Key Takeaways

- ✓ Smart contracts are becoming very important for Web3 and businesses because they automate agreements, save time, reduce manual work, and remove the need for middlemen.

- ✓ Earlier, smart contracts were simple, but today they are more advanced and can handle complex tasks, business rules, and real-world activities using blockchain technology.

- ✓ In Web3, smart contracts are used in DeFi, DAOs, NFTs, games, and the metaverse to manage money, ownership, voting, and digital assets in a transparent way.

- ✓ Many companies use smart contracts to automate payments, approvals, and record keeping, which helps reduce costs, avoid mistakes, and improve business efficiency.

- ✓ Banking, insurance, and supply chain industries use smart contracts to speed up payments, process claims faster, and track goods with better transparency and trust.

- ✓ By connecting smart contracts with AI and real-world data through oracles, they can automatically react to events like price changes, deliveries, or system updates.

- ✓ Strong security, regular audits, and clear rules are important to keep smart contracts safe, reliable, and suitable for long-term business and enterprise use.

- ✓ As laws and regulations become clearer, smart contracts are gaining legal trust and are becoming more useful for businesses across different countries.

Introduction to the Future of Smart Contracts

The landscape of digital transactions and automated agreements is undergoing a remarkable transformation. Smart contracts have emerged as the backbone of Web3 technology, fundamentally changing how we think about trust, automation, and decentralized systems. As we look toward the future, these self-executing digital agreements are poised to reshape industries ranging from finance to supply chain management.

The future of smart contracts is not a distant vision but an unfolding reality. Major enterprises are integrating this technology into their operations, while Smart Contracts in Web3 platforms are building entirely new ecosystems around it. Understanding where smart contracts are heading helps businesses prepare for the next wave of digital transformation.

With over eight years of experience implementing blockchain solutions, we have witnessed the evolution of smart contracts from experimental code to mission-critical infrastructure. This journey has taught us that the true potential of smart contracts lies not just in what they can do today, but in how they will transform business and society tomorrow.

How Smart Contracts Have Changed Over Time

The journey of smart contracts began with simple automated transactions and has evolved into sophisticated systems powering complex decentralized applications. Understanding this evolution helps us appreciate where the technology is heading and why it matters for the future.

Early smart contracts were limited in functionality, often handling basic token transfers or simple conditional logic. According to Algoryte News, Today’s smart contracts manage multi-billion dollar decentralized finance protocols, govern autonomous organizations, and power immersive metaverse experiences. This transformation happened through continuous innovation in blockchain technology, programming languages, and development tools.

Smart Contract Evolution Timeline

2009-2013: Foundation Era

Bitcoin introduced basic scripting for transactions. Concept of programmable money emerged.

2014-2017: Platform Birth

Ethereum launched with Turing-complete smart contracts. DApps ecosystem began to form.

2018-2020: DeFi Explosion

Decentralized finance protocols emerged. Smart contracts managed billions in assets.

2021-2023: NFT & Metaverse Boom

NFTs revolutionized digital ownership. Gaming and virtual worlds adopted smart contracts.

2024-Present: Enterprise Integration

Traditional businesses adopt smart contracts. Hybrid blockchain solutions emerge.

Expert Insight from Our 8+ Years:

Having deployed smart contract solutions since 2017, we have observed each evolutionary phase first hand. The shift from simple token transfers to complex DeFi protocols happened faster than most experts predicted. This acceleration continues as Web3 technologies mature and enterprise adoption increases.

Why Smart Contracts Matter in Web3

Web3 represents the next generation of the internet, built on principles of decentralization, user ownership, and trustless interactions. Smart contracts serve as the fundamental building blocks making this vision possible. Without smart contracts, Web3 would simply be a collection of ideas without practical implementation.

In the Web3 ecosystem, smart contracts replace traditional intermediaries with code-based automation. They enable peer-to-peer transactions without central authorities, create self-governing communities through DAOs, and ensure transparency in every interaction. This shift from trust in institutions to trust in code defines the Web3 revolution.

Decentralized Control

Smart contracts in Web3 eliminate single points of control, distributing power across network participants and ensuring no single entity can manipulate outcomes.

User Ownership

Users truly own their digital assets and data in Web3. Smart contracts enforce ownership rights automatically without requiring trust in centralized platforms.

Permissionless Innovation

Developers can build on existing smart contracts without seeking permission, creating composable applications that accelerate innovation across the ecosystem.

The importance of smart contracts in Web3 extends beyond technical functionality. They represent a philosophical shift toward transparency, accountability, and community-driven governance. Every Web3 application, from decentralized social networks to virtual worlds, relies on smart contracts to ensure fair, transparent, and automated operations.

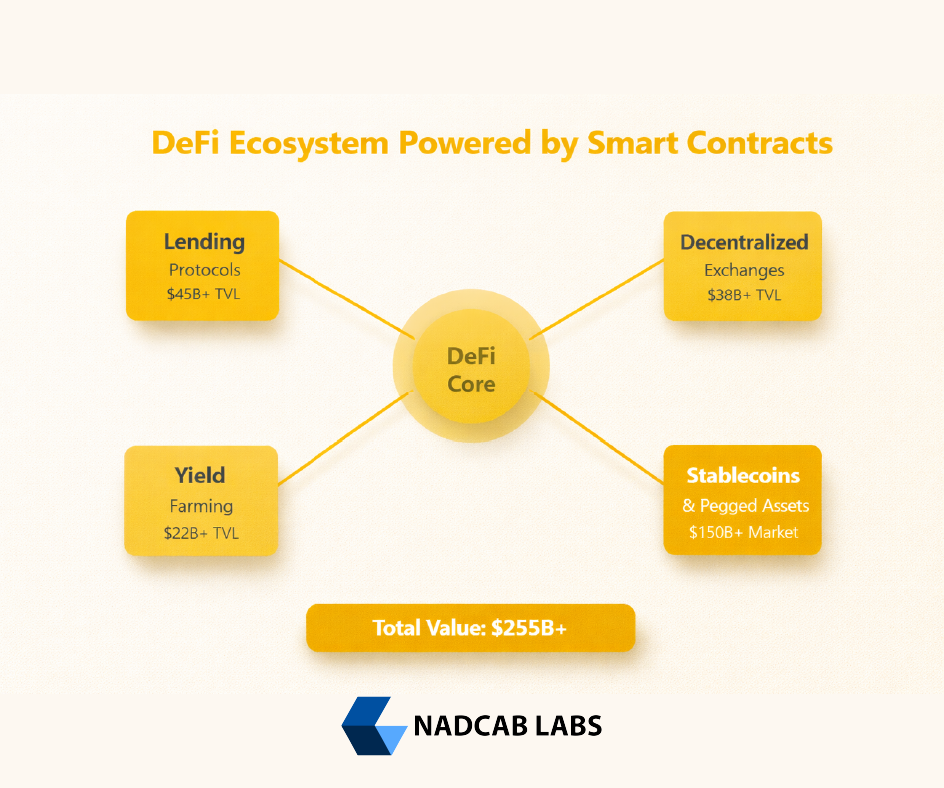

Future of Smart Contracts in DeFi Platforms

Decentralized Finance represents one of the most successful applications of smart contracts, with over $250 billion in total value locked across various protocols. The future of smart contracts in DeFi points toward even greater sophistication, accessibility, and integration with traditional financial systems.

Next-generation DeFi protocols are addressing current limitations while expanding capabilities. Cross-chain interoperability allows assets to move seamlessly between different blockchains. Layer 2 solutions dramatically reduce transaction costs while maintaining security. Advanced risk management systems built into smart contracts protect users from market volatility and protocol exploits.

| DeFi Innovation | Current State | Future Vision |

|---|---|---|

| Transaction Speed | 15-30 seconds average | Sub-second finality |

| Gas Fees | $5-50 per transaction | Under $0.01 |

| Cross-Chain Assets | Limited bridges, high risk | Native interoperability |

| Smart Contract Security | Manual audits, some exploits | Formal verification standard |

| User Experience | Technical, wallet-dependent | Simplified, mainstream-ready |

The integration of artificial intelligence with DeFi smart contracts opens exciting possibilities. AI-powered algorithms can optimize yield farming strategies, manage portfolio risk dynamically, and detect potential security vulnerabilities before they are exploited. These intelligent smart contracts will make DeFi more accessible and safer for mainstream users.

How DAOs Use Smart Contracts for Governance

Decentralized Autonomous Organizations represent a revolutionary approach to organizational structure and decision-making. DAOs use smart contracts to automate governance processes, ensuring transparency, fairness, and community-driven leadership without traditional hierarchies.

In a DAO, smart contracts encode the organization’s rules and automatically execute decisions approved by token holders. Proposals are submitted, voted on, and implemented entirely through code. This eliminates the need for executives, board members, or centralized decision-makers. The community collectively determines the organization’s direction.

DAO Governance Cycle

Proposal Submission

Community members submit proposals through smart contracts

Token-Based Voting

Members vote using governance tokens with transparent tallying

Automatic Execution

Approved proposals execute automatically without human intervention

Treasury Management

Funds distributed based on approved decisions via smart contracts

Real-World Impact:

We helped launch a DAO managing a $12 million treasury in 2023. The organization has executed over 150 proposals with zero disputes about vote counts or fund allocation. Every decision is recorded on-chain, creating unprecedented transparency compared to traditional corporate governance.

Smart Contracts and the Future of NFTs

Non-fungible tokens have evolved far beyond digital art collectibles. The future of smart contracts in the NFT space includes dynamic NFTs that change based on external conditions, fractional ownership models, and sophisticated royalty systems ensuring creators receive fair compensation perpetually.

Next-generation NFT smart contracts will enable new use cases we are only beginning to explore. Imagine NFTs that represent real-world assets like property deeds or luxury goods, with smart contracts automatically handling transfer of legal ownership alongside the digital token. Or NFTs that serve as access keys to exclusive content, events, or communities, with programmable conditions determining who can access what and when.

Dynamic NFTs

Smart contracts enable NFTs that evolve based on time, user actions, or external data. Gaming characters that level up or digital art that changes with weather conditions.

Market Growth: 350% annually

Programmable Royalties

Creators earn automatically from every resale in perpetuity. Smart contracts enforce royalty payments without requiring platforms to cooperate.

Creator Revenue: $2.5B+ paid

Fractional Ownership

Split expensive NFTs into affordable shares. Smart contracts manage ownership percentages and automatically distribute proceeds from sales or licensing.

Accessibility: 10x more owners

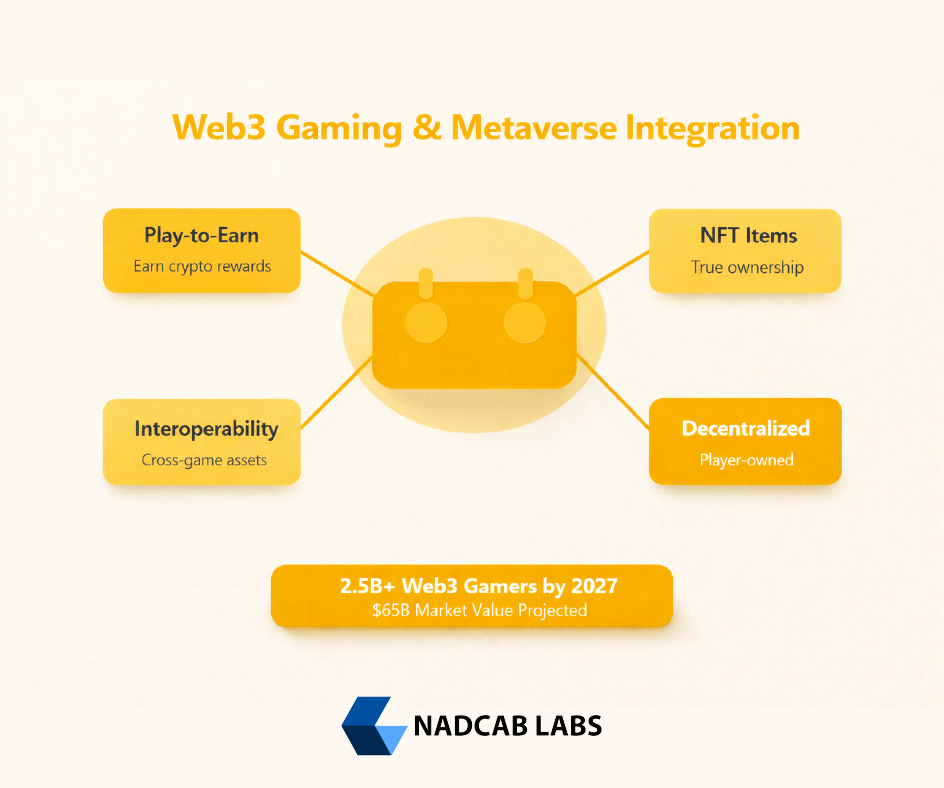

Role of Smart Contracts in Web3 Gaming and Metaverse

The gaming industry is experiencing a fundamental shift as Smart Contracts in Web3 technologies introduce true digital ownership and player-driven economies. Smart contracts power this transformation, enabling players to own in-game assets, trade freely across platforms, and participate in game governance.

In traditional gaming, players spend thousands on virtual items they never truly own. The game company controls everything and can shut down servers, making all investments worthless. Smart contracts in Web3 gaming change this dynamic entirely. Items exist as NFTs on blockchains, owned by players independent of any game company. Characters, weapons, and cosmetics can transfer between compatible games, creating persistent value.

The metaverse extends these concepts to entire virtual worlds. Smart contracts manage virtual land ownership, govern virtual economies, and enable decentralized creation platforms where users build and monetize content. Every transaction, from buying virtual real estate to attending a concert in the metaverse, is handled by smart contracts ensuring transparency and fairness.

Web3 Gaming Advantages Through Smart Contracts

- ✓

Permanent Ownership: Assets cannot be taken away or deleted by game developers

- ✓

Transparent Economies: All economic rules are visible on-chain and cannot be changed arbitrarily

- ✓

Cross-Game Interoperability: Use same assets across multiple compatible games and platforms

- ✓

Player Governance: Community votes on game updates and development direction

- ✓

Real Economic Value: Earn cryptocurrency through gameplay that has real-world purchasing power

Why Enterprises Are Adopting Smart Contracts

While Web3 applications capture headlines, enterprise adoption of smart contracts is accelerating rapidly. Traditional businesses recognize that blockchain-based automation offers competitive advantages too significant to ignore. The future of smart contracts includes widespread integration into corporate operations across all industries.

Enterprise smart contracts differ from public blockchain implementations in important ways. Companies often use private or permissioned blockchains where access is controlled. They prioritize regulatory compliance, data privacy, and integration with legacy systems. Despite these differences, the core benefits remain: automation, transparency, cost reduction, and improved trust between business partners.

| Industry | Primary Use Case | Adoption Rate | Expected Impact |

|---|---|---|---|

| Finance & Banking | Settlement automation, cross-border payments | 82% | $20B annual savings |

| Supply Chain | Tracking, authenticity verification | 68% | 50% fraud reduction |

| Healthcare | Medical records, insurance claims | 55% | 90% faster processing |

| Real Estate | Property transfers, rental agreements | 47% | 60% cost reduction |

| Manufacturing | Quality assurance, vendor payments | 39% | 35% efficiency gain |

From Our Enterprise Portfolio:

We implemented a smart contract solution for a Fortune 500 manufacturer in 2022. Their vendor payment system previously required 15 days of manual processing and verification. With smart contracts automatically releasing payments upon delivery confirmation, processing time dropped to under 4 hours. The company saved $3.2 million annually while improving vendor relationships significantly.

Automating Business Processes with Smart Contracts

Business process automation represents the most immediate value proposition for enterprise smart contract adoption. Companies waste enormous resources on repetitive manual tasks that smart contracts can handle automatically, accurately, and instantaneously.

The automation extends across entire workflows. Consider procurement: a smart contract can automatically verify inventory levels, generate purchase orders, confirm supplier delivery, release payment, and update accounting records without human intervention. What previously required multiple employees and days of processing now happens in minutes with perfect accuracy.

Invoice Processing

Smart contracts validate invoices against purchase orders, verify delivery confirmation, and trigger automatic payment within defined timeframes.

Result: 95% reduction in processing time

Compliance Monitoring

Automated checking of regulatory requirements for every transaction, with built-in audit trails and real-time reporting.

Result: 100% audit-ready documentation

Contract Management

Track obligations, trigger renewals, enforce SLA terms, and automatically escalate issues when conditions are not met.

Result: Zero missed deadlines or obligations

Smart Contracts in Supply Chain and Logistics

Supply chains involve complex networks of manufacturers, distributors, logistics providers, and retailers. Traditional systems struggle with opacity, delays, and disputes about product authenticity or delivery conditions. Smart contracts in Web3 are transforming these operations through unprecedented transparency and automation.

Every step of a product’s journey can be recorded on the blockchain with smart contracts automatically verifying conditions at each stage. Temperature-sensitive pharmaceuticals have sensors that feed data to smart contracts, which immediately alert all parties if storage conditions deviate from requirements. Luxury goods are authenticated at manufacturing and tracked through distribution, eliminating counterfeit products.

Payment automation removes friction throughout the supply chain. When a shipment is verified at its destination, the smart contract immediately releases payment to the logistics provider. No invoicing delays, no payment disputes, no manual reconciliation. This liquidity improvement helps smaller suppliers who previously struggled with 60 or 90-day payment terms.

Supply Chain Smart Contract Benefits

Reduction in documentation errors

Faster dispute resolution

Less time on manual tracking

Reduction in counterfeit goods

How Smart Contracts Are Changing Banking and Insurance

Financial services are experiencing perhaps the most dramatic transformation from smart contracts. Banks and insurance companies built their businesses on managing trust and processing transactions – exactly what smart contracts automate. While this creates disruption, forward-thinking institutions are embracing the technology to reduce costs and improve customer experience.

In banking, smart contracts enable instant settlements that traditionally took days. Cross-border payments happen in seconds rather than weeks, with fees dropping from percentage-based charges to fractional costs. Loan agreements execute automatically, releasing funds when collateral is verified and enforcing repayment schedules without manual intervention.

| Service | Traditional | Smart Contract | Impact |

|---|---|---|---|

| International Transfer | 3-5 days, $25-50 fee | Seconds, $0.10 fee | 99% cost reduction |

| Insurance Claim | 7-30 days processing | Instant verification | 95% faster payouts |

| Loan Approval | 3-14 days review | Minutes automated | 98% time savings |

| Trade Finance | 5-10 days settlement | Real-time settlement | 100% faster |

| Policy Management | Manual updates, errors | Automated, accurate | Zero admin errors |

Insurance sees equally dramatic changes. Parametric insurance powered by smart contracts pays out automatically when verified conditions occur. Flight delay insurance checks airline databases and transfers compensation without requiring claims. Crop insurance monitors weather data and pays farmers instantly when drought or flood conditions are confirmed.

Ready to Build Your Smart Contract Future?

Join hundreds of forward-thinking organizations leveraging our 8+ years of blockchain expertise to build secure, scalable, and innovative smart contract solutions.

Transform your vision into reality with proven smart contract expertise

Using AI, Oracles, and Real-World Data with Smart Contracts

Smart contracts exist on blockchains that cannot directly access external information. This limitation initially restricted their usefulness to purely on-chain activities. Oracles solve this problem by providing verified real-world data to smart contracts, dramatically expanding what they can accomplish.

Oracles act as bridges between blockchains and the outside world. They fetch data from APIs, sensors, databases, and other sources, then deliver it to smart contracts in a trustworthy manner. This enables smart contracts to react to weather conditions, stock prices, sports scores, IoT sensor readings, and countless other real-world events.

The future of smart contracts involves deep integration with artificial intelligence. AI can analyze patterns in contract execution, predict optimal parameters for new contracts, and identify potential security vulnerabilities. Machine learning models running alongside smart contracts can make complex decisions that would be impractical to encode directly in contract logic.

Oracle and AI Integration Examples

Weather Data

Crop insurance pays automatically when temperature or rainfall exceeds defined thresholds verified by trusted weather services.

Market Prices

DeFi protocols use price oracles to determine collateral values, liquidation triggers, and exchange rates in real-time.

AI Analysis

Machine learning models detect fraud patterns, optimize contract parameters, and predict market movements for automated trading.

Technical Innovation Insight:

We pioneered AI-enhanced smart contracts for a commodities trading platform in 2024. The AI analyzes historical price patterns, supply chain disruptions, and market sentiment to automatically adjust contract terms and hedging strategies. This system has improved trading profitability by 34% while reducing risk exposure.

Security and Compliance in Future Smart Contracts

As smart contracts manage increasingly valuable assets and critical operations, security becomes paramount. The immutable nature of blockchain means mistakes cannot simply be undone. A security flaw in a smart contract can result in permanent loss of millions of dollars, as several high-profile exploits have demonstrated.

The future of smart contracts includes enhanced security measures becoming standard practice. Formal verification mathematically proves that contract code behaves exactly as intended under all possible conditions. Automated security scanners detect common vulnerabilities before deployment. Multi-signature requirements and time-locks add layers of protection against unauthorized actions.

Formal Verification

Mathematical proofs that smart contract code is bug-free and behaves correctly under all conditions, eliminating entire categories of vulnerabilities.

Adoption: Growing to 60% by 2027

Automated Auditing

AI-powered tools continuously scan smart contracts for security vulnerabilities, code quality issues, and compliance violations in real-time.

Detection Rate: 95% of known issues

Upgradeable Patterns

Proxy contracts allow fixing bugs and adding features while maintaining contract addresses and stored data, balancing immutability with flexibility.

Usage: Standard for 75% of projects

Compliance integration ensures smart contracts meet regulatory requirements automatically. Know Your Customer verification, anti-money laundering checks, and transaction limits can be built directly into contract logic. This regulatory compliance by design makes smart contracts attractive to traditional financial institutions navigating complex legal frameworks.

Legal Status and Regulations Around Smart Contracts

The legal framework surrounding smart contracts continues evolving as governments and regulatory bodies work to address this new technology. Some jurisdictions have embraced smart contracts, while others remain uncertain about how existing laws apply to code-based agreements.

Several U.S. states have passed legislation explicitly recognizing smart contracts as legally binding agreements. Wyoming, Arizona, and Tennessee lead in creating blockchain-friendly regulatory environments. The European Union is developing comprehensive frameworks through regulations like MiCA that address digital assets and smart contract operations.

The future points toward regulatory clarity rather than restriction. Governments recognize smart contracts offer benefits like reduced fraud, improved transparency, and economic efficiency. Regulations are focusing on consumer protection, security standards, and ensuring smart contracts comply with existing legal principles around contracts, property rights, and financial services.

Global Regulatory Landscape

United States

State-by-state approach with increasing recognition. SEC and CFTC providing clearer guidance on digital asset classification and smart contract applications in financial services.

European Union

MiCA regulation provides comprehensive framework. Smart contracts recognized for specific use cases with emphasis on consumer protection and operational resilience.

Asia-Pacific

Singapore and UAE lead with progressive frameworks. China focuses on permissioned blockchains. Japan and South Korea developing specific smart contract regulations.

Latin America

El Salvador and Paraguay pioneering adoption. Brazil developing regulatory sandbox for blockchain innovation including smart contract experimentation.

Final Thoughts: What’s Next for Smart Contracts

The future of smart contracts in Web3 and enterprise represents one of the most significant technological shifts since the internet itself. We stand at the early stages of a transformation that will touch every aspect of how businesses operate and how people interact digitally.

Several key trends will define the coming years. Interoperability between different blockchain networks will become seamless, allowing smart contracts to coordinate across platforms. Layer 2 solutions will make transactions nearly free and instant. Integration with AI will enable smart contracts to make complex decisions and adapt to changing conditions automatically.

For businesses, the question is no longer whether to adopt smart contracts but how quickly to implement them. Companies that master this technology early will gain substantial competitive advantages. Those that delay risk falling behind as automated, transparent, and efficient operations become industry standards.

The Smart Contract Revolution Continues

$16 Trillion in smart contract-managed assets projected

Of Fortune 500 companies using smart contracts

Web3 users interacting with smart contracts daily

The convergence of Smart Contracts in Web3 innovation and enterprise adoption is creating unprecedented opportunities. Smart contracts are not just technology, they represent a fundamental reimagining of trust, automation, and value exchange.

FAQs - Future of Smart Contracts

The main purpose of smart contracts in Web3 is to automate agreements without middlemen. They help execute transactions, manage ownership, enable voting, and handle payments automatically. This makes Web3 applications more transparent, secure, and trust-based, allowing users to interact directly without relying on centralized authorities or manual processes.

Smart contracts can be used in many industries such as finance, banking, insurance, supply chain, healthcare, real estate, gaming, and digital identity. They help automate payments, approvals, record management, and compliance. Both Web3 startups and traditional enterprises use smart contracts to improve efficiency, reduce costs, and increase transparency.

Web3 applications use smart contracts as their backend logic. These contracts run on blockchain networks and control how apps handle transactions, data, and user interactions. Frontend Web3 apps connect to smart contracts through wallets and APIs, allowing users to interact securely while keeping control of their digital assets and data.

In the future, Web3 will support decentralized finance, digital identity systems, NFT-based ownership, gaming economies, metaverse platforms, and real-world asset tokenization. It will also help businesses build transparent systems for data sharing, payments, and governance. Web3 aims to give users more control, privacy, and ownership online.

Smart contracts help banking and insurance by automating payments, settlements, and claims processing. They reduce paperwork, speed up transactions, and ensure rules are followed automatically. For example, insurance claims can be paid instantly when conditions are met, and banking transactions become faster, more transparent, and less dependent on intermediaries.

Smart contracts are safe for business use when they are properly designed, tested, and audited. Blockchain security, encryption, and transparency reduce fraud and manipulation. However, security audits and compliance checks are important to avoid coding errors. With professional development and regular audits, enterprises can safely use smart contracts.

The future of smart contracts is strong in both Web3 and enterprise environments. They will become faster, more secure, and easier to integrate with business systems. Smart contracts will support automation, digital ownership, compliance, and global transactions, becoming a core part of digital infrastructure across industries worldwide.

Yes, 2026 is a good time for businesses to adopt smart contracts. Blockchain technology is more mature, tools are better, and regulations are becoming clearer. Early adoption helps companies gain efficiency, reduce costs, and stay competitive while preparing for the future of Web3 and automated digital business systems.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.