Key Takeaways

- An order book is a real-time digital ledger that displays all pending buy and sell orders for a specific asset, serving as the fundamental mechanism for price discovery and trade execution in financial markets.

- Order books consist of two primary sides: the bid side showing buy orders with prices buyers are willing to pay, and the ask side displaying sell orders with prices sellers will accept, with the spread between them indicating market liquidity.

- Market depth revealed through the order book shows the cumulative volume at various price levels, helping traders assess whether the market can absorb large orders without significant price impact or slippage.

- Level 2 order book data provides detailed visibility into multiple price levels beyond just the best bid and ask, enabling sophisticated analysis of market structure, support and resistance zones, and institutional activity patterns.

- Crypto order books function similarly to traditional stock market order books but often feature higher volatility, 24/7 trading, and varying liquidity conditions across different exchanges and trading pairs.

- DEX order books offer decentralized trading with self-custody benefits but may have lower liquidity compared to centralized exchanges, while AMM models provide constant liquidity through algorithmic pricing at the cost of potential slippage and impermanent loss.

- Reading an order book effectively requires analyzing order sizes, identifying buy and sell pressure imbalances, recognizing spoofing patterns, and understanding how market participants position themselves around key price levels.

- Common mistakes in order book analysis include misinterpreting large orders that may be canceled, ignoring liquidity signals that warn of execution difficulties, and over-relying on short-term order flow data without considering broader market context.

What Is an Order Book?

An order book represents the electronic backbone of modern financial markets, functioning as a comprehensive real-time list of all buy and sell orders for a specific trading instrument. Whether you are trading stocks, cryptocurrencies, forex, or commodities, the order book serves as the central repository where market participants express their trading intentions through limit orders, market orders, and other order types. This sophisticated system captures every bid to purchase and every offer to sell, organizing them by price level and timestamp to create a transparent view of market supply and demand.

With over eight years of experience analyzing order flow dynamics across multiple asset classes, we have observed that understanding what is an order book forms the foundation for successful trading strategies. The order book is not merely a passive display of numbers but rather a living, breathing representation of market psychology, showing where buyers believe value exists and where sellers think prices have peaked. Every entry in the book tells a story about trader expectations, risk appetite, and market sentiment.

The concept of an order book has evolved significantly from the days of physical trading floors where specialists maintained handwritten records. Today’s electronic order books process millions of orders per second, updating in real time as market conditions change. This technological advancement has democratized access to trading information that was once available only to exchange members and professional market makers, allowing retail traders to see the same order book data that institutional participants use to make trading decisions.

Order Book Meaning

The order book meaning extends beyond a simple list of orders to encompass the entire mechanism through which modern markets establish fair prices and facilitate trade execution. At its core, an order book aggregates the collective wisdom and intentions of all market participants, creating a consensus on what an asset is worth at any given moment. This aggregation happens through a continuous auction process where buyers compete to pay the highest price while sellers compete to accept the lowest price that meets their requirements.

In practical terms, the order book meaning translates to a structured dataset that reveals critical trading information. Each entry contains specific details: the price at which someone is willing to trade, the quantity they want to buy or sell, the time the order was placed, and the order type. This granular information allows sophisticated traders to gauge market depth, identify potential support and resistance levels, and anticipate short-term price movements based on the balance between buying and selling pressure.

The significance of the order book extends to its role in ensuring market transparency and fairness. By making order information visible to all participants, the order book prevents information asymmetry and reduces the potential for market manipulation. Traders can see exactly what prices are available, how much volume sits at each level, and how the market structure changes in response to new information or large trades. This transparency is fundamental to maintaining trust in financial markets and ensuring that prices reflect genuine supply and demand rather than artificial manipulation.

Order Book Definition in Trading

The formal order book definition in trading describes it as an electronic list of buy and sell orders for a specific security or financial instrument, organized by price level. This definition encompasses several critical components that work together to create a functional marketplace. The order book maintains strict price-time priority, meaning that orders at better prices receive execution priority, and among orders at the same price, those placed earlier take precedence.

From a technical standpoint, the order book definition includes both visible and hidden elements. While most orders appear in the public order book, allowing all market participants to view them, some markets also support iceberg orders or hidden liquidity that does not display in the visible book. This hidden liquidity can significantly impact actual market depth and execution quality, particularly for large institutional orders that seek to minimize market impact by concealing their full size.

The order book operates as a double auction system where buyers and sellers continuously submit orders, creating a dynamic equilibrium point. When buy orders meet sell orders at compatible prices, the matching engine executes trades automatically, removing the filled portions from the book and updating the market price. This continuous process of order submission, matching, and execution creates the price discovery mechanism that determines fair market value for traded assets across global financial markets.

Why the Order Book Matters

Understanding why the order book matters is essential for anyone serious about trading or investing in financial markets. The order book serves as the primary mechanism for price discovery, the process through which markets determine the fair value of assets based on supply and demand. Without a functioning order book, there would be no transparent way to establish prices, match buyers with sellers, or ensure that trades execute at fair market values.

For traders, the order book provides invaluable insights into market microstructure and short-term price dynamics. By analyzing order book data, skilled traders can identify areas where large buyers or sellers are positioned, anticipate potential breakouts or reversals, and optimize their entry and exit timing. The order book reveals information that price charts alone cannot show, such as the actual liquidity available at different price levels and whether the market can absorb large orders without significant price impact.

The order book also matters from a market efficiency perspective. Deep, liquid order books with tight spreads indicate healthy markets where participants can trade with confidence at fair prices. Conversely, thin order books with wide spreads suggest potential difficulties in executing trades and higher transaction costs. Regulators and exchange operators monitor order book quality as a key indicator of market health, implementing rules and incentives to encourage market makers to provide consistent liquidity across various market conditions.

Beyond individual trading decisions, the order book impacts broader market stability and risk management. During periods of market stress, the order book can reveal whether sufficient liquidity exists to handle selling pressure or whether a market crash might be imminent. Risk managers at financial institutions analyze order book depth to assess the potential market impact of large portfolio trades, helping them develop execution strategies that minimize costs and reduce market disruption.

How Does an Order Book Work?

Understanding how does an order book work requires examining the intricate process through which orders flow from submission to execution. The system begins when a trader decides to buy or sell an asset and submits an order to the exchange or trading platform. This order contains critical information including the order type (market, limit, stop, etc.), the quantity desired, and for limit orders, the specific price at which the trader is willing to transact.

Once submitted, the order travels through the exchange’s infrastructure to reach the matching engine, a sophisticated software system that processes orders at incredible speeds. The matching engine evaluates the incoming order against existing orders in the book, following strict price-time priority rules. If the new order can match immediately with existing counter-party orders, the trade executes and both parties receive confirmations. If no immediate match exists, limit orders join the queue at their specified price levels, waiting for future matching opportunities.

The order book works continuously throughout trading hours, processing thousands or even millions of orders per second in high-volume markets. Each new order, cancellation, or modification triggers updates to the order book display, ensuring that all participants see current market conditions in real time. This constant activity creates the dynamic environment that characterizes modern electronic trading, where market conditions can shift dramatically in milliseconds based on incoming order flow.

Order Placement Process

The order placement process begins when a trader analyzes market conditions and decides to enter a position or exit an existing one. The trader selects their desired order type based on their execution preferences and risk tolerance. Market orders prioritize speed over price, executing immediately at the best available prices in the order book. Limit orders specify exact prices, offering price certainty but with the risk that the order may never execute if the market does not reach the specified level.

After order submission, the exchange validates the order to ensure it meets all requirements, including sufficient account balance or margin, compliance with price limits or circuit breakers, and adherence to lot size requirements. This validation process happens nearly instantaneously but serves as a critical safeguard against erroneous orders that could disrupt market functioning. Once validated, the order receives a unique identifier and timestamp, establishing its position in the execution priority queue.

Different order types interact with the order book in distinct ways. Aggressive orders that cross the spread (market orders or marketable limit orders) take liquidity from the book by executing against existing orders. Passive orders that join the book at prices away from the current market add liquidity, creating new trading opportunities for future participants. Understanding this distinction between liquidity-taking and liquidity-providing orders is fundamental to advanced trading strategies and market making activities.

Order Matching and Execution

Order matching and execution represent the critical moment when buyer and seller meet in the order book. The matching engine compares incoming orders against the opposite side of the book, searching for compatible prices and quantities. When a match occurs, the system executes the trade at the price specified by the resting limit order, following the principle that passive liquidity providers set the execution price while aggressive liquidity takers pay the spread to receive immediate execution.

The execution process follows strict rules designed to ensure fairness and prevent manipulation. Price-time priority means that the best-priced orders execute first, and among orders at the same price, those submitted earliest receive priority. This creates strong incentives for market participants to offer competitive prices and rewards those who commit capital to the market by posting limit orders. Some markets also implement pro-rata matching or other allocation algorithms for specific situations, but price-time priority remains the dominant model across most exchanges.

Partial fills occur when the order book lacks sufficient liquidity to completely fill an incoming order at a single price level. In these cases, the order executes against multiple levels in the book, receiving fills at progressively worse prices until the entire order quantity is satisfied or the order’s limit price is reached. This phenomenon, known as walking the book, can result in slippage where the average execution price differs from the initially quoted best bid or ask price.

Real-Time Order Book Updates

Real time order book updates occur continuously as market participants submit new orders, cancel existing ones, or modify their positions. Modern exchanges broadcast these updates through data feeds that subscribers can access, typically with latency measured in microseconds for co-located servers or milliseconds for remote connections. The speed and reliability of these updates are critical for algorithmic trading systems that make decisions based on current market conditions.

The update frequency in active markets can be overwhelming, with popular trading pairs experiencing thousands of updates per second during volatile periods. Trading platforms aggregate these updates to provide human traders with manageable information displays, typically showing snapshots of the book at regular intervals rather than every individual change. However, high-frequency trading firms and sophisticated algorithmic traders often consume raw, tick-by-tick data to gain every possible informational advantage.

Order book updates provide transparency but also create challenges for traders trying to interpret rapidly changing data. A large order appearing in the book might signal genuine buying or selling interest, or it could be a spoofing attempt designed to manipulate other traders’ perceptions. Similarly, rapid cancellations and resubmissions might indicate algorithmic market making or potentially manipulative layering strategies. Experienced traders learn to distinguish between meaningful order flow and noise, focusing on sustained patterns rather than momentary fluctuations.

Key Parts of an Order Book

The key parts of an order book work together to create a comprehensive view of market supply and demand. Each component serves a specific function in the price discovery and trade execution process, and understanding these elements is essential for effective order book analysis. The order book typically displays as a two-column structure with bids on one side and asks on the other, though some platforms use graphical representations or depth charts to visualize the same information.

At the top of the order book sits the best bid and best ask, representing the highest price any buyer is currently willing to pay and the lowest price any seller will accept. The difference between these two prices creates the bid-ask spread, one of the most important metrics in trading. A tight spread indicates high liquidity and low transaction costs, while a wide spread suggests the opposite. Professional traders monitor spread dynamics closely as they directly impact trading profitability and execution quality.

Beyond the top of the book, deeper levels reveal the full market depth available at various price points. This depth information shows not just where the next trade might occur but also how much volume the market can absorb before prices need to adjust. Traders use this depth information to assess whether they can execute large orders without causing significant market impact, a critical consideration for institutional traders managing large positions across multiple assets.

Buy Side: Bids and Buy Orders

The buy side of the order book displays all active bids and buy orders arranged in descending price order, with the highest bid at the top. Each entry shows the price level and the cumulative quantity of shares, contracts, or coins that buyers want to purchase at that price. The buy side represents demand in the market, showing where buyers believe value exists and how much they are willing to purchase at different price levels.

Buy orders enter the book when traders believe an asset is worth purchasing at their specified price or better. Aggressive buyers who want immediate execution submit market orders or limit orders priced at or above the current ask, while patient buyers post limit orders below the current market price, waiting for the market to come to them. This mixture of aggressive and passive buying creates the layered structure visible in the order book, with each level representing a different valuation assessment by market participants.

Analyzing the buy side reveals important information about support levels and buying interest. Large bid quantities at specific prices can act as psychological support, attracting additional buyers who see those levels as good entry points. However, traders must remember that orders can be canceled at any time, so what appears as strong support might evaporate if market conditions change. The most reliable support comes from consistent buying pressure demonstrated through actual executions rather than just resting orders in the book.

Sell Side: Ask Prices and Sell Orders

The sell side of the order book contains all ask prices and sell orders organized in ascending price order, with the lowest ask displayed at the top. This side represents supply in the market, showing where sellers are willing to part with their holdings and how much volume is available at each price level. The ask side essentially creates a menu of prices where buyers can immediately acquire the asset by accepting seller terms.

Sell orders reflect seller motivations and expectations about future price movements. Sellers placing orders just above the current price may be taking profits on recent gains or exiting positions based on technical resistance levels. Higher ask prices might represent sellers who are willing to wait for better prices or who are using the order book to gauge market interest at elevated levels. The distribution of sell orders across different price levels provides insights into whether sellers are eager to exit or holding out for premium prices.

The sell side can also reveal potential resistance levels where upward price movement might stall. Large concentrations of sell orders at specific prices create selling walls that buyers must absorb before prices can advance further. However, similar to the buy side, these selling walls can disappear quickly if market sentiment shifts or if they represent spoofing attempts rather than genuine selling interest. Successful traders learn to read sell-side dynamics in conjunction with actual transaction data to distinguish real resistance from artificial barriers.

Market Depth and Price Levels

Market depth and price levels combine to show the full spectrum of liquidity available across the order book. Market depth measures the total volume of orders at progressively worse prices from the current market level, indicating how much trading can occur before prices move significantly. Deep markets with substantial volume at multiple price levels can absorb large trades with minimal price impact, while shallow markets may experience dramatic price swings from relatively modest trading activity.

Each price level in the order book represents a discrete point where traders have expressed willingness to transact. The spacing between price levels and the volume at each level creates a liquidity profile that sophisticated traders analyze to optimize execution strategies. In highly liquid markets, price levels might be separated by just one tick (the minimum price increment), creating a nearly continuous liquidity curve. In less liquid markets, significant gaps between price levels can create execution challenges and increased slippage risk.

Understanding price level dynamics helps traders anticipate how their orders will interact with the existing market structure. A large order submitted in a deep market might execute entirely within a few ticks of the current price, while the same order in a shallow market could walk the book extensively, receiving fills across many price levels with substantial slippage. This relationship between order size and market depth fundamentally influences execution strategy and ultimately trading profitability.

Liquidity and Order Book Data

Liquidity represents one of the most critical metrics derivable from order book data, measuring how easily assets can trade without causing price disruptions. High liquidity manifests through tight spreads, large volumes at multiple price levels, and the ability to execute substantial orders with minimal market impact. Order book data provides the raw information needed to assess liquidity conditions, but traders must interpret this data carefully as visible liquidity does not always reflect actual available liquidity due to hidden orders and rapid order flow changes.

Order book data encompasses not just static snapshots of current conditions but also the dynamic flow of orders over time. Analyzing how quickly orders are added, modified, and canceled provides insights into market participant behavior and institutional activity. High cancellation rates might indicate algorithmic market making or potential manipulation, while steady order flow suggests genuine trading interest. These patterns are not always visible from price charts alone, making order book data analysis an essential complement to traditional technical analysis.

Professional traders often combine order book data with trade data (the actual transactions occurring) to get a complete picture of market dynamics. An order book showing large buy orders but few actual purchases suggests weak buying conviction, while sustained buying that absorbs sell orders indicates genuine demand. This integration of order book and transaction data forms the foundation of advanced order flow analysis techniques used by institutional traders and sophisticated retail participants.

Understanding Market Depth Through the Order Book

Understanding market depth through the order book requires looking beyond the best bid and ask to examine the full liquidity profile available at different price levels. Market depth visualization tools, such as depth charts and cumulative volume displays, help traders see at a glance how much volume exists on each side of the market and where significant buying or selling walls might impede price movement. This visual representation makes it easier to identify liquidity imbalances that could signal impending price moves.

The market depth order book reveals asymmetries between supply and demand that create trading opportunities. When the buy side shows significantly more depth than the sell side, it suggests stronger demand than supply, potentially indicating upward price pressure. Conversely, deeper sell-side liquidity relative to the buy side might forecast downward pressure. However, these imbalances must be interpreted in context, as large orders can appear and disappear quickly, and what looks like strong demand might evaporate if those orders are canceled before execution.

Experienced traders use market depth information to plan their execution strategies and manage risk. Before entering a large position, checking market depth helps determine whether sufficient exit liquidity exists at favorable prices. A deep market provides confidence that positions can be unwound without excessive slippage, while a thin market requires more careful position sizing and potentially wider stop-loss margins to account for higher execution uncertainty.

What Market Depth Reveals

What market depth reveals extends far beyond simple supply and demand metrics to include insights into trader psychology, institutional positioning, and potential price inflection points. Deep liquidity at specific price levels often indicates areas where large market participants have determined value exists, creating natural support and resistance zones. These areas frequently correspond with technical analysis levels, as professional traders position themselves around psychologically significant prices or key chart patterns.

Market depth also reveals the market’s capacity to handle volatility and sudden order flow imbalances. During calm periods, deep markets might show substantial liquidity on both sides, creating a stable environment for price discovery. As volatility increases or significant news events approach, this depth can evaporate quickly as market makers widen spreads and reduce their quoted sizes. Monitoring these changes in market depth provides early warning signals about changing market conditions and elevated risk environments.

The relationship between market depth and trading volume offers additional insights. Markets with deep order books but low trading volume might be artificially supported by quote stuffing or spoofing, while markets with moderate depth but high volume demonstrate genuine trading interest. Combining depth analysis with volume analysis helps traders distinguish between authentic market conditions and potentially manipulated scenarios, improving decision quality and risk management.

Market Depth Order Book Visualization

Market depth order book visualization transforms raw numerical data into intuitive graphical representations that make market structure immediately apparent. The most common visualization is the depth chart, which plots cumulative order volume against price levels, creating stepped lines that show how much volume exists at each price. The area between the buy and sell curves represents the current spread, while the slopes of the curves indicate how quickly liquidity accumulates or depletes away from the current price.

Modern trading platforms offer various visualization options beyond basic depth charts. Heat maps color-code order sizes to highlight areas of concentrated liquidity, making it easy to spot large orders or liquidity clusters. 3D visualizations add a time dimension, showing how depth has evolved over recent periods and revealing patterns in how market makers and traders adjust their orders in response to price movements. These advanced visualizations help traders process complex order book information more efficiently than scanning numerical tables.

Effective visualization of market depth order book data requires balancing detail with usability. Too much information creates cognitive overload, while too little obscures important nuances. Professional traders customize their displays to show the price range and depth levels most relevant to their trading style, whether that means focusing on the immediate few ticks around the current price for scalping or examining deeper levels for swing trading and position building strategies.

Order Book in Stock Market Trading

The order book in stock market trading functions as the foundational infrastructure supporting equity trading worldwide. Stock market order books aggregate buy and sell orders from diverse participants including retail investors, institutional fund managers, market makers, and algorithmic trading systems. This diversity creates deep, liquid markets for popular stocks where millions of shares trade daily, while smaller-cap stocks might have thinner order books with wider spreads and greater execution uncertainty.

Stock market order books operate under regulatory frameworks designed to ensure fair access and prevent manipulation. In the United States, Regulation National Market System (Reg NMS) requires brokers to execute trades at the best available price across all trading venues, while similar regulations exist in other jurisdictions. These rules impact how orders interact with multiple order books across different exchanges and alternative trading systems, creating a complex but transparent execution environment.

Understanding the order book in the stock market helps investors optimize their trading outcomes beyond simply buying at market prices. By analyzing order book depth, investors can identify optimal entry points, avoid executing large orders during low-liquidity periods, and detect potential institutional activity that might signal important price movements. This knowledge becomes particularly valuable during earnings announcements, economic data releases, or other events that temporarily disrupt normal order book patterns.

How the Order Book Works in the Stock Market

How the order book works in the stock market involves a sophisticated interplay between multiple trading venues, each maintaining its own order book for the same securities. When an investor places an order through their broker, smart order routing systems analyze order books across all exchanges to find the best execution prices and ensure compliance with best execution requirements. This fragmented market structure can create complexity but ultimately benefits traders through competition among venues for order flow.

Stock market order books typically operate during defined trading hours, with pre-market and after-hours sessions offering limited liquidity compared to regular trading hours. During market hours, continuous trading occurs with the order book updating in real time as orders arrive, execute, or cancel. At the market open and close, special auction mechanisms aggregate orders to establish opening and closing prices, temporarily replacing the continuous order matching process with a batch auction that maximizes trading volume at a single price point.

Different order types interact with stock market order books in specific ways designed to meet various trading objectives. Market orders execute immediately against the best available prices, providing certainty of execution but not price. Limit orders specify maximum buy prices or minimum sell prices, offering price protection at the cost of execution uncertainty. Stop orders trigger when prices reach specified levels, converting into market or limit orders to help manage risk or capitalize on momentum. Understanding how these order types interact with the order book is essential for effective trade execution and portfolio management.

Level 2 Order Book Explained

The Level 2 order book explained reveals a detailed view of market depth beyond the top-of-book quotes available in Level 1 data. While Level 1 shows only the best bid and ask with their associated sizes, Level 2 order book displays multiple price levels on both sides of the market, typically showing 5, 10, or even 20 levels deep. This enhanced visibility allows traders to see not just where the next trade will likely occur but also what liquidity exists at nearby price levels.

Access to Level 2 order book data traditionally required professional trading platforms and subscription fees, but many brokers now offer this information to active retail traders. The data typically displays in a ladder format with price levels in the center, bid quantities on the left, and ask quantities on the right. Some platforms enhance this basic display with additional information such as order counts at each level, the identity of market makers posting quotes, or time and sales data showing recent executions.

Understanding Level 2 order book dynamics helps traders make more informed decisions about order placement and execution timing. Seeing large orders several levels away from the current price can indicate where significant support or resistance might exist, while observing how quickly orders are added or removed provides insights into market maker behavior and institutional positioning. However, traders must remember that Level 2 data shows only the visible portion of the order book and may not capture hidden orders or the full intentions of sophisticated market participants.

Crypto Order Book Explained

The crypto order book explained reveals similarities with traditional financial markets but also important distinctions driven by cryptocurrency’s unique characteristics. Crypto order books operate 24/7 without the trading halts or market closures common in stock markets, creating continuous price discovery across global time zones. This constant operation means traders must monitor order books continuously or use automated tools, as significant price movements can occur at any time without the predictable patterns associated with traditional market hours.

What is a crypto order book in practical terms is a real-time ledger maintained by cryptocurrency exchanges showing all pending buy and sell orders for specific trading pairs like BTC/USDT or ETH/BTC. Each exchange maintains its own order book, and prices can vary across exchanges due to differences in liquidity, trading volume, and participant composition. This fragmentation creates arbitrage opportunities but also means that analyzing a single exchange’s order book may not capture the full market picture for a cryptocurrency.

Crypto order books often exhibit higher volatility and less depth than major stock market order books, particularly for smaller-cap tokens or during periods of market stress. The cryptocurrency market’s relative youth and lower institutional participation (though growing) can result in sudden liquidity disappearances and sharp price movements when large orders hit the market. Traders must adjust their strategies accordingly, using smaller position sizes and wider stop losses than they might employ in more mature markets.

What Is a Crypto Order Book

What is a crypto order book can be understood as the digital mechanism that centralized crypto exchanges use to match buyers and sellers for cryptocurrency trading pairs. Unlike blockchain transactions that occur directly between wallets, centralized exchange order books operate similarly to traditional exchanges with the exchange acting as intermediary. The order book aggregates all limit orders from exchange users, organizing them by price and time to facilitate efficient trade matching and price discovery.

Crypto order books display information in formats familiar to stock traders but denominated in cryptocurrency units and quote currencies. A Bitcoin order book might show bid sizes in BTC and prices in USDT, with each entry representing a trader’s willingness to exchange specific amounts at defined prices. The continuous nature of crypto trading means order books can change dramatically during what would be after-hours in traditional markets, requiring traders to remain vigilant or implement automated trading strategies.

The transparency of crypto order books varies by exchange, with some platforms providing full depth visibility while others restrict detailed order book data to premium users or API subscribers. This information asymmetry can disadvantage retail traders who lack access to complete market depth information. However, the competitive nature of crypto exchanges has pushed many platforms to offer comprehensive order book data as a standard feature to attract sophisticated traders who demand transparency.

How Crypto Order Books Function

How crypto order books function involves the same basic principles as traditional order books but implemented within cryptocurrency exchange infrastructure. When users deposit cryptocurrency into exchange wallets, those funds become available for trading through the order book system. Users submit orders specifying trading pairs, quantities, prices, and order types, which the exchange’s matching engine processes according to price-time priority rules. Successful matches result in trades that update both participants’ exchange wallet balances without requiring blockchain transactions.

The off-chain nature of order book operations enables the high-speed trading that crypto markets demand. Trades execute within the exchange’s internal database at speeds comparable to traditional exchanges, far faster than on-chain transactions could support. Only when users deposit or withdraw cryptocurrency do blockchain transactions occur, allowing the order book to function efficiently while still providing users the option to withdraw funds to personal wallets for self-custody.

Crypto order books must handle unique challenges not present in traditional markets, including the need to support hundreds or thousands of trading pairs, manage various blockchain confirmation times for deposits and withdrawals, and implement security measures to protect against hacking and theft. Leading exchanges invest heavily in matching engine technology, cybersecurity, and liquidity partnerships to maintain competitive order books that attract traders with tight spreads and deep liquidity across multiple cryptocurrency pairs.

Transparency in Crypto Trading

Transparency in crypto trading represents both a strength and a challenge for the cryptocurrency ecosystem. Order books on centralized exchanges provide transparency into market supply and demand, showing traders exactly what prices and quantities are available. However, this transparency exists only within individual exchanges, and the lack of consolidated reporting across venues means traders must check multiple order books to understand overall market conditions for a particular cryptocurrency.

The transparency of crypto order books has improved significantly as the market has matured and regulatory oversight has increased. Major exchanges now provide extensive market data, including historical order book snapshots, trade history, and liquidity metrics. This data transparency enables better price discovery and helps traders make more informed decisions, though it also creates opportunities for sophisticated participants to exploit less experienced traders through tactics like front-running or spoofing.

Blockchain technology itself offers a different kind of transparency through publicly verifiable transaction records, but this on-chain transparency does not extend to centralized exchange order books which operate off-chain. This creates a transparency paradox where blockchain transactions are completely open yet centralized trading remains opaque beyond what exchanges choose to reveal. Decentralized exchanges attempt to address this by implementing on-chain order books or alternative mechanisms, though these solutions face their own tradeoffs in terms of speed, cost, and functionality.

DEX Order Book vs AMM Model

The DEX order book vs AMM model debate represents one of the most important architectural decisions in decentralized finance (DeFi). Traditional order books require active market makers to provide liquidity by constantly updating bid and ask quotes, which works well in centralized settings but faces challenges in decentralized environments with slower transaction speeds and higher costs. Automated Market Makers emerged as an alternative approach that algorithmically provides liquidity through smart contracts, eliminating the need for continuous order management.

When designing or using crypto exchanges, the choice between order book and AMM models significantly impacts user experience, trading costs, and capital efficiency. Order books excel at price discovery and can offer better execution for large trades when sufficient liquidity exists, but they require active participation from market makers and can suffer from liquidity fragmentation. AMMs provide guaranteed liquidity for any trade size but introduce slippage based on pool depth and expose liquidity providers to impermanent loss risk.

The evolution of decentralized exchanges has produced hybrid models attempting to capture benefits from both approaches. Some platforms implement order books with on-chain matching while using AMM pools as fallback liquidity sources. Others use order books for price discovery while settling trades through liquidity pools. These innovations demonstrate that the order book versus AMM question is not binary but rather a spectrum of design choices optimizing for different priorities and use cases.

How a DEX Order Book Works

How a DEX order book works differs fundamentally from centralized exchange order books due to the decentralized infrastructure requirements. In a decentralized order book exchange, orders may be stored on-chain in smart contracts, making them publicly visible and verifiable but also subject to blockchain transaction costs and speed limitations. Each order placement, modification, or cancellation requires a blockchain transaction with associated gas fees, making high-frequency trading and tight spread market making economically impractical for most participants.

Some DEX order book implementations use off-chain order books with on-chain settlement to mitigate gas cost issues. In these hybrid systems, orders are submitted and managed off-chain through centralized servers or peer-to-peer networks, with only the final trade execution occurring on-chain. This approach reduces costs and increases speed but reintroduces some centralization risk, as the off-chain order book operator could potentially manipulate or censor orders before they reach the blockchain.

The matching process in DEX order books must account for blockchain-specific considerations like transaction ordering, miner extractable value (MEV), and front-running risks. Traders on decentralized order book platforms face challenges not present in centralized exchanges, including the possibility that their transactions may be front-run by bots monitoring the mempool or that network congestion could prevent their orders from executing at intended prices. Advanced DEX designs implement batch auctions, time locks, or other mechanisms to mitigate these risks while preserving decentralization benefits.

Order Book vs AMM: Key Differences

The key differences between order book and AMM models extend across multiple dimensions including liquidity provision mechanisms, price discovery processes, and user experiences. Order books rely on active market participants posting limit orders, creating discrete price levels where trades can occur. AMMs use mathematical formulas to determine prices based on asset ratios in liquidity pools, providing continuous pricing curves without the need for counterparty orders. This fundamental difference affects everything from how traders interact with the platform to how liquidity providers earn returns.

| Feature | Order Book Model | AMM Model |

|---|---|---|

| Liquidity Provision | Active market makers post limit orders | Passive liquidity pools funded by LPs |

| Price Discovery | Bid-ask matching determines prices | Mathematical formula based on pool ratios |

| Slippage Pattern | Discrete levels, walking the book | Continuous curve, proportional to trade size |

| Capital Efficiency | Higher for concentrated liquidity | Lower, spreads liquidity across price range |

| LP Risk | Market risk from inventory | Impermanent loss from price divergence |

| Gas Costs | Higher (multiple transactions for orders) | Lower (single swap transaction) |

| Large Trade Execution | Can be better with deep liquidity | Subject to increasing slippage |

Trading experience differs substantially between order book and AMM platforms. Order book traders can see exact prices and quantities available, place limit orders to target specific entry points, and potentially achieve zero-slippage execution if their orders are filled at their limit prices. AMM users always experience some price impact proportional to their trade size relative to pool depth, but they benefit from guaranteed execution and do not need to wait for counterparty orders to fill their trades.

Pros and Cons of Each Model

The pros and cons of each model create different optimal use cases for order books versus AMMs. Order books excel in markets with high trading volumes and active market makers, offering tight spreads and efficient price discovery for popular trading pairs. They provide professional traders with familiar interfaces and tools for executing complex strategies, making them attractive for institutional adoption and sophisticated trading operations. However, order books struggle with long-tail assets that lack market makers, often resulting in wide spreads and poor liquidity for less popular tokens.

AMMs democratize liquidity provision by allowing anyone to become a liquidity provider without the technical skills or capital requirements of professional market making. They guarantee some level of liquidity for even the most obscure token pairs, though potentially at high slippage costs. The automated nature of AMMs makes them easy to implement and maintain in decentralized environments, contributing to their popularity in DeFi. However, liquidity providers face impermanent loss risk that can erode or eliminate trading fee earnings during volatile market conditions.

From a trader’s perspective, order books generally provide better execution for informed traders who can use limit orders strategically and read market depth to time entries and exits. AMMs favor convenience and simplicity, allowing quick swaps without needing to understand order book dynamics or worry about order types. The choice between platforms often depends on trade size, desired execution speed, and whether the trader values price certainty or execution certainty more highly.

How to Read an Order Book

Learning how to read an order book effectively transforms raw market data into actionable trading insights. The process begins with understanding the basic layout and information hierarchy within the order book display. Most platforms show prices in the center column with bid quantities on one side and ask quantities on the other, though some variations exist. The key is identifying the best bid and best ask prices, which represent the current market price and the immediate execution prices available to traders.

Reading an order book requires looking beyond the top-of-book prices to analyze deeper liquidity levels. Traders should scan several levels down on both sides to identify where significant liquidity clusters exist, as these areas often represent important support and resistance zones. Large orders sitting in the book may indicate where professional traders or institutions have positioned themselves, though these orders can disappear quickly if they represent iceberg orders or if market participants cancel them in response to changing conditions.

The dynamic aspect of order book reading involves monitoring how the book changes over time rather than just analyzing static snapshots. Watching orders being added or removed provides insights into whether buyers or sellers are becoming more aggressive, whether market makers are widening spreads in response to volatility, and whether institutional players are accumulating or distributing positions. This time-based analysis complements static depth analysis to create a comprehensive understanding of current market dynamics.

Reading an Order Book Step-by-Step

Reading an order book step-by-step starts with identifying the current market price, which sits between the best bid and best ask. This spread tells you the immediate cost of trading, with market buy orders executing at the ask price and market sell orders executing at the bid price. A narrow spread indicates high liquidity and low trading costs, while a wide spread suggests the opposite. Note both the spread width and how it changes over time, as widening spreads often precede volatility increases or liquidity withdrawals.

Next, examine the size of orders at the best bid and ask levels to gauge immediate liquidity. Large sizes suggest strong interest at current prices, while small sizes might indicate a thin market where prices could move quickly. Continue scanning several levels away from the current price, looking for significant size increases that might represent support or resistance levels. Pay attention to round numbers and psychological price points like $100, $1.00, or 10,000, as these often attract clustered orders.

The final step involves integrating your order book analysis with recent trade data and price movement. Compare the visible liquidity with actual transaction volume to assess whether orders are executing or simply sitting in the book. Watch for order flow patterns such as aggressive buying (market orders consuming the ask side) or defensive selling (limit orders added to the bid side). These patterns reveal the balance of power between buyers and sellers and help predict short-term price direction based on which side demonstrates stronger conviction.

Identifying Buy and Sell Pressure

Identifying buy and sell pressure through order book analysis involves looking for imbalances between bid and ask sides that signal potential price movements. When the bid side shows significantly larger cumulative volume than the ask side, it suggests buying pressure that could push prices higher if market orders begin consuming the relatively thin sell side. Conversely, a heavy ask side relative to bids indicates selling pressure that might drive prices lower if buyers are unwilling to absorb the supply.

However, visible order book imbalances do not always translate directly into price movements because of hidden liquidity and the ability to cancel orders quickly. Large visible bids might represent genuine buying interest or could be spoofing attempts designed to create false impressions of demand. Successful traders confirm order book signals with actual trade execution data, watching whether large orders actually fill or if they disappear before execution. Orders that persistently reappear after cancellation or that move with the price suggest more genuine interest than static orders that vanish when tested.

Advanced techniques for identifying buy and sell pressure include monitoring order flow velocity (how quickly orders are added versus canceled) and analyzing the relationship between order size and price distance from the market. Aggressive traders who are willing to pay higher prices or accept lower prices demonstrate stronger conviction than passive participants posting orders far from current levels. Additionally, watching how the order book responds to large trades provides insights into whether additional buyers or sellers are waiting to enter or if the market lacks depth beyond visible levels.

Understanding Order Books for Smarter Trades

Understanding order books for smarter trades involves applying order book knowledge to improve trading outcomes through better execution, improved timing, and enhanced risk management. Traders who master order book analysis can identify optimal entry and exit points, avoid unnecessary slippage, and detect market conditions that favor or disfavor their strategies. This understanding provides an edge that compounds over many trades, significantly impacting long-term profitability and performance metrics.

Smart traders use order book information to optimize order types and execution strategies based on current market conditions. In deep, liquid markets with tight spreads, aggressive market orders may be appropriate for immediate execution with minimal cost. In thinner markets or when executing large positions, limit orders placed strategically within the order book can capture better prices while providing liquidity and potentially earning rebates. Understanding these nuances allows traders to adapt their approach to each situation rather than applying one-size-fits-all execution rules.

The integration of order book analysis with other analytical techniques creates a comprehensive trading framework. Combining order book insights with technical analysis helps confirm support and resistance levels, as areas with both chart-based significance and deep order book liquidity are more likely to hold. Similarly, fundamental analysis can be enhanced by monitoring how order books respond to news events or earnings announcements, revealing whether the market agrees with fundamental valuations or is positioning for different outcomes.

Why Order Books Matter for Traders

Why order books matter for traders extends beyond simple trade execution to encompass strategy development, risk management, and market understanding. Order books provide the most granular view available into real-time market dynamics, showing exactly where supply meets demand and how this equilibrium shifts moment by moment. This information allows traders to make more informed decisions about position sizing, entry timing, and exit strategies based on actual market liquidity rather than assumptions or historical averages.

For active traders and scalpers, order book information is essential for identifying short-term opportunities that last seconds or minutes. By monitoring order flow and detecting imbalances between buyers and sellers, these traders can position themselves ahead of price movements and capture small profits that accumulate to significant returns. Even longer-term traders benefit from order book analysis when building or reducing positions, as understanding current market structure helps minimize execution costs and market impact.

Risk management improves dramatically when traders incorporate order book analysis into their processes. Before entering a position, checking order book depth at intended stop-loss levels reveals whether sufficient liquidity exists to exit if necessary. This awareness helps traders set more realistic stops that account for actual market structure rather than arbitrary percentages. Similarly, understanding order book dynamics helps traders recognize when market conditions have deteriorated to the point where holding positions becomes excessively risky, prompting defensive actions before catastrophic losses occur.

Order Books and Trading Information

Order books and trading information work synergistically to provide comprehensive market intelligence. While price charts show historical patterns and trends, order books reveal current market structure and where participants are positioned for future moves. Trade data (time and sales) shows what actually happened, while the order book shows what might happen based on pending orders. Combining these information sources creates a multi-dimensional view that no single data type can provide alone.

Modern trading platforms integrate order book data with various other information streams including news feeds, social sentiment indicators, and fundamental metrics. This integration helps traders understand not just what is happening in the order book but why it is happening. For example, seeing large sell orders appear in the book shortly after negative news helps confirm that the news is material and that market participants are responding by liquidating positions. Without this context, the same order book pattern might be interpreted very differently.

The quality and timeliness of order book information directly impact trading effectiveness. Professional traders often pay for premium data feeds that provide order book updates with minimal latency, recognizing that even millisecond delays can mean the difference between profitable and unprofitable trades in fast-moving markets. Retail traders should ensure their platforms provide sufficiently current order book data for their trading style, whether that means tick-by-tick updates for active trading or regular snapshots for longer-term position trading.

Order Books and Market Transparency

Order books and market transparency represent interconnected concepts that fundamentally shape market fairness and efficiency. Transparent order books allow all participants to see the same information about pending orders, creating a level playing field where success depends on analysis and execution rather than privileged access to information. This transparency is mandated by regulation in many traditional markets and has become a competitive differentiator among cryptocurrency exchanges seeking to attract sophisticated traders.

However, order book transparency has limits and tradeoffs. While visible order books benefit small traders by showing market structure, they can disadvantage large traders whose intentions become obvious when they post sizable orders. This has led to the development of dark pools and other mechanisms for executing large orders away from public order books, creating a two-tiered market structure. Understanding both lit (public order book) and dark (hidden) liquidity is increasingly important for traders seeking best execution across all available venues.

Market transparency extends beyond order book visibility to encompass execution quality reporting, best execution obligations, and trade reporting requirements. These regulatory frameworks ensure that even when orders execute away from public order books, information about those trades eventually becomes available to all participants. This post-trade transparency helps maintain market integrity while allowing flexibility in execution methods to meet diverse participant needs, from retail investors buying small lots to institutions moving multi-million dollar positions.

Common Mistakes in Order Book Analysis

Common mistakes in order book analysis can lead traders to misinterpret market conditions and make poor trading decisions despite having access to comprehensive data. Many of these mistakes stem from treating the order book as a static snapshot rather than a dynamic system where orders constantly change in response to market developments. Avoiding these errors requires combining theoretical understanding with practical experience gained through careful observation of how order books behave across different market conditions and asset types.

One fundamental mistake involves assuming that all orders visible in the book represent genuine trading interest. In reality, a significant portion of visible orders may be canceled before execution, particularly in markets prone to spoofing or where algorithmic traders constantly update their quotes. This means that the apparent support or resistance suggested by large orders might evaporate the moment price approaches those levels. Experienced traders learn to distinguish between sticky orders that persist as price moves toward them and phantom orders that disappear when tested.

Another common error is analyzing order books in isolation without considering broader market context. An order book that appears bullish based on bid-ask imbalances might tell a different story when combined with declining trading volume or bearish technical indicators. Similarly, order book patterns that work well during normal market conditions may become unreliable during high volatility or when major news events disrupt typical trading patterns. Successful order book analysis requires integrating multiple data sources and adjusting interpretations based on current market regime.

Misinterpreting Large Orders

Misinterpreting large orders represents one of the most costly mistakes traders make when analyzing order books. A large buy order sitting in the book might seem to indicate strong support, encouraging traders to buy in anticipation of prices bouncing off that level. However, these large orders frequently cancel before execution or represent iceberg orders where only a portion of the true size is visible. When price reaches the apparent support level and the order disappears, traders who positioned themselves based on that support often suffer losses as prices continue falling.

Large orders can serve multiple purposes beyond simple buying or selling interest. Market participants use large visible orders to manipulate other traders’ perceptions through techniques like spoofing, where they place orders with no intention of execution to create false impressions of supply or demand. Alternatively, large orders might represent hedging activity or portfolio rebalancing rather than directional trading views. Without understanding the motivation behind large orders, traders risk making decisions based on misleading signals.

To avoid misinterpreting large orders, traders should observe how these orders behave over time rather than reacting to their mere presence. Orders that remain in the book as price approaches, that get filled partially and replenished, or that persist across multiple sessions are more likely to represent genuine interest. Orders that constantly cancel and reappear at different prices or that disappear entirely when tested suggest manipulation or algorithmic market making rather than committed buying or selling interest.

Develop a Crypto Exchange That Delivers True Market Depth Transparency

Exchange Development Driven by Order Book Precision

Ignoring Liquidity Signals

Ignoring liquidity signals from the order book can lead to poor execution and unexpected trading costs. Many traders focus solely on price levels and technical patterns while overlooking clear warnings in the order book about deteriorating liquidity conditions. When spreads widen significantly, when order book depth decreases across multiple price levels, or when previously stable market makers withdraw from the book, these signals indicate that normal trading assumptions may no longer apply and that extra caution is warranted.

Liquidity signals become particularly important when planning to execute large orders that could impact market prices. A trader preparing to buy a significant position should carefully assess whether sufficient ask-side liquidity exists to absorb their intended purchase without excessive slippage. Similarly, checking bid-side depth before entering a position reveals whether adequate exit liquidity will be available if the trade goes wrong. Ignoring these pre-trade liquidity assessments often results in much worse execution than expected and can turn potentially profitable trades into losers purely through poor execution.

The timing of liquidity changes also provides valuable information that traders often ignore. Liquidity typically follows predictable patterns, being deepest during major market sessions and thinner during off-hours or around major announcements. However, unexpected liquidity withdrawals outside these normal patterns can signal that informed participants know something the broader market does not. When institutional market makers suddenly widen spreads or reduce quoted sizes ahead of scheduled news, it suggests they expect higher volatility and are adjusting risk accordingly, which should prompt similar caution from other traders.

Over-Reliance on Short-Term Data

Over-reliance on short-term data from order books can cause traders to lose sight of broader trends and make reactive decisions based on temporary fluctuations. While order books update in real time and can provide insights into immediate market conditions, the very short-term patterns they reveal may not persist long enough to generate profitable trades. Traders who constantly react to every order book change often find themselves whipsawed by market noise, executing poorly timed trades that would have been avoided with a longer-term perspective.

The challenge with short-term order book data is distinguishing between meaningful signals and random noise. In active markets, order books change thousands of times per minute as algorithmic traders and market makers update their quotes. Not all of these changes carry predictive information, and attempting to trade every apparent opportunity leads to overtrading, excessive transaction costs, and decision fatigue. Successful traders develop filters to identify significant order book events while ignoring routine fluctuations that do not warrant action.

Balancing short-term order book analysis with longer-term market context helps avoid this pitfall. Before acting on an apparent order book signal, consider whether it aligns with the overall trend, whether trading volume supports the suggested move, and whether the timeframe matches your trading strategy. A scalper might legitimately trade based on order book changes lasting seconds, while a swing trader should largely ignore the same data in favor of patterns that persist for hours or days. Understanding your trading timeframe and filtering order book information accordingly prevents over-reliance on data that is not relevant to your approach.

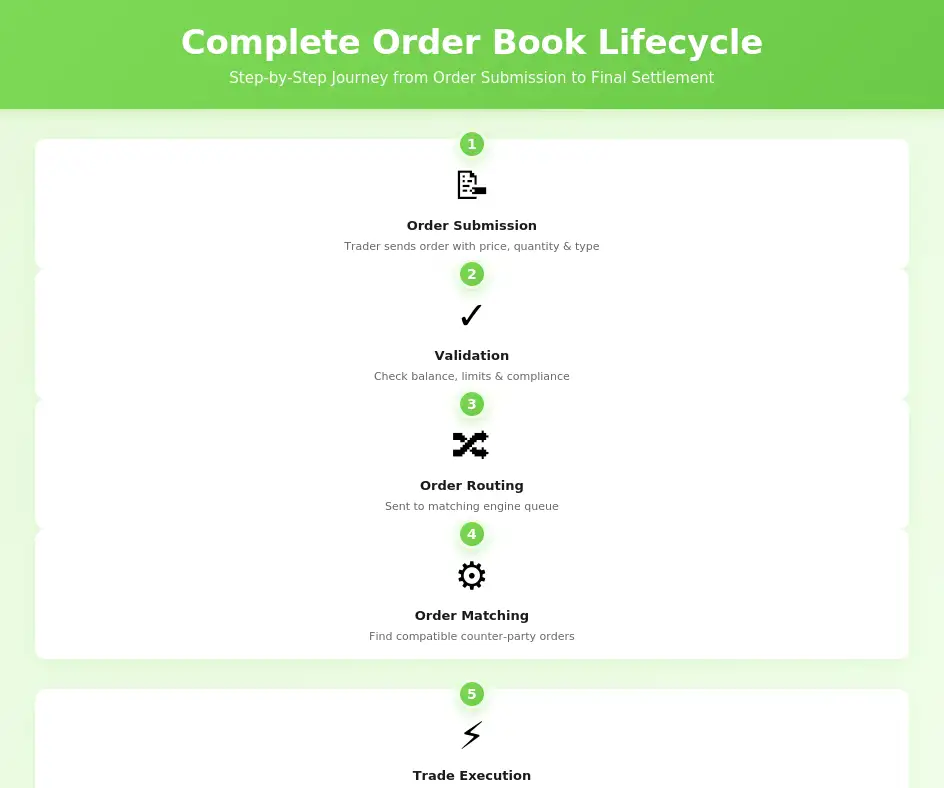

| Stage | Process | Key Participants | Outcome |

|---|---|---|---|

| Order Submission | Trader sends order with price, quantity, and type specifications to exchange | Retail traders, institutions, algorithms | Order enters exchange system for validation |

| Order Validation | Exchange checks account balance, price limits, lot sizes, regulatory compliance | Exchange systems, risk management | Order receives unique ID and timestamp or gets rejected |

| Order Routing | Validated order sent to matching engine based on price-time priority rules | Matching engine, order routing systems | Order queued for execution or placed in book |

| Order Matching | Matching engine pairs compatible buy and sell orders at valid prices | Matching algorithms, counterparties | Trade execution or order remains pending |

| Trade Execution | Matched orders execute, assets and funds exchange between parties | Clearinghouse, settlement systems, traders | Both parties receive confirmations, accounts updated |

| Order Book Update | Filled orders removed, new orders added, market data distributed | Data distribution systems, market participants | Real-time order book reflects current state |

| Settlement | Final transfer of ownership, clearing of obligations, risk mitigation | Clearing firms, depositories, custodians | Trade finalized, assets delivered to buyers |

Final Thoughts

Mastering order book analysis represents a critical skill that separates successful traders from those who struggle to achieve consistent profitability. With over eight years of experience in financial markets and trading technology, we have observed that traders who invest time in understanding order book dynamics gain a substantial edge in execution quality, risk management, and market timing. The order book provides transparency into real-time market structure that no other data source can match, revealing where market participants have positioned themselves and how supply and demand dynamics evolve moment by moment.

Whether trading stocks through traditional exchanges, cryptocurrencies on centralized platforms, or exploring decentralized alternatives, the fundamental principles of order book analysis remain consistent. Successful traders learn to read order books effectively, distinguish between genuine liquidity and manipulation, and integrate order book insights with broader analytical frameworks. They understand that while technology has transformed how order books function, the core concepts of price discovery, liquidity provision, and trade execution continue to govern all markets.

As markets continue evolving with new technologies and trading mechanisms, the importance of understanding order books will only grow. Traders who build strong foundations in order book analysis will adapt more easily to innovations like hybrid exchange models, advanced order types, and emerging market structures. The principles covered in this guide provide that foundation, but true mastery comes from applying these concepts in real market conditions, learning from both successes and failures, and continuously refining your approach based on experience and changing market dynamics. For those looking to build crypto exchanges that leverage order book technology, partnering with experienced development teams ensures proper implementation of the sophisticated matching engines and infrastructure required for modern trading platforms.

Frequently Asked Questions

An order book is a digital ledger that displays all buy and sell orders for a specific asset in real time. It shows the prices at which traders are willing to buy (bids) and sell (asks), along with the quantities available at each price level. The order book serves as the foundation for price discovery and trade execution in both traditional stock markets and cryptocurrency exchanges, providing transparency into market supply and demand dynamics.

An order book works by collecting and organizing all incoming buy and sell orders based on price and time priority. When a trader places an order, it enters the book and waits for a matching order on the opposite side. Market orders execute immediately against the best available prices, while limit orders sit in the queue until their price conditions are met. The matching engine continuously updates the order book in real time, removing filled orders and adding new ones to maintain an accurate picture of market conditions.

The bid represents the highest price a buyer is willing to pay for an asset, while the ask (or offer) represents the lowest price a seller is willing to accept. The difference between these two prices is called the spread, which indicates market liquidity and trading costs. A narrow spread suggests high liquidity with many active traders, while a wide spread indicates lower liquidity and potentially higher transaction costs for market participants.

Market depth refers to the market’s ability to absorb relatively large orders without significantly impacting the asset’s price. It is visualized through the order book by showing the cumulative volume of buy and sell orders at various price levels. Deep markets have substantial order volumes on both sides of the book, allowing large trades to execute with minimal price slippage, while shallow markets may experience significant price movements from even moderate-sized orders.

A crypto order book matches buyers and sellers directly through a central limit order book, similar to traditional exchanges, while an Automated Market Maker (AMM) uses liquidity pools and algorithmic pricing. Order books provide precise price control and potentially better execution for large trades, but require sufficient liquidity from market makers. AMMs ensure constant liquidity through pool reserves but may suffer from slippage on larger trades and expose liquidity providers to impermanent loss risks.

Liquidity in an order book refers to the ease with which an asset can be bought or sold without causing significant price changes. High liquidity is characterized by tight spreads, large order volumes at multiple price levels, and the ability to execute trades quickly at predictable prices. Low liquidity results in wider spreads, fewer orders in the book, and greater price volatility when trades occur, making it more challenging and costly to enter or exit positions.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.