Key Takeaways

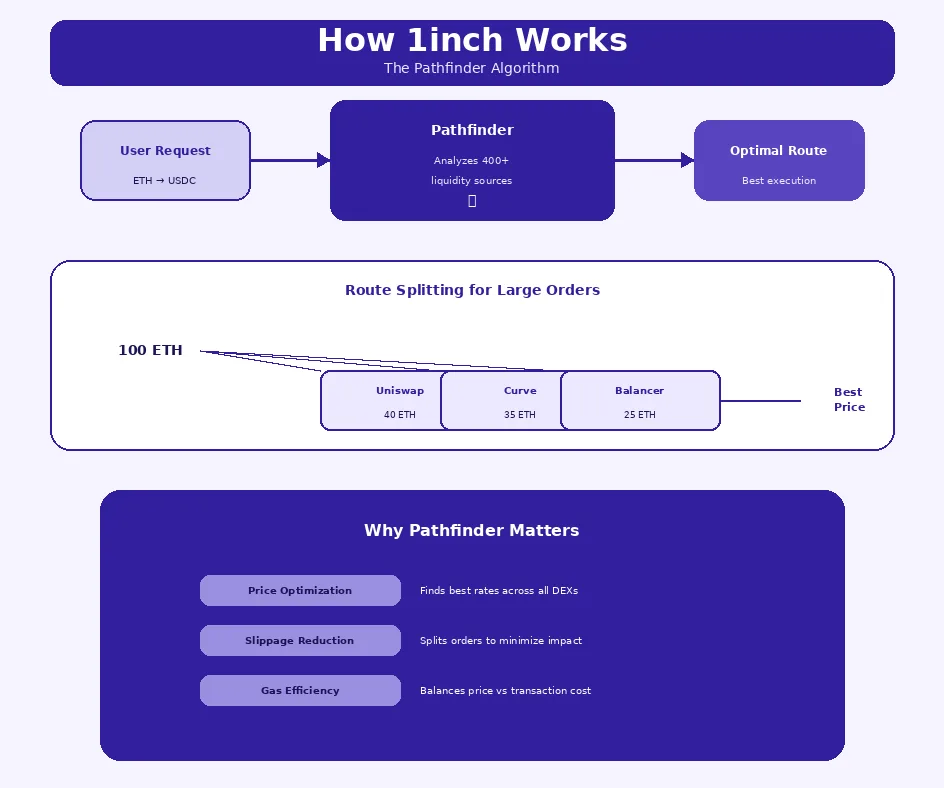

- 1inch DEX is a leading decentralized exchange aggregator that searches across 400+ liquidity sources to find optimal trading rates for users.

- The Pathfinder algorithm powers 1inch’s price discovery, splitting orders across multiple DEXs to minimize slippage and maximize value for traders.

- 1inch offers gas-efficient trading through optimized routing, Chi gastoken integration, and support for gas-free limit orders stored off-chain.

- Core services include token swapping, liquidity aggregation, limit orders, and the 1inch Wallet for secure non-custodial trading.

- Unlike single-liquidity DEXs, 1inch aggregation improves trade efficiency by accessing combined liquidity pools across the DeFi ecosystem.

- The platform supports multiple blockchains including Ethereum, Polygon, Arbitrum, and Optimism, enabling cross-chain liquidity access.

- Developers can integrate 1inch APIs into their applications for optimized swap functionality without building custom routing infrastructure.

- 1inch governance operates through the 1INCH token and DAO, allowing community participation in protocol decisions and future expansion.

The decentralized finance ecosystem continues evolving, and 1inch has emerged as one of the most important infrastructure protocols enabling efficient trading across this fragmented landscape. Understanding how 1inch services work helps traders maximize value and helps builders integrate powerful trading capabilities into their applications. This comprehensive guide explores every aspect of 1inch DEX services, from core functionality to real-world applications.

Introduction to 1inch DEX

Introduction to 1inch DEX begins with understanding the problem it solves: fragmented liquidity across hundreds of decentralized exchanges. When traders use a single DEX, they access only that platform’s liquidity, potentially missing better rates elsewhere. 1inch emerged as a solution, aggregating liquidity across the entire DeFi ecosystem to provide optimal trade execution.

What Is 1inch DEX?

1inch DEX is a decentralized exchange aggregator that connects to multiple liquidity sources, comparing prices and routing trades through optimal paths. Rather than being a single exchange with its own liquidity pools, 1inch serves as an intelligent routing layer that finds the best available rates across the DeFi ecosystem. This approach benefits users by providing better prices than they could typically find on any individual platform.

Overview of 1inch as a Decentralized Exchange Aggregator

As a decentralized exchange aggregator, 1inch searches across more than 400 liquidity sources on supported networks. When a user requests a swap, 1inch algorithms analyze available options and construct optimal trade routes that may split orders across multiple sources. This aggregation model transforms how users interact with DeFi liquidity, removing the need to manually compare rates across platforms.

The platform operates non-custodially, meaning users maintain control of their assets throughout the trading process. Understanding how decentralized exchanges implement trading functionality reveals the technical sophistication behind aggregation services like 1inch.

Why 1inch Matters in the DeFi Ecosystem

1inch matters in the DeFi ecosystem because it addresses the fundamental challenge of liquidity fragmentation. Without aggregation, traders must either accept suboptimal rates on their chosen platform or manually search across multiple DEXs, a time-consuming and often ineffective process. 1inch automates this optimization, making professional-grade trade execution accessible to all users.

Role of Liquidity Aggregation in Modern DEXs

Liquidity aggregation plays a critical role in modern DEXs by improving market efficiency and user outcomes. By connecting fragmented liquidity pools, aggregators create effectively deeper markets than any individual platform provides. This aggregation benefits smaller traders who might otherwise face significant slippage, and large traders who need to access liquidity across multiple sources to execute size without moving markets.

Market Insight: DEX aggregators like 1inch have become essential DeFi infrastructure, with billions of dollars routed through these protocols monthly. This aggregation layer has fundamentally changed how traders approach decentralized trading.

How 1inch DEX Works

Understanding how 1inch DEX works reveals the sophisticated technology enabling optimal trade execution. The platform combines advanced routing algorithms, efficient smart contracts, and deep protocol integrations to deliver value for users. Each component contributes to the overall goal of finding and executing the best possible trades.

The 1inch Aggregation Model

The 1inch aggregation model searches liquidity across all connected DEX protocols, compares available rates, and constructs optimal execution paths. This model considers not just spot prices but also available liquidity depth, gas costs, and potential slippage to determine truly optimal routes. Building crypto exchanges with comparable aggregation capabilities requires significant technical investment.

Connecting Multiple DEX Liquidity Sources

Connecting multiple DEX liquidity sources requires integrations with each protocol’s smart contracts and understanding of their specific mechanics. 1inch maintains these integrations across hundreds of DEXs including Uniswap, SushiSwap, Curve, Balancer, and many others. This extensive connectivity enables comprehensive market coverage and ensures users access the broadest possible liquidity.

Pathfinder Algorithm Explained

The Pathfinder algorithm represents 1inch’s core innovation, determining how trades are routed for optimal execution. This algorithm analyzes all possible paths through available liquidity sources, calculating expected outcomes for each option. It then selects or combines paths that maximize user value while minimizing costs and risks.

Best Price Routing and Slippage Optimization

Best price routing through the Pathfinder algorithm considers multiple factors beyond simple price comparison. Slippage optimization ensures that large trades are split across liquidity sources to minimize market impact. The algorithm may route portions through different DEXs, intermediate tokens, or even multiple hops to achieve better overall execution than any direct route would provide.

Gas Efficiency in 1inch

Gas efficiency in 1inch addresses one of the major concerns in DEX trading: transaction costs. While aggregation provides better prices, complex routes through multiple protocols could consume significant gas. 1inch optimizes for gas efficiency alongside price, sometimes accepting slightly worse rates if gas savings make the overall transaction more favorable.

How 1inch Reduces Transaction Costs

1inch reduces transaction costs through several mechanisms including optimized smart contract code, Chi gastoken utilization when beneficial, and intelligent routing that balances price improvement against gas costs. The protocol’s focus on efficiency means users often achieve better net outcomes than trading directly on underlying DEXs, even accounting for the complexity of aggregated routes.

1inch vs Single DEX Comparison

| Aspect | 1inch Aggregator | Single DEX |

|---|---|---|

| Liquidity Access | 400+ sources combined | Own pools only |

| Price Discovery | Cross-platform optimization | Internal pricing only |

| Large Trade Handling | Split across sources | Single pool impact |

| Complexity | Higher (multi-hop routes) | Lower (direct swaps) |

| Best For | Large trades, best rates | Simple swaps, specific pools |

Core Services Offered by 1inch DEX

Core services offered by 1inch DEX extend beyond simple aggregation to encompass a comprehensive trading toolkit. These services address different user needs, from immediate swaps to scheduled orders to wallet management. Understanding these offerings helps users maximize the value they extract from the 1inch ecosystem.

Token Swapping Services

Token swapping services form the foundation of 1inch functionality. Users select tokens to exchange, specify amounts, and receive optimized quotes showing expected outcomes across different routing options. The interface displays price impact, estimated gas costs, and minimum received amounts, enabling informed trading decisions.

Cross-DEX Token Swaps with Optimized Rates

Cross-DEX token swaps with optimized rates represent 1inch’s primary value proposition. Rather than settling for rates on a single platform, users access the best available prices across all connected DEXs. For popular trading pairs, differences may be small; for less liquid tokens or large trades, the improvement can be substantial. Understanding how tokens gain visibility on DEX aggregators reveals the importance of liquidity distribution.

Liquidity Aggregation Services

Liquidity aggregation services provide access to combined liquidity pools across the DeFi ecosystem. This aggregation creates effectively deeper markets, enabling larger trades with less slippage than individual platforms could support. For institutional users and large traders, this depth is essential for efficient execution.

Accessing Deep Liquidity Across Multiple Protocols

Accessing deep liquidity across multiple protocols transforms the trading experience for size-sensitive users. When executing large orders, 1inch distributes volume across liquidity sources, minimizing the impact on any single pool. This distribution achieves better overall execution while reducing the market footprint of significant trades.

Limit Orders on 1inch

Limit orders on 1inch enable traders to set specific execution prices rather than accepting current market rates. This feature brings traditional exchange functionality to decentralized trading, allowing users to specify desired prices and have orders execute automatically when market conditions meet their criteria.

Gas-Free Limit Orders and Execution Logic

Gas-free limit orders represent a significant innovation, storing orders off-chain until execution conditions are met. Users sign orders without paying gas, and specialized keepers monitor markets for matching opportunities. When prices reach specified levels, keepers execute orders on-chain, with execution costs covered through small fees or positive slippage capture. This approach makes limit orders economically viable for smaller trades.

1inch Wallet and User Tools

The 1inch Wallet and user tools complement trading services with secure asset management capabilities. The wallet provides a native interface for 1inch services while supporting broader DeFi interactions. Additional tools include portfolio tracking, price alerts, and transaction management features.

Wallet Features Supporting Secure DEX Trading

Wallet features supporting secure DEX trading include hardware wallet integration, transaction simulation before signing, and protection against common attack vectors. The 1inch wallet is designed specifically for DeFi usage, with interfaces optimized for swap execution, token approvals, and position management across supported protocols.

1inch Swap Execution Lifecycle

| Step | Phase | Actions | Output |

|---|---|---|---|

| 1 | Connect Wallet | Link Web3 wallet to 1inch | Account access |

| 2 | Select Tokens | Choose input/output tokens | Trade pair defined |

| 3 | Enter Amount | Specify swap quantity | Quote request |

| 4 | Route Analysis | Pathfinder calculates options | Optimal route |

| 5 | Approve Token | Authorize contract access | Spend allowance |

| 6 | Execute Swap | Sign and submit transaction | Tokens received |

Key Features and Benefits of Using 1inch DEX

Key features and benefits of using 1inch DEX combine technical capabilities with user-focused design to deliver superior trading experiences. These advantages make 1inch particularly valuable for traders seeking optimal execution, security, and control over their trading activities.

Best Price Discovery

Best price discovery through 1inch consistently delivers better rates than manual searching across individual platforms. The algorithmic approach considers factors humans would struggle to evaluate quickly, including real-time liquidity depth across hundreds of pools, gas costs for different routes, and slippage expectations based on order size.

Minimizing Slippage for Large Trades

Minimizing slippage for large trades represents where 1inch provides maximum value. By distributing orders across multiple liquidity sources, the platform reduces the price impact that would occur from large orders hitting single pools. This distribution achieves better average execution prices while reducing the market footprint visible to other traders.

Enhanced User Control

Enhanced user control through 1inch’s non-custodial design ensures traders maintain complete ownership of their assets. Users interact directly with smart contracts, approving and signing transactions without surrendering custody. This control extends to trading parameters including slippage tolerance, gas settings, and route preferences.

Non-Custodial and Permissionless Trading

Non-custodial and permissionless trading means anyone with a compatible wallet can access 1inch services without account creation, identity verification, or custody transfer. This permissionless access aligns with DeFi principles while providing institutional-grade execution quality to all users regardless of status or location.

Security and Transparency

Security and transparency through audited smart contracts and open-source code enable users to verify exactly how 1inch operates. Multiple security audits from reputable firms have examined the protocol, identifying and addressing potential vulnerabilities. This transparency builds trust while enabling community verification of security claims.

Smart Contract-Based Execution

Smart contract-based execution ensures trades execute according to programmed logic without human intervention. Once users sign transactions, smart contracts handle execution deterministically, routing trades through specified paths and enforcing slippage protections. This automation eliminates manual processing delays and reduces operational risks.

When to Use 1inch vs Direct DEX Trading

Consider these factors when choosing between aggregated and direct trading:

- Trade Size: Larger trades benefit more from aggregation’s slippage reduction

- Token Liquidity: Less liquid tokens often have better rates through aggregation

- Gas Costs: Simple direct swaps may be cheaper for small amounts

- Specific Pool Access: Direct trading needed for LP positions or specific pools

- Rate Sensitivity: When best price matters, aggregation typically wins

- Time Urgency: Both options offer similar execution speed

1inch DEX vs Traditional DEX Platforms

Comparing 1inch DEX versus traditional DEX platforms reveals the fundamental differences between aggregators and single-liquidity exchanges. Each model has appropriate use cases, and understanding these distinctions helps traders select optimal approaches for different situations. Exploring how professional exchange platforms implement various trading models provides context for these architectural choices.

Aggregator vs Single-Liquidity DEX

Aggregators versus single-liquidity DEXs represent different approaches to decentralized trading. Single-liquidity DEXs like Uniswap maintain their own pools where liquidity providers deposit assets. Aggregators like 1inch do not hold liquidity but instead route trades through optimal paths across existing pools. Both models serve important functions in the ecosystem.

Why Aggregation Improves Trade Efficiency

Aggregation improves trade efficiency by eliminating the constraints of single-pool liquidity. When trading on individual DEXs, users are limited to available liquidity in that platform’s pools. Aggregation combines liquidity across all sources, creating effectively deeper markets that support larger trades with less slippage and better overall execution.

Cost and Performance Comparison

Cost and performance comparison between aggregators and direct DEX trading depends on trade characteristics. For small, simple swaps in liquid pairs, differences may be minimal, and direct trading might save gas. For larger trades, less liquid tokens, or complex routing needs, aggregators typically provide superior outcomes that justify any additional complexity.

Gas Fees, Speed, and Trade Outcomes

Gas fees, speed, and trade outcomes vary based on specific circumstances. Aggregated routes may consume more gas due to complexity but often achieve better net outcomes through improved execution prices. Speed is comparable between approaches, as both execute through blockchain transactions. Trade outcomes generally favor aggregation for most scenarios except the smallest, simplest swaps.

Trading Notice: All DEX trading involves risks including smart contract vulnerabilities, market volatility, and potential for front-running. While 1inch optimizes for best execution, users should understand that DeFi trading carries inherent risks. Always verify transaction details before signing and trade only amounts you can afford to lose.

How to Use 1inch DEX

Learning how to use 1inch DEX enables access to its full range of services. The interface is designed for accessibility while providing advanced options for sophisticated users. Following proper procedures ensures successful trades and helps avoid common pitfalls that new DeFi users sometimes encounter.

Step-by-Step Guide to Trading on 1inch

This step-by-step guide to trading on 1inch covers the complete process from wallet connection through trade execution. Each step is important for successful trading, and understanding the full flow helps users make informed decisions at each stage.

Connecting Wallets and Executing Swaps

Connecting wallets and executing swaps begins with selecting a supported wallet like MetaMask, WalletConnect, or hardware wallets. After connection, users select input and output tokens, enter amounts, and review the proposed route. Token approval may be required for first-time trades with specific tokens. Finally, users confirm and sign the swap transaction, waiting for blockchain confirmation.

Understanding Fees and Settings

Understanding fees and settings helps users optimize their 1inch experience. While 1inch itself charges minimal direct fees, users pay gas for transactions and may incur fees from underlying DEX protocols. Settings like slippage tolerance and gas price affect trade success and cost, requiring appropriate configuration for different market conditions.

Slippage Tolerance and Gas Controls

Slippage tolerance defines how much price movement is acceptable during execution. Setting it too low causes transaction failures; too high may result in worse execution. Gas controls allow manual adjustment of transaction fees, useful during network congestion or when transactions need faster confirmation. Default settings work for most situations, but active traders should understand these options.

Use Cases and Real-World Applications of 1inch

Use cases and real-world applications of 1inch span from individual traders seeking best rates to developers building applications requiring liquidity access. This versatility has made 1inch an essential infrastructure component serving diverse needs across the DeFi ecosystem.

Retail Traders and DeFi Users

Retail traders and DeFi users benefit from 1inch’s price optimization without needing to understand the technical complexity behind aggregation. The simple interface allows casual users to access professional-grade execution, while advanced features satisfy more sophisticated trading needs.

Cost-Efficient Token Swaps

Cost-efficient token swaps through 1inch help users maximize value from every trade. By automatically finding optimal routes, users save money they would otherwise lose to suboptimal pricing or excessive slippage. These savings accumulate significantly for active traders executing numerous transactions.

Developers and DeFi Platforms

Developers and DeFi platforms integrate 1inch to provide optimized trading within their applications. The 1inch API offers programmatic access to aggregation functionality, enabling wallets, portfolio managers, and other applications to offer competitive swap rates without building routing infrastructure. Understanding how skilled teams implement 1inch integrations helps developers approach these projects effectively.

Integrating 1inch APIs for Liquidity Access

Integrating 1inch APIs for liquidity access allows applications to leverage 1inch’s routing capabilities. The API returns optimal routes for specified swaps, which applications can present to users or execute programmatically. This integration model has made 1inch a behind-the-scenes component in many DeFi applications users interact with daily.

Challenges and Limitations of 1inch DEX

Understanding challenges and limitations of 1inch DEX provides a balanced perspective on the platform. While 1inch offers significant advantages, certain factors may affect user experience or outcomes in specific situations. Awareness of these limitations helps users make appropriate decisions about when and how to use the platform.

Dependency on Underlying DEX Liquidity

Dependency on underlying DEX liquidity means 1inch can only aggregate what exists across connected platforms. If overall market liquidity for a token pair is low, aggregation improves but cannot eliminate execution challenges. The platform’s effectiveness depends fundamentally on the health of the broader DeFi liquidity ecosystem.

Market Conditions and Network Congestion

Market conditions and network congestion affect 1inch performance like all blockchain applications. During high volatility, prices may move between quote and execution. Network congestion increases gas costs and may cause transaction delays. These challenges are inherent to blockchain trading rather than specific to 1inch.

Learning Curve for New Users

The learning curve for new users exists because DeFi trading differs significantly from traditional exchange experiences. Concepts like wallet connection, token approvals, slippage tolerance, and gas fees require understanding before trading safely. While 1inch’s interface is relatively intuitive, underlying concepts take time to learn.

Understanding Advanced Trading Features

Understanding advanced trading features like limit orders, custom routing, and gas optimization requires deeper knowledge. New users can successfully execute basic swaps, but extracting maximum value from 1inch’s full feature set requires learning about these advanced capabilities and how to apply them appropriately.

1inch Feature Comparison by User Type

| Feature | Casual Users | Active Traders | Developers |

|---|---|---|---|

| Basic Swaps | Primary use | Frequent use | API integration |

| Limit Orders | Occasional | Regular use | Custom integration |

| Gas Optimization | Default settings | Custom tuning | Programmatic control |

| API Access | Not needed | Power users | Core requirement |

Future of 1inch DEX in DeFi

The future of 1inch DEX in DeFi involves continued expansion, protocol improvements, and adaptation to evolving market conditions. As decentralized trading matures, aggregation services will likely become even more important for efficient market function. 1inch’s continued innovation positions it to remain a leading infrastructure provider.

Upcoming Protocol Enhancements

Upcoming protocol enhancements focus on improved routing efficiency, expanded chain support, and enhanced user features. Development continues on the Pathfinder algorithm to better handle complex routing scenarios and new DeFi primitives. These improvements will further differentiate 1inch from simple swap interfaces.

Expansion to New Chains and Features

Expansion to new chains and features brings 1inch services to additional blockchain ecosystems. As new networks gain traction and liquidity, 1inch integration provides users on those chains with aggregation benefits. Cross-chain functionality may eventually enable seamless trading across blockchain boundaries.

Role of 1inch in the Evolving DEX Landscape

The role of 1inch in the evolving DEX landscape will likely grow as liquidity fragmentation increases with new protocols and chains. Aggregation becomes more valuable as the ecosystem expands, positioning 1inch as essential infrastructure for efficient DeFi trading.

Build a High-Performance DEX Like 1inch

Looking to develop a DEX with smart liquidity aggregation, gas optimization, and secure smart contracts? Our DEX development experts help you launch scalable, cost-efficient trading platforms.

Launch Your Exchange Now

Long-Term Impact on Decentralized Trading

The long-term impact on decentralized trading includes establishing aggregation as a standard layer between users and liquidity. This intermediary role improves market efficiency, reduces friction, and enables more sophisticated trading strategies across decentralized markets. 1inch’s innovations have already shaped how the industry thinks about DEX design and user experience.

Looking Forward: As DeFi matures, the distinction between aggregators and DEXs may blur, with hybrid models emerging. 1inch’s position as a leading aggregator and its continuous innovation suggest it will remain central to decentralized trading infrastructure regardless of how the ecosystem evolves.

Conclusion

Understanding 1inch DEX services provides the foundation for more effective decentralized trading. The platform’s aggregation model, advanced routing algorithms, and comprehensive feature set address real challenges traders face when navigating fragmented DeFi liquidity. From basic swaps to limit orders to developer integrations, 1inch offers capabilities serving diverse user needs.

The benefits of using 1inch, including best price discovery, minimized slippage, and non-custodial security, make it a valuable tool for traders of all sizes. While limitations exist, understanding when and how to use aggregation effectively maximizes the value users extract from the platform.

As DeFi continues evolving, 1inch’s role as essential trading infrastructure will likely expand. Users and developers who understand these services position themselves to benefit from improved execution quality and access to the deepest available liquidity across decentralized markets.

Frequently Asked Questions

1inch DEX is a decentralized exchange aggregator that searches across multiple DEX platforms to find the best trading rates for users. It works by using the Pathfinder algorithm to split orders across different liquidity sources, optimizing for price, gas costs, and slippage. Users connect their wallets, select tokens to swap, and 1inch automatically routes trades through the most efficient paths.

1inch DEX is generally considered safe as a non-custodial platform where users maintain control of their funds. Smart contracts have undergone multiple security audits by reputable firms. However, like all DeFi platforms, users face risks including smart contract vulnerabilities and market volatility. Always verify transactions before signing and use proper security practices.

1inch finds the best prices through its Pathfinder algorithm, which analyzes liquidity across hundreds of DEX platforms simultaneously. The algorithm considers price, available liquidity, gas costs, and potential slippage to calculate optimal trade routes. For large orders, it may split trades across multiple sources to achieve better overall execution than any single DEX could provide.

1inch limit orders allow users to set specific prices at which they want trades executed, similar to traditional exchange limit orders but in a decentralized manner. These orders are gas-free to place because they are stored off-chain until execution conditions are met. When market prices reach the specified level, keepers execute the orders on-chain.

1inch does not charge direct trading fees on most swaps. Users pay only the underlying blockchain gas fees and any fees from the DEX protocols their trades route through. Some advanced features or specific swap routes may include small protocol fees. The platform generates revenue through various mechanisms including positive slippage capture and referral programs.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.