Key Takeaways

- Bitcoin is a cryptocurrency built on blockchain technology, but blockchain itself is a foundational technology that operates independently of Bitcoin and cryptocurrency.

- Blockchain is a distributed ledger technology with applications across finance, supply chain, healthcare, and enterprise solutions far beyond cryptocurrency.

- Bitcoin uses blockchain to record transactions and maintain a decentralized ledger, but blockchain can function with or without cryptocurrency.

- Understanding these differences is essential for evaluating blockchain implementations, crypto investments, and technology adoption decisions.

- Bitcoin blockchain operates on Proof of Work consensus, while other blockchains use alternatives like Proof of Stake for different performance characteristics.

The distinction between Bitcoin and blockchain impacts technology selection, regulatory compliance, and long-term scalability planning for organizations. Many people use the terms “Bitcoin” and “blockchain” interchangeably, but this common misconception obscures the critical differences between a specific cryptocurrency and the underlying technology that powers it. Bitcoin represents a digital currency system created in 2009, while blockchain constitutes a distributed ledger technology framework that existed as a concept before Bitcoin implemented it. Understanding the distinction between these two technologies is essential for anyone involved in cryptocurrency investment, blockchain implementation, or enterprise technology decisions, as conflating them leads to poor decision-making in adoption strategies, risk assessment, and long-term technology planning.

According to research from the Journal of Blockchain Research and leading blockchain industry reports, approximately 73% of enterprise blockchain implementations have nothing to do with cryptocurrency or Bitcoin itself. The World Economic Forum’s 2023 report indicates that blockchain technology adoption is growing 3.7 times faster in enterprise sectors than in cryptocurrency markets, demonstrating that blockchain has evolved far beyond its initial Bitcoin implementation. This data-driven perspective reveals that blockchain represents a fundamental infrastructure technology similar to the internet or databases, while Bitcoin represents just one application of blockchain technology within the financial sector.

This comprehensive guide explains the fundamental differences between Bitcoin and blockchain technology, explores how they relate to each other, examines their distinct characteristics, and clarifies why understanding this distinction matters for technical professionals, business leaders, and investors. Throughout this article, you will discover how Bitcoin functions as a cryptocurrency application built on blockchain, how blockchain technology operates independently across multiple industries, and why these differences create significantly different implications for security, scalability, regulatory compliance, and organizational implementation.

What is Bitcoin?

Defination

Bitcoin is a decentralized digital currency that allows people to send and receive money directly without banks. It uses blockchain technology to securely record transactions and allows users to send money directly to each other.

Bitcoin is a peer-to-peer digital currency system that operates on a decentralized network without requiring a central bank or financial institution. Created by an anonymous person or group known as Satoshi Nakamoto in 2009, it runs on blockchain technology, which records all transactions securely on a public network. Bitcoin is often called digital gold because it can be used for payments, saving value, and investment. It also has a fixed supply of only 21 million coins, making it scarce and valuable.

The Bitcoin network operates through a consensus mechanism called Proof of Work, where specialized computers known as miners compete to solve complex mathematical problems to validate transactions and add new blocks to the blockchain. This process, called mining, secures the network by making it economically infeasible for bad actors to manipulate the ledger. Bitcoin has a fixed supply cap of 21 million coins, creating scarcity and digital uniqueness that appeals to investors who view Bitcoin as “digital gold” or a hedge against inflation and currency devaluation.

Key Bitcoin Characteristics:

- Digital cryptocurrency with a fixed supply of 21 million tokens

- Operates on a Proof of Work consensus mechanism requiring computational power

- Decentralized network maintained by thousands of independent miners globally

- Transactions recorded on the public ledger are visible to all network participants

- Pseudonymous rather than anonymous transactions

- Average transaction time of 10 minutes per block confirmation

- Transaction fees vary based on network congestion and miner priority

What is Blockchain?

Blockchain is a distributed ledger technology that records transactions or data in blocks that are cryptographically linked together in chronological order, creating an immutable chain. Unlike Bitcoin, which is a specific cryptocurrency application, blockchain represents a foundational technology infrastructure that can record any type of information and operate without cryptocurrency altogether. Blockchain technology enables multiple parties to maintain a shared, tamper-resistant record of information without requiring a central authority or intermediary to validate and manage the data.

Key Blockchain Characteristics:

- Distributed ledger technology records data across multiple nodes

- Operates with or without cryptocurrency components

- Supports various consensus mechanisms, including Proof of Work, Proof of Stake, and others

- Enables private blockchains for enterprise use or public blockchains for open access

- Can record financial transactions, supply chain events, medical records, or any data type

- Provides immutability through cryptographic hashing and chaining

- Varies greatly in transaction speed, energy consumption, and governance based on design

Key Differences Between Bitcoin and Blockchain

Although Bitcoin and blockchain are closely related, they are not the same. The table below highlights the key differences between Bitcoin and blockchain across purpose, scope, technology, and use cases.

| Aspect | Bitcoin | Blockchain |

|---|---|---|

| Definition | Digital cryptocurrency and payment system | Distributed ledger technology infrastructure |

| Purpose | Store of value and medium of exchange | Secure data recording and verification |

| Scope | Specific cryptocurrency application | Broad technology platform with many applications |

| Launch Year | 2009 | Conceptual framework predates Bitcoin; implementations post-2009 |

| Requires Cryptocurrency | Yes (Bitcoin tokens) | No (can operate without crypto) |

| Consensus Mechanism | Proof of Work only | Multiple options (PoW, PoS, DPoS, etc.) |

| Transaction Speed | ~10 minutes per block | Varies widely (seconds to minutes) |

| Energy Consumption | Very high (Proof of Work intensive) | Varies by consensus mechanism |

| Supply Cap | Fixed at 21 million BTC | No inherent supply limit |

| Use Cases | Digital currency, store of value, speculation | Finance, supply chain, healthcare, government, enterprise |

The main difference between Bitcoin and blockchain is that Bitcoin is a digital currency, while blockchain is the underlying technology that makes Bitcoin possible. Bitcoin was created specifically for transferring and storing value, whereas blockchain is a broader technology that can be used across multiple industries such as finance, healthcare, supply chain, and government systems. In simple terms, Bitcoin is an application, and blockchain is the platform. This is why blockchain can exist without Bitcoin, but Bitcoin cannot function without blockchain.

How Bitcoin Uses Blockchain Technology

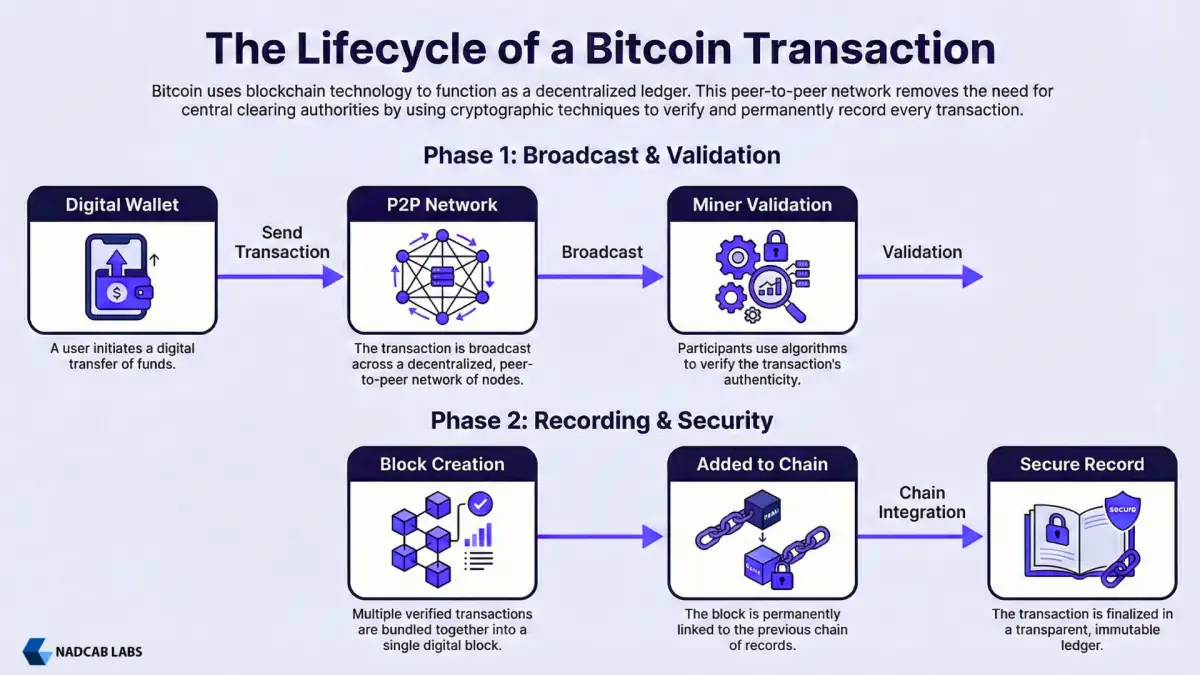

Bitcoin implements blockchain technology as its foundational infrastructure, using the distributed ledger to record all transactions in a chronological chain. Every Bitcoin transaction is bundled with thousands of other transactions into a block, which is then added to the blockchain after miners solve complex mathematical problems through Proof of Work. This process creates an immutable record where altering any historical transaction would require recalculating all subsequent blocks faster than the network could add new blocks, making such attacks economically infeasible and practically impossible.

The Bitcoin blockchain operates as a public ledger where every participant (node) maintains a complete copy of all transactions since Bitcoin’s inception in 2009. This redundancy ensures that no single entity can unilaterally manipulate transaction history, and participants can independently verify the legitimacy of any transaction by checking it against the established rules. Bitcoin’s use of blockchain technology solved the double-spending problem by creating a consensus mechanism where the network agrees on which transactions are valid, eliminating the need for a central bank to prevent spending the same digital coins multiple times.

Beyond Bitcoin: Blockchain Applications

While Bitcoin brought blockchain technology into mainstream awareness, blockchain technology has evolved to power numerous applications that have nothing to do with cryptocurrency or Bitcoin itself. Enterprise organizations implement blockchain for supply chain tracking, enabling them to record every step of a product’s journey from manufacturer to consumer with transparent, tamper-resistant documentation. Healthcare providers use blockchain to maintain patient medical records securely while allowing authorized providers to access information without exposing data to unnecessary parties or intermediaries.

Governments explore blockchain for land registries, voting systems, and credential verification, leveraging the immutability and transparency properties for public services. Financial institutions use private blockchains to accelerate settlement of securities transactions, reducing the time from days to minutes or seconds while maintaining cryptographic security. Real estate platforms implement blockchain to create permanent property ownership records that cannot be disputed or lost. These applications demonstrate that blockchain’s value proposition extends far beyond Bitcoin’s use case as a cryptocurrency.

Enterprise Blockchain Use Cases Beyond Bitcoin:

- Supply chain management tracks goods from origin to consumer using transparent and tamper-proof records.

- Healthcare records enable secure access to patient data while protecting privacy and supporting easy portability.

- Government services support land records, digital voting systems, and reliable identity and credential verification.

- Intellectual property protection strengthens patent registration and copyright security through trusted timestamping.

- Real estate management maintains accurate property ownership records and complete transaction history.

- Educational credentials allow instant diploma verification and trusted skill certification.

- Insurance systems improve claims processing speed while reducing fraud risks.

- Legal contracts use smart contracts to automate agreement execution and ensure reliable verification

Having trouble with blockchain adoption? Our expert team delivers secure, scalable blockchain solutions tailored to your business goals.

Bitcoin Blockchain vs Other Blockchains

The Bitcoin blockchain, while revolutionary, represents only one implementation of blockchain technology with specific design choices that optimize for security and decentralization at the cost of transaction speed and energy efficiency. Bitcoin’s Proof of Work consensus mechanism prioritizes security by making attacks computationally expensive, but it consumes significant electricity and processes transactions slowly. Other blockchains like Ethereum have adopted different consensus mechanisms like Proof of Stake, which drastically reduces energy consumption while maintaining security through economic incentives rather than computational work.

Enterprise blockchains have taken different design philosophies entirely, implementing permissioned networks where participants are known and vetted rather than anonymous. These private blockchains achieve faster transaction speeds and lower energy consumption by sacrificing the complete decentralization that characterizes Bitcoin. Some blockchains like Ripple focus on cross-border payments without cryptocurrency components, using the distributed ledger to facilitate financial settlement between institutions. These variations illustrate that blockchain technology serves as a flexible platform adaptable to different requirements, while Bitcoin remains locked into its specific design optimizations.

Why This Distinction Matters

Understanding the difference between Bitcoin and blockchain is crucial for investment decisions, technology adoption, and regulatory compliance. Investors confusing Bitcoin with blockchain often make poor decisions, assuming all blockchain projects will perform similarly to Bitcoin or carry equivalent risks. Organizations considering blockchain implementation sometimes waste resources attempting to use Bitcoin itself for use cases better served by alternative blockchains designed for specific industries, performance requirements, or governance models. Regulatory bodies increasingly differentiate between cryptocurrency regulations and blockchain technology regulations, requiring organizations to understand which technologies fall under which legal frameworks.

From a technical perspective, this distinction shapes how professionals evaluate security properties, scalability characteristics, regulatory compliance pathways, and implementation strategies. A developer working with Bitcoin understands specific constraints, while a developer implementing enterprise blockchain for supply chain management faces entirely different requirements and opportunities. This clarity enables better decision-making about technology selection, resource allocation, and long-term strategy for both investment and implementation contexts.

Conclusion

The difference between Bitcoin and blockchain represents the distinction between a specific application and a foundational technology infrastructure. Bitcoin is a cryptocurrency that uses blockchain as its underlying ledger system, while blockchain is a distributed ledger technology that operates independently of any cryptocurrency. Understanding this distinction enables better decision-making across investment, technology selection, and regulatory compliance contexts. Bitcoin remains the most famous blockchain implementation, and the first cryptocurrency to solve the double-spending problem, but blockchain technology has evolved far beyond Bitcoin into supply chain management, healthcare, government services, and countless enterprise applications.

For investors, this clarity means understanding that blockchain opportunities extend well beyond Bitcoin price movements and cryptocurrency volatility. For developers and technology professionals, this understanding enables selecting appropriate technologies for specific use cases rather than forcing all applications into Bitcoin or cryptocurrency frameworks. For organizations evaluating blockchain implementation, this distinction clarifies that blockchain’s value proposition encompasses far more than cryptocurrency, opening possibilities for transparent record-keeping, operational efficiency, and trust establishment across numerous industries. As blockchain technology continues to mature beyond its Bitcoin origins, this foundational understanding becomes increasingly essential for navigating the evolving technology landscape.

Frequently Asked Questions

No, Bitcoin cannot exist without blockchain. Bitcoin’s entire architecture depends on blockchain technology to maintain a distributed ledger of transactions and prevent double-spending. The Bitcoin network literally is a blockchain implementation. However, blockchain can absolutely exist without Bitcoin, as demonstrated by countless enterprise blockchains, public blockchains like Ethereum, and private implementations that never involve cryptocurrency or Bitcoin.

Blockchain technology and Bitcoin serve different purposes and derive value from different sources. Bitcoin’s value comes from its role as a store of value and medium of exchange, with market value determined by supply and demand dynamics. Blockchain technology’s value comes from enabling secure, decentralized record-keeping across numerous industries and applications. From an enterprise perspective, blockchain technology may offer significantly more value than Bitcoin itself for organizations implementing supply chain tracking, healthcare records, or government services. From an investment perspective, Bitcoin represents a specific asset with market value, while blockchain technology represents infrastructure enabling various applications.

Bitcoin and blockchain are often confused because Bitcoin was the first widely adopted blockchain implementation and introduced the technology to a global audience. Early media coverage frequently used both terms interchangeably, which blurred public understanding of the difference between the application and the underlying technology. Today, as blockchain development solutions evolve far beyond cryptocurrency, confusion still exists because Bitcoin remains the most recognized digital asset. Its popularity continues to shape how non-technical audiences perceive blockchain technology.

BTC is the ticker symbol for Bitcoin, so “BTC blockchain” refers to the Bitcoin blockchain specifically. BTC is commonly used in cryptocurrency exchanges and financial discussions as shorthand for Bitcoin. The Bitcoin blockchain itself is the distributed ledger that records all Bitcoin transactions, maintained by thousands of nodes worldwide and secured through the Proof of Work consensus mechanism. When discussing “BTC blockchain,” this specifically refers to Bitcoin’s implementation rather than other blockchains like Ethereum, Ripple, or enterprise blockchain platforms.

Yes, absolutely. Many enterprise blockchains operate without any cryptocurrency component whatsoever. Permission-based blockchains used for supply chain management, healthcare records, or property registries simply record data without requiring cryptocurrency tokens. Even when blockchains do use cryptocurrency-like tokens for governance or incentive purposes, these differ fundamentally from Bitcoin, which exists primarily as currency. This distinction is crucial for organizations implementing blockchain for non-financial use cases, as it eliminates regulatory complications related to cryptocurrency while maintaining the immutability and transparency benefits of blockchain technology.

No, Ethereum and Bitcoin are different blockchains with different purposes, different consensus mechanisms, different design philosophies, and different capabilities. Bitcoin optimizes for security and decentralization as a store of value, using Proof of Work consensus. Ethereum primarily serves as a platform for smart contracts and decentralized applications, initially using Proof of Work but transitioning to Proof of Stake. While both use blockchain technology, their implementations differ significantly, making them suitable for different use cases and user bases. An investor or developer choosing between them must understand these differences rather than treating them as interchangeable blockchain implementations.

Bitcoin blockchain security derives from multiple overlapping mechanisms working together. First, Proof of Work requires miners to solve computationally expensive problems to add blocks, making attacks economically infeasible because an attacker would need to control 51% of the network’s computing power. Second, cryptographic hashing creates an immutable chain where altering any historical transaction would require recalculating all subsequent blocks, an increasingly impossible task as the blockchain grows. Third, Bitcoin’s distributed nature means thousands of independent nodes verify transactions, preventing any single entity from manipulating the ledger. Together, these mechanisms create a security model that has protected Bitcoin without central authority for over fifteen years.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.