Key Takeaways

- Fast and Global Fundraising – ICOs allow blockchain startups to raise capital quickly, reaching investors worldwide without relying on traditional venture capital or banks.

- Lower Costs and Fewer Intermediaries – Digital contracts and blockchain automation reduce legal, administrative, and brokerage fees, directing more funds into development.

- Community Engagement and Loyalty – ICO investors often become early adopters and advocates, supporting promotion, feedback, and adoption.

- Transparency and Security – Blockchain records and digital contracts ensure funds are allocated as promised, increasing trust and reducing fraud risk.

- Liquidity for Investors – Tokens can be traded on exchanges shortly after an ICO, offering flexibility and potential returns.

- Alternative to Traditional Funding – ICOs democratize access to capital, especially for startups facing banking or regional limitations.

- Regulatory Awareness is Crucial – Global legal frameworks vary, making compliance essential for both startups and investors.

- Integration with EU and Global Initiatives – Programs like Horizon 2020 and InvestEU strengthen ICO viability for European startups.

- Emerging Trends Enhance ICO Potential – STOs and hybrid models combine regulatory protection with ICO flexibility.

- Strategic ICOs Drive Growth – Well-planned ICOs accelerate development, expand global reach, and build long-term community support.

Blockchain funding is one of the biggest hurdles for startups in the industry. While traditional funding methods such as venture capital and bank loans have long been the preferred options, they often involve long delays, high costs, and strict eligibility requirements. For innovative projects—especially those in regions with limited investment opportunities or restrictive banking regulations—accessing capital can feel like an uphill battle.

This is where Initial Coin Offering has emerged as a game-changing solution. By leveraging blockchain technology, ICOs allow startups to raise funds quickly, reach a global pool of investors, and build engaged communities all while minimizing intermediaries and lowering costs.

In this information, we’ll explore the challenges of blockchain funding, how ICOs work, their key benefits, and how global initiatives, particularly in the European Union, are shaping the future of blockchain investment.

Overview of Blockchain Funding Challenges

Raising capital is one of the most critical steps for blockchain projects, yet it comes with significant hurdles. Traditional funding avenues, such as venture capital (VC) or bank loans, often involve long approval cycles, stringent eligibility requirements, and high costs. Many startups face geographical limitations that make accessing global investors difficult.

For instance, a blockchain funding startup in Southeast Asia may have an innovative solution but lack local investors with sufficient capital. Similarly, projects in regions with strict banking regulations may struggle to secure traditional funding. These barriers slow down development, limit market reach, and often force teams to compromise on their original vision.

Additionally, conventional funding methods often require startups to give up significant equity stakes or control over the project. This can create long-term challenges in decision-making and revenue sharing, which is particularly sensitive in decentralized blockchain ecosystems.

In Europe, governments and institutions are trying to address this blockchain funding gap. The EU provides financial support through grants, prizes, and direct investments. For example, the Horizon 2020 program funded over €180 million for projects in areas such as e-identity, healthcare, IoT, cybersecurity, music/media, industrial applications, and the environment. However, even with such support, many startups still face challenges raising large-scale blockchain funding.

This is where Initial Coin Offerings (ICOs) present an alternative. ICOs enable blockchain projects to bypass traditional intermediaries, tap into a global pool of investors, and raise funds quickly and efficiently.

How ICO Work in Blockchain Projects?

An Initial Coin Offering (ICO) is a fundraising method in which blockchain projects sell digital tokens to investors in exchange for cryptocurrencies such as Bitcoin (BTC) or Ethereum (ETH). These tokens can serve different purposes, including utility access, governance rights, or profit-sharing mechanisms. Unlike traditional funding, ICOs allow projects to reach a global investor base without relying on venture capital firms, banks, or brokers.

The ICO process generally involves the following steps:

- Whitepaper Creation: The project team releases a detailed document, known as an ICO whitepaper, outlining the technology, roadmap, tokenomics, and crypto fundraising objectives and mechanisms. This document is critical for transparency and investor confidence.

- Pre-Sale and Public Sale: Tokens are sold to early supporters and the broader public. Pre-sales often provide discounts to incentivize early investment.

- Exchange Listing: After the ICO, tokens are listed on cryptocurrency exchanges, giving investors liquidity and allowing the market to determine token value.

- Project Development: Funds raised are used to develop the blockchain funding solution, marketing, partnerships, and operational costs.

ICOs are highly adaptable. For example, projects can structure token offerings to incentivize long-term participation, such as locking certain tokens for a period to prevent early sell-offs, which increases investor confidence.

By leveraging blockchain transparency, ICOs allow investors to track fund usage and project milestones. digital contracts automatically execute transactions, reducing the risk of fraud and ensuring that the funds are allocated according to pre-agreed rules.

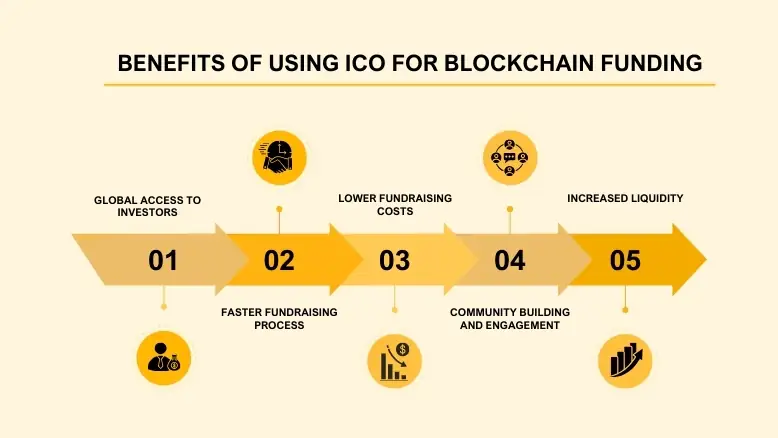

Key Benefits of Using ICO for Blockchain Funding

Global Access to Investors

One of the most significant advantages of ICOs is the ability to attract investors from all over the world. Traditional funding often restricts investment to accredited investors or local venture capital firms. In contrast, ICOs democratize access, enabling anyone with cryptocurrency to participate.

This global approach not only increases the fundraising potential but also helps build a diverse and engaged investor community. A blockchain project with investors across North America, Europe, and Asia gains valuable insights into different markets, helping tailor products for global adoption.

For example, European startups raised roughly 60% of their blockchain funding[1] through ICOs between 2009 and 2018, while U.S. startups raised just 18%. Ethereum’s 2014 ICO raised over $18 million from thousands of participants worldwide, creating one of the largest communities in the blockchain space. This global network provided Ethereum with a strong foundation for adoption, partnerships, and future blockchain funding rounds.

Faster Fundraising Process

Speed is critical in the fast-moving blockchain industry. Traditional funding rounds can take months or even years, involving due diligence, negotiations, and legal documentation. ICOs, on the other hand, can raise significant funds in just a few weeks.

Projects can launch pre-sales to early supporters, followed by public token sales. Digital contracts handle transactions automatically, reducing administrative overhead and ensuring instant fund transfer. This rapid fundraising allows startups to begin development immediately, capturing market opportunities before competitors.

For instance, Filecoin’s ICO in 2017 raised over $200 million in less than a month, enabling the team to accelerate development and secure key partnerships quickly.

Lower Fundraising Costs

Traditional funding comes with high costs, including legal fees, broker commissions, and bank charges. ICOs significantly reduce these expenses by eliminating intermediaries and using automated blockchain processes.

Digital contracts enforce token distribution and fund allocation, minimizing the need for lawyers or middlemen. This efficiency ensures that a larger portion of raised funds is directed toward product development, marketing, and operations rather than administrative costs.

Lower costs also make it easier for smaller projects to launch ICOs, leveling the playing field for startups that might not have access to large-scale venture blockchain funding.

Community Building and Engagement

ICOs are more than just a capital-raising tool they are a means of creating a loyal community. Investors are often early adopters of the project, actively participating in testing platforms, providing feedback, and promoting the project.

This engagement builds trust, enhances transparency, and creates a network effect that drives adoption. Unlike traditional funding, where investors may be distant stakeholders, ICO participants have a vested interest in the project’s success.

Community engagement also provides valuable marketing benefits. Enthusiastic supporters spread awareness on social media, online forums, and at conferences, often serving as grassroots ambassadors for the project.

The EU’s InvestEU program complements this by providing advisory services, investor matchmaking, community-building activities, and portfolio support, enhancing the ecosystem for blockchain startups in Europe.

Increased Liquidity

Tokens sold in an ICO are typically listed on exchanges soon after the sale, providing liquidity for investors. This is a stark contrast to traditional equity investments, which often have long lock-up periods.

Liquidity attracts more investors, as participants can buy, sell, or trade tokens freely, knowing they have an exit strategy. Projects benefit as well, as liquid markets can help determine fair token valuation, improve transparency, and foster a thriving ecosystem.

Liquidity also encourages long-term investment. Investors who can trade tokens freely are more likely to support project development, participate in governance, and contribute to community growth.

ICO vs Traditional Funding Models

ICOs are fundamentally different from conventional funding options, providing unique advantages for blockchain startups.

| Feature | ICO | Traditional Funding |

|---|---|---|

| Accessibility | Open to global investors | Often limited to accredited investors |

| Fundraising Speed | Weeks | Months to years |

| Costs | Lower due to automation | Higher due to legal and intermediary fees |

| Liquidity | Immediate token trading | Long-term equity lock-up |

| Community Engagement | High; investors become advocates | Moderate; limited interaction with users |

While ICOs carry regulatory risks, they offer speed, flexibility, and community-driven growth, making them particularly suitable for innovative blockchain projects.

Regional Funding Trends and Future Outlook

Globally, there remains a significant investment gap in blockchain funding. Between 2009 and 2018:

- US startups raised roughly €4.4B

- European startups raised about €2.9B

- Chinese startups raised around €2.8B

To bridge this gap, initiatives like the AI/Blockchain Investment Fund aim to provide equity to high-risk blockchain startups, scaling blockchain funding to €1–2B.

As blockchain adoption grows, regulators are creating clearer frameworks that reduce fraud while supporting innovation. Emerging trends such as Security Token Offerings (STOs) and hybrid models are expanding the fundraising landscape. STOs combine the benefits of ICOs with regulatory oversight, making blockchain investment safer for both projects and investors.

Moreover, the growing adoption of decentralized finance and tokenized assets is likely to drive further demand for ICOs. Blockchain projects that embrace ICOs strategically can access faster blockchain funding, build global communities, and achieve scalability more effectively than ever before.

Why ICO Are a Smart Choice for Blockchain Funding?

ICO Services offers blockchain projects a unique and powerful blockchain funding method. By combining global access, speed, lower costs, community engagement, and liquidity, they provide advantages that traditional funding cannot match.

Projects leveraging ICOs can raise significant capital quickly, engage investors as active participants, and build a global brand presence. Supported by EU initiatives like Horizon 2020 and InvestEU, startups in Europe now have additional tools to complement ICOs, including grants, advisory services, and portfolio support.

For startups seeking flexible, efficient, and community-driven fundraising, ICOs are not just an alternative; they are a smart choice.

Frequently Asked Questions

An ICO is a method for blockchain startups to raise money by selling their own digital tokens to investors, typically in exchange for cryptocurrencies like Bitcoin or Ethereum. These tokens can have utility, governance functions, or other rights.

Projects publish a whitepaper detailing goals and tokenomics, then sell tokens to investors during a pre‑sale and public sale. After the ICO, tokens may be listed on crypto exchanges for trading.

To invest, connect your crypto wallet, buy tokens using supported cryptocurrencies (e.g., ETH), and often complete KYC/whitelisting if required. Tokens are then held until—and if—they list on exchanges.

Legality varies by country. Some regulators treat ICO tokens as unregistered securities and enforce compliance; others offer clearer rules or restrict ICOs entirely. Always check local regulations before investing.

A whitepaper explains the project’s technology, goals, token economics, and roadmap. It’s essential for evaluating legitimacy and investment potential.

ICOs carry regulatory uncertainty, high volatility, and risk of scams or project failure. Some tokens become worthless if the project doesn’t deliver.

ICOs let anyone with crypto invest and don’t typically offer equity — unlike IPOs (Initial Public Offerings), which are regulated stock sales giving ownership shares in a company.

A rug pull is when founders take investor money and abandon the project, leaving tokens worthless. Other scams include fake whitepapers and sham teams.

ICOs provide fast access to global capital, bypass intermediaries, and can build an engaged investor community early in the project lifecycle.

Check the team’s background, clarity of the whitepaper, token utility, audit reports, legal compliance, and community feedback.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.