Synthetic Futures, a groundbreaking financial instrument, are shaping DEX Development in the rapidly evolving landscape of decentralized finance. As a pivotal innovation in the realm of Decentralized Exchange Software Development, synthetic futures offer unique opportunities and challenges for both traders and developers. Understanding their role and impact is essential for anyone involved in Decentralized Exchange Development or seeking to leverage DEX Software Development Services for enhancing their trading platforms.

What Are Synthetic Futures in the Context of DEX?

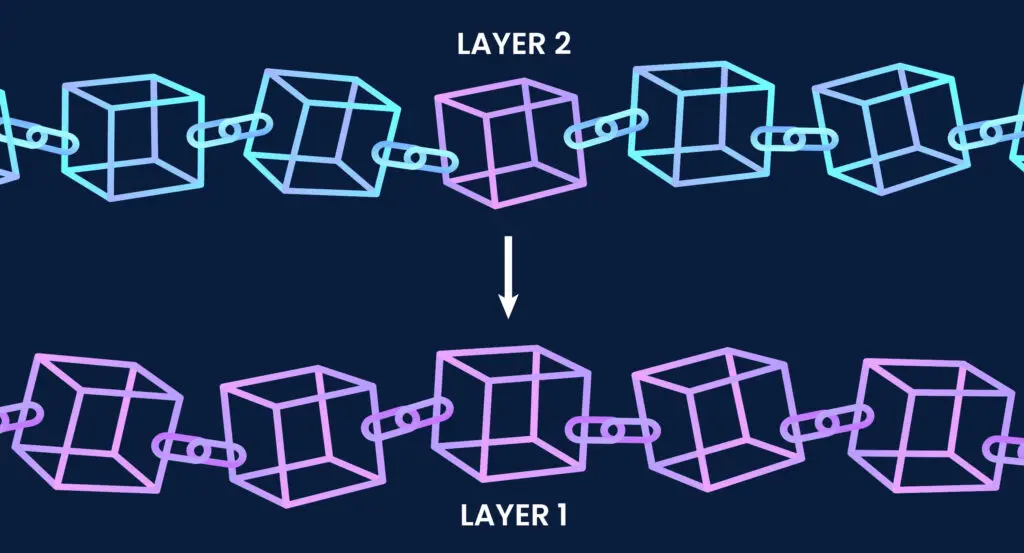

Synthetic futures are financial derivatives that replicate the performance of traditional futures contracts without requiring the actual underlying asset. In the context of DEX development, these instruments allow traders to gain exposure to various assets through smart contracts on a decentralized exchange. By utilizing Decentralized Exchange Development, these futures offer a decentralized way to trade futures contracts, providing the benefits of transparency, security, and efficiency inherent in blockchain technology.

Unlike conventional futures contracts that are typically traded on centralized exchanges, synthetic futures are built using smart contracts on decentralized platforms. This means they are not bound by the limitations and restrictions of traditional exchanges. DEX Software Development Services enable the creation of these synthetic futures, offering a way for traders to hedge, speculate, and diversify their portfolios in a decentralized environment.

How Do Synthetic Futures Differ from Traditional Futures Contracts?

Synthetic futures differ from traditional futures contracts in several key ways. Traditional futures are standardized contracts traded on centralized exchanges, requiring the physical delivery or settlement of the underlying asset. In contrast, synthetic futures are purely digital constructs created through smart contracts, eliminating the need for physical settlement. This distinction is crucial for Decentralized Exchange Software Development, as it highlights the benefits of digital innovation in financial markets.

Furthermore, synthetic futures on Decentralized Exchange Development platforms offer increased flexibility compared to their traditional counterparts. Traders can create custom synthetic futures that mimic various asset classes, including those not typically available on traditional exchanges. This customization is made possible through advanced DEX Software Development Services, which facilitate the creation and management of complex synthetic instruments.

What Are the Benefits of Trading Synthetic Futures on a DEX?

Trading synthetic futures on a decentralized exchange offers numerous benefits. One of the primary advantages is the elimination of intermediaries, which enhances transparency and reduces costs. With Decentralized Exchange Development, transactions are executed directly through smart contracts, minimizing the need for third-party involvement and lowering transaction fees.

Another significant benefit is the increased accessibility and inclusivity provided by DEX development. Synthetic futures allow traders from around the world to participate in markets without the barriers often imposed by traditional exchanges. This global accessibility is a key advantage of Decentralized Exchange Software Development , as it democratizes access to financial instruments and trading opportunities.

Additionally, trading synthetic futures on a DEX benefits from enhanced security features inherent in blockchain technology. The use of smart contracts ensures that transactions are executed automatically and securely, reducing the risk of fraud and manipulation. This security aspect is a critical component of DEX Software Development Services, ensuring that traders’ assets and trades are protected in a decentralized environment.

What Impact Do Synthetic Futures Have on DEX Development?

The introduction of synthetic futures has a profound impact on DEX development. By expanding the range of available financial instruments, synthetic futures drive innovation and attract new users to decentralized platforms. This growth necessitates advancements in Decentralized Exchange Software Development to accommodate the complexities and requirements of synthetic futures trading.

Synthetic futures also influence the design and functionality of decentralized exchanges. Developers must integrate sophisticated smart contracts and develop robust mechanisms for managing synthetic assets. This integration is a key focus for DEX Software Development Services, as it ensures that decentralized platforms can handle the unique challenges associated with synthetic futures while maintaining performance and reliability.

Furthermore, the growing popularity of synthetic futures can lead to increased competition among Decentralized Exchange Development platforms. To stay competitive, platforms must continuously improve their offerings and incorporate innovative features that enhance the trading experience. This competitive pressure drives ongoing development and refinement of Decentralized Exchange Software Development, benefiting the entire ecosystem.

What Are the Risks Associated with Synthetic Futures on DEXs?

While synthetic futures have many benefits, they also come with risks. One big risk is smart contract vulnerabilities. Since synthetic futures run on smart contracts, any bugs or weaknesses in the code can cause financial losses. That’s why Decentralized Exchange Software Development must include thorough testing and audits to ensure security.

Another challenge is the complexity and volatility of synthetic futures. Unlike traditional futures, they often involve high leverage and complicated pricing. Traders need to fully understand how these instruments work to manage risk properly. DEX Development platforms should offer the right tools and guidance to help users make informed decisions.

Liquidity can also be a concern. While synthetic futures give traders more flexibility, they may not have the same market depth as traditional futures. This can make large trades harder to execute without affecting prices. Decentralized Exchange Development should focus on improving liquidity to create a smooth trading experience. Additionally, using Synthetic Tokens in DEX Development can help boost market efficiency and give traders more options.

Why Choose Nadcab Labs for Trading Synthetic Futures on a DEX?

Choosing Nadcab Labs for trading synthetic futures on a decentralized exchange (DEX) offers several compelling advantages. As a leading DEX Development Company, Nadcab Labs provides specialized expertise in Decentralized Exchange Software Development and DEX Software Development Services. Their deep understanding of the complex nature of synthetic futures ensures that clients receive tailored solutions that meet the unique demands of trading these advanced financial instruments.

Nadcab Labs stands out due to its commitment to innovation and security in Decentralized Exchange Development. The company integrates sophisticated smart contracts and cutting-edge technologies into their platforms, enhancing the functionality and security of synthetic futures trading. Their rigorous approach to development ensures that the DEXs they create are robust, reliable, and capable of handling the complexities associated with synthetic futures, including smart contract risks and market liquidity challenges.

Furthermore, Nadcab Labs offers comprehensive support and customization through their Custom Blockchain Development Services . They work closely with clients to understand their specific needs and develop solutions that enhance trading capabilities while addressing any potential risks. This personalized approach, combined with their extensive experience in Decentralized Exchange Development, makes Nadcab Labs an ideal partner for businesses looking to leverage synthetic futures on a decentralized platform effectively and securely.

- DEX Lending Platforms

- MLM Software Delhi

- MLM

- Go

- Rust

- Solidity

- Crypto Token

- Token Launch

- Polkadot Blockchain Development

- Polkadot JAM Chain

- Governance Proposal

- Governance Proposals in Web3

- Mining Pool

- DEX Lending

- Listing Platforms

- ICO listing services

- ICO Listing

- DeFi Aggregator

- Blockchain Technologies

- Metaverse Development

- Pre-Mined Tokens

- Supply chain

- Storage Platforms

- Decentralized Data Storage

- Decentralized Storage

Blockchain

Blockchain  Apps & Game

Apps & Game  AI & ML

AI & ML  AR & VR

AR & VR  IOT Services

IOT Services  E-commerce

E-commerce  Frontend Developer

Frontend Developer  Backend Developers

Backend Developers  Game Developers

Game Developers  Ecommerce Developer

Ecommerce Developer  Dedicated Developers

Dedicated Developers