Think of buying Bitcoin as easily as you buy groceries online. That’s exactly what cryptocurrency exchanges have made possible. According to Statista, over 420 million people globally owned cryptocurrencies by 2025, and this number continues to climb as exchanges make crypto trading accessible, fast, and secure.

But have you ever wondered what happens behind the scenes when you click “Buy Bitcoin”? What systems process your order? Who sets the price? How is your digital asset secured in a decentralized environment? Let’s unravel the inner workings of a cryptocurrency exchange, the backbone of the crypto economy.

What Is a Cryptocurrency Exchange?

A cryptocurrency exchange is a digital platform that enables users to buy, sell, and trade cryptocurrencies for other assets, such as fiat currencies (USD, INR, EUR) or digital tokens (BTC, ETH, USDT).

These exchanges act as intermediaries, much like stock exchanges, but instead of company shares, users trade digital currencies powered by blockchain technology.

There are two main types-

- Centralized Exchanges (CEXs) like Binance, Coinbase, and WazirX act as trusted intermediaries.

- Decentralized Exchanges (DEXs) like Uniswap and PancakeSwap, which use smart contracts to allow peer-to-peer trading without a middleman.

Each type has distinct mechanisms, advantages, and risk levels, which we’ll explore next.

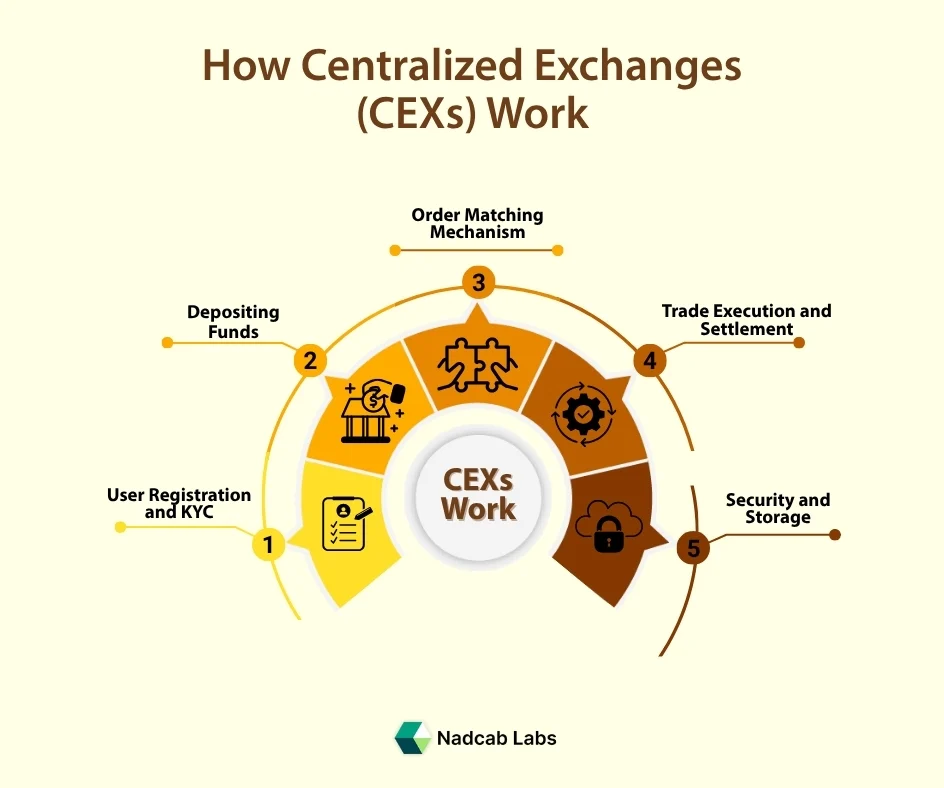

How Centralized Exchanges (CEXs) Work

1- User Registration and KYC

The first step is account creation. CEXs require users to verify their identity through KYC (Know Your Customer) procedures, uploading ID proof, selfies, and sometimes address verification.

This ensures compliance with AML (Anti-Money Laundering) laws, making platforms trustworthy and legally compliant.

Fact- Binance handles over $65 billion in daily trading volume (CoinMarketCap, 2025), proving that user trust in regulated centralized exchanges remains strong.

2- Depositing Funds

Once verified, users deposit funds, either-

- Fiat currency via bank transfer or card payment, or

- Cryptocurrency from another wallet.

These funds are then stored in the exchange’s custodial wallets until a trade occurs.

3- Order Matching Mechanism

At the heart of every CEX lies an order book, a real-time digital ledger containing buy and sell orders.

- When a user places a buy order (bid) or sell order (ask), it enters the order book.

- The matching engine pairs orders of equal value and executes the trade instantly.

For example, if Alice wants to buy 1 BTC for $60,000 and Bob wants to sell 1 BTC at the same price, the exchange matches their orders, facilitating the trade.

This process ensures liquidity, the ability to quickly buy or sell assets without affecting their price.

4- Trade Execution and Settlement

Once matched-

- The exchange updates user balances.

- BTC is credited to Alice’s exchange wallet.

- USD (or other fiat) is credited to Bob.

This happens within seconds due to the exchange’s off-chain ledger system, which records trades internally before final blockchain settlement.

5- Security and Storage

CEXs secure assets through:

- Cold wallets (offline storage for large reserves),

- Hot wallets (online storage for active trading), and

- Multi-signature wallets for added protection.

Platforms like Coinbase ensure digital assets through FDIC or private coverage, a vital trust factor.

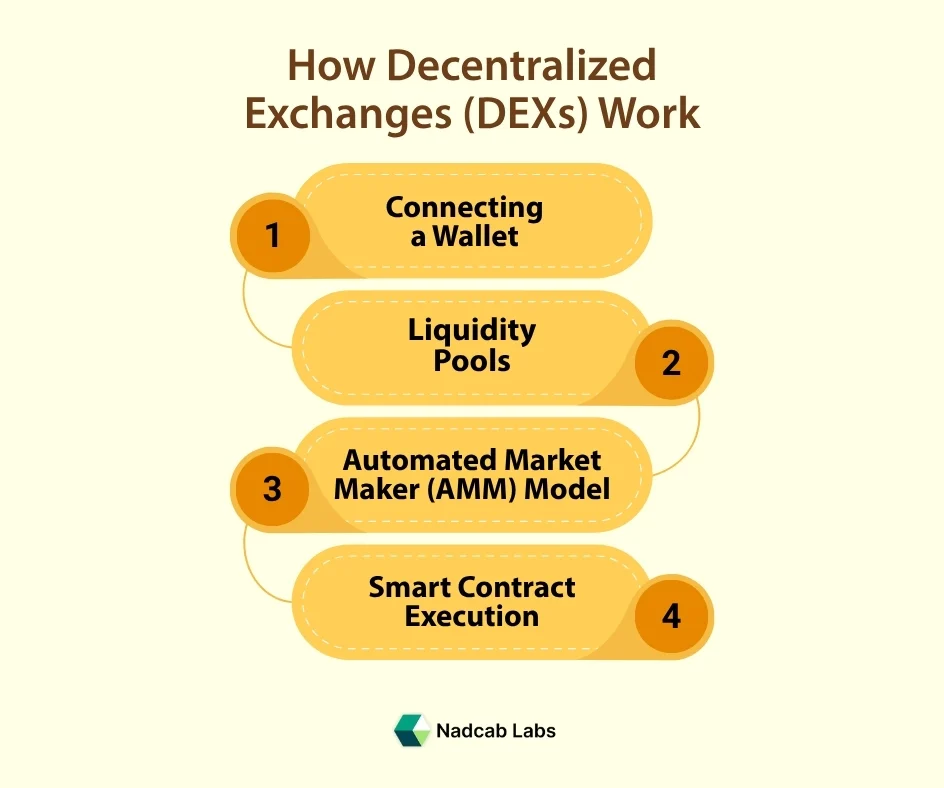

How Decentralized Exchanges (DEXs) Work

Unlike CEXs, DEXs operate without intermediaries. They use smart contracts, self-executing blockchain programs, to enable peer-to-peer trading.

1- Connecting a Wallet

Users connect wallets like MetaMask or Trust Wallet directly to the DEX. No sign-up, no KYC, just blockchain interaction.

2- Liquidity Pools

DEXs replace order books with liquidity pools, reserves of tokens locked by users (liquidity providers).

Example: An ETH/USDT pool allows traders to swap ETH for USDT using the pool’s liquidity.

In return, liquidity providers earn fees and rewards proportionate to their contribution.

3- Automated Market Maker (AMM) Model

AMMs determine asset prices through mathematical formulas rather than through buyers and sellers.

For example, Uniswap’s formula (x*y = k) ensures the product of the two token reserves remains constant.

As more of one asset is purchased, its price increases, mimicking supply and demand.

4- Smart Contract Execution

When a trade is initiated, the smart contract automatically:

- Calculates the exchange rate,

- Executes the swap, and

- Transfers the assets between wallets.

No centralized authority ever touches user funds, offering complete decentralization but also placing responsibility for security on users.

The Technology Behind the Exchange

Cryptocurrency exchanges rely on an integrated ecosystem of technologies:

| Component | Function |

| Blockchain Network | Verifies and records transactions transparently. |

| Smart Contracts | Automate trades and settlements on DEXs. |

| Order Matching Engine | Matches buy/sell orders on CEXs in milliseconds. |

| APIs and Market Data Feeds | Provide real-time pricing and chart updates. |

| Security Protocols | Include encryption, 2FA, SSL, and DDoS protection. |

| Custodial Infrastructure | Manages users’ private keys and digital assets safely. |

Many modern exchanges also integrate AI and machine learning to detect fraudulent transactions and enhance trading efficiency.

Revenue Model- How Exchanges Make Money

Crypto exchanges are profit-driven entities with multiple income sources:

- Trading Fees- A percentage of every trade (usually 0.1%–0.5%).

- Withdrawal Fees- Charged when moving assets off the exchange.

- Listing Fees- New tokens often pay to be listed.

- Margin and Futures Trading- Earns from interest and liquidation fees.

- Staking and Earn Programs- Platforms like Binance Earn or Kraken Staking share the yield with users while keeping a portion.

For instance, Coinbase earned over $3.1 billion in transaction revenue in 2024, demonstrating the massive scale of crypto trading economics.

Security- The Pillar of Trust

Given the digital nature of crypto assets, security is paramount.

Exchanges adopt multi-layered measures:

- Cold Storage (98% of assets offline)

- Two-Factor Authentication (2FA)

- Encryption & SSL Certificates

- Regular Security Audits & Penetration Testing mic

- Bug Bounty Programs reward ethical hackers.

Still, even top platforms aren’t immune; the Mt. Gox hack (2014) and FTX collapse (2022) highlighted why transparency and regulatory oversight are crucial.

As a result, newer exchanges now undergo Proof-of-Reserves (PoR) audits, where blockchain data proves they hold customer assets 1:1.

Regulatory Framework and Compliance

In 2025, governments worldwide will continue tightening regulations:

- India imposes TDS (1%) and a 30% tax on crypto gains.

- The U.S. SEC regulation classifies certain tokens as securities, requiring registration.

- The EU’s MiCA regulation (2024) introduced clear compliance standards for crypto businesses.

Adhering to such frameworks enhances the trustworthiness and longevity of exchanges, aligning with EEAT principles of transparency and user safety.

How a Real Trade Happens

Let’s take an example:

- You open Coinbase and deposit $500.

- You place a buy order for 0.005 BTC at the market price ($100,000/BTC).

- The matching engine finds a seller instantly.

- The trade executes, and your Coinbase wallet now shows 0.005 BTC.

If this were on Uniswap, you’d connect MetaMask, swap USDC → BTC (wrapped form), and the smart contract would complete the trade without an intermediary.

Launch Your Own Crypto Exchange Today

Ready to Build the Next Big Cryptocurrency Exchange? Partner with Nadcab Labs to create a secure, scalable, and high-performance trading platform.

The Future of Cryptocurrency Exchanges

The next phase of evolution includes:

- Cross-Chain Exchanges- Seamless swaps across blockchains via bridges.

- AI-Driven Risk Monitoring- Detects suspicious trades in real time.

- Regulated Hybrid Exchanges (HEXs)- Combining centralized liquidity with decentralized custody.

- Web3 Integration- Direct crypto-to-NFT and DeFi protocol connections.

With global crypto trading volume projected to exceed $10 trillion annually by 2030 (PwC forecast), exchanges will continue driving digital finance innovation.

Read More: Step-by-Step Roadmap to Launch a Crypto Exchange

Closing Insights – The Core Engine of the Crypto Economy

A cryptocurrency exchange isn’t just a crypto trading platform; it’s a sophisticated fusion of blockchain technology, finance, and security architecture.

Whether centralized or decentralized, every exchange performs one core mission: connecting people to the future of money.

Understanding how these exchanges work helps investors trade confidently, assess platform credibility, and embrace the decentralized financial revolution responsibly.

As the digital economy grows, exchanges remain the heartbeat of crypto adoption, empowering millions to participate in the blockchain era.

How do crypto exchanges make money?

Crypto exchanges earn through trading fees, withdrawal fees, token listing charges, and interest from margin trading or staking programs. For example, Coinbase earned over $3 billion from transaction fees alone, showcasing the strong revenue model of these platforms.

Are cryptocurrency exchanges safe to use?

Most leading exchanges adopt multi-layered security measures like cold storage, 2FA, encryption, and Proof-of-Reserves audits. However, users should always use trusted platforms, enable extra security options, and store long-term assets in private wallets.

How does a centralized crypto exchange (CEX) work?

Centralized exchanges like Binance or Coinbase act as intermediaries, handling user funds, verifying identities through KYC, and using an order-matching engine to execute trades instantly. They also offer strong security via cold wallets and multi-signature systems.

What really happens when you buy or sell crypto on an exchange?

When you hit “Buy” or “Sell” on a crypto exchange, a lot happens instantly behind the scenes. The system verifies your funds, matches your order with another trader, updates your wallet balance, and records the transaction securely. All of this occurs within seconds, powered by blockchain technology and high-speed trading algorithms.

What makes decentralized exchanges (DEXs) different from CEXs?

DEXs like Uniswap and PancakeSwap run on smart contracts, enabling peer-to-peer crypto swaps without intermediaries. They use liquidity pools and the Automated Market Maker (AMM) model instead of traditional order books, giving users full control over their funds.