Key Takeaways

- Flash loans in Web3 enable borrowing large amounts of capital without collateral, with the requirement that borrowed funds must be repaid within a single atomic transaction

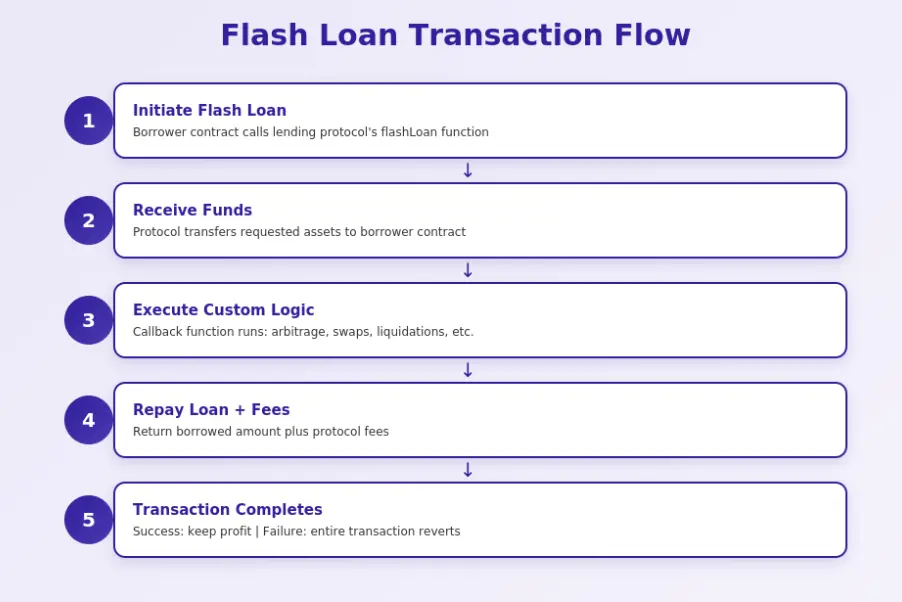

- Flash loan implementation requires understanding smart contract interactions, the flash loan transaction flow, and the flash loan execution process that ensures single-block completion

- The flash loan architecture consists of lending protocols, borrower contracts, and callback mechanisms that enable flash loan atomic transactions to execute custom logic before repayment

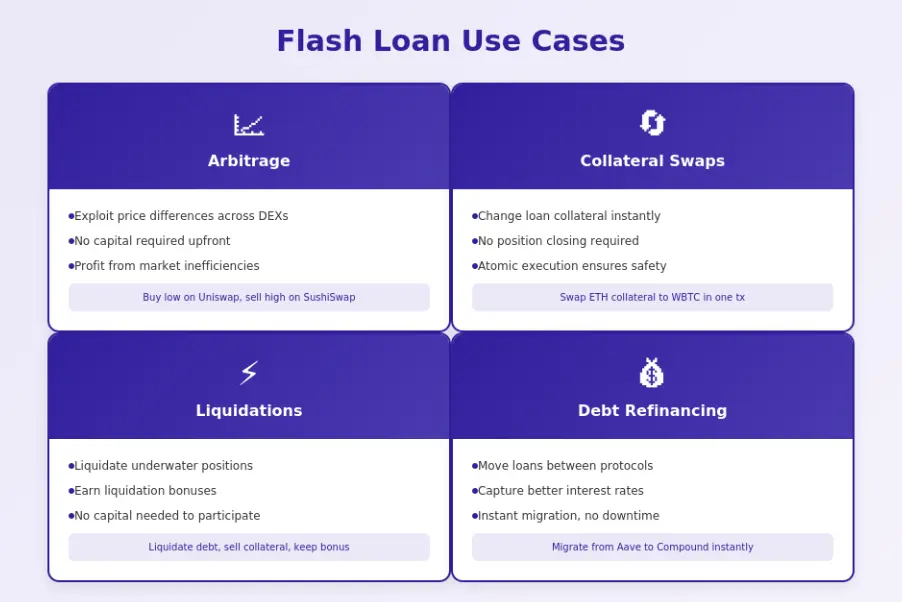

- DeFi flash loans power multiple use cases including flash loan arbitrage across exchanges, collateral swaps, flash loan liquidation of underwater positions, and yield optimization strategies

- Flash loan security risks include price oracle manipulation, reentrancy attacks, and smart contract vulnerabilities that have resulted in hundreds of millions in losses across DeFi

- Flash loan best practices include using decentralized oracles, implementing reentrancy guards, limiting exposure, and conducting thorough security audits before deployment

- DeFi lending protocols flash loans from Aave, dYdX, and Uniswap offer different fee structures, liquidity depths, and integration patterns for various implementation needs

- Understanding how flash loans work is essential for both implementing profitable strategies and protecting protocols from potential flash loan attack vectors

- Flash loan without collateral mechanisms represent a paradigm shift in capital efficiency, enabling sophisticated financial operations previously impossible without significant capital

What Are Flash Loans in Web3

Flash loans represent one of the most innovative financial primitives to emerge from decentralized finance. Unlike any instrument in traditional finance, flash loans in Web3 enable borrowing unlimited capital without collateral, interest calculations, or credit checks. The only requirement is that borrowed funds must be returned within the same transaction they were borrowed. This seemingly simple constraint unlocks extraordinary possibilities while maintaining zero risk for lenders.

Flash Loans Explained in Simple Terms

Imagine being able to borrow millions of dollars, use that money for a profitable operation, and return it all within seconds without ever needing to prove you could repay it. That’s essentially what flash loans enable. The borrower receives funds, executes their strategy (like buying assets cheap on one exchange and selling high on another), and repays the loan plus a small fee, all in a single transaction that either completes entirely or fails entirely.

The magic lies in blockchain’s atomic transaction property. When you submit a transaction, either everything inside it succeeds, or nothing does. If your flash loan strategy fails to generate enough profit to repay, or if any step encounters an error, the blockchain simply reverts everything, returning funds to the lending pool as if the loan never happened. The lender faces zero risk because they never actually lose control of their funds in any scenario where repayment doesn’t occur.

How Flash Loans Differ from Traditional Loans?

Traditional loans involve credit assessments, collateral requirements, interest rates, and repayment schedules spanning weeks to years. Banks evaluate borrower risk, lock up collateral, and charge interest proportional to loan duration and perceived risk. Flash loan without collateral mechanisms bypass all of this because the temporal dimension that creates risk in traditional lending simply doesn’t exist.

The differences extend beyond collateral requirements. Traditional loans allow borrowers to use funds freely over extended periods. Flash loans restrict usage to operations that can complete within approximately 12-15 seconds (one Ethereum block). This constraint might seem limiting, but within those seconds, a well-designed smart contract can execute dozens of operations across multiple protocols, achieving outcomes that would require substantial capital and time in traditional finance.

Why Flash Loans Are Unique to DeFi?

Flash loans could only emerge in the DeFi ecosystem because they require two capabilities unique to programmable blockchains: atomic transactions and composable smart contracts. Atomic transactions ensure that multi-step operations either complete fully or revert entirely. Composability means smart contracts can call other smart contracts, enabling complex operations to chain together within single transactions.

Traditional financial systems lack both properties. Bank transactions process asynchronously, sometimes taking days to settle. Financial services operate as isolated systems requiring manual integration. These architectural differences mean flash loans have no traditional finance equivalent and represent genuinely novel financial infrastructure that Web3 uniquely enables.

Important: Flash loans are powerful tools that require careful implementation. While the borrowing mechanism itself is safe (failed loans simply revert), the strategies executed using flash loans carry significant risks including smart contract bugs, oracle manipulation, and failed arbitrage. Always audit flash loan contracts thoroughly before deployment.

How Flash Loans Work on the Blockchain?

Understanding how flash loans work requires grasping the technical mechanisms that make them possible. The flash loan execution process leverages blockchain’s transaction model to create a financial instrument with seemingly impossible properties.

Atomic Transactions and Flash Loan Logic

Flash loan atomic transactions ensure all operations within a transaction either succeed together or fail together. When a borrower initiates a flash loan, the lending protocol transfers funds to the borrower’s contract. The borrower’s contract then executes custom logic, perhaps trading across multiple exchanges. Finally, the contract must return the borrowed amount plus fees to the lending protocol.

The atomicity guarantee means the lending protocol can confidently release funds knowing that if repayment fails, the entire transaction reverts including the initial transfer. The protocol’s funds never actually leave their control in any failure scenario. This property eliminates counterparty risk entirely, enabling truly trustless lending without collateral.

Single-Block Execution Flow

The flash loan transaction flow must complete within a single block, typically 12-15 seconds on Ethereum. During this window, the transaction executes sequentially: loan initiation, custom operations, and repayment. The Ethereum Virtual Machine processes each step in order, checking balances and state changes as it proceeds.

This single-block constraint shapes what flash loans can accomplish. Operations must be deterministic and completable within gas limits. Strategies requiring external input, user confirmation, or cross-chain operations don’t fit the flash loan model. However, within these constraints, sophisticated multi-step operations across numerous DeFi protocols remain entirely feasible.

Flash Loan Repayment Mechanism

Flash loan repayment must occur before the transaction ends. Lending protocols verify repayment by checking that borrowed amount plus fees have been returned. If the check fails, the entire transaction reverts. The repayment mechanism typically involves the borrower’s contract calling an approve function followed by a transfer, or using the protocol’s specific repayment interface.

Fees vary by protocol and represent the lender’s profit from providing flash loan liquidity. These fees are typically very small (0.05-0.3%) because the loan duration is effectively zero. Despite low per-loan fees, high volumes and large loan sizes can generate substantial returns for liquidity providers over time.

Flash Loan Architecture in Web3

Flash loan architecture consists of interacting components that together enable the borrowing, execution, and repayment cycle. Understanding this architecture is essential for successful flash loan implementation.

Core Components of Flash Loan Architecture

The architecture includes three primary components: the lending protocol (holding liquidity and managing loans), the borrower contract (executing custom logic), and the callback mechanism (enabling the lending protocol to trigger borrower logic). These components interact through standardized interfaces that define how loans initiate, execute, and conclude.

Lending protocols maintain liquidity pools from which flash loans draw. Borrower contracts implement the custom strategy logic. Callback functions allow the lending protocol to transfer funds, then call the borrower’s execution function, then verify repayment, all within the atomic transaction structure.

Role of Smart Contracts in Flash Loans

Smart contracts make flash loans possible by encoding the entire loan lifecycle in deterministic, automatically-executing code. The lending protocol’s smart contracts define loan terms, manage liquidity, and enforce repayment. The borrower’s smart contracts implement strategy logic and handle fund movement. The interaction between these contracts, governed by immutable code, creates the trustless environment flash loans require.

Interaction Between Borrower and Lending Protocol

The interaction follows a specific pattern: borrower calls the lending protocol’s flash loan function, specifying desired assets and amounts. The protocol transfers funds to the borrower’s contract and calls the borrower’s callback function. The borrower’s callback executes custom logic, then approves repayment. The protocol verifies repayment and completes (or reverts) the transaction.

| Component | Role | Key Functions |

|---|---|---|

| Lending Protocol | Provides liquidity | flashLoan(), verifyRepayment() |

| Borrower Contract | Executes strategy | executeOperation(), repay() |

| Callback Interface | Enables execution | onFlashLoan() |

| Liquidity Pool | Stores assets | deposit(), withdraw() |

Flash Loan Implementation Process

Flash loan implementation requires careful planning and precise execution. The process involves preparing contracts, integrating with lending protocols, and ensuring reliable repayment mechanisms.

Preparing Smart Contracts for Flash Loans

Preparation begins with designing the borrower contract architecture. The contract must implement the callback interface required by the chosen lending protocol. For Aave, this means implementing the IFlashLoanReceiver interface with its executeOperation function. The contract should also include access controls, error handling, and the specific logic for your intended strategy.

Testing is critical during preparation. Deploy contracts to testnets like Goerli or Sepolia where flash loans can be tested without risking real funds. Verify that all execution paths work correctly, including failure scenarios that should trigger transaction reverts.

Calling Flash Loan Functions

Initiating a flash loan involves calling the lending protocol’s flash loan function with appropriate parameters. For Aave V3, this means calling Pool.flashLoan() or Pool.flashLoanSimple(), specifying the receiver contract, assets to borrow, amounts, and any additional data needed for execution.

The call triggers the lending protocol to transfer requested assets to your contract and invoke your callback function. Your callback receives the borrowed assets along with calculated fees and premium amounts that must be repaid.

Executing Custom Logic Within a Flash Loan

Custom logic executes inside your callback function after receiving borrowed funds. This is where the actual strategy runs: swapping assets across DEXs for arbitrage, repaying and reborrowing for collateral swaps, or acquiring liquidation assets. The logic must be gas-efficient and deterministic, completing reliably within transaction limits.

Complex strategies may involve multiple protocol interactions. For example, an arbitrage strategy might: receive borrowed DAI, swap DAI for ETH on Uniswap (where ETH is cheap), swap ETH for DAI on SushiSwap (where ETH is expensive), then repay the original DAI plus fees while keeping the profit.

Ensuring Successful Repayment in One Transaction

Repayment must occur before your callback function returns. The standard pattern involves calculating the total repayment amount (borrowed plus fees), ensuring your contract holds sufficient funds, approving the lending protocol to pull funds, and returning successfully from the callback. The lending protocol then verifies the repayment and completes the transaction.

Failed repayment causes the entire transaction to revert. While this protects against fund loss, it does consume gas. Implementing pre-execution checks that verify profitability before initiating loans can prevent wasteful failed transactions.

Popular Flash Loan Protocols in DeFi

Several DeFi lending protocols flash loans capabilities have emerged, each with distinct characteristics. Choosing the right protocol depends on available assets, fee structures, and integration requirements.

Flash Loans in Aave Protocol

Aave pioneered DeFi flash loans and remains the dominant provider. Aave V3 offers flash loans across multiple chains including Ethereum, Polygon, Arbitrum, and Optimism. The protocol charges 0.05% fees (reduced from 0.09% in V2) and provides access to billions in liquidity across dozens of assets.

Aave’s implementation is well-documented with extensive developer resources. The protocol supports both single-asset flash loans (flashLoanSimple) and multi-asset flash loans (flashLoan) for more complex strategies. Aave’s widespread adoption means most flash loan tutorials and examples use its interfaces.

Flash Loan Support in Other DeFi Platforms

Uniswap offers flash swaps, a variant allowing borrowing one asset and repaying with another. This flexibility enables different arbitrage patterns without requiring the original borrowed asset for repayment. Flash swap fees are 0.3%, matching standard swap fees.

dYdX historically offered zero-fee flash loans, making it attractive for smaller arbitrage opportunities where fees significantly impact profitability. Other protocols including Euler Finance, Balancer, and MakerDAO provide flash loan capabilities with varying terms and available assets.

Choosing the Right Protocol for Implementation

Protocol selection depends on multiple factors. Consider available liquidity for your target assets, fee structures that affect profitability, chain deployment matching your target environment, and integration complexity for your team’s capabilities. Aave’s documentation quality and community support make it the default choice for most implementations.

| Protocol | Fee | Chains | Best For |

|---|---|---|---|

| Aave V3 | 0.05% | Multi-chain | General purpose, large loans |

| Uniswap | 0.3% | Ethereum, L2s | Cross-asset swaps |

| dYdX | Variable | Ethereum | Trading strategies |

| Balancer | 0% | Multi-chain | Fee-sensitive operations |

Flash Loan Use Cases in Web3

Flash loan use cases span multiple DeFi operations, from simple arbitrage to complex financial restructuring. Understanding these applications reveals the breadth of possibilities flash loans enable.

Arbitrage Opportunities Using Flash Loans

Flash loan arbitrage exploits price differences across decentralized exchanges. When ETH trades at $2000 on Uniswap but $2010 on SushiSwap, a flash loan enables buying on the cheaper exchange and selling on the expensive one without requiring capital. The profit margin minus fees and gas determines whether the arbitrage is viable.

Arbitrage opportunities are competitive and often fleeting. MEV (Maximal Extractable Value) bots constantly scan for these opportunities, often outbidding human traders through higher gas prices. Successful arbitrage requires sophisticated monitoring infrastructure and optimized execution to capture opportunities before competitors.

Collateral Swaps and Debt Refinancing

Flash loans enable changing collateral assets in lending positions without closing positions. A user with ETH collateral backing a DAI loan could swap to WBTC collateral by: borrowing enough DAI to repay their loan, withdrawing ETH collateral, swapping ETH for WBTC, depositing WBTC as new collateral, borrowing DAI again, and repaying the flash loan. All steps execute atomically, maintaining continuous collateralization.

Debt refinancing similarly allows moving loans between protocols to capture better interest rates. If Compound offers lower borrowing rates than Aave, flash loans enable instant migration without the capital that would otherwise be needed to simultaneously hold funds and maintain positions.

Liquidations Through Flash Loans

Flash loan liquidation enables participating in lending protocol liquidations without holding capital. When underwater positions become liquidatable, anyone can use flash loans to borrow required assets, liquidate the position (receiving discounted collateral), sell the collateral, and repay the flash loan while keeping the liquidation bonus.

Liquidation is essential for DeFi lending protocol health, as it removes bad debt and maintains system solvency. Flash loans democratize liquidation access, allowing anyone to participate rather than only well-capitalized actors. This competition helps ensure liquidations happen promptly, benefiting overall system stability.

Yield Optimization Strategies

Flash loans enable yield optimization strategies that rebalance positions across protocols to maximize returns. A user might flash loan funds to temporarily boost liquidity provision for a reward snapshot, then withdraw and repay after capturing rewards. While potentially profitable, such strategies exist in regulatory gray areas and may affect protocol fairness.

Common Flash Loan Use Cases

- Arbitrage: Profit from price differences across exchanges

- Collateral Swaps: Change loan collateral without closing positions

- Liquidations: Liquidate underwater positions profitably

- Debt Refinancing: Move loans to better rates instantly

- Self-Liquidation: Close positions efficiently to avoid forced liquidation

Security Risks Associated with Flash Loans

Flash loan security risks have resulted in hundreds of millions in losses across DeFi. Understanding attack patterns is essential for both implementing secure flash loan strategies and protecting protocols from exploitation.

Common Flash Loan Attack Patterns

Flash loan attacks typically follow a pattern: borrow large amounts, manipulate some system state (usually prices or governance), extract value from the manipulated state, and repay the loan. The attack profits from the delta between borrowed amount and extracted value. Attackers have stolen hundreds of millions through these patterns.

Notable attacks include the bZx attacks (2020), which manipulated Uniswap prices to profit from bZx margin trading; the Harvest Finance attack ($34M), which manipulated Curve pool prices; and the Cream Finance attacks (over $100M combined), which exploited price oracle vulnerabilities. Each demonstrates different variations on the core manipulation pattern.

Reentrancy and Price Manipulation Risks

Reentrancy attacks occur when malicious contracts call back into vulnerable functions before previous calls complete. Flash loans amplify reentrancy risks by providing the capital needed for exploitation. Protocols must implement reentrancy guards and carefully order state changes to prevent these attacks.

Price manipulation leverages flash loan capital to move prices on decentralized exchanges. Borrowing millions and executing large trades can temporarily move prices substantially. If a target protocol uses these manipulated prices for calculations, attackers can extract value during the manipulation window.

Oracle Vulnerabilities in Flash Loan Scenarios

Oracle vulnerabilities represent the most exploited attack vector. Protocols using spot prices from single DEXs are especially vulnerable: flash loans can move these prices arbitrarily within a transaction. Secure oracle design requires aggregating multiple sources, implementing time-weighted averages, and adding sanity checks that reject extreme price movements.

Best Practices for Secure Flash Loan Implementation

Flash loan best practices have evolved from painful lessons across the industry. Implementing these practices significantly reduces vulnerability to common attack patterns.

Validating External Calls

All external calls made during flash loan execution should be validated thoroughly. Verify that called contracts are legitimate, expected addresses. Check return values for success indicators. Limit what external contracts can do through careful interface design. Never trust that external calls will behave as expected.

Using Secure Price Oracles

Oracle security is paramount for flash loan resistance. Use decentralized oracle networks like Chainlink that aggregate multiple independent sources. Implement time-weighted average prices (TWAP) that cannot be manipulated within single transactions. Add circuit breakers that pause operations during extreme price movements.

Limiting Flash Loan Exposure

Protocols can limit flash loan exposure through several mechanisms. Implement flash loan guards that detect and reject transactions containing flash loans when such protection is appropriate for the use case. Add rate limits on price-sensitive operations. Require delays between certain operations that prevent single-transaction exploitation.

Smart Contract Auditing Considerations

Smart contract audits should specifically test for flash loan vulnerabilities. Auditors should simulate flash loan attacks against all price-dependent functions, test reentrancy resistance, and verify oracle integration security. Multiple independent audits provide stronger assurance than single reviews.

Gas Optimization and Performance Considerations

Gas efficiency directly impacts flash loan profitability. Complex operations can consume substantial gas, potentially eliminating arbitrage margins or making strategies economically unviable.

Gas Costs in Flash Loan Transactions

Flash loan transactions typically involve multiple contract calls, token transfers, and state changes, all of which consume gas. On Ethereum mainnet, complex flash loan operations can cost hundreds of dollars in gas during congested periods. Layer 2 networks like Arbitrum and Optimism offer dramatically lower costs, making smaller arbitrage opportunities viable.

Optimizing Smart Contract Logic

Gas optimization techniques for flash loan contracts include: minimizing storage operations (the most expensive gas cost), batching similar operations, using calldata instead of memory where possible, implementing efficient loops, and avoiding redundant calculations. Profiling tools help identify optimization opportunities.

Managing Failed Flash Loan Transactions

Failed transactions still consume gas up to the failure point. Implementing early exit checks that verify profitability before proceeding can reduce wasted gas. Accurate gas estimation helps set appropriate limits. Monitoring failed transaction patterns can reveal optimization opportunities.

Flash Loans and Regulatory Considerations

Flash loans operate in an evolving regulatory landscape. Understanding compliance implications is important for teams building flash loan capabilities or strategies.

Compliance Challenges in DeFi Flash Loans

Flash loans present unique regulatory challenges. They enable activities that could resemble market manipulation in traditional markets, though legality depends on jurisdiction and specific circumstances. The pseudonymous nature of blockchain transactions complicates regulatory enforcement, while the global, permissionless nature of DeFi protocols makes jurisdiction determination complex.

Risk Management for DeFi Platforms

Platforms offering flash loan capabilities should implement risk management frameworks. This includes monitoring for suspicious patterns, maintaining incident response capabilities, and considering voluntary compliance measures that demonstrate good faith. Documentation of risk controls can be valuable if regulatory scrutiny increases.

Future Regulatory Outlook

Regulatory clarity for DeFi and flash loans continues evolving. Jurisdictions are developing frameworks that may classify certain flash loan activities as regulated financial services. Staying informed about regulatory developments and building adaptable systems positions teams to respond to changing requirements.

When to Use Flash Loans in Web3 Applications?

Flash loans aren’t appropriate for every situation. Evaluating when flash loans provide genuine value helps focus implementation efforts on high-impact opportunities.

Identifying Suitable Business Scenarios

Flash loans suit scenarios where: large capital is needed temporarily, the operation can complete in one transaction, profit opportunities exist that justify complexity, and alternatives would require capital that’s unavailable or expensive. Common fits include arbitrage, liquidation participation, and position restructuring.

Flash Loans vs Other DeFi Liquidity Options

Flash loans compete with traditional borrowing, liquidity pooling, and just-in-time capital raising. Flash loans excel for one-time, high-value operations but aren’t suitable for ongoing capital needs. Traditional collateralized borrowing better serves extended capital requirements. Evaluating alternatives ensures flash loans are genuinely the best tool for each situation.

Evaluating ROI and Risk

Flash loan ROI calculations must account for: protocol fees, gas costs, potential competition (especially for arbitrage), execution risk, and smart contract risk. Profitable opportunities may be rare or highly competitive. Realistic ROI projections help determine whether flash loan implementation is worth the investment.

Future of Flash Loans in Web3

Flash loans continue evolving as the DeFi ecosystem matures. Understanding future directions helps teams prepare for emerging opportunities and challenges.

Advancements in Flash Loan Design

Protocol designers are exploring enhanced flash loan mechanisms. Proposals include cross-chain flash loans that span multiple blockchains, flash loans with extended execution windows on optimistic rollups, and flash loans with built-in MEV protection. These advancements could expand flash loan applications significantly.

Role of Flash Loans in Advanced DeFi Systems

Flash loans increasingly integrate into complex DeFi protocols as composable building blocks. Advanced systems use flash loans internally for efficiency, abstracting complexity from end users. This integration pattern suggests flash loans will become infrastructure primitives rather than standalone tools.

Long-Term Sustainability of Flash Loans

Flash loan sustainability depends on continued DeFi growth providing opportunities worth exploiting, fee structures that remain attractive, and security improvements that reduce attack frequency. As the ecosystem matures, flash loan use cases may shift from exploitation toward efficiency-enabling functions that benefit all participants.

Teams at professional blockchain infrastructure providers continue investing in flash loan capabilities, recognizing their growing importance in the DeFi stack.

| Phase | Stage | Activities | Output |

|---|---|---|---|

| 1 | Planning | Define strategy, select protocol, analyze ROI | Strategy specification |

| 2 | Contract Build | Implement callback, execution logic | Smart contracts |

| 3 | Testing | Testnet deployment, edge case testing | Validated contracts |

| 4 | Audit | Security review, flash loan attack testing | Audit report |

| 5 | Deploy | Mainnet deployment, monitoring setup | Live system |

| 6 | Operate | Execute strategies, monitor performance | Ongoing operations |

Build Flash Loan Solutions

Implement secure flash loan capabilities with expert DeFi architecture guidance.

Flash loans in Web3 solutions represent a fundamental DeFi primitive that enables capital-efficient operations impossible in traditional finance. Understanding flash loan architecture, the flash loan execution process, and flash loan best practices equips teams to implement secure, profitable strategies while protecting protocols from common attack vectors. As DeFi continues maturing, flash loans will remain central to the ecosystem’s capital efficiency and operational sophistication. The key to success lies in combining technical excellence with robust security practices and realistic assessment of opportunities and risks.

Frequently Asked Questions

A flash loan is an uncollateralized loan unique to decentralized finance that must be borrowed and repaid within a single blockchain transaction. Unlike traditional loans that require credit checks and collateral, flash loans in Web3 leverage the atomic nature of blockchain transactions, meaning the entire operation either completes successfully or reverts entirely. This innovative mechanism allows users to borrow substantial amounts of cryptocurrency instantly without providing upfront capital, provided they can execute profitable operations and repay within the same block.

Flash loans work without collateral because of the atomic transaction property of blockchain technology. When you initiate a flash loan, the lending protocol releases funds to your smart contract, which must execute its intended operations and return the borrowed amount plus fees before the transaction concludes. If the repayment condition is not satisfied by the end of the transaction, the entire operation automatically reverts as if it never happened. This eliminates default risk for the lender since unsuccessful loans simply do not occur on the blockchain.

The primary use cases for flash loans include arbitrage trading across decentralized exchanges to profit from price discrepancies, collateral swaps to change loan positions without closing them, liquidating undercollateralized positions in lending protocols, and self-liquidation to avoid penalties. Additionally, flash loans enable yield optimization strategies, debt refinancing across protocols, and complex DeFi operations that would otherwise require significant capital. These applications make flash loans powerful tools for capital-efficient DeFi participation.

Flash loan arbitrage involves borrowing large amounts through a flash loan, using those funds to exploit price differences between exchanges, and repaying the loan with profits. For example, if a token trades at different prices on two DEXs, a trader can borrow via flash loan, buy on the cheaper exchange, sell on the expensive one, repay the loan plus fees, and keep the profit. This entire sequence executes in one transaction, enabling arbitrage without personal capital at risk.

Traditional loans require credit assessment, collateral, and repayment over extended periods, while flash loans require no collateral and must be repaid instantly within one transaction. Traditional loans involve default risk for lenders and interest accumulation over time, whereas flash loans eliminate default risk through atomic execution and charge only flat fees. Traditional loans serve long-term capital needs, while flash loans enable instant capital access for specific blockchain operations that can be completed atomically.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.