Key Takeaways

- On and off chain assets exist entirely on blockchain networks with full transparency, immutability, and decentralized verification, eliminating intermediaries but facing scalability and cost constraints inherent to distributed ledger architecture.

- Off-chain assets reside in external systems while being referenced or represented on blockchain, requiring oracles or trusted bridges to maintain connection and data integrity between traditional and decentralized infrastructures.

- Security trade-offs differ fundamentally between asset types: on-chain assets benefit from cryptographic guarantees and consensus mechanisms, while off-chain assets introduce centralization risks and trust dependencies requiring additional safeguards.

- Scalability and transaction costs create practical boundaries, with on-chain operations consuming expensive block space while off-chain solutions enable higher throughput through external processing and periodic settlement mechanisms.

- Smart contracts automate on-chain asset management with self-executing logic, while oracles serve as critical middleware connecting off-chain data sources to blockchain networks through decentralized verification protocols and cryptographic attestations.

- Tokenization bridges physical and digital worlds by creating blockchain representations of off-chain assets, enabling fractional ownership, enhanced liquidity, and programmable compliance while maintaining legal enforceability in traditional jurisdictions.

- Hybrid architectures combining on-chain and off-chain elements dominate practical blockchain implementations across USA, UK, UAE, and Canadian markets, balancing decentralization ideals with operational efficiency and regulatory compliance requirements.

- Regulatory frameworks increasingly distinguish between asset types, with off-chain tokenized securities facing stricter compliance requirements than purely digital on-chain assets, particularly in established financial jurisdictions like Dubai and London.

Introduction to On-Chain and Off-Chain Assets in Blockchain

The blockchain revolution has fundamentally transformed how we conceptualize, store, and transfer value in digital ecosystems. At the heart of this transformation lies a critical architectural distinction that shapes every blockchain application: the divide between on-chain and off-chain assets. With over eight years of experience implementing blockchain solutions across North American, European, and Middle Eastern markets, we have witnessed how this fundamental classification determines security models, scalability potential, regulatory compliance frameworks, and ultimately, the practical viability of blockchain projects in real-world environments.

Understanding the distinction between on-chain and off-chain assets transcends mere technical taxonomy. This classification influences transaction costs, determines privacy models, shapes regulatory treatment, and defines the trust assumptions underlying blockchain systems. In the United States, regulatory bodies like the SEC have begun distinguishing between these asset types when evaluating securities classifications. Similarly, the UK’s Financial Conduct Authority and Dubai’s Virtual Assets Regulatory Authority have developed frameworks that treat on-chain cryptocurrencies differently from tokenized off-chain securities. Canadian financial regulators have also established guidelines recognizing these architectural differences, acknowledging that on-chain and off-chain assets present distinct risk profiles requiring tailored oversight approaches.

The emergence of hybrid models combining on-chain and off-chain elements has added complexity to blockchain architectures. Modern decentralized applications rarely exist at either extreme of the spectrum. Instead, they strategically employ on-chain mechanisms for critical security functions, ownership records, and value transfer, while leveraging off-chain systems for data storage, computational processing, and integration with external information sources. This architectural pragmatism reflects the maturation of blockchain technology from ideological purity toward practical implementation that balances decentralization’s benefits against real-world constraints of cost, speed, and interoperability with existing systems.

The technical implications of asset classification extend throughout the entire blockchain stack. On-chain assets benefit from the full security guarantees of blockchain consensus mechanisms, with every transaction validated by network participants and permanently recorded in distributed ledgers. This architecture eliminates single points of failure and ensures censorship resistance, but imposes significant costs in terms of computational resources, storage requirements, and transaction throughput limitations. Off-chain assets, conversely, can leverage centralized or semi-centralized infrastructure for efficiency, but must carefully manage the introduction of trust assumptions and potential vulnerabilities that arise when bridging blockchain and traditional systems.

What Are On-Chain Assets?

On-chain assets represent digital value that exists entirely within blockchain networks, with all transaction history, ownership records, and asset state stored directly in distributed ledgers accessible to network participants. These assets are native to blockchain infrastructure, created through protocol-defined mechanisms and transferred through cryptographically signed transactions that undergo validation by network consensus. Every aspect of an on-chain asset, from its creation event to current ownership status, lives permanently on the blockchain, subject to the same security guarantees, immutability properties, and transparency characteristics that define blockchain technology itself.

The defining characteristic of on-chain assets is their complete independence from external systems. They require no trusted intermediaries, external databases, or off-blockchain infrastructure to verify authenticity, process transactions, or maintain state. A Bitcoin transaction, for example, can be validated by any node running Bitcoin software, with no need to consult external authorities or centralized databases. This self-contained nature extends to all aspects of asset lifecycle: creation follows protocol rules encoded in blockchain software, transfers execute through peer-to-peer mechanisms, and ownership verification requires only access to the public blockchain state, which any participant can independently verify.

Technical Principle: On-chain assets derive their value and functionality exclusively from blockchain protocol rules and network consensus, with no dependencies on external systems, centralized authorities, or off-chain data sources. This architectural purity ensures that asset integrity relies solely on cryptographic proofs and distributed consensus mechanisms rather than institutional trust.

The scope of on-chain assets has expanded significantly beyond simple cryptocurrency transfers. Modern blockchain platforms support complex on-chain constructs including smart contract-based tokens, decentralized autonomous organization governance tokens, non-fungible tokens with on-chain metadata, synthetic assets created through decentralized protocols, and programmable financial instruments like automated market maker liquidity positions. Each of these asset types maintains the core characteristic of existing entirely on-chain: their state, logic, and transaction history reside in blockchain storage, accessible and verifiable through standard blockchain interfaces without external system dependencies.

Understanding on-chain assets requires recognizing both their strengths and inherent limitations. The transparency and immutability that make these assets trustworthy also mean that all transaction history remains permanently visible on public blockchains, creating privacy considerations. The decentralized validation that eliminates intermediaries also imposes computational costs on every network participant, limiting transaction throughput. The protocol-enforced rules that ensure security also constrain flexibility, making it difficult to reverse erroneous transactions or adapt to unforeseen circumstances. These trade-offs are not flaws but fundamental characteristics of systems that prioritize security, censorship resistance, and decentralization over efficiency, privacy, and administrative flexibility.

What Are Off-Chain Assets?

Off-chain assets exist primarily outside blockchain infrastructure, residing in traditional databases, physical form, or external digital systems, while being referenced, represented, or tracked through blockchain-based mechanisms. These assets maintain their core existence in conventional environments but leverage blockchain technology for specific functions such as ownership recording, transfer authorization, or verification of asset-related data. The blockchain component serves as a registry, coordination layer, or verification mechanism rather than the primary storage and processing infrastructure for the asset itself.

The relationship between off-chain assets and blockchain systems varies significantly across implementations. In some cases, blockchain merely records ownership of an external asset, similar to how traditional title registries document real estate ownership without housing the property itself. Other implementations create blockchain tokens that represent claims on off-chain assets, enabling digital trading of fractional interests in physical goods, traditional securities, or centralized digital resources. More sophisticated systems use blockchain as a coordination mechanism for off-chain processes, with smart contracts triggering external actions based on on-chain events or external data inputs validated through oracle networks.

The critical distinguishing feature of off-chain assets is their dependence on systems, entities, or processes external to the blockchain for core aspects of their existence, valuation, or functionality. A tokenized real estate property remains subject to physical location, local regulations, maintenance requirements, and market conditions that exist independently of blockchain records. A stablecoin backed by fiat currency depends on custodial banks, reserve audits, and redemption mechanisms that operate outside blockchain consensus. An NFT representing digital art typically stores the actual image file on centralized servers or distributed file systems separate from the blockchain that records ownership, creating a dependency on external storage infrastructure for the asset’s core utility.

Primary Categories of Off-Chain Assets

Physical Assets

Real estate properties, precious metals, commodities, artwork, and other tangible items that exist in the physical world. Blockchain tokens represent ownership rights or fractional interests, but the assets themselves remain subject to physical custody, geographical location, and traditional legal frameworks governing property rights and transfer mechanisms.

Traditional Financial Assets

Stocks, bonds, derivatives, and other securities that originate in conventional financial markets. When tokenized, these maintain their fundamental characteristics as regulated financial instruments, subject to securities laws, issuer obligations, and settlement through traditional financial infrastructure, with blockchain serving primarily as an alternative ownership registry and transfer mechanism.

Centralized Digital Assets

Digital files, game items, user accounts, intellectual property, and other intangible assets stored in centralized databases or platforms. While blockchain may record ownership or facilitate transfer, the underlying digital resources exist on servers controlled by specific entities, creating dependencies on platform operators for asset accessibility, functionality, and continued existence.

External Data References

Assets whose value or functionality depends on external information feeds, such as prediction market positions, insurance contracts, or synthetic assets tracking external indices. These require continuous data input from sources outside blockchain consensus, relying on oracle networks or trusted data providers to bridge between external reality and on-chain smart contract logic.

The integration of off-chain assets with blockchain systems creates inherent trust trade-offs. While blockchain provides transparency and immutability for the records it maintains, it cannot directly verify the accuracy of information about off-chain assets or enforce real-world consequences. A blockchain can record that someone owns a tokenized share of a building, but it cannot prevent the physical building from being damaged, seized by authorities, or sold through alternative legal channels. This disconnect between on-chain records and off-chain reality necessitates additional layers of trust, legal frameworks, and verification mechanisms that partially reintroduce the intermediaries blockchain technology aims to eliminate.

Why Asset Classification Matters in Blockchain Systems

The classification of assets as on-chain or off-chain fundamentally shapes system architecture, security models, regulatory treatment, and operational characteristics of blockchain applications. This distinction drives critical design decisions that cascade through every layer of implementation, from consensus mechanisms and smart contract design to user interface development and legal compliance strategies. Organizations deploying blockchain solutions in the United States, United Kingdom, United Arab Emirates, and Canada must carefully evaluate asset classification early in the design process, as this choice constrains future options and determines the technical and regulatory landscape the project will navigate.

Security architecture differs dramatically between asset types. On-chain assets inherit blockchain’s security properties automatically: cryptographic protection, distributed consensus validation, and immutable audit trails. Security concerns center on smart contract vulnerabilities, private key management, and consensus mechanism attacks. Off-chain assets, however, require comprehensive security frameworks that extend beyond blockchain boundaries. Protecting off-chain assets demands securing external databases, hardening oracle infrastructure, validating data sources, and managing relationships with custodians or service providers. The attack surface expands significantly when assets depend on systems outside blockchain consensus, requiring defense-in-depth strategies that combine traditional information security practices with blockchain-specific protections.

Critical Risk Warning: Misclassifying asset types or failing to account for their distinct security requirements has led to significant losses in blockchain projects. Off-chain dependencies create vulnerabilities that blockchain consensus cannot prevent or detect. Projects must conduct thorough threat modeling specific to their asset classification and implement appropriate safeguards beyond basic blockchain security measures.

Regulatory implications vary substantially based on asset classification. Pure on-chain cryptocurrencies face regulatory scrutiny primarily around money transmission, tax reporting, and anti-money laundering compliance. Off-chain asset tokenization, particularly of securities or real estate, triggers comprehensive regulatory frameworks governing the underlying asset class. In the United States, tokenized securities must comply with SEC regulations regardless of blockchain implementation details. UK regulatory approaches distinguish between crypto assets (predominantly on-chain) and digital representations of traditional assets (off-chain), applying different oversight regimes. Dubai’s VARA framework explicitly recognizes this distinction, with separate guidance for virtual assets versus tokens representing external value. Canadian securities regulators have issued guidance emphasizing that blockchain implementation does not alter the fundamental regulatory treatment of securities, meaning tokenized off-chain assets retain full regulatory obligations of their conventional counterparts.

Operational complexity and cost structures diverge significantly between asset classifications. On-chain operations incur gas fees, blockchain storage costs, and computational expenses proportional to transaction complexity and network congestion. These costs are transparent, predictable in structure though variable in magnitude, and paid directly to network validators. Off-chain asset management introduces different cost structures: database hosting, API maintenance, oracle service fees, custodian charges, legal compliance expenses, and potentially traditional financial infrastructure costs. The total cost of ownership for off-chain asset systems often exceeds initial blockchain transaction costs but provides greater flexibility for optimization, caching, and selective on-chain settlement of critical operations.

Scalability constraints manifest differently across asset types. On-chain assets compete for limited block space, with throughput fundamentally constrained by blockchain consensus requirements. As transaction volume grows, networks face congestion, rising fees, and longer confirmation times. Off-chain assets can leverage traditional scalability approaches including database sharding, content delivery networks, and application-level caching, with blockchain interaction required only for critical state transitions or periodic settlements. This architectural flexibility enables off-chain systems to handle orders of magnitude more operations than pure on-chain implementations, though at the cost of introducing centralized components and trust assumptions that blockchain technology aims to eliminate.

How On-Chain Assets Work on Blockchain Networks

On-chain assets function through a sophisticated interplay of cryptographic primitives, distributed consensus mechanisms, and protocol-enforced rules that collectively create trustless digital value systems. The lifecycle of an on-chain asset begins with creation events defined by blockchain protocol rules, whether through mining rewards in proof-of-work systems, minting functions in smart contracts, or protocol-defined issuance schedules. Each creation event is recorded in blockchain state, verified by network participants, and incorporated into the immutable transaction history that constitutes blockchain’s permanent ledger.

The fundamental mechanism enabling on-chain assets is the unspent transaction output model or account-based state machine that tracks asset ownership and enables transfers. In UTXO systems like Bitcoin, assets exist as discrete outputs of previous transactions, with ownership defined by cryptographic conditions that must be satisfied to spend the output. Account-based systems like Ethereum maintain a global state mapping addresses to balances, updating this state through transaction execution validated by network consensus. Both approaches achieve the same core objective: establishing cryptographically verifiable ownership that can be transferred through signed transactions without requiring trusted intermediaries to maintain authoritative records or authorize transfers.

Smart contract platforms extend the on-chain asset model beyond simple transfers to include programmable logic governing asset behavior. ERC-20 tokens on Ethereum, for instance, implement standardized interfaces that define how tokens can be transferred, queried, and approved for third-party spending. The smart contract code itself resides on-chain, immutably defining the rules that govern the token. Every interaction with the token executes through the smart contract, with the Ethereum Virtual Machine enforcing contract logic and updating state accordingly. This programmability enables complex asset types including governance tokens with voting rights, utility tokens with usage-based mechanics, and synthetic assets whose value depends on oracle-provided external data processed through on-chain logic.

The economic model underlying on-chain assets creates direct alignment between network security and asset value. Transaction fees paid to validators incentivize honest behavior and resource allocation to network security. In proof-of-work systems, the computational cost of attacking the network scales with network hash rate, which increases with the value of assets secured. Proof-of-stake systems achieve security through economic bonding, where validators risk staked capital to participate in consensus. This economic security model means that on-chain assets benefit from increasing security as their value grows, assuming network parameters adjust appropriately to maintain meaningful validator costs and incentives.

Composability represents a powerful emergent property of on-chain assets. Because all asset state exists on the same blockchain and follows standardized interfaces, different protocols can interact seamlessly without requiring partnerships, API integrations, or trusted intermediaries. A DeFi protocol can accept any ERC-20 token as collateral, automated market makers can create liquidity pools for arbitrary token pairs, and yield aggregators can optimize across multiple protocols, all through permissionless composition of on-chain primitives. This composability has fostered rapid innovation in decentralized finance, enabling complex financial products to be built by combining simpler on-chain components in novel configurations.

Core Characteristics of On-Chain Assets

On-chain assets exhibit distinctive characteristics that differentiate them from traditional digital assets and off-chain blockchain implementations. These properties emerge from fundamental blockchain architecture rather than specific design choices, making them inherent to any asset fully residing on decentralized ledger systems. Understanding these characteristics is essential for evaluating when on-chain solutions are appropriate and what trade-offs they entail compared to alternative architectures.

Fundamental On-Chain Asset Properties

Transparency

- All transaction history publicly visible on blockchain explorers

- Asset supply verifiable by any network participant independently

- Smart contract code viewable and auditable by anyone

- State changes traceable through complete transaction graph

- Ownership distribution analyzable through blockchain analytics

Immutability

- Historical transactions cannot be altered retroactively

- Confirmed asset transfers achieve practical permanence

- Smart contract code immutable post-deployment unless upgradability built in

- Audit trails preserved indefinitely across network nodes

- Reversal requires consensus-level intervention extremely difficult to achieve

Decentralized Control

- No single entity controls asset issuance, transfer, or validation

- Network consensus required for any state change

- Censorship resistance prevents arbitrary transaction blocking

- Elimination of single points of failure through distribution

- Permissionless access enables participation without authorization

Programmability

- Smart contracts enable complex conditional logic

- Automated execution without manual intervention

- Composable with other on-chain protocols and assets

- Self-enforcing rules eliminate need for trusted executors

- Deterministic behavior verifiable before interaction

Trustless Operation

- Cryptographic proofs replace trust in intermediaries

- Transactions verifiable by any participant independently

- No reliance on external systems or authorities

- Security derives from mathematics and consensus, not institutional trust

- Users maintain direct control through private key ownership

Self-Custody Capability

- Users can hold assets directly without custodians

- Private keys provide ultimate control over asset access

- Eliminates counterparty risk from custodial arrangements

- Assets cannot be frozen or seized through protocol-level intervention

- Personal responsibility for security and key management

The transparency of on-chain assets creates both advantages and challenges for users and applications. Complete transaction visibility enables unprecedented auditability, allowing anyone to verify supply schedules, track fund flows, analyze network activity patterns, and detect anomalous behavior. Researchers, regulators, and users can independently verify claims about protocol behavior without relying on self-reported data or trusted auditors. However, this transparency conflicts with privacy expectations from traditional financial systems. Sophisticated blockchain analytics can cluster addresses, identify real-world entities, and track financial behavior across multiple transactions. Users in the USA, UK, UAE, and Canada increasingly demand privacy-preserving solutions like zero-knowledge proofs, confidential transactions, or mixing services that provide transactional privacy while maintaining verifiability.

Immutability serves as a double-edged sword in on-chain asset management. The permanence of blockchain records provides certainty and prevents post-hoc manipulation, essential qualities for financial infrastructure and digital property rights. Once a transaction achieves sufficient confirmations, reversal becomes computationally infeasible in proof-of-work systems or impossible in chains with deterministic finality. This certainty eliminates chargebacks, disputed transactions, and retroactive fraud that plague traditional payment systems. Conversely, immutability means mistakes are permanent. Tokens sent to incorrect addresses are irretrievable without recipient cooperation. Bugs in smart contracts cannot be patched without complex upgrade mechanisms or migration procedures. Compromised private keys grant permanent access to attackers unless funds are moved before exploitation.

The decentralized nature of on-chain assets eliminates central authorities but distributes responsibility and decision-making across network participants. This architecture provides censorship resistance valuable for users facing financial exclusion, political persecution, or geographic restrictions. Transactions cannot be blocked by payment processors, banks, or governments acting unilaterally. However, decentralization also means no authority can intervene to reverse fraudulent transactions, freeze stolen assets, or provide customer support for user errors. Governance challenges emerge around protocol upgrades, dispute resolution, and collective decision-making. On-chain governance mechanisms attempt to coordinate decentralized communities, but often struggle with low participation, plutocratic voting, and difficulty achieving consensus on contentious issues.

Examples of On-Chain Assets in Real-World Blockchain Use

The practical applications of on-chain assets span diverse use cases across financial services, digital ownership, governance systems, and emerging decentralized applications. These real-world implementations demonstrate how on-chain architecture delivers tangible value while highlighting the constraints and trade-offs inherent to blockchain-native assets. Examining specific examples provides insight into when on-chain solutions offer superior properties compared to conventional alternatives and where they face practical limitations.

| Asset Type | Blockchain Platform | Primary Use Case | Key Advantages |

|---|---|---|---|

| Bitcoin (BTC) | Bitcoin Blockchain | Digital currency and store of value | Highest security budget, strongest decentralization, established network effects, censorship resistant |

| ERC-20 Tokens | Ethereum | Fungible tokens for DeFi, governance, utility | Programmable logic, composability with DeFi protocols, standardized interface, automated market making |

| Uniswap LP Tokens | Ethereum | Liquidity provision in automated market makers | Represents proportional pool ownership, accrues trading fees automatically, transferable and composable |

| NFT Collections | Ethereum, Solana | Digital art, collectibles, unique identifiers | Verifiable scarcity, provenance tracking, programmable royalties, permissionless trading |

| DAO Governance Tokens | Multiple Chains | Decentralized organization voting rights | Transparent vote counting, time-locked voting, delegation mechanisms, immutable proposal history |

| Synthetic Assets | Ethereum (Synthetix) | On-chain exposure to external assets | Permissionless creation, instant settlement, composable with DeFi, no custodial risk |

| Wrapped Tokens | Cross-Chain | Cross-chain asset representation | Enables cross-chain DeFi participation, maintains fungibility, auditable reserves |

Bitcoin represents the original and most established on-chain asset, serving primarily as digital currency and store of value. Its simple UTXO model prioritizes security and decentralization over programmability and throughput. Bitcoin’s on-chain properties enable censorship-resistant payments, verifiable scarcity capped at 21 million coins, and the strongest network security in cryptocurrency measured by hash rate and economic value securing the network. Major institutions in the United States and Canada have begun treating Bitcoin as a legitimate asset class, with regulated futures markets, exchange-traded products, and corporate treasury allocations. However, Bitcoin’s limited scripting capabilities and conservative development philosophy restrict its use to relatively simple payment and store-of-value applications compared to more programmable platforms.

ERC-20 tokens on Ethereum demonstrate the power of standardized programmable assets. The common interface enables any token to interact with decentralized exchanges, lending protocols, yield aggregators, and other DeFi applications without custom integration. This composability has fostered rapid innovation, with thousands of tokens serving diverse functions: governance rights in decentralized protocols, utility tokens for accessing network services, synthetic assets tracking external indices, and experimental economic designs testing novel tokenomics models. The UK and UAE have seen growing adoption of ERC-20 tokens for fundraising, loyalty programs, and experimental governance structures, though regulatory treatment remains evolving and varies by jurisdiction based on token functionality and distribution mechanisms.

Non-fungible tokens have emerged as the dominant on-chain mechanism for representing unique digital items. While most NFTs store actual content off-chain due to blockchain storage limitations, the on-chain ownership record provides verifiable authenticity and provenance that conventional digital files lack. High-value NFT collections have demonstrated that blockchain can establish digital scarcity and ownership even when underlying files are copyable. Smart contract programmability enables automated royalty payments to creators on secondary sales, fractional ownership of expensive items, and complex rights management impossible with traditional digital distribution. However, the disconnect between on-chain ownership records and off-chain content storage creates practical concerns around content persistence, metadata accuracy, and the meaningful enforcement of ownership rights for digital assets that remain infinitely copyable at the file level.

Decentralized finance has produced increasingly sophisticated on-chain assets representing complex financial positions. Automated market maker liquidity provider tokens represent proportional ownership in liquidity pools, automatically accruing trading fees and tracking pool composition changes. Compound cTokens represent lending positions that accrue interest through an increasing exchange rate mechanism. Yield aggregator vault tokens represent automated strategies across multiple protocols. These composable financial primitives enable users to hold assets that represent complex, actively managed positions while maintaining the full transparency, transferability, and security properties of simpler on-chain assets. The composability of these instruments has enabled financial innovation at unprecedented speed, though it has also created complex interdependencies and systemic risks when protocol failures or exploits cascade through the DeFi ecosystem.

How Off-Chain Assets Work in Blockchain Ecosystems

Off-chain assets integrate with blockchain systems through bridging mechanisms that maintain references, representations, or records on distributed ledgers while the assets themselves exist in external systems. This hybrid architecture attempts to combine blockchain’s transparency, programmability, and immutability with the practicality of storing large data off-chain, representing physical assets, or connecting to existing infrastructure. The fundamental challenge lies in maintaining reliable connections between on-chain records and off-chain reality, ensuring that blockchain representations accurately reflect external asset state despite operating in different trust environments with different security guarantees.

The most straightforward off-chain asset model uses blockchain as an ownership registry for external items. A blockchain token represents a claim on an off-chain asset, with the token transfer mechanism providing transparent, programmable exchange of ownership rights. This approach is commonly employed for tokenizing physical assets like real estate, commodities, or art. The property deed or warehouse receipt exists in traditional legal form, but ownership of that claim is recorded and transferred on blockchain. Smart contracts can enforce transfer restrictions, automate compliance checks, or coordinate multi-party transactions, while the actual asset remains in physical custody with trusted warehouses, vaults, or property managers. This model enables benefits like fractional ownership, 24/7 trading, and reduced settlement friction while maintaining necessary connections to legal systems and physical reality.

Industry Standard Practice: Off-chain asset tokenization requires robust legal frameworks that recognize blockchain ownership records and establish clear rights and obligations for token holders. Successful implementations integrate traditional legal structures with blockchain technology, ensuring enforceability in conventional court systems while leveraging blockchain’s operational efficiencies. Projects should engage qualified legal counsel in all relevant jurisdictions before launching off-chain asset tokenization platforms.

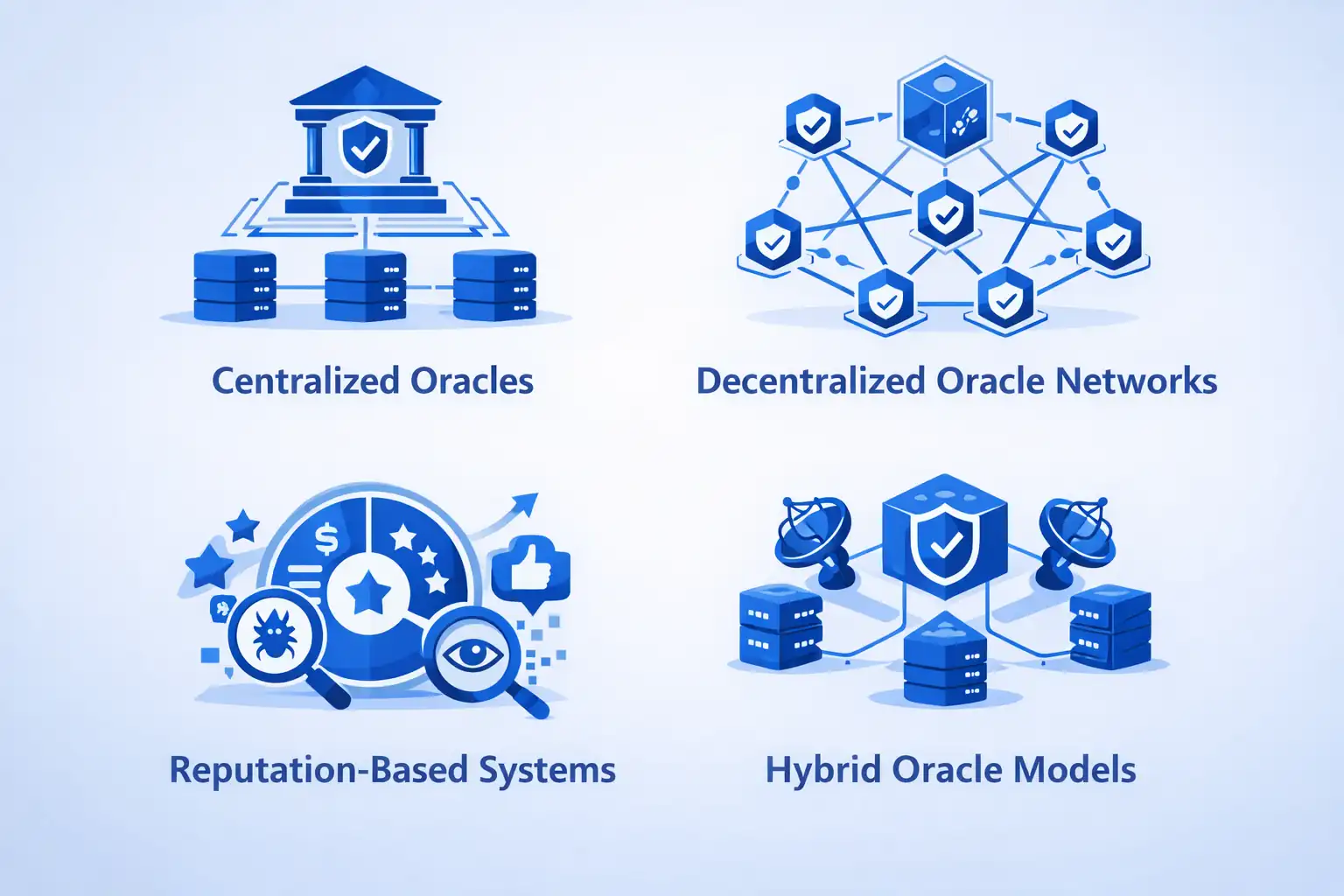

Oracle networks serve as the primary mechanism for bringing external data on-chain, enabling smart contracts to react to real-world events. Oracles function as middleware services that fetch data from external APIs, aggregate information from multiple sources, perform computation off-chain, and submit results to blockchain systems through cryptographically signed transactions. Decentralized oracle networks employ multiple independent node operators to eliminate single points of failure and reduce manipulation risk. Each oracle node queries external data sources independently, and the network reaches consensus on the correct value before submitting it on-chain. This architecture provides greater security than single-oracle designs but introduces complexity, latency, and additional costs while still requiring trust in oracle node operators and underlying data sources.

Hybrid storage architectures address blockchain’s limited capacity for large data by storing content hashes on-chain while maintaining actual data in external systems. An NFT might store only a reference hash on Ethereum, with the actual image hosted on IPFS, Arweave, or centralized servers. The on-chain hash serves as a cryptographic fingerprint, enabling verification that retrieved content matches the original without requiring blockchain storage for large files. This approach dramatically reduces blockchain storage costs and enables representation of rich media assets, but creates dependencies on external storage infrastructure. If off-chain storage becomes unavailable, the on-chain token becomes a pointer to nothing, losing its practical value despite maintaining technical ownership validity on the blockchain.

Sidechain and layer-2 architectures represent another approach to managing off-chain assets, processing most transactions on separate systems while periodically settling to main blockchain networks. These systems maintain their own transaction processing infrastructure, often with different consensus mechanisms, security assumptions, and performance characteristics than main chains. Periodic checkpoints or state commitments to the main chain provide security anchors and enable asset transfers between layers. Users can deposit assets from the main chain to layer-2 systems, conduct thousands of transactions off the main chain at lower cost and higher speed, then withdraw back to the main chain when desired. This architecture enables scaling while maintaining some connection to base-layer security, though it introduces complexity around withdrawal periods, challenge mechanisms, and cross-layer asset management.

Core Characteristics of Off-Chain Assets

Off-chain assets exhibit characteristics that reflect their hybrid nature, combining elements of traditional asset management with blockchain integration. These properties differ fundamentally from pure on-chain assets, introducing different security models, trust assumptions, operational requirements, and capability sets. Understanding these characteristics helps determine when off-chain approaches are appropriate and what additional safeguards are necessary to manage the risks introduced by external dependencies.

The trust model for off-chain assets differs fundamentally from on-chain equivalents, introducing explicit dependencies on external entities and systems. Users must trust that physical custodians properly secure and maintain assets, that oracles accurately report external data, that database operators preserve information integrity, and that legal frameworks will enforce ownership rights recorded on blockchain. While blockchain provides transparency for on-chain records and transactions, it cannot verify the accuracy of claims about off-chain reality. A tokenized gold system can record ownership transfers transparently, but users must trust auditors who certify that gold actually exists in vaults, custodians who secure it physically, and legal systems that would enforce token holders’ claims if custodians attempted fraud or misappropriation.

Flexibility represents a significant advantage of off-chain architectures. External systems can be updated, patched, and modified without requiring blockchain consensus or protocol upgrades. Databases can be optimized for query performance, user interfaces can be improved continuously, and business logic can adapt to changing requirements. This flexibility enables rapid iteration and responsiveness to market needs, user feedback, or regulatory changes. However, this same flexibility creates uncertainty around system behavior and introduces potential for unilateral changes by system operators. On-chain assets derive certainty from immutable protocols, while off-chain systems gain adaptability at the cost of predictability and user autonomy.

Interoperability with existing systems represents both an opportunity and requirement for off-chain assets. Traditional financial infrastructure, payment networks, legal systems, and business processes can integrate more naturally with off-chain components than with pure blockchain systems. Off-chain assets can leverage existing KYC providers, payment processors, accounting systems, and regulatory reporting frameworks. This compatibility facilitates adoption by established institutions in the USA, UK, UAE, and Canada that require familiar interfaces and established compliance procedures. Conversely, this integration creates dependencies on legacy systems and limits the transformative potential of blockchain technology, potentially reducing implementations to database optimization rather than fundamental architectural innovation.

Examples of Off-Chain Assets and Their Applications

The practical implementations of off-chain asset integration demonstrate the diversity of approaches and use cases where blockchain provides value despite assets residing primarily outside blockchain infrastructure. These examples illustrate how organizations balance blockchain benefits against practical constraints, regulatory requirements, and existing infrastructure realities across different industries and asset classes.

Real-World Off-Chain Asset Implementations

Fiat-Backed Stablecoins

Examples: USDC, USDT, GUSD

Structure: Tokens issued on-chain backed by equivalent fiat currency deposits held in regulated bank accounts, with regular attestations from auditors verifying reserves match circulating token supply.

Key Dependency: Trust in custodial banks, reserve audits, issuer solvency, and redemption mechanisms that connect on-chain tokens to off-chain banking systems.

Tokenized Real Estate

Examples: RealT, Propy, Harbor

Structure: Blockchain tokens representing fractional ownership or investment interests in physical properties, with legal frameworks establishing token holder rights to rental income and property appreciation.

Key Dependency: Property management, local legal systems, physical asset maintenance, and traditional title insurance and registration systems that establish enforceable ownership rights.

Commodity-Backed Tokens

Examples: PAXG (gold), XAUT (gold), petroleum tokens

Structure: Each token represents ownership of specific quantities of physical commodities stored in secure facilities, enabling digital trading of commodity exposure without physical delivery requirements.

Key Dependency: Secure storage facilities, regular audits verifying physical commodity reserves, insurance against theft or loss, and redemption processes for converting tokens to physical commodities.

Security Tokens

Examples: tZERO, Polymath issuances, Securitize platform

Structure: Blockchain-based representations of traditional securities like equity, debt, or investment fund shares, with embedded compliance logic enforcing regulatory requirements and transfer restrictions.

Key Dependency: Regulatory compliance frameworks, transfer agent services, investor accreditation verification, and legal enforceability of tokenized securities under jurisdiction-specific securities laws.

Supply Chain Tracking Tokens

Examples: VeChain, IBM Food Trust, Provenance

Structure: Blockchain records track physical goods movement through supply chains, with RFID tags, IoT sensors, or manual data entry creating on-chain records of off-chain events and product attributes.

Key Dependency: IoT infrastructure accuracy, participants honestly recording data, physical product integrity, and systems that prevent recorded items from being substituted or tampered with during transit.

Gaming Assets and Virtual Goods

Examples: Axie Infinity, Decentraland, Gods Unchained

Structure: Blockchain tokens represent in-game items, characters, or virtual land, with game functionality and asset utility dependent on centralized game servers and developer-maintained infrastructure.

Key Dependency: Game developer continued operation, server availability, game balance decisions, and developer willingness to respect blockchain ownership records for in-game functionality and benefits.

Fiat-backed stablecoins represent the most successful off-chain asset integration by transaction volume and adoption, bridging cryptocurrency markets with traditional banking systems. These tokens circulate on-chain with the programmability and transferability of blockchain assets while deriving value stability from off-chain fiat currency reserves. USDC, issued by Circle in partnership with Coinbase, maintains reserves in US financial institutions subject to regular attestation by accounting firms. The system depends critically on custodial banks maintaining proper segregation of customer funds, Circle honoring redemption requests, and accurate reserve reporting. Regulatory scrutiny has intensified globally, with UAE authorities requiring stablecoin issuers to obtain specific licenses, while Canadian regulators have issued guidance treating stablecoins as securities or derivatives depending on their structure and redemption mechanisms.

Tokenized real estate platforms enable fractional ownership and increased liquidity for traditionally illiquid property investments. RealT, operating primarily in the United States, tokenizes individual rental properties, with each token representing a proportional ownership interest entitling holders to rental income distributions. The blockchain provides transparent ownership records and automated distribution of rental proceeds, while traditional property management companies handle physical maintenance, tenant relations, and local compliance. Legal structures typically involve LLCs or trusts that own properties, with blockchain tokens representing membership interests in these entities. This approach requires careful legal engineering to ensure tokens convey meaningful rights enforceable in traditional court systems while complying with securities regulations, real estate laws, and local property ownership requirements.

Security token platforms attempt to bring traditional financial securities onto blockchain infrastructure while maintaining full regulatory compliance. These platforms enforce transfer restrictions programmatically through smart contracts, implementing accredited investor requirements, lock-up periods, geographic restrictions, and other compliance rules that traditional securities must satisfy. The challenge lies in maintaining blockchain’s permissionless and programmable characteristics while implementing the extensive compliance requirements that securities regulations impose. Platforms operating in the UK and UAE must navigate different regulatory frameworks than US-based platforms, with varying requirements around investor classification, disclosure obligations, and cross-border transfer restrictions. Despite significant investment and development, security token adoption has remained limited compared to initial enthusiasm, suggesting that blockchain’s core value propositions of permissionless access and disintermediation conflict fundamentally with securities regulation’s emphasis on investor protection through mandatory intermediaries and restrictions.

On-Chain vs Off-Chain Assets – Key Differences Explained

The distinction between on-chain and off-chain assets manifests across multiple dimensions including technical architecture, security models, operational characteristics, and regulatory treatment. Understanding these differences enables informed architectural decisions when designing blockchain systems and helps stakeholders evaluate trade-offs between alternative approaches for specific use cases. The choice between on-chain and off-chain implementation profoundly shapes project feasibility, cost structure, risk profile, and ultimate value proposition.

| Dimension | On-Chain Assets | Off-Chain Assets |

|---|---|---|

| Data Storage Location | Complete asset state stored in distributed blockchain ledger accessible to all network participants | Asset data resides in external databases, physical form, or centralized systems with blockchain references only |

| Verification Mechanism | Cryptographic proofs and consensus validation enable anyone to verify asset authenticity independently | Requires trust in external verifiers, auditors, custodians, or oracle networks to confirm off-chain asset status |

| Transaction Finality | Deterministic finality achieved through blockchain consensus with predictable confirmation times | May depend on external settlement processes, custodian confirmation, or manual verification steps |

| Cost Structure | Gas fees proportional to computational complexity and storage requirements, paid per transaction | Infrastructure hosting, API maintenance, custodian fees, oracle costs, and traditional service charges |

| Scalability | Constrained by blockchain throughput limits, typically 10-4000 transactions per second depending on chain | Can leverage traditional scaling techniques achieving millions of operations per second off-chain |

| Privacy Level | Transparent by default with all transactions publicly visible unless advanced cryptography employed | Traditional privacy controls possible through access restrictions and selective disclosure mechanisms |

| Regulatory Flexibility | Difficult to implement geographic restrictions, KYC requirements, or transaction reversals programmatically | Easier integration with compliance systems, identity verification, and regulatory reporting requirements |

| Interoperability | Native composability within blockchain ecosystems through standardized interfaces and protocols | Better integration with legacy systems but requires custom bridging logic for each external system |

| Censorship Resistance | High resistance to censorship through decentralized consensus and distributed infrastructure | Vulnerable to censorship at external system level through custodian control or regulatory intervention |

The security implications of asset classification extend beyond simple technical considerations to encompass entire threat models and attack surfaces. On-chain assets face risks primarily from smart contract vulnerabilities, consensus attacks, and private key compromises. Security efforts focus on formal verification of contract code, multi-signature custody solutions, hardware wallet integration, and monitoring for suspicious consensus behavior. The attack surface is well-defined and largely technical in nature. Off-chain assets expand the threat landscape dramatically, introducing risks from database breaches, API vulnerabilities, oracle manipulation, custodian fraud, physical theft, legal seizure, and coordination failures between blockchain and external systems. Securing off-chain assets requires comprehensive defense strategies spanning information security, physical security, operational procedures, legal protections, and continuous monitoring of external dependencies.

Economic incentives differ substantially between asset types. On-chain assets align economic value directly with network security through transaction fees, block rewards, and stake-based consensus. As asset value increases, validator rewards grow, attracting additional security resources and making attacks more expensive. This creates self-reinforcing security where valuable on-chain assets naturally incentivize stronger network protection. Off-chain assets lack this direct alignment. The blockchain component may be well-secured, but the off-chain asset’s value depends on external custodians, legal frameworks, and physical security that operate under different incentive structures. A highly valuable tokenized real estate portfolio might run on a secure blockchain, but the actual security depends on property management companies, local law enforcement, and title insurance systems that have no direct stake in blockchain token value.

The composability advantage of on-chain assets represents a powerful network effect that off-chain implementations struggle to replicate. DeFi protocols can interact seamlessly because all participants access the same blockchain state through standardized interfaces. A lending protocol automatically accepts any ERC-20 token, automated market makers create pools for arbitrary token pairs, and yield optimizers route capital across protocols without requiring partnerships or custom integrations. This permissionless composability accelerates innovation and creates emergent behaviors as protocols combine in novel ways. Off-chain systems, even when blockchain-integrated, typically require explicit partnerships, custom API development, and trusted relationships between parties. Each integration represents a specific business agreement rather than an emergent property of shared infrastructure, fundamentally limiting the pace of innovation and experimentation that characterizes pure on-chain ecosystems.

Security Implications of On-Chain and Off-Chain Assets

Security considerations fundamentally shape the viability and risk profile of blockchain asset implementations, with dramatic differences between on-chain and off-chain approaches. Organizations deploying blockchain solutions in the USA, UK, UAE, and Canada must thoroughly understand these security implications to design appropriate safeguards, allocate security resources effectively, and communicate risks accurately to stakeholders and users. The security framework for each asset type requires different expertise, tooling, and ongoing monitoring practices.

Critical Security Warning: The majority of significant blockchain asset losses result from vulnerabilities in off-chain components rather than blockchain protocol failures. Smart contract exploits, oracle manipulation, custodian breaches, and private key compromises have collectively resulted in billions of dollars in losses. Projects must allocate security resources proportionally to actual risk surfaces, which for hybrid systems typically means extensive investment in securing off-chain infrastructure and integration points beyond basic blockchain security measures.

On-chain asset security begins with smart contract code quality and formal verification where appropriate. Bugs in contract logic can enable unauthorized asset transfers, manipulation of protocol mechanics, or complete draining of contract-held funds. The immutability of deployed contracts means that security must be perfect from launch, as patches require complex upgrade mechanisms or full migration to new contracts. Professional audits from reputable firms represent minimum due diligence for high-value contracts, though audits cannot guarantee bug-free code. Formal verification using mathematical proofs provides stronger guarantees for critical logic but requires significant expertise and remains impractical for complex systems. Ongoing monitoring for unusual activity, bug bounty programs, and gradual deployment strategies help mitigate risks despite thorough pre-launch security efforts.

Consensus-level security protects on-chain assets from unauthorized state modifications and double-spending attacks. Proof-of-work chains like Bitcoin derive security from computational cost, making attacks expensive proportional to network hash rate. Proof-of-stake systems achieve security through economic bonding, where validators risk staked capital when attempting malicious behavior. Both approaches assume that the cost of attacking the network exceeds potential gains, maintaining security through economic incentives rather than trust. However, nascent blockchain networks with low market capitalization and modest security budgets remain vulnerable to majority attacks, where attackers temporarily control consensus to enable double-spending or transaction censorship. Assessing on-chain asset security requires evaluating the underlying blockchain’s consensus mechanism, validator distribution, and economic security budget relative to asset value.

Private key management represents the most critical security concern for on-chain asset holders, as key compromise grants complete control over associated assets. Users bear responsibility for securing their private keys through hardware wallets, secure enclaves, or multi-signature arrangements that distribute signing authority across multiple parties. Lost keys result in permanent asset loss, while stolen keys enable irreversible theft. This security model empowers users with self-custody but eliminates the safety nets of traditional finance like password recovery, fraud protection, and account freezing. Institutions managing significant on-chain assets typically employ sophisticated custody solutions with multi-signature requirements, hardware security modules, and carefully designed operational procedures that balance security against accessibility for legitimate operations.

Off-Chain Asset Security Threat Vectors

Oracle Manipulation

Attackers compromise data feeds that smart contracts depend on, submitting false information that triggers incorrect protocol behavior. Flash loan attacks can manipulate price oracles by temporarily distorting market prices on low-liquidity exchanges. Mitigation requires decentralized oracle networks, multiple independent data sources, time-weighted average pricing, and circuit breakers that pause operations during anomalous conditions.

Custodian Risk

Entities holding physical assets or fiat reserves face operational failures, fraud, insolvency, or regulatory seizure. Blockchain records cannot prevent custodians from misappropriating assets or verify that claimed reserves actually exist. Protection requires regular independent audits, proof-of-reserve mechanisms, insurance coverage, jurisdictional diversification, and selecting custodians with strong financial standing and regulatory oversight.

Bridge Vulnerabilities

Cross-chain bridges connecting blockchain to external systems represent high-value targets with complex attack surfaces. Exploits of bridge contracts have resulted in some of the largest cryptocurrency thefts. Bridges often require trusted validators or multi-signature schemes that introduce centralization. Users should evaluate bridge security models, validator reputations, insurance mechanisms, and track records before trusting significant value to bridging infrastructure.

Off-Chain Data Integrity

External databases storing critical asset information face standard information security threats including unauthorized access, data corruption, and availability failures. Unlike blockchain’s distributed redundancy, centralized databases represent single points of failure. Implementing database encryption, access controls, backup systems, intrusion detection, and disaster recovery procedures prevents data loss or unauthorized modification that could invalidate blockchain ownership records.

The oracle problem represents perhaps the most fundamental security challenge for off-chain assets, creating unavoidable trust assumptions when connecting blockchain to external reality. Smart contracts are deterministic systems that can only process information available on-chain. Oracles break this determinism by introducing external data that blockchain consensus cannot verify independently. Even decentralized oracle networks with multiple independent nodes still depend on underlying data sources being accurate and available. An oracle network can ensure that multiple participants agree on what an API returned, but cannot verify that the API itself provided correct information. This limitation means that off-chain asset security can never exceed the security of the least reliable component in the information supply chain, regardless of blockchain’s own security properties.

Regulatory and legal risks represent a unique security dimension for off-chain assets that pure on-chain implementations largely avoid. Governments can seize physical assets, freeze bank accounts holding stablecoin reserves, or compel custodians to block transactions regardless of blockchain records. Regulatory changes can invalidate business models, impose new compliance requirements, or prohibit certain activities entirely. These risks manifest differently across jurisdictions, with the USA, UK, UAE, and Canada each maintaining distinct regulatory approaches to tokenized assets. Projects must consider regulatory security as seriously as technical security, ensuring that legal structures, compliance programs, and jurisdictional choices provide robust protection against regulatory intervention that could compromise asset value or accessibility.

Scalability and Cost Considerations in Asset Storage

Scalability limitations and cost structures profoundly influence the practical viability of blockchain implementations, often determining whether projects can achieve commercial success at scale. On-chain and off-chain approaches face dramatically different scalability characteristics and cost models, with each presenting unique advantages and constraints that shape appropriate use cases and deployment strategies. Understanding these economics enables realistic project planning and helps avoid architectures that become economically infeasible as usage grows.

On-chain scalability faces fundamental constraints from distributed consensus requirements. Every full node must process every transaction, validate all state transitions, and maintain complete blockchain history. This architecture ensures decentralization and security but limits throughput to what individual nodes can process. Bitcoin handles approximately 7 transactions per second, Ethereum’s base layer processes 15-30 transactions per second, and even high-performance blockchains like Solana achieve only thousands of transactions per second under optimal conditions. These throughput limits pale compared to centralized systems that routinely process hundreds of thousands of operations per second. Network congestion during high demand periods causes transaction fees to spike dramatically, sometimes reaching hundreds of dollars per transaction on Ethereum during peak congestion, making small-value transactions economically infeasible.

| Cost Component | On-Chain Implementation | Off-Chain Implementation |

|---|---|---|

| Transaction Processing | Gas fees ranging from cents to hundreds of dollars depending on network congestion and transaction complexity | Minimal marginal cost per transaction, absorbed into overall infrastructure operating expenses |

| Data Storage | Extremely expensive, with permanent storage costs calculated per byte and multiplied across all network nodes | Standard cloud storage rates, typically fractions of cents per gigabyte per month with volume discounts |

| Smart Contract Deployment | One-time gas cost proportional to contract size, potentially thousands of dollars for complex contracts on expensive networks | Standard application deployment costs, potentially including server provisioning and software licensing fees |

| Oracle Services | Not required for pure on-chain assets operating independently of external data | Ongoing fees for oracle network data feeds, potentially ranging from hundreds to thousands monthly depending on update frequency |

| Custody and Insurance | Self-custody possible with no recurring fees beyond security tooling and practices | Custodian fees, insurance premiums, audit costs for maintaining physical assets or fiat reserves |

| Compliance and Legal | Minimal ongoing compliance for pure cryptocurrency applications in permissive jurisdictions | Significant legal expenses, regulatory filings, compliance infrastructure, and ongoing reporting obligations |

| Infrastructure Maintenance | Node operation costs if running own infrastructure, otherwise reliance on third-party RPC providers | Server hosting, database management, API infrastructure, monitoring systems, and DevOps personnel |

Layer-2 scaling solutions attempt to overcome base-layer limitations by processing most transactions off the main chain while leveraging it for security and final settlement. State channels enable participants to conduct unlimited transactions off-chain, settling only opening and closing balances to the main chain. Optimistic rollups bundle thousands of transactions into single on-chain submissions, assuming validity unless challenged. Zero-knowledge rollups use cryptographic proofs to verify off-chain computation correctness without revealing underlying transactions. These approaches dramatically improve throughput and reduce per-transaction costs while maintaining varying degrees of main-chain security inheritance. However, they introduce complexity around liquidity fragmentation, withdrawal periods, and cross-layer asset management that creates user experience friction and operational challenges.

Off-chain systems scale using proven traditional infrastructure patterns including database sharding, content delivery networks, caching layers, and horizontal scaling across multiple servers. These techniques enable handling millions of operations per second at marginal costs approaching zero per transaction. The challenge lies not in technical scalability but in maintaining meaningful decentralization and trustlessness when leveraging centralized infrastructure. A truly centralized system could handle planetary-scale throughput trivially but loses blockchain’s core value propositions. Successful off-chain scaling requires carefully balancing efficiency gains against trust minimization, often through periodic on-chain settlement, cryptographic proofs of off-chain computation, or economic incentives that align centralized operators’ interests with honest behavior.

The economic viability threshold differs dramatically between architectures. On-chain applications must generate sufficient value to justify expensive blockchain operations, limiting viable use cases to high-value transactions, financial applications, or scenarios where decentralization provides critical advantages. Micropayments, high-frequency trading, gaming transactions, and social media interactions typically cannot justify direct on-chain processing costs. Off-chain systems can economically support low-value, high-frequency operations but must generate revenue sufficient to cover infrastructure costs, oracle fees, custodial expenses, and compliance overhead. Total cost of ownership analysis must account for both direct blockchain fees and indirect costs including development complexity, security investments, and ongoing operational requirements that vary significantly between architectural choices.

Role of Smart Contracts in Managing On-Chain Assets

Smart contracts serve as the fundamental programming layer for on-chain asset management, enabling complex logic, automated execution, and composable interactions that transform simple tokens into sophisticated financial instruments and programmable digital property. These self-executing programs run on blockchain virtual machines, with their code and state stored on-chain and execution guaranteed by network consensus. Understanding smart contract capabilities and limitations is essential for architecting on-chain systems that leverage their unique properties while avoiding common pitfalls that have led to significant losses in deployed systems.

The execution model of smart contracts fundamentally differs from traditional software, operating in a adversarial environment where code visibility, immutability, and financial incentives create unique security requirements. All contract code is publicly visible, enabling anyone to analyze it for vulnerabilities or profitable exploits. Once deployed, contracts cannot be modified except through explicitly programmed upgrade mechanisms, meaning bugs are permanent unless elaborate migration procedures extract value to new contracts. Execution is deterministic and validated by all network participants, ensuring transparent and verifiable behavior but limiting capabilities to computations that can be reproduced identically across all nodes. These constraints demand exceptional code quality and security practices that exceed standards for conventional software development.

Core Smart Contract Functions for Asset Management

Issuance and Minting

- Controlled token creation following predefined supply schedules

- Authority management determining who can mint new assets

- Supply caps preventing unlimited inflation

- Vesting schedules for gradual token distribution

- Burn mechanisms enabling permanent supply reduction

Transfer Logic

- Basic transfer functions moving assets between addresses

- Approval mechanisms enabling third-party transfers

- Transfer restrictions implementing compliance rules

- Pausable transfers for emergency situations

- Batch transfers optimizing gas efficiency

Conditional Execution

- Time-locked transactions executing at specific timestamps

- Multi-signature requirements for high-value operations

- Threshold conditions triggering automated actions

- Oracle-dependent logic responding to external events

- Complex state machines managing multi-step processes

Governance Mechanisms

- Proposal submission and voting systems

- Delegation enabling representative governance

- Time-locks delaying governance changes

- Quorum requirements ensuring participation thresholds

- Parameter adjustment capabilities for protocol tuning

Yield Distribution

- Automated reward calculations and distributions

- Staking mechanisms accumulating yields over time

- Fee collection and distribution to stakeholders

- Compounding logic maximizing returns

- Proportional allocation based on holdings or participation

Integration Interfaces

- Standardized ABIs enabling universal compatibility

- Event emission for off-chain monitoring

- Query functions providing state information

- Callback mechanisms for composable interactions

- Fallback functions handling unexpected calls

Token standards like ERC-20, ERC-721, and ERC-1155 provide common interfaces that enable ecosystem-wide compatibility and composability. These standards define required functions that tokens must implement, ensuring wallets, exchanges, and other protocols can interact with any compliant token through identical interfaces. ERC-20 establishes fungible token standards with transfer, balance query, and approval functions. ERC-721 defines non-fungible tokens with unique identifiers and ownership tracking. ERC-1155 enables hybrid semi-fungible tokens efficient for gaming and complex asset systems. Adhering to these standards dramatically reduces integration friction, as new tokens automatically work with existing infrastructure designed around standard interfaces. However, standards also constrain design choices and may not accommodate all desired functionality, requiring careful evaluation of when standard compliance justifies limitations versus implementing custom contract logic.

DeFi protocols demonstrate smart contracts’ capacity for creating complex financial instruments from simple primitives. Automated market makers implement constant product formulas enabling decentralized trading without order books. Lending protocols calculate interest rates algorithmically based on utilization, automatically adjusting rates to balance supply and demand. Yield aggregators optimize capital deployment across protocols through programmatic strategy execution. Synthetic asset platforms create exposure to external assets through collateralized debt positions managed entirely by smart contract logic. These applications achieve functionality comparable to traditional financial services while eliminating intermediaries, operating 24/7 without downtime, and maintaining complete transparency of operations and reserves.

Upgradeability patterns address the immutability challenge through proxy contracts that separate logic from storage. The proxy contract maintains asset state while delegating function calls to separate logic contracts that can be replaced. This architecture enables bug fixes and feature additions post-deployment while preserving asset continuity and user balances. However, upgradeability introduces centralization concerns and trust assumptions around who controls upgrade authority and under what conditions upgrades can occur. Projects must balance the practical necessity of fixing bugs against the security benefits of truly immutable contracts. Time-locks requiring delays before upgrades take effect, multi-signature upgrade authorization, and community governance over upgrade decisions help mitigate centralization risks while maintaining necessary flexibility.

Role of Oracles in Connecting Off-Chain Assets to Blockchain

Oracles function as critical middleware enabling smart contracts to interact with external data and off-chain systems, bridging blockchain’s deterministic execution environment with the messy complexity of real-world information. Without oracles, smart contracts operate in isolation, unable to access price feeds, weather data, sports scores, or any other external information necessary for most practical applications. Understanding oracle architecture, security models, and limitations is essential for projects integrating off-chain assets, as oracles represent both the enabler of functionality and a significant source of risk and centralization.

The oracle problem arises from blockchain’s fundamental need for deterministic consensus. All network participants must independently verify all computations and reach identical conclusions about blockchain state. External data introduces non-determinism, as different nodes querying APIs at different times might receive different responses. Additionally, blockchain cannot directly verify the accuracy of external information through consensus mechanisms that work well for on-chain transactions. An oracle claiming that Bitcoin’s price is $50,000 cannot be validated through cryptographic proofs or mathematical verification. Instead, smart contracts must trust oracles to report accurate information, creating a centralized point of failure that potentially undermines blockchain’s decentralization and trustlessness.

Chainlink has emerged as the dominant decentralized oracle network, operating across multiple blockchains and providing diverse data feeds including cryptocurrency prices, commodities, foreign exchange rates, and custom data through its any-API functionality. The system employs independent node operators who stake LINK tokens as collateral and aggregate data from multiple sources before submitting consensus values on-chain. Smart contracts pay for oracle services in LINK tokens, creating economic incentives for honest operation. However, even Chainlink’s decentralized architecture cannot verify underlying data source accuracy. If all queried exchanges report manipulated prices during a flash crash or coordinated attack, the oracle network will faithfully report the manipulated data, as it can only aggregate information from available sources without independent verification of real-world truth.

Ready to Leverage Blockchain Assets for Your Business?

Partner with our blockchain experts to design the perfect on-chain and off-chain asset strategy. Get a free consultation on tokenization and implementation.

Time-weighted average price feeds partially mitigate manipulation risks by calculating prices over extended periods rather than using spot prices susceptible to temporary manipulation. This approach makes attacks more expensive, as manipulators must sustain false prices over hours rather than seconds to meaningfully influence oracle outputs. Circuit breakers and deviation thresholds provide additional protections, pausing oracle updates or flagging suspicious data when prices change beyond configured limits. However, these safeguards cannot distinguish legitimate volatility from manipulation attempts, creating tradeoffs between responsiveness to real market movements and resistance to attack. Projects must carefully configure oracle parameters balancing these competing concerns based on their specific security requirements and acceptable latency.

Beyond price feeds, oracles enable diverse blockchain interactions with external systems including verifiable randomness for gaming and NFT generation, weather data for agricultural insurance contracts, sports results for prediction markets, and cross-chain state information for bridges. Each use case presents unique security considerations and trust assumptions. Verifiable random functions use cryptographic techniques to generate provably random numbers that oracles cannot manipulate. IoT oracles report sensor data from physical devices, requiring trust in device authenticity and tamper-resistance. Computation oracles execute complex calculations off-chain and submit results with proofs enabling verification, balancing blockchain computational limitations against needs for complex processing.

Tokenization of Off-Chain Assets: How It Works

Tokenization transforms off-chain assets into blockchain-based digital representations, enabling fractional ownership, enhanced liquidity, programmable compliance, and automated settlement while maintaining connections to underlying asset value and legal rights. This process bridges traditional asset classes with blockchain infrastructure, potentially unlocking trillions of dollars in illiquid assets for more efficient markets. However, successful tokenization requires sophisticated legal engineering, robust custody solutions, and careful management of the relationship between digital tokens and underlying assets that exist outside blockchain systems.

The tokenization process begins with legal structuring that establishes what rights token holders actually possess. For real estate, this typically involves creating a special purpose vehicle that owns the property, with tokens representing membership interests or shares in that entity. Security tokenization wraps traditional financial instruments in compliant blockchain representations, with legal agreements defining how token transfers affect beneficial ownership of underlying securities. Commodity tokenization requires custodial arrangements where physical assets are stored securely, with tokens representing claims on specific quantities held in reserve. Each structure must navigate jurisdiction-specific regulations in the USA, UK, UAE, Canada, and anywhere else token holders might reside, ensuring tokens convey legally enforceable rights recognizable in traditional court systems.

Legal Framework Requirement: Tokenization success depends fundamentally on legal recognition and enforceability rather than technical implementation. Projects must engage qualified legal counsel to structure tokenized assets with clear ownership rights, regulatory compliance, and judicial enforceability in relevant jurisdictions. Technical blockchain implementation cannot substitute for proper legal foundation, and gaps between on-chain records and legal reality create unresolved risks that have undermined numerous tokenization attempts.