The decentralized finance ecosystem has experienced explosive growth, with weekly DEX trading volume averaging $18.6 billion in Q2 2025-2026, marking a 33% year-over-year increase.[1] As liquidity becomes increasingly fragmented across hundreds of platforms and dozens of blockchains, DEX aggregators have emerged as essential tools for traders seeking optimal execution. A decentralized exchange aggregator connects multiple DEXs simultaneously, scanning for the best prices and routing trades through the most efficient paths. This comprehensive guide explores how DeFi aggregators work and why they’ve become indispensable for modern crypto trading strategies.

Key Takeaways

- Best Price Discovery: DEX aggregators scan multiple exchanges simultaneously to find optimal swap rates across fragmented liquidity pools.

- Reduced Slippage: Smart order routing splits large trades across multiple DEXs, minimizing price impact on high-volume transactions.

- Gas Optimization: Advanced algorithms calculate total transaction costs including network fees to maximize net value returned.

- Multi-Chain Support: Leading aggregators operate across Ethereum, Polygon, Arbitrum, BNB Chain, and Solana for seamless cross-chain trading.

- Non-Custodial Security: Users retain complete control of their crypto assets throughout the trading process.

- MEV Protection: Built-in safeguards prevent front-running and sandwich attacks that exploit regular DEX users.

- Institutional Growth: Aggregator routing volume via platforms like 1inch and Matcha exceeds $3.9 billion weekly in 2025.

What is a DEX Aggregator and Why Does It Matter?

A DEX aggregator is a specialized DeFi protocol that pools liquidity from multiple decentralized exchanges to help users find the best possible price for their token swaps. Unlike trading on a single platform, a decentralized exchange aggregator simultaneously queries dozens of liquidity sources, including automated market makers (AMMs) like Uniswap, SushiSwap, and Curve, along with order book DEXs and private market makers.

The concept functions similarly to how travel aggregators compare flight prices across airlines. When you initiate a swap through a crypto liquidity aggregator, the platform scans all connected exchanges in real-time, identifies which sources offer the most favorable rates, and routes your transaction accordingly. This process happens within seconds, eliminating the need for manual comparison across multiple platforms.

In the current DeFi landscape where liquidity is scattered across hundreds of protocols and multiple blockchains, the importance of DEX aggregation cannot be overstated. In 2023, three protocols accounted for roughly 75% of all DEX volume. By 2025-2026, that same share is distributed across approximately ten protocols, making aggregation essential for price discovery.[2]

How DEX Aggregators Work: The Technical Foundation?

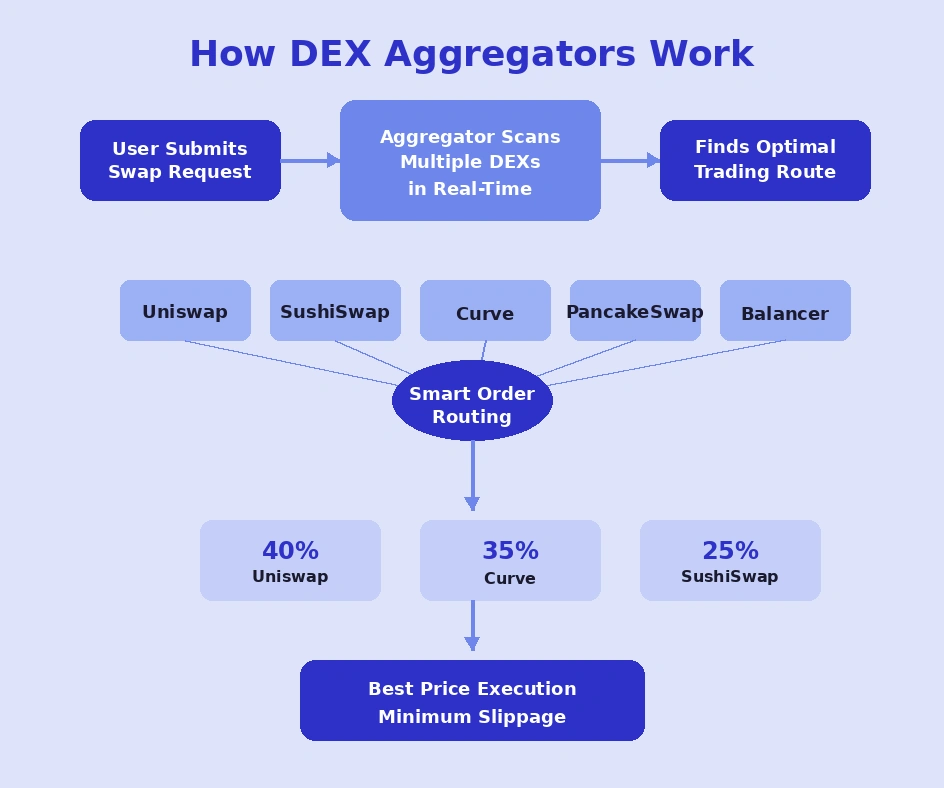

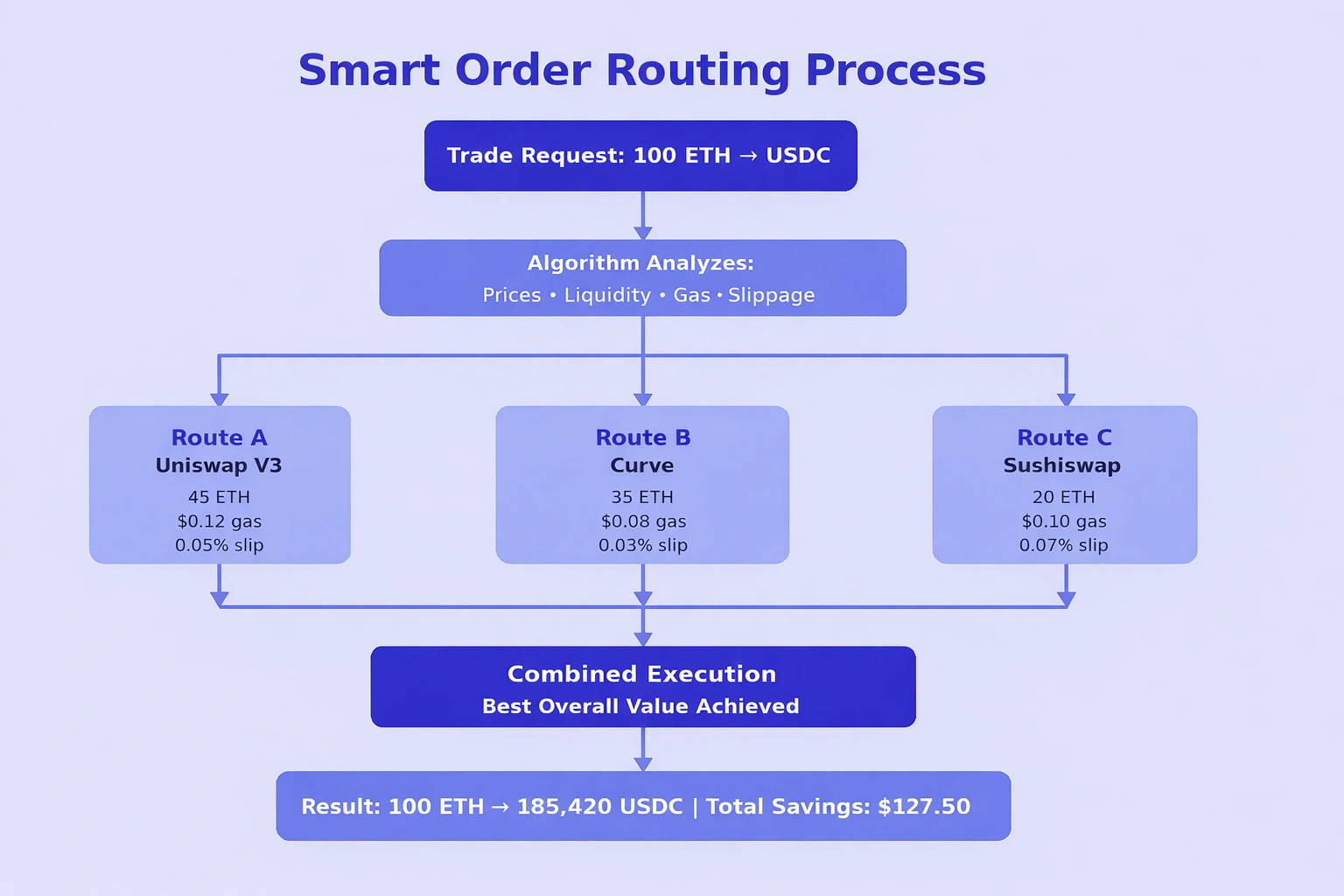

Understanding how DEX aggregators work reveals why they consistently deliver better results than single-exchange trading. The process begins when a user submits a swap request specifying the input token, output token, and amount. The aggregator’s algorithm then executes a sophisticated analysis across all connected liquidity sources.

Smart Order Routing Explained

Smart order routing represents the core technology powering DEX aggregators. Rather than simply identifying the exchange with the best quoted price, these algorithms perform complex calculations that consider exchange rates, transaction fees, gas costs, and potential slippage across every possible trading path. The 1Inch DEX Pathfinder algorithm, for instance, can split a single order across multiple exchanges and liquidity pools when this produces a better overall outcome.

For large trades, smart routing becomes particularly valuable. A $100,000 swap executed on a single DEX might experience significant price impact due to limited liquidity depth. The aggregator addresses this by dividing the order, perhaps routing 40% through Uniswap, 35% through Curve, and 25% through SushiSwap, achieving better average execution than any single venue could provide.

Real-Time Price Discovery

DEX aggregators maintain constant connections to on-chain liquidity sources, updating price data in real-time as market conditions change. This continuous monitoring ensures users receive accurate quotes that reflect current market depth. Advanced platforms also incorporate gas price predictions to estimate total transaction costs, enabling more informed trading decisions during periods of network congestion.

Top Benefits of DEX Aggregators for Crypto Traders

The benefits of DEX aggregators extend far beyond simple price comparison. These platforms fundamentally transform how users interact with DeFi by addressing key challenges in decentralized trading.

1. Access to Best Prices Across Fragmented Liquidity

Liquidity fragmentation represents one of DeFi’s most significant challenges. With tokens trading across multiple exchanges at varying prices, finding the optimal rate manually becomes nearly impossible. A crypto swap aggregator eliminates this problem by providing unified access to all available liquidity. The difference in execution price between using an aggregator versus a single DEX can range from 0.5% to over 3% on less liquid pairs, representing substantial savings on larger trades.

2. Reduced Slippage on Large Trades

Executing substantial orders on a single exchange often results in unfavorable slippage as the trade consumes available liquidity at progressively worse prices. Slippage protection through aggregated routing solves this by distributing orders across multiple venues with deeper combined liquidity. This capability makes aggregators particularly valuable for institutions and whales making high-value transactions. For a DEX aggregator for large trades, the ability to minimize price impact directly translates to preserved capital.

3. Gas Fee Optimization

Network fees on Ethereum can fluctuate dramatically, sometimes making smaller trades economically unviable. Leading aggregators address this through gas-optimized routing that calculates total transaction costs, including both swap fees and network expenses. Some platforms offer “Fusion mode” features that enable gasless swaps by having resolvers cover network fees. This DeFi price optimization ensures users receive maximum net value regardless of network conditions.

4. MEV Protection Against Front-Running

Maximal Extractable Value (MEV) attacks, including front-running and sandwich attacks, cost DeFi users millions annually. Price impact protection features in modern aggregators help users avoid these exploits. By submitting transactions through private mempools or using intent-based architectures, aggregators shield trades from predatory bots that would otherwise profit at users’ expense.

5. Multi-Chain and Cross-Chain Trading

Modern DeFi operates across numerous blockchains, from Ethereum DEX platforms to Polygon DeFi protocols and Binance Smart Chain DEX applications. A multi-chain DEX aggregator unifies access to all these ecosystems through a single interface. Users can compare prices across chains and even execute cross-chain liquidity swaps without manually bridging assets between networks. This interoperability dramatically simplifies the user experience while expanding trading opportunities.

6. Non-Custodial Security

Unlike centralized exchanges that hold user funds, DEX aggregators operate entirely non-custodially. Users maintain complete control of their assets through their own wallets throughout the trading process. Transactions only execute when explicitly approved, eliminating counterparty risk associated with platform insolvency or security breaches. This DeFi trading platform architecture aligns with the core principles of decentralized finance.

DEX Aggregator vs DEX: Understanding the Key Differences

When comparing a DEX aggregator vs DEX, the fundamental distinction lies in liquidity access. A standalone DEX like Uniswap operates its own liquidity pools where users trade directly against deposited assets. An aggregator, by contrast, doesn’t maintain its own liquidity but instead routes trades to wherever the best execution exists.

Single DEXs offer simplicity and direct pool access, making them suitable for straightforward swaps on popular pairs with deep liquidity. However, they cannot optimize across the broader market. Aggregators provide superior execution through their ability to compare and combine multiple venues but may involve slightly more complex interfaces and additional smart contract interactions.

For users asking why use a DEX aggregator, the answer often comes down to trade size and token liquidity. Small swaps of major tokens may see minimal difference, while larger orders or trades involving less liquid assets benefit substantially from aggregated routing.

Best DEX Aggregators Dominating the Market in 2026

Several platforms have established themselves as the best DEX aggregator options for different use cases. The 1inch DEX aggregator leads the EVM ecosystem, having routed approximately $28.6 billion in Q2 2026 alone and capturing over 59% of aggregator market share on Ethereum-compatible chains.[3] The 1inch Pathfinder algorithm continues setting industry standards for route optimization.

Jupiter has emerged as the dominant aggregator on Solana, processing nearly $30.66 billion in average trading volume with its Juno engine that delivers precision pricing across SPL tokens. The Matcha DEX aggregator powered by the 0x Swap API offers an exceptionally clean interface while accessing liquidity across 16 blockchains. ParaSwap distinguishes itself through industry-leading gas optimization, having surpassed $100 billion in historical volume.

Other notable platforms include CoWSwap, which pioneered intent-based trading to batch orders and eliminate MEV, and Rubic, which supports over 70 chains and 360 DEX integrations for users seeking maximum cross-chain coverage.

How to Get the Best Price in DeFi Trading?

Learning how to get the best price in DeFi requires understanding several factors beyond basic aggregator usage. Token swap optimization starts with selecting the right platform for your specific trade. For EVM chains, 1inch typically delivers strongest results, while Solana traders should default to Jupiter.

Timing also matters significantly. Network congestion directly impacts gas costs, so executing trades during lower-activity periods can substantially reduce total transaction expenses. Many aggregators display estimated gas costs upfront, allowing users to make informed decisions about trade timing.

For best price crypto trading, consider comparing quotes across multiple aggregators before executing larger orders. While 1inch often wins, platforms like ParaSwap or CoWSwap may occasionally offer better rates depending on the specific token pair and current market conditions. Setting appropriate slippage tolerances also protects against unfavorable execution without causing unnecessary transaction failures.

The Growing Importance of DEX Aggregators for Institutions

Institutional adoption of DeFi has accelerated dramatically, with aggregators serving as critical infrastructure for professional capital deployment. The 24-hour trading volume for 1inch reached a new all-time high of $7.26 billion in June 2025, with market analysts speculating about an emerging “DeFi Summer” comparable to 2021.[4]

Several aggregators are actively building compliance features to attract institutional flows. These include KYC-compatible trading interfaces and whitelisted liquidity pools that meet regulatory requirements while preserving DeFi’s efficiency advantages. This convergence between traditional finance infrastructure and decentralized execution suggests aggregators will play an increasingly central role in Web3 trading infrastructure.

For developers and businesses, platforms offering DeFi trading API and crypto swap API integrations enable adding aggregated swap functionality to applications. The Liquidity API services from major aggregators allow projects to enable crypto trading in app experiences without building complex routing logic from scratch.

Future of DEX Aggregation: What Traders Should Expect?

The DeFi aggregator landscape continues evolving rapidly. Intent-based architectures are gaining traction, where users specify desired outcomes and compete with resolvers to fulfill orders optimally. This approach shifts from reactive pathfinding to proactive trade settlement, potentially delivering even better execution for complex orders.

Integration with liquidity protocols through connections to Aave Compound liquidity and similar lending platforms enables more sophisticated trading strategies directly through aggregator interfaces. Cross-chain interoperability improvements are making seamless multi-network trading increasingly frictionless. As the DeFi market continues expanding toward its projected $78.49 billion valuation by 2030, aggregators will remain central to efficient capital allocation.

Start Trading Smarter with DEX Aggregators

DEX aggregators have transformed from niche tools into essential infrastructure for anyone serious about DeFi trading. Their ability to discover optimal prices, reduce slippage in DeFi, and avoid price impact in crypto trading makes them indispensable for both retail users and institutional participants. Whether you’re executing your first token swap or managing a substantial portfolio, leveraging aggregator technology ensures you’re capturing the full benefits of decentralized finance’s competitive liquidity landscape.

For those looking to build or integrate DEX aggregator functionality into their own platforms, partnering with experienced blockchain developers can accelerate your roadmap while ensuring robust, scalable implementation. The decentralized trading revolution is well underway, and aggregators are leading the charge toward more efficient, accessible, and profitable DeFi experiences.

Upgrade Your Crypto Trading with Smarter Aggregation

Connect with our Web3 experts to integrate DEX aggregators, optimize trade execution, reduce slippage, and maximize returns across chains.

Frequently Asked Questions

A DEX aggregator is a decentralized finance protocol that combines liquidity from multiple decentralized exchanges to find optimal swap rates for users. It scans various platforms like Uniswap, SushiSwap, and Curve simultaneously, then routes transactions through the most efficient paths. This technology eliminates manual price comparison and helps traders secure better execution prices automatically.

DEX aggregators use smart order routing algorithms to analyze prices, liquidity depth, gas costs, and potential slippage across all connected exchanges in real-time. When you submit a swap request, the aggregator calculates the most profitable trading path. It may split your order across multiple DEXs simultaneously to minimize price impact and maximize returns on your trade.

DEX aggregators provide significant advantages including better prices through unified liquidity access, reduced slippage on large orders via smart routing, gas fee optimization, and MEV protection against front-running attacks. They consolidate fragmented DeFi liquidity into a single interface, saving time while improving trade execution. For serious traders, these benefits translate directly to preserved capital.

The best DEX aggregator depends on your blockchain and trading needs. 1inch dominates EVM chains with 59% market share and industry-leading Pathfinder routing technology. Jupiter leads Solana trading with its Juno engine. ParaSwap excels at gas optimization, while CoWSwap pioneers MEV-resistant intent-based trading. Comparing quotes across multiple platforms often yields optimal results.

DEX aggregators operate non-custodially, meaning users maintain complete control of their funds through personal wallets like MetaMask throughout the entire trading process. Transactions only execute when explicitly approved by the user. Leading platforms undergo regular security audits and implement MEV protection features. However, users should always verify contract addresses and use established platforms with proven track records.

Most DEX aggregators charge minimal or zero direct platform fees to remain competitive. Users pay standard blockchain network gas fees plus any swap fees charged by the underlying DEXs being routed through. The price improvements and gas savings from optimized routing typically far outweigh any additional costs. Some platforms offer gasless “Fusion mode” swaps where resolvers cover network fees.

Yes, DEX aggregators significantly reduce slippage by intelligently splitting large orders across multiple liquidity sources simultaneously. Instead of consuming all available liquidity on a single exchange at progressively worse prices, aggregated routing distributes the trade. This approach accesses deeper combined liquidity pools, minimizing price impact substantially, especially valuable for high-volume institutional trades.

Leading DEX aggregators support multiple major blockchains including Ethereum, Polygon, Arbitrum, Optimism, BNB Chain, Avalanche, Base, and Solana. Multi-chain platforms like Rubic extend coverage to over 70 networks with 360+ DEX integrations. Cross-chain aggregators also enable seamless asset bridging between different blockchain ecosystems, eliminating the need for manual bridging operations.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.