Key Takeaways

- Collateral in DeFi serves as the foundation of trustless lending, allowing users to borrow assets without intermediaries by locking up crypto or tokenized assets into smart contracts.

- DAOs in DeFi Space are responsible for governing critical collateral parameters such as ratios, liquidation thresholds, and the addition or removal of supported assets through community driven proposals.

- Overcollateralization is the most common model in decentralized finance, typically requiring borrowers to deposit 150% or more of the loan value to mitigate volatility risk.

- The process of forgiving or releasing collateral begins when a borrower repays the full loan amount including any interest or stability fees accumulated over time.

- Liquidation mechanisms automatically trigger when the collateral value falls below the required threshold, selling a portion or all of the locked assets to protect lenders.

- Smart contracts play a central role in collateral management by automating deposits, value checks via oracles, loan issuance, and repayment verification without human intervention.

- Real world assets (RWAs) such as tokenized real estate and treasury bonds are emerging as a new class of DeFi collateral, expanding the ecosystem beyond native crypto tokens.

- Cross chain collateral solutions are enabling users to lock assets on one blockchain and borrow on another, increasing capital efficiency across the entire DeFi landscape.

- Price oracle manipulation remains one of the most significant risks in DeFi collateral systems, and DAOs are implementing multi oracle strategies to reduce this vulnerability.

- The future of DeFi collateral models will likely incorporate AI based risk assessment, reputation scoring, and decentralised storage for data integrity across lending protocols.

Introduction to Collateral in DeFi

The decentralized finance ecosystem has transformed how people borrow, lend, and manage financial products without relying on traditional banks or institutions. At the heart of this transformation lies the concept of collateral, which enables trustless interactions between unknown parties on blockchain networks. In traditional finance, a borrower typically undergoes identity verification, credit checks, and manual approvals. In DeFi, collateral replaces these processes, allowing smart contracts to automatically secure loans and protect lenders.

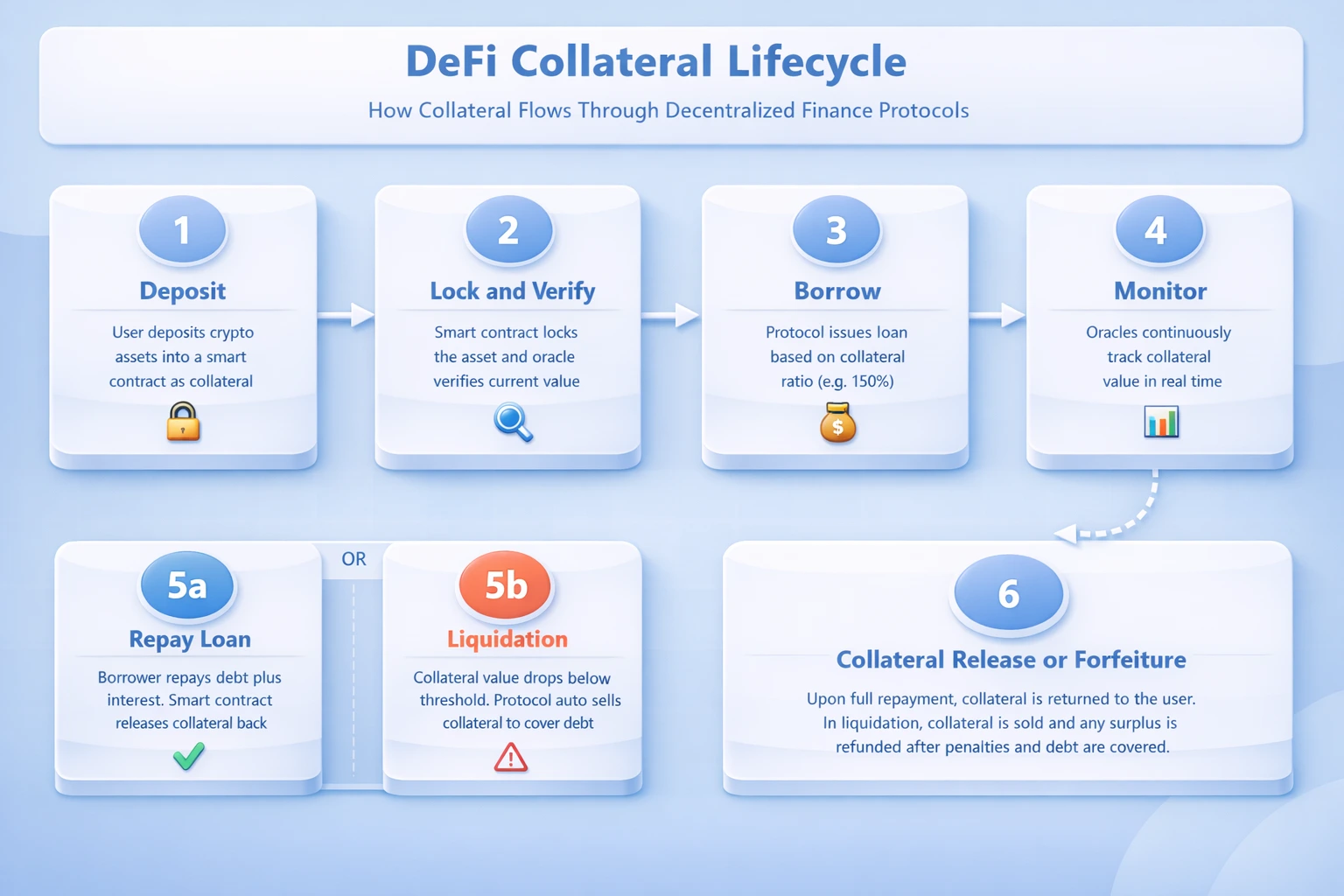

Understanding the process for forgiving collateral in DeFi is essential for anyone participating in decentralized lending and borrowing. The term “forgiving” in this context refers to the release, return, or liquidation of collateral based on borrower actions and market conditions. Whether a borrower successfully repays their debt or faces liquidation, the collateral undergoes a defined lifecycle that is entirely governed by code and, increasingly, by DAOs in DeFi Space. These decentralized autonomous organizations play a pivotal role in setting the rules, adjusting parameters, and evolving the protocols that manage billions of dollars in locked collateral.

This comprehensive guide will walk you through every stage of collateral management in decentralized finance, from initial deposit to final release or liquidation. We will explore the types of collateral used, how ratios are calculated, the smart contract mechanisms that power these systems, and the governance models that DAOs in DeFi Space use to maintain protocol stability and user confidence.

What Is Collateral in Decentralized Finance?

Collateral in decentralized finance refers to a digital asset that a borrower locks into a smart contract as a guarantee against the loan they receive. This locked asset acts as a security deposit. If the borrower fails to repay or if the value of the collateral drops significantly, the protocol can seize and sell the collateral to recover the lender’s funds. This mechanism eliminates the need for trust between parties, as the smart contract enforces the agreement programmatically.

The concept is similar to how a mortgage works in traditional finance, where a house acts as collateral for the home loan. However, in DeFi, the collateral is digital, the process is instantaneous, and there are no human intermediaries. Everything is handled by code deployed on a blockchain. The transparency and immutability of blockchain technology ensure that all collateral movements are publicly auditable, which builds confidence among participants.

For example, a user who wants to borrow DAI on MakerDAO would need to deposit ETH worth at least 150% of the loan amount. If they wish to borrow $10,000 in DAI, they would lock approximately $15,000 in ETH. This overcollateralization buffer protects the protocol against price volatility. The governance rules around these ratios are determined by DAOs in DeFi Space, which vote on changes based on market conditions and risk analysis.

Why Collateral Is Essential for DeFi Protocols

Without collateral, decentralized lending would be impossible in its current form. Traditional banks can use legal systems, credit scores, and collections agencies to recover bad debt. DeFi protocols have none of these mechanisms. Collateral is the only line of defense that ensures lenders are protected if borrowers default on their obligations. This is why almost every major DeFi lending protocol operates on a collateral based model.

Collateral also plays a crucial role in maintaining the overall health and stability of DeFi ecosystems. When protocols hold sufficient collateral, they can absorb market shocks without becoming insolvent. The total value locked (TVL) in DeFi lending protocols is a direct reflection of the collateral deposited by users. A high TVL indicates strong confidence in the protocol, while sudden drops may signal risk or vulnerability.

Furthermore, collateral enables yield generation for depositors. Users who provide liquidity or deposit assets as collateral often earn interest or governance tokens in return. This creates a positive feedback loop where more collateral leads to more lending, which generates more fees, which attracts more participants. DAOs in DeFi Space continuously optimize these incentives to maintain healthy collateral levels and attract new users to their platforms.

Types of Collateral Used in DeFi

The DeFi ecosystem accepts a wide variety of assets as collateral, each carrying its own risk profile and collateral ratio requirements. Understanding these types is important for borrowers who want to maximize their capital efficiency and for DAOs in DeFi Space that govern which assets are eligible. Below we explore the major categories of collateral used across decentralized finance protocols.

Crypto Assets Commonly Used as DeFi Collateral

Native cryptocurrencies such as Ethereum (ETH), Bitcoin (wrapped as WBTC), and Solana (SOL) remain the most popular forms of collateral in DeFi. These assets have deep liquidity, wide market adoption, and are supported by virtually every major lending protocol. However, their price volatility means that protocols must enforce higher collateral ratios. For instance, borrowing against ETH on Aave may require a 150% to 180% collateral ratio, depending on the current market conditions and DAO governance settings.

Stablecoins as Collateral in DeFi Lending

Stablecoins like USDC, USDT, and DAI offer a lower risk alternative for collateral. Because their value is pegged to a fiat currency (usually the US dollar), the price volatility is minimal. This allows protocols to offer lower collateral ratios, sometimes as low as 100% to 110%. Stablecoin collateral is especially popular for users who want to borrow other stablecoins or engage in yield farming strategies without exposure to crypto price swings.

Overcollateralization in DeFi Explained

Overcollateralization is the dominant model in DeFi lending. It requires borrowers to deposit collateral that exceeds the value of the loan they receive. This surplus acts as a buffer against price volatility. If the borrower deposits $15,000 worth of ETH to borrow $10,000 in DAI, the overcollateralization ratio is 150%. This means the protocol has a $5,000 cushion before the loan becomes undercollateralized.

The reason DeFi protocols rely on overcollateralization is the absence of credit scores and legal recourse. In traditional finance, a lender can pursue legal action against a defaulting borrower. In DeFi, the smart contract must be self sufficient. The extra collateral ensures that even in a rapid market downturn, the protocol can liquidate the position and recover the lender’s funds. DAOs in DeFi Space regularly review and adjust these ratios through governance proposals to ensure they reflect current market conditions and risk tolerances.

Example: A user deposits 10 ETH (valued at $3,000 each, totaling $30,000) into MakerDAO. With a 150% collateral ratio, they can borrow up to $20,000 in DAI. If ETH drops to $2,200, the collateral value falls to $22,000, and the position nears the liquidation threshold. The user must either add more collateral or repay part of the loan to avoid liquidation.

Undercollateralized and Uncollateralized DeFi Loans

While overcollateralization dominates, there is a growing segment of DeFi that explores undercollateralized and even uncollateralized lending. Protocols like Maple Finance, TrueFi, and Goldfinch offer loans to institutional borrowers based on reputation, credit assessments, and agreements rather than purely on locked collateral. These models bring DeFi closer to traditional lending and open up capital access for businesses that cannot afford to lock up large amounts of crypto.

However, undercollateralized lending carries significantly higher risk. If a borrower defaults, there may not be enough collateral to cover the losses. This is where DAOs in DeFi Space become especially important, as they must carefully evaluate borrower eligibility, set credit limits, and establish reserve funds to absorb potential defaults. Governance token holders assume responsibility for risk management through voting and proposal review.

How Collateral Ratios Are Calculated in DeFi

The collateral ratio is one of the most important metrics in DeFi lending. It represents the relationship between the value of the locked collateral and the value of the outstanding loan. A higher ratio means more safety for the protocol, while a lower ratio means more capital efficiency for the borrower. The formula is straightforward:

Different protocols enforce different minimum ratios depending on the asset type, market conditions, and DAO governance decisions. The following table compares common collateral ratio requirements across leading DeFi platforms:

| Protocol | Collateral Asset | Minimum Ratio | Liquidation Threshold | Governance |

|---|---|---|---|---|

| MakerDAO | ETH | 150% | 145% | MKR DAO |

| Aave V3 | ETH | 130% | 82.5% | AAVE DAO |

| Compound V3 | WBTC | 150% | 80% | COMP DAO |

| Liquity | ETH | 110% | 110% | Immutable |

| Spark Protocol | stETH | 125% | 80% | Spark DAO |

As illustrated in the table above, each protocol has different parameters that are shaped by the type of collateral accepted and the governance decisions of their respective DAOs in DeFi Space. Users should compare these values carefully before choosing where to deposit their assets.

Smart Contracts and Collateral Management

Smart contracts are the backbone of collateral management in decentralized finance. These self executing programs, deployed on blockchains like Ethereum, Solana, and Avalanche, handle every step of the collateral lifecycle automatically. When a user deposits collateral, the smart contract records the transaction, verifies the asset type and value through price oracles, calculates the maximum borrowing capacity, and issues the loan, all within seconds and without any human involvement.

The beauty of smart contracts lies in their transparency and determinism. Every user can audit the code to understand exactly how collateral is managed. There are no hidden clauses or subjective decisions. If the conditions for liquidation are met, the contract executes the liquidation automatically. If the borrower repays the loan in full, the contract releases the collateral instantly. This level of automation is what makes DeFi fundamentally different from traditional finance.

Price oracles, such as Chainlink and Pyth Network, feed real time market data into these smart contracts. The accuracy and reliability of oracles are critical because incorrect price data could trigger false liquidations or allow undercollateralized positions to persist. DAOs in DeFi Space often vote on which oracle services to use and may implement multi oracle strategies to reduce the risk of manipulation or failure. Additionally, the emergence of decentralised storage solutions is helping protocols maintain resilient data feeds and backup systems for oracle reliability.

Liquidation Mechanisms in DeFi Platforms

Liquidation is the process by which a DeFi protocol sells a borrower’s collateral to repay the outstanding loan when the collateral value falls below the required threshold. This mechanism protects lenders from losses and maintains the solvency of the entire protocol. Liquidations can be partial (only a portion of the collateral is sold) or full (the entire position is closed), depending on the protocol’s design.

In most DeFi protocols, liquidations are carried out by third party participants known as liquidators. These are individuals or automated bots that monitor the blockchain for undercollateralized positions. When they find one, they repay part of the borrower’s debt and receive the corresponding collateral at a discount, known as the liquidation bonus. This incentive structure ensures that liquidations happen quickly and efficiently, even during periods of extreme market volatility.

For example, on Aave, if a borrower’s health factor drops below 1.0, their position becomes eligible for liquidation. A liquidator can repay up to 50% of the debt and receive the equivalent collateral plus a 5% to 10% bonus. This bonus compensates the liquidator for the gas costs and risk associated with the transaction. The parameters governing these bonuses are set and adjusted by the protocol’s DAO through governance votes.

Risks Associated With DeFi Collateral

While collateral provides a robust security mechanism, it is not without risks. Users and protocols face several challenges that can impact the effectiveness of collateral in protecting both parties. Understanding these risks is essential for anyone participating in DeFi lending or borrowing.

Smart Contract Vulnerabilities: Even audited smart contracts can contain bugs or exploits. If a vulnerability is discovered, attackers could drain collateral from the protocol. This risk underscores the importance of rigorous security audits, bug bounty programs, and the governance oversight provided by DAOs in DeFi Space.

Oracle Manipulation: Since collateral values depend on price feeds from oracles, any manipulation of these feeds can lead to incorrect liquidations or allow positions to become dangerously undercollateralized. Multi oracle strategies and time weighted average prices (TWAPs) help mitigate this risk.

Cascade Liquidations: During sharp market downturns, a large number of positions may become eligible for liquidation simultaneously. This creates a cascade effect where the selling pressure from liquidations further drives down asset prices, triggering even more liquidations. The March 2020 “Black Thursday” event on MakerDAO is a classic example of this phenomenon.

Regulatory Uncertainty: As governments around the world develop regulatory frameworks for cryptocurrency and DeFi, the legal status of collateral arrangements remains unclear. Changes in regulation could impact how protocols operate and how users interact with collateral.

Concentration Risk: If a large portion of a protocol’s collateral is in a single asset type, a significant price drop in that asset could threaten the protocol’s solvency. Diversification of accepted collateral types, guided by DAO governance, helps reduce this risk.

Price Volatility and Its Impact on Collateral

Cryptocurrency markets are known for their extreme price volatility. A 20% to 30% price swing in a single day is not uncommon, especially for smaller cap tokens. This volatility directly affects collateral values and, consequently, the health of lending positions. A borrower who was safely overcollateralized in the morning could face liquidation by the afternoon if prices drop sharply.

To manage this risk, DeFi protocols implement several strategies. Higher collateral ratios provide larger buffers against price drops. Stability fees discourage excessive borrowing during volatile periods. Real time oracle updates ensure that collateral values reflect current market conditions. And DAOs in DeFi Space can implement emergency measures such as raising collateral requirements or pausing certain markets during extreme volatility events.

Users can also protect themselves by maintaining a collateral ratio well above the minimum requirement, diversifying their collateral across multiple asset types, and using automated tools to monitor their positions and add collateral when needed. Some protocols even offer automated collateral top up features that trigger when the health factor approaches a dangerous level

Cross Chain Collateral in DeFi Ecosystems

As the DeFi ecosystem expands across multiple blockchains, the ability to use collateral from one chain on another has become increasingly important. Cross chain collateral solutions allow users to lock assets on Ethereum and borrow on Avalanche, or deposit collateral on Polygon and access liquidity on Arbitrum. This interoperability significantly increases capital efficiency and opens up new opportunities for users who hold assets across multiple networks.

Protocols like LayerZero, Wormhole, and Chainlink CCIP (Cross Chain Interoperability Protocol) enable these cross chain interactions by providing secure messaging and asset bridging between blockchains. However, cross chain collateral introduces additional complexity and risk. Bridge exploits have been among the most costly hacks in DeFi history, with billions of dollars lost to vulnerabilities in bridging protocols.

DAOs in DeFi Space play a vital role in evaluating the risks of cross chain integrations and deciding which bridges and interoperability protocols to support. Governance proposals for adding cross chain collateral support undergo rigorous community review, security assessments, and often require successful audits before implementation.

Real World Assets (RWA) as DeFi Collateral

One of the most exciting developments in decentralized finance is the tokenization of real world assets (RWAs) for use as collateral. This includes tokenized real estate, treasury bonds, invoices, and even intellectual property. By bringing these assets on chain, DeFi protocols can access a much larger pool of collateral and offer lending services that were previously limited to traditional finance.

Protocols like Centrifuge, Maple Finance, and Ondo Finance are leading the RWA collateral movement. MakerDAO, one of the most prominent DAOs in DeFi Space, has already allocated a significant portion of its collateral backing to US Treasury bonds and other real world assets. This diversification away from purely crypto based collateral reduces the protocol’s exposure to crypto market volatility and creates a more stable foundation for its DAI stablecoin.

The integration of RWAs with DeFi also creates opportunities for synthetic asset platforms that tokenise real world value on the blockchain, enabling users to gain exposure to traditional financial instruments without leaving the decentralized ecosystem. This convergence of traditional and decentralized finance represents a significant step toward mainstream adoption.

Overcollateralized vs Undercollateralized Lending: A Comparison

Understanding the differences between these two lending models is crucial for anyone navigating the DeFi landscape. The following comparison table highlights the key distinctions:

| Parameter | Overcollateralized Lending | Undercollateralized Lending |

|---|---|---|

| Collateral Required | 110% to 200% of loan value | 0% to 100% of loan value |

| Risk Level for Lenders | Lower risk due to collateral buffer | Higher risk due to insufficient backing |

| Capital Efficiency | Lower (more capital locked) | Higher (less capital required) |

| Borrower Access | Open to anyone with assets | Requires reputation or credit review |

| Liquidation Mechanism | Automatic via smart contracts | Manual recovery or insurance pools |

| DAO Governance Role | Sets ratios and liquidation parameters | Evaluates borrower credibility |

| Example Protocols | Aave, MakerDAO, Compound | Maple Finance, TrueFi, Goldfinch |

Collateral Optimization Strategies for DeFi Users

Experienced DeFi users employ various strategies to maximize the efficiency of their collateral while minimizing risk. These strategies range from simple diversification to complex multi protocol strategies that leverage composability across the DeFi ecosystem.

Collateral Diversification: Instead of depositing a single asset as collateral, users can spread their deposits across multiple asset types. This reduces the impact of a single asset’s price decline on the overall collateral position. Protocols like Aave V3 support multi asset collateral, making diversification straightforward.

Recursive Borrowing: This strategy involves depositing an asset as collateral, borrowing against it, and then redepositing the borrowed asset as additional collateral to borrow more. While this amplifies returns, it also amplifies risk and should be approached with extreme caution. A small price movement can trigger cascading liquidations across the entire leveraged position.

Yield Bearing Collateral: Using liquid staking tokens like stETH or rETH as collateral allows users to earn staking rewards while simultaneously borrowing against their assets. This dual income approach maximizes capital efficiency without adding additional risk beyond the inherent smart contract risk of the staking protocol.

Automated Position Management: Tools like DeFi Saver and Instadapp offer automated features that can adjust collateral ratios, rebalance positions, and even migrate between protocols based on predefined rules. These tools help users maintain healthy positions without constant manual monitoring.

Regulatory Considerations for DeFi Collateral

As DeFi continues to grow, regulators worldwide are paying closer attention to how collateral is managed, who has access to lending services, and what protections exist for users. The regulatory landscape for DeFi collateral is still evolving, but several key themes are emerging that will shape the future of the industry.

In the United States, the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have both signaled interest in regulating aspects of DeFi lending. The classification of certain collateral tokens as securities could have significant implications for how protocols operate and which assets they accept. In the European Union, the Markets in Crypto Assets (MiCA) regulation provides a framework that may influence how collateral arrangements are structured.

DAOs in DeFi Space are increasingly considering regulatory compliance in their governance decisions. Some protocols have implemented Know Your Customer (KYC) requirements for institutional borrowers or created separate permissioned pools that comply with local regulations. This hybrid approach allows protocols to serve both the permissionless DeFi community and regulated institutional participants.

Future of Collateral Models in DeFi

The evolution of collateral models in DeFi is far from over. Several emerging trends and technologies are poised to transform how collateral is managed, valued, and utilized across decentralized protocols.

Artificial intelligence and machine learning are beginning to play a role in risk assessment for DeFi lending. AI models can analyze on chain data, historical price patterns, and user behavior to provide more accurate risk scores, potentially enabling lower collateral ratios for verified, low risk borrowers. This approach could bridge the gap between overcollateralized and undercollateralized models.

Reputation based lending systems are another frontier. By building on chain credit histories, protocols could allow users with strong repayment records to borrow with lower collateral requirements. This concept, sometimes called “DeFi credit scores,” would make lending more accessible and capital efficient while maintaining the trustless nature of the ecosystem.

The integration of decentralised storage technologies will also play an increasingly important role in collateral management. Secure, tamper proof data storage ensures that oracle feeds, audit reports, and governance records remain accessible and verifiable, strengthening the overall infrastructure that supports collateral in DeFi.

As these innovations mature, DAOs in DeFi Space will continue to be the driving force behind adopting new collateral models, managing risk parameters, and ensuring that the DeFi ecosystem remains secure, efficient, and accessible to users around the world.

Ready to Build Your DeFi Protocol with Expert Collateral Management?

Partner with experienced blockchain specialists who understand the complexities of collateral systems, DAO governance, and smart contract security.

Why Nadcab Labs Is Your Trusted Partner for DeFi Collateral Solutions

With over 8 years of hands on experience in the blockchain and decentralized finance industry, Nadcab Labs has established itself as a leading authority in building, auditing, and optimizing DeFi protocols with robust collateral management systems. Our team has worked extensively with DAOs in DeFi Space, helping them design governance frameworks, implement smart contract based collateral logic, and deploy liquidation mechanisms that protect both lenders and borrowers. From overcollateralized lending platforms to innovative RWA tokenization solutions, Nadcab Labs brings deep technical expertise and strategic insight to every project. We understand the nuances of oracle integration, cross chain interoperability, and regulatory compliance that are critical to building DeFi protocols that stand the test of time. Our commitment to security, transparency, and innovation makes us the ideal partner for organizations looking to launch or enhance their DeFi collateral infrastructure. Whether you are building a new lending protocol, integrating real world assets, or optimizing your existing collateral model, Nadcab Labs has the knowledge, tools, and proven track record to help you succeed in the rapidly evolving world of decentralized finance.

Frequently Asked Questions

In most DeFi protocols, once a liquidation is triggered, the collateral is sold to repay the debt. However, any surplus remaining after the debt and liquidation penalty are covered is typically returned to the borrower’s wallet. The exact process varies by protocol. Some platforms like Aave allow partial liquidations, meaning only a portion of your collateral may be affected, preserving the rest for you.

DAOs in DeFi Space use governance tokens that grant holders voting power. When a proposal to change collateral parameters is submitted, token holders cast votes during a defined voting period. If the proposal reaches quorum and majority approval, it is executed through a smart contract. Platforms like MakerDAO and Compound rely on this community driven governance to adjust collateral ratios, add new asset types, or modify liquidation thresholds.

Yes, several DeFi insurance protocols such as Nexus Mutual and InsurAce offer coverage against smart contract failures and liquidation losses. Users pay a premium to secure a policy that compensates them if a covered event occurs. However, insurance in DeFi is still evolving, and not all risks are covered. Users should carefully read policy terms to understand exclusions, claim procedures, and the maximum payout limits before purchasing coverage.

If a DeFi protocol is exploited, your collateral could be partially or fully lost, depending on the severity of the hack. Some protocols maintain treasury reserves or insurance funds to compensate affected users. Others rely on community governance to decide recovery plans. It is wise to diversify collateral across multiple protocols and use platforms that have undergone rigorous smart contract audits to reduce exposure to such risks.

Yes, NFT backed lending is growing rapidly. Platforms like NFTfi and BendDAO allow users to lock NFTs as collateral to borrow crypto assets. The loan amount depends on the floor price and rarity of the NFT. However, NFT collateral introduces unique risks including illiquidity and volatile floor prices, making it harder for lenders to recover value if the borrower defaults on the loan agreement.

Flash loans are unique because they require zero collateral. The borrower takes and repays the loan within a single blockchain transaction. If repayment fails, the entire transaction is reversed automatically. While flash loans eliminate collateral requirements, they are primarily used for arbitrage, liquidation, and collateral swaps rather than traditional borrowing. They showcase how DeFi innovates beyond traditional finance by leveraging smart contract capabilities for trustless instant lending.

The collateral factor determines how much you can borrow against your deposited assets, while the liquidation threshold is the point at which your position becomes eligible for liquidation. For example, a collateral factor of 75% means you can borrow up to 75% of your deposit value. A liquidation threshold of 80% means liquidation begins when your debt exceeds 80% of the collateral value, providing a safety buffer between borrowing and liquidation

Most DeFi protocols do not charge a direct fee for withdrawing collateral, but you will need to pay blockchain gas fees for the transaction. Some platforms may apply an exit fee or a stability fee that accumulates over time. It is important to check the specific protocol’s fee structure before depositing. High gas fees on networks like Ethereum can sometimes make small withdrawals economically impractical during periods of network congestion.

Collateral delegation allows a depositor to assign their unused borrowing power to another user without transferring the actual collateral. The delegator maintains ownership of the asset while the delegatee gains borrowing capacity. Aave’s credit delegation feature is a prominent example. This system relies on trust or off chain agreements since the delegator bears the risk of the delegatee’s position being liquidated, potentially affecting their deposited collateral in the protocol.

With liquid staking derivatives like stETH or rETH, yes. These tokens represent staked assets and continue to earn staking rewards even when deposited as collateral in DeFi lending platforms. This allows users to enjoy dual yield from both staking returns and lending interest. However, using liquid staking tokens as collateral introduces additional smart contract risk since it relies on the security of both the staking and lending protocols simultaneously.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.