Before diving into projections, it helps to understand exactly what we mean by DePIN. Simply put: DePIN are blockchain-based networks that link physical infrastructure assets (e.g., routers, sensors, storage nodes, energy systems) with decentralized coordination and token incentives. Anyone can contribute resources; network operations and resource usage are recorded on-chain; contributors are rewarded with tokens; and the result is a shared, transparent, and community-owned infrastructure network.

Unlike traditional infrastructure where a central authority owns, maintains, and charges for service, DePIN distributes ownership and operation among many participants. This approach promises more resilient, accessible, and democratized infrastructure globally.

1. Why DePIN Growth Projections Matter

Decentralized Physical Infrastructure Networks (DePIN) are redefining how we think about infrastructure, shifting from centralized, corporate-owned systems to community-driven networks powered by distributed assets and blockchain-based incentives. DePIN refers to blockchain-enabled networks where individuals contribute real-world resources like connectivity, storage, computing power, energy, or IoT devices which are coordinated, verified, and rewarded through on-chain mechanisms. [1]

As the world becomes more connected, and as demand grows for decentralized compute, storage, connectivity, energy, and IoT infrastructure, the growth potential for DePIN is enormous. Understanding DePIN growth projections is critical whether you’re a developer, investor, policymaker, or enthusiast. Reliable forecasts help chart the future of infrastructure, guide strategic decisions, and identify opportunities in a world where decentralization may become the infrastructure standard.

In the sections below, we explore data-backed forecasts, historical context, and key drivers shaping DePIN’s future up to 2030, covering market size, user adoption, IoT integration, sector-level growth, and risk-adjusted DePIN growth projections.

2. DePIN Market Today & Early Growth Signs

These data points show DePIN is moving beyond niche experiments it’s gaining traction, building infrastructure, and attracting capital. The foundation is laid, and DePIN growth projections for future growth rest on this early momentum.

2.1 Current Market Valuation & Momentum

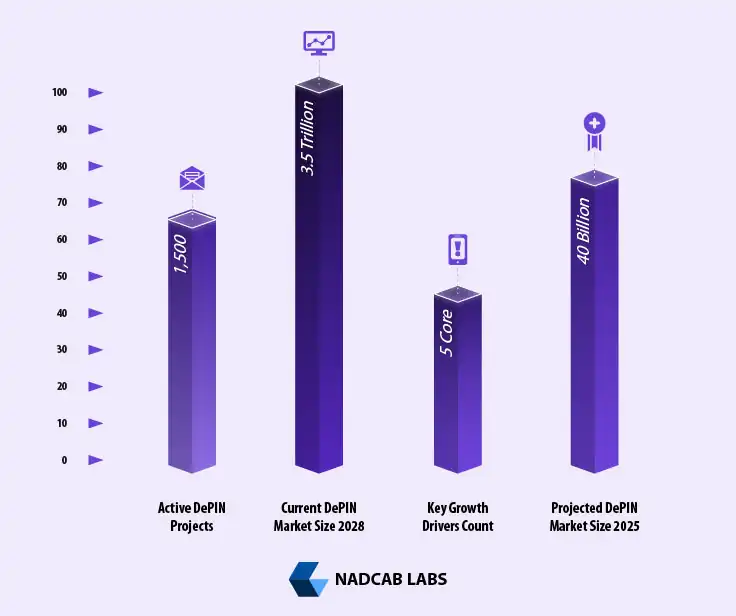

- A 2025 report from World Economic Forum (WEF) estimates that the DePIN market currently valued between US $30–50 billion could surge to US $3.5 trillion by 2028, driven by the convergence of blockchain, AI (DePAI), and decentralized infrastructure adoption. [2]

- According to Messari, a leading crypto data analytics firm, the DePIN ecosystem has seen rapid growth; their recent 2025 report reflects increased investor interest, asset deployment, and expansion of network infrastructure.

- As of 2024, over 13 million devices globally contribute to various DePIN networks, a clear sign that the infrastructure is already active and scaling. [4]

- Analysts note that the DePIN market has grown rapidly from fewer than a few hundred projects in the early 2020s to more than 1,500 active projects globally by 2025. This expansion, alongside the market reaching approximately 17.9 billion dollars in value, highlights strong real-world commitment toward decentralized infrastructure adoption and long-term ecosystem development. [5]

2.2 2023–2025 Growth Trends

- The increasing intersection of DePIN with AI and IoT has bolstered growth: as IoT devices proliferate and demand for decentralized storage/compute rises, DePIN networks have attracted diverse infrastructure providers. The WEF report points to this “fundamental shift” as a key driver. [6]

- Market coverage shows a shift: early adopters in North America and Europe are expanding, but emerging markets (especially Asia-Pacific and Latin America) are witnessing rapid DePIN project launches attributed to infrastructure gaps and favorable digital-adoption trends. [7]

This context sets the stage for aggressive forecasts, but also reveals that DePIN remains in an early growth phase meaning DePIN growth projections depend heavily on adoption, regulatory clarity, and infrastructure deployment execution.

3. DePIN Growth Projections Why 2025–2026 Could Mark a Turning Point

Over the past 2–3 years, the concept of Decentralized Physical Infrastructure Networks (DePIN) has moved from niche Web3/crypto circles into broader mainstream infrastructure discourse and for good reason. By 2025, analysts and institutions are pointing to DePIN as a paradigm shift in how the world builds and uses physical infrastructure: from decentralized storage and compute, to wireless connectivity, sensor networks, and even energy systems.

According to a major recent forecast by World Economic Forum (WEF), the DePIN market currently estimated at about US $30–50 billion could explode to US $3.5 trillion by 2028 [8]

. This DePIN growth projections reflects what many believe will be a wave of adoption in decentralized wireless, decentralized compute/storage, sensors/IoT, and even decentralized energy all coordinated via blockchain and token‑based economics.

As of mid‑2025, DePIN is still at a relatively early stage (with “over 1,500 active projects worldwide” per the WEF report) but the structural tailwinds are strong: the growth of IoT, edge computing, AI workloads, 5G/6G rollout, and demand for data sovereignty and decentralization.

Given that backdrop 2025 may well be the “inflection point” for DePIN growth projections: the transition from early-stage experiments and small-scale deployments to rapid scaling across sectors.

4. Tracking DePIN Adoption and Market Size (2023–2025)

| Year | Metric / What’s Measured | Report / Source / Notes |

|---|---|---|

| 2023 | ~ US $35 billion DePIN ecosystem total market cap (projects ~650) | One article claims “as of 2023 DePIN ecosystem comprised 650 projects with total market cap of ~ $35 B”. [9] |

| 2024 | ~ US $50 billion total DePIN sector market cap (≈1,500 projects) | According to a report cited by an industry-news post. [10] |

| 2024 | ~ US $226 million DePIN “Solution Market” (i.e. infrastructure-services market, not token-cap) | From a recent research report on DePIN solution market. [11] |

| 2024 | ~ US $1.92 billion DePIN Data Marketplaces market size | According to a market-research report on DePIN data marketplaces. [12] |

| 2025 (projection-based report) | ~ US $265 million forecast DePIN solution market size in 2025 | From the “DePIN Solution Market 2025-2032” report. [13] |

| 2025 (2025-report claim) | “Market cap of DePIN sector” reportedly crossed ~US $50 B in 2024; 25+ projects generating revenue; DRNs outperform PRNs | According to a 2025-analysis article / press release. [14] |

5. Related Infrastructure Trends Supporting DePIN Growth Projections

DePIN doesn’t grow in isolation. Its rise is tightly linked to broader infrastructure and technology trends, edge computing, IoT growth, decentralized data centers, and increasing demand for low‑latency, distributed networks. Some key supporting data:

- Meanwhile, demand for decentralized data‑center and edge‑computing infrastructure is also rising. According to a 2025 report, the global “edge data center” market which overlaps with many DePIN use cases is set to grow from US $20.62 billion in 2024 to nearly US $109.78 billion by 2034. [15]

- Given these macro trends, DePIN by offering decentralized, token‑incentivized infrastructure stands to benefit as companies and communities seek more resilient, scalable, and decentralized alternatives to legacy centralized systems.

6. What Could 2026 Look Like for DePIN Growth Projections Scenarios

Because public forecasts rarely provide a precise “2026 number,” we rely on extrapolation combining existing data, growth trajectories, and macro trends. Below is a table summarizing plausible 2026 market‑size ranges under different scenarios.

| Scenario | Assumptions | Estimated Global DePIN Market Size in 2026 |

|---|---|---|

| Conservative (slow ramp-up) | Gradual adoption, some regulatory and infrastructure lag, moderate IoT and utilization growth | US $50–100 billion |

| Base-case / Moderate | Steady edge computing and IoT growth, increasing real-world DePIN adoption across wireless, storage, and compute, modest regulatory clarity | US $200–400 billion |

| Accelerated / Bullish | Strong adoption across multiple sectors including wireless, storage, compute, energy, and data with widespread token-economy usage and favorable macro conditions | US $500–800 billion or potentially more |

7. What Experts & Reports Are Saying About DePIN Growth Projections (2024–2025)

7.1 What sources say about Energy’s share in DePIN

The energy sector is currently the largest adopter of DePIN, accounting for approximately 38% of global deployments in 2024. This reflects early-stage implementations like decentralized microgrids and renewable-energy projects, which have proven to be some of the first practical use cases for decentralized infrastructure. However, this figure represents deployment share, not market value, and may shift as other sectors such as compute, storage, wireless, and IoT scale rapidly in the coming years.

Key Points:

- 38% of DePIN deployments in 2024 are in the energy sectors

- Reflects early adoption via decentralized microgrids and renewable-energy projects

- Not market value: 38% refers to project count, not revenue or TAM

- Other sectors like compute, storage, wireless, and IoT are expected to grow, gradually reducing energy’s proportional share

- Useful for DePIN growth projections: consider 30–40% energy share in short-term forecasts (2025–2027)

8. DePIN Data Marketplaces Growing Segment of DePIN Infrastructure

8.1 Why Data Marketplaces Matter in DePIN

- Data marketplaces give users, individuals, enterprises, governments a decentralized, blockchain‑backed platform to share, exchange or monetize data (IoT data, environmental data, mobility data, etc.), while preserving privacy and removing centralized intermediaries. [16]

- In the context of DePIN, data marketplaces leverage the same decentralized infrastructure that powers networks for storage, compute, and connectivity turning “real‑world data + real‑world infrastructure” into tradable, secure digital assets.

- As IoT, sensor networks, decentralized storage and edge‑computing grow, the demand for secure, decentralized data exchanges is expected to rise sharply, driving expansion of DePIN data marketplaces.

8.2 What This Means for DePIN’s Future & For Your Strategy

- Data marketplaces are becoming a distinct growth vertical within DePIN not just storage, compute or connectivity. That means DePIN’s value proposition broadens beyond physical infrastructure to data economy and monetization.

- For projects like Web3 services: data marketplaces could present a use‑case for stablecoins or utility tokens e.g. paying for data access, rewarding data providers, tokenizing data assets.

- As DePIN adoption scales (IoT, decentralized storage, edge‑compute), data marketplaces may capture a growing share of the DePIN ecosystem’s value making it strategic to monitor and integrate data‑marketplace opportunities into long‑term forecasts.

9. Drivers Behind the DePIN Growth Projections

9.1 IoT Explosion & Edge-First Growth

The massive increase in connected devices fuels demand for distributed infrastructure, centralized clouds and data centers may become bottlenecks, so DePIN offers scalable alternatives through distributed nodes. As IoT devices reach billions globally, DePIN becomes a logical backbone for connectivity, storage, compute, and data flow.

9.2 Intersection of DePIN + AI + Data Demand

As AI workloads grow from edge inference to global training there is growing need for decentralized compute/storage to support privacy, latency, and distribution. DePIN’s decentralized architecture aligns with these demands. WEF’s “DePAI” (decentralized physical AI) concept highlights this convergence.

9.3 Infrastructure Gaps in Emerging Markets

Regions with weak legacy infrastructure, limited broadband, weak power grids, poor data centers stand to benefit enormously from DePIN deployments. Tokenized incentives attract local participation and investment, enabling leapfrog infrastructure development.

9.4 Token-Based Incentives & Community Ownership

DePIN’s value rests on tokenomics: contributors are rewarded for resources, creating a community-owned network rather than corporate-owned infrastructure. This aligns long-term stakeholder interest and enables decentralized growth, a key factor behind optimistic DePIN growth projections.

9.5 Regulatory & Market Trends Favoring Decentralization

As data privacy, decentralization, and resilience gain prominence and as traditional centralized systems show vulnerabilities decentralized infrastructure becomes more attractive. Regulatory shifts toward supporting decentralized systems (in some jurisdictions) further fuel adoption.

10. Risks, Uncertainties & What Could Change the Forecasts

While DePIN growth projections are ambitious, several risk factors and uncertainties could influence actual outcomes. These include:

- Regulatory and compliance uncertainty globally, especially around tokenized infrastructure, crypto regulations, and data security laws.

- Infrastructure deployment challenges hardware, maintenance, scalability, and node reliability.

- Adoption risks if user or enterprise adoption lags projections, demand may not meet tokenomics expectations.

- Tokenomics design flaws, inflation, poor incentive structures, governance capture could undermine long-term value.

- Competition from traditional infrastructure or hybrid models centralized incumbents may update to compete with DePIN models.

- Technological and logistical risks IoT, connectivity, energy distribution, hardware failure, security breaches.

Therefore, DePIN growth projections indicate strong growth, realistic planning must account for such risks and include safeguards such as robust governance, gradual rollouts, and compliance alignment.

11. What 2030 Could Look Like A Scenario Map

| Indicator / Metric | Baseline 2025 | Optimistic 2030 Projection |

|---|---|---|

| Connected IoT Devices | ~18–20 billion | ~39–50 billion [17] |

| Sector Penetration (Connectivity + Energy + Storage + Compute + Data) | Early-stage deployments | Widespread adoption across emerging and developed markets |

| Decentralized Infrastructure Users | Early adopters and niche users | Tens to hundreds of millions globally (consumer and enterprise) |

| Infrastructure Diversity | Narrow use-cases | Diverse wireless, compute, energy, storage, data services, IoT, and edge AI |

| Ecosystem Impact | Experimental | Core backbone for Web3, IoT, data marketplaces, decentralized AI, and edge computing |

12. Strategic Implications for Stakeholders

12.1 For Developers & Builders

- Design infrastructure for scale, interoperability, and flexibility to serve across sectors.

- Prioritize modular, proof-based architectures to support a wide range of physical resources (compute, storage, connectivity, energy).

- Ensure tokenomics and governance models are sustainable, transparent, and community-aligned.

12.2 For Investors & Backers

- View DePIN as long-term infrastructure investment rather than short-term speculative asset.

- Diversify across infrastructure verticals (connectivity, compute, energy, data) to hedge risks.

- Monitor regulatory developments and compliance frameworks regulatory clarity will influence long-term viability.

12.3 For Policy-Makers & Regulators

- Recognize DePIN as a potential backbone for decentralized infrastructure, supportive regulation could foster innovation and resilience.

- Encourage standards for data privacy, security, and fair competition between centralized and decentralized models.

12.4 For Enterprises & Service Providers

- Consider integrating DePIN infrastructure for scalability, resilience, and decentralized access especially in underserved regions or high-growth markets.

- Leverage DePIN for flexibility: pay-as-you-go compute, storage, connectivity potentially reducing CAPEX and operational overhead.

13. Why “DePIN Growth Projections” Are Not Just Hype

The concept of DePIN is more than a theoretical idea; it represents a potential paradigm shift in how the world builds and uses infrastructure. The convergence of blockchain, IoT, AI, and decentralized economics is creating structural demand for distributed infrastructure across sectors.

However, this future depends on real adoption, robust tokenomics, solid governance, and deployment execution. If those align, DePIN could evolve from a niche Web3 concept into a foundational layer for global infrastructure.

For stakeholders, builders, investors, regulators, enterprises the coming years present a rare opportunity to shape and benefit from the next generation of infrastructure, where community, decentralization, and real-world utility converge.

Frequently Asked Questions

Depending on adoption speed, DePIN Growth Projections global market size in 2026 could range from 50 billion dollars under conservative scenarios to 800 billion dollars under accelerated conditions.

By mid-2025, more than 1,500 active DePIN projects operated globally, covering wireless networks, decentralized storage, compute infrastructure, sensors, data platforms, and energy systems.

Token incentives reward contributors for supplying resources, aligning economic participation with infrastructure growth and enabling community-owned networks instead of centralized corporate control.

As of 2025, estimates place the DePIN market between 30 to 50 billion dollars, reflecting early but rapidly expanding adoption across multiple decentralized infrastructure sectors.

IoT fuels DePIN Growth Projections demand by generating massive data, requiring decentralized storage, compute, and connectivity for real-time processing, privacy, and scalable infrastructure coordination.

The energy sector leads current DePIN deployment with around 38 percent share in 2024, mainly through decentralized microgrids and renewable energy infrastructure projects.

Key risks include regulatory uncertainty, infrastructure deployment challenges, slow enterprise adoption, weak tokenomics, governance failures, and competition from traditional centralized infrastructure providers.

They help developers, investors, and policymakers understand future infrastructure demand, adoption speed, capital flow, and long-term opportunities across Web3, IoT, AI, and energy sectors.

Major forecasts suggest DePIN could reach up to 3.5 trillion dollars by 2028, driven by decentralized wireless, computing, storage, IoT, and decentralized energy adoption.

DePIN stands for Decentralized Physical Infrastructure Networks, where blockchain coordinates real-world assets like wireless, storage, compute, energy, and data using token-based economic incentives.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.