework | Evolving and varies by jurisdiction; less established | Well-defined regulations with decades of precedent |

| Liquidity | Potentially immediate through cryptocurrency exchanges | Limited until exit events (IPO, acquisition) or restricted secondary markets |

| Due Diligence | Primarily self-directed by investors; variable quality | Institutional processes with professional oversight |

| Transparency | Blockchain-based transparency of transactions and token distribution | Disclosure requirements vary; generally, less transparent to the public |

In our eight years of experience guiding clients through both traditional and blockchain-based fundraising processes, we’ve observed that ICOs excel in scenarios requiring rapid capital deployment, global reach, and community building. The direct connection between projects and their supporter base creates powerful network effects, with early investors often becoming passionate advocates and contributors to the project’s success. However, traditional fundraising methods offer advantages in regulatory clarity, investor protection mechanisms, and established due diligence processes that the ICO cryptocurrency market is still developing.

Benefits of ICOs for Startups and Entrepreneurs

The advantages that ICO projects offer to entrepreneurs extend far beyond simple capital acquisition. Perhaps most significantly, ICO fundraising enables startups to retain greater ownership and control compared to traditional venture capital routes, where founders often sacrifice substantial equity stakes and board representation in exchange for funding. Through an ICO coin offering, projects can raise substantial capital while maintaining operational autonomy and strategic decision-making authority, distributing tokens rather than equity shares.

The global reach of crypto fundraising eliminates geographic barriers that have historically constrained entrepreneurship. A developer in Southeast Asia, an innovator in Africa, or a researcher in Eastern Europe can access the same global capital pool as their counterparts in Silicon Valley or London. This democratization of funding opportunities has unleashed innovation in regions previously underserved by traditional investment infrastructure. Throughout our consultancy work, we’ve supported numerous entrepreneurs from emerging markets who successfully raised millions through ICOs cryptocurrency offerings—funding that would have been virtually impossible to secure through conventional channels.

Key Benefits for Project Creators

- Rapid Capital Access: Funds can be raised in weeks rather than months or years

- Community Building: Early token holders become invested stakeholders and brand advocates

- Retained Ownership: Distribute utility tokens while maintaining equity control

- Market Validation: Direct feedback from early adopters during token sale phase

- Network Effects: Token economics can incentivize ecosystem growth and adoption

Additionally, the marketing and community-building aspects inherent to successful ICOs create valuable network effects that compound over time. Projects that effectively engage their token holder communities often benefit from grassroots advocacy, user-generated content, and organic growth that traditional funded startups must purchase through expensive marketing campaigns. The alignment of incentives—where token holders benefit directly from the project’s success—creates a powerful dynamic that can accelerate product solutions, market penetration, and brand recognition.

Advantages for Investors Participating in ICOs

From the investor perspective, participating in ICO cryptocurrency offerings presents opportunities that diverge significantly from traditional investment vehicles. The potential for substantial returns represents an obvious attraction—early participants in successful ICOs projects have realized gains that would be extraordinary in conventional markets. Projects that execute on their roadmaps and achieve market adoption can see their ICO tokens appreciate dramatically, sometimes by orders of magnitude. However, experienced investors in the ICO crypto space recognize that these potential rewards come with commensurate risks.

Beyond return potential, ICO fundraising enables investors to participate in projects aligned with their values and interests at the earliest stages. Unlike traditional markets where retail investors typically access opportunities only after institutional investors have captured significant value, the ICO initial coin offering model provides simultaneous access to all participants. This democratization of early-stage investment has been transformative for individuals who believe in specific technological visions or social missions. Our experience working with investor communities has shown that many participants are motivated as much by ideological alignment and belief in transformative technologies as by financial returns.

Expert Insight: Through our years of guiding both projects and investors, we’ve learned that the most successful ICO participants conduct thorough due diligence, diversify their portfolios across multiple projects, and maintain realistic expectations about timelines and outcomes. The liquidity offered by cryptocurrency exchanges is a double-edged sword—while it provides exit opportunities unavailable in traditional early-stage investing, it can also lead to short-term thinking that undermines long-term project solutions.

Global Reach and Decentralization of ICO Fundraising

The borderless nature of blockchain technology has enabled ICO projects to transcend geographic limitations that constrain traditional fundraising. A startup in Nairobi can raise capital from investors in Seoul, São Paulo, Stockholm, and San Francisco simultaneously, with transactions settling in minutes rather than days or weeks. This global accessibility has profound implications for innovation distribution and wealth creation, potentially redistributing economic opportunities away from traditional financial centers toward a more geographically diverse landscape.

Decentralization extends beyond geography to encompass organizational structures and governance models. Many ICO cryptocurrency projects implement decentralized autonomous organization (DAO) principles, where token holders participate directly in decision-making processes through on-chain voting mechanisms. This represents a fundamental reimagining of corporate governance, replacing hierarchical management structures with community-driven consensus models. Throughout our advisory work, we’ve helped numerous projects design governance frameworks that balance efficiency with inclusivity, ensuring that decentralization serves practical purposes rather than becoming an ideological hindrance to effective operations.

Regulatory Landscape Surrounding Initial Coin Offerings

The regulatory environment governing ICO fundraising remains one of the most dynamic and challenging aspects of the ecosystem. Jurisdictions worldwide have adopted diverse approaches ranging from comprehensive prohibition to cautious acceptance and active encouragement. The United States, through the Securities and Exchange Commission (SEC), has applied existing securities laws to ICO tokens, utilizing the Howey Test to determine whether a given token constitutes a security requiring registration or qualifying for exemption. This approach has created complexity for both projects and investors, as the regulatory status of a token may not be immediately clear.

Other jurisdictions have developed more specific frameworks for crypto fundraising. Switzerland’s FINMA has established a multi-category classification system distinguishing payment tokens, utility tokens, and asset tokens. Singapore’s Monetary Authority has taken a similar approach, while countries like China have imposed comprehensive bans on ICO coin offerings. The fragmented global regulatory landscape creates challenges for projects seeking to maintain compliance across multiple jurisdictions. Our regulatory consulting practice has accumulated extensive experience navigating these complexities, helping clients structure offerings to meet requirements in target markets while avoiding jurisdictions with prohibitive regulations.

Regulatory Landscape Surrounding Initial Coin Offerings

| Jurisdiction | Regulatory Approach | Key Characteristics |

|---|---|---|

| United States | Application of existing securities laws | Howey Test determines security status; strict enforcement |

| Switzerland | Token categorization framework | Payment, utility, and asset tokens with specific regulations |

| Singapore | Progressive regulation with guidelines | Licensing requirements for security tokens; utility token exemptions |

| European Union | Harmonized approach solutions | MiCA regulation providing comprehensive framework |

| Malta | Blockchain-friendly jurisdiction | Specific legislation for blockchain and crypto assets |

The evolving nature of regulations means that compliance strategies must remain adaptive and forward-looking. Projects launching today must anticipate regulatory solutions and structure their offerings with sufficient flexibility to accommodate changing requirements. This includes implementing know-your-customer (KYC) and anti-money laundering (AML) procedures, restricting participation from certain jurisdictions, and maintaining detailed records of all transactions and communications. While these compliance measures add cost and complexity, they’re essential for long-term viability and legitimacy in the upcoming ICO landscape.

Risks and Challenges Associated with ICOs

Despite the opportunities presented by ICO cryptocurrency offerings, the model carries substantial risks that have manifested repeatedly throughout the industry’s evolution. Fraud and scams represent perhaps the most visible challenge—projects with no genuine intention of building viable products have exploited the hype surrounding crypto fundraising to abscond with investor funds. These “exit scams” have damaged the reputation of legitimate projects and undermined confidence in the ICO model. Our due diligence framework, developed over years of evaluating ICO projects, includes verification of team identities, assessment of technical feasibility, analysis of tokenomics sustainability, and examination of project governance structures.

Beyond outright fraud, many ICO projects fail due to unrealistic ambitions, inadequate technical expertise, poor execution, or market conditions that render their solutions obsolete or unnecessary. The cryptocurrency market’s volatility compounds these challenges—projects that raise funds in volatile cryptocurrencies like Bitcoin or Ethereum may find their operating capital dramatically reduced during market downturns. Additionally, the lack of investor protections characteristic of securities regulations means that participants in unsuccessful ICOs initial coin offerings typically have little recourse for recovering their investments.

Common Risk Categories in ICO Participation

Project Risks

Technical infeasibility, execution failures, team incompetence, and abandonment

Market Risks

Cryptocurrency volatility, lack of liquidity, competitive pressures, and changing demand

Regulatory Risks

Changing legal frameworks, enforcement actions, jurisdictional restrictions, and compliance costs

Security Risks

Digital contract vulnerabilities, hacking incidents, phishing attacks, and private key loss

Security, Transparency, and Trust in ICO Projects

Security considerations permeate every aspect of successful ICO fundraising operations. Digital contract vulnerabilities have resulted in millions of dollars in losses across numerous projects, highlighting the critical importance of professional security audits before launching token sales. The immutability of blockchain transactions means that coding errors cannot be easily corrected—bugs in Digital contracts can be exploited by malicious actors with devastating consequences. Our technical consulting practice mandates multiple independent security audits for all client projects, recognizing that the investment in professional security review represents essential insurance against catastrophic failures.

Transparency, while often touted as a fundamental advantage of blockchain-based fundraising, requires intentional implementation to be meaningful. Simply recording transactions on a public ledger doesn’t automatically create transparency regarding project operations, fund usage, solutions progress, or strategic decision-making. The most successful ICO cryptocurrency projects implement comprehensive transparency practices including regular progress updates, public roadmap tracking, open-source code repositories, and community engagement forums. These practices build trust with token holders and create accountability mechanisms that encourage consistent execution.

Best Practices for Building Trust

Based on our extensive experience guiding projects through the ICO process, we recommend the following practices for establishing and maintaining trust with stakeholders:

- Multiple Independent Security Audits: Engage reputable blockchain security firms to audit all Digital contracts before deployment

- Team Identity Verification: Provide verifiable information about all team members, advisors, and partners

- Regular Progress Reporting: Establish consistent communication cadence with detailed updates on solutions milestones

- Fund Usage Transparency: Disclose how raised capital is being allocated and spent

- Open-Source solutions: Make code publicly available for community review and contribution

- Community Governance: Implement mechanisms for token holder participation in key decisions

- Third-Party Escrow: Consider using trusted escrow services for fund management

Steps Involved in Launching an ICO

Launching a successful ICO coin offering requires methodical planning and execution across technical, legal, marketing, and operational dimensions. The process typically spans several months and demands coordination among diverse specialists. From our eight years guiding clients through ICO launches, we’ve developed a comprehensive framework that breaks the process into distinct phases, each with specific objectives and deliverables. The initial conceptualization phase focuses on validating the core idea, assessing market demand, analyzing competitive landscape, and assembling a team with requisite expertise.

ICO Launch Lifecycle

Phase 1: Conceptualization (2-4 weeks)

Idea validation, market research, team formation, and preliminary tokenomics design

Phase 2: Documentation (4-8 weeks)

Whitepaper creation, technical specifications, legal structure establishment, and compliance planning

Phase 3: Technical solutions (6-12 weeks)

Digital contract solutions, platform creation, security audits, and testing protocols

Phase 4: Marketing & Community Building (8-12 weeks)

Website launch, social media presence, community engagement, PR campaigns, and partnership announcements

Phase 5: Pre-Sale (2-4 weeks)

Private sale to strategic investors, early supporter engagement, and initial capital raising

Phase 6: Public ICO (2-6 weeks)

Public token sale, ongoing marketing, community support, and transparent communication

Phase 7: Post-ICO (Ongoing)

Token distribution, exchange listings, product solutions, roadmap execution, and community governance

The documentation phase centers on whitepaper creation—this foundational document must comprehensively articulate the project’s vision, technical architecture, market opportunity, competitive advantages, tokenomics, team qualifications, and roadmap. A well-crafted whitepaper serves multiple purposes: attracting investors, establishing technical credibility, providing a reference for community discussions, and documenting the project’s commitments. Legal considerations also emerge during this phase, including entity formation, regulatory compliance assessment, terms and conditions drafting, and intellectual property protection strategies.

Technical solutions proceeds in parallel with marketing preparations. Digital contracts governing token creation, distribution, and any embedded logic must be developed, tested extensively, and audited by independent security firms. The project’s website, often serving as the primary interface for potential investors, requires careful design to convey professionalism while clearly communicating value propositions and participation instructions. Marketing efforts during the pre-launch phase focus on community building through social media channels, content marketing, influencer partnerships, and media outreach. The goal is to build anticipation and establish a engaged community before the token sale begins.

Notable ICO Success Stories and Market Impact

The history of ICO fundraising includes remarkable success stories that have shaped the broader blockchain ecosystem and demonstrated the model’s potential. Ethereum itself conducted one of the earliest and most successful ICO cryptocurrency offerings in 2014, raising approximately $18 million and establishing the platform that would become the foundation for thousands of subsequent projects. The Ethereum ICO proved that blockchain-based fundraising could finance major technological infrastructure solutions, and the platform’s success validated the model for countless followers.

Other notable successes include projects that raised substantial capital and delivered on their roadmap commitments, creating lasting value for token holders and the broader ecosystem. These successful ICO projects shared common characteristics that our analysis has identified over years of study: clear use cases solving genuine problems, experienced teams with relevant track records, transparent communication with stakeholders, realistic timelines and expectations, and strong community engagement. The coin market cap ICO achievements of these projects demonstrated that when executed properly, the model could fund ambitious technological solutions while generating substantial returns for early supporters.

Market Impact Observations

Throughout our eight years of active participation in the ICO crypto market, we’ve observed several significant impacts on the broader technology and financial landscapes:

Democratization of Innovation Funding: ICOs have enabled individuals and small teams to pursue ambitious projects without requiring connections to traditional capital sources, fostering innovation in previously underserved markets and demographics.

Acceleration of Blockchain solutions: The capital influx from successful ICO initial coin offerings has funded extensive research and solutions in blockchain infrastructure, Digital contract platforms, scalability solutions, and decentralized applications.

Global Talent Mobilization: The borderless nature of crypto fundraising has enabled developers, designers, and entrepreneurs worldwide to collaborate on projects without geographic constraints, creating truly global teams and communities.

Alternative Asset Class Creation: ICO tokens have established themselves as a distinct asset class with unique characteristics, attracting institutional attention and spawning entirely new categories of financial services including specialized exchanges, custody solutions, and investment vehicles.

Common Reasons for ICO Failures

Understanding why ICO projects fail provides valuable lessons for both entrepreneurs planning offerings and investors evaluating opportunities. Our analysis of hundreds of failed ICOs over the years has revealed recurring patterns and contributing factors. Inadequate market research represents a fundamental error—projects that fail to validate demand for their solutions before launching token sales often discover post-fundraising that their target market is smaller than anticipated or that competitors have already captured available demand.

Technical incompetence or overambition causes many projects to fail during the solutions phase. Teams may overestimate their capabilities, underestimate the complexity of their proposed solutions, or lack the specialized expertise required to execute on their roadmaps. The transparency inherent to blockchain solutions means that technical failures become publicly visible, eroding community confidence and making it difficult to recover from setbacks. Additionally, poor tokenomics design can doom projects even when the underlying technology functions as intended—if token utility is unclear, distribution is inequitable, or economic incentives are misaligned, the project struggles to maintain value and engagement.

Common Reasons for ICO Failures

| Failure Category | Description | Prevention Strategy |

|---|---|---|

| Lack of Market Demand | Solution doesn’t address genuine need or market is too small | Conduct thorough market research and validation before fundraising |

| Technical Infeasibility | Proposed solution cannot be built with current technology or team expertise | Realistic scope definition, expert technical advisors, and proof-of-concept solutions |

| Poor Token Economics | Unclear utility, inequitable distribution, or misaligned incentives | Professional tokenomics design with game-theory analysis and stress testing |

| Regulatory Issues | Enforcement actions, compliance failures, or jurisdictional restrictions | Proactive legal consultation and compliance-first approach to structuring |

| Team Dysfunction | Internal conflicts, departures, or inadequate expertise | Careful team selection, clear governance structures, and contingency planning |

| Insufficient Funding | Fail to reach minimum targets or inadequate treasury management | Conservative budgeting, diversified treasury, and milestone-based fund allocation |

| Market Timing | Launching during unfavorable market conditions or excessive competition | Market analysis, flexible timing, and differentiation strategy |

Marketing and community management failures represent another common category of ICO cryptocurrency project failures. Projects that successfully raise capital but fail to maintain engagement with their token holder communities often see declining interest and value. Effective communication requires consistent updates, transparent acknowledgment of challenges, and responsive engagement with community concerns. Projects that disappear after their token sale or provide only sporadic updates quickly lose credibility and support, making it extremely difficult to recover momentum even if technical solutions continue behind the scenes.

Future Trends of ICOs in Fundraising Ecosystems

The ICO fundraising model continues to evolve in response to regulatory solutions, technological advances, and lessons learned from earlier iterations. Several trends are shaping the upcoming ICO landscape based on our observations and strategic forecasting. Hybrid fundraising models combining elements of traditional finance with blockchain innovations are gaining prominence—Security Token Offerings (STOs) that comply with securities regulations while leveraging blockchain efficiency represent one such evolution. Initial Exchange Offerings (IEOs), where cryptocurrency exchanges conduct due diligence and host token sales, provide additional credibility and security for participants.

Increased regulatory clarity in major jurisdictions will likely standardize certain aspects of ICO cryptocurrency offerings, potentially reducing flexibility but increasing institutional participation and investor confidence. We anticipate continued solutions of decentralized fundraising platforms that reduce intermediary roles while maintaining security and compliance features. The integration of artificial intelligence and machine learning into due diligence processes may help investors evaluate ICO projects more effectively, analyzing whitepapers, code repositories, team credentials, and market conditions to provide risk assessments and recommendations.

Emerging Trends in Crypto Fundraising

Regulatory Compliance Focus

Projects increasingly prioritize compliance from inception, working with legal experts to navigate jurisdictional requirements

Institutional Participation

Growing involvement of traditional financial institutions as blockchain infrastructure matures and regulations clarify

Enhanced Due Diligence

Sophisticated evaluation tools and services helping investors assess project viability and risk profiles

Cross-Chain Interoperability

Projects leveraging multiple blockchain platforms to optimize functionality and reach broader audiences

Sustainable Tokenomics

Long-term value creation models replacing short-term speculative designs

Real-World Asset Integration

Increased tokenization of physical assets creating bridges between traditional and digital economies

Sustainability considerations are also influencing ICO project design, with growing awareness of environmental impacts associated with certain blockchain consensus mechanisms. Projects increasingly adopt energy-efficient protocols or carbon-neutral strategies to address these concerns. The maturation of decentralized finance (DeFi) ecosystems is creating new opportunities for ICO tokens to integrate with lending protocols, decentralized exchanges, and yield-generating mechanisms, potentially enhancing utility and value propositions for token holders.

Why Are Initial Coin Offerings Gaining Attention in Capital Raising?

The growing attention directed toward ICO fundraising reflects fundamental shifts in how entrepreneurs, investors, and institutions conceptualize capital formation in the digital age. Traditional fundraising mechanisms, while well-established and regulated, impose barriers that exclude large segments of the global population from both raising and accessing capital. ICOs address these limitations by creating permissionless systems where geographic location, institutional connections, and accredited investor status become less determinative of participation opportunities.

The technological infrastructure supporting ICO cryptocurrency offerings has matured significantly since early implementations, addressing many security concerns and operational challenges that plagued initial projects. Improved Digital contract solutions practices, comprehensive security audit services, sophisticated wallet technologies, and user-friendly interfaces have reduced technical barriers to participation. These advances, combined with growing public awareness of blockchain technology and cryptocurrency assets, have expanded the potential participant base for ICO projects substantially.

Perhaps most significantly, ICOs align with broader trends toward decentralization, community ownership, and direct stakeholder participation in value creation. The millennial and Gen Z demographics that will dominate economic activity in coming decades demonstrate strong preferences for transparent systems, direct participation, and alignment between personal values and investment decisions. The ICO initial coin offering model satisfies these preferences more effectively than traditional capital markets, creating natural synergies between technological capabilities and generational expectations. Our strategic consulting work consistently reveals that clients view ICOs not merely as fundraising mechanisms but as tools for building engaged communities around shared visions of technological and social transformation.

Expert Perspective: The Future of ICO Fundraising

After eight years of deep involvement in the blockchain fundraising ecosystem, including Nadcab Labs’ hands-on experience supporting ICO fundraising initiatives, guiding over a hundred projects through successful launches, advising investors on evaluation criteria, and navigating regulatory frameworks across multiple jurisdictions, we maintain the conviction that ICOs represent a fundamental innovation in capital formation rather than a temporary phenomenon.

The model will continue evolving, incorporating lessons from failures, adapting to regulatory requirements, and integrating with traditional financial systems where appropriate. The upcoming ICO projects that succeed will be those that balance innovation with responsibility, transparency with privacy, and ambitious vision with realistic execution. They will recognize that fundraising represents only the beginning of their journey, with the real challenge lying in delivering value to token holders and building sustainable ecosystems.

For entrepreneurs considering ICO cryptocurrency offerings, success requires more than technological capability; it demands clear communication, genuine community engagement, ethical decision-making, and unwavering commitment to stated objectives. For investors, the opportunities within crypto fundraising remain substantial, but they require diligent research, diversified strategies, realistic expectations, and patience to see projects through their full ICO solution cycles. As Nadcab Labs has consistently observed through years of practical industry engagement, the intersection of blockchain technology and capital formation will continue producing innovations that reshape how we think about ownership, value, and collective enterprise.

Conclusion

Initial Coin Offerings have fundamentally transformed fundraising landscapes, creating unprecedented opportunities for entrepreneurs worldwide while introducing new paradigms for investor participation. As the ecosystem matures, the synthesis of blockchain innovation with regulatory compliance, security best practices, and sustainable tokenomics will define the next generation of successful projects. The future of ICO fundraising lies not in replacing traditional systems entirely, but in creating complementary mechanisms that expand access, enhance transparency, and align incentives between creators and communities. Whether you’re an entrepreneur with a transformative vision or an investor seeking exposure to blockchain innovation, understanding the complexities, opportunities, and responsibilities inherent to ICO cryptocurrency offerings remains essential for navigating this dynamic and evolving landscape.

“`

Frequently Asked Questions

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.