Key Takeaways: DeFi Lending Rates

- Unlike traditional finance, DeFi lending rates are determined by real-time supply and demand within liquidity pools. As borrowing demand increases or available liquidity decreases, rates automatically adjust through smart contracts, making them highly responsive to market conditions.

- The percentage of assets being borrowed from a lending pool directly influences lending and borrowing rates. Higher utilization leads to higher interest rates to attract more lenders and control borrowing demand, while lower utilization results in reduced rates.

- By eliminating banks and centralized authorities, DeFi increases efficiency and transparency. However, this shift also introduces smart contract risk, governance risk, and protocol-level vulnerabilities that users must actively manage.

- Interest rate models, collateral requirements, reserve factors, and incentive programs are all controlled through decentralized governance. Community-driven governance ensures protocols evolve based on user needs rather than centralized decision-making.

- Stablecoins generally offer lower but more predictable returns, while volatile crypto assets provide higher potential yields with increased risk. Different protocols apply unique rate models, leading to meaningful variations in returns for the same asset.

- During volatile periods, borrowing demand often increases, pushing lending rates higher. Conversely, risk-off environments reduce borrowing activity, lowering rates. Understanding market cycles helps users anticipate rate changes.

- Larger, well-capitalized liquidity pools experience smoother rate movements, while smaller pools can see sharp rate fluctuations. Protocol maturity and total value locked play important roles in rate consistency.

- Exceptionally high yields may indicate elevated smart contract risk, aggressive token incentives, or unsustainable economic models. Users should evaluate why rates are high rather than focusing solely on returns.

- Variable rates offer flexibility and higher potential upside, while fixed rates provide predictability and cost certainty. Choosing between them depends on risk tolerance, market outlook, and investment duration.

- Compliance requirements, geographic restrictions, and legal uncertainty affect protocol design, capital flows, and rate competitiveness, making regulation an important factor to monitor.

- Lenders can improve returns through rate comparison, timing, and incentives, while borrowers can reduce costs through collateral selection, refinancing, and fixed-rate options.

- As protocols mature, interest rate models, governance mechanisms, and risk controls continue improving, making DeFi lending more resilient, competitive, and accessible over time.

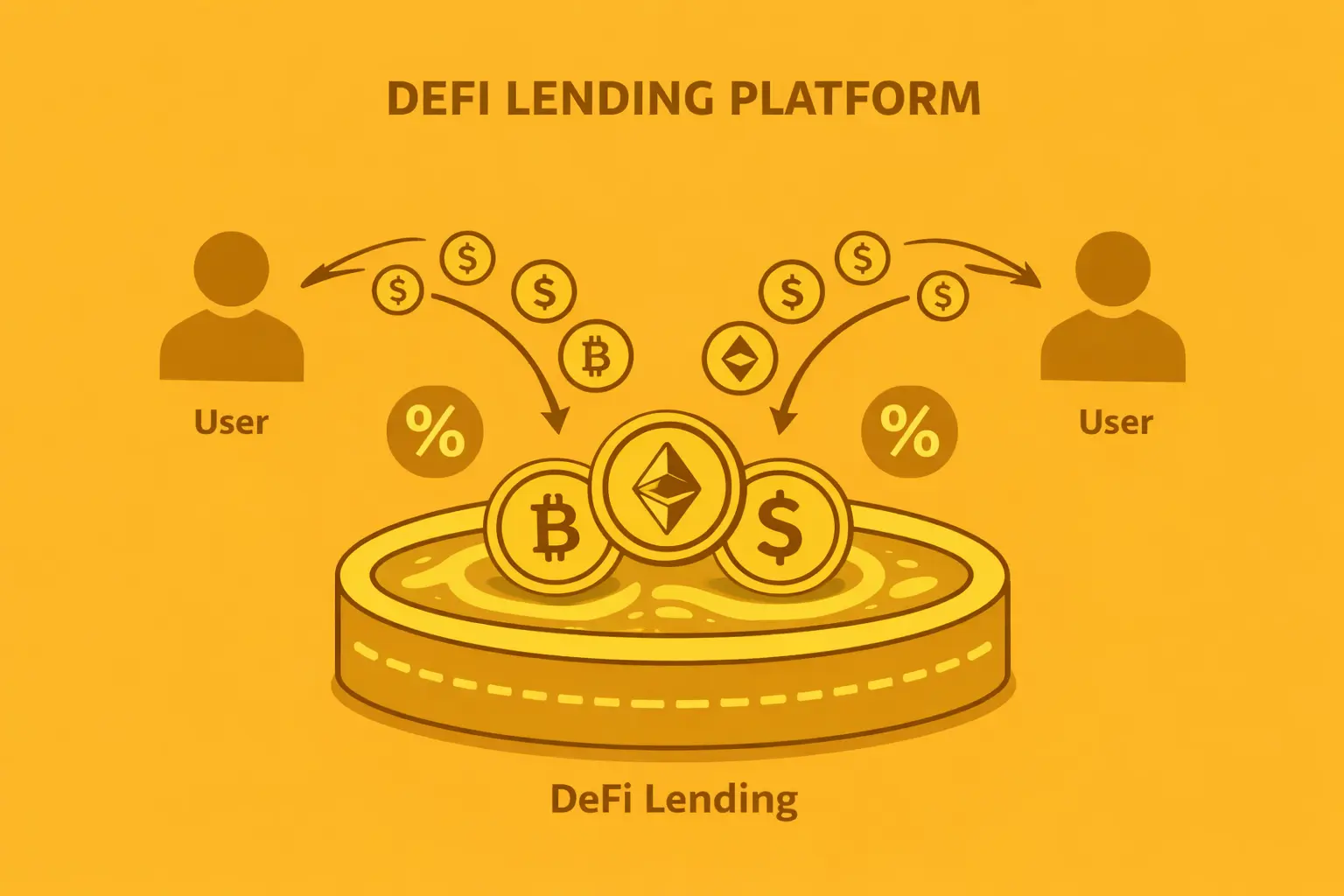

Decentralized Finance, commonly known as DeFi, has revolutionized the way individuals and institutions interact with financial services. Unlike traditional banking systems that rely on intermediaries, DeFi operates on blockchain technology, enabling peer-to-peer transactions without the need for central authorities. At the heart of this ecosystem lies lending and borrowing, two fundamental activities that have attracted billions of dollars in total value locked across various protocols.

DeFi lending and borrowing platforms allow users to lend their digital assets to earn interest or borrow assets by providing collateral. This creates a dynamic marketplace where rates fluctuate based on supply and demand, protocol-specific mechanisms, and broader market conditions. The beauty of DeFi lending lies in its accessibility, transparency, and efficiency, offering opportunities that were previously available only to institutional investors in traditional finance.

The emergence of DeFi application development has enabled developers to create sophisticated platforms that automate lending and borrowing processes through smart contracts. These self-executing agreements eliminate the need for manual intervention, reducing costs and increasing efficiency. As the DeFi ecosystem continues to mature, understanding lending rates becomes crucial for both lenders seeking to maximize returns and borrowers looking to minimize their cost of capital.

The governance structure of DeFi protocols plays a significant role in shaping lending rates and overall platform dynamics. Community members can vote on critical parameters such as interest rate models, collateral requirements, and risk management strategies. These Governance Proposals for decentralized finance ensure that platforms evolve according to the collective will of their users rather than the decisions of a centralized authority.

What Are Lending Rates on DeFi?

Lending rates in DeFi represent the annual percentage yield (APY) or annual percentage rate (APR) that lenders receive for supplying their assets to lending pools, or the interest that borrowers must pay to access liquidity. These rates are expressed as percentages and can vary significantly across different protocols, assets, and market conditions. Unlike traditional finance where banks set rates based on central bank policies and internal risk assessments, DeFi lending rates are algorithmically determined and continuously adjusted based on real-time market dynamics.

The calculation of Lending Rates on DeFi involves complex mathematical models embedded within smart contracts. These models consider the utilization rate of each lending pool, which is the ratio of borrowed assets to total supplied assets. When utilization is high, indicating strong borrowing demand, interest rates increase to incentivize more lenders to supply assets and discourage excessive borrowing. Conversely, when utilization is low, rates decrease to encourage borrowing and optimize capital efficiency.

DeFi platform development has led to the creation of various interest rate models, each with its own approach to balancing supply and demand. The most common model is the kinked interest rate model, which features different slopes before and after a target utilization rate. This creates a gradual increase in rates as utilization rises, followed by a steeper increase once a threshold is crossed, preventing liquidity crises while maintaining competitive rates during normal market conditions.

Governance Proposals in DeFi frequently address the calibration of these interest rate parameters. Token holders can submit and vote on proposals to adjust the slope of the interest rate curve, change the optimal utilization target, or modify the reserve factor that determines how much interest is retained by the protocol. These DeFi Governance Proposals ensure that lending rates remain competitive while maintaining the long-term sustainability of the protocol.

How DeFi Lending Rates Differ from Traditional Finance

The fundamental differences between DeFi lending rates and traditional finance rates stem from their underlying operational structures. Traditional banks operate as intermediaries, collecting deposits from customers and lending those funds to borrowers while capturing the spread between deposit rates and lending rates as profit. This intermediated model involves significant overhead costs, including physical branches, regulatory compliance, and employee salaries, all of which impact the rates offered to customers.

In contrast, DeFi eliminates intermediaries through the use of smart contracts and blockchain technology. Lenders and borrowers interact directly through protocol interfaces, with automated systems handling all transactions, interest calculations, and collateral management. This disintermediation results in narrower spreads between lending and borrowing rates, allowing lenders to earn higher yields while borrowers often access capital at more competitive rates than traditional financial institutions would offer.

| Feature | Traditional Finance | DeFi Lending |

|---|---|---|

| Intermediaries | Banks and financial institutions | Smart contracts and protocols |

| Rate Determination | Set by institutions based on policies | Algorithmic based on supply and demand |

| Transparency | Limited visibility into rate calculations | Fully transparent and auditable on-chain |

| Accessibility | Requires KYC, credit checks, approvals | Permissionless access with crypto wallet |

| Rate Adjustment Speed | Periodic updates, often quarterly | Real-time adjustments per block |

| Governance | Centralized board decisions | Decentralized community voting |

Another critical distinction lies in the transparency and auditability of rates. Traditional banks often obscure the exact methodology behind their rate calculations, leaving customers with limited insight into why they receive certain rates. DeFi protocols, however, operate with complete transparency, as all smart contract code is publicly viewable and all transactions are recorded on the blockchain. Users can verify exactly how rates are calculated and track historical rate changes to make informed decisions.

The role of Governance Proposals in DeFi further differentiates these platforms from traditional finance. While traditional banks make decisions through closed-door board meetings, DeFi protocols enable token holders to participate directly in governance through voting on proposals. These Governance Proposals for decentralized finance can modify interest rate models, adjust risk parameters, or implement entirely new features, giving users a democratic voice in shaping the platforms they use.

Key Factors That Influence DeFi Lending Rates

Multiple interconnected factors influence Lending Rates on DeFi ecosystems, creating a complex web of variables that determine the yields lenders receive and the interest borrowers pay. Understanding these factors is essential for anyone participating in DeFi lending markets, as they directly impact profitability and risk exposure. The primary factors include utilization rates, asset volatility, protocol-specific parameters, market liquidity, and broader macroeconomic conditions affecting the cryptocurrency market.

Utilization rate stands as the most immediate factor affecting lending rates in most DeFi protocols. This metric measures the percentage of supplied assets currently being borrowed. When utilization is low, excess supply relative to demand pushes rates down as the protocol incentivizes borrowing to improve capital efficiency. As utilization increases, rates rise to attract more lenders and moderate borrowing demand, preventing liquidity shortages that could leave lenders unable to withdraw their funds.

Asset-specific characteristics also play a crucial role in determining lending rates. Volatile assets typically command higher borrowing rates due to increased liquidation risk, while stablecoins generally offer lower but more predictable rates. The collateralization requirements for different assets vary based on their historical price volatility, with riskier assets requiring higher collateral ratios to protect lenders from potential losses during market downturns.

Protocol reputation and security track record significantly influence the rates that platforms can offer. Established protocols with extensive auditing histories and proven security measures can offer more competitive rates because users have greater confidence in the safety of their funds. Newer protocols or those with past security incidents may need to offer higher rates to attract liquidity, compensating users for taking on additional smart contract risk.

Example: Impact of Utilization on Lending Rates

Consider a USDC lending pool on a major DeFi protocol with 10 million USDC supplied by lenders. At 40% utilization (4 million borrowed), the lending rate might be 3% APY. If borrowing demand increases to 70% utilization (7 million borrowed), the rate could jump to 8% APY. If utilization reaches 90% (9 million borrowed), approaching the protocol’s optimal threshold, rates might spike to 20% APY or higher to encourage additional supply and discourage further borrowing.

The broader cryptocurrency market environment also exerts considerable influence on DeFi lending rates. During bull markets, when asset prices are rising, borrowing demand typically increases as traders seek leverage to maximize gains. This elevated demand pushes utilization higher, resulting in increased lending rates. Conversely, during bear markets or periods of high volatility, risk aversion tends to reduce borrowing activity, leading to lower utilization and decreased rates.

Governance Proposals in DeFi serve as the mechanism through which communities can adjust these various factors to optimize protocol performance. Token holders regularly evaluate whether current interest rate parameters are achieving desired outcomes and submit proposals to modify them when necessary. These DeFi Governance Proposals might adjust the base rate, slope coefficients, optimal utilization targets, or reserve factors, all of which directly impact the rates users experience.

Supply and Demand Dynamics in DeFi Markets

The fundamental economic principle of supply and demand operates as the core mechanism governing DeFi lending rates. However, the speed and precision with which these markets clear distinguishes them from traditional financial markets. Smart contracts continuously monitor supply and demand conditions, adjusting rates in real-time to maintain equilibrium and ensure that both lenders and borrowers find attractive opportunities within the ecosystem.

On the supply side, lenders deposit their digital assets into lending pools with the expectation of earning passive income. The total supply available in a lending pool represents the aggregate capital that lenders have made available for borrowing. When supply is abundant relative to demand, competition among lenders for yield leads to lower rates, as the market clears at a price point where borrowers find it attractive to access this plentiful capital.

Demand for borrowed assets stems from various use cases within the DeFi ecosystem. Traders may borrow to establish leveraged positions, arbitrageurs might borrow to exploit price discrepancies across markets, liquidity providers could borrow to enhance their capital efficiency, and some users simply need temporary access to specific assets without selling their holdings. Each of these demand sources responds differently to changes in interest rates, creating a complex demand curve that protocols must navigate.

| Market Condition | Supply Level | Demand Level | Rate Direction |

|---|---|---|---|

| Bull Market Peak | Moderate to High | Very High | Rising Sharply |

| Market Consolidation | Stable | Moderate | Stable |

| Bear Market | High (flight to safety) | Low | Declining |

| Volatility Spike | Decreasing (withdrawals) | Increasing (hedging) | Rising Rapidly |

| New Protocol Launch | Low Initially | Low to Moderate | Variable |

The elasticity of supply and demand in DeFi markets varies significantly across different assets and protocols. Stablecoin markets typically exhibit more predictable supply and demand patterns, with users responding rationally to rate changes. In contrast, markets for volatile assets like ETH or BTC can experience rapid shifts in supply and demand based on market sentiment, leading to more dramatic rate fluctuations.

Seasonal patterns and cyclical trends also influence supply and demand dynamics in DeFi lending markets. For instance, during periods of high network activity and gas fees on Ethereum, borrowing demand might decrease as the cost of interacting with smart contracts becomes prohibitive for smaller positions. Conversely, during times of major DeFi protocol launches or liquidity mining campaigns, both supply and demand can surge simultaneously as users seek to maximize their participation in new opportunities.

Through Governance Proposals in DeFi, communities can implement mechanisms to smooth out extreme supply and demand imbalances. These proposals might introduce reserve requirements, implement rate caps or floors, or create incentive programs that encourage supply during periods of high demand. Such Governance Proposals for decentralized finance demonstrate how protocols can adapt their economic models to maintain stability while preserving the fundamental market-driven nature of rate determination.

Role of Liquidity Pools in Rate Determination

Liquidity pools serve as the foundational infrastructure enabling DeFi lending and borrowing, functioning as smart contract-based reserves where lenders deposit assets and borrowers withdraw them. The composition, size, and utilization of these pools directly determine the interest rates that participants receive or pay. Each liquidity pool operates as an independent market with its own supply and demand dynamics, though interconnections between pools can create complex cross-pool effects on rates.

The total value locked in a liquidity pool represents the aggregate capital available for lending, providing a measure of the pool’s depth and capacity to meet borrowing demand. Deeper pools can accommodate larger borrowing transactions without experiencing significant rate increases, while shallow pools may see dramatic rate spikes when utilization rises quickly. This relationship between pool depth and rate stability makes liquidity attraction a critical priority for DeFi platforms through DeFi platform development initiatives.

Pool composition matters significantly, as different assets within the same protocol can exhibit vastly different utilization patterns and rates. A protocol might have abundant USDC supply with low utilization and correspondingly low rates, while simultaneously experiencing high demand for DAI borrowing with elevated rates. These discrepancies create arbitrage opportunities that sophisticated users exploit, gradually bringing rates across similar assets into closer alignment through market forces.

The reserve factor, a parameter specific to each liquidity pool, determines what portion of interest payments are retained by the protocol rather than distributed to lenders. This factor creates a buffer that protocols can use to build treasury reserves, fund development, or provide insurance against potential losses. Higher reserve factors reduce the effective yield that lenders receive, potentially making a pool less attractive compared to competitors, while lower reserve factors maximize lender returns at the expense of protocol revenue.

Liquidity Pool Lifecycle

Phase 1: Pool Initialization

Protocol deploys smart contracts and sets initial parameters including interest rate model, reserve factor, and collateral requirements. Early liquidity providers receive incentives to bootstrap the pool.

Phase 2: Growth and Adoption

As awareness grows, more lenders supply assets while borrowers begin utilizing the pool. Rates find equilibrium based on organic supply and demand. Protocol may adjust parameters through governance.

Phase 3: Maturity and Optimization

Pool reaches stable size with consistent utilization patterns. Community fine-tunes parameters through governance proposals to optimize capital efficiency and competitive positioning.

Phase 4: Evolution or Migration

Pool either continues operating with periodic governance updates, undergoes major upgrades through migration to new smart contracts, or potentially winds down if demand diminishes significantly.

Cross-pool dynamics create interesting effects on rate determination across DeFi ecosystems. When one protocol offers significantly higher rates than competitors for the same asset, liquidity tends to flow toward the higher-yielding opportunity, increasing supply and gradually lowering rates until equilibrium is restored across platforms. This capital mobility ensures that DeFi lending markets remain relatively efficient, though information asymmetries and smart contract risk considerations can maintain persistent rate differentials.

Governance Proposals in DeFi frequently address liquidity pool management, as communities seek to optimize pool parameters for maximum efficiency and competitiveness. These proposals might adjust reserve factors, modify interest rate curves, introduce new collateral types, or implement incentive programs to attract liquidity during crucial growth phases. The effectiveness of these Governance Proposals for decentralized finance in maintaining healthy liquidity pools ultimately determines a protocol’s long-term success in attracting and retaining users.

Fixed vs Variable Lending Rates on DeFi

The choice between fixed and variable lending rates represents one of the most significant decisions that DeFi users must make when participating in lending markets. Each approach offers distinct advantages and trade-offs, appealing to different user preferences regarding certainty, risk tolerance, and market outlook. Understanding these differences enables lenders and borrowers to select strategies that align with their financial goals and risk management requirements.

Variable rates, the default option in most DeFi lending protocols, fluctuate continuously based on real-time supply and demand conditions within liquidity pools. These rates adjust automatically according to the interest rate model embedded in the protocol’s smart contracts, providing maximum flexibility and capital efficiency. Lenders benefit from rate increases during periods of high demand, while borrowers enjoy lower costs when markets are quiet. However, this flexibility comes with uncertainty, as rates can change dramatically within short timeframes.

Fixed rate lending protocols introduce certainty into DeFi borrowing and lending by allowing users to lock in rates for predetermined periods. These platforms employ sophisticated mechanisms such as yield tokenization, where future yield is separated from the principal and traded as distinct assets. Lenders who prioritize predictable returns can lock in fixed rates, sacrificing potential upside from rate increases in exchange for guaranteed yields. Borrowers seeking budget certainty for leveraged positions or other purposes can similarly lock in borrowing costs, protecting themselves from rate spikes.

| Aspect | Variable Rates | Fixed Rates |

|---|---|---|

| Predictability | Low; rates change continuously | High; rates locked for term duration |

| Flexibility | Maximum; enter/exit anytime | Limited; early exit may incur penalties |

| Capital Efficiency | Higher; instant deployment | Lower; requires matching counterparties |

| Risk Exposure | Rate volatility risk | Opportunity cost risk |

| Best For | Active traders, short-term positions | Long-term planning, risk-averse users |

| Protocol Complexity | Simple algorithmic models | Complex yield splitting mechanisms |

The implementation of fixed rate protocols requires sophisticated DeFi application development to create mechanisms for rate discovery and term matching. Some protocols use automated market makers specifically designed for interest rate swaps, allowing users to exchange variable rate exposure for fixed rates without requiring direct counterparties. Others employ order book systems where users can specify desired rates and terms, waiting for matches from counterparties with opposing preferences.

Hybrid models have emerged that attempt to combine the best features of both approaches. These systems might offer base variable rates with optional fixed rate overlays, allowing users to lock in portions of their positions while maintaining flexibility on the remainder. Some protocols provide dynamic fixed rates that adjust periodically based on realized market conditions, offering medium-term certainty without permanently locking users into potentially unfavorable rates.

The choice between fixed and variable rates often depends on market conditions and individual circumstances. During periods of historically low rates, locking in fixed rates may appear attractive if users anticipate future increases. Conversely, when rates are elevated, variable exposure allows users to benefit from eventual normalization. Borrowers planning leveraged strategies with defined timeframes often prefer fixed rates to avoid liquidation risks from rate spikes, while lenders seeking maximum yield during volatile markets may favor variable exposure.

Governance Proposals in DeFi play a crucial role in expanding rate options available to users. Communities might vote on proposals to introduce fixed rate functionality to existing variable rate protocols, adjust the terms and maturities available for fixed rate positions, or modify the mechanisms through which fixed rates are determined. These Governance Proposals for decentralized finance ensure that protocols can evolve to meet diverse user needs while maintaining the core principles of decentralization and transparency.

Impact of Market Volatility on Lending Rates

Market volatility exerts profound influence on DeFi lending rates, creating both opportunities and risks for protocol participants. Volatility affects lending markets through multiple channels, including changes in borrowing demand, shifts in risk perception, liquidation events, and broader impacts on cryptocurrency market liquidity. Understanding these dynamics helps users anticipate rate movements and position themselves advantageously during different market regimes.

During periods of high volatility, borrowing demand typically increases as traders seek leverage to capitalize on price movements or hedge existing positions. This elevated demand pushes utilization rates higher across lending pools, triggering automatic interest rate increases according to protocol algorithms. The magnitude of these increases depends on the steepness of the interest rate curve and how close utilization approaches the optimal threshold defined in the protocol’s parameters.

Conversely, extreme volatility can trigger risk-off behavior where users reduce leverage and repay loans to avoid liquidation risks. This deleveraging decreases borrowing demand, lowering utilization rates and subsequently reducing lending rates. The net effect on rates during volatile periods depends on which force dominates, with early volatility phases often seeing rate increases from leverage-seekers, followed by rate decreases as risk aversion takes hold and positions are unwound.

Case Study: Volatility Event Impact on Rates

Scenario: A major cryptocurrency experiences a 30% price drop within 24 hours, triggering widespread market volatility.

Hour 0 to 6: Initial panic leads to increased borrowing as traders attempt to short the market or hedge positions. Stablecoin lending rates spike from 5% to 15% APY as utilization jumps from 60% to 85%.

Hour 6 to 12: Liquidation cascades begin as collateral values fall. Borrowed assets are automatically repaid through liquidations, reducing utilization. Rates begin to moderate, falling to 10% APY.

Hour 12 to 24: Risk aversion dominates as remaining borrowers voluntarily reduce leverage. Utilization drops to 45%, and rates decline to 3% APY, below pre-event levels as many traders remain sidelined.

Day 2 onwards: Market stabilizes and rates gradually normalize to 4% to 6% range as borrowing appetite cautiously returns and new opportunities emerge.

Asset-specific volatility considerations create differential impacts on lending rates across various tokens. Volatile assets like altcoins typically maintain higher baseline lending rates compared to stablecoins, reflecting the greater liquidation risk that lenders face. When volatility spikes, the rate differential between stable and volatile assets often widens further as risk premiums expand. This relationship creates natural risk gradients across DeFi lending markets, with users able to choose their preferred risk-return profile.

Protocol design choices significantly influence how volatility translates into rate changes. Protocols with aggressive interest rate curves experience dramatic rate swings during volatile periods, potentially reaching triple-digit APYs when utilization approaches maximum levels. More conservative protocols with gentler slopes exhibit greater rate stability but may struggle to maintain adequate liquidity during stress periods. Finding the optimal balance represents an ongoing challenge addressed through governance and protocol evolution.

Volatility also affects lending rates indirectly through its impact on other DeFi activities. High volatility often corresponds with increased trading volumes and liquidity mining opportunities across decentralized exchanges and yield farming protocols. As users redirect capital toward these higher-yielding temporary opportunities, lending pool supply may decrease, pushing rates higher even if borrowing demand remains constant. This interconnectedness across DeFi protocols creates complex feedback loops that amplify or dampen rate movements.

Through Governance Proposals in DeFi, communities can implement mechanisms to mitigate extreme rate volatility while preserving market responsiveness. These proposals might introduce rate change caps that limit how quickly rates can adjust, implement smoothing functions that average recent utilization data rather than responding instantly to spikes, or create dynamic reserve requirements that automatically adjust during volatile periods. Such Governance Proposals for decentralized finance demonstrate the ongoing evolution of protocols in response to real-world market conditions and user feedback.

Smart Contracts and Automated Interest Rate Models

Smart contracts form the technological backbone of DeFi lending, executing complex interest rate calculations and adjustments without human intervention. These self-executing programs encode the economic logic that governs how protocols respond to changing market conditions, translating abstract interest rate theories into concrete algorithmic implementations that run continuously on blockchain networks. The sophistication and reliability of these smart contracts directly determine a protocol’s ability to maintain stable operations while providing competitive rates.

The most prevalent interest rate model in DeFi is the utilization-based approach, where rates are mathematical functions of the utilization ratio. A typical implementation features a piecewise linear function with different slopes before and after an optimal utilization point. Below optimal utilization, rates increase gradually to encourage borrowing and optimize capital efficiency. Above optimal utilization, rates increase more steeply to attract additional supply and discourage excessive borrowing that could threaten liquidity availability for lenders wanting to withdraw funds.

Advanced interest rate models incorporate additional variables beyond simple utilization, creating more nuanced responses to market conditions. Some protocols consider historical volatility metrics, adjusting rate sensitivity based on recent market turbulence. Others implement time-weighted utilization calculations that prevent temporary spikes from causing dramatic rate changes, smoothing out short-term fluctuations while still responding to sustained shifts in supply and demand.

Common Interest Rate Model Formula

When Utilization ≤ Optimal:

Borrow Rate = Base Rate + (Utilization / Optimal Utilization) × Slope 1

When Utilization > Optimal:

Borrow Rate = Base Rate + Slope 1 + ((Utilization – Optimal) / (1 – Optimal)) × Slope 2

Where: Base Rate represents minimum interest, Slope 1 governs rate increase in normal range, Slope 2 creates steeper increase above optimal utilization, and Optimal Utilization is typically set between 70% and 90%.

Smart contract security represents a paramount concern for DeFi lending protocols, as vulnerabilities in rate calculation logic could be exploited to drain liquidity pools or manipulate rates. Rigorous auditing processes examine interest rate implementations for potential exploits, edge cases, and unintended behaviors under extreme conditions. Multiple rounds of professional audits, formal verification where possible, and gradual deployment with conservative parameters help minimize risks associated with novel rate model implementations.

The automation enabled by smart contracts creates unprecedented efficiency in lending markets, eliminating delays and manual processes that characterize traditional finance. Rate adjustments occur every block on most networks, providing near-instantaneous responses to changing conditions. Interest accrual happens continuously rather than being calculated periodically, ensuring that all parties receive precisely fair compensation for the exact duration of their participation. This level of precision and automation represents a fundamental advantage of blockchain-based lending over traditional systems.

Upgradeability considerations create tension between security and flexibility in smart contract design. Immutable contracts provide maximum security assurance but cannot be modified to fix bugs or improve rate models. Upgradeable contracts through proxy patterns allow improvements but introduce centralization risks if upgrade authority is not properly decentralized. Most mature protocols navigate this trade-off through time-locked governance processes where Governance Proposals in DeFi must pass through waiting periods before implementation, giving users time to react to undesirable changes.

As DeFi platform development continues advancing, interest rate models grow increasingly sophisticated, incorporating machine learning predictions, cross-protocol data feeds, and adaptive algorithms that evolve based on historical performance. These innovations require community approval through Governance Proposals for decentralized finance, ensuring that improvements align with user preferences and maintain the trustless properties that make DeFi appealing. The ongoing evolution of automated interest rate models represents one of the most active areas of innovation in the DeFi lending space.

Governance Tokens and Their Effect on Lending Rates

Governance tokens serve as the cornerstone of decentralized decision-making in DeFi protocols, giving holders the power to influence critical parameters including interest rate models, reserve factors, collateral requirements, and protocol revenue distribution. The relationship between governance tokens and lending rates operates through multiple channels, both direct through protocol parameter adjustments and indirect through token incentive programs that affect supply and demand dynamics across lending pools.

Direct governance influence on lending rates occurs through Governance Proposals in DeFi that explicitly modify interest rate parameters. Token holders can propose and vote on changes to base rates, slope coefficients, optimal utilization targets, or even complete overhauls of interest rate models. These decisions reflect the community’s collective assessment of optimal protocol configuration, balancing considerations such as competitive positioning, capital efficiency, risk management, and protocol revenue generation.

Liquidity mining programs represent an indirect but powerful way that governance affects lending rates. Protocols often distribute governance tokens to lenders and borrowers as additional incentives beyond interest payments, effectively subsidizing participation and altering the true economic returns. When protocols offer high governance token rewards, the nominal lending rate might appear modest while the total APY including token rewards reaches much higher levels. These programs must be carefully calibrated through governance to ensure sustainability while achieving growth objectives.

| Governance Action | Impact on Lending Rates | Time Frame |

|---|---|---|

| Increase optimal utilization target | Lower rates at same utilization level | Immediate |

| Launch liquidity mining rewards | Increase supply, decrease rates | Days to weeks |

| Increase reserve factor | Lower effective lender yields | Immediate |

| Add new collateral asset | Increase borrowing demand, raise rates | Weeks to months |

| Steepen interest rate curve | More volatile rates, higher at high utilization | Immediate |

| Implement rate smoothing | Reduce rate volatility | Immediate |

The governance process itself creates interesting dynamics around rate changes. Proposals that would significantly alter lending rates often generate extensive debate within protocol communities, with different stakeholders advocating for changes that benefit their positions. Lenders typically favor parameters that increase yields, such as higher slope coefficients or lower reserve factors. Borrowers prefer configurations that minimize borrowing costs, like higher optimal utilization targets or gentler rate curves. Finding compromises that satisfy diverse constituencies while optimizing protocol health requires thoughtful deliberation and data-driven analysis.

Vote timing and execution delays introduce temporal considerations into how governance affects rates. Most protocols implement waiting periods between proposal passage and execution, ranging from days to weeks, during which users can react to upcoming changes. This creates anticipation effects where users might adjust their positions ahead of parameter changes, pre-emptively shifting supply and demand in ways that alter rates before governance modifications even take effect. These dynamics add layers of complexity to predicting how governance actions will ultimately impact markets.

Governance token value often correlates with protocol success, creating incentive alignment between token holders and protocol health. When governance decisions improve lending rates’ competitiveness or risk management, attracting more users and generating greater revenue, the governance token typically appreciates. This positive feedback loop encourages responsible governance, as token holders recognize that short-sighted decisions prioritizing immediate benefits over long-term sustainability could damage token value more than any temporary rate advantage provides.

The evolution of governance systems continues advancing with innovations like delegation, where token holders can assign their voting power to trusted experts, and reputation-weighted voting, where consistent participation and quality contributions earn greater influence. These improvements make Governance Proposals in DeFi more effective by ensuring that well-informed participants drive decisions about complex technical matters like interest rate optimization. As governance mechanisms mature, their ability to maintain optimal lending rates while preserving decentralization improves, demonstrating the viability of community-driven protocol management through thoughtful Governance Proposals for decentralized finance.

Comparison of Lending Rates Across Major DeFi Protocols

The DeFi lending landscape features numerous protocols, each implementing unique approaches to rate determination, user experience, and protocol governance. Comparing lending rates across these platforms reveals important differences in economic models, risk tolerances, and competitive positioning strategies. Users benefit from understanding these variations to optimize their capital allocation, while protocol designers learn from competitor approaches to improve their own platforms through informed DeFi application development.

Established lending protocols like Aave and Compound dominate DeFi lending markets, collectively managing billions in total value locked. These platforms offer relatively similar base rates for major assets like USDC, DAI, and ETH, though differences emerge in how aggressively rates respond to utilization changes. Aave typically features slightly higher peak rates due to its steeper interest rate curve above optimal utilization, providing stronger incentives for supply during high-demand periods. Compound’s more conservative approach produces greater rate stability but potentially less attractive yields during utilization spikes.

Newer protocols often differentiate themselves through innovative rate mechanisms or specialized market niches. Some focus on isolated lending pools that reduce contagion risk but may exhibit more volatile rates due to lower liquidity. Others implement cross-chain lending, enabling users to supply assets on one blockchain while borrowing on another, creating arbitrage opportunities that influence rates across networks. Still others target specific assets like real-world asset tokens or synthetic assets, developing customized rate models appropriate for these unique collateral types.

| Protocol Feature | Traditional Model | Aggressive Model | Conservative Model |

|---|---|---|---|

| Base Rate | 2% to 4% | 0% to 2% | 3% to 5% |

| Optimal Utilization | 80% | 90% | 70% |

| Rate at Optimal | 8% to 12% | 15% to 25% | 6% to 10% |

| Max Rate (100% util) | 50% to 100% | 100% to 300% | 30% to 60% |

| Rate Volatility | Moderate | High | Low |

| Target User | Balanced risk/reward | Yield maximizers | Conservative lenders |

Protocol maturity significantly influences the rates that platforms can offer sustainably. Established protocols with proven security records and large communities can often offer slightly lower rates than newer competitors because users accept reduced yields in exchange for lower smart contract risk. New protocols must compensate for perceived higher risk by offering premium rates, often supplemented by governance token incentives that boost total returns well beyond base lending rates. This creates a lifecycle pattern where protocols initially compete on high yields, then gradually transition to competing on security and feature richness as they mature.

Asset-specific rate variations across protocols create arbitrage opportunities for sophisticated users. The same stablecoin might earn 5% on one platform and 8% on another due to differences in utilization, incentive programs, or user preferences. Rational capital flows should theoretically eliminate these discrepancies, but practical considerations like gas costs, user inertia, smart contract risk assessment differences, and information asymmetries maintain persistent rate gaps that attentive users can exploit.

Cross-protocol rate competition drives continuous improvement across the DeFi lending ecosystem. When one protocol implements an attractive new feature or rate structure, competitors must respond through their own innovations or risk losing market share. This competitive pressure benefits users through better rates, lower fees, improved user experiences, and more robust risk management. The pace of innovation in DeFi lending far exceeds traditional finance precisely because this competitive dynamic operates without regulatory barriers to entry or incumbent advantages beyond genuine technological and economic superiority.

Through systematic Governance Proposals in DeFi, communities monitor competitive landscapes and adjust their protocols to maintain attractive positioning. Regular rate comparison analyses inform governance decisions about parameter adjustments, helping protocols optimize their position in the market. These Governance Proposals for decentralized finance demonstrate how decentralized communities can collectively navigate competitive pressures while preserving the democratic principles that distinguish DeFi from traditional financial institutions.

Risks Associated with High Lending Rates on DeFi

While high lending rates naturally attract capital to DeFi protocols, these elevated yields often signal underlying risks that users must carefully evaluate before committing funds. Understanding the relationship between rates and risk enables informed decision-making, helping users distinguish between sustainable yield opportunities and potentially dangerous situations where high rates mask fundamental problems. Risk assessment requires examining multiple dimensions including smart contract security, economic sustainability, counterparty risks, and broader market conditions.

Smart contract risk represents the most acute danger associated with DeFi lending, as vulnerabilities in protocol code can result in total loss of deposited funds. Protocols offering exceptionally high rates relative to market norms may lack comprehensive security audits, employ novel untested mechanisms, or have insufficient insurance coverage against potential exploits. While established protocols undergo rigorous testing and auditing, even audited contracts can contain undiscovered vulnerabilities, making diversification and position sizing critical risk management strategies.

Unsustainable economic models often manifest through artificially elevated rates that protocols maintain through governance token emissions rather than organic revenue generation. When protocols subsidize yields with token rewards that far exceed protocol earnings, they create ponzi-like dynamics where new user deposits effectively fund existing user returns. This model can persist temporarily but inevitably collapses when token prices decline or emission schedules reduce rewards, causing cascading withdrawals that leave late participants with losses.

Warning Signs of Risky High Rate Situations

Excessive Token Emissions: Total APY composed primarily of governance tokens rather than organic interest, especially if token has no clear value capture mechanism.

Unaudited Smart Contracts: Protocol lacks audits from reputable security firms or has recently deployed major updates without fresh audits.

Anonymous Team: Developers remain anonymous without established reputation in DeFi community, making accountability difficult.

Concentrated Liquidity: Few large depositors control majority of lending pool, creating vulnerability to coordinated withdrawal attacks.

Unusual Collateral: Protocol accepts exotic or illiquid assets as collateral without clear pricing mechanisms or liquidation infrastructure.

Liquidity risk emerges when high utilization rates, often accompanying elevated lending rates, prevent lenders from withdrawing their funds promptly. Protocols implement interest rate spikes at high utilization specifically to discourage this scenario, but during extreme market stress, rates alone may prove insufficient to restore liquidity quickly. Users locked into positions during crisis periods face opportunity costs from inability to deploy capital elsewhere or realize losses from being forced to wait for borrowers to repay before accessing their funds.

Counterparty concentration risk arises when a small number of large borrowers account for significant portions of lending pool utilization. If these borrowers face financial difficulties or deliberately exploit protocol mechanics, their defaults could impact lender returns or protocol solvency. Protocols manage this risk through collateralization requirements and automated liquidation systems, but extreme market volatility can create situations where collateral value falls faster than liquidations can process, leaving lenders exposed to losses.

Regulatory uncertainty represents an often-overlooked risk associated with high-yield DeFi lending. Protocols offering rates that significantly exceed traditional finance may attract regulatory scrutiny, particularly if they serve users in jurisdictions with aggressive securities enforcement. Sudden regulatory actions could force protocol shutdowns, freeze assets, or impose compliance requirements that fundamentally alter economic models, potentially leaving users with stranded funds or significantly reduced yields.

Governance structures play crucial roles in managing these risks, with robust Governance Proposals in DeFi enabling communities to implement risk mitigation measures proactively. Effective governance can introduce position size limits, adjust collateralization requirements, implement insurance funds, or establish emergency pause mechanisms that protect users during crisis scenarios. The quality of risk management governance, evaluated through the track record of past Governance Proposals for decentralized finance, provides important signals about whether high rates represent attractive opportunities or dangerous traps that prudent users should avoid.

Opportunities for Lenders to Maximize Returns

Sophisticated lenders employ various strategies to optimize their returns in DeFi lending markets, going beyond simply depositing assets into the highest-yielding pools. These approaches combine rate comparison, timing optimization, risk management, and strategic use of protocol incentives to generate superior risk-adjusted returns. Successful implementation requires understanding market dynamics, monitoring multiple protocols, and maintaining flexibility to shift capital as opportunities evolve.

Rate shopping across multiple protocols represents the most straightforward optimization strategy, though execution complexity increases with the number of platforms monitored. Lenders can use aggregation platforms and analytics tools to track rates across the DeFi ecosystem in real-time, identifying the most attractive opportunities for each asset they hold. Gas costs for moving funds between protocols must be factored into return calculations, as frequent rebalancing can erode gains, particularly for smaller position sizes. Strategic lenders establish minimum rate differentials that justify migration costs before executing moves.

Timing market cycles to capitalize on rate volatility offers enhanced returns for active lenders willing to monitor markets closely. Rates typically spike during periods of high market volatility as borrowing demand surges, creating temporary windows of elevated yields. Lenders who maintain liquid positions or use limit order systems can quickly deploy capital when rates spike, capturing premium returns before market normalization brings rates back down. This strategy requires constant attention and quick execution capabilities but can significantly outperform passive holding strategies.

| Strategy | Complexity Level | Potential Return Boost | Risk Level |

|---|---|---|---|

| Simple rate shopping | Low | 1% to 3% additional APY | Low |

| Automated vault strategies | Low to Medium | 2% to 5% additional APY | Medium |

| Liquidity mining optimization | Medium | 5% to 15% additional APY | Medium to High |

| Volatility timing | High | 10% to 30% additional APY | Medium |

| Cross-chain arbitrage | Very High | 15% to 50% additional APY | High |

| Incentive farming rotation | Very High | 20% to 100% additional APY | Very High |

Automated yield optimization vaults simplify return maximization for lenders who prefer passive strategies. These smart contract-based systems automatically reallocate capital across multiple lending protocols based on algorithmic strategies that target optimal risk-adjusted returns. Vaults handle the complexity of monitoring rates, executing rebalancing transactions, and claiming rewards, charging management fees that typically range from 1% to 5% annually. For lenders with smaller positions where gas costs make active management uneconomical, vaults provide access to sophisticated strategies that would otherwise be impractical.

Strategic participation in liquidity mining programs can dramatically boost total returns beyond base lending rates. Protocols frequently launch incentive campaigns distributing governance tokens to lenders, sometimes offering rewards that exceed organic interest income by multiples. Skilled lenders track upcoming program launches, position capital ahead of announcements, and manage token claim timing and disposition strategies to maximize value capture. Success requires understanding tokenomics, monitoring governance discussions where programs are proposed, and acting decisively when opportunities arise.

Diversification across multiple protocols and assets reduces concentration risk while potentially improving total returns through uncorrelated yield sources. Rather than maximizing exposure to the single highest-yielding opportunity, prudent lenders spread capital across several attractive options, protecting against smart contract failures or unexpected rate changes at any single protocol. This approach sacrifices some upside potential for significantly improved downside protection, aligning with principles of modern portfolio theory adapted to DeFi lending contexts.

Active engagement with protocol governance creates opportunities for lenders to influence rate structures in ways that benefit their positions. By participating in Governance Proposals in DeFi, lenders can advocate for parameter changes that improve yields, such as reduced reserve factors or optimized interest rate curves. Contributing thoughtful analysis and engaging constructively in governance forums builds reputation that enhances proposal influence. These Governance Proposals for decentralized finance represent more than technical parameter adjustments, they embody the democratic values that make DeFi uniquely responsive to user needs and preferences.

Borrower Perspective: Cost of Capital in DeFi

For borrowers, DeFi lending rates represent the cost of accessing liquidity without selling existing holdings, enabling leverage strategies, arbitrage opportunities, and flexible liquidity management. Understanding how to minimize borrowing costs while maintaining appropriate risk levels helps borrowers maximize the profitability of their strategies. The borrower perspective on rates differs fundamentally from the lender view, as borrowers balance cost minimization against the value generated through capital deployment.

Collateral selection significantly impacts borrowing costs, as different assets command varying loan-to-value ratios and interest rates based on their volatility and liquidity profiles. Stable, liquid collateral like ETH or wrapped BTC typically allows higher leverage with lower rates compared to volatile altcoins. Borrowers must assess whether the opportunity they’re pursuing justifies the higher costs associated with using riskier collateral, or whether converting to more favorable collateral assets makes economic sense after accounting for transaction costs and potential tax implications.

Borrowing duration strategy impacts total costs, particularly during periods of rate volatility. Short-term borrowing to capture immediate arbitrage opportunities minimizes exposure to rate fluctuations but requires careful monitoring to avoid situations where rates spike unexpectedly, eroding profit margins. Long-term borrowing for sustained leverage positions exposes borrowers to average rates over extended periods, benefiting from periods of low rates but suffering during high-rate environments. Fixed rate protocols address this uncertainty at the cost of potentially higher average rates.

Borrowing Cost Calculation Example

Scenario: Borrower wants to leverage a long ETH position by borrowing 50,000 USDC against 20 ETH collateral

Direct Costs:

Interest Rate: 8% APY on USDC borrow = $4,000 annual cost

Gas Fees: Initial borrow + periodic repayments = approximately $200

Opportunity Costs:

Lost ETH lending yield: 20 ETH at 3% APY = $1,800 (assuming ETH at $3,000)

Locked capital unable to participate in other opportunities

Risk Costs:

Liquidation risk if ETH falls below safety threshold

Smart contract risk exposure

Total Annual Cost: Approximately $6,000 in direct costs plus opportunity and risk costs, meaning ETH position must appreciate by more than 10% to justify the leverage

Protocol selection for borrowing involves comparing rates across platforms while weighing other factors like liquidation thresholds, maximum loan-to-value ratios, and protocol reliability. Newer protocols might offer lower rates to attract users but potentially expose borrowers to higher smart contract risks or less favorable liquidation parameters. Established protocols command trust that justifies marginally higher rates for risk-averse borrowers who prioritize capital preservation over marginal cost savings.

Active rate management enables sophisticated borrowers to minimize costs through strategic refinancing. When rates fall significantly at competing protocols, borrowers can repay existing loans and reborrow elsewhere at lower rates, though gas costs and potential price slippage during the migration must justify the effort. Some borrowers maintain positions across multiple protocols, reallocating borrow allocation to favor the lowest-cost source at any given time, effectively creating a dynamic weighted average cost of capital that tracks the most competitive market rates.

Participation in borrowing incentive programs can offset or even reverse net borrowing costs. Some protocols distribute governance tokens to borrowers in addition to lenders, subsidizing borrow costs to encourage utilization. In extreme cases, token rewards can exceed interest payments, creating situations where borrowers earn net income simply by maintaining loan positions. These opportunities rarely persist long-term as arbitrageurs exploit them, but attentive borrowers can capture significant value during promotional periods.

Through Governance Proposals in DeFi, borrowers can advocate for rate structures that reduce their costs while maintaining protocol sustainability. Proposals might suggest flattening interest rate curves to reduce costs at high utilization, increasing optimal utilization targets, or implementing borrower-focused incentive programs. Active borrower participation in governance ensures that Governance Proposals for decentralized finance represent balanced community interests rather than skewing exclusively toward lender preferences, creating healthier long-term protocol dynamics that serve all stakeholders equitably.

Stablecoins vs Crypto Assets: Rate Differences

The distinction between stablecoin lending rates and volatile crypto asset rates represents one of the most fundamental divisions in DeFi lending markets. These two asset categories exhibit markedly different rate behaviors, risk profiles, and use cases, reflecting their distinct roles within the broader cryptocurrency ecosystem. Understanding these differences helps users select appropriate assets for their lending or borrowing needs based on risk tolerance and strategic objectives.

Stablecoin lending rates typically range from 2% to 10% under normal market conditions, providing relatively predictable yields with limited principal volatility. These rates reflect the stable nature of underlying collateral and the reduced liquidation risk that lenders face. Stablecoins serve primarily as sources of liquid capital for borrowers seeking to leverage volatile crypto positions or access working capital without converting holdings. The competitive stablecoin lending market, with multiple protocols offering similar assets, keeps rates relatively tight and responsive to broad DeFi market conditions.

Volatile crypto asset rates vary more dramatically, both across different assets and over time based on market conditions. Major assets like ETH and BTC often earn 1% to 5% in lending yields during calm markets, though rates can spike to 10% or higher during periods of intense leverage demand. Altcoins with higher volatility typically command premium rates, sometimes reaching double-digit yields even during normal conditions, reflecting the greater liquidation risk that lenders assume. These higher rates compensate lenders for accepting principal value fluctuations alongside interest rate uncertainty.

| Characteristic | Stablecoins | Major Crypto Assets | Altcoins |

|---|---|---|---|

| Typical Lending Rate | 3% to 8% APY | 1% to 5% APY | 5% to 15% APY |

| Rate Volatility | Low to Moderate | Moderate | High |

| Principal Risk | Very Low (depegging risk) | High | Very High |

| Liquidation Frequency | Rare | Occasional | Common |

| Borrower Use Case | Leverage, liquidity | Short positions, hedging | Speculation, yield farming |

| Market Depth | Very High | High | Variable |

The relationship between stablecoin and crypto asset rates creates interesting market dynamics during different cycle phases. Bull markets typically see stablecoin rates rise as traders borrow stables to purchase crypto assets, while crypto asset lending rates may decline as holders prefer to maintain exposure rather than lending. Bear markets reverse this pattern, with reduced stablecoin demand lowering rates while crypto assets that are borrowed for shorting may see rate increases. Understanding these cycles helps users optimize their positioning across asset classes.

Stablecoin depeg risk, though rare, represents the primary concern for stablecoin lenders beyond standard smart contract risks. Events where stablecoins lose their dollar peg can cause rapid devaluation, potentially erasing months or years of accumulated interest in minutes. Diversification across multiple stablecoin types, preferring decentralized stablecoins backed by transparent collateral, and maintaining position sizes appropriate to personal risk tolerance all help manage this low-probability but high-impact risk.

Tax implications differ significantly between stablecoin and crypto asset lending. Stablecoin interest typically qualifies as ordinary income without capital gains complications, simplifying tax reporting. Crypto asset lending involves both interest income and potential capital appreciation or depreciation of the principal, creating more complex tax situations that vary by jurisdiction. Some users prefer stablecoin lending specifically to avoid these complications, even if absolute returns might be higher from crypto asset exposure.

Protocol governance through Governance Proposals in DeFi often addresses the balance between stablecoin and crypto asset markets within protocols. Proposals might adjust relative rate parameters to encourage balance between asset types, introduce specialized pools for specific stablecoin or crypto asset categories, or implement cross-asset borrowing mechanisms. These Governance Proposals for decentralized finance shape how protocols serve diverse user needs across the full spectrum of digital assets, ensuring that both conservative stablecoin users and aggressive crypto speculators find attractive opportunities within the same platform.

Regulatory and Compliance Considerations Affecting DeFi Rates

The regulatory landscape surrounding DeFi continues evolving rapidly, with government agencies worldwide grappling with how to apply existing financial regulations to decentralized protocols or whether new frameworks are required. Regulatory uncertainty and compliance requirements directly impact DeFi lending rates through multiple channels, including geographic restrictions, protocol design choices, insurance requirements, and user verification processes. Understanding these regulatory dimensions helps users and developers navigate the complex intersection of innovation and compliance.

Geographic restrictions imposed by protocols in response to regulatory concerns affect the composition of user bases and consequently the rates that protocols can sustainably offer. When protocols exclude users from major markets due to regulatory uncertainty, they sacrifice potential liquidity and must compete for smaller pools of permissible users. This reduced addressable market can lead to less competitive rates compared to fully permissionless alternatives, though it may provide greater regulatory clarity and reduced legal risks that some users value highly.

Know Your Customer and Anti-Money Laundering requirements, when implemented by lending protocols, introduce friction that affects user behavior and rate dynamics. Protocols requiring identity verification may attract more conservative institutional participants who prefer regulatory compliance but deter privacy-focused users who form a significant portion of DeFi user bases. The resulting user composition influences aggregate risk tolerance, capital availability, and borrowing patterns, all of which flow through to affect prevailing rates across asset classes.

Securities law considerations loom large over DeFi lending, as regulatory authorities in some jurisdictions may view lending interest as securities returns or lending pool tokens as investment contracts. Protocols navigate these concerns through careful token design, avoiding features that could trigger securities classification while maintaining sufficient functionality for effective lending markets. The legal conservatism necessary to minimize securities law risk may constrain protocol innovation, potentially limiting the rate optimization strategies available to development teams through DeFi platform development initiatives.

Regulatory Impact Pathways on Lending Rates

Direct Rate Caps: Jurisdictions might impose maximum interest rates that protocols can charge, directly limiting rate ranges regardless of market conditions.

Capital Requirements: Reserve requirements similar to traditional banking could force protocols to hold larger buffers, reducing capital efficiency and affecting rate competitiveness.

Insurance Mandates: Requirements for deposit insurance increase operational costs that protocols pass through to users via wider spreads or lower lending rates.

Reporting Obligations: Extensive transaction reporting requirements create compliance costs that reduce net returns or require fee increases.

Tax Treatment: Unfavorable tax categorization of DeFi lending income reduces after-tax returns, affecting net attractiveness of rates offered.

Regulatory clarity, when achieved, can actually improve DeFi lending rates by attracting institutional capital that had remained sidelined due to legal uncertainty. Well-designed regulatory frameworks that provide safe harbors for compliant DeFi protocols enable pension funds, endowments, and corporate treasuries to participate in lending markets, bringing significant capital that increases supply and potentially reduces borrowing costs. The challenge lies in developing regulations that facilitate this institutional participation without undermining the permissionless innovation that makes DeFi unique.

Cross-border regulatory arbitrage enables protocols to optimize their regulatory positioning by choosing favorable jurisdictions for legal incorporation while remaining accessible to global user bases through decentralized infrastructure. This regulatory shopping can help protocols avoid overly restrictive frameworks, though it creates legal complexity and potential exposure if regulators pursue enforcement actions based on where users are located rather than where protocols are established. The ongoing evolution of international regulatory cooperation will significantly influence how effectively this strategy works long-term.

Decentralized autonomous organization structures, where protocols operate without centralized corporate entities, present both opportunities and challenges from regulatory perspectives. True decentralization may place protocols beyond the practical reach of many regulatory frameworks designed for traditional corporations, potentially allowing more aggressive rate optimization and feature development. However, regulators increasingly seek to attribute responsibility to developers, token holders, or other participants even in nominally decentralized systems, creating uncertainty about liability exposure that may constrain innovation and affect rate competitiveness.

Governance participation becomes even more critical in regulatory contexts, as Governance Proposals in DeFi often address compliance questions and regulatory risk management strategies. Communities must collectively decide how to respond to regulatory developments, whether through implementing optional compliance features, restricting geographic access, or maintaining fully permissionless operation despite legal risks. These Governance Proposals for decentralized finance shape not just technical protocol parameters but fundamental philosophical questions about how DeFi balances innovation, accessibility, and regulatory acceptability in ways that ultimately affect the rates and services available to all users.

Build Smarter DeFi Lending Solutions

Launch secure, scalable DeFi lending and borrowing platforms with optimized interest rate models, robust smart contracts, and governance-driven control.

Future Trends in DeFi Lending Rates

The DeFi lending landscape continues evolving rapidly, with emerging trends likely to significantly reshape how lending rates are determined, what ranges are sustainable, and how users interact with lending protocols. Anticipating these developments helps current participants prepare for coming changes while informing developers building the next generation of lending infrastructure through advanced DeFi application development. Several key trends appear positioned to influence DeFi lending rates substantially over the coming years.

Institutional adoption of DeFi lending represents perhaps the most consequential trend, with major financial institutions increasingly exploring DeFi participation despite regulatory uncertainties. As institutional capital enters lending markets, bringing billions in conservative long-term capital, supply could increase dramatically, potentially compressing lending rates across many assets. However, institutional borrowing demand for leverage and hedging could offset this supply increase, and the net effect remains unclear. The institutional presence may also reduce rate volatility as professional treasury managers provide more stable liquidity compared to retail participants prone to panic withdrawals.

Real-world asset tokenization promises to expand the scope of DeFi lending beyond purely digital assets to include traditional securities, real estate, commodities, and other tangible assets. These new collateral types will require specialized rate models that account for their unique risk characteristics, potentially creating entirely new rate regimes within DeFi. Real-world assets typically exhibit lower volatility than cryptocurrencies but introduce new risks like regulatory seizure, physical damage, or illiquidity during stress periods, necessitating novel approaches to rate determination that existing DeFi protocols must develop.

| Emerging Trend | Potential Impact on Rates | Timeline |

|---|---|---|

| Institutional participation | Increased supply, potentially lower rates | 2 to 5 years |

| Real-world asset integration | New rate markets, diverse profiles | 3 to 7 years |

| AI-driven rate optimization | More efficient pricing, reduced spreads | 1 to 3 years |

| Cross-chain liquidity | Rate convergence across networks | 2 to 4 years |

| Credit scoring introduction | Personalized rates, tiered pricing | 3 to 6 years |

| Regulatory frameworks | Potential caps or stabilization | 2 to 5 years |

Artificial intelligence and machine learning integration into rate determination algorithms represents another frontier for DeFi innovation. Advanced models could analyze vast datasets encompassing on-chain metrics, market sentiment, macroeconomic indicators, and protocol-specific factors to optimize interest rate responses more effectively than current algorithmic approaches. These AI-driven systems might predict demand shifts before they fully materialize, allowing proactive rate adjustments that maintain optimal utilization more consistently. However, the complexity and potential opacity of machine learning models could create governance challenges around Governance Proposals in DeFi regarding their implementation and parameter tuning.

Decentralized credit scoring systems could revolutionize DeFi lending by enabling personalized interest rates based on borrower history and reputation rather than treating all borrowers identically. Users with strong repayment records and responsible leverage usage might qualify for preferential rates, while those with poor histories face premium pricing. This transition from pure collateral-based lending to hybrid credit-plus-collateral models would bring DeFi closer to traditional finance efficiency while maintaining blockchain transparency. The technical challenges of creating tamper-proof on-chain credit histories without compromising privacy remain significant but appear increasingly solvable.

Layer 2 scaling solutions and alternative layer 1 blockchains are reducing transaction costs that currently limit DeFi lending participation for smaller users. As gas fees decline toward negligible levels, rate shopping and active position management become economically viable even for modest capital amounts, intensifying competition between protocols and likely compressing rate spreads. Lower transaction costs also enable more sophisticated automated strategies, potentially increasing overall market efficiency and reducing the rate premiums that currently exist due to various friction costs.

The future development of DeFi lending will be shaped substantially by community governance, with Governance Proposals for decentralized finance determining how protocols adapt to these emerging trends. Communities must balance innovation with risk management, efficiency with decentralization, and growth with sustainability. The protocols that successfully navigate these trade-offs through effective governance, incorporating community feedback while maintaining technical excellence through careful DeFi platform development, will likely emerge as the dominant lending platforms of the next decade, offering the most competitive and sustainable lending rates in an increasingly sophisticated DeFi ecosystem.

FAQs

No, DeFi lending rates are not guaranteed. Unlike traditional savings accounts where interest rates are set by banks, DeFi lending rates are market-driven and algorithmically adjusted. Most protocols use variable interest rate models that respond instantly to changes in supply and demand within lending pools. Even fixed-rate DeFi products depend on smart contract execution and protocol stability, meaning returns are predictable but still not risk-free.

Yes, it is possible to lose money when lending on DeFi, although lending is generally considered lower risk than trading or leverage. Risks include smart contract vulnerabilities, protocol insolvency, stablecoin depegging, governance failures, and liquidity shortages during extreme market conditions. While reputable protocols reduce these risks through audits and conservative parameters, DeFi lending does not offer capital guarantees.

DeFi lending rates can change continuously, often every blockchain block. Rates adjust automatically whenever borrowing or lending activity alters the utilization of a liquidity pool. This means rates can shift multiple times per hour, especially during volatile market periods. Unlike traditional finance, there is no fixed update schedule—rate changes happen in real time.

In DeFi, borrowers typically cannot default in the traditional sense. Loans are overcollateralized, meaning borrowers must deposit more value than they borrow. If the value of collateral falls below required thresholds, smart contracts automatically trigger liquidations to repay lenders. This automated risk management system is designed to protect lenders, though extreme market crashes can still introduce slippage and liquidation risks.

DeFi lending offers greater transparency, self-custody, and permissionless access, as users retain control of their funds and interact directly with smart contracts. Centralized platforms may offer fixed returns and easier onboarding but introduce custodial risk and reliance on company solvency. The choice depends on whether a user prioritizes control and decentralization or simplicity and customer support.

There is no protocol-imposed minimum amount for DeFi lending. However, transaction fees (gas costs) can make small deposits inefficient, particularly on Ethereum mainnet. Many users prefer Layer 2 networks or low-fee blockchains, which allow profitable lending even with smaller amounts of capital.

Base lending rates themselves do not become negative, but net returns can appear negative or positive depending on incentives. In some cases, borrowers receive governance token rewards that exceed interest costs, effectively creating negative borrowing costs. For lenders, sudden rate drops can reduce returns but not result in negative interest on supplied assets.

Interest accrues automatically and continuously through smart contracts. Earnings are typically paid in the same asset supplied to the lending pool and become claimable or withdrawable alongside the principal. If incentive rewards are involved, governance tokens must usually be claimed separately and may fluctuate in value.

In many jurisdictions, DeFi lending income is considered taxable income at the time it is earned. Governance token rewards, capital gains, and liquidation events may be taxed differently depending on local regulations. Because tax treatment varies widely, users should maintain transaction records and consult tax professionals familiar with crypto regulations.

Non-custodial wallets such as MetaMask, Rabby, Trust Wallet, and hardware wallets like Ledger are commonly used for DeFi lending. The best wallet depends on the blockchain ecosystem you use and your security preferences. Hardware wallets provide additional protection by keeping private keys offline.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.