The way people invest is changing fast. Blockchain technology is no longer just about Bitcoin or speculative crypto tokens. It is now reshaping how real financial assets like stocks, bonds, and funds are owned, traded, and managed. Tokenized stocks sit right at the center of this shift, and they are attracting a generation of investors who grew up with smartphones, apps, and on-demand everything.

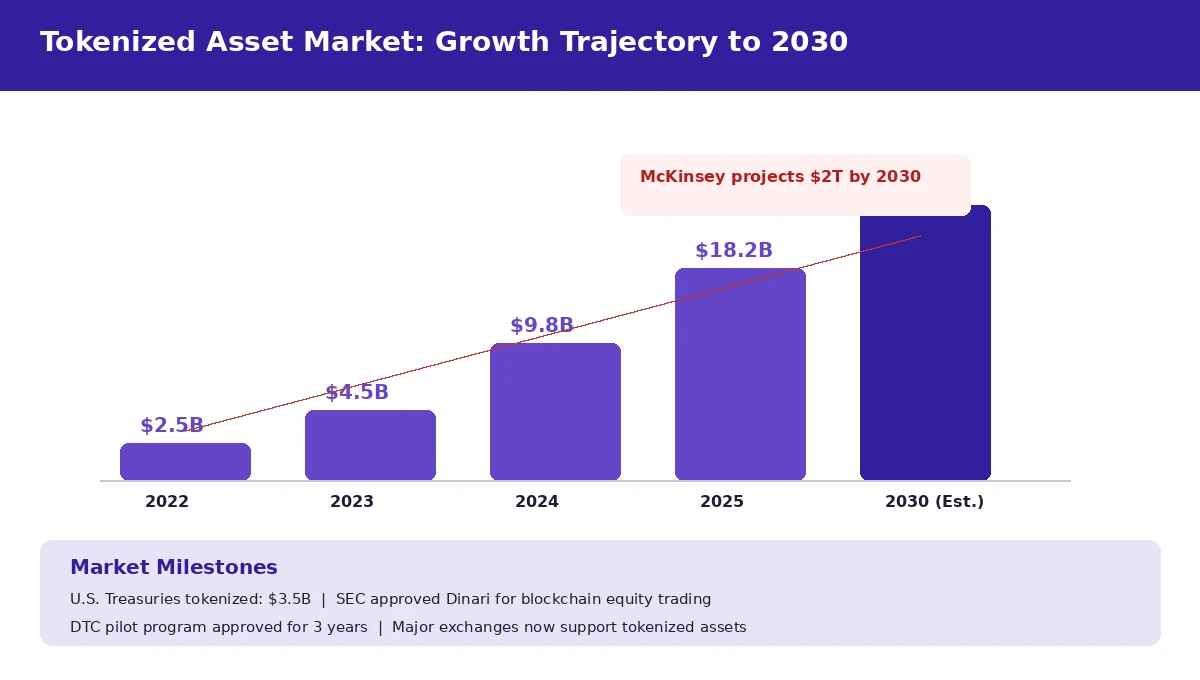

The tokenized real-world asset market has more than quadrupled over the past year, reaching roughly $18.2 billion according to recent tracking data. That is not a small niche anymore. It signals that younger investors are not just curious about digital finance. They are putting real money behind it. This article breaks down what tokenized stocks are, why Millennials and Gen Z are drawn to them, and where this market is headed.

Key Takeaways

- The tokenized real-world asset market has crossed $18.2 billion, with younger investors driving most of the adoption and growth.

- 28% of Millennials and Gen Z rank digital assets as their second preferred investment category, right behind real estate.

- Fractional ownership lets investors buy into high-value stocks like Alphabet and Berkshire Hathaway for as little as one dollar.

- Tokenized stocks trade around the clock on blockchain networks, removing the restrictions of traditional market hours.

- Major exchanges including Robinhood, Coinbase, and Kraken now offer tokenized securities, while institutions like BlackRock and JPMorgan have launched tokenized funds.

- Regulatory clarity is improving with SEC guidance, the Dinari approval, and the DTC pilot program advancing over a three-year window.

- McKinsey projects the tokenized asset market could reach $2 trillion by 2030, making this far more than a passing trend.

What Are Tokenized Stocks and Why Do They Matter?

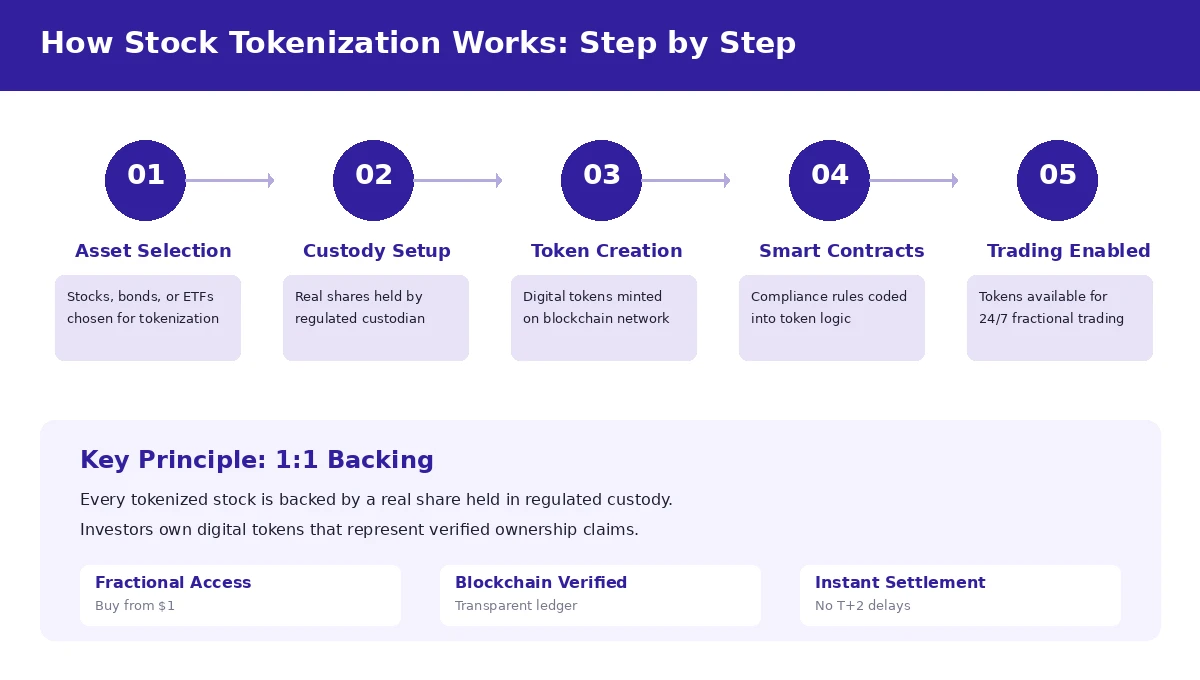

A tokenized stock is a digital version of a traditional share of stock. It lives on a blockchain, which is the same type of distributed ledger technology that powers cryptocurrencies. But unlike a typical crypto coin, each tokenized stock is backed one-to-one by a real share held in custody by a regulated financial institution.

Think of it like a digital receipt that proves you own a piece of Tesla, Apple, or Nvidia stock. The actual share sits safely with a custodian. The token on the blockchain represents your ownership claim. You can trade it, sell it, or hold it, and it works much like a regular stock except with some significant upgrades.

The process starts when a company or platform selects assets for tokenization. A regulated custodian takes possession of the actual shares. Then, digital tokens are created on a blockchain network, with smart contracts built in to handle compliance rules automatically. Once everything is set up, those tokens become available for trading on supported platforms.

This matters because it removes layers of friction that have existed in traditional stock markets for decades. Settlement that used to take two business days can happen almost instantly. Stocks that cost hundreds or thousands of dollars per share become accessible for a single dollar. And trading is no longer locked to the hours when Wall Street is open.

The underlying blockchain technology also ties into the broader ecosystem of decentralized applications (dApps) that are changing how financial services operate. These applications run on distributed networks and offer transparency that centralized systems cannot match.

The Generational Shift Toward Digital Investment

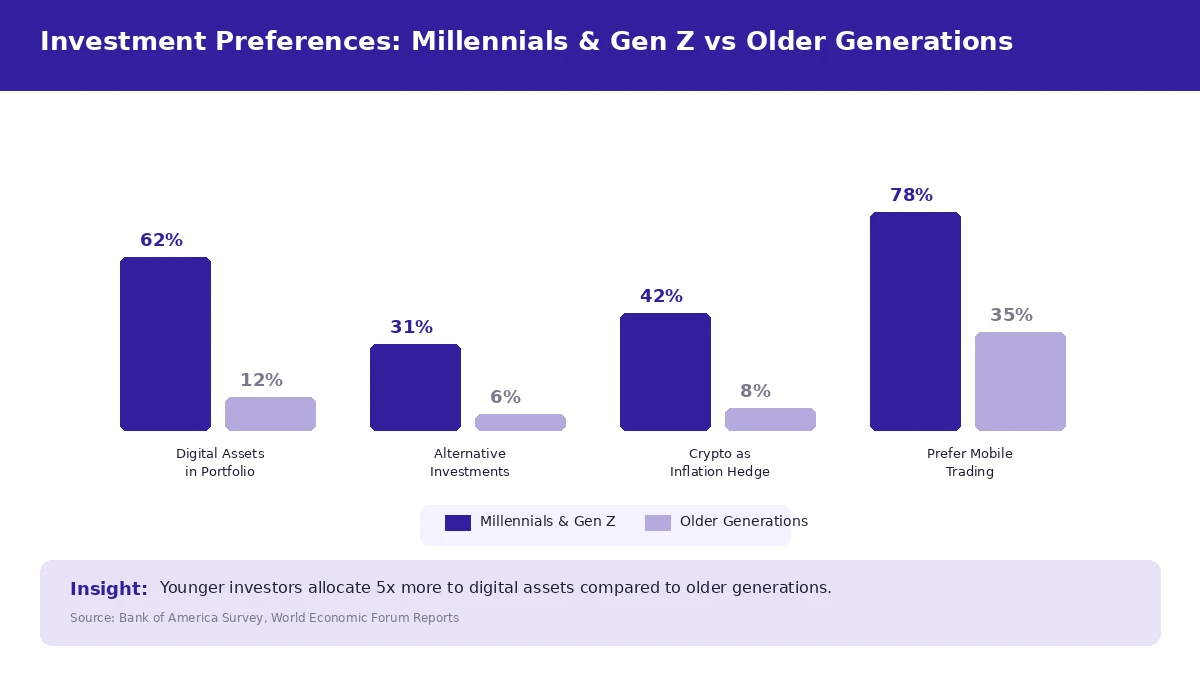

Younger investors are not approaching money the same way their parents did. A Bank of America survey found that 28% of Millennials (ages 27 to 42) and Gen Z (ages 18 to 26) ranked digital assets as their second most preferred investment category. Only real estate ranked higher, partly because real estate tokenization has opened up liquidity in a traditionally illiquid market.

The numbers tell a clear story. Alternative investments and cryptocurrency now make up 31% of younger investors’ portfolios. For older generations, that figure is just 6%. That is not a rounding error. It represents a fundamental difference in how these groups think about building wealth.

Several factors are driving this shift. First, these generations grew up online. They learned about investing from YouTube creators, TikTok finance influencers, and Discord communities rather than from bank advisors or financial planners. This peer-driven education model made complex concepts like smart contracts and tokenized assets feel approachable rather than intimidating.

Second, many younger people feel shut out of traditional wealth-building paths. High housing costs, student loan debt, and stagnant wages have pushed them to look for alternatives. They see tokenized stocks and other blockchain-based investments as tools that level the playing field instead of favoring those who already have significant capital.

Third, this generation watched the 2008 financial crisis unfold during their formative years. Many lost trust in traditional financial institutions. Blockchain-based assets offer something those institutions cannot: verifiable, transparent records of ownership that do not depend on trusting a single company or bank.

Generational Investment Behavior: A Side-by-Side Look

| Investment Factor | Millennials & Gen Z | Older Generations |

|---|---|---|

| Preferred investment platform | Mobile apps, crypto exchanges, DeFi protocols | Traditional brokerages, financial advisors |

| Digital asset allocation | 31% of portfolio in alternatives and crypto | 6% of portfolio in alternatives and crypto |

| Financial education source | YouTube, TikTok, Discord, online communities | Financial advisors, newspapers, TV |

| Risk tolerance | Higher (62% of Millennials invest 50%+ in digital assets) | Lower, preference for bonds and blue-chip stocks |

| Trust in institutions | Lower, prefer transparent blockchain verification | Higher, comfortable with bank and brokerage custody |

| Inflation hedge strategy | 42% of UK Gen Z use crypto as an inflation hedge | Gold, real estate, government bonds |

This table makes one thing clear: the gap between generations is not just about age. It is about fundamentally different approaches to money, risk, and trust. Tokenized stocks sit at the intersection of these differences, offering a product that feels native to younger investors while still connecting to the traditional financial system.

Why Millennials and Gen Z Specifically Prefer Tokenized Stocks

They Grew Up Digital

This is not a generation that had to learn how to use the internet. They were born into it. Navigating a crypto exchange or setting up a blockchain wallet feels natural to someone who has been using apps since childhood. The technical barriers that make older investors hesitant simply do not exist for Millennials and Gen Z.

According to the World Economic Forum, 62% of Millennials and 35% of Gen Z allocate more than half of their portfolios to digital assets. These numbers point to genuine conviction rather than casual experimentation.

They Want Control Over Their Money

Traditional brokerage accounts mean your shares sit inside an institution’s custody. You trust that institution to keep accurate records and act in your interest. Blockchain-based ownership flips this model. Your tokens exist on a public ledger that anyone can verify. Nobody needs to take anyone’s word for it.

For a generation that has seen banks fail and financial scandals play out in real time, that kind of transparency matters. It aligns with a broader desire for financial independence that goes beyond just making money. These investors want to understand exactly what they own and be able to prove it without relying on a middleman.

They Are Comfortable with Risk

Younger investors tend to have higher risk tolerance compared to their parents and grandparents. Part of this comes from having longer time horizons. A 25-year-old can afford to ride out volatility in ways that a 60-year-old planning for retirement cannot. But part of it also comes from a different relationship with risk itself.

Many young investors do not see blockchain-based assets as risky bets. They view them as the future of finance. In the UK, 42% of Gen Z crypto investors use digital assets specifically as hedges against inflation, a strategy that has actually delivered better returns than traditional savings accounts in recent years. This is calculated risk-taking, not gambling.

They Expect Seamless Experiences

When you can order food in 30 minutes, stream any movie instantly, and send money to a friend in seconds, the idea of waiting two business days for a stock trade to settle feels absurd. Tokenized stocks match the pace that younger investors expect from every other service in their lives. The on-chain trading infrastructure powering these assets enables the instant, seamless experience that this generation demands.

Key Benefits of Tokenized Stocks Over Traditional Stocks

The advantages of tokenized stocks are not abstract. They solve real problems that have plagued traditional markets for years. Here is how tokenized stocks compare to conventional stock trading across the factors that matter most to investors.

| Feature | Tokenized Stocks | Traditional Stocks |

|---|---|---|

| Minimum investment | As low as $1 through fractional tokens | Full share price (can be $200+ per share) |

| Trading hours | 24 hours a day, 7 days a week, 365 days a year | Market hours only (closed weekends and holidays) |

| Settlement time | Near-instant (minutes or seconds) | T+2 (two business days after trade date) |

| Compliance handling | Automated through smart contracts | Manual processes with multiple intermediaries |

| Ownership verification | Transparent blockchain ledger, publicly verifiable | Centralized records held by brokers and transfer agents |

| Access to private company shares | Available (OpenAI, SpaceX through platforms like Robinhood) | Typically limited to accredited investors |

| Intermediaries involved | Fewer (blockchain replaces many middlemen) | Multiple (brokers, clearinghouses, transfer agents) |

The fractional ownership piece deserves extra attention. Consider a stock like Alphabet, which trades around $200 per share. A college student working part-time cannot easily build a diversified portfolio when single shares cost that much. With tokenized stocks, that same student can put $10 into Alphabet, $10 into Tesla, and $10 into Nvidia. The tokenized market cap has already passed $9.8 billion, with tokens like TSLAX (tokenized Tesla) and GOOGLX (tokenized Alphabet) actively trading.

Markus Infanger, Senior Vice President of RippleX, put it well when discussing the continuous trading advantage. He noted that continuous intraday settlement fundamentally changes how capital flows, freeing transactions from the constraints of market hours and slow clearing processes. For investors who work night shifts, live in different time zones, or simply want to react to news as it happens, this flexibility is a game changer.

The automated compliance angle also matters more than it might seem at first. In traditional markets, regulatory compliance involves layers of manual checks across brokers, clearinghouses, and transfer agents. Smart contracts can encode these rules directly, so compliance happens automatically every time a token changes hands. This cuts costs and reduces the chances of human error. Understanding how high-performance blockchains like Solana support this infrastructure helps explain why settlement can happen so quickly.

The Tokenized Stock Lifecycle: From Asset to Investor

Understanding the full lifecycle of a tokenized stock helps clarify what happens behind the scenes when you buy one. Each stage involves specific parties, processes, and safeguards that keep the system working.

| Stage | What Happens | Key Parties Involved |

|---|---|---|

| 1. Asset Selection | Stocks, ETFs, or bonds are chosen for tokenization based on demand and regulatory viability | Tokenization platform, legal advisors |

| 2. Legal Structuring | Regulatory framework established, custody agreements signed, compliance rules defined | Regulators (SEC), custodians, law firms |

| 3. Custody Deposit | Real shares purchased and deposited with a regulated custodian for safekeeping | Regulated custodian, auditors |

| 4. Token Minting | Digital tokens created on a blockchain, each representing a specific fraction of the underlying asset | Blockchain developers, smart contract engineers |

| 5. Smart Contract Deployment | Compliance rules, transfer restrictions, and dividend distribution logic are coded and deployed | Smart contract developers, compliance officers |

| 6. Platform Listing | Tokens listed on exchanges and trading platforms, made available to retail and institutional investors | Exchanges (Coinbase, Robinhood), market makers |

| 7. Trading and Settlement | Investors buy, sell, and trade tokens 24/7 with near-instant settlement on the blockchain | Investors, exchanges, blockchain validators |

Each stage in this lifecycle has checks and balances. The one-to-one backing is verified through regular audits. Smart contracts are tested and reviewed before deployment. And platforms must obtain proper licenses before listing tokenized securities. For those interested in the technical side of building on blockchain platforms, understanding the development process for blockchain-based applications provides useful context on how these systems are built and maintained.

Major Platforms and Institutional Adoption

The tokenized stock space is no longer dominated by small startups and experimental projects. Major financial players have entered the market, and their involvement is accelerating adoption on both the retail and institutional sides.

Robinhood made one of the biggest moves in mid-2025 when it launched tokenized U.S. stocks and ETFs for European customers. The platform now offers access to over 200 tokenized securities, including something that traditional brokerages cannot easily match: shares in private companies like OpenAI and SpaceX. These are companies that regular retail investors have never been able to access before.

Coinbase followed suit later in 2025, launching tokenized stocks specifically for U.S. investors. Kraken rolled out 60 tokenized assets for its European customer base. And in a milestone moment, the SEC approved Dinari as the first company authorized for U.S. blockchain equity trading. These are not small, speculative platforms. They are established, regulated companies making strategic bets on the future of securities.

On the institutional side, the names involved speak volumes. BlackRock, the world’s largest asset manager, launched tokenized funds. So did Franklin Templeton and JPMorgan. The market for tokenized U.S. Treasuries alone reached $3.5 billion, which shows that institutions see this technology as viable for even the most conservative asset classes.

Standard Chartered CEO Bill Winters stated at a late 2025 conference that blockchain settlement would eventually handle the majority of financial transactions. That is not a crypto enthusiast making a bold prediction. It is the head of a 170-year-old global bank acknowledging where the industry is heading.

For businesses and entrepreneurs looking to participate in this growing market, working with experienced crypto token developers is a practical first step toward building tokenization solutions that meet regulatory standards and user expectations.

Ready to Build Your Tokenization Platform?

Launch a secure, compliant tokenized asset platform backed by blockchain infrastructure. Fractional ownership, 24/7 trading, and smart contract compliance built in from day one.

Regulatory Landscape: Where Things Stand

One of the biggest concerns around tokenized stocks has always been regulation. If these tokens represent real securities, they need to follow securities laws. The good news is that regulators have been moving in a constructive direction rather than trying to shut things down.

The U.S. Securities and Exchange Commission (SEC) has been clear that tokenized securities are still securities. That means they fall under existing laws governing how stocks are issued, traded, and reported. SEC Commissioner Hester Peirce has been vocal about the need for clear rules while also acknowledging that the technology itself is not the problem.

In December 2025, the SEC issued a no-action letter to The Depository Trust Company (DTC) allowing a pilot version of tokenized services to operate for three years. This is significant because the DTC is the backbone of the U.S. securities settlement system. If they are piloting blockchain-based services, it means the traditional financial infrastructure is actively preparing for this transition.

That said, regulatory uncertainty remains a real factor. Different countries have different rules, and cross-border transactions can create compliance headaches. Investors should be aware that the legal frameworks governing their tokenized stock purchases may differ depending on where they live and which platform they use.

Risks and Considerations Investors Should Know

Tokenized stocks come with real advantages, but they are not without risks. Being honest about these risks is part of making informed investment decisions.

You Do Not Own the Stock Directly

When you buy a tokenized stock, you own a digital token that represents a claim on a real share. You do not own the share directly in the way you would through a traditional broker. This distinction matters for things like voting rights, dividend distributions, and what happens if the tokenization platform goes bankrupt. Always read the fine print to understand exactly what legal rights your tokens carry.

Platform Risk Is Real

The platforms offering tokenized stocks introduce their own set of risks. Smart contract bugs, custodial failures, hacking incidents, and operational mistakes can all affect your holdings. Unlike traditional brokerage accounts that are often protected by insurance programs like SIPC in the United States, tokenized assets may not carry the same protections. Research the platform’s security practices, regulatory licenses, and custody arrangements before committing money.

Private Company Shares Are Harder to Evaluate

Platforms like Robinhood now offer tokenized access to private companies such as OpenAI and SpaceX. While this is exciting, private companies do not have the same disclosure requirements as publicly traded ones. They do not file quarterly reports with the SEC. Their financial details are much harder to verify. Investors buying tokenized private company shares should understand that they are working with less information than they would get with a public stock.

Liquidity Can Vary

While tokenized versions of popular stocks like Tesla and Apple may have strong trading volume, less popular tokenized assets could face liquidity challenges. Low liquidity means wider spreads between buy and sell prices, and it can be harder to exit positions quickly when you need to.

Practical Example: How a Gen Z Investor Might Use Tokenized Stocks

Consider Maya, a 23-year-old recent graduate working her first job. She earns a modest salary and has about $150 per month she can set aside for investing after expenses. In traditional markets, here is what she faces: Alphabet shares cost around $200 each. A single share of Berkshire Hathaway Class A costs over $700,000. Even diversified ETFs can require meaningful per-share investments.

With tokenized stocks, Maya can split her $150 across ten different companies. She puts $15 into tokenized Alphabet, $15 into tokenized Tesla, $15 into tokenized Nvidia, and spreads the rest across other stocks she has been researching. She does this on a Sunday evening from her phone because tokenized markets do not close. By Monday morning, her trades have already settled, and she can see her diversified portfolio reflected in her account.

Now compare that to her experience with a traditional brokerage. She would need to wait until Monday morning to place trades. Settlement would take until Wednesday. She could only buy full shares unless her broker offers its own fractional share program, and even then she would not have the blockchain-verified ownership that tokenized stocks provide.

This is not a hypothetical scenario. It describes the actual experience that thousands of young investors are having right now.

Where the Market Is Headed

The growth trajectory for tokenized assets tells a compelling story. The market went from a few billion dollars in 2022 to over $18 billion in 2025. McKinsey, one of the most respected consulting firms in the world, estimates that tokenized asset market capitalization could reach $2 trillion by 2030.

That projection is not based on hype. It accounts for the convergence of several factors: improving regulatory frameworks, growing institutional participation, maturing blockchain technology, and a generational shift in investor preferences. Each of these factors reinforces the others, creating a flywheel effect that accelerates adoption.

The institutional endorsements matter enormously here. When BlackRock, the firm managing over $10 trillion in assets, launches tokenized funds, it sends a signal to the rest of the financial industry. When the DTC gets SEC approval for a three-year blockchain pilot, it tells everyone that the traditional infrastructure is preparing to integrate this technology rather than resist it.

For younger investors, this means the tokenized stocks they are buying today are not experimental products from the fringe of finance. They are early positions in what is becoming a mainstream asset class. As Investopedia notes, tokenized equity represents a growing segment where blockchain technology meets traditional securities law, and the pace of convergence continues to increase.

Getting Started: What New Investors Should Consider

If you are a Millennial or Gen Z investor interested in tokenized stocks, here are some practical things to think about before jumping in.

Start by understanding exactly what you are buying. A tokenized stock is not the same as owning a share directly through a broker like Fidelity or Schwab. Make sure you understand the ownership structure, what rights the token carries, and what happens to your investment if the platform faces problems.

Choose your platform carefully. Look for platforms that are properly licensed and regulated in your jurisdiction. Check whether the underlying shares are held by a reputable custodian. Read user reviews and look into the platform’s security track record. The big names like Coinbase, Robinhood, and Kraken have regulatory oversight, but smaller platforms may not offer the same protections.

Do not put all your money into tokenized assets. Diversification still matters. A balanced approach might include some tokenized stocks, some traditional stocks, some bonds, and some cash reserves. The goal is to use tokenized stocks as one tool in a broader investment strategy rather than your entire strategy.

Keep learning. The technology and regulatory landscape are evolving quickly. Follow reputable financial news sources, stay updated on SEC developments, and continue educating yourself about blockchain technology. The more you understand, the better positioned you will be to make smart decisions as this market matures.

Conclusion

Tokenized stocks are not a passing trend. They represent a structural shift in how financial assets are owned, traded, and managed. The growth from a niche corner of crypto to an $18.2 billion market backed by the world’s largest financial institutions reflects genuine demand and real utility.

For Millennials and Gen Z, these products fit naturally into how they already interact with money and technology. Fractional ownership removes capital barriers. Continuous trading fits their schedules. Blockchain transparency matches their expectations for accountability. And institutional adoption tells them this is not just some experimental sideshow.

The risks are real and worth taking seriously. Ownership structures differ from traditional stocks. Platform risk exists. Regulation is still catching up. But the direction is clear: tokenized securities are moving toward the mainstream, and the generation driving that shift is the one that will inherit the financial system.

Whether you are a new investor considering your first purchase or someone already deep into DeFi and crypto, tokenized stocks offer a bridge between the traditional financial world and the blockchain-powered future. The question is not whether this transition will happen. It is how fast.

Frequently Asked Questions

Tokenized stocks are digital representations of traditional company shares issued and traded on blockchain networks. They enable fractional ownership, continuous trading, and near-instant settlement while maintaining backing by actual shares held in custody.

Millennials and Gen Z grew up with digital technology, making blockchain-based investments feel natural. They value transparency, accessibility, and control over assets that tokenized platforms provide compared to traditional brokerage accounts.

Yes, tokenized stocks operate on blockchain infrastructure enabling round-the-clock trading. Unlike traditional markets with fixed hours and weekend closures, tokenized assets can be bought or sold at any time.

The SEC confirms tokenized securities remain subject to existing securities laws. Regulatory frameworks continue evolving, with recent developments including DTC pilot programs and platform approvals for blockchain equity trading.

Tokenization divides stock ownership into smaller digital units, allowing investors to purchase portions of shares. This enables investment in high-value stocks like Alphabet or Tesla for as little as one dollar.

Major platforms including Robinhood, Coinbase, and Kraken now offer tokenized securities. Robinhood launched over 200 tokenized stocks for European customers, while Coinbase serves U.S. investors with similar offerings.

Tokenized stocks involve platform counterparty risks, regulatory uncertainty, and ownership structure complexities. Investors should research custody arrangements, compliance frameworks, and understand differences from direct stock ownership.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.