Key Takeaways

- DeFi interest rate curves algorithmically determine borrowing costs and lending yields based on utilization rates, creating self-regulating markets without central authority intervention.

- The kinked interest rate model features gentle slopes at low utilization and steep increases above optimal thresholds, preventing liquidity exhaustion while maintaining protocol stability.

- Smart contracts continuously calculate and update interest rates with every transaction, ensuring transparent and deterministic rate discovery accessible to all participants.

- Variable and fixed interest rate mechanisms serve different user needs, with variable rates offering market efficiency and fixed rates providing predictability for financial planning.

- Market liquidity profoundly impacts interest rate dynamics, creating feedback loops that can amplify trends and occasionally trigger rapid rate movements during stressed conditions.

- Leading protocols implement distinct interest rate models customized to their specific assets, risk tolerances, and user bases, demonstrating ongoing innovation in curve design.

- Interest rate curve understanding empowers both lenders and borrowers to make strategic decisions about capital allocation, leverage timing, and protocol selection.

- Multiple risk factors affect DeFi interest rates including rate volatility, smart contract vulnerabilities, governance manipulation, and regulatory uncertainty requiring comprehensive risk management.

- Advanced participants employ optimization strategies such as rate arbitrage, dynamic yield farming, and leveraged positions to maximize returns while managing interest rate exposure.

- The future of DeFi interest rate models involves increased sophistication through AI integration, cross-chain liquidity aggregation, and potential convergence with traditional finance systems.

The evolution of decentralized finance has brought revolutionary changes to how we understand and interact with financial instruments. At the heart of DeFi lending and borrowing protocols lies a sophisticated mechanism that determines the cost of capital: the interest rate curve. Unlike traditional finance where central banks and financial institutions dictate rates through policy decisions, DeFi interest rate curves operate autonomously through smart contracts, responding dynamically to market conditions and liquidity availability.

Understanding the DeFi interest rate curve is essential for anyone participating in decentralized lending markets. Whether you are a liquidity provider seeking optimal yields, a borrower looking to minimize costs, or a protocol developer designing economic models, comprehending how these curves function provides a strategic advantage. The interest rate curve serves as the pricing mechanism that balances supply and demand for digital assets in lending pools, creating an efficient market without intermediaries.

This comprehensive guide explores every aspect of DeFi interest rate curves, from fundamental concepts to advanced optimization strategies. We examine how smart contracts calculate rates, what factors influence curve dynamics, and how different protocols implement varying models. By the end of this article, you will have gained the knowledge necessary to make informed decisions in DeFi lending and borrowing markets while understanding the risks and opportunities presented by dynamic interest rate mechanisms.

What Is an Interest Rate Curve in DeFi?

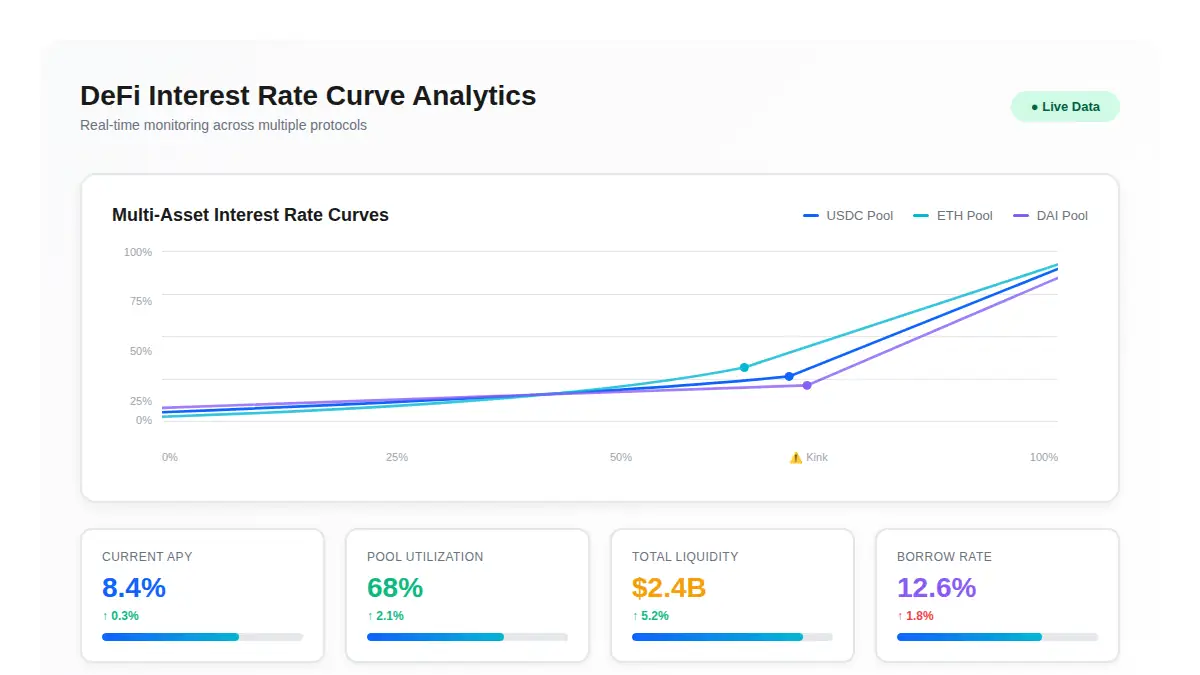

An interest rate curve in DeFi represents the mathematical relationship between the utilization rate of a lending pool and the interest rates applied to borrowers and lenders. This curve is programmatically defined within smart contracts and adjusts automatically based on the supply and demand dynamics of the protocol. The curve visualizes how borrowing costs increase as more of the available liquidity gets utilized, creating economic incentives that maintain protocol stability.

The utilization rate forms the foundation of the interest rate curve calculation. This metric represents the percentage of supplied assets that borrowers have currently borrowed. When utilization is low, abundant liquidity exists in the pool, resulting in lower interest rates for borrowers and modest returns for lenders. As utilization increases and available liquidity becomes scarce, the curve steepens dramatically, pushing rates higher to attract more suppliers and discourage excessive borrowing.

The DeFi interest rate curve typically features multiple segments with different slopes. The initial segment maintains relatively low rates when utilization stays below a certain threshold, often around 80%. As utilization approaches this critical point, the curve enters a steep segment called the “kink,” where rates increase exponentially. This design prevents liquidity exhaustion while ensuring that lenders can always withdraw their funds when needed, maintaining the protocol’s solvency and user confidence.

Importance of Interest Rate Curves in DeFi Lending and Borrowing

Interest rate curves serve as the backbone of DeFi lending protocols, enabling autonomous markets that operate without traditional financial intermediaries. These curves establish a self-regulating system where prices adjust automatically to balance supply and demand. For lenders, the curve determines the yield they earn on deposited assets, directly influencing their decision to supply liquidity to specific protocols. For borrowers, it defines the cost of accessing leverage, affecting their strategies for trading, yield farming, and capital deployment.

The importance of well-designed interest rate curves extends beyond simple price discovery. These curves create economic incentives that maintain protocol health and prevent catastrophic scenarios like bank runs or liquidity crises. When designed effectively, the curve encourages lenders to deposit funds during high-demand periods by offering attractive returns, while simultaneously discouraging excessive borrowing through higher costs. This dynamic equilibrium ensures that protocols can always honor withdrawal requests, maintaining trust and stability.

Furthermore, interest rate curves enable sophisticated financial strategies that were previously accessible only to institutional investors. Traders can leverage rate differentials between protocols for arbitrage opportunities. Yield optimizers can automatically shift capital to pools offering the best risk-adjusted returns. Borrowers can time their leverage based on predicted rate movements. These capabilities democratize access to advanced financial tools while creating more efficient markets through increased participation and capital allocation.

How DeFi Interest Rate Curves Are Determined?

DeFi protocols determine interest rate curves through mathematical models encoded directly into their smart contracts. The most common approach involves a kinked interest rate model, which calculates rates based on a formula that considers the current utilization rate and predefined parameters. These parameters include the base rate (minimum interest when utilization is zero), the rate at optimal utilization, the maximum rate at full utilization, and the optimal utilization threshold where the kink occurs.

The formula typically works in two segments. Below the optimal utilization point, the rate increases gradually according to a linear or slightly exponential function. Above this threshold, the rate accelerates rapidly, often following an exponential curve that makes borrowing prohibitively expensive as pools approach full utilization. This design prevents the last remaining liquidity from being borrowed, ensuring that lenders can always exit their positions, which is crucial for maintaining confidence in the protocol.

Protocol governance plays a significant role in determining and adjusting these curve parameters. Many DeFi platforms allow token holders to vote on changes to interest rate models, enabling the community to optimize curves based on market conditions and competitive dynamics. Some protocols employ dynamic parameter adjustment mechanisms that automatically fine-tune the curve based on historical utilization patterns and volatility metrics. This governance layer adds flexibility while maintaining the algorithmic nature of rate determination.

Role of Digital Contracts in Interest Rate Models

Smart contracts serve as the execution layer for DeFi interest rate models, translating mathematical formulas into code that runs autonomously on blockchain networks. These contracts continuously monitor the state of lending pools, calculating utilization rates and updating interest rates with every block or transaction. The deterministic nature of smart contracts ensures that all participants receive transparent, consistent rate calculations without relying on centralized authorities or subjective decision-making processes.

The smart contract interest rate mechanism operates through several interconnected functions. When users deposit or borrow assets, the contract recalculates the pool’s utilization rate by dividing total borrows by total supply. It then plugs this utilization rate into the interest rate formula, determining the current borrowing rate. The lending rate for suppliers is calculated by multiplying the borrowing rate by the utilization rate and applying a reserve factor that allocates a portion of interest to the protocol treasury.

Advanced smart contract implementations incorporate additional features that enhance interest rate model sophistication. Some protocols implement time-weighted average rates to smooth out short-term volatility. Others include circuit breakers that prevent rate spikes during abnormal market conditions. Security measures ensure that interest calculations remain accurate even during network congestion or attempted exploits. The immutable yet upgradeable nature of these contracts through governance mechanisms creates a balance between stability and adaptability.

Fixed vs Variable Interest Rate Mechanisms

The DeFi ecosystem offers both variable and fixed interest rate mechanisms, each serving different user needs and risk preferences. Variable interest rate mechanisms, which most protocols use by default, adjust continuously based on real-time supply and demand dynamics. These rates change with every transaction that affects pool utilization, providing market efficiency but creating uncertainty for users who want predictable costs or returns over extended periods.

Fixed interest rate protocols have emerged to address the demand for rate predictability. These platforms allow users to lock in specific interest rates for predetermined durations through various mechanisms. Some protocols create separate fixed-rate markets where users trade interest rate positions. Others use zero-coupon bonds or similar instruments to synthesize fixed rates. Advanced implementations employ interest rate swaps where users exchange their variable rate exposure for fixed payments, creating derivatives markets within DeFi.

The choice between fixed and variable rates involves tradeoffs that users must evaluate based on their circumstances. Variable rates typically offer better returns during periods of high demand but expose users to rate volatility. Fixed rates provide certainty and enable precise financial planning but may underperform variable rates if market conditions change favorably. Sophisticated users often split their capital between both mechanisms, maintaining flexibility while hedging against adverse rate movements through diversification across different rate structures.

Factors Affecting DeFi Interest Rate Curves

Multiple factors influence the shape and position of DeFi interest rate curves, creating complex dynamics that participants must understand. Market demand for leverage represents the primary driver, as increased borrowing activity pushes utilization higher and shifts the entire market along the curve toward higher rates. During bull markets or yield farming frenzies, demand for borrowed assets surges, leading to elevated rates across most protocols. Conversely, during bearish periods or market uncertainty, borrowing demand drops, resulting in lower utilization and reduced rates.

Protocol-specific factors also significantly impact interest rate dynamics. The reserve factor, which determines what percentage of interest goes to the protocol treasury versus lenders, directly affects lending yields. Protocols with lower reserve factors provide better returns to liquidity providers but accumulate fewer resources for development and security. Collateral factors and liquidation parameters influence borrowing demand by determining how much leverage users can access, indirectly affecting utilization rates and consequently interest rates.

External market conditions create additional pressures on DeFi interest rate curves. When traditional finance rates rise, DeFi protocols often see reduced capital inflows as investors seek safer yields in conventional markets. Regulatory developments can trigger sudden shifts in DeFi participation, affecting liquidity availability. Network congestion and gas costs on layer-one blockchains can make small transactions uneconomical, concentrating activity among larger players and altering utilization patterns. Cross-chain bridge efficiency affects capital movement between different DeFi ecosystems, influencing rate convergence across platforms.

Dynamic Interest Rate Models in Popular DeFi Protocols

Leading DeFi protocols have developed distinct interest rate models that reflect their unique approaches to balancing efficiency, stability, and user experience. Aave, one of the largest lending platforms, employs a kinked model with carefully calibrated parameters for each asset. Their curves feature a gentle slope below 80% utilization, then steepen dramatically to discourage excessive borrowing. Aave also introduced stable rate borrowing options that provide rate predictability for specific periods, though these rates adjust if certain utilization thresholds are breached.

Compound Finance pioneered the algorithmic interest rate model that many protocols have since adapted. Their approach uses a simple formula where rates increase proportionally with utilization until reaching a kink point, after which the slope increases significantly. The beauty of Compound’s model lies in its simplicity and predictability, making it easy for users to understand rate behavior. The protocol periodically adjusts model parameters through governance votes, allowing the community to optimize curves based on market evolution and competitive pressures.

Newer protocols have experimented with more sophisticated models. Some platforms implement adaptive interest rate mechanisms that automatically adjust curve parameters based on historical volatility and utilization patterns. Others use machine learning algorithms to predict optimal parameter settings. Certain protocols have introduced multi-tiered curves with several kink points, creating more granular control over rate progression. These innovations demonstrate the ongoing evolution of interest rate models as protocols compete to offer the most attractive and stable markets for their users.

Comparison with Traditional Finance Interest Rate Curves

DeFi interest rate curves differ fundamentally from traditional finance rate structures in their determination, transparency, and responsiveness. In traditional finance, central banks set benchmark rates through policy decisions influenced by economic data, inflation targets, and employment goals. Commercial banks then add their spreads based on credit risk, relationship factors, and profit margins. This system involves human judgment, opacity in pricing, and significant time lags between economic changes and rate adjustments.

The traditional finance yield curve, which plots government bond yields across different maturities, reflects market expectations about future rate movements and economic conditions. This curve can invert, flatten, or steepen based on complex macroeconomic factors. In contrast, DeFi protocol interest curves respond instantly to supply and demand within specific lending pools, without incorporating forward-looking economic forecasts or policy expectations. DeFi curves operate in a more mechanical, algorithmic manner, though they indirectly reflect broader market sentiment through changes in borrowing demand.

Both systems aim to efficiently allocate capital, but they achieve this goal through different mechanisms. Traditional finance relies on creditworthiness assessments and relationship banking, creating barriers to access while theoretically pricing risk more accurately. DeFi uses over-collateralization to eliminate credit risk, making loans accessible to anyone with sufficient collateral but potentially creating capital inefficiencies. As DeFi matures, protocols are exploring ways to incorporate undercollateralized lending through on-chain credit scoring and reputation systems, potentially bridging the gap between these two paradigms.

Impact of Market Liquidity on Interest Rate Curves

Market liquidity profoundly influences DeFi interest rate dynamics, creating feedback loops that can amplify both positive and negative trends. When substantial liquidity flows into lending protocols, the increased supply pushes utilization rates down, resulting in lower borrowing costs. These attractive rates then stimulate borrowing demand, which gradually increases utilization and pushes rates back toward equilibrium. During periods of abundant market liquidity, this cycle creates stable, moderate rates that benefit both lenders seeking steady yields and borrowers requiring affordable leverage.

Conversely, liquidity crises can trigger rapid rate escalation that threatens protocol stability. When lenders suddenly withdraw capital due to market panic or better opportunities elsewhere, the remaining liquidity must support existing borrows at much higher utilization rates. The interest rate curve’s steep segment activates, dramatically increasing borrowing costs. If rates spike too high, borrowers may choose liquidation over maintaining their positions, creating cascading effects. Well-designed curves anticipate these scenarios by calibrating the kink point and slope to encourage gradual deleveraging rather than panic-driven market disruption.

Liquidity and interest rate dynamics also interact with broader market conditions in complex ways. During volatile periods, even protocols with deep liquidity may experience rate instability as participants rapidly adjust positions. The introduction of liquidity mining incentives can temporarily distort interest rate curves by attracting mercenary capital that inflates supply without corresponding demand increases. As incentives diminish, this capital often exits quickly, causing utilization spikes and rate volatility. Understanding these liquidity-driven dynamics helps users anticipate rate movements and position themselves advantageously.

Comparison of Interest Rate Models Across Major DeFi Protocols

| Protocol | Model Type | Optimal Utilization | Base Rate | Max Rate |

|---|---|---|---|---|

| Aave | Kinked Model | 80% to 90% | 0% to 2% | 50% to 150% |

| Compound | Jump Rate Model | 80% | 0% to 2% | 40% to 100% |

| MakerDAO | Stability Fee Model | Governance Based | Variable | Governance Set |

| Venus | Dynamic Kinked | 75% to 85% | 0% to 3% | 60% to 200% |

| Euler | Reactive Model | Variable per Asset | Dynamic | Dynamic |

Interest Rate Curves and Borrower/Lender Decisions

Understanding interest rate curves empowers lenders to make strategic decisions about capital allocation across different protocols and assets. Sophisticated lenders monitor multiple factors when choosing where to deploy liquidity. Current interest rates represent just one consideration, as experienced participants also evaluate historical rate stability, protocol security track records, governance quality, and competitive dynamics. By analyzing how different curves respond to utilization changes, lenders can anticipate rate movements and position themselves to capture optimal yields.

For borrowers, interest rate curves provide crucial information for timing leverage decisions and selecting appropriate protocols. Savvy borrowers recognize that current rates alone do not tell the complete story. The curve’s shape indicates how quickly rates will increase if utilization rises, helping borrowers assess the risk of sudden cost spikes. During periods of moderate utilization, borrowers enjoy stable, predictable rates. However, as utilization approaches the kink point, prudent borrowers either reduce positions or prepare for potential rate volatility that could impact their profitability.

Both lenders and borrowers increasingly utilize analytics tools and dashboards that visualize interest rate curves alongside real-time utilization data. These tools enable participants to simulate various scenarios, such as how rates would change if they added substantial liquidity or initiated large borrows. Advanced users develop automated strategies that rebalance positions when rates cross predetermined thresholds or when utilization patterns suggest impending rate changes. This data-driven approach to DeFi participation represents a significant evolution from the early days when users relied primarily on intuition and limited information.

Risks Associated with DeFi Interest Rate Curves

DeFi interest rate curves introduce several risk categories that participants must carefully evaluate and manage. Rate volatility represents the most immediate concern, particularly for borrowers who may face rapidly escalating costs if utilization spikes unexpectedly. Unlike traditional finance where rate changes occur through announced policy decisions, DeFi rates can shift dramatically within minutes as market participants adjust their positions. Borrowers who fail to monitor utilization levels may suddenly find themselves paying unsustainable interest rates, potentially leading to liquidation if they cannot quickly respond.

Smart contract risk poses another significant concern related to interest rate mechanisms. Bugs in the rate calculation code could lead to incorrect interest accrual, either overcharging borrowers or shortchanging lenders. More severely, vulnerabilities in the interest rate model could be exploited to manipulate rates artificially, creating opportunities for attacks that drain protocol funds. While established protocols undergo extensive audits, the complexity of interest rate calculations combined with interactions between multiple contract components creates potential attack surfaces that require constant vigilance.

Governance risk affects interest rate curves when protocols allow parameter modifications through token voting. Malicious or poorly considered governance proposals could alter curve parameters in ways that destabilize markets or favor certain participants at others’ expense. Additionally, governance attacks where adversaries accumulate sufficient tokens to control protocol decisions represent existential threats. Lenders face the risk that governance changes could reduce their yields or lock their funds, while borrowers might suddenly face prohibitive rates if curve parameters shift unfavorably. Understanding these governance dynamics forms an essential part of comprehensive risk assessment.

Risk Factors in DeFi Interest Rate Mechanisms

| Risk Category | Impact Level | Affected Parties | Mitigation Strategy |

|---|---|---|---|

| Rate Volatility | High | Borrowers, Lenders | Monitor utilization, use rate alerts |

| Smart Contract Bugs | Critical | All Participants | Choose audited protocols, diversify |

| Liquidity Crisis | High | Lenders, Borrowers | Maintain buffer liquidity, avoid full utilization |

| Governance Manipulation | Medium | All Participants | Participate in governance, monitor proposals |

| Oracle Failure | Medium | Borrowers | Use protocols with robust oracle systems |

| Network Congestion | Low to Medium | Active Traders | Keep emergency funds, use layer 2 solutions |

Strategies to Optimize Returns Using Interest Rate Curves

Advanced DeFi participants employ sophisticated strategies to maximize returns by exploiting interest rate curve dynamics. Rate arbitrage represents one popular approach where users borrow from protocols offering lower rates and lend to those providing higher yields. This strategy requires careful monitoring of cross-protocol rate spreads and consideration of gas costs, which can eliminate profits on smaller positions. Successful rate arbitrageurs automate their operations through bots that continuously scan for opportunities and execute rebalancing transactions when profitable spreads emerge.

DeFi yield optimization involves strategically allocating capital across multiple protocols and assets based on interest rate curve analysis. Yield optimizers study historical utilization patterns to predict when rates might spike or drop, positioning themselves accordingly. During periods of low utilization when curves suggest stable rates ahead, optimizers might lock capital into longer-term positions. Conversely, when utilization approaches critical thresholds, they maintain flexibility to quickly exit if rates become unfavorable. This dynamic approach requires active management but can significantly enhance returns compared to passive strategies.

Leveraged yield farming strategies combine borrowing and lending activities to amplify returns, carefully managing interest rate risk throughout the process. Farmers borrow assets at low rates, deploy them in high-yield opportunities, and use earned returns to cover borrowing costs while generating net profits. Success requires identifying sustainable yield differentials and monitoring how interest rate curves might shift due to changing market conditions. Advanced farmers use recursive strategies, repeatedly depositing and borrowing to multiply their effective position size, though this amplifies both gains and risks associated with rate movements.

Regulatory Considerations Affecting Interest Rates in DeFi

The regulatory landscape surrounding DeFi continues evolving, with implications for how interest rate mechanisms operate and how protocols must structure their offerings. Regulators in various jurisdictions are examining whether DeFi lending platforms should be classified as securities offerings, money transmission services, or entirely new categories requiring bespoke regulatory frameworks. These classifications could mandate specific disclosures about interest rate risks, impose reserve requirements that affect curve parameters, or require licenses that limit protocol accessibility.

Tax treatment of DeFi interest income and expenses remains unclear in many regions, creating uncertainty for participants. Some jurisdictions treat interest earned from DeFi lending as ordinary income, while others may classify it as capital gains. Borrowing interest deductibility varies based on local tax codes and the purpose for which borrowed funds are used. As regulatory clarity emerges, interest rate dynamics may shift if tax considerations become more prominent in user decision-making processes, potentially affecting utilization rates and consequently the interest rate curves themselves.

Compliance requirements could necessitate significant modifications to interest rate models and protocol operations. Anti-money laundering regulations might require user identification, potentially reducing participation and affecting liquidity dynamics. Interest rate caps or usury laws could limit how high rates can climb, forcing protocols to redesign their curves or risk operating in regulatory gray areas. Forward-thinking protocols are beginning to implement compliance layers and geographic restrictions, creating fragmented markets where interest rate curves may differ based on user location and regulatory jurisdiction.

Case Studies of DeFi Protocols Using Interest Rate Curves

Aave’s evolution of its interest rate models provides valuable insights into how protocols refine their approaches based on market experience. Initially launching with relatively simple curves, Aave observed that certain assets experienced persistent high utilization that prevented lenders from withdrawing funds smoothly. In response, the protocol introduced more aggressive curves for volatile assets, with steeper slopes and lower optimal utilization points. This adjustment successfully discouraged excessive borrowing while maintaining competitive rates during normal conditions, demonstrating the importance of asset-specific curve customization.

Compound’s experience during the 2020 DeFi summer illustrated both the strengths and challenges of algorithmic interest rate models. As yield farming frenzy drove unprecedented borrowing demand, utilization rates for certain assets remained near maximum levels for extended periods. The protocol’s interest rate curves successfully increased rates to attract more lenders, but the high rates also created opportunities for rate manipulation through flash loans and coordinated actions. Compound responded by implementing governance changes to curve parameters and introducing additional safeguards, showcasing the need for ongoing model refinement.

Euler Finance’s permissionless listing approach combined with reactive interest rate models represents an innovative case study in adaptive curve design. Rather than using fixed parameters set by governance, Euler implements algorithms that automatically adjust curve parameters based on asset volatility and historical utilization patterns. This approach allows the protocol to support long-tail assets without requiring constant governance attention for each market. Early results suggest that reactive models can provide better risk management for diverse asset types, though they introduce additional complexity that users must understand.

Future Outlook of DeFi Interest Rate Models

The future of DeFi interest rate models will likely involve increased sophistication as protocols incorporate artificial intelligence and machine learning to optimize curve parameters dynamically. These advanced systems could analyze vast amounts of historical data, identify patterns that humans might miss, and automatically adjust curves to balance efficiency and stability. Machine learning models might predict utilization changes before they occur, proactively modifying rates to prevent liquidity crises or excessive rate volatility. However, this increased complexity raises questions about transparency and whether users can truly understand the mechanisms determining their costs and returns.

Cross-chain interest rate arbitrage and unified liquidity pools represent another frontier for DeFi rate evolution. As blockchain interoperability improves, protocols are exploring ways to aggregate liquidity across multiple chains, potentially creating more stable and efficient interest rate curves. Imagine a future where a single lending position automatically sources liquidity from the cheapest available chain, or where interest rates converge across ecosystems through seamless arbitrage. These developments could dramatically improve capital efficiency while introducing new complexities around bridge security and cross-chain governance.

Integration with real-world assets and traditional finance systems may fundamentally transform DeFi interest rate dynamics. As protocols begin incorporating tokenized treasuries, real estate, and other traditional assets, interest rate curves will need to account for factors beyond crypto-native supply and demand. Curves might reference off-chain benchmark rates, incorporate credit risk assessments, or adjust based on macroeconomic indicators. This convergence between DeFi and traditional finance could create hybrid models that combine the best aspects of both systems while navigating regulatory requirements and maintaining decentralization principles.

As decentralized finance continues its rapid evolution, having experienced partners who understand the intricacies of interest rate mechanisms becomes increasingly valuable. Organizations seeking to build or optimize DeFi protocols must navigate complex technical, economic, and regulatory considerations that require deep expertise across multiple domains. The design of interest rate curves represents just one element of successful DeFi protocol development, albeit a critical one that fundamentally affects user experience and protocol sustainability.

Nadcab Labs brings over eight years of specialized experience in blockchain development and DeFi solutions, having worked with numerous protocols to design, implement, and optimize interest rate models. Their team combines technical proficiency in smart contract development with economic modeling expertise necessary for creating balanced, efficient interest rate curves. Whether you are launching a new lending protocol, upgrading existing interest rate mechanisms, or seeking to understand how rate dynamics affect your DeFi participation, Nadcab Labs provides the authoritative guidance and technical capabilities required for success in the competitive decentralized finance landscape.

Frequently Asked Questions

The shape of a DeFi interest rate curve is determined by parameters set in smart contracts, including base rate, optimal utilization rate, slope multipliers, and maximum rate. Protocol governance typically sets these parameters based on asset characteristics, risk assessments, and competitive positioning. The curve design aims to balance lender returns with borrower costs while preventing liquidity exhaustion.

DeFi interest rates update continuously with every transaction that affects pool utilization. When users deposit, withdraw, borrow, or repay assets, the smart contract recalculates utilization and adjusts rates accordingly. On Ethereum, this means rates can change every 12 seconds with each new block. Some protocols implement time-weighted averages to smooth short-term volatility while maintaining responsiveness to sustained changes.

Rate spikes occur when utilization approaches or exceeds the optimal threshold where the interest rate curve’s steep segment activates. This happens during high borrowing demand, sudden lender withdrawals, or market volatility that reduces available liquidity. The steep curve design intentionally creates prohibitive rates at high utilization to attract new lenders, discourage additional borrowing, and ensure some liquidity always remains available for withdrawals.

While you cannot predict exact future rates, you can analyze historical utilization patterns, monitor current trends, and understand curve parameters to anticipate likely rate directions. Tools and dashboards that track utilization approaching critical thresholds help participants prepare for potential rate changes. However, sudden market events, large transactions, or shifts in DeFi dynamics can cause unexpected rate movements that defy historical patterns.

Lending APY represents the annual percentage yield lenders earn on deposited assets, calculated by multiplying the borrowing rate by the utilization rate and subtracting the protocol’s reserve factor. Borrowing APR is the annual percentage rate borrowers pay on loans, directly derived from the interest rate curve. The difference between these rates compensates lenders for providing liquidity while generating protocol revenue through the reserve factor.

Protocols implement several safeguards against rate manipulation including time-weighted average calculations, minimum borrow periods, flash loan restrictions for certain actions, and monitoring systems that detect abnormal utilization patterns. The steep curve design itself discourages manipulation by making it economically unviable to push utilization to extreme levels. However, sophisticated attacks remain possible, which is why audits and security reviews focus heavily on interest rate mechanism integrity.

Fixed interest rates in DeFi are fixed for the duration agreed upon at loan origination, but they are not guaranteed in the same way as traditional finance fixed rates. Some protocols include clauses allowing rate adjustments under extreme circumstances, such as sustained high utilization that threatens protocol stability. Additionally, fixed rates are achieved through various mechanisms like zero-coupon bonds or interest rate swaps, each with different underlying risk profiles that users should understand.

Stablecoin curves typically feature lower base rates and gentler slopes due to lower volatility risk and higher liquidity depth. Volatile asset curves have higher base rates reflecting increased risk and steeper slopes to discourage excessive utilization that could create liquidation cascades. Protocols also set lower optimal utilization thresholds for volatile assets, activating the steep curve segment earlier to maintain larger liquidity buffers for potential market turbulence.

Governance token holders typically have authority to propose and vote on interest rate curve parameter changes. This includes modifying base rates, optimal utilization points, slope multipliers, and reserve factors. Governance decisions balance competing interests of lenders seeking higher yields, borrowers wanting lower costs, and protocol sustainability requiring adequate reserves. Active governance participation helps ensure curves remain optimized as market conditions evolve.

Risk minimization strategies include diversifying across multiple protocols and assets, maintaining conservative leverage ratios, using protocols with stable rate options when available, setting up monitoring alerts for utilization thresholds, keeping emergency funds for rate spikes, and avoiding positions during known volatile periods. Understanding the specific interest rate curve parameters of protocols you use enables better risk assessment and proactive position management before rates become unfavorable.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.