Key Takeaways

- Flash loans let you borrow large amounts of cryptocurrency without any collateral, but the full amount must be returned within a single blockchain transaction or the whole thing gets reversed.

- Cross-exchange arbitrage and triangular arbitrage remain the most common and accessible flash loan strategies heading into 2026.

- Collateral swapping through flash loans is a practical way to protect your DeFi loan positions from liquidation during sudden price drops.

- Debt refinancing with flash loans can save you money by instantly moving your loans to protocols with lower interest rates.

- Governance voting via flash loans is technically possible but highly controversial and can damage community trust in a protocol.

- Smart contract vulnerabilities, price slippage, and regulatory uncertainty are the three biggest risks you need to plan for before using flash loans.

- Working with experienced blockchain developers and auditing every smart contract is essential to executing flash loan strategies safely.

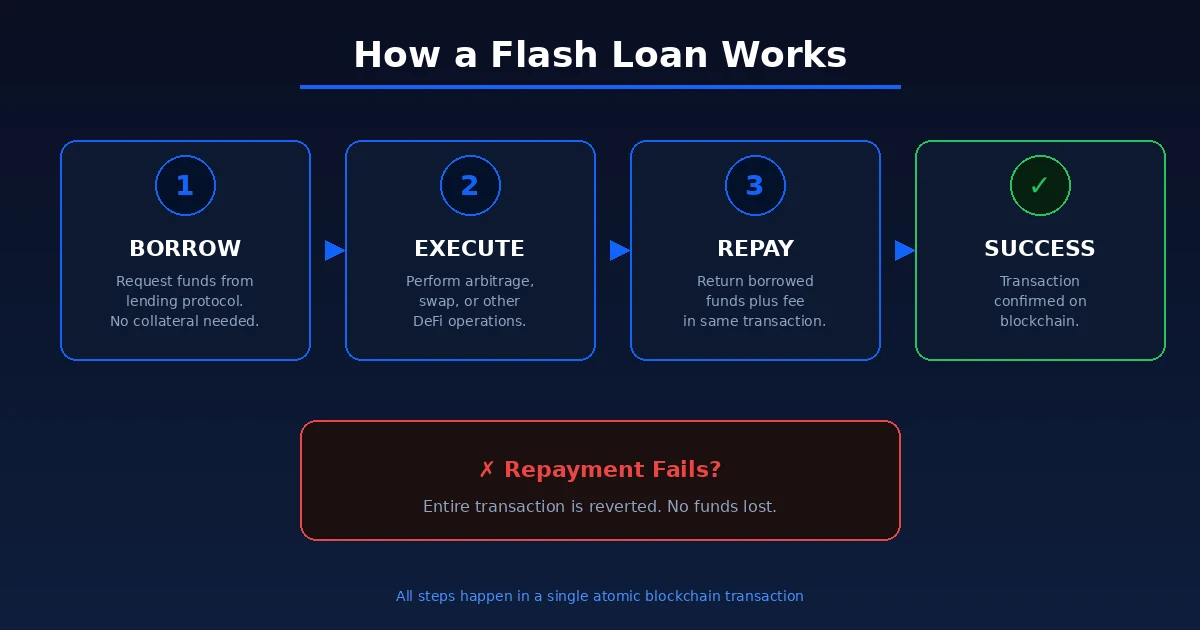

Flash loans have become one of the most talked about innovations in decentralized finance. They let anyone borrow millions of dollars in cryptocurrency without putting up a single dollar in collateral. The only catch? You have to return the money in the exact same transaction. If you fail to do that, the blockchain rolls everything back as if nothing happened. No debt, no loss, no trace.

This concept sounds almost too good to be true, and it would be in traditional finance. But on programmable blockchains like Ethereum, smart contracts make it possible. Flash loans were first introduced by Aave in early 2020, and since then they have grown into a major pillar of DeFi strategy. By 2026, traders, developers, and DeFi protocols are using flash loans in more refined and creative ways than ever before.

In this article, we break down the top seven flash loan strategies that are shaping the blockchain space in 2026. Whether you are a developer looking to build flash loan bots, an investor exploring DeFi opportunities, or a business considering blockchain services for your project, this guide covers what you need to know in plain language.

What Is a Flash Loan and How Does It Work?

A flash loan is a type of uncollateralized loan that exists only within a single blockchain transaction. In regular lending, you need to deposit something of value before you can borrow. Flash loans throw that requirement out the window. You borrow the funds, do whatever you need to do with them, and pay them back, all in one atomic transaction that either completes entirely or fails entirely.

The technology behind flash loans relies on smart contracts. These are self-executing programs stored on the blockchain. When you request a flash loan, the smart contract sends you the funds, waits for you to complete your operations, and then checks whether you have returned the funds plus a small fee. If the check passes, the transaction is confirmed. If it fails, the entire sequence of operations is reverted. The blockchain treats it as though nothing happened, and you only lose the gas fee you paid to submit the transaction.

This design makes flash loans essentially risk-free for the lender. The protocol never actually loses money because the loan either gets repaid within the same block or it never existed. For the borrower, the risk is limited to gas fees and the time spent building the strategy. The real challenge is in the execution. You need to write or deploy smart contract code that carries out your entire plan in a single transaction, which requires solid technical skills and a deep understanding of DeFi protocols.

Platforms like Aave, dYdX, and Uniswap are the most popular sources for flash loans. Aave charges a 0.09% fee on flash loan amounts, while dYdX has historically offered them with no fee at all, though this may change as protocols update their fee structures. If you are exploring how decentralized applications fit into the bigger picture, our guide on dApps in blockchain covers the foundational concepts.

Flash Loan Transaction Lifecycle

Understanding the step-by-step lifecycle of a flash loan helps you see why timing and precision matter so much. Below is a breakdown of each phase in a typical flash loan transaction and what happens at every stage.

| Phase | What Happens | Who Is Involved | Time Frame |

|---|---|---|---|

| Loan Request | Borrower calls the flash loan function on a lending protocol | Borrower, Lending Protocol | Instant |

| Fund Transfer | Protocol sends the requested tokens to the borrower’s contract | Lending Protocol | Same block |

| Strategy Execution | Borrower performs arbitrage, collateral swap, or other operations | Borrower’s Smart Contract | Same block |

| Repayment | Borrowed amount plus fee is returned to the lending pool | Borrower, Lending Protocol | Same block |

| Validation | Protocol checks if full repayment was made; if not, everything reverts | Lending Protocol, Blockchain | Same block |

| Settlement | Transaction is finalized on the blockchain and profits are kept | Blockchain Network | ~12 seconds (Ethereum) |

The entire lifecycle above happens within a single block on the blockchain. On Ethereum, that means roughly 12 seconds from start to finish. On faster chains like Solana, it can be even quicker. If you are interested in building on high speed networks, check out our detailed guide on Solana blockchain development.

Top Platforms for Flash Loans in 2026

Not every DeFi platform supports flash loans, and among those that do, the features and fees vary quite a bit. Choosing the right platform depends on what strategy you plan to run and which blockchain you prefer. Here is a comparison of the leading flash loan platforms as of 2026.

| Platform | Flash Loan Fee | Supported Chains | Best For | Liquidity Depth |

|---|---|---|---|---|

| Aave | 0.09% | Ethereum, Polygon, Arbitrum, Optimism, Avalanche | Multi-asset arbitrage and collateral swaps | Very High |

| dYdX | 0% (may change) | Ethereum, Cosmos-based chain | Margin trading and leveraged strategies | High |

| Uniswap | Pool fee applies | Ethereum, Polygon, Arbitrum, Base, BNB Chain | Flash swaps and liquidity arbitrage | Very High |

| Balancer | 0% | Ethereum, Polygon, Arbitrum | Custom pool arbitrage | Moderate |

| SushiSwap | 0.3% swap fee | Ethereum, Polygon, Arbitrum, Fantom | Cross-DEX trading strategies | Moderate |

Aave is the go-to for most flash loan users because of its deep liquidity and multichain support. Balancer stands out because it offers zero-fee flash loans, which can make a real difference in profitability when you are working with thin arbitrage margins. If you are looking at how on-chain trading plays into these strategies, our article on on-chain trading in blockchain goes deeper into the mechanics.

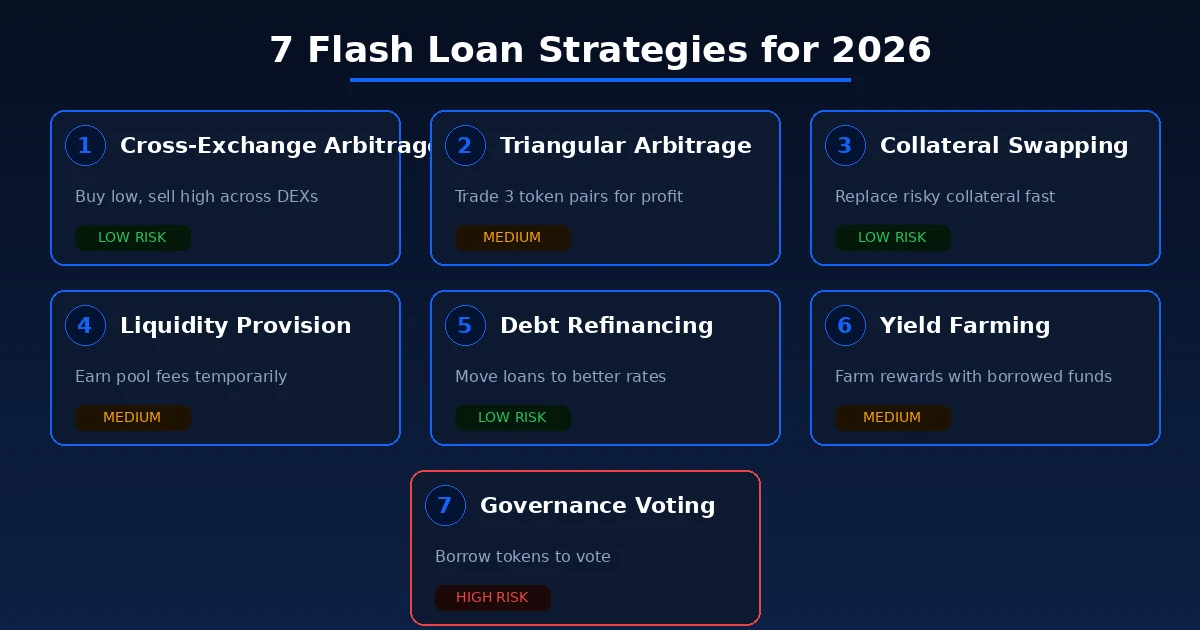

The Top 7 Flash Loan Strategies for 2026

Now let us get into the actual strategies. These are the seven most practical and widely used approaches to flash loans in 2026. Some are relatively simple, while others require deeper technical knowledge and more complex smart contract logic.

1. Cross-Exchange Arbitrage

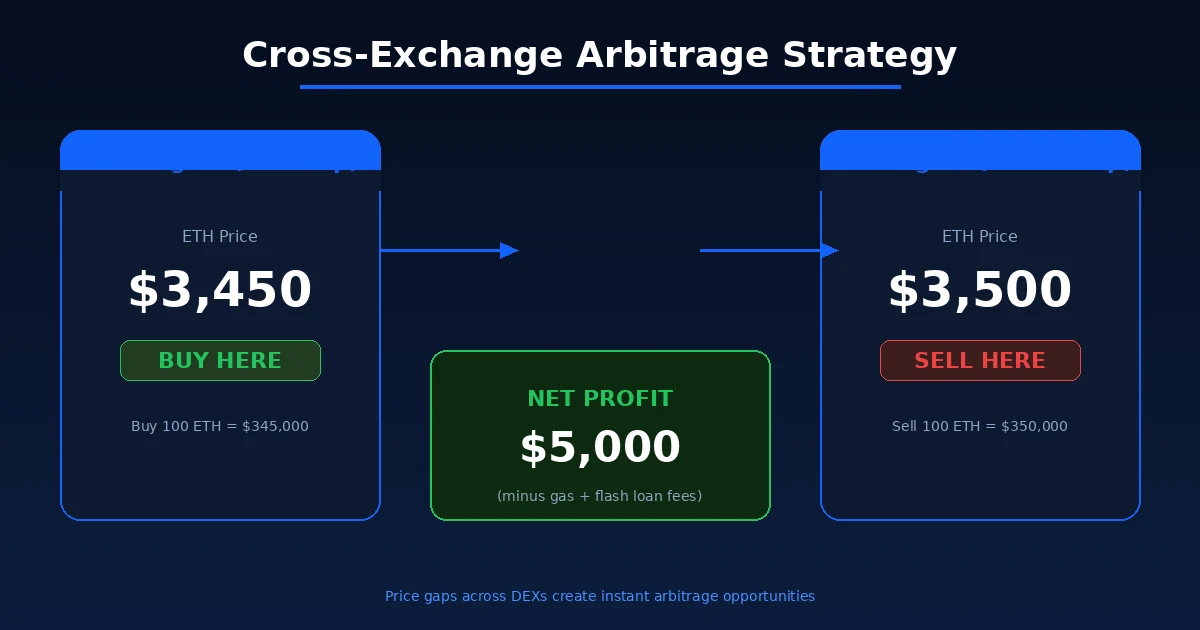

Cross-exchange arbitrage is the most straightforward flash loan strategy and the one most people start with. The idea is simple: you find a price difference for the same token on two different decentralized exchanges, borrow funds through a flash loan, buy on the cheaper exchange, and sell on the more expensive one. The profit is the price gap minus fees.

For example, say ETH is trading at $3,450 on Uniswap and $3,500 on SushiSwap. You take a flash loan for $345,000, buy 100 ETH on Uniswap, immediately sell them on SushiSwap for $350,000, repay the flash loan with fee, and keep the difference. That could be around $4,600 in profit after accounting for the 0.09% Aave fee and gas costs.

The reality, though, is that these price gaps close quickly. Arbitrage bots scan blockchain mempools constantly, and competition is fierce. According to research on DeFi markets, arbitrage activity plays a major role in keeping token prices consistent across exchanges. To succeed, your bot needs to detect opportunities and execute trades faster than the competition, which often comes down to gas optimization and smart contract efficiency.

This strategy works best during periods of high market volatility when prices swing sharply and DEX liquidity pools have not yet rebalanced.

2. Triangular Arbitrage

Triangular arbitrage takes the concept of arbitrage and adds a layer of complexity. Instead of trading between two exchanges, you trade across three different token pairs on the same exchange. The goal is to find a pricing loop where converting Token A to Token B, then B to Token C, and then C back to A gives you more of Token A than you started with.

Here is a concrete example. Suppose you borrow 10 BTC through a flash loan. You trade those 10 BTC for 320 ETH on the BTC/ETH pair. Then you swap 320 ETH for 48,000 LTC on the ETH/LTC pair. Finally, you convert 48,000 LTC back to 10.05 BTC on the LTC/BTC pair. After repaying the 10 BTC loan plus the fee, you keep the 0.05 BTC difference as profit.

Triangular arbitrage is harder to spot manually, which is why bots handle the detection. These opportunities arise when the exchange rates between three pairs are slightly out of sync, a situation that can happen frequently on AMMs (Automated Market Makers) because their prices are determined by liquidity pool ratios rather than order books. The math behind triangular arbitrage has been well studied in traditional forex markets and applies in similar ways to crypto.

3. Collateral Swapping

Collateral swapping is less about making a quick profit and more about protecting your existing DeFi positions. If you have a loan on a platform like Aave or Compound and the token you used as collateral starts losing value, you are at risk of liquidation. That means the protocol will sell your collateral at a discount to cover the loan, and you end up losing money.

A flash loan lets you fix this situation in a single transaction. You borrow enough to repay your existing loan, which frees up your original collateral. You then swap that collateral for a more stable asset (like USDC or DAI), redeposit the stable asset as new collateral, and take out a new loan to repay the flash loan. The whole process happens atomically, so there is no window where your position is exposed to liquidation.

This strategy is especially useful during sudden market downturns. If your ETH collateral drops 15% in an hour, a manual swap would take multiple transactions and leave you vulnerable between steps. A flash loan compresses everything into one seamless operation. For businesses dealing with real-world asset management on blockchain, the principles behind collateral management connect closely to how blockchain is transforming the property market.

4. Liquidity Provision

This strategy uses flash loans to temporarily provide liquidity to a decentralized exchange pool, earn fees, and withdraw everything in the same transaction. It is a way to capture trading fees without keeping your capital locked up in a pool for days or weeks.

In practice, this works by borrowing a large sum via flash loan, depositing it into a liquidity pool on a DEX like Uniswap or Balancer, collecting a share of the trading fees generated during that block, removing your liquidity, and repaying the flash loan. The profit comes from the fees you earned during the brief period your funds were in the pool.

The profits from this strategy are typically small per transaction. However, when executed at scale and repeatedly, they can add up. The key factor is choosing pools with high trading volume where fees are generated rapidly. Pools with low liquidity but high demand tend to offer the best opportunities because your deposited funds make up a larger share of the total pool, which means you earn a bigger portion of the fees.

There is a risk of impermanent loss during this process, but since your liquidity is only in the pool for a single transaction, the exposure is minimal compared to long-term liquidity providers.

Build Your Flash Loan Strategy with Expert Guidance

Need help designing and deploying smart contracts for flash loan operations? Our blockchain development team builds secure, optimized solutions tailored to your DeFi strategy.

5. Debt Refinancing

Debt refinancing through flash loans works much like refinancing a mortgage in real life, except it happens in seconds rather than weeks. If you have an outstanding loan on one DeFi protocol and another protocol is offering a better interest rate, a flash loan lets you move your entire position instantly.

The process goes like this: you take out a flash loan to repay your existing debt on Protocol A, which releases your collateral. You then deposit that collateral on Protocol B, take out a new loan at the lower rate, and use those funds to repay the flash loan. Your debt is now on Protocol B at a better rate, and you completed the switch in a single transaction.

Without flash loans, this would require multiple transactions across protocols. You would need to find temporary funds to repay your first loan, then move your collateral, then open the new position. Each step costs gas and creates risk. The flash loan approach eliminates all of that.

In 2026, with dozens of lending protocols operating across multiple chains, rate differences are common. Even a 0.5% difference in annual interest rate can translate to significant savings on a large position held over months. Protocols frequently adjust their rates based on supply and demand, which creates ongoing refinancing opportunities for active DeFi users.

6. Yield Farming with Flash Loans

Yield farming involves putting your crypto to work in DeFi protocols that reward you with additional tokens for providing capital. Flash loans can amplify this by letting you farm with much larger amounts than you actually own.

Here is how it works in a simplified example. You borrow $1 million through a flash loan, deposit it into a yield farming protocol that offers a one-time bonus or reward distribution, collect the reward tokens, sell them for profit, and repay the flash loan. This strategy works best when protocols are running limited-time incentive programs or when reward distributions happen at specific block intervals.

The important thing to understand is that this does not work for long-term yield farming where rewards accrue over days or weeks. Flash loans only last for one transaction. So this strategy targets very specific opportunities where rewards are distributed immediately upon deposit, or where there is a short-lived bonus structure you can take advantage of within a single block.

Some protocols have started adjusting their reward mechanisms to prevent this type of flash loan farming, requiring tokens to be staked for a minimum period before rewards are claimable. But new opportunities continue to appear as the DeFi space keeps evolving. If you are curious about how blockchain-based gaming platforms handle similar reward structures, take a look at our piece on blockchain games development.

7. Governance Voting

This is the most controversial flash loan strategy on the list. Many DeFi protocols use governance tokens to let holders vote on important decisions like fee changes, treasury allocations, or protocol upgrades. The more tokens you hold, the more voting power you have.

A flash loan can be used to borrow a massive amount of governance tokens right before a vote, cast a vote that benefits the borrower, and then repay the tokens immediately. This gives someone temporary but significant influence over a protocol without actually having a long-term stake in it.

Real examples of this have happened. In 2020, a governance attack on the Beanstalk protocol used a flash loan to acquire enough voting tokens to pass a malicious proposal, resulting in the theft of around $182 million. This event pushed many protocols to implement safeguards like time-locked voting, where tokens must be held for a certain period before they grant voting rights, or snapshot voting, where your voting power is based on your token holdings at a specific past block rather than at the time of the vote.

While governance manipulation through flash loans is technically possible, it is widely considered unethical and is actively being countered by protocol designers. If you use this strategy, expect community backlash and potential blacklisting from protocols.

Comparing All 7 Flash Loan Strategies

Each flash loan strategy has different requirements, risk profiles, and profit potential. The table below puts all seven side by side so you can quickly compare them and decide which ones match your goals and technical capabilities.

| Strategy | Difficulty | Risk Level | Profit Potential | Requires Bot? | Best Platform |

|---|---|---|---|---|---|

| Cross-Exchange Arbitrage | Moderate | Low | Moderate | Yes | Aave + Uniswap |

| Triangular Arbitrage | High | Medium | Moderate | Yes | Uniswap / Balancer |

| Collateral Swapping | Moderate | Low | Defensive (loss prevention) | No | Aave |

| Liquidity Provision | High | Medium | Low per trade, scalable | Yes | Uniswap / SushiSwap |

| Debt Refinancing | Low | Low | Savings-based (interest reduction) | No | Aave / Compound |

| Yield Farming | High | Medium | Variable | Optional | Protocol-specific |

| Governance Voting | Moderate | High | Indirect / controversial | No | Any governance protocol |

Risks and Challenges of Flash Loans

Flash loans come with a unique set of risks that anyone considering them should fully understand. The fact that failed transactions simply revert does not mean you cannot lose money or face consequences. Here are the main risks to keep in mind.

Smart Contract Vulnerabilities: Your flash loan strategy is only as safe as the code behind it. If there is a bug in your smart contract, attackers can exploit it and drain your funds. Every contract should be thoroughly audited before deployment. Even established protocols have suffered exploits. In 2022 and 2023, several DeFi protocols lost hundreds of millions of dollars due to smart contract flaws that were exploited using flash loans.

Price Slippage: When you execute a large trade on a DEX, the price can shift between the moment you submit your transaction and the moment it gets included in a block. This is called slippage, and it can eat into your arbitrage profits or even turn a profitable trade into a loss. Setting slippage tolerance correctly in your smart contract is critical.

Gas Cost Volatility: On Ethereum, gas prices can spike dramatically during periods of network congestion. A flash loan transaction that would have been profitable at 20 gwei might become unprofitable at 100 gwei. Your bot needs to factor in real-time gas prices before executing any trade.

MEV and Front-Running: Miners and validators can see your pending transactions in the mempool and front-run your arbitrage by inserting their own transactions ahead of yours. This is part of a broader problem known as Maximal Extractable Value (MEV). To mitigate this, many flash loan operators use private transaction relays like Flashbots that bypass the public mempool.

Regulatory Uncertainty: As DeFi grows, regulators around the world are paying more attention. Some flash loan activities, particularly those that manipulate governance or exploit protocol weaknesses, could face legal scrutiny. The regulatory landscape for DeFi is still taking shape, and what is technically legal today might not be tomorrow.

Flash Loans vs. Traditional Crypto Loans

To put flash loans in perspective, it helps to compare them against traditional collateralized loans in DeFi. The table below highlights the fundamental differences between the two approaches.

| Feature | Flash Loans | Traditional DeFi Loans |

|---|---|---|

| Collateral Required | None | Yes (often 150%+ over-collateralized) |

| Loan Duration | Single transaction (~12 seconds) | Days to months (open-ended) |

| Interest / Fee | One-time fee (e.g., 0.09%) | Ongoing interest (variable or fixed APR) |

| Liquidation Risk | None (transaction reverts if unpaid) | Yes (collateral can be sold off) |

| Technical Skill Needed | High (smart contract development) | Low (basic DeFi knowledge) |

| Primary Use Case | Arbitrage, collateral swaps, refinancing | Leveraged trading, holding positions, earning yield |

Flash loans are not a replacement for traditional DeFi loans. They serve different purposes. Flash loans are tools for instant, complex operations. Traditional loans are for ongoing capital needs. Understanding when to use each one is a key part of building an effective DeFi strategy.

Practical Tips for Getting Started with Flash Loans

If you are new to flash loans and want to try these strategies, here are some practical steps that will help you get started on the right foot.

First, learn Solidity. Flash loans on Ethereum and EVM-compatible chains are written in Solidity. You do not need to be an expert, but you need to understand how to write and deploy basic smart contracts. There are free courses and documentation available through the official Ethereum developer portal and the Aave developer docs.

Second, use testnets before mainnet. Every major blockchain has a test network where you can deploy and test your flash loan contracts without risking real money. Ethereum’s Sepolia testnet and Polygon’s Mumbai testnet are good options. Run your strategy dozens of times on a testnet before even thinking about mainnet deployment.

Third, audit your contracts. If you are handling significant amounts, get a professional audit. Even a small bug can be exploited. This is one area where working with an experienced blockchain development company can save you from costly mistakes.

Fourth, monitor gas prices. Use tools like Etherscan’s gas tracker to understand when network fees are lowest. Submitting your transactions during off-peak hours can significantly improve profitability.

Fifth, stay updated on protocol changes. DeFi protocols frequently update their smart contracts, fee structures, and security measures. What worked last month might not work today. Follow the official channels of the protocols you use and keep your contracts updated.

The Future of Flash Loans Beyond 2026

Flash loans are still a relatively young innovation, and the space continues to evolve. Several trends are shaping where flash loans are heading in the coming years.

Cross-chain flash loans are one of the most anticipated developments. Right now, flash loans operate within a single blockchain. But with the growth of cross-chain bridges and interoperability protocols, we may soon see flash loans that span multiple blockchains, borrowing on Ethereum and executing on Arbitrum or Solana in a single coordinated operation. This would open up entirely new categories of arbitrage and strategy.

Protocol-level protection against flash loan attacks is also improving. More DeFi projects are implementing time-weighted average price (TWAP) oracles, time-locked governance voting, and other mechanisms that reduce the effectiveness of flash loan exploits. This makes the ecosystem healthier overall while still allowing legitimate flash loan use cases to thrive.

Institutional interest in flash loans is growing as well. As DeFi becomes more accessible and regulatory frameworks become clearer, traditional financial institutions may start incorporating flash loan mechanics into their own products and services. The efficiency gains from instant, collateral-free transactions are hard to ignore.

Frequently Asked Questions

If the borrowed funds and the required fee are not returned to the lending protocol by the end of the same blockchain transaction, the entire transaction is automatically reverted by the smart contract. This means every action taken during that transaction is undone. No tokens are transferred, no swaps happen, and no state changes are recorded on the blockchain. The only cost the borrower incurs is the gas fee that was spent to submit the failed transaction to the network. This built-in safety mechanism protects lenders completely.

Yes, most flash loan strategies require you to write or at least understand smart contract code written in Solidity or a similar language for EVM-compatible blockchains. You need to deploy a custom smart contract that handles the borrowing, the strategy execution, and the repayment all in one call. Some platforms and third-party tools offer no-code flash loan interfaces, but they are limited in what strategies they support. For serious use, coding knowledge is practically essential and gives you the flexibility to build custom strategies.

Flash loans themselves are a neutral financial tool and are legal to use. However, how you use them matters a great deal. Using flash loans for legitimate arbitrage, collateral management, or debt refinancing is considered acceptable. But using them to exploit protocol vulnerabilities, manipulate governance votes, or conduct activities that resemble market manipulation could attract legal scrutiny depending on your jurisdiction. Regulatory clarity around DeFi is still developing in most countries, so it is important to stay informed about the rules that apply in your region.

The profit from flash loan arbitrage varies significantly depending on the size of the price discrepancy, the trade volume, gas costs, and the speed of your execution. A single successful cross-exchange arbitrage trade might net anywhere from a few hundred dollars to several thousand dollars. However, large and obvious price gaps are rare and highly competitive because hundreds of bots are scanning for the same opportunities. Consistent profits usually come from running well-optimized bots that execute many small trades over time rather than relying on one big trade.

Ethereum remains the most popular blockchain for flash loans because of its deep DeFi liquidity and the number of protocols that support flash loan functionality. However, Layer 2 networks like Arbitrum and Optimism are gaining traction because they offer much lower gas fees while still benefiting from Ethereum’s security. Solana, Avalanche, and BNB Chain also support flash loan style operations and can be attractive options depending on your strategy. The best chain for you depends on where the price discrepancies exist and where your target protocols operate.

Unfortunately, yes. Flash loans have been used in multiple high-profile DeFi exploits over the years. Attackers have used them to manipulate price oracles, drain liquidity pools, and push through malicious governance proposals. These attacks exploit weaknesses in specific protocol designs rather than being a flaw in flash loans themselves. The DeFi community has responded by building stronger oracle systems, implementing time locks on governance decisions, and requiring smart contract audits. Using flash loans to exploit protocols is considered unethical and can result in legal consequences as regulators pay closer attention to DeFi activity.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.