Key Takeaways

- Smart Contracts Are Everywhere: Smart contracts run DeFi, NFTs, gaming, supply chains, healthcare, and more. They automate processes but need audits because bugs can cause huge financial losses.

- Market Size & Growth: The smart contract audit market is growing fast. Estimates range from $940 million to $2.7 billion in 2024, expected to reach $7.6–$12 billion by 2033. Growth is driven by blockchain adoption and rising hacks.

- Service Types: Audits are done manually, automatically, or as a hybrid. Manual audits are detailed but slower; automated audits are fast but less thorough; hybrid audits combine both for better security.

- Blockchain Platforms: Ethereum, Binance Smart Chain, Solana, Polygon, Cardano, and others need audits. Ethereum dominates, while other platforms grow with gaming, DeFi, and NFT projects.

- End Users: Enterprises, SMEs, individual developers, and organizations like governments or universities use smart contract audits to protect money, ensure compliance, and reduce risks.

- Applications: DeFi is the largest user, followed by NFTs, gaming, supply chain, healthcare, and other areas like real estate and voting. Audits help prevent hacks and secure transactions.

- Industry Verticals: Finance leads, followed by healthcare, supply chain, gaming, and real estate. All industries use audits to keep operations safe and reliable.

- Opportunities & Challenges: AI, automation, and hybrid audits are growing. Emerging markets and SMEs offer new opportunities. Challenges include lack of skilled auditors, fast-changing blockchain tech, and no standard rules.

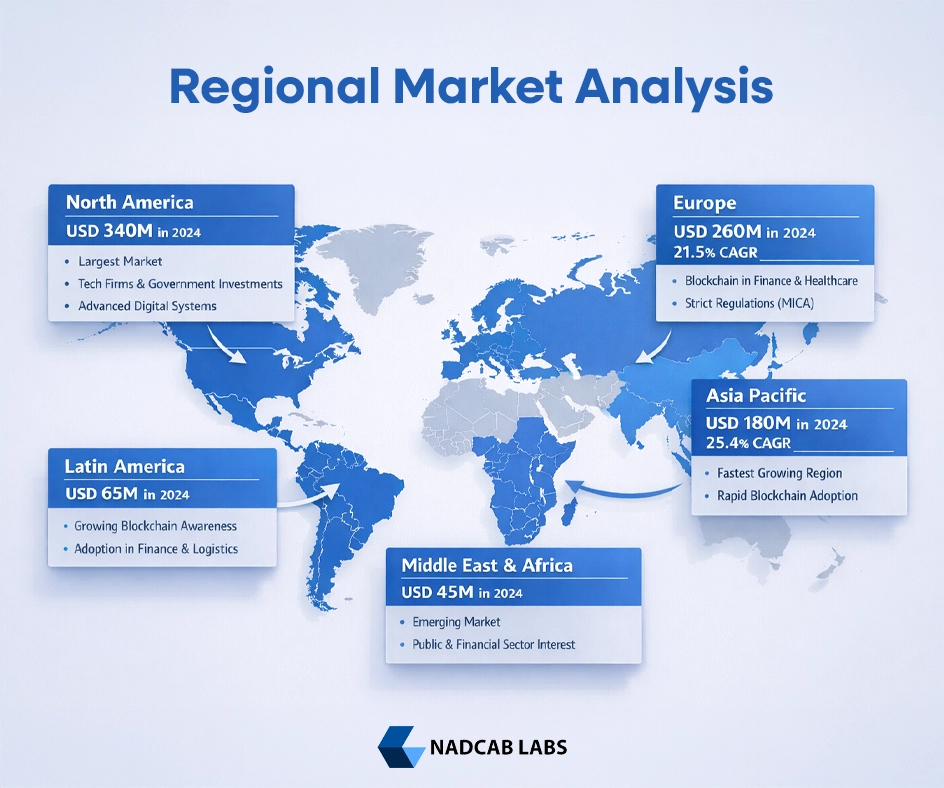

- Regional Outlook: North America is the largest market ($340M in 2024), Europe is second ($260M), and Asia Pacific grows fastest ($180M) due to blockchain adoption. Latin America ($65M) and MEA ($45M) are growing steadily.

Blockchain and decentralized applications are everywhere now. From decentralized finance platforms to NFT marketplaces and supply chains, smart contracts are powering much of the digital world. However, smart contracts are just computer code. If there is a bug or vulnerability, it can lead to losses of millions or even billions of dollars.

Smart contracts are now a core part of the blockchain world. From DeFi platforms and NFT marketplaces to enterprise automation and tokenized assets, smart contracts are everywhere. These self-executing programs remove middlemen, reduce costs, and speed up transactions. But with this power comes risk.

A single bug in a smart contract can lock or steal millions of dollars. Because smart contracts are immutable once deployed, fixing mistakes later is often impossible. This is why smart contract audits have become essential, not optional.

Over the last few years, high-profile hacks, growing regulations, and rapid blockchain adoption have pushed the smart contract audit market into strong growth. Between 2025 and 2033, this market is expected to expand significantly across finance, DeFi, NFTs, enterprises, and government use cases.

This report explores the smart contract audit market size, share, trends, drivers, challenges, regional outlook, and future growth of the smart contract audit market, using real data from trusted research sources.

Why Smart Contract Audit Market Matters?

The smart contract audit market is important because a lot of money is involved in blockchain projects, especially in DeFi platforms. Many hacks happen because smart contracts are not checked properly for mistakes or security problems. Audits make sure contracts work correctly, keep funds safe, prevent hacks, and help users trust the platform.That’s why thorough audits have become essential for any serious blockchain project, ensuring the contracts work correctly and funds stay safe.

Global Smart Contract Audit Market Overview

According to Coinlaw Report Analysis report, the smart contract audit market is growing fast, though it is often counted as part of the bigger smart contracts market, which was worth around $2.1 to $2.7 billion in 2024 and is expected to go beyond $12 billion by 2032. The market is growing very quickly, with CAGR between 20% and 80%, because companies need better security to avoid huge losses from hacks. The main reasons for growth are more people using blockchain, increasing hacks (over $3.5 billion lost in 2024), the need to automate transactions, and new rules from regulators. Tools using AI and mixed audit methods are also becoming popular.

According to this alternative Growth Market Reports Analysis report , the global smart contract audit market size was valued at $940 million in 2024 and is expected to grow at a CAGR of 22.7% from 2025 to 2033, reaching $7.6 billion by 2033. This growth comes from more industries using blockchain and the need to make sure smart contracts work safely and correctly. A big reason for this growth is the rise in security problems and hacks, which makes companies spend more on auditing services to protect their money and reputation.

Looking ahead, the analysis for the year 2034 shows that the smart contract audit market is expected to keep growing strongly. As more businesses adopt blockchain and smart contracts are used in bigger and more complex applications, the demand for auditing services will rise even further. Companies will continue to invest in audits to prevent hacks, protect their reputation, and follow new regulations. Experts predict that this growth trend will continue steadily, opening new opportunities for audit service providers across all industries.

Key Drivers of Smart Contract Audit Market Growth

The smart contract audit market is growing fast, mainly because more industries like finance, healthcare, supply chain, and gaming are using blockchain. As companies and developers use smart contracts to handle complex transactions automatically, the chances of security problems and hacks increase. Big hacks in areas like decentralized finance (DeFi) and NFTs show why auditing smart contracts is so important. Businesses now focus on strong security checks before launching smart contracts, which increases the demand for both manual and automated audit services. Awareness of potential financial and reputation losses from weak smart contracts is a major reason the market is expanding.

Another important factor is the variety of blockchain platforms, each with its own structure and security rules. Platforms like Ethereum, Binance Smart Chain, Solana, Polygon, and Cardano need experts who understand their specific systems. As smart contracts become more advanced and used in important business apps, the need for specialized audits grows. Rules and standards for blockchain security are also being introduced worldwide, making companies follow best practices and get regular audits. These regulations boost the demand for audit services, especially in banks and big companies.

The growth of decentralized applications (dApps) in gaming, supply chain, healthcare, and other areas also helps the audit market expand. dApps use smart contracts to automate processes and make trustless transactions, so it’s very important that these contracts are reliable. More businesses in emerging economies are adopting blockchain, and investments in digital technology are increasing, creating new opportunities for audit providers. Small and medium businesses and individual developers are also joining the blockchain space, widening the market for audits. These trends suggest the market will keep growing steadily in the coming years.

Regionally, North America leads the smart contract audit market in 2024, followed by Europe and Asia Pacific. North America’s advantage comes from big blockchain companies, strong digital infrastructure, and supportive regulations. Asia Pacific is growing the fastest, driven by countries like China, India, Japan, and South Korea adopting blockchain. Latin America and the Middle East & Africa are also growing steadily as more people learn about blockchain and use it in different sectors. Overall, the market for digital contract audits is expanding globally, with strong growth expected in both developed and emerging regions.

Analysis by Service Type

The smart contract audit market is divided into three main service types: manual audits, automated audits, and hybrid audits.

-

Manual audits

Manual audits are very important, especially for smart contracts that handle a lot of money or are complex. Expert auditors go through the code carefully, line by line, to find mistakes, security problems, or risks that automated tools might miss. Companies prefer manual audits for important projects because errors can be very costly. These audits usually involve several checks and teamwork between auditors and developers to make sure everything is safe.

-

Automated audits

Automated audits are becoming very popular, especially for smaller projects or individual developers who need faster and cheaper solutions. These audits use software and algorithms to check smart contracts for common problems. They are quick and help developers find and fix issues early. However, they can miss complicated mistakes, so it’s often best to combine them with manual checks. AI and machine learning are also making automated audits smarter and more accurate over time.

-

Hybrid audits

Hybrid audits mix both manual and automated checks to get the best results. First, automated tools scan for common problems, then human auditors look for deeper issues. This method is popular in DeFi and NFT projects because it is fast but also thorough. Hybrid audits save time and money while giving reliable results, making them a good choice for many projects.

As smart contracts get more complex and security threats grow, audit methods are evolving. Companies are using advanced analytics, AI, and collaborative platforms to improve audits. Decentralized audit platforms and bug bounty programs are also helping by letting more people find vulnerabilities. In the future, demand for specialized audits for specific blockchain platforms, industries, and regulations is expected to grow, further expanding the types of services offered.

Report Scope for Smart Contract Audit Market

This report gives a complete view of the smart contract audit market, covering different services, blockchain platforms, industries, regions, and future growth predictions.[3]

| Attribute | Details |

|---|---|

| Report Title | Smart Contract Audit Market Size, Growth, Share & Global Analysis Report (2025–2033) |

| By Service Type | Manual Audit, Automated Audit, Hybrid Audit |

| By Blockchain Platform | Ethereum, Binance Smart Chain, Solana, Polygon, Cardano, Others |

| By End-User | Enterprises, SMEs, Individual Developers, Others |

| By Application | DeFi, NFTs, Gaming, Supply Chain, Healthcare, Others |

| By Industry Vertical | Finance, Healthcare, Supply Chain, Gaming, Real Estate, Others |

| Regions Covered | North America, Europe, APAC, Latin America, MEA |

| Countries Covered | North America: United States, Canada Europe: Germany, France, Italy, United Kingdom, Spain, Russia, Rest of Europe Asia Pacific: China, Japan, South Korea, India, Australia, SEA, Rest of Asia Pacific Latin America: Mexico, Brazil, Rest of Latin America Middle East & Africa: Saudi Arabia, South Africa, United Arab Emirates, Rest of MEA |

| Base Year | 2024 |

| Historic Data | 2018–2023 |

| Forecast Period | 2025–2033 |

Analysis by Blockchain Platform

This analysis shows how different blockchain platforms need smart contract audits to keep projects safe, secure, and running smoothly.

- Ethereum: Ethereum is the most used platform for smart contracts. Its large ecosystem, strong developer community, and high-value DeFi and NFT contracts make security audits essential to prevent hacks and ensure reliability across applications.

- Binance Smart Chain (BSC): BSC is popular for low fees and fast transactions. Many DeFi and exchange projects need audits tailored to BSC’s structure, including risks like cross-chain problems and smart contract upgrades. Demand for specialized audit solutions is rising.

- Solana and Polygon: Solana offers high-speed performance, while Polygon is compatible with Ethereum and lowers costs. Both are growing in gaming and NFT projects. Auditors are creating specific security checks to ensure safe and efficient contract execution.

- Cardano: Cardano focuses on formal verification and peer-reviewed development. Its use by enterprises and governments increases the need for audits. Specialized audits help maintain security and compliance for projects running on Cardano’s platform.

- Other Platforms: Platforms like Avalanche, Tezos, and Algorand have unique structures and security needs. Auditors must constantly learn and adapt to cross-chain applications and new threats to provide safe, reliable smart contract audits.

Analysis by End Users

Different users like big companies, small businesses, developers, and public organizations use smart contract audits to keep their blockchain projects secure and trustworthy.[4]

-

Enterprises:

Large companies are the biggest users of smart contract audits. They use blockchain in finance, healthcare, and supply chains. Because these systems are critical, enterprises need detailed audits to avoid hacks, follow regulations, and protect money and reputation.

-

Small and Medium Enterprises (SMEs):

SMEs are quickly adopting blockchain for DeFi, NFTs, and gaming projects. Even with limited budgets, they face security risks. Many audit companies offer affordable and flexible audit services to help SMEs secure smart contracts without high costs.

-

Individual Developers:

Individual developers and small teams create many dApps and smart contracts. As blockchain tools become easier, more people enter the space. Professional audits help them find security issues, build trust, and attract users or investors.

-

Others (Government, Academia, Non-Profits):

Government bodies, universities, and non-profit organizations use smart contracts for research and public services. These users need customized audits to meet legal and security requirements, which increases demand for specialized and reliable audit services.

Application-Based Analysis

This shows that smart contract audits are important in many areas to reduce risks, protect data and money, and make blockchain systems more secure and reliable.

-

Decentralized Finance (DeFi):

DeFi is the biggest user of smart contracts. It includes lending, trading, and asset management platforms. Because DeFi handles large amounts of money, audits are needed to prevent hacks, flash loan attacks, and losses caused by coding mistakes.

-

Non-Fungible Tokens (NFTs):

NFTs are widely used for digital art and collectibles. High-value NFT transactions attract hackers, so audits help protect ownership, royalties, and marketplace connections. Secure smart contracts are important for building trust in NFT and metaverse projects.

-

Gaming:

Blockchain games use smart contracts for in-game assets, tokens, and player rewards. As these games grow, audits help prevent cheating, token misuse, and security issues. Auditors work with game developers to keep gaming platforms safe and reliable.

-

Supply Chain:

In supply chains, smart contracts track goods, automate payments, and ensure agreements are followed. Audits help confirm data accuracy and prevent fraud. Secure contracts improve transparency and trust between suppliers, manufacturers, and buyers.

-

Healthcare:

Healthcare uses smart contracts for secure data sharing, patient consent, and clinical trials. Audits are important to protect sensitive data and meet legal rules. Strong security helps healthcare organizations safely use blockchain technology.

-

Other Applications:

Other uses include real estate, insurance, voting systems, and digital identity. These areas need audits to avoid errors and security risks. As smart contracts are used in more industries, demand for audits continues to grow.

Industry Vertical Insights

This shows how different industries use smart contracts, and why security audits are important to keep systems safe, trusted, and error-free.

-

- Finance:

Finance is the biggest user of smart contracts. Banks and fintech companies use them for payments, trading, and asset management. Because large amounts of money are involved, regular audits are needed to meet rules, reduce risks, and avoid losses. - Healthcare:

Healthcare uses smart contracts to manage patient data, insurance claims, and clinical trials. Audits help protect sensitive medical information and follow health regulations. Strong security checks make sure data sharing is safe, private, and reliable for patients and organizations. - Supply Chain:

Supply chains use smart contracts to track products, automate payments, and reduce fraud. Audits ensure data is accurate and contracts work as expected. Secure smart contracts improve transparency and trust between suppliers, manufacturers, and distributors. - Gaming:

The gaming industry uses smart contracts for in-game assets, tokens, and rewards. Audits help stop cheating, hacking, and token misuse. Secure contracts make games fair, reliable, and trustworthy for players and investors. - Real Estate:

In real estate, smart contracts are used for property transfers, escrow services, and shared ownership. Audits help prevent errors and fraud. Secure contracts make property deals more transparent, faster, and safer for buyers and sellers. - Other Industries:

Other sectors like insurance, energy, government, and education are also using smart contracts. Audits help manage risks and meet legal needs. As more industries adopt blockchain, the demand for smart contract audits keeps growing.

- Finance:

Future-Ready Smart Contracts, Built with Confidence

Nadcab Labs helps you understand the smart contract audit market and ensures your blockchain projects are safe, secure, and compliant worldwide.

Opportunities and Challenges

The smart contract audit market has many chances to grow because more industries are using blockchain. Using AI, machine learning, and automated tools can make audits faster, easier, and more accurate. As smart contracts get more complex, the need for automated and mixed audits is rising. Companies that invest in new tools and skilled people can grow faster.[5]

New markets like Asia Pacific, Latin America, and the Middle East are also growing. These areas need local experts who know the rules. More small businesses, startups, and individual developers are joining blockchain, so easy and cheap audit services are needed.

But there are challenges too. There aren’t enough skilled blockchain auditors, which makes it hard to meet demand. Blockchain changes fast, so auditors need constant learning. Also, there are no standard rules for audits, which can make results inconsistent. To fix this, better training, clear rules, and teamwork are needed.

Regional Smart Contract Audit Market Analysis

The smart contract audit market is growing everywhere. North America is the biggest, Asia Pacific is growing fastest, and Europe, Latin America, and MEA are also using more blockchain, so the need for safe audits is rising.[6]

- North America: North America is the largest market, worth USD 340M in 2024. Big blockchain companies, advanced digital systems, and supportive rules drive growth. Banks, tech firms, and governments invest in smart contract audits, boosting demand for skilled auditors and innovation.

- Europe: Europe is the second-largest market, valued at USD 260M in 2024 and growing at 21.5% CAGR. Blockchain adoption in finance, healthcare, and supply chains is rising. Regulations like MiCA encourage security, and new audit firms provide high-quality services across industries.

- Asia Pacific: Asia Pacific is the fastest-growing market, USD 180M in 2024, with 25.4% CAGR. Countries like China, India, Japan, and South Korea are adopting blockchain fast. Investments in digital solutions, fintech, and smart contracts increase demand for secure audits.

- Latin America: Latin America’s market is USD 65M in 2024. Growing blockchain awareness and gradual adoption in industries such as finance, logistics, and healthcare are driving demand for smart contract audit services across small and large enterprises.

- Middle East & Africa: MEA market is USD 45M in 2024. Rising interest in blockchain for public services, finance, and supply chains is increasing the need for audit services. Organizations are seeking secure and compliant smart contract solutions.

Smart Contract Audit Market Segments

The smart contract audit market is divided into different parts based on services, platforms, users, applications, and industries.

Service Type:

- Manual Audit: Experts check the code line by line to find errors.

- Automated Audit: Tools scan contracts for known issues quickly.

- Hybrid Audit: Combines manual and automated checks for better security.

Blockchain Platform:

- Ethereum, Binance Smart Chain, Solana, Polygon, Cardano, Others: Audits are done for different blockchains depending on their technology and usage.

End-User:

- Enterprises: Big companies using smart contracts for critical operations.

- SMEs: Small and medium businesses using blockchain for projects.

- Individual Developers: Freelancers or small teams creating smart contracts.

- Others: Governments, academic institutions, or non-profits using smart contracts.

Application:

- DeFi: Lending, trading, and other finance apps.

- NFTs: Digital art, collectibles, and virtual items.

- Gaming: In-game assets, rewards, and tokens.

- Supply Chain: Tracking goods, payments, and contracts.

- Healthcare: Patient data, consent, and clinical trials.

- Others: Real estate, insurance, voting, and identity systems.

Industry Vertical:

- Finance, Healthcare, Supply Chain, Gaming, Real Estate, Others: Different industries use smart contracts and need audits for security and compliance.

Final Words

The smart contract audit market is growing fast because more industries are using blockchain. Audits help stop hacks, keep money and data safe, and follow rules. Both manual and automated audits are used, and hybrid audits are becoming common. Big blockchain platforms like Ethereum, BSC, Solana, Polygon, and Cardano need special audits. North America, Europe, and Asia Pacific lead the market, but other regions are growing too.

By 2033, the market is expected to grow even more, with higher demand for audits across finance, healthcare, gaming, and supply chain. More businesses will adopt blockchain, and smart contracts will become more complex, increasing the need for skilled auditors. Automated and AI-based audit tools will become more popular to handle large-scale contracts efficiently. Regulatory standards will improve, pushing companies to perform regular audits. Overall, the market will expand globally, offering new opportunities for audit providers.

If you are planning to use blockchain now or in the coming years, understanding the smart contract audit market from 2025 to 2033 is extremely important. As smart contracts manage more important tasks and large amounts of funds, audits play a key role in security and trust. Nadcab Labs helps you understand market growth, major trends, and audit needs, so you can build secure, reliable smart contracts that scale easily and earn user confidence.

Frequently Asked Questions

Smart contracts are usually audited by specialized security firms, blockchain-focused companies, and expert consultants. These auditors include dedicated blockchain security teams, cybersecurity companies that offer smart contract services, and independent developers with deep blockchain knowledge. They check code for bugs, vulnerabilities, and logic errors before deployment. Some well-known audit providers include CertiK, Quantstamp, OpenZeppelin, and Trail of Bits. Auditors help make sure the contract is safe, reliable, and ready for real-world use.

A smart contract auditor reviews the code behind a smart contract to find bugs, weaknesses, and security risks. They test how the contract behaves, simulate attacks, and check for logical errors. Auditors help developers fix issues before launch to prevent hacks or loss of funds. They also provide reports and suggestions for improving security. Their job ensures that smart contracts are safe, trustworthy, and follow best coding practices before being used in live blockchain environments.

The smart contract audit market was estimated between around $940 million to $2.7 billion in 2024, depending on the report. It is expected to grow significantly as more industries adopt blockchain. By 2033, projections show the market could reach roughly $7.6 billion to over $12 billion. This growth is driven by the increasing use of DeFi, NFTs, gaming, and enterprise blockchain projects, which all need security audits to protect against hacks and coding mistakes.

Smart contract auditors’ pay varies widely based on experience, location, and skill level. Entry-level auditors or freelancers might earn modest fees per audit, while experienced auditors with deep blockchain expertise can earn much more, especially working with big DeFi or enterprise projects. Salaries can range from moderate amounts early on to significantly higher earnings as experts, especially if they work with top firms, consult for large blockchain platforms, or run their own audit services.

The cost of a smart contract audit depends on factors like contract complexity, the audit firm’s reputation, and the platform used. Simple audits for small projects may cost a few thousand dollars, while detailed audits for large DeFi or enterprise-level contracts can cost tens of thousands or more. Audits combining manual and automated analysis usually cost more but provide stronger security. The price also increases if ongoing monitoring or multiple revisions are included.

Major players include firms focused on blockchain security and audit services. Some well-known names are CertiK, Quantstamp, OpenZeppelin, Trail of Bits, ConsenSys Diligence, Hacken, SlowMist, PeckShield, and Least Authority. These companies provide manual, automated, and hybrid audits. They work across platforms like Ethereum, BSC, Solana, and others. Each brings different strengths, whether deep technical checks, open-source tools, region-focused services, or privacy-centered audits.

The smart contract audit market is largely led by North America, which has the biggest share due to advanced tech infrastructure and strong blockchain investment. Europe follows closely, driven by increasing regulations and blockchain use in finance and healthcare. Asia Pacific is the fastest-growing region with rapid blockchain adoption in countries like China, India, Japan, and South Korea. Latin America and the Middle East & Africa are also growing steadily as more businesses adopt blockchain solutions.

The most audited blockchain platforms include Ethereum, which leads due to its large DeFi and NFT ecosystem. Binance Smart Chain (BSC) follows, popular for fast and low-cost transactions. Solana and Polygon are also widely audited as they grow in gaming and NFT projects. Cardano is gaining interest for enterprise and research use. Other platforms like Avalanche, Tezos, and Algorand also need audits based on their unique smart contract designs and security needs.

Industries adopting smart contract audits include finance and DeFi, which lead due to high-value transactions and security risks. Healthcare uses smart contracts for secure data sharing and consent management. Supply chain benefits from trustless tracking and automated contracts. The gaming sector uses audits for secure in-game assets and economy systems. Real estate uses them for transparent property deals. Other industries like insurance, government, and education also increasingly use audited smart contracts.

In 2024, the smart contract audit market was estimated between roughly $940 million and $2.7 billion depending on different reports. Future projections show strong growth, with the market expected to expand to about $7.6 billion to over $12 billion by 2033. This increase is fueled by broader blockchain adoption across DeFi, NFTs, gaming, enterprise apps, and government use, all needing reliable security audits to prevent hacks and ensure trust.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.