Liquidity pools have become the backbone of decentralized finance (DeFi), and at their center sits a critical asset: Liquidity Provider Tokens, commonly known as LP tokens. In 2025, DeFi’s total value locked surpassed $100 billion, with staking and yield farming capturing over $63.2 billion across protocols.[1] As more users provide liquidity on decentralized exchanges (DEXs) like Uniswap, PancakeSwap, and SushiSwap, understanding how LP tokens work has become essential for anyone navigating DeFi.

Key Takeaways

- LP Tokens Explained: Liquidity pool tokens represent your proportional share of a liquidity pool and serve as a receipt for your deposited assets.

- Earning Mechanism: LPs earn rewards through transaction fees (typically 0.05%–0.3% per swap) plus potential farming incentives.

- LP Token Formula: Value of 1 LP Token = Total Value of Liquidity Pool ÷ Circulating Supply of LP Tokens.

- Multiple Use Cases: LP tokens can be used for yield farming, staking, collateral in DeFi lending, IDO participation, and ownership transfer.

- Impermanent Loss Risk: Price divergence between pooled assets can reduce LP returns compared to simply holding the tokens.

- Major Platforms: Uniswap, PancakeSwap, SushiSwap, and Curve dominate LP token issuance across Ethereum, BNB Chain, and multi-chain ecosystems.

What Are Liquidity Pool Tokens?

Liquidity pool tokens are digital assets issued to users who deposit cryptocurrency pairs into liquidity pools on decentralized exchanges. When you provide liquidity — depositing equal values of two tokens into a pool — the protocol mints LP Tokens that represent your proportional share of that pool. These tokens act as a receipt, proving your ownership of the underlying assets and entitling you to a share of the transaction fees generated by trading activity within the pool.

From a technical perspective, LP tokens are standard blockchain tokens. Uniswap LP tokens and SushiSwap LP tokens on Ethereum are ERC20 tokens, while PancakeSwap LP tokens on BNB Chain are BEP-20 tokens. This means they can be transferred between wallets, traded, or used across other DeFi protocols — just like any other token on the same network. The development of LP token standards across multiple blockchains has made them interoperable within their respective ecosystems, enabling a wide range of DeFi composability.

How Do Liquidity Pools and AMMs Work?

To understand LP tokens in DeFi, you first need to understand liquidity pools. Unlike centralized exchanges that use order books to match buyers and sellers, decentralized exchanges use an Automated Market Maker (AMM) model. Liquidity pools are smart contracts holding reserves of token pairs, and the AMM algorithm determines prices based on the ratio of assets within the pool.

The most widely used pricing mechanism is the constant product formula: x × y = k, where x and y represent the quantities of two tokens, and k is a constant maintained after each trade. When a trader swaps tokens, the AMM adjusts quantities to maintain this constant, automatically setting the price. This model, pioneered by Uniswap, ensures that liquidity is always available for trading.

The development of advanced AMM models has significantly improved capital efficiency. Uniswap V3 introduced concentrated liquidity, allowing providers to allocate capital within specific price ranges. Curve Finance optimized its AMM for stablecoin swaps, minimizing slippage on pegged assets. By mid-2025, Curve exceeded $20 billion in TVL and Aave maintained over $14.6 billion in active pools.

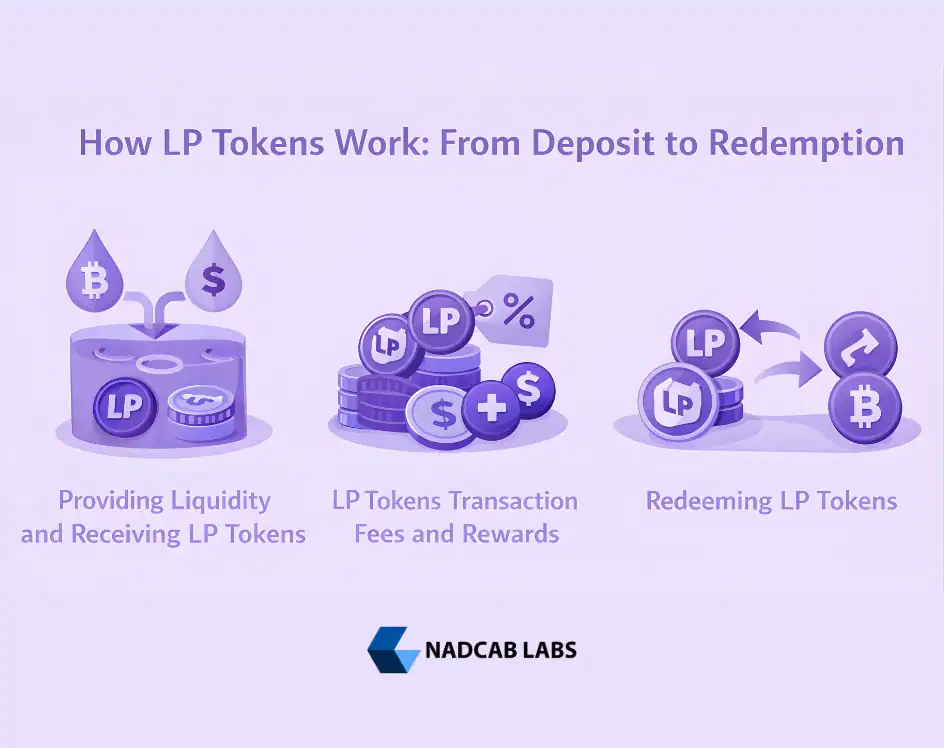

How LP Tokens Work: From Deposit to Redemption

Understanding LP tokens is crucial before diving into their mechanics, as they represent both your ownership and your earned rewards within the liquidity pool.

Providing Liquidity and Receiving LP Tokens

When you deposit a token pair into a liquidity pool, the smart contract calculates your share relative to the pool’s total size and mints LP tokens proportionally. For example, if you deposit $10,000 worth of liquidity into a pool containing $1,000,000 total, you receive LP tokens representing 1% of the pool. Every time a trader pays swap fees within that pool, your 1% share of those fees accrues automatically. The LP token value formula reflects this relationship: Total Value of Liquidity Pool ÷ Circulating Supply of LP Tokens = Value of 1 LP Token.

LP Tokens Transaction Fees and Rewards

Liquidity providers earn rewards primarily through LP tokens transaction fees. Each swap incurs a fee — typically 0.3% on Uniswap V2, with variable tiers on V3. These fees are distributed proportionally among all liquidity providers based on their pool share. Many platforms supplement fee income with additional LP tokens rewards in the form of governance or native tokens, further incentivizing liquidity provision.

Redeeming LP Tokens

When you are ready to withdraw, redeeming LP tokens returns your proportional share of the pool’s current assets plus accumulated fees. Most pools allow instant redemption, though some protocols charge a small penalty for early withdrawal. It is critical to safeguard your LP tokens because losing them means permanently losing access to your deposited assets.

What Can You Do with LP Tokens?

LP Token Staking and Yield Farming

One of the most powerful uses of LP tokens is staking them in yield farms to earn additional rewards. LP token staking involves depositing your LP tokens into a separate smart contract that distributes bonus tokens — often the platform’s native governance token — as an incentive. LP token farming has become a cornerstone of DeFi income strategies, with protocols like SushiSwap, PancakeSwap, and Curve offering dedicated farming pools. Yield farming with LP tokens allows users to compound returns by earning both trading fees from the liquidity pool and staking rewards from the farm simultaneously.

Collateral for DeFi Loans

LP tokens represent ownership of underlying assets, making them viable collateral for decentralized lending protocols. Some platforms accept specific LP tokens as collateral, enabling you to borrow stablecoins against your liquidity position without withdrawing from the pool, thus maintaining your fee-earning position while unlocking additional capital.

LP Tokens and IDOs

Initial DEX Offerings (IDOs) increasingly use LP token holdings as a qualification metric for participation. To join certain IDO launches, users must hold a minimum value of LP tokens from designated pools. This approach ensures that IDO participants are active DeFi contributors with genuine liquidity commitment, rather than purely speculative participants. Understanding the Cost to Create a Crypto token helps projects design effective IDO strategies that align with their liquidity goals.

Build Custom Liquidity Pool Solutions

Nadcab Labs designs and deploys custom liquidity pool smart contracts, LP token mechanisms, and yield farming infrastructure tailored to your DeFi project’s requirements.

Popular DEX Platforms for LP Tokens

Different DEX platforms offer unique LP token mechanics, rewards, and fee structures, making it essential to understand each protocol before providing liquidity.

Uniswap LP Tokens

Uniswap remains the dominant decentralized exchange on Ethereum, with over 6.3 million active wallets in 2025. Uniswap LP tokens are ERC20 tokens representing shares in V2 or V3 pools. The V4 upgrade introduced customizable “hooks” for dynamic fees and MEV protection. From December 2025, Uniswap began directing a portion of fees toward UNI buybacks, adding protocol-level value accrual alongside LP rewards.

PancakeSwap LP Tokens

PancakeSwap operates primarily on BNB Chain with lower transaction fees and faster confirmations. PancakeSwap LP tokens are BEP-20 tokens, and the platform’s TVL crossed $5 billion in 2025. Beyond standard liquidity provision, PancakeSwap offers Syrup Pools for LP token staking and has expanded cross-chain through LayerZero bridging.

SushiSwap and Curve LP Tokens

SushiSwap LP tokens provide access to multi-chain liquidity across Ethereum and BSC, with additional SUSHI token farming rewards. Curve Finance specializes in stablecoin and pegged asset pools, where its optimized AMM minimizes slippage. Curve’s CRV governance token system includes vote-locking mechanics that boost LP rewards, attracting over $20 billion in TVL. The development of these specialized AMM models has created distinct earning opportunities for different types of liquidity providers.

Risks of LP Tokens: Impermanent Loss and Beyond

While LP tokens offer rewards, providers must carefully consider risks like impermanent loss and smart contract vulnerabilities to protect their deposited assets effectively.

Understanding Impermanent Loss

Impermanent loss is the most significant risk facing liquidity providers. It occurs when the price of assets within a pool diverges from their price at the time of deposit. The AMM’s constant rebalancing means that as one token appreciates, the pool automatically sells it for the depreciating token — resulting in the LP holding less of the appreciating asset than if they had simply held both tokens in a wallet. For instance, if a token’s price doubles, the impermanent loss is approximately 5.7%. A 500% price increase results in roughly 25% impermanent loss.

The loss is called “impermanent” because it reverses if prices return to their original ratio. However, if you withdraw while prices have diverged, the loss becomes permanent. Strategies to mitigate impermanent loss include choosing stablecoin pairs (USDC/DAI), selecting correlated asset pools (wBTC/ETH), using concentrated liquidity ranges, and prioritizing high-fee pools where trading income offsets the loss. When a token experiences unexpected volatility and its value drops, understanding token falling scenarios helps LPs make informed withdrawal decisions.

Smart Contract and Security Risks

LP tokens depend entirely on the smart contracts governing the liquidity pool. Bugs, exploits, or vulnerabilities can lead to partial or complete loss of deposited funds. In 2025, the Cetus DEX hack resulted in approximately $223–260 million in losses. The development of robust security practices — including multiple independent audits, formal verification, and bug bounty programs — is essential for protecting LP assets.

How to Become a Liquidity Provider

Becoming a liquidity provider involves a straightforward process. Choose a DeFi platform aligned with your preferred blockchain — Uniswap for Ethereum, PancakeSwap for BNB Chain, or Raydium for Solana. Connect your wallet, select a liquidity pool, and deposit equal values of both tokens. The protocol mints LP tokens to your wallet, and you immediately begin earning transaction fees.

Pool selection is the most consequential decision. Evaluate pools based on total value locked, trading volume, fee tier, and the volatility profile of paired assets. Stablecoin pools offer lower but predictable returns with minimal impermanent loss, while volatile pairs generate higher fees but carry greater risk. For teams seeking comprehensive crypto token solutions including custom liquidity pool architecture, working with experienced blockchain engineers ensures optimized pool design and secure deployment.

The Future of LP Tokens in DeFi

The development of DeFi infrastructure continues expanding LP token utility. Concentrated liquidity positions are evolving into tradeable NFTs, as seen with Uniswap V3, enabling precise capital allocation and secondary market trading. Cross-chain liquidity protocols connect pools across blockchains, allowing LP tokens to represent multi-chain positions. Institutional participation is accelerating — by mid-2025, institutional DeFi exposure reached $41 billion, with permissioned pools managing $6.4 billion in volume.[2]

Real-world asset tokenization is also reshaping liquidity pools. Tokenized treasuries, real estate, and commodities are entering DeFi pools, creating new LP token categories bridging traditional finance with decentralized markets. The development of intent-based trading and protocol-owned liquidity models is further transforming how liquidity is provisioned, moving beyond purely user-supplied models toward hybrid approaches. As these innovations mature, LP tokens will remain fundamental to DeFi’s evolution.

Conclusion

Liquidity Pool (LP) Tokens are far more than simple receipts — they are versatile DeFi primitives that unlock earning opportunities through transaction fees, yield farming, staking rewards, and IDO participation. As DeFi continues its rapid growth, understanding how LP tokens work, their risks, and strategies for maximizing value is essential. With proper development planning, pool selection, and risk management, LP tokens offer one of the most accessible pathways to participating in decentralized finance.

Frequently Asked Questions

LP tokens are digital assets issued to liquidity providers representing their proportional share of a liquidity pool. They serve as proof of deposit and entitle holders to accumulated trading fees and rewards.

LP token value equals the total liquidity pool value divided by the circulating supply of LP tokens. This formula ensures each token accurately represents its proportional share of the underlying pooled assets.

Impermanent loss occurs when token prices in a liquidity pool diverge from their deposit-time values. The AMM rebalances holdings, resulting in reduced value compared to simply holding both tokens outside the pool.

Yes, many DeFi platforms allow LP token staking in dedicated yield farms. Staking LP tokens earns additional rewards, typically in the platform’s native governance token, on top of regular liquidity pool fees.

Major platforms issuing LP tokens include Uniswap and SushiSwap on Ethereum, PancakeSwap on BNB Chain, Curve Finance for stablecoin pools, and Raydium on Solana, each using their respective token standards.

LP tokens earn rewards through trading fees generated by swap activity within the liquidity pool, distributed proportionally among all providers. Additional rewards come from yield farming incentives and governance token distributions.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.