Development Secure Yield in CeDeFi

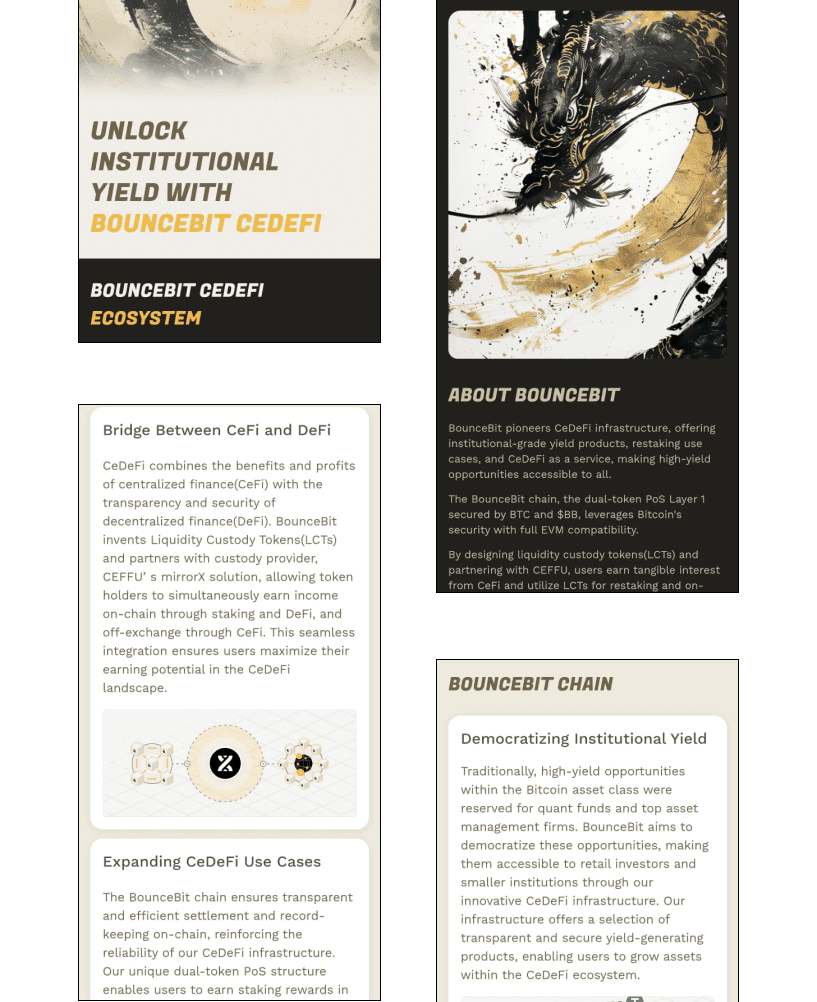

BounceBit is a pioneering platform in the CeDeFi (Centralized Decentralized Finance) space, designed to bridge the gap between CeFi and DeFi. By combining the security of centralized finance with the transparency and flexibility of decentralized protocols, BounceBit offers high-yield opportunities previously reserved for institutions to a broader audience. Its dual-token PoS Layer 1 Chain Development, secured by Bitcoin, enhances the safety and functionality of its infrastructure, making yield generation accessible, transparent, and efficient.

Get Started with this product

MirrorX enhances off-exchange settlements by securing user assets in custody while enabling CeFi and DeFi yields. It ensures fast, secure, transparent transactions, reducing risks and improving investor confidence and efficiency.

LCTs enable users to earn through staking and CeFi partnerships simultaneously. These tokens support restaking, increase earning potential, and provide secure, cross-chain liquidity management for seamless CeFi and DeFi engagement.

BounceBit’s dual-token PoS chain supports governance and staking while enhancing security and performance. It bridges CeFi and DeFi activities, ensuring scalable infrastructure and efficient yield opportunities for all participants.

BounceBit offers delta-neutral arbitrage by capturing funding rate differences on exchanges. This strategy generates stable, low-risk returns while MirrorX and LCTs secure and streamline asset management for optimal performance.

BounceBit’s on-chain broker provides fast trades, low fees, and tight spreads. Eliminating intermediaries, it uses LCTs and PoS security to ensure transparent execution with real-time settlements and enhanced user control.

BounceBit enables CeDeFi liquidity mining through Binance APIs. Users earn $BB or BBTC by contributing liquidity during trades, creating passive income and strengthening the platform’s ecosystem with automation and transparency.

BBScan is BounceBit’s blockchain explorer, showing live transaction data and staking history. It empowers users to verify asset movements, audit activity transparently, and build trust through detailed, real-time blockchain insights.

BounceClub is an AI-driven aggregator on BounceBit, combining DeFi, GameFi, and Memecoin tools. It simplifies discovery and decision-making, giving users one platform to explore and maximize earning opportunities efficiently.

The growing demand for secure, transparent, and high-yield financial products prompted clients to seek a platform that could democratize these opportunities, making them accessible beyond traditional institutional investors. Clients required a robust infrastructure that offered secure on-chain and off-chain settlement while maintaining the transparency and flexibility of DeFi. The platform needed to provide seamless integration between CeFi and DeFi, allowing retail investors and smaller institutions to benefit from these high-yield opportunities.

In addition to this, clients wanted a comprehensive asset management solution that combined the stability of CeFi with the yield-generating potential of DeFi. The system needed to cater to their diverse yield-generating needs, whether through staking, liquidity mining, or trading activities. Furthermore, clients prioritized security, seeking a solution that leveraged Bitcoin’s security while offering EVM compatibility for broader DeFi participation.

BounceBit uses CEFFU’s MirrorX for secure off-chain settlements, enabling fast CeFi transactions. It ensures trusted, seamless trading without moving assets, reducing risks and improving security within the CeDeFi ecosystem.

BounceBit’s DPoS lets users delegate tokens to validators for faster transactions and decentralization. Delegators earn rewards, supporting scalability and empowering all token holders to participate in network security and governance.

BounceBit’s restaking allows Liquidity Custody Tokens (LCTs) to be staked across multiple pools. This boosts rewards, flexibility, and network security while increasing user engagement and long-term ecosystem participation.

Users stake $BB and BBTC tokens to validate transactions and secure BounceBit’s network. This energy-efficient consensus boosts scalability, rewards participants, and supports a secure, decentralized CeDeFi ecosystem.

Users stake BB tokens for transaction validation on BounceBit on-chain consensus. This promotes transparency, distributes, prevents centralization & rewards participants, enhancing trust & ecosystem engagement.

BounceBit’s Liquidity Proof shows real-time liquidity availability. It increases transparency, reduces trading risks, and supports safe participation in markets, especially for institutional users needing assurance before staking or trading.

BounceBit conducts automated audits for all smart contracts before execution. This process ensures security, prevents vulnerabilities, and maintains safe, smooth operations across CeDeFi staking and transaction environments.

BounceBit supports cross-chain compatibility, enabling users to transfer assets securely across blockchains. This expands access to DeFi and CeFi opportunities while ensuring transaction integrity through multi-chain consensus validation.

Visual identity and design elements

Primary font family and usage

Brand colors

#eeeadd

#21201c

Project Approach: The BounceBit project was developed with a focus on bridging the gap between CeFi and DeFi, offering users a seamless experience to access high-yield opportunities across both financial models. The project team began by designing a dual-token Proof of Stake (PoS) Layer 1 blockchain, secured by Bitcoin and $BB tokens. This approach leveraged Bitcoin’s robust security while incorporating the flexibility and efficiency of a PoS system, allowing users to stake their tokens and earn rewards. Additionally, the creation of Liquidity Custody Tokens (LCTs) provided users with a unique mechanism to earn yields from both centralized and decentralized finance platforms. To ensure security and scalability, BounceBit integrated CEFFU’s MirrorX technology for off-chain settlement, providing a secure environment for institutional and retail users.

Project Results: The BounceBit project successfully achieved its goal of democratizing institutional-grade yield opportunities for both retail and institutional investors. By leveraging its dual-token PoS system and integrating innovative technologies like Liquidity Custody Tokens and CEFFU’s MirrorX, BounceBit enabled users to earn consistent returns while maintaining security and transparency. The platform’s on-chain staking and off-chain settlement mechanisms proved highly effective, allowing users to participate in both DeFi and CeFi activities without the risk of centralization or liquidity issues. BounceBit’s focus on ease of use and flexibility led to significant user engagement across its ecosystem, with the BounceClub aggregator and on-chain brokerage services becoming popular among users seeking efficient trading and staking opportunities. The platform also expanded its liquidity mining and restaking features, providing users with multiple avenues for generating income.

One of the major challenges BounceBit faced was ensuring that their platform maintained high levels of security while remaining accessible to a wide range of users, from institutional investors to retail traders. With the integration of both CeFi and DeFi components, the team had to ensure that the security architecture was robust enough to protect users’ assets, particularly during off-chain settlements via CEFFU’s MirrorX.

Another significant challenge was ensuring seamless cross-chain compatibility. BounceBit operates with a dual-token Proof of Stake (PoS) mechanism that interacts with multiple blockchain networks. While this cross-chain functionality enables users to take advantage of yield opportunities on different platforms, it also introduces technical complexities. Each blockchain has its own set of protocols, consensus mechanisms, and security standards, making it difficult to ensure smooth, secure interaction between them.

Though BounceBit aimed to democratize access to high-yield opportunities, educating retail investors on how to utilize the platform effectively was a challenge. Many retail users are unfamiliar with advanced financial strategies like delta-neutral funding rate arbitrage or liquidity mining, which are crucial to maximizing returns within the CeDeFi ecosystem. The team needed to develop comprehensive educational resources and user-friendly tools, such as the BounceClub aggregator, to simplify complex yield-generating opportunities.

BounceBit offers CeDeFi solutions, including staking, liquidity mining and cross-chain asset management.