Uniswap DEX Listing Company

Unleash the full potential of your token listings with the leading Uniswap Dex Listing Company. We provide comprehensive uniswap token listing services, ensuring instant global exposure and frictionless trading experience to thrive in a competitive marketplace.

Choose from Nadcab Labs comprehensive Mobile App Porting services

Uniswap Token Listing Services

Global Market Launch

We deploy your token directly to Uniswap’s global trading environment, providing worldwide exposure, unlocking 24/7 trading access, and attracting decentralized users and investors across multiple regions instantly.

Accurate Token Pairing

We ensure your token is paired with optimal assets like ETH or stablecoins, helping reduce slippage, increase liquidity, and attract more traders by offering price stability and deeper pool depth from the very beginning.

Custom Metadata Integration

We integrate essential token metadata such as name, logo, website, and description on Uniswap to enhance your token’s credibility, improve searchability, and make it easily recognizable within the decentralized ecosystem.

Liquidity Pool & AMM Setup

Initial Liquidity Provisioning

We establish initial Automated Market Maker (AMM) pools and supply the required liquidity to kickstart seamless trading while ensuring fair token pricing, low slippage, and protection against market manipulation.

Liquidity Pool Monitoring

Our continuous liquidity monitoring services ensure the health and balance of token pools, preventing imbalances that can lead to price volatility, rug pulls, or decreased user trust within your token’s market.

LP Token Management

We manage LP token creation, distribution, and staking features to help incentivize liquidity providers and build user participation, ultimately increasing retention and depth within the liquidity pool.

Smart Contract Deployment

Secure ERC-20 Deployment

Our developers deploy fully audited, error-free ERC-20 smart contracts with secure coding standards and robust performance to ensure your token operates flawlessly within the Ethereum blockchain ecosystem.

Multi-Network Compatibility

Our smart contracts are deployable across multiple blockchain networks, allowing your token to operate on Ethereum, BSC, Polygon, and more-expanding your token’s reach and multi-chain capabilities.

Comprehensive Security Audits

We conduct rigorous smart contract audits to identify and resolve bugs or vulnerabilities, enhancing user trust and ensuring your token meets all safety standards before public deployment on Uniswap.

Token Visibility & Marketing

Cross-DEX Promotion

We provide multi-DEX listing support with cross-bridge deployment so your token gains visibility and liquidity across platforms like PancakeSwap, SushiSwap, and more, helping reach broader trading communities.

Strategic Liquidity Boost

We set up yield farming and staking reward programs to drive liquidity, encourage investor participation, and foster a thriving trading ecosystem around your token, while maintaining pool balance and volume.

Advanced Token Pair Optimization

Our experts help you choose high-performing trading pairs like ETH, USDC, or DAI to increase trading volume, reduce volatility, and ensure consistent activity for your token within Uniswap’s decentralized market.

Community Growth & Engagement

Automated Airdrop Setup

We develop custom airdrop scripts for token distribution, targeting early adopters to generate engagement, attract active users, and build a loyal token community during the early phase of listing.

Scratch Rewards & Incentives

Add gamified reward features like scratch cards or NFT-based incentives that boost user engagement, make trading fun, and increase token activity by encouraging return visits and ecosystem participation.

Governance Token Integration

Empower your users with DAO-based governance mechanisms using your token, enabling community voting, proposals, and upgrades that increase user retention and promote long-term protocol evolution.

Post-Listing Support & Analytics

Price Stability Monitoring

We monitor price charts and liquidity pool metrics to ensure balanced trading activity and protect your token from extreme volatility, price manipulation, or sudden slippage that could hurt investor confidence.

AI-Based Listing Analytics

Using advanced AI tools, we analyze token performance, pool movements, and user interactions to provide deep insights, helping you adapt strategies for better ROI and sustained token growth over time.

Technical Maintenance & Support

We offer round-the-clock technical support, updates, and performance optimization to ensure your token stays compliant, bug-free, scalable, and secure throughout its listing lifecycle on Uniswap.

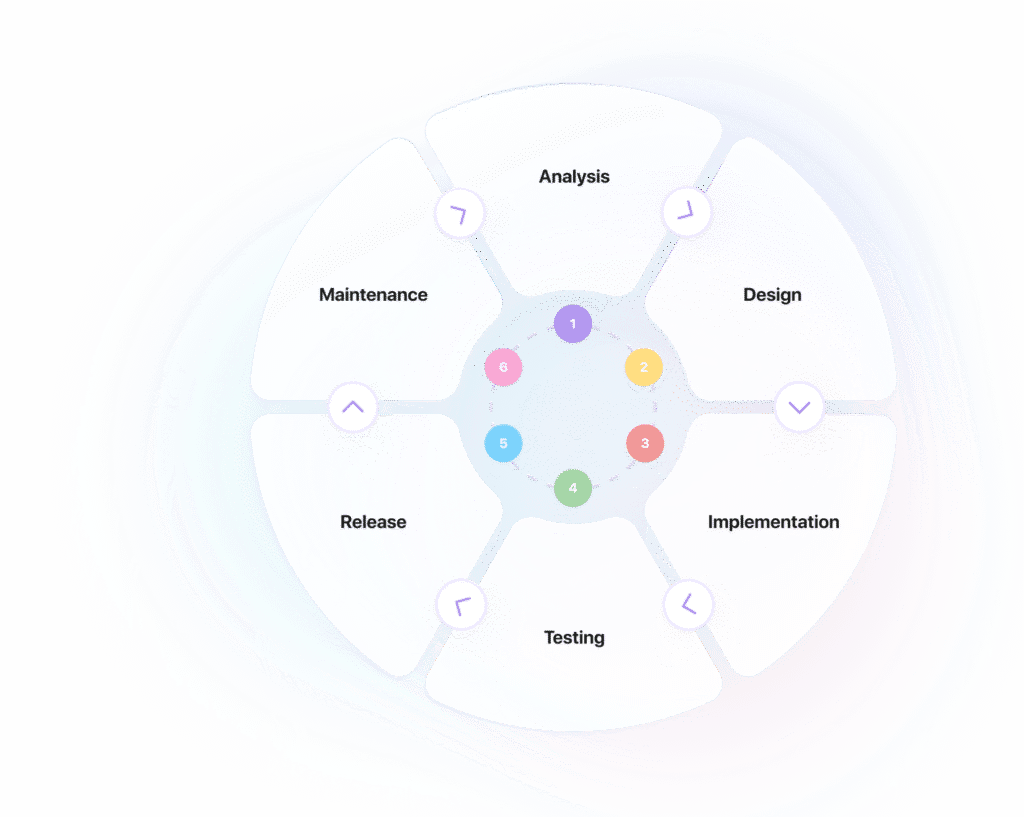

Uniswap DEX Listing Process

We follow a result-driven, secure, and fast-track process to get your token successfully listed on Uniswap DEX.

Smart Contract Creation

We develop secure, ERC-20-compliant smart contracts tailored to your token needs, ensuring safe deployment and future scalability.

Token Verification & Metadata Setup

We register your token with logo, name, and URL on Uniswap, allowing traders to easily verify and interact with your asset.

Liquidity Pool Creation

We set up an AMM pool, provide initial liquidity, and monitor pool health to keep your token actively tradable and visible.

Price Stabilization Strategy

Our team works to reduce volatility with smart pairing strategies, supporting price stability and user trust across trading.

Post-Listing Support & Promotion

We provide ongoing monitoring, airdrop integration, and liquidity incentives to support long-term token visibility and engagement.

Key features of our Uniswap Token Launch

Smart Contract Deployment

Our expert team ensures flawless ERC-20 smart contract deployment, full audits, and compliance to standards for security, performance, and long-term token functionality.

Token Integration on Uniswap

We fully integrate your token on Uniswap with custom front-end details including token logo, description, and website link for seamless user visibility and credibility.

Airdrop Automation

Our professionals automate token distribution through custom scripts, enabling effective airdrops that drive initial user interest, boost engagement, and increase early trading volume.

Liquidity Incentive Setup

We craft yield farming and liquidity mining strategies to encourage token staking, support contract deployment, and reward liquidity providers to grow your token ecosystem.

Token Pair Strategy

We guide you in selecting high-performing token pairs like ETH or stablecoins, improving liquidity, enhancing trading volume, and supporting cross-chain DeFi expansion.

Liquidity Pool Setup

We set up AMM liquidity pools with initial liquidity provisioning and continuous monitoring to ensure stability, attract liquidity providers, and maintain token health.

Our Advanced Tech Stack

With modern blockchain technologies, our stack supports fast deployment, modular development, strong security, and compliance with global industry standards.

Uniswap DEX Listing Case Studies

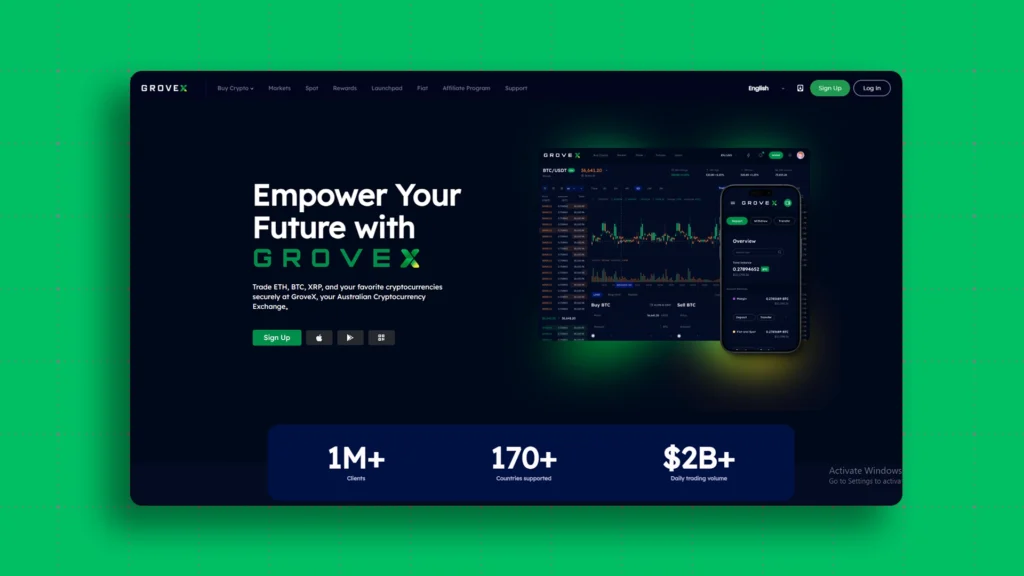

GroveX - Secure & Global Crypto Exchange

GroveX is a secure Australian crypto exchange supporting major and emerging tokens. With 100K+ users in 170+ countries, it offers high liquidity, 2FA, and real-time monitoring.

Rubic - Decentralized Crypto Exchange

Rubic is a decentralized instant Crypto Exchange that aggregates over 200 DEXs, offering users the best crypto rates and seamless cross-chain swaps across 80+ networks, including Non-EVM chains.

Delta Exchange is a leading crypto trading platform offering Bitcoin and Ethereum futures and options. It provides powerful tools for both novice and expert traders to optimize their trading experience.

Advantages of Mobile App Porting

Machine Learning (ML) tools analyze trends and past data to predict token listing outcomes, helping traders and liquidity providers make better, data-backed decisions on Uniswap and beyond.

Cross-DEX Token Listing

We enable multi-DEX listings to increase token exposure and liquidity across chains using decentralized bridges, helping tokens grow visibility and reach new DeFi audiences effectively.

Enhanced Liquidity Incentives

We design programs that reward liquidity providers using NFTs and governance tokens, boosting liquidity depth and keeping traders engaged on your decentralized trading platform.

We implement smart contract-based voting and DAO tools that empower token holders to govern key decisions, enhancing trust and driving community-led token evolution.

Real-Time Price Monitoring Tools

Advanced monitoring tools track token price changes, detect anomalies, and stabilize market performance, ensuring transparency, accuracy, and security in DeFi token listings.

Token Reputation Management

We offer strategic campaigns, reviews, and trust-building mechanisms to enhance token reputation post-listing, helping foster user confidence and long-term project credibility.

Frequently Asked Questions

What is DEX listing?

DEX listing defines making a crypto token available for trading on decentralized platforms such as Uniswap, allowing users to trade from their wallets without central authority.

How do I get listed on Uniswap?

With Nadcab Labs’ expert Uniswap DEX listing services, traders can seamlessly list their tokens, ensuring better liquidity, improved security, and high liquidity for guaranteed success.

Does Uniswap exchange require KYC?

Uniswap does not enforce any Know Your Customer (KYC) verification. However, third-party platforms integrated with Uniswap may initiate their own KYC verifications.

Which blockchain network Uniswap uses?

Uniswap is a decentralized platform, built on the Ethereum blockchain network, that enables users to trade ERC-20 tokens directly from the wallet.

How much does Uniswap charge to list tokens?

There is no charge for Uniswap token listings, but other potential charges associated with Uniswap such as gas fees and liquidity provisional charges.

Get Global Exposure with Uniswap Listing

Maximize your token’s reach with our expert Uniswap DEX listing services—ensuring fast, global exposure and seamless, secure trading for your project.

Blockchain

Blockchain  Apps & Game

Apps & Game  AI & ML

AI & ML  AR & VR

AR & VR  IOT Services

IOT Services  E-commerce

E-commerce  Frontend Developer

Frontend Developer  Backend Developers

Backend Developers  Game Developers

Game Developers  Ecommerce Developer

Ecommerce Developer  Dedicated Developers

Dedicated Developers