Decentralized Options Trading with Blockchain Integration

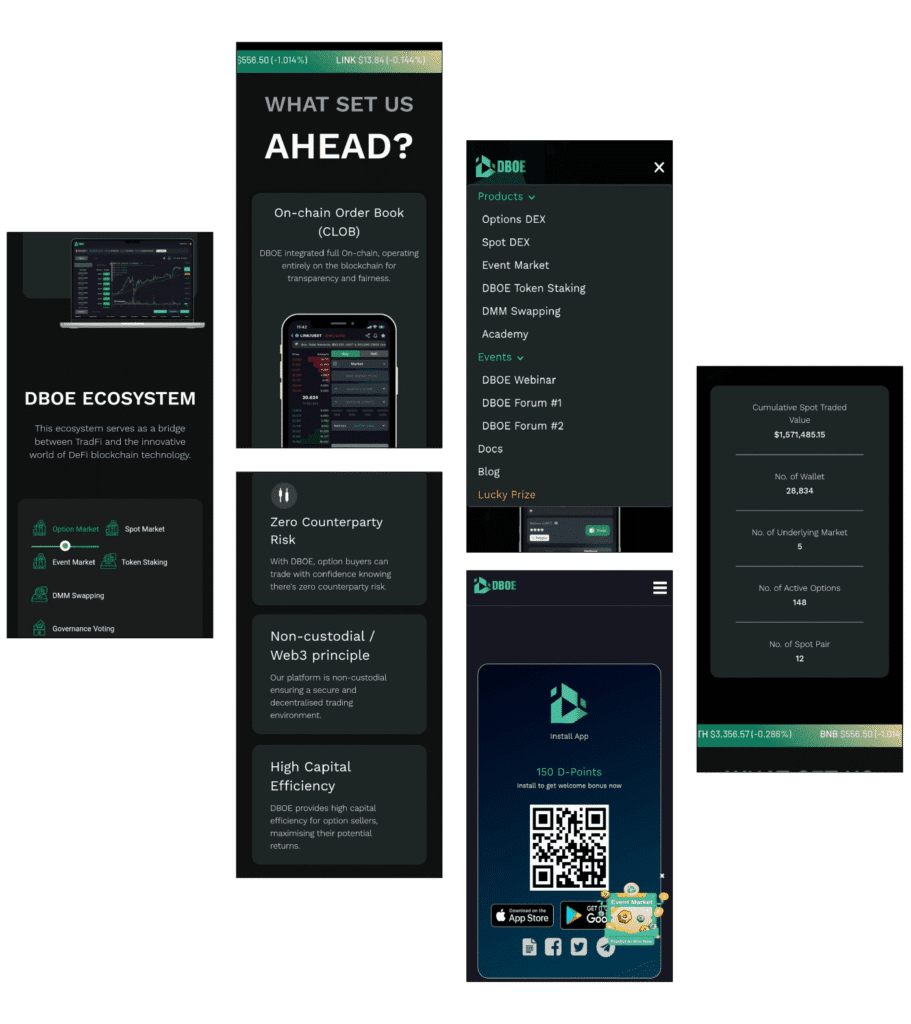

DBOE is a pioneering decentralized options exchange designed for the DeFi space. Operating on Ethereum and Polygon blockchains, it offers non-custodial trading with an on-chain order book, ensuring transparency and zero counterparty risk.

Get Started with this product

DBOE enables direct wallet-to-wallet trading, eliminating fund deposits into centralized exchanges. Users retain full control and ownership of assets, ensuring security without reliance on custodial services or intermediaries.

DBOE’s on-chain order book, powered by Blockchain Technology, ensures real-time trade execution and market visibility, eliminating off-chain systems and promoting fairness in every decentralized transaction.

Smart contracts automate all transactions, eliminating counterparty risk. Option buyers trade securely, knowing settlements are enforced by blockchain, removing the threat of default or manual intervention.

DBOE evolves continuously through user feedback, updates, and audits. This ensures a secure, modern platform that adapts to the growing demands of DeFi and options trading communities.

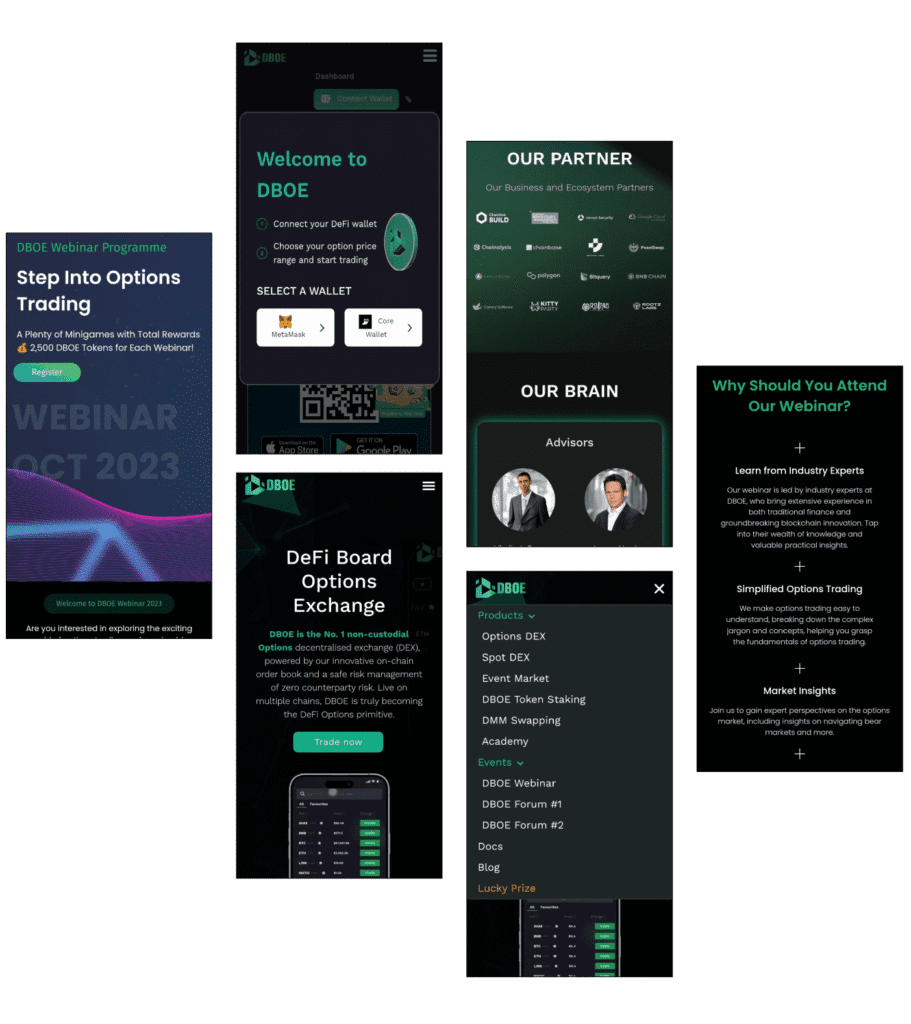

DBOE Academy educates users through tutorials, guides, and paper trading. It empowers traders with essential knowledge to navigate decentralized options markets confidently and effectively without financial risk.

Supporting Ethereum, Polygon, and more, DBOE’s multi-chain approach lowers fees, boosts scalability, and provides users broader market access with flexible network options for seamless trading experiences.

DBOE reduces collateral requirements for option sellers, enhancing capital efficiency. This boosts liquidity, increases returns, and supports greater participation in the decentralized options trading ecosystem.

Operating under global regulations, DBOE ensures a legally compliant platform. It proactively addresses legal challenges to provide a safe, trustworthy environment for decentralized trading worldwide.

DBOE was driven by a set of comprehensive client requirements aimed at revolutionizing options trading within the decentralized finance (DeFi) sector. Key among these was the imperative for a non-custodial trading platform, ensuring that users retain control over their assets at all times without the need to trust a central authority. This requirement stemmed from a growing demand for secure, transparent trading solutions in the blockchain space, where incidents of hacking and fraud have historically plagued centralized exchanges.

Additionally, DBOE prioritized the implementation of an on-chain order book (CLOB), leveraging blockchain technology to ensure transparency and fairness in market operations. This innovative approach not only aligns with the ethos of decentralized systems but also addresses concerns around liquidity and order execution integrity. Another critical requirement was the mitigation of counterparty risk through smart contract mechanisms, offering assurance to option buyers that transactions would be settled as agreed upon without the possibility of default. Furthermore, the platform aimed to enhance capital efficiency for option sellers, enabling them to maximize returns with minimal capital outlay. Alongside these technical specifications, DBOE sought to educate and empower its user base through the DBOE Academy, providing resources and a risk-free environment for learning the intricacies of options trading.

DBOE uses Ethereum Blockchain Solutions for secure, transparent options trading, ensuring decentralized validation and trust through a network of nodes that verify and settle all transactions.

DBOE integrates with Polygon for scalability and low fees, supporting fast, cost-effective transactions using a Proof of Stake system ideal for high-frequency decentralized finance trading.

Decentralized validators verify transactions on DBOE, ensuring accurate order book updates and maintaining transparency, security, and trust across the trading ecosystem without centralized control.

Smart contracts on DBOE are immutable after deployment, locking in trading terms and preventing tampering to guarantee fairness, predictability, and user protection throughout the trading process.

DBOE empowers stakeholders through a decentralized governance model, enabling collective decision-making for platform upgrades, protocol changes, and ecosystem growth aligned with community interests.

DBOE supports multiple blockchains, enabling seamless cross-chain options trading and increasing liquidity, accessibility, and performance by leveraging diverse decentralized ecosystems.

All DBOE transactions are audit-ready and verifiable, allowing users and stakeholders to ensure operational integrity, build trust, and maintain regulatory compliance.

DBOE undergoes regular third-party security audits to detect and resolve vulnerabilities, ensuring continuous protection of user funds, data, and platform operations.

Visual identity and design elements

Primary font family and usage

Brand colors

#0e7a5e

#000508

Project Approach DBOE embarked on its development journey with a strategic and meticulous approach aimed at revolutionizing decentralized options trading. The initial focus was on laying down foundational elements essential for a robust trading platform. This included implementing non-custodial trading features, ensuring that users maintain control over their assets at all times without relying on centralized intermediaries. The integration of an on-chain order book (CLOB) was another critical milestone, leveraging blockchain technology to provide transparency and reliability in order matching and execution.

The development phase involved rigorous testing and optimization to ensure seamless operation across multiple blockchain networks, particularly Ethereum and Polygon. Scalability was a key consideration, with DBOE working to handle increasing transaction volumes efficiently while minimizing costs and latency. User feedback played a pivotal role in shaping iterative updates, focusing on enhancing user experience, security protocols, and operational efficiency.

Project Results Since its inception, DBOE has achieved significant milestones within the decentralized finance (DeFi) sector. The platform has successfully facilitated over $1.5 million in spot trading value across a diverse range of assets, demonstrating strong market participation and liquidity. With an expanding user base exceeding 28,000 wallets, DBOE has solidified its position as a trusted platform for decentralized options trading.Integration with Ethereum and Polygon networks has not only enhanced transaction speeds but also significantly reduced costs, providing users with a seamless trading experience. Immutable smart contracts and regular security audits have further strengthened user confidence by ensuring the integrity and transparency of all transactions on the platform.

One of the primary challenges for DBOE has been navigating the complex regulatory landscape surrounding decentralized finance (DeFi) and options trading. As a platform offering financial services, DBOE must adhere to evolving regulatory requirements across different jurisdictions. Regulatory clarity varies globally, and compliance efforts require substantial resources and legal expertise to ensure that the platform operates within legal boundaries while maintaining its decentralized nature.

Ensuring scalability while maintaining decentralization poses another significant challenge for DBOE. As the platform grows and attracts more users and transactions, scalability becomes crucial to handle increased network traffic and maintain optimal performance. This challenge is exacerbated by the inherent limitations of blockchain networks, such as throughput and latency issues.

Security remains a paramount concern for DBOE, given the decentralized and open nature of blockchain technology. Smart contract vulnerabilities, phishing attacks, and malicious activities pose risks to user funds and platform integrity. DBOE mitigates these risks through rigorous security audits of its smart contracts and platform infrastructure by reputable third-party firms. Despite these measures, the ever-evolving nature of cybersecurity threats necessitates constant vigilance and proactive measures to protect against potential exploits and vulnerabilities.

DBOE’s groundbreaking approach to options trading with transparency.