A Next-Generation Decentralized Exchange

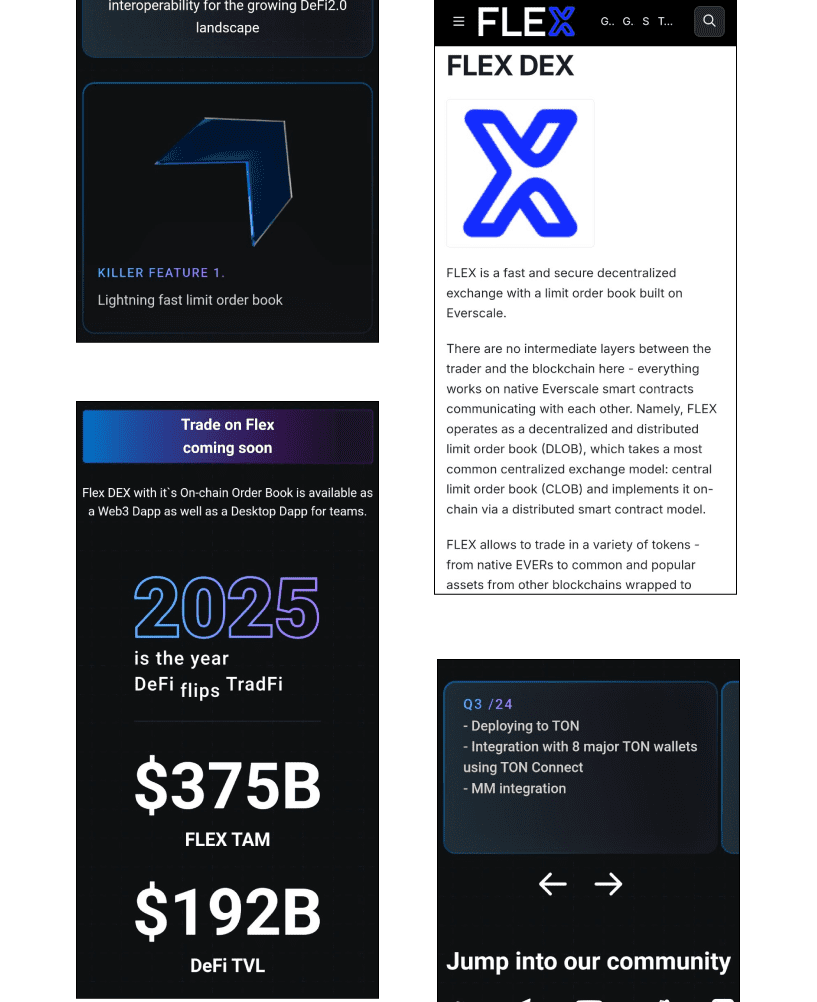

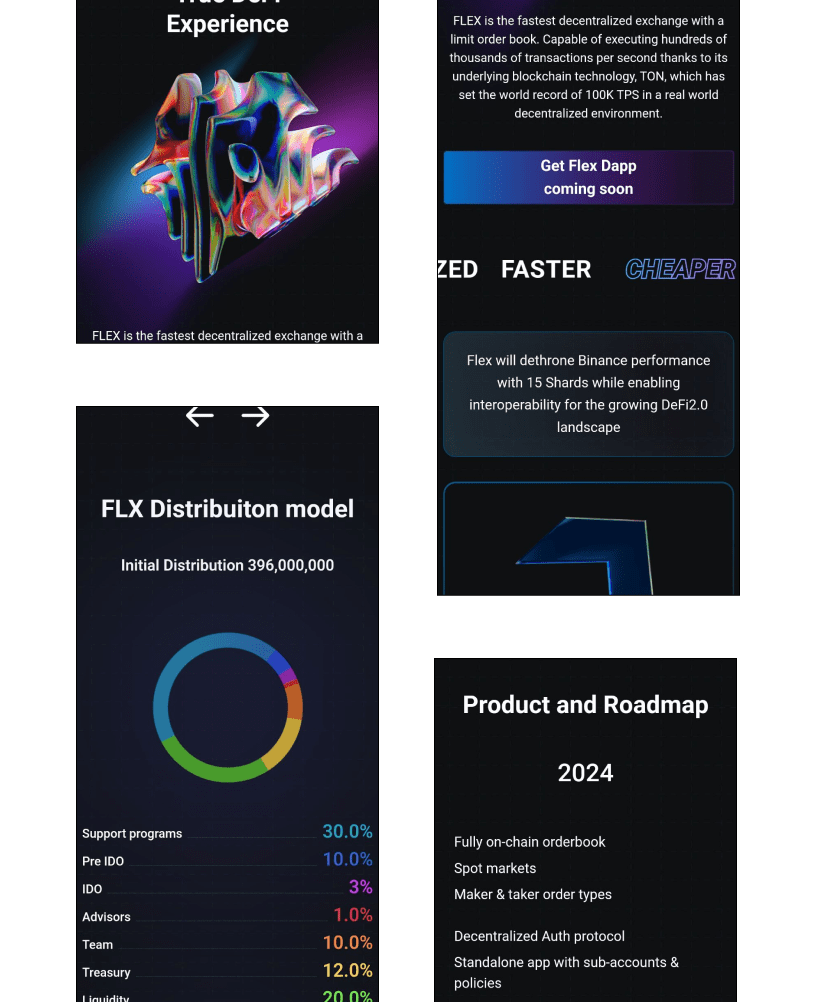

Flex is an advanced decentralized exchange (DEX) built on the TON blockchain, designed to overcome the limitations of existing DeFi platforms. By integrating a decentralized and distributed limit order book (DLOB) model, Flex mimics a traditional centralized limit order book (CLOB) but with superior scalability and speed. The platform addresses common issues in decentralized exchanges, such as slow execution and complex management, through the use of Smart Contracts.

Get Started with this product

Flex uses a decentralized limit order book with smart contracts for each order, enabling scalable, real-time, efficient trade execution without central control, even during high transaction volumes.

Flex achieves near-instant trades with 0.08-second execution times. Distributed smart contracts and user-side logic allow the system to handle 80,000 messages per second per shardchain.

Built on TON, Flex supports multiple blockchains. This cross-chain capability enhances liquidity, expands trading pairs, and ensures adaptability in the evolving DeFi and blockchain ecosystem.

Flex supports market, limit, and iceberg orders. Its infrastructure enables algorithmic trading, giving both novices and pros the tools to execute precise, complex strategies effectively.

Order book data is dynamically retrieved via contract addresses tied to trading pairs and prices. This ensures traders access real-time, accurate market conditions for better decisions.

Flex integrates AMM features with subscription-based contracts. This enables automated trading, maintains liquidity, and ensures users access competitive pricing in a vibrant trading environment.

Flex leverages DeBot for a simple, customizable UI, enabling users to create pairs, place orders, and manage trades seamlessly, ensuring accessibility and ease of use for beginners and experienced traders alike.

Flex employs formal verification to mathematically prove software correctness. This ensures platform security, reliability, and trust—protecting users with rigorously tested smart contracts.

Flex was developed to address critical shortcomings in existing decentralized exchanges, primarily their slow execution speeds and complex management challenges. Clients needed a platform capable of handling a high volume of transactions with minimal latency, ensuring that trades were executed quickly and efficiently. Traditional decentralized exchanges often struggled with performance issues and lacked advanced trading functionalities, making it essential for Flex to offer a solution that could compete with the speed and reliability of centralized exchanges. The goal was to create a system that would not only enhance trade execution but also support a broad range of DeFi applications, including lending, borrowing, and trading strategies.

Additionally, Flex aimed to integrate seamlessly with the growing DeFi ecosystem while maintaining decentralization and security. Clients required a platform that could support innovative financial products and provide an intuitive user experience. This involved developing a robust infrastructure capable of managing complex trading strategies and high transaction throughput without compromising the platform’s decentralization principles. Flex’s architecture needed to ensure that it could handle millions of transactions per second, meet the demands of advanced DeFi applications, and provide a reliable and efficient trading environment.

PoS selects validators based on tokens staked as collateral, reducing energy use. Validators create blocks proportional to stake, promoting honesty, scalability, decentralization, and eco-friendly efficient consensus.

DPoS lets token holders elect delegates to validate blocks, improving speed and scalability. It reduces validators while maintaining PoS security, encouraging active stakeholder participation through voting.

PoW miners solve cryptographic puzzles to validate blocks. It’s secure and attack-resistant but energy-intensive and slower, limiting scalability compared to newer consensus methods.

PBFT achieves consensus despite malicious nodes by requiring majority agreement. It’s fault-tolerant with high throughput but less efficient as node count grows due to communication overhead.

PoA uses trusted, pre-approved validators to confirm transactions. It offers high speed and low latency but sacrifices decentralization, ideal for private or consortium blockchains.

PoSpace uses participants’ disk storage to validate blocks. It’s energy-efficient compared to PoW but may be less secure and less tested than other consensus protocols.

PoET randomly assigns block creation rights after waiting periods managed by trusted execution environments, offering fairness and energy efficiency. Common in permissioned blockchains relying on trust.

This hybrid combines PoS staking with delegate voting. It streamlines block validation, boosting transaction speed and efficiency while preserving PoS’s security and decentralization benefits.

Visual identity and design elements

Primary font family and usage

Brand colors

#9a7ffa

#16131c

The development of Flex began with a thorough analysis of the existing landscape in decentralized staking platforms. The team embarked on extensive market research to identify gaps and challenges in current staking solutions, aiming to address issues related to security, transparency, and user experience. This research involved studying competitors, understanding user pain points, and evaluating industry trends. The objective was to craft a platform that not only met the essential requirements of staking but also introduced innovative features to enhance user engagement and satisfaction. During the design phase, the focus was on creating an intuitive and user-friendly interface that catered to both novice and experienced users. The platform’s features, including the staking calculator and full control over funds, were designed to be easily accessible and straightforward. To ensure robustness, the development team implemented a secure and scalable architecture using advanced cryptographic techniques.

Flex has demonstrated substantial success and impact since its inception, marking a significant milestone in the decentralized staking space. The platform has successfully accumulated a substantial staked value of $34,366,628, reflecting its ability to attract and sustain considerable user investment. This impressive figure is complemented by the platform’s daily rewards system, which has consistently delivered value to users. With over 2,359 active participants and a remarkable 99.9% success rate in staking rounds, Flex has proven its capability to maintain a high level of operational efficiency and reliability. The success of Flex is further underscored by its innovative features, such as the staking calculator and the ability to maintain full control over staked funds. The staking calculator has provided users with valuable insights into their potential earnings, enhancing their ability to make informed investment decisions.

One of the significant challenges Flex faced was achieving high-speed execution and scalability within a decentralized environment. Traditional decentralized exchanges often struggle with latency and slow order processing due to the time required to validate and execute transactions on the blockchain. To address this, Flex needed to design a system that could handle large volumes of transactions while maintaining rapid execution times. This required a novel approach to order book management, utilizing a decentralized limit order book (DLOB) model on the TON blockchain.

Front-running, where traders exploit transaction visibility to gain an unfair advantage, has been a persistent issue in decentralized exchanges. In traditional systems, this problem is often mitigated by miners who prioritize transactions based on gas fees. Flex faced the challenge of preventing front-running within its decentralized framework, where traditional solutions do not apply. To counteract this, Flex implemented a system where each order is handled by individual smart contracts, and the matching logic is processed by user clients.

Managing a decentralized limit order book (DLOB) presents inherent complexities, particularly in terms of user interface and experience. Flex needed to create a platform that not only offered advanced trading functionalities but also remained user-friendly. The challenge was to design an interface that could handle the complexity of order book management, including various order types and trading strategies, while being accessible to users with varying levels of expertise. Flex addressed this by integrating automated market makers (AMMs) and dynamic order book composition into its platform.

Flex offers high-speed trading with 0.08-second execution, automated market makers, a user-friendly interface, formal verification for security, flexible order management, cross-platform integration, and comprehensive trading tools for their users.