Key Takeaways

- Liquidity lockup in DEX prevents token creators from withdrawing pool reserves by depositing LP tokens into time-locked smart contracts, protecting investors from rug pulls.

- DEX liquidity lock creates verifiable security that investors can independently confirm through blockchain explorers and dedicated verification platforms.

- Locked liquidity importance extends beyond scam prevention to building trust, enabling fair price discovery, and establishing project credibility in competitive DeFi markets.

- DeFi liquidity management best practices recommend locking 80-100% of team-provided liquidity for minimum periods of 6-12 months, with longer locks indicating stronger commitment.

- Liquidity pool security through locking prevents sudden liquidity removal that would crash token prices and trap investors in worthless positions.

- Smart contract-based locks are immutable and trustless, meaning no party including the original depositor can access locked funds until the predetermined unlock time.

- Crypto token liquidity lock has become an industry standard for legitimate launches, with projects lacking locks facing significant investor skepticism and reduced market participation.

- While locks protect against one attack vector, comprehensive due diligence should evaluate multiple factors including audits, team credentials, and tokenomics alongside lock status.

Liquidity lockup has become one of the most important security mechanisms in decentralized finance, directly addressing the epidemic of rug pulls that has plagued the crypto industry. Understanding what is liquidity lock in crypto and why it matters enables investors to make informed decisions while helping legitimate projects demonstrate their commitment. This comprehensive guide explores the mechanics, importance, and implementation of liquidity locks in DEX environments.

Understanding Liquidity Lockup in DEX

Understanding liquidity lockup in DEX requires grasping how decentralized exchange liquidity functions and the vulnerabilities that locks address. When token projects launch on DEXs, they create liquidity pools that enable trading. Without locks, these pools remain vulnerable to sudden drainage, making security mechanisms essential for investor protection and market stability.

What is Liquidity Lock in Crypto?

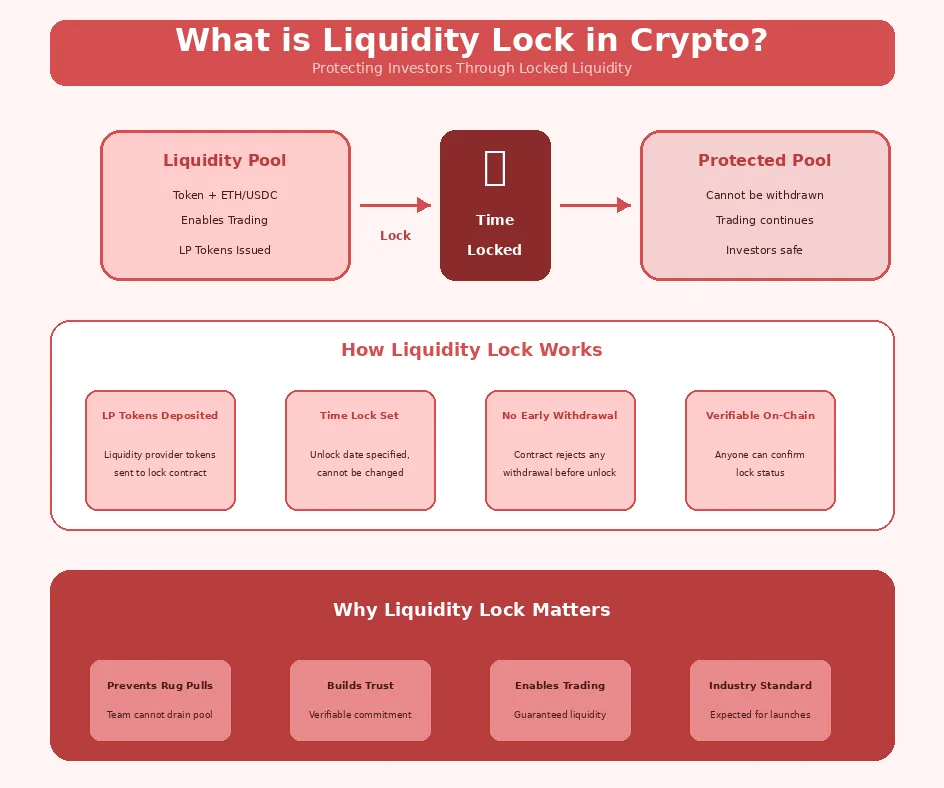

What is liquidity lock in crypto fundamentally involves depositing LP (Liquidity Provider) tokens into specialized smart contracts that enforce time-based withdrawal restrictions. When someone provides liquidity to a DEX pool, they receive LP tokens representing their share. Normally, these tokens can be redeemed anytime for the underlying assets. Locking deposits these LP tokens into contracts that reject any withdrawal attempts until the lock period expires.

The mechanism creates trustless security because the restriction exists in immutable code rather than promises. No one, including the original depositor, platform operators, or any third party, can access locked tokens prematurely. This cryptographic guarantee provides investors with verifiable assurance that trading liquidity will remain available for the specified duration. Building crypto exchanges that integrate lock verification helps users identify safer trading opportunities.

How Liquidity Lock Works in Decentralized Exchanges

How liquidity lock works in decentralized exchanges involves a straightforward technical process with significant security implications. After creating a liquidity pool and receiving LP tokens, the token team transfers these tokens to a locking contract specifying the unlock date. The contract records the deposit, beneficiary address, and unlock timestamp, then holds the tokens until conditions permit withdrawal.

The decentralized exchange liquidity lock operates independently of the underlying DEX. Whether liquidity exists on Uniswap, PancakeSwap, or other platforms, the LP tokens themselves can be locked through third-party services. Understanding how liquidity pools function in decentralized exchanges provides essential context for appreciating lock mechanics.

Difference Between Locked and Unlocked Liquidity

The difference between locked and unlocked liquidity determines investor risk exposure fundamentally. Unlocked liquidity can be withdrawn instantly by the provider, meaning a malicious actor could drain an entire pool within seconds, crashing the token price and leaving holders with unsellable assets. Locked liquidity removes this possibility for the lock duration, providing assured market depth.

From an investor perspective, this distinction often separates potential investments from clear risks. Projects with 100% unlocked liquidity require extraordinary trust in anonymous teams, while projects with verified locks provide cryptographic guarantees. The locked status is publicly verifiable, enabling due diligence that would be impossible with centralized systems relying on trust.

Security Principle: Liquidity locks provide trustless verification rather than requiring faith in project teams. Always verify lock status independently through blockchain data rather than trusting screenshots or claims.

Locked vs Unlocked Liquidity Comparison

| Aspect | Locked Liquidity | Unlocked Liquidity |

|---|---|---|

| Withdrawal Access | Blocked until unlock date | Available anytime |

| Rug Pull Risk | Eliminated during lock | Constant vulnerability |

| Investor Confidence | High (verifiable) | Low (trust required) |

| Verification | On-chain, transparent | Requires monitoring |

| Market Stability | Assured depth | Can vanish instantly |

Importance of Liquidity Lock in DEX

The importance of liquidity lock in DEX stems from the permissionless nature of decentralized exchanges where anyone can create tokens and trading pools. Without gatekeepers verifying legitimacy, technical mechanisms like liquidity locks become essential for investor protection. The locked liquidity importance has grown as DeFi adoption increased alongside sophisticated scam operations.

Why Liquidity Lock Matters in Decentralized Exchanges

Why liquidity lock matters in decentralized exchanges relates directly to the trust problem in anonymous, permissionless environments. Traditional finance relies on regulated intermediaries who verify counterparties; DeFi replaces this with cryptographic verification. Liquidity locks provide one crucial verification layer, proving that trading infrastructure will remain functional regardless of team intentions.

The matter extends beyond individual project safety to ecosystem health. Widespread rug pulls damage DeFi’s reputation and deter mainstream adoption. As locked liquidity becomes standard practice, the overall trustworthiness of decentralized trading improves. Understanding how liquidity functions across decentralized exchange ecosystems reveals why protection mechanisms matter.

Protecting Investors Through Locked Liquidity

Protecting investors through locked liquidity addresses the most damaging attack vector in DeFi: rug pulls where developers drain pools after accumulating investor purchases. Billions have been lost to such schemes, with victims having no recourse. Locked liquidity makes this specific attack impossible during the lock period, providing concrete rather than promised protection.

The protection operates automatically without requiring investor action beyond initial verification. Once confirmed locked, investors know the liquidity cannot disappear regardless of what the team claims or does. This shifts the security model from trusting anonymous parties to trusting audited, battle-tested smart contracts with transparent, verifiable behavior.

Ensuring Stability in Liquidity Pools

Ensuring stability in liquidity pools through locks provides benefits beyond scam prevention. Stable, predictable liquidity enables better price discovery, reduces volatility from supply shocks, and encourages larger trading activity. Traders and liquidity providers alike benefit from knowing that pool depth will remain consistent, enabling more confident participation.

Liquidity pool security through locking also supports healthier token economics. Projects can demonstrate commitment, enabling longer-term holder mentality rather than speculative gambling. This stability enables legitimate projects to focus on building rather than constantly reassuring investors about liquidity safety.

Benefits of Liquidity Lock in DeFi Platforms

Benefits of liquidity lock in DeFi platforms extend across multiple dimensions affecting investors, projects, and the broader ecosystem. Understanding these benefits clarifies why locked liquidity has become an expected standard for legitimate token launches and ongoing DeFi liquidity management.

Enhancing Trust and Security in DEX

Enhancing trust and security in DEX through liquidity locks creates conditions for broader participation. Investors who might avoid unknown tokens entirely can participate when locks provide baseline protection. This expanded participation benefits legitimate projects through larger communities while marginalizing scam projects that cannot provide equivalent assurances.

The trust enhancement operates at individual and ecosystem levels. Individual projects gain credibility through verified locks, while the collective adoption of locking standards improves DeFi’s overall reputation. As locks become ubiquitous, the absence of locks increasingly signals potential problems.

Preventing Rug Pulls and Exit Scams

Preventing rug pulls and exit scams represents the primary value proposition of liquidity locks. The classic rug pull involves creating a token, adding liquidity to enable trading, promoting to accumulate buyer investment, then removing all liquidity to extract value. Locked liquidity breaks this attack pattern by making the extraction step impossible.

While locks do not prevent all scam types, they eliminate the most common and damaging variant. Other risks like mint functions or hidden fees require additional verification, but addressing liquidity removal covers a significant portion of historical DeFi losses. The combination of locks with other security measures provides comprehensive protection.

Maintaining Market Confidence and Price Stability

Maintaining market confidence and price stability through locked liquidity supports healthier market dynamics. When participants trust that liquidity will remain, they can make decisions based on fundamentals rather than constantly worrying about sudden pool drainage. This confidence enables longer-term investment perspectives rather than pure speculation.

Price stability benefits from assured liquidity depth. Without lock risks, prices reflect actual supply and demand rather than incorporating liquidity uncertainty premiums. This cleaner price discovery benefits all participants by providing more accurate market signals for investment decisions.

Liquidity Lock Implementation Lifecycle

| Stage | Action | Details | Outcome |

|---|---|---|---|

| 1 | Create Liquidity Pool | Add token + base pair to DEX | Receive LP tokens |

| 2 | Select Lock Platform | Choose Unicrypt, Team Finance, etc. | Connect wallet to locker |

| 3 | Configure Lock | Set duration and unlock date | Review lock parameters |

| 4 | Deposit LP Tokens | Transfer to lock contract | Tokens secured |

| 5 | Verify and Share | Confirm on explorer, share proof | Public verification available |

| 6 | Lock Period Active | Liquidity secured until unlock | Investors protected |

How to Implement Liquidity Lock in a DEX

How to implement liquidity lock in a DEX involves technical steps that token teams and project developers should understand thoroughly. Proper implementation ensures the lock functions as intended, providing genuine security rather than false assurance from improperly configured mechanisms.

Smart Contract-Based Liquidity Lock

Smart contract-based liquidity lock operates through specialized contracts designed to hold tokens until specified conditions are met. The basic mechanism involves a deposit function that accepts LP tokens and records lock parameters, combined with a withdrawal function that reverts if called before the unlock timestamp. This simplicity makes the mechanism robust and easily auditable.

Key contract features include time-lock enforcement, beneficiary designation, and transparency for public verification. Well-designed lock contracts have no admin functions that could bypass the time restriction, ensuring truly trustless operation. Understanding how decentralized exchanges integrate security features provides context for lock contract implementation.

Tools and Platforms for Locking Liquidity

Tools and platforms for locking liquidity have become essential DeFi infrastructure, with several established services dominating the market. Unicrypt pioneered liquidity locking and remains widely used across Ethereum and BSC. Team Finance (formerly TrustSwap) offers similar functionality with additional features. Pink Lock and Mudra Locker serve specific chain ecosystems with competitive alternatives.

Choosing a platform involves evaluating track record, supported chains and DEXs, fee structures, and verification tools provided. Established platforms have processed billions in locked value, providing proven reliability. The verification tools these platforms provide help investors confirm lock status, making the choice relevant for both project teams and their investors.

Best Practices for Developers and Token Teams

Best practices for developers and token teams implementing liquidity locks include maximizing lock percentage (ideally 100% of team liquidity), choosing appropriate lock duration (minimum 6-12 months), using established locking platforms, and providing clear verification links. Transparency about lock details builds trust more effectively than minimal compliance.

Additional best practices involve communicating lock intentions before launch, providing regular updates as unlock dates approach, and considering lock extensions or renewals to maintain protection. Teams that exceed minimum expectations demonstrate stronger commitment, differentiating themselves in competitive markets.

Liquidity Lock Platform Selection Criteria

When choosing a liquidity locking platform, evaluate these factors:

- Track Record: Choose platforms with proven history and significant total value locked

- Chain Support: Verify the platform supports your target blockchain and DEX

- Contract Audits: Confirm locking contracts have been professionally audited

- Verification Tools: Evaluate the ease of public lock verification for investors

- Fee Structure: Compare costs across platforms for your lock requirements

- Community Trust: Consider platform reputation within investor and developer communities

Real-World Examples of Liquidity Lock in DEX

Real-world examples of liquidity lock in DEX demonstrate how the mechanism operates in practice and the outcomes it enables. Examining successful implementations provides models for new projects while illustrating why locked liquidity has become industry standard for legitimate launches.

Popular DEXs with Locked Liquidity Pools

Popular DEXs with locked liquidity pools include virtually all legitimate token launches on Uniswap, PancakeSwap, SushiSwap, and similar platforms. While the DEXs themselves do not require locks, market expectations have made locking standard practice. Tokens launching without locks face immediate skepticism from experienced investors who recognize the elevated risk.

The prevalence of locks across major DEXs reflects investor education and community standards that have evolved organically. Platforms like DEXTools prominently display lock status, making it trivially easy for investors to filter for locked projects. This visibility creates strong incentives for legitimate projects to lock while making unlocked projects stand out negatively.

Case Studies of Successful Liquidity Lock Implementation

Case studies of successful liquidity lock implementation show how projects use locks strategically to build trust. Many successful DeFi tokens launched with multi-year locks, demonstrating commitment that helped attract early investors. The lock acted as a credibility signal that differentiated them from the constant stream of scam launches.

Successful implementations typically feature clear communication about lock terms, easy verification through established platforms, and proactive lock extensions as initial periods approach expiration. These practices build ongoing trust rather than treating locks as one-time compliance exercises.

Build Your DEX with Staking Features

We build DEX platforms with integrated staking systems. Smart contract rewards, governance voting, and multi-tier staking included.

Launch Your Exchange Now

Lessons for New Token Launches

Lessons for new token launches from liquidity lock history emphasize treating locks as foundational rather than optional. The market has matured to expect locks, and projects launching without them start at a significant disadvantage. Beyond mere compliance, exceeding minimums (longer locks, higher percentages) provides competitive differentiation.

Additional lessons include the importance of verification accessibility, communication transparency, and viewing locks as part of broader security practices rather than standalone measures. Understanding how professional exchange platforms integrate comprehensive security provides context for holistic approaches to project credibility.

Liquidity Locking Platform Comparison

| Platform | Supported Chains | Key Features |

|---|---|---|

| Unicrypt | ETH, BSC, Polygon, more | Pioneer, widely trusted, extensive verification |

| Team Finance | ETH, BSC, Arbitrum, more | Vesting options, token locks, dashboard |

| Pink Lock | BSC, ETH | PinkSale integration, competitive fees |

| Mudra Locker | BSC | BSC-focused, lower fees, simple interface |

Important Notice: Liquidity locks protect against one specific risk (liquidity removal) but do not guarantee project safety. Always conduct comprehensive due diligence including contract audits, team verification, tokenomics analysis, and community assessment alongside lock verification.

Conclusion

Liquidity lockup in DEX has evolved from optional precaution to essential standard for legitimate token launches. Understanding what is liquidity lock in crypto enables investors to make informed decisions while helping project teams meet market expectations. The mechanism directly addresses the most damaging attack vector in DeFi, providing cryptographic guarantees that build trust in permissionless environments.

The benefits of locked liquidity importance extend throughout the ecosystem, from individual investor protection to overall market credibility. DeFi liquidity management incorporating proper locks creates conditions for healthier markets with better price discovery and reduced manipulation risk. As the space matures, lock standards will likely become even more rigorous and widely expected.

For token projects, implementing comprehensive liquidity locks demonstrates commitment that differentiates from less serious efforts. For investors, verifying lock status provides one crucial layer of due diligence that can prevent significant losses. Together, widespread adoption of liquidity pool security through locking contributes to a more trustworthy decentralized finance ecosystem where legitimate projects can thrive.

Frequently Asked Questions

What is liquidity lock in crypto refers to the process of depositing liquidity pool tokens into smart contracts that prevent withdrawal for a specified period. When token creators lock liquidity, they cannot remove the trading pair’s reserves, ensuring investors that the market will remain functional. This mechanism protects against rug pulls where developers drain pools and disappear with investor funds.

Liquidity lockup in DEX is important because it provides verifiable security for investors trading new tokens. Without locked liquidity, token creators can withdraw all pool reserves at any time, crashing the token price and leaving holders with worthless assets. Locked liquidity importance extends to building trust, enabling fair price discovery, and establishing credibility for legitimate projects in the DeFi ecosystem.

Typical liquidity lock periods range from 6 months to 2+ years, with longer locks generally indicating stronger project commitment. Minimum recommended periods are often 6-12 months for new token launches, while more established projects may lock for multiple years. The ideal duration depends on project roadmap, investor expectations, and the balance between showing commitment and maintaining operational flexibility.

Locked liquidity cannot be withdrawn by the provider until the lock period expires, while unlocked liquidity can be removed at any time. DEX liquidity lock uses smart contracts to enforce this restriction, making it technically impossible to access locked funds prematurely. Unlocked liquidity poses risks because providers could drain pools suddenly, whereas locked liquidity provides assured market depth for the lock duration.

Check locked liquidity status using blockchain explorers and dedicated tools like Unicrypt, Team Finance, or DEXTools. These platforms display lock details including the amount locked, lock duration, unlock date, and the locker contract address. Always verify directly on-chain rather than trusting project claims, as fake lock screenshots are a common scam tactic. Legitimate projects provide transparent lock verification links.

When liquidity lock expires, the locked LP tokens become withdrawable by the original depositor. The token team can then remove liquidity, potentially impacting token price and market depth. Responsible projects typically announce intentions before unlocks and often relock or extend lock periods. Investors should monitor upcoming unlocks and evaluate project communications to assess intentions regarding liquidity management post-unlock.

Properly implemented liquidity locks cannot be unlocked early; the smart contract enforces the time restriction without override capabilities. This immutability is precisely what makes locks trustworthy. Some locking platforms offer migration or emergency functions, but legitimate services require governance approval or have no early unlock mechanism. Always verify the specific locker contract to understand its exact restrictions.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.