Key Takeaways

- Liquidation buffers serve as essential safety margins that protect both borrowers and lending protocols from sudden market downturns in the DeFi ecosystem.

- DAOs in the DeFi Space play a critical role in governing and adjusting liquidation buffer parameters to maintain optimal protocol health.

- Well-designed liquidation buffers can prevent cascade liquidation events that destabilize entire DeFi markets during periods of extreme volatility.

- The optimal liquidation buffer size varies significantly between stablecoins, major cryptocurrencies, and volatile governance tokens.

- Oracle reliability and price feed accuracy directly impact the effectiveness of liquidation buffer mechanisms in protecting protocol solvency.

- Capital efficiency and borrower safety exist in constant tension, requiring careful calibration of liquidation buffer parameters.

- Dynamic and adaptive liquidation buffers represent the future of DeFi risk management, adjusting automatically based on market conditions.

- Protocol governance decisions around liquidation buffers can significantly impact user adoption and competitive positioning in the DeFi landscape.

- Historical case studies demonstrate that inadequate liquidation buffers have contributed to protocol insolvencies and user fund losses.

- Understanding liquidation buffers is essential for both DeFi users seeking to protect their positions and protocol designers building sustainable lending platforms.

Introduction: Why Liquidation Buffers Matter in DeFi

The decentralized finance ecosystem has revolutionized how individuals access financial services, enabling permissionless lending, borrowing, and trading without traditional intermediaries. At the heart of every successful DeFi lending protocol lies a sophisticated risk management framework, with liquidation buffers serving as one of the most critical yet often misunderstood components. These buffers act as financial shock absorbers, providing essential protection against the inherent volatility of cryptocurrency markets while ensuring protocol solvency even during extreme market conditions.

As DAOs in DeFi Space continue to govern increasingly complex financial protocols, understanding the mechanics and importance of liquidation buffers becomes essential for participants at all levels. Whether you are a borrower seeking to maximize capital efficiency, a liquidator looking for profitable opportunities, or a protocol designer building the next generation of lending platforms, the principles covered in this comprehensive guide will provide valuable insights into one of DeFi’s most fundamental risk management mechanisms.

The total value locked in DeFi lending protocols has grown exponentially over recent years, making robust liquidation mechanisms more important than ever. When these systems fail or prove inadequate, the consequences can be severe, ranging from individual borrower losses to cascading liquidations that threaten entire protocol ecosystems. This guide explores every aspect of liquidation buffers, from basic definitions to advanced design considerations, providing you with the knowledge needed to navigate the DeFi lending landscape safely and effectively.

Understanding Liquidation in DeFi Lending Protocols

Liquidation in DeFi lending protocols refers to the process by which undercollateralized loan positions are forcibly closed to protect lenders and maintain protocol solvency. Unlike traditional finance, where loan defaults might be handled through lengthy legal processes, DeFi protocols execute liquidations automatically through smart contracts, often within seconds of a position becoming eligible for liquidation. This automated approach is necessary because DeFi protocols cannot pursue borrowers through legal means or rely on credit scores to assess default risk.

The liquidation process typically involves third-party liquidators who monitor blockchain data for eligible positions. When a borrower’s collateral value drops below the required threshold relative to their debt, liquidators can repay a portion of the debt and claim the corresponding collateral plus a liquidation bonus. This incentive structure ensures that liquidations occur promptly, protecting the protocol from accumulating bad debt while providing profitable opportunities for liquidators who help maintain system health.

What Is a Liquidation Buffer? Core Definition and Purpose

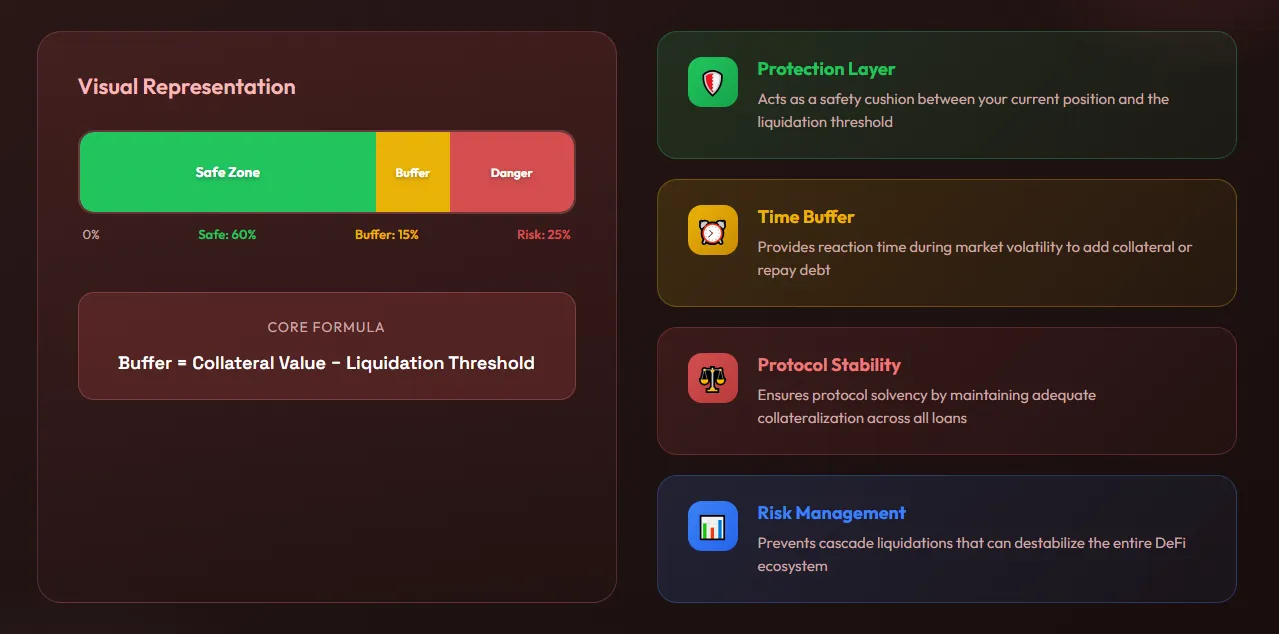

A liquidation buffer is the safety margin between a borrower’s current collateralization ratio and the liquidation threshold. This buffer represents the amount of price movement that can occur before a position becomes eligible for liquidation. For example, if a protocol requires a minimum collateralization ratio of 150% and a borrower maintains their position at 180% collateralization, they have a 30 percentage point buffer protecting them from liquidation.

The primary purpose of liquidation buffers is to provide time for borrowers to respond to adverse market movements. In the fast-moving world of cryptocurrency, prices can change dramatically within minutes or hours. Without adequate buffers, borrowers would face constant liquidation risk from even minor price fluctuations. The buffer creates a grace period during which borrowers can add more collateral, repay some debt, or simply wait for price recovery without losing their position.

From a protocol perspective, liquidation buffers serve multiple critical functions. They ensure that even if prices move rapidly, liquidators have sufficient margin to profitably close positions without creating bad debt for the protocol. They also help smooth out liquidation activity, preventing sudden spikes in selling pressure that could further destabilize markets. Well-calibrated buffers balance these protective functions against the desire to maximize capital efficiency for borrowers.

The Role of Liquidation Buffers in Risk Management

Risk management in DeFi protocols operates on multiple levels, and liquidation buffers form a crucial layer in this defensive architecture. At the individual position level, buffers protect borrowers from the consequences of short-term price volatility. At the protocol level, they ensure that the aggregate value of collateral always exceeds outstanding debt, maintaining system solvency. At the ecosystem level, properly designed buffers help prevent the contagion effects that can occur when one protocol’s failure triggers problems across interconnected DeFi platforms.

The relationship between liquidation buffers and other risk parameters creates a comprehensive safety framework. Loan-to-value ratios determine how much users can borrow against their collateral, while liquidation thresholds set the point at which positions become eligible for closure. The buffer is the dynamic space between these fixed parameters, expanding and contracting with market movements. DAOs in the DeFi Space must carefully consider how these parameters interact when making governance decisions about protocol risk settings.

Key Risk Management Parameters in DeFi Lending

| Parameter | Definition | Typical Range | Impact on Buffer |

|---|---|---|---|

| Loan to Value (LTV) | Maximum borrowing capacity as percentage of collateral | 50% to 80% | Lower LTV creates larger initial buffer |

| Liquidation Threshold | Collateralization level triggering liquidation | 65% to 85% | Higher threshold shrinks buffer zone |

| Liquidation Penalty | Bonus paid to liquidators from collateral | 5% to 15% | Higher penalty requires larger buffer |

| Health Factor | Real-time position safety metric | 1.0+ (safe) | Directly reflects current buffer size |

| Close Factor | Maximum debt repayable per liquidation | 25% to 100% | Affects buffer recovery speed |

How Liquidation Buffers Protect Against Market Volatility

Cryptocurrency markets are renowned for their volatility, with major assets routinely experiencing double digit percentage swings within single trading sessions. Liquidation buffers serve as the primary defense mechanism against this volatility, providing borrowers with protection that scales with the magnitude of their positions and the riskiness of their chosen collateral assets. Understanding how buffers interact with different volatility scenarios helps users make informed decisions about position sizing and collateral selection.

During periods of normal market activity, buffers absorb the natural fluctuations in collateral values without triggering liquidation events. A borrower maintaining a healthy buffer can weather typical price swings, allowing their position to remain open through short-term drawdowns that eventually recover. This persistence is valuable because it allows users to maintain their strategic positions without being shaken out by temporary volatility.

Extreme volatility events present the greatest challenge for liquidation buffer design. Flash crashes, liquidation cascades, and black swan events can rapidly deplete even substantial buffers. Protocols must design their parameters assuming worst case scenarios while still offering competitive capital efficiency during normal conditions. This balance is particularly challenging for volatile assets where historical price movements may not fully predict future extremes.

The relationship between leverage in DeFi and liquidation buffers is particularly important for users seeking to maximize their capital efficiency. Higher leverage means smaller buffers and greater liquidation risk, creating a direct tradeoff between potential returns and position safety.

Liquidation Buffers vs. Liquidation Thresholds: Key Differences

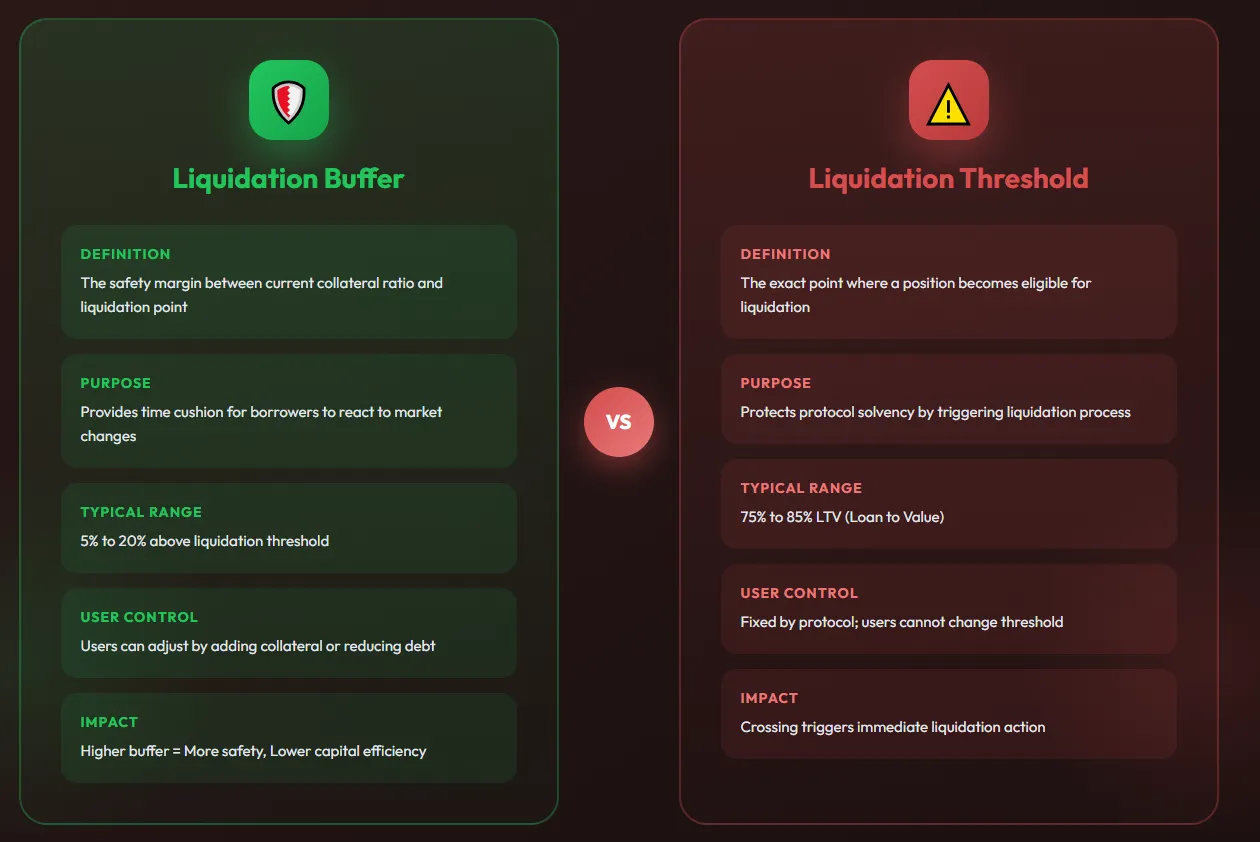

While often confused or used interchangeably, liquidation buffers and liquidation thresholds represent distinct concepts in DeFi risk management. Understanding the difference is essential for both borrowers managing their positions and developers designing lending protocols. The threshold is a fixed parameter set by protocol governance, while the buffer is a dynamic measure that changes constantly with market conditions.

Comparison: Liquidation Buffer vs. Liquidation Threshold

| Aspect | Liquidation Buffer | Liquidation Threshold |

|---|---|---|

| Definition | Safety margin between current ratio and threshold | Fixed point where liquidation becomes possible |

| Nature | Dynamic, changes with market prices | Static, set by governance |

| Control | User controlled through position management | Protocol controlled through governance |

| Measurement | Expressed in percentage points or health factor | Expressed as fixed percentage |

| Purpose | Provides time to react to market changes | Defines the boundary for liquidation eligibility |

| User Impact | Larger buffer means more safety, less capital efficiency | Higher threshold means earlier liquidation trigger |

Impact of Liquidation Buffers on Borrower Safety

For borrowers, liquidation buffers represent their primary defense against forced position closure and the associated penalties. The size of a borrower’s buffer directly correlates with their level of protection, but maintaining larger buffers comes at the cost of reduced capital efficiency. Understanding this tradeoff allows borrowers to make informed decisions that align with their risk tolerance and investment objectives.

Borrower safety is not merely about avoiding liquidation but also about managing the psychological stress of position monitoring. Users with adequate buffers can participate in DeFi lending without constant anxiety about minor price movements. This peace of mind has real value, allowing users to maintain their positions through temporary downturns rather than panic closing at unfavorable moments.

The consequences of inadequate buffer management can be severe. When liquidation occurs, borrowers face multiple penalties including the liquidation bonus paid to liquidators, potential slippage from forced selling in volatile markets, and the opportunity cost of lost positions. These costs often exceed the apparent savings from maintaining minimal buffers, making conservative buffer management a financially sound strategy for most users.

How Liquidation Buffers Improve Protocol Solvency

Protocol solvency depends on maintaining sufficient collateral to cover all outstanding debts at all times. Liquidation buffers contribute to this goal by ensuring that positions are closed before they become undercollateralized. When buffers are properly calibrated, the collateral recovered during liquidation exceeds the debt being repaid, preserving protocol health and protecting depositors who supply the lending capital.

The mathematical relationship between buffer size and protocol solvency can be expressed through the concept of the solvency margin. This margin represents the excess collateral value beyond what is strictly necessary to cover debts. Larger aggregate buffers across all borrowing positions translate to higher solvency margins, providing greater resilience against market shocks and reducing the probability of protocol-level losses.

Protocols that experience solvency crises typically suffer from inadequate buffer requirements, oracle manipulation, or cascade liquidation scenarios that overwhelm their protective mechanisms. Understanding these failure modes helps both users in selecting safer protocols and developers in designing more robust systems. The importance of appropriate buffer requirements becomes especially clear when examining historical protocol failures that resulted from insufficient safety margins.

Preventing Cascade Liquidations Through Buffer Design

Cascade liquidations represent one of the most dangerous failure modes in DeFi lending. These occur when initial liquidations trigger selling pressure that pushes prices lower, causing more positions to become eligible for liquidation, which creates additional selling pressure in a destructive feedback loop. Proper liquidation buffer design is essential for breaking this cycle before it can threaten protocol stability or broader market health.

Several buffer design strategies help mitigate cascade risk. Graduated liquidation thresholds allow partial position closure, reducing the immediate selling pressure from any single liquidation event. Time-weighted price oracles prevent flash crashes from triggering unnecessary liquidations. Liquidation caps limit the rate at which positions can be closed, spreading selling pressure over longer periods and allowing markets to absorb the impact more gradually.

The interconnected nature of DeFi means that cascade events in one protocol can spread to others. Collateral assets used across multiple platforms can experience correlated liquidations, amplifying market stress. DAOs in the DeFi Space governing lending protocols must consider these systemic risks when setting buffer parameters, balancing individual protocol competitiveness against broader ecosystem stability.

Liquidation Buffers and Capital Efficiency Trade-offs

Capital efficiency measures how effectively users can deploy their assets within a lending protocol. Higher capital efficiency means users can borrow more against the same collateral, maximizing the productive use of their capital. However, increased capital efficiency inherently reduces liquidation buffers, creating a fundamental tension between maximizing returns and maintaining adequate safety margins.

Different user profiles require different approaches to this trade-off. Professional traders with sophisticated monitoring systems and rapid response capabilities may operate with minimal buffers, accepting higher liquidation risk in exchange for greater capital efficiency. Casual users who cannot monitor positions continuously should maintain larger buffers, sacrificing some efficiency for reduced stress and lower liquidation probability.

Understanding risks in DeFi is essential for making informed decisions about buffer size. Users must weigh the potential returns from aggressive capital deployment against the very real possibility of liquidation losses. Historical data on asset volatility and liquidation frequency can inform these decisions, but ultimately, each user must determine their own risk tolerance.

Designing Optimal Liquidation Buffers: Key Parameters

Optimal liquidation buffer design requires careful consideration of multiple interrelated parameters. Protocol designers must balance competing objectives, including borrower protection, lender security, capital efficiency, and liquidator incentives. The following framework outlines the key considerations for achieving this balance while maintaining protocol competitiveness in the broader DeFi landscape.

Critical Parameters for Buffer Design

| Parameter | Considerations | Recommended Approach |

|---|---|---|

| Asset Volatility | Historical price swings, correlation patterns | Larger buffers for volatile assets |

| Market Liquidity | Depth of order books, slippage risk | Account for liquidation slippage |

| Oracle Latency | Price feed update frequency | Buffer must exceed potential price lag |

| Network Congestion | Transaction delays during stress | Extra margin for delayed liquidations |

| Liquidator Competition | Number and efficiency of liquidators | Ensure profitable liquidation incentives |

The Relationship Between Liquidation Buffers and Oracle Risk

Oracles provide the price data that determines whether positions are eligible for liquidation, making them a critical dependency for any lending protocol. Oracle failures, manipulation attacks, or simple latency can cause incorrect liquidations or, conversely, prevent necessary liquidations from occurring. Liquidation buffer design must account for oracle risk by incorporating sufficient safety margins to handle imperfect price information.

Time-weighted average price oracles protect against flash loan attacks and short-term manipulation by smoothing price data over defined periods. However, this smoothing introduces latency that can cause the oracle price to lag behind rapid market movements. Buffers must be large enough to cover this potential gap between oracle prices and true market prices during volatile conditions.

Multi-oracle systems that aggregate prices from multiple sources provide additional resilience against single point failures. These systems typically require consensus among data sources before accepting price updates, reducing manipulation risk but potentially increasing latency. The choice of Oracle architecture directly impacts appropriate buffer sizing, with more robust Oracle systems permitting slightly tighter buffers while maintaining equivalent safety levels.

Case Studies: Liquidation Buffer Failures in DeFi

Historical analysis of DeFi protocol failures provides valuable lessons about the importance of adequate liquidation buffer design. Several high-profile incidents have demonstrated how insufficient buffers, combined with extreme market conditions or oracle failures, can lead to significant user losses and protocol insolvency. These case studies inform current best practices and highlight the ongoing challenges of DeFi risk management.

Black Thursday in March 2020 saw cryptocurrency prices crash dramatically within hours, triggering massive liquidations across DeFi lending protocols. Network congestion prevented many liquidations from executing promptly, allowing positions to become severely undercollateralized. Some protocols accumulated bad debt when collateral values dropped below outstanding loans before liquidators could act. This event prompted widespread reassessment of buffer requirements across the industry.

Oracle manipulation attacks have exploited insufficient buffers by artificially manipulating price feeds to trigger unwarranted liquidations or prevent necessary ones. These attacks highlight the interconnection between oracle security and buffer design, demonstrating that neither mechanism alone provides adequate protection. Comprehensive risk management requires both robust oracles and appropriate buffers working together.

Having proper DeFi insurance coverage can provide an additional layer of protection against protocol failures and liquidation events that exceed normal parameters.

Case Studies: Protocols with Effective Liquidation Buffers

While failure cases provide important warnings, successful protocols demonstrate that well-designed liquidation buffers can maintain stability through even severe market conditions. These success stories share common characteristics, including conservative initial parameters, active governance oversight, and continuous monitoring and adjustment of risk settings based on market conditions and user behavior.

Leading lending protocols have survived multiple market crashes without accumulating bad debt, demonstrating the effectiveness of their buffer designs. Key success factors include asset-specific parameter tuning, graduated liquidation mechanisms, and robust oracle implementations. These protocols typically maintain higher buffers than strictly necessary during normal conditions, accepting reduced capital efficiency in exchange for resilience during stress scenarios.

The role of active governance in maintaining effective buffers cannot be overstated. DAOs in the DeFi Space that regularly review and adjust parameters based on changing market conditions maintain healthier protocols than those with static settings. This ongoing attention to risk management represents a significant operational commitment but proves essential for long-term protocol sustainability.

Liquidation Buffers in High Volatility vs. Stable Asset Markets

Different asset classes require fundamentally different approaches to liquidation buffer design. Stablecoins, major cryptocurrencies, and governance tokens each present unique risk profiles that demand tailored parameter settings. Understanding these differences helps both users select appropriate collateral for their risk tolerance and protocol designers create comprehensive parameter frameworks.

Buffer Requirements by Asset Class

| Asset Type | Typical LTV | Liquidation Threshold | Recommended Buffer | Key Risks |

|---|---|---|---|---|

| Stablecoins | 75% to 85% | 80% to 90% | 10% to 15% | Depeg events |

| Major Crypto (BTC, ETH) | 70% to 80% | 75% to 85% | 20% to 30% | Market volatility |

| Altcoins | 50% to 65% | 60% to 75% | 30% to 50% | High volatility, liquidity |

| Governance Tokens | 40% to 55% | 50% to 65% | 40% to 60% | Extreme volatility, thin markets |

| LP Tokens | 60% to 70% | 65% to 75% | 25% to 35% | Impermanent loss, complexity |

Users dealing with LP tokens as collateral should also understand impermanent loss mitigation strategies to protect their positions from value erosion that compounds liquidation risk.

Governance Considerations When Adjusting Liquidation Buffers

Protocol governance plays a central role in managing liquidation buffer parameters over time. As market conditions evolve, user bases grow, and new risks emerge, governance must adapt parameters to maintain appropriate safety margins while remaining competitive. This ongoing responsibility requires careful consideration of multiple stakeholder interests and potential unintended consequences of parameter changes.

Governance proposals affecting liquidation parameters typically undergo extensive community discussion and analysis before implementation. Risk committees, security researchers, and experienced community members contribute perspectives that help identify potential issues with proposed changes. This deliberative process, while sometimes slow, helps prevent hasty adjustments that could destabilize the protocol or harm users.

The role of decentralized identity in DeFi may eventually enable more sophisticated approaches to parameter setting, potentially allowing protocols to offer customized risk parameters based on verified user credentials or track records.

Circular flow showing: Market Analysis → Risk Assessment → Community Discussion → Proposal Creation → Voting Period → Implementation → Monitoring → Back to Market Analysis

Future Trends: Adaptive and Dynamic Liquidation Buffers

The future of liquidation buffer design points toward increasingly sophisticated dynamic systems that automatically adjust parameters based on real time market conditions. These adaptive buffers could provide optimal protection during volatile periods while maximizing capital efficiency during stable conditions, eliminating the need for manual governance intervention in response to changing markets.

Machine learning models trained on historical market data could predict volatility spikes and preemptively tighten buffer requirements before problems develop. Such predictive systems would need careful design to avoid false positives that unnecessarily restrict borrowing capacity, but the potential benefits in terms of both safety and efficiency are substantial.

Cross-protocol buffer coordination represents another frontier in DeFi risk management. As the ecosystem becomes more interconnected, cascade risks increasingly span multiple protocols. Future systems might share risk information across platforms, enabling coordinated responses to systemic threats that would overwhelm individual protocol defenses.

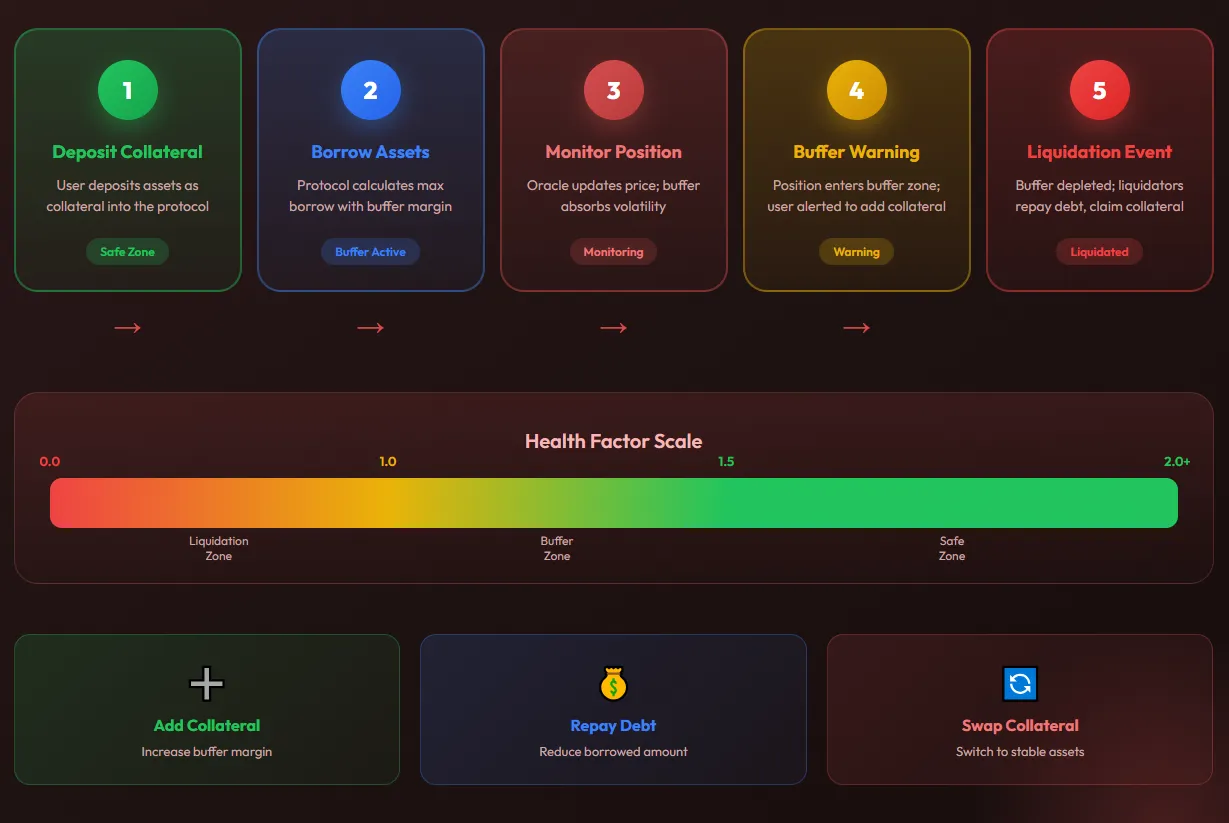

Liquidation Buffer Lifecycle

1. Position Creation

User deposits collateral and borrows, establishing initial buffer

2. Market Fluctuation

Buffer expands or contracts with price movements

3. User Response

Add collateral, repay debt, or accept current risk level

4. Resolution

Position survives volatility or liquidation occurs

Ready to Build a Secure DeFi Lending Protocol?

Partner with Nadcab Labs to design robust liquidation mechanisms that protect users and ensure protocol sustainability.

Conclusion: Liquidation Buffers as a Foundation for Sustainable DeFi

Liquidation buffers represent a fundamental pillar of sustainable DeFi lending protocol design. These safety margins protect borrowers from the consequences of market volatility, maintain protocol solvency during stress conditions, and help prevent the cascade liquidation events that can destabilize entire markets. Understanding how buffers work and how to manage them effectively is essential knowledge for anyone participating in DeFi lending, whether as a borrower, liquidator, protocol designer, or governance participant.

The evolution of liquidation buffer design reflects the broader maturation of the DeFi ecosystem. Early protocols often launched with minimal risk management infrastructure, learning painful lessons when market conditions tested their assumptions. Today’s leading protocols incorporate sophisticated buffer mechanisms informed by years of real-world experience and rigorous quantitative analysis. This progress demonstrates the DeFi community’s capacity for learning and improvement, suggesting that future iterations will continue to enhance both safety and efficiency.

As DAOs in the DeFi Space continue to evolve their approaches to risk management, liquidation buffers will remain central to protocol design considerations. The ongoing tension between capital efficiency and safety will drive continued innovation in buffer mechanisms, potentially including the dynamic and adaptive systems discussed in this guide. Users and developers who understand these fundamentals will be well-positioned to navigate the opportunities and challenges that lie ahead in the rapidly evolving DeFi landscape.

Frequently Asked Questions

While maintaining a higher buffer significantly reduces liquidation risk, no buffer can guarantee complete protection during extreme market events. Black swan events with sudden 50%+ price drops can still trigger liquidations even with conservative buffers. The key is balancing adequate protection with capital efficiency.

During high volatility periods, monitoring every 4 to 6 hours is recommended. Many experienced DeFi users set up automated alerts when their health factor drops below 1.5 or when their buffer shrinks to less than 20% above the liquidation threshold.

After partial liquidation, your remaining collateral stays in the protocol, but your health factor improves as a portion of debt is repaid. You can then choose to add more collateral, repay additional debt, or withdraw excess collateral if your position is healthy enough.

Yes, liquidation buffer requirements vary based on blockchain speed and congestion. Slower networks or those prone to congestion often require larger buffers because price updates and liquidation transactions may be delayed, increasing risk during rapid price movements.

Liquidation buffers provide limited protection against flash loan attacks since these attacks manipulate prices within a single transaction. Protocols combat this through time-weighted average price (TWAP) oracles and multi-block confirmation requirements rather than buffer size alone.

Most protocols apply stricter liquidation parameters to governance tokens due to their higher volatility and lower liquidity. This often means lower loan-to-value ratios and effectively larger required buffers compared to stablecoins or major cryptocurrencies.

Liquidation gas costs vary by network and protocol complexity, typically ranging from $5 to $50 on Ethereum mainnet during normal conditions. During network congestion, costs can spike significantly, which is why some liquidators may delay actions, making larger buffers more important.

Cross-chain protocols face additional challenges with bridge delays and cross-chain oracle latency. They typically require larger buffers (often 10% to 15% more) to account for the time needed to relay price information and execute liquidations across different networks.

Yes, liquidation events are typically taxable in most jurisdictions. The forced sale of collateral may trigger capital gains or losses, and the liquidation penalty could affect your cost basis calculations. Consult a crypto tax professional for jurisdiction-specific guidance.

Isolated margin positions have separate buffers for each position, limiting risk to that specific collateral. Cross margin shares collateral across positions, meaning one position’s buffer can absorb losses from another, but also exposes the entire portfolio to liquidation if overall health deteriorates.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.