Key Takeaways

- Sui blockchain was created by Mysten Labs, founded by former Meta executives who previously worked on the Diem blockchain and the Move programming language, and the project raised $300 million in its Series B funding round at a valuation exceeding $2 billion.[1]

- The SUI token has a fixed total supply capped at 10 billion tokens, and as of early February, approximately 3.8 billion SUI tokens (about 38 percent of the total supply) are in circulation across the market.[2]

- Sui uses an object-centric data model instead of the traditional account-based model, which allows the network to process independent transactions simultaneously through parallel execution rather than sequential processing.[3]

- In benchmark testing, Sui has demonstrated throughput of up to 297,000 transactions per second (TPS), with transaction finality achieved in approximately 390 milliseconds through its Mysticeti consensus protocol.[4]

- Sui’s DeFi ecosystem has seen Total Value Locked (TVL) surge from approximately $25 million at launch to over $2 billion, with peak TVL exceeding $2.5 billion, positioning Sui as the third largest non-EVM chain by TVL.[5]

- The Series B funding round was led by FTX Ventures, with participation from Andreessen Horowitz (a16z crypto), Jump Crypto, Apollo, Binance Labs, Franklin Templeton, Coinbase Ventures, and Circle Ventures, among others.[6]

- Sui reached an all-time high price of $5.35 on January 6, 2025, and its circulating market capitalization has placed it among the top 30 cryptocurrencies by market cap on major tracking platforms.[7]

- The minimum staking requirement for delegation on Sui is 25 SUI, while becoming a validator requires 2,000 SUI, and staked tokens are locked for the duration of an epoch, which lasts approximately 24 hours.[8]

- Sui’s monthly active developers increased 219 percent year over year, and the Sui Overflow hackathon received 352 project submissions, reflecting substantial growth in the builder community around the ecosystem.[9]

- Institutional adoption has accelerated with Grayscale launching Sui Trust products, the filing of a SUI ETF with the SEC for potential NASDAQ listing through 21Shares, and integrations with Fireblocks for institutional-grade custody and DeFi access.[10]

The blockchain industry continues to expand, and among the newer Layer 1 networks attracting serious attention from both developers and investors, Sui stands out for its technical architecture and rapidly growing ecosystem. If you are someone exploring the crypto space for the first time or looking to diversify your portfolio with a next-generation blockchain token, understanding what Sui brings to the table is a practical first step. This Sui crypto guide walks you through every important detail, from its origins and technology to tokenomics, staking, ecosystem development, and what to consider before making any investment decisions.

Unlike many blockchain projects that simply replicate existing models, Sui was built from the ground up with a fundamentally different approach to how digital assets are managed and transactions are processed. The network was designed by a team with deep experience in large-scale systems, and its technology addresses some of the most persistent bottlenecks in blockchain adoption, namely speed, cost, and usability. Whether you are trying to understand how Sui crypto works or evaluating whether the SUI token fits your investment strategy, this article covers what matters most in clear and practical terms.

What Is Sui Crypto and Where Did It Come From?

Sui is a Layer 1 blockchain platform designed to make digital asset ownership fast, accessible, and affordable for everyone. It was created by Mysten Labs, a company founded by five former executives from Meta’s (formerly Facebook) Novi Research division. These founders, including CEO Evan Cheng, CTO Sam Blackshear, Chief Scientist George Danezis, Chief Cryptographer Kostas Chalkias, and Chief Product Officer Adeniyi Abiodun, were the architects behind Meta’s Diem blockchain project and the Move programming language. When Meta shelved its blockchain ambitions, this team took their expertise and built something entirely new.

Mysten Labs launched in late September of the year before Sui’s mainnet debut and quickly attracted significant investor interest. The company secured $36 million in a Series A round and then raised $300 million in a Series B round led by FTX Ventures, with participation from Andreessen Horowitz’s a16z crypto division, Binance Labs, Franklin Templeton, Coinbase Ventures, Jump Crypto, Apollo, Circle Ventures, Lightspeed Venture Partners, and O’Leary Ventures. This Series B valued Mysten Labs at over $2 billion, signaling strong institutional confidence in the project’s vision and the team’s capability.

Sui’s mainnet went live on May 3, 2023, and since that launch, the network has grown into one of the most active Layer 1 ecosystems in the blockchain space. The platform’s core mission centers on removing the barriers that have traditionally prevented mainstream adoption of blockchain technology, from slow transaction speeds and high fees to complicated user experiences that intimidate newcomers.

The Technology Behind Sui Blockchain Explained

What makes Sui genuinely different from older blockchains is not just incremental improvement but a fundamental rethinking of how blockchain data is structured and processed. To understand why Sui has attracted so much attention, you need to grasp three core technical innovations that power the network.

1. The Object Centric Data Model

Most blockchains, including Ethereum, use an account-based model. Think of it like a bank ledger where all your assets (ETH, USDC, NFTs) are simply balances tied to your address within a massive centralized smart contract for each asset type. Every time anyone wants to make a transfer, the entire ledger has to be checked sequentially, which creates bottlenecks as network usage grows.

Sui takes a completely different approach. Instead of accounts and balances, everything on Sui is an “object.” A token, an NFT, a game character, a DeFi position, each exists as its own independent, programmable unit with defined ownership. Because these objects are independent, the network can identify which transactions affect which objects and process non-overlapping transactions simultaneously. This is the foundation of Sui’s ability to handle enormous transaction volumes without congestion.

2. Parallel Transaction Execution

The object-centric model enables what makes Sui truly fast: parallel execution. When a transaction only involves objects owned by a single user (like sending tokens from your wallet), it can be processed almost instantly without needing to go through the slower process of global consensus. Only complex transactions that involve shared objects (such as interacting with a DeFi liquidity pool) require consensus ordering.

In benchmark testing, Sui has demonstrated throughput of up to 297,000 transactions per second. While real-world performance varies based on network conditions and transaction complexity, this architecture means that Sui can handle the kind of volume that consumer applications, games, and financial platforms demand. Transaction finality on Sui takes approximately 390 milliseconds through its Mysticeti consensus protocol, which is significantly faster than most competing Layer 1 networks.

3. The Move Programming Language

Sui uses the Move programming language for its smart contracts, originally created by Sam Blackshear during his time at Meta for the Diem project. Move was designed from scratch with digital assets in mind, incorporating what developers call “resource safety.” This means that assets defined in Move cannot be accidentally duplicated, lost, or destroyed through programming errors.

For context, Ethereum’s Solidity language has been associated with numerous costly bugs and exploits (reentrancy attacks, for example) because its design did not inherently prevent these issues. Move addresses this by treating every digital asset as a unique resource with strict ownership rules baked into the language itself. The development process for building on Sui, while different from Solidity, offers stronger safety guarantees, which is particularly important for financial applications handling real value.

Recommended Reading:

Understanding the SUI Token and Its Tokenomics

The native cryptocurrency of the Sui network is SUI. Understanding its tokenomics is essential for anyone considering an investment because supply dynamics, distribution schedules, and utility directly affect a token’s long term value proposition.

1. Total Supply and Circulating Supply

SUI has a fixed maximum supply of 10 billion tokens. Unlike some cryptocurrencies that have unlimited or inflationary supply models, this hard cap means no additional SUI tokens will ever be created beyond this number. As of early this year, approximately 3.8 billion SUI tokens are in circulation, representing about 38 percent of the total supply. The remaining tokens are released according to predetermined vesting schedules that extend into the next decade.

2. Token Distribution Breakdown

The distribution of SUI tokens follows a structured allocation designed to balance ecosystem growth, investor returns, and network security. The largest allocation, approximately 52 percent, is set aside for release after the year and is classified as a reserved allocation. Community reserves account for about 10.65 percent, stake subsidies take approximately 9.49 percent, and investor allocations include 7.14 percent for Series A participants and 6.96 percent for Series B participants. Early contributors received about 6.13 percent, the Community Access Program accounts for 5.82 percent, and the Mysten Labs Treasury holds 1.63 percent.

3. Four Core Utilities of the SUI Token

SUI tokens serve four primary functions within the network. First, they are used to pay gas fees for executing transactions and storing data on the blockchain. Second, holders can stake SUI to participate in the delegated proof of stake consensus mechanism that secures the network. Third, SUI plays a role in governance, giving token holders the right to participate in on-chain voting on protocol upgrades and network parameters. Fourth, SUI acts as a versatile asset within the growing ecosystem of decentralized applications built on the network, serving as a unit of account and medium of exchange across DeFi platforms, gaming applications, and NFT marketplaces.

4. The Storage Fund Mechanism

One of the more innovative aspects of Sui’s tokenomics is its storage fund. Gas fees on Sui are split into two components: computation fees and storage fees. The storage portion goes into a dedicated fund that compensates validators for the ongoing cost of maintaining data on the blockchain. This creates a natural deflationary pressure on the token supply because gas fees are partially burned through this mechanism. As network usage grows and more transactions occur, this burning effect increases, potentially reducing the effective circulating supply over time.

SUI Token Allocation and Distribution Structure

| Allocation Category | Percentage of Total Supply | Purpose and Details |

|---|---|---|

| Reserved Allocation (Post Vesting) | 52.17% | Locked tokens are scheduled for release after the main vesting period concludes |

| Community Reserve | 10.65% | Grants, delegation programs, developer education, and ecosystem support |

| Stake Subsidies | 9.49% | Rewards are distributed to validators and stakers for network security participation |

| Series A Investors | 7.14% | Early-stage investors who participated in the $36 million initial funding round |

| Series B Investors | 6.96% | Investors from the $300 million round led by FTX Ventures with a16z, Binance Labs |

| Early Contributors | 6.13% | Founding team members and initial builders who contributed to early development |

| Community Access Program | 5.82% | Public sale and community distribution programs for broader token accessibility |

| Mysten Labs Treasury | 1.63% | Corporate treasury for operational expenses and ongoing protocol development |

How Sui Compares to Other Major Layer 1 Blockchains

When evaluating any blockchain investment, context matters. Sui exists in a competitive landscape alongside established networks like Ethereum and high-performance chains like Solana. Understanding where Sui fits helps new investors make more informed decisions about what they are buying into.

Ethereum remains the most widely adopted smart contract platform, with the largest ecosystem of decentralized applications and the highest Total Value Locked across DeFi protocols. However, Ethereum’s base layer processes roughly 12 to 15 transactions per second, with transaction finality taking up to 12 to 13 minutes. Gas fees on Ethereum can spike to several dollars during periods of high network congestion, making it expensive for everyday transactions.

Solana positioned itself as a high-performance alternative, processing up to 50,000 transactions per second in real-world conditions through its Proof of History mechanism combined with Proof of Stake. Solana offers very low fees, typically fractions of a cent per transaction. However, the network has experienced several notable outages since its inception, raising questions about reliability.

Sui enters this landscape with a distinct approach. Its object-centric model and parallel execution enable theoretical throughput exceeding 297,000 TPS in testing, and its Mysticeti consensus achieves sub-second finality at approximately 390 milliseconds. Transaction fees on Sui have averaged approximately 0.0025 SUI per transaction, typically below one cent. While Sui’s ecosystem is younger and smaller than both Ethereum’s and Solana’s, its technical architecture is designed to handle the demands of consumer-scale applications from the start.

The key differentiator for Sui is not just raw speed, but the architectural philosophy. By treating every asset as an independent object, Sui avoids the global state bottlenecks that constrain older blockchains as they scale. This makes it particularly well-suited for applications that involve complex asset interactions, such as gaming, dynamic NFTs, and composable DeFi protocols.

Recommended Reading:

Aptos or Sui? Exploring the Differences Between Two Promising Layer 1 Platforms

Sui’s Growing DeFi Ecosystem and Adoption Trends

One of the strongest indicators of a blockchain’s long-term viability is the health and growth of its decentralized finance ecosystem. On this front, Sui has shown remarkable momentum since its mainnet launch. The network’s Total Value Locked in DeFi protocols has surged from approximately $25 million at launch to over $2 billion, with peak TVL exceeding $2.5 billion. This positions Sui as the third-largest non-EVM chain by TVL, a significant achievement for a relatively young network.

1. Major DeFi Protocols on Sui

The Sui DeFi ecosystem has attracted several notable protocols that provide lending, borrowing, trading, and yield generation services. Suilend currently operates as the largest protocol on the network, handling hundreds of millions in TVL. Navi Protocol follows closely, offering lending and borrowing services with features like automatic leverage vaults. Cetus Protocol serves as a major decentralized exchange and concentrated liquidity protocol, while Momentum has emerged as a rapidly growing DEX that reached over $107 million in TVL and generated $4.6 billion in total swap volume from 478,000 unique wallets. Bluefin has established itself in the perpetual trading space, introducing innovative products like its Request for Quote system and spot trading aggregator.

2. Institutional Adoption and Strategic Partnerships

Institutional interest in Sui has accelerated significantly. Grayscale launched Sui Trust products, providing traditional investors with exposure to the SUI token through regulated investment vehicles. 21Shares filed for an SUI ETF with the SEC for a potential NASDAQ listing, which would make SUI accessible to a much broader investor base through conventional brokerage accounts. Fireblocks integrated Sui support, enabling institutional clients to custody SUI assets and connect to the DeFi ecosystem through MPC-based wallets. Sygnum Bank, a FINMA-regulated digital asset bank, fully integrated SUI into its platform, offering institutional clients custody, trading, and derivatives services.

Beyond financial products, Sui has formed strategic partnerships with Google Cloud for developer tools and AI integration, and with xMoney and xPortal for retail consumer products, including virtual MasterCard functionality. The Sui Foundation collaborated with World Liberty Financial (WLFI) for stablecoin integration, and partnerships with Wormhole have enabled cross-chain liquidity flows into the Sui ecosystem.

3. Developer Ecosystem Growth

The strength of any blockchain ultimately depends on the developers building on it. Sui’s monthly active developers have increased 219 percent year over year, growing to approximately 1,300 active contributors. The Sui Overflow hackathon attracted 352 project submissions, demonstrating strong builder interest. Code commits on Sui’s GitHub repositories have shown some of the highest growth rates among major blockchains, with a 120 percent monthly spike in development activity driven by improvements to core Move architecture, validator tools, and storage systems.

How Staking Works on the Sui Network

Staking is one of the primary ways SUI token holders can participate in the network while earning rewards. Sui uses a delegated proof of stake (DPoS) consensus mechanism, which means that token holders do not need to run their own validator nodes to contribute to network security. Instead, they can delegate their SUI tokens to existing validators and receive a share of the staking rewards.

1. Delegation Process

The minimum requirement to delegate SUI is just 25 tokens, making staking accessible even to smaller holders. You choose a validator you trust, delegate your tokens to them, and begin earning rewards proportional to your stake. The process can be done through the Sui Wallet or compatible third-party wallets. Validators are responsible for processing transactions and maintaining the network, and they set their own commission rates, which affect the rewards delegators receive.

2. Epoch Structure and Flexibility

Sui operates on an epoch system, with each epoch lasting approximately 24 hours. At the beginning of each epoch, staked tokens are counted, the validator committee is formed, and reference gas prices are set. Staked SUI is locked for the duration of the current epoch, but users are free to withdraw their tokens or switch to a different validator before a new epoch begins. This daily flexibility is more accommodating than many staking systems that require lock-up periods of weeks or months.

3. Reward Sources

Staking rewards on Sui come from two sources: stake subsidies (which are gradually decreasing over time as the network matures) and transaction fees generated by network activity. As stake subsidies phase out, validator compensation will increasingly depend on actual network usage, creating a direct connection between the ecosystem’s growth and staking returns. This transition is designed to ensure long-term sustainability without requiring perpetual token inflation.

Sui vs Other Layer 1 Blockchains: Technical Comparison

| Feature | Sui | Ethereum | Solana |

|---|---|---|---|

| Consensus Mechanism | Delegated Proof of Stake (Mysticeti) | Proof of Stake (Casper) | Proof of History + Proof of Stake |

| Benchmark TPS | Up to 297,000 TPS | 12 to 15 TPS (base layer) | Up to 50,000 TPS (real world) |

| Transaction Finality | ~390 milliseconds | 12 to 13 minutes | ~12 seconds |

| Smart Contract Language | Sui Move | Solidity | Rust, C, C++ |

| Data Model | Object Centric | Account Based | Account Based |

| Average Transaction Fee | Less than $0.01 | $1 to $20+ (variable) | Less than $0.01 |

| Total Supply | 10 Billion (fixed cap) | No hard cap (variable supply) | No hard cap (inflationary) |

Key Features That Make Sui Attractive for Beginners

Sui was designed with mainstream adoption in mind, and several of its features directly address the usability problems that have historically made blockchain intimidating for new users.

1. zkLogin (Social Login for Blockchain)

One of Sui’s most user-friendly innovations is zkLogin, which allows users to create blockchain wallets and sign transactions using their existing Google, Facebook, or other social media accounts. This eliminates the need for newcomers to manage complex seed phrases or private keys when they first enter the ecosystem. Using zero-knowledge cryptography, zkLogin provides the convenience of familiar web login experiences while preserving the security and ownership benefits of blockchain technology. For new investors, this dramatically lowers the barrier to entry.

2. Sponsored Transactions

In most blockchain networks, users must hold the native token just to pay gas fees before they can do anything. Sui allows application developers to sponsor transaction fees on behalf of their users. This means someone can interact with a Sui-based application without owning any SUI tokens initially. For gaming applications, social platforms, and consumer products, this feature removes a major friction point that typically discourages non crypto native users from engaging with blockchain applications.

3. Programmable Transaction Blocks

Sui allows developers to group multiple actions into a single transaction block. Instead of requiring separate transactions (each with its own gas fee) for a multi-step operation, users can execute complex workflows in one action. For example, swapping tokens, providing liquidity, and staking rewards could all happen in a single transaction. This simplifies user experience and reduces costs, making blockchain interactions feel closer to conventional web applications.

4. Dynamic On-Chain Assets

Unlike static NFTs on other blockchains, objects on Sui can be extended with custom fields that developers add or remove over time. This enables rich, evolving digital assets. Imagine a game character NFT that levels up and gains new abilities, or a membership badge that unlocks additional features as the holder’s engagement grows. These dynamic capabilities open up use cases in gaming, loyalty programs, and digital identity that are difficult to implement on traditional account-based blockchains.

Recommended Reading:

How to Buy and Store SUI Tokens Safely

For new investors looking to acquire SUI tokens, the process is straightforward but requires attention to security best practices. Here is what you need to know about purchasing and holding SUI safely.

1. Choosing a Crypto Exchange

SUI is listed on most major centralized exchanges, including Binance, Coinbase, Kraken, KuCoin, and others. When selecting an exchange, prioritize platforms with strong security track records, regulatory compliance in your jurisdiction, reasonable trading fees, and sufficient liquidity for the SUI trading pair you intend to use. Create an account, complete the required identity verification (KYC), and fund your account through supported payment methods such as bank transfer or card payment.

2. Wallet Options for Storing SUI

After purchasing SUI tokens, transferring them to a personal wallet is recommended for long-term holding rather than leaving them on an exchange. The Sui Wallet is the official browser extension wallet that allows you to store SUI, interact with Sui-based dApps, and participate in staking. Third-party wallets, including Phantom and Backpack, also support SUI. For larger holdings, hardware wallets from providers like Ledger offer the highest level of security by keeping your private keys offline and protected from online threats.

3. Security Best Practices

Regardless of which wallet you choose, always write down your recovery phrase on paper and store it in a safe physical location. Never share your seed phrase or private keys with anyone. Enable two-factor authentication on your Exchange accounts. Be cautious of phishing websites that impersonate legitimate platforms. And remember the fundamental rule of cryptocurrency: if you don’t hold your private keys, you don’t truly own your tokens.

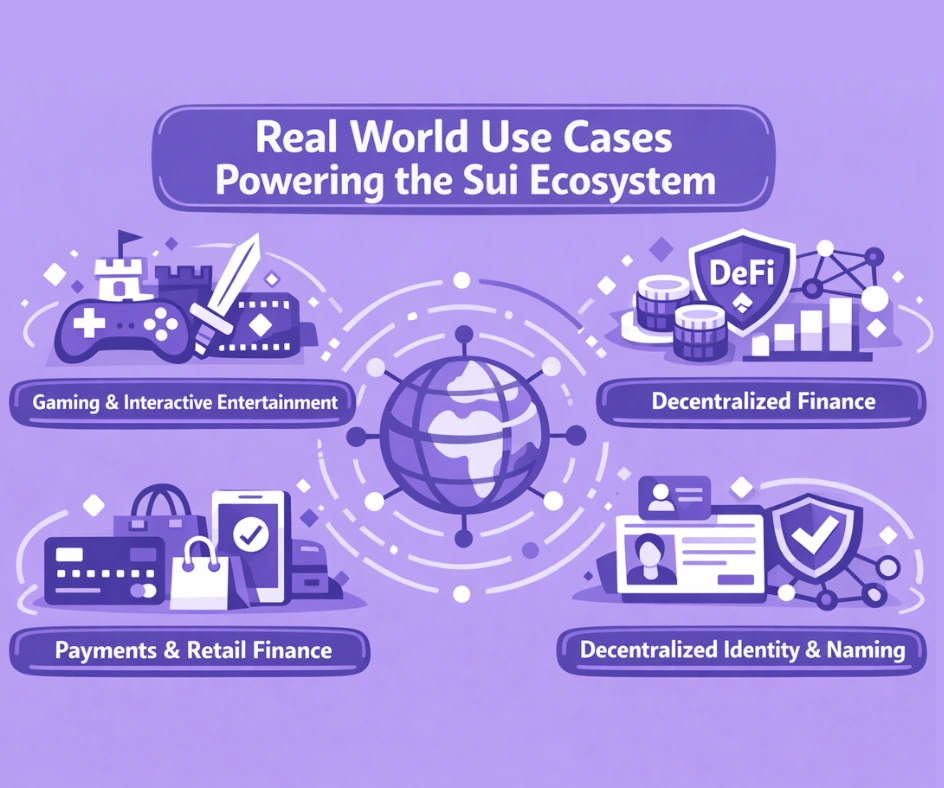

Real World Use Cases Powering the Sui Ecosystem

The practical applications being built on Sui span multiple sectors, and understanding these use cases helps investors appreciate what drives demand for the SUI token beyond speculative trading.

1. Gaming and Interactive Entertainment

Sui’s architecture is particularly well-suited for blockchain gaming. Its parallel execution allows game assets (characters, items, achievements) to be processed simultaneously without delays, and the object-centric model maps naturally to how game assets work. Mysten Labs itself has ventured into gaming hardware with the SuiPlay0X1 handheld gaming console, designed to bring Web3 gaming to mainstream consumers. Multiple gaming titles and studios are building on Sui, attracted by the network’s ability to handle the real-time transaction demands that games require.

2. Decentralized Finance

The DeFi sector on Sui encompasses lending and borrowing protocols, decentralized exchanges, perpetual futures platforms, liquid staking derivatives, and yield farming opportunities. Bitcoin-backed assets like tBTC and xBTC have been brought onto Sui, allowing Bitcoin holders to put their assets to work within DeFi protocols. The development of cross-chain bridges and the integration of Wormhole’s Native Token Transfer framework are expanding the liquidity available within the Sui DeFi ecosystem.

3. Payments and Retail Finance

Sui has moved into retail payment territory through partnerships with xMoney and xPortal, which are developing consumer products on Sui, including virtual MasterCard functionality. In Nigeria, the LINQ partnership enables crypto-to-fiat conversions, and in South Korea, T’order is facilitating stablecoin-based payments. These real-world payment integrations demonstrate Sui’s ambition beyond purely crypto native applications.

4. Decentralized Identity and Naming

The Sui Name Service (SuiNS) allows users to register human-readable names (like yourname.sui) that map to complex wallet addresses. This simplifies the experience of sending and receiving tokens, similar to how domain names made the internet more accessible than raw IP addresses. As the ecosystem grows, these naming services become increasingly valuable for establishing digital identity and simplifying blockchain interactions.

Blockchain Development Implementations in the Real World

The following projects reflect how blockchain architecture is already being applied across DeFi, gaming, cross-chain interoperability, and high-throughput network development. Each implementation showcases the same distributed infrastructure principles discussed throughout this article, from parallel execution and token governance to developer-friendly tooling and community-driven scaling.

🔗

Kaon: Cross-Chain Bitcoin Interoperability

Built a hybrid blockchain infrastructure that bridges Bitcoin and Ethereum, enabling Bitcoin interoperability with smart contracts without relying on bridges or wrapped tokens. By integrating Bitcoin’s UTXO model with Ethereum’s account-based system, Kaon allows DeFi applications to leverage Bitcoin liquidity natively, mirroring the cross-chain integration principles central to modern Layer 1 development.

🤖

Athene Network: Decentralized AI Mining Platform

Created a decentralized mining platform for AI development and deployment where researchers, developers, and users share AI models, data, and services. The platform uses Proof of Stake consensus and token holder governance, enabling community-driven AI infrastructure without centralized control, reflecting the same DPoS and staking principles used by Layer 1 networks like Sui.

Build Your Layer 1 Blockchain Project Today:

We bring 8+ years of blockchain expertise to Layer 1 development, DeFi protocol creation, and token development. Our specialized team handles everything from smart contract creation to custom consensus integration, ensuring your platform is built for performance, safety, and user experience. Whether you need a DeFi protocol, token ecosystem, or blockchain application, we deliver solutions that work.

Risks and Considerations for New Sui Investors

No honest investment overview would be complete without addressing risks. Sui, like all cryptocurrencies, carries significant risk factors that new investors must understand before committing capital.

1. Token Unlock and Supply Dilution

With only about 38 percent of the total SUI supply currently in circulation, there are substantial token unlocks scheduled over the coming years. Large amounts of previously locked tokens entering the market can create selling pressure, potentially affecting the price. Investors should monitor the token release schedule and understand that major unlock events can influence short-term price movements regardless of fundamental progress.

2. Network Maturity and Outage Risk

Sui is still a relatively young network. It experienced a mainnet disruption in early January that resulted in nearly six hours of downtime, and a previous outage occurred in late autumn of the prior period. While these issues were resolved and the team has worked on improving network reliability, they serve as reminders that newer blockchains are still proving their stability under various conditions.

3. Ecosystem Size Relative to Competitors

While Sui’s ecosystem is growing rapidly, it is still considerably smaller than Ethereum’s and Solana’s in terms of total applications, user base, and developer tooling maturity. The success of any blockchain token is closely tied to the breadth and depth of its ecosystem. Investors should evaluate whether the current growth trajectory is sustainable and whether Sui can continue attracting developers and users at its current pace.

4. Market Volatility

SUI has demonstrated significant price volatility. After reaching an all-time high of $5.35, the price has fluctuated considerably. The cryptocurrency market as a whole is subject to macroeconomic factors, regulatory developments, and shifting investor sentiment that can drive dramatic price swings. New investors should only allocate capital they can afford to lose and consider dollar cost averaging as a strategy to reduce timing risk.

5. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies continues to evolve globally. Changes in regulations regarding token classifications, exchange operations, or DeFi protocols could affect the accessibility and value of SUI tokens. U.S. citizens and residents are excluded from certain community programs and public sales, reflecting the complex regulatory environment that crypto projects must navigate.

What Lies Ahead for the Sui Ecosystem

Sui’s roadmap for the near future includes several ambitious developments that could shape its trajectory. The network is transitioning toward what the team calls S2 (Sui Stack), evolving from a pure Layer 1 blockchain into a unified developer platform. This transformation includes the planned launch of USDsui, a native stablecoin with gas-free transfers, and upgrades to DeepBook with margin trading capabilities.

Protocol-level private transactions using native zero-knowledge proofs are planned, aiming to enable regulation-compliant on-chain payments with built-in privacy features. The Walrus protocol, a decentralized storage solution, has been integrated into the Sui ecosystem, providing infrastructure for data-heavy applications. These developments suggest a platform moving beyond basic blockchain functionality toward a comprehensive infrastructure for real-world applications.

The gaming vertical continues to be a priority, with the SuiPlay0X1 console and partnerships with gaming studios positioning Sui as a blockchain purpose-built for interactive entertainment. Cross-chain interoperability improvements through Wormhole integration and native token transfers are expanding the ecosystem’s reach and liquidity. As these initiatives mature, they could drive increased demand for the SUI token through greater utility and broader adoption.

Conclusion

Sui represents a genuinely novel approach to blockchain design. Rather than iterating on existing architectures, the team behind Sui rethought how blockchain data should be structured and processed, resulting in a network that can handle enormous transaction volumes with sub-second finality and near-zero fees. The object-centric data model, the Move programming language, and features like zkLogin and sponsored transactions collectively create a platform that is technically advanced while remaining accessible to users who have never interacted with blockchain before.

For new investors exploring this Sui crypto guide, the fundamentals present a compelling picture. Strong team credentials, significant institutional backing, a rapidly growing DeFi ecosystem with over $2 billion in TVL, and a clear technical advantage in transaction speed and architectural design. The network’s emphasis on real-world use cases in gaming, payments, and DeFi suggests it is building for long term utility rather than short term speculation.

However, the investment case for SUI also comes with meaningful risks. Token unlock schedules that will increase circulating supply significantly over the coming years, occasional network stability issues typical of younger blockchains, and the inherent volatility of the cryptocurrency market all deserve careful consideration. The ecosystem, while growing fast, is still in its early stages compared to established networks. Smart investing in any cryptocurrency means doing thorough research, understanding the technology, assessing the risks honestly, and never investing more than you can afford to lose. If you are drawn to Sui’s technology and its vision for the future of blockchain, approach it as a long-term position, stay informed about development milestones and token economics, and keep your expectations grounded in a realistic assessment of both the opportunities and the challenges ahead.

Frequently Asked Questions

Sui is a Layer 1 blockchain platform built by Mysten Labs that uses an object-centric data model and the Move programming language to enable fast, low-cost transactions with parallel processing. The native SUI token is used for gas fees, staking, governance, and interacting with decentralized applications across the ecosystem.

New investors can purchase SUI through major centralized exchanges like Binance, Coinbase, or Kraken by creating an account, completing identity verification, depositing funds, and then trading for SUI. After buying, transferring tokens to a personal wallet, such as Sui Wallet or a hardware wallet, is recommended for better security.

Staking SUI allows token holders to earn rewards by delegating their tokens to validators with a minimum requirement of just 25 SUI. The rewards come from stake subsidies and network transaction fees, and tokens are only locked for approximately 24 hours per epoch, giving stakers flexibility to withdraw or change validators regularly.

Sui processes transactions in parallel through its object-centric model rather than sequentially like Ethereum, achieving finality in approximately 390 milliseconds compared to Ethereum’s 12 to 13 minutes. Sui uses the Move language instead of Solidity, has a fixed token supply of 10 billion, and offers transaction fees consistently below one cent.

Key risks include significant token unlocks that will increase circulating supply, occasional network outages as the blockchain matures, a smaller ecosystem compared to established competitors, cryptocurrency market volatility, and evolving regulatory frameworks that could impact token accessibility or value over time.

The SUI token has a fixed maximum supply capped at 10 billion tokens, with approximately 3.8 billion currently in circulation. The remaining tokens follow a structured vesting schedule extending into the next decade, with major allocations going to community reserves, stake subsidies, investors, early contributors, and the Mysten Labs treasury.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.