This article focuses on the cryptocurrency wallet protocol, explaining how blockchain networks define account state, address-scoped authority, and protocol-level wallet behavior. For a complete system-level overview covering wallet architecture, key management, infrastructure, and security design. see our guide on cryptocurrency wallet architecture.

At the cryptocurrency wallet protocol level, a wallet is not a storage container for coins or tokens. Many users mistakenly think that crypto is “stored” inside wallets like money in a bank. However, for the crypto wallet protocol level, this is inaccurate. A wallet is a tool that allows users to interact with the blockchain by producing cryptographic signatures to authorize transactions. It does not hold, move or control assets. Its authority is derived entirely from the private key.

According to Chainalysis’s 2025 Crypto Crime Mid-Year Update, more than $2.17 billion had been stolen from crypto services in 2025, already exceeding the full losses of 2024 and if current trends continued, total losses could surpass $4 billion [1]by year-end. Personal wallet compromises also represent a growing share of total theft, underscoring the impact of mismanagement and security flaws at the individual level. Wallets act purely as interfaces that translate human intent into protocol-compliant transactions without storing actual funds.

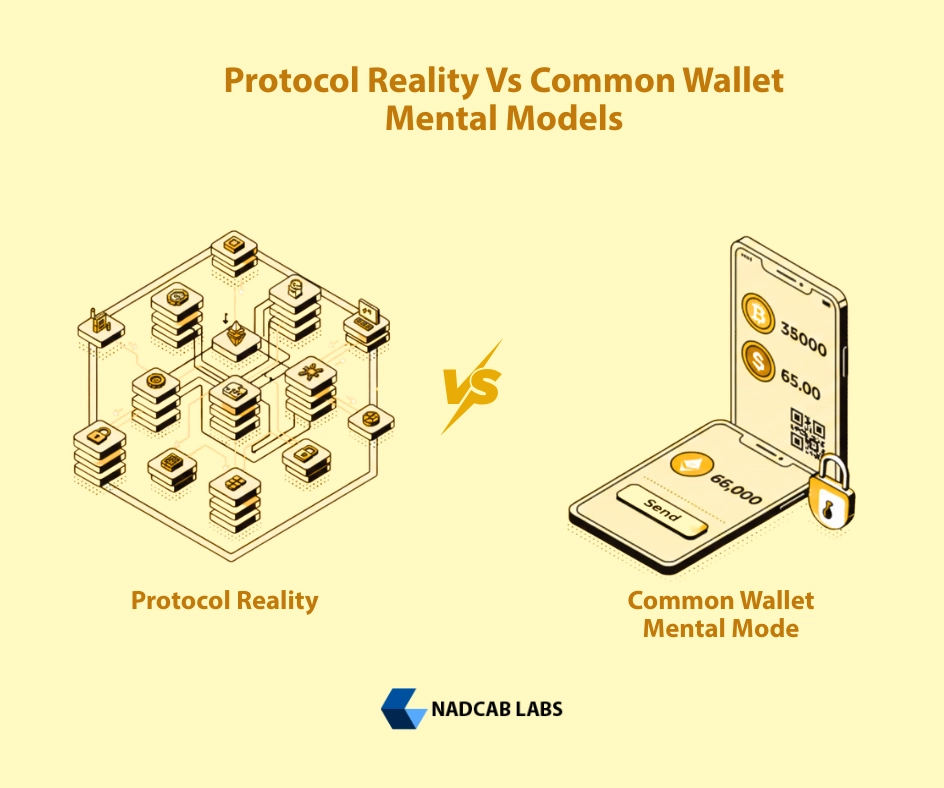

Protocol Reality Vs Common Wallet Mental Models

Most people imagine wallets as digital containers or accounts that “hold” cryptocurrency. This model is familiar from traditional banking, but it does not reflect blockchain reality. At the cryptocurrency wallet protocol level, blockchains are ledger-centric systems. They track state transitions and cryptographic authority, not possessions. Wallets reconstruct balances by querying the blockchain and producing valid signatures, they do not control assets themselves.

The misconception is so widespread that even many educational resources continue to describe wallets as storage. This leads to UX misunderstandings, poor recovery practices and misplaced trust in software. At the crypto wallet protocol level, wallets are passive tools facilitating interaction with cryptographic authority, not custodians of value.

Why is “holding crypto” a misleading abstraction?

The phrase “holding crypto” is misleading. Wallets do not contain funds, they display balances by interpreting blockchain state. When a wallet shows 10 ETH, it is merely reconstructing ownership from past transactions and blockchain state data. Misinterpreting this can lead users to believe uninstalling an app or copying files secures assets, which is false. For the cryptocurrency wallet protocol level, ownership is defined mathematically by control of the private key, not by the wallet software.

Ledger-centric systems and the absence of asset possession

Blockchains operate as ledger-centric systems, not storage systems. Each address corresponds to a mathematical condition for state modification. At the crypto wallet protocol level, possession is replaced by authority. Whoever controls the private key has the right to authorize state transitions. This principle underpins security and decentralization, software cannot hold crypto and human error or device loss can permanently affect access.

The wallet as an interpreter, not a container

At the cryptocurrency wallet protocol level, wallets act as interpreters between human intent and blockchain enforcement. They translate actions like “send 1 BTC” into cryptographically valid transactions. Once a transaction is signed and broadcasted, the wallet has completed its role. It cannot execute transactions, enforce rules or protect assets beyond key management. Misunderstanding this leads to overconfidence and poor design choices.

The Blockchain’s View of a Wallet

At the cryptocurrency wallet protocol level, the blockchain does not recognize wallet software. From the network’s perspective, there are only addresses, transactions and signatures. It does not know whether a transaction originated from a mobile app, a hardware wallet or a script. The blockchain only evaluates whether a transaction meets protocol rules and whether the signature demonstrates valid authority.

This design is deliberate. By remaining neutral to wallet software, blockchains maintain decentralization, security and permissionless operation. Recognizing wallet software would introduce trust dependencies and potential centralization risks. Therefore, wallets exist entirely outside the blockchain’s conceptual model. For the crypto wallet protocol level, software identity is irrelevant, only cryptographic authority matters.

Accounts, state transitions and address-scoped authority

Blockchains operate with accounts or outputs that define address-scoped authority. With the cryptocurrency wallet protocol level, each address is a scope in which certain state transitions are allowed. Ownership is mathematical, controlling the private key associated with an address enables authorization of transactions.

State transitions are atomic and deterministic. They either satisfy protocol rules and are applied or they fail. Wallet software does not influence this outcome, it only constructs a transaction that may satisfy the blockchain’s validation rules. Misunderstanding this mechanism can lead to flawed wallet designs or user errors.

Signature validity as the sole proof of control

At the cryptocurrency wallet protocol level, control over funds is defined entirely by signature validity. If a transaction contains a valid signature corresponding to the private key, it is authorized. Invalid signatures are rejected. There is no secondary verification of identity, intent or legitimacy.

This binary model is both simple and unforgiving. It allows trustless systems, but it also means that mistakes, phishing attacks or compromised keys result in irreversible losses. By the crypto wallet protocol level, the blockchain enforces authority mathematically, independent of any user interface or wallet software.

Why do blockchains not recognize wallet software?

Blockchains deliberately avoid recognizing wallet software. Doing so would introduce bias, censorship and potential centralization, all of which undermine the permissionless nature of decentralized networks. From the cryptocurrency wallet protocol level, wallets are tools for humans, they cannot be treated as participants by the protocol.

This principle is crucial for both security and usability. Wallets provide convenience and interpret human intent, but at the protocol level, they have no special status. Every transaction is treated identically by the blockchain, ensuring fairness and trustlessness.

Cryptographic Authority as the Only Wallet Primitive

At the cryptocurrency wallet protocol level, cryptographic authority is the only primitive that determines control. The private key is the core element, it allows the holder to authorize state changes associated with addresses. Wallet software, devices or human interfaces cannot create authority on their own. This is a fundamental distinction that underpins secure blockchain operations and explains why many wallet-related incidents occur due to mismanagement of private keys rather than protocol vulnerabilities.

The importance of understanding cryptographic authority is growing. Recent security reports show that private key leaks and wallet takeovers were one of the biggest reasons for crypto losses in 2025. In just the first half of the year, wallet compromises led to around $1.7 billion [2]in stolen funds. This clearly shows why a crypto wallet should not be treated as a safe vault, but as a tool that must be built with strong key management and clear protocol-level security rules. At the cryptocurrency wallet protocol level, all other functionalities, balance display, transaction history or fee estimation are secondary conveniences built on top of this cryptographic foundation.

Private key material as an authorization capability, not identity

At the cryptocurrency wallet protocol level, the private key is strictly an authorization capability. It does not identify a user, device or software. Controlling a private key is sufficient to authorize transactions from an address, independent of any identity verification.

This distinction prevents wallets from being falsely treated as identity providers. Misunderstanding this principle can lead to insecure design choices, such as assuming a password or app can replace key security. Users must recognize that authority resides entirely in the private key by the crypto wallet protocol level, and losing it results in permanent loss of control.

Public keys, addresses and irreversible derivation constraints

Public keys and addresses are derived irreversibly from private keys using cryptographic functions. At the cryptocurrency wallet protocol level, this ensures that only the private key holder can authorize transactions associated with the address. Wallets perform these derivations for convenience, but the protocol does not recognize the software performing them.

This irreversible derivation guarantees security, sharing a public key or address is safe but losing the private key is catastrophic. Wallet software cannot recover authority, it can only facilitate user access to cryptographic functions. Understanding these constraints is critical for wallet developers and users alike.

Authority persistence independent of software lifecycle

Authority is independent of wallet software. Deleting an app, switching devices or reinstalling software does not change blockchain control. At the cryptocurrency wallet protocol level, authority persists solely as long as the private key is available.

This principle explains why mnemonic phrases, hardware wallets and secure key backups are standard in modern wallet design. Wallet software provides convenience but the true source of authority is always the private key, independent of apps or devices.

Separation of Responsibilities Wallet vs Node vs Network

At the cryptocurrency wallet protocol level, wallets, nodes, and the blockchain network have clearly defined responsibilities. Understanding these boundaries is essential for secure wallet design and effective user education, especially in the context of a Web3 wallet, which acts as the user’s primary interface with decentralized applications. Wallets are responsible for generating private keys, creating transactions, and producing valid cryptographic signatures, while nodes handle transaction propagation and validation, and the network enforces consensus and ledger finality. A Web3 wallet does not control the blockchain itself; instead, it securely signs user intent and communicates with nodes on the user’s behalf. Misunderstanding this separation of roles can lead to security flaws, failed transactions, or misplaced trust in wallet software rather than in the underlying blockchain protocol.

Wallets depend heavily on nodes and RPC (Remote Procedure Call) infrastructure to interact with blockchain data. They query nodes to reconstruct balances, track transaction confirmations and estimate network fees. From the crypto wallet protocol level, wallets have no independent authority to verify network consensus. Users often assume wallets operate autonomously but in reality, their functionality is strictly limited to signing transactions and interpreting blockchain state.

What transaction validation actually belongs to?

At the cryptocurrency wallet protocol level, wallets don’t enforce rules or decide which transactions go through. That’s the job of blockchain nodes. Nodes check that signatures are valid, funds are available and all protocol rules are followed. Wallets simply create transactions, sign them and send them to the network.

A common mistake is assuming wallets control transaction validation. This misunderstanding often leads to frustration when transactions fail or take longer than expected. In reality, the blockchain is working correctly and the wallet is just a tool to interact with it. Understanding that nodes handle validation helps both developers and users avoid confusion.

Why can’t wallets enforce consensus rules?

Consensus is enforced at the network level, not by wallet software. At the cryptocurrency wallet protocol level, wallets only generate transactions and signatures. They cannot dictate which transactions are included in a block or influence block ordering. Consensus mechanisms, whether proof-of-work, proof-of-stake or others operate independently of any wallet.

Wallets may simulate outcomes or suggest optimal fees but they cannot guarantee transaction success. Misinterpreting this often leads to misplaced trust and improper design assumptions in both software and user behavior.

The dependency boundary between wallet and RPC infrastructure

Wallets rely on RPC endpoints to interact with the blockchain. These nodes provide essential information such as current balances, transaction history and network state. At the cryptocurrency wallet protocol level, wallets cannot operate without this infrastructure.

This dependency introduces challenges, including partial state visibility, latency and potential RPC failures. Developers must design wallets that gracefully handle incomplete or delayed information while ensuring users understand the limitations of software versus protocol authority.

Wallet vs Node vs Network Responsibilities

| Layer | Key Responsibilities | Detailed Functions / Examples |

|---|---|---|

| Wallet | Transaction creation & signing | Generate transactions, sign with private keys, build inputs/outputs, select UTXOs. Wallets interpret blockchain state and express user intent. |

| Key management | Secure private key generation and storage, public key derivation, seed phrase backup and recovery. Losing keys means permanent loss. | |

| UI & policy enforcement | Display balances and history, set fees and alerts, warn about network conditions. Wallets enforce local—not protocol—rules. | |

| Network interaction | Broadcast signed transactions and query nodes for confirmations and balances. Wallets are stateless tools. | |

| Node | Transaction validation | Verify signatures, enforce protocol rules, and reject invalid transactions before block inclusion. |

| State verification | Track UTXOs or account balances and maintain blockchain state used by wallets. | |

| Block propagation | Relay valid transactions and blocks to peers, ensuring redundancy and reliability. | |

| Network | Consensus enforcement | Maintain global agreement (PoW, PoS), handle forks, and achieve ledger finality. |

| Security & integrity | Prevent double-spending, resist 51% attacks, and protect protocol integrity. | |

| Ledger finality | Ensure confirmed transactions become irreversible and globally propagated. |

Stateless Chains and the Illusion of Wallet State

At the cryptocurrency wallet protocol level wallets do not store balances or maintain ledger state. Instead, they reconstruct ownership by querying the blockchain in real-time. This gives users the illusion of storage but in reality, the wallet is simply interpreting cryptographic authority to display balances and transaction history.

Understanding this distinction is critical for both developers and users. Wallets cannot guarantee that a balance displayed is final until the transaction is confirmed on-chain. Delayed confirmations, partial state visibility and network propagation latency are common. With the crypto wallet protocol level, wallets are advisory interfaces not authoritative record-keepers.

Why are balances not stored by wallets?

Wallets compute balances by analyzing blockchain data. At the cryptocurrency wallet protocol level, all state information resides on the blockchain itself. The wallet merely interprets this data to display user-friendly information. This explains why uninstalling a wallet app does not “delete” crypto assets, the authority to control addresses remains intact as long as the private key exists.

Read-time reconstruction of ownership claims

Each time a wallet is opened it queries nodes or RPC endpoints to reconstruct ownership claims. At the cryptocurrency wallet protocol level, this reconstruction is read-only. It does not modify the blockchain, nor does it guarantee transaction inclusion. Misunderstanding this can lead users to believe wallets provide finality or execution guarantees, which they do not.

Implications of delayed or partial state visibility

Network latency, node failures or partial blockchain data can result in temporary discrepancies between displayed balances and actual authority. Wallets must handle these conditions gracefully, warning users of potential delays or inconsistencies. At the cryptocurrency wallet protocol level, this is an inherent limitation of stateless interactions rather than a software flaw.

Transaction Origination Without Protocol Ownership

Wallets create transactions by signing them with private keys, expressing user intent without directly executing state changes. At the crypto wallet protocol level, broadcasting a transaction does not ensure it will be included in a block or confirmed. This distinction is crucial, the wallet originates intent, the network enforces execution and consensus determines finality.

Wallet Software as a Policy Layer Above Protocol Rules

Wallets can enforce local policies, such as maximum spending limits, custom fees or alert thresholds. However, at the cryptocurrency wallet protocol level, these policies are advisory. They cannot override immutable blockchain rules, consensus or protocol-level validation. This separation ensures wallets remain flexible interfaces without compromising decentralization or security.

Misclassification Risks in Wallet Design

Treating wallets as storage devices, security guarantees or execution environments leads to systemic flaws. At the cryptocurrency wallet protocol level, wallets are tools for interpreting cryptographic authority. Security and finality depend on correct key management and adherence to protocol rules, not on software features. Misclassification increases user risk and can result in financial loss.

Why This Definition Shape All Downstream Wallet Architecture?

Understanding the cryptocurrency wallet protocol level informs custody models, UX design and error handling. In non-custodial wallets, responsibility lies with the user to safeguard private keys. In custodial solutions, the provider assumes authority but still depends on blockchain protocols for transaction validation. Misunderstanding the wallet’s role can result in flawed design, poor user experience and security breaches.

Build My Crypto wallet Now!

Turn your dream into reality with a powerful, secure crypto wallet built just for you. Start building now and watch your idea come alive!

Global Market Statistics, Trends and Future Outlook

As of 2025, there are an estimated 820 million [3] unique cryptocurrency wallets active worldwide, according to industry adoption data. Wallet-related security incidents continue to rise, mid-year Chainalysis data shows that over $2.17 billion in digital assets were stolen in 2025 alone, with personal wallet compromises making up more than 23 % of losses, underscoring the ongoing security risks connected to private key management and protocol misunderstandings. Industry forecasts also suggest that digital wallet usage overall could exceed 6 billion users by 2030, as the broader wallet ecosystem continues expanding.

Understanding these principles ensures wallet developers and users maintain security, prevent systemic errors and interact with blockchain networks confidently. At the cryptocurrency wallet protocol level, wallets remain interfaces for cryptographic authority, not containers or execution environments.

Frequently Asked Questions

A crypto wallet is the interface or application you use to interact with the blockchain, while a crypto wallet protocol describes the rules and cryptographic mechanisms that govern how wallets generate signatures, authorize transactions, and communicate with the blockchain. The wallet app is just the tool, the protocol is how the blockchain interprets the actions initiated by that tool.

A crypto wallet protocol ensures security through cryptographic primitives such as private and public keys, signature validation, and deterministic algorithms. Private keys are mathematically linked to public keys and addresses, and only valid signatures generated by the private key can authorize transactions on the blockchain. This prevents unauthorized transfers and secures assets even though the wallet app itself does not store the crypto.

Yes, if your private key or seed phrase is compromised, an attacker can generate valid signatures and authorize transactions, effectively taking control of your assets. Because assets are stored on the blockchain and governed by cryptographic authority, the wallet app is just a bridge, once the key is exposed, the protocol accepts malicious signatures as valid.

Wallets need to connect to blockchain nodes via RPC or API endpoints to fetch the latest ledger state, such as balances and transaction history. At the cryptocurrency wallet protocol level, wallets do not store blockchain data themselves, they only interpret it. Nodes provide the data required to compute balances and to broadcast signed transactions.

Wallets are pseudonymous, not truly anonymous. While wallet addresses do not contain personal information, all transactions are publicly recorded on the blockchain. Anyone can trace transaction history from an address, but unless that address is linked to a real‑world identity, the owner remains pseudonymous.

Deleting the wallet application does not remove your crypto. Since assets are recorded on the blockchain and access is controlled by your private key, you can reinstall a wallet app or use a different one and recover your funds using your seed phrase or private key.

Hardware wallets are secure devices that store private keys offline and interact with the blockchain through the wallet protocol. They generate signatures within the device, keeping keys isolated from the internet. At the crypto wallet protocol level, this enhances security by protecting the key material used to authorize transactions.

In a crypto wallet protocol, the private key authorizes transactions by signing them, and the public key or address allows the blockchain to verify those signatures. The irreversible mathematical derivation from private to public key ensures that only the key owner can authorize state changes on the blockchain.

No. Wallets can only construct and sign transactions. The actual execution validation, block inclusion, and final state changes happen through the blockchain network as it follows consensus rules. The wallet’s job ends once it broadcasts a validly signed transaction to the network. This distinction is fundamental at the cryptocurrency wallet protocol level.

You should use secure key management (like hardware wallets), enable two‑factor authentication where possible, update wallet software regularly and avoid unsafe dependencies. Because the protocol trusts signatures, protecting your private key is the most important step in securing your crypto assets.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.