Key Takeaways

1. Block Size in Bitcoin refers to the maximum amount of transaction data that can fit inside a single block on the Bitcoin blockchain. The base block size limit is 1 megabyte (MB), though the effective capacity with SegWit reaches approximately 4 MB in block weight.

2. Smaller blocks help keep the Bitcoin network decentralized because regular users with basic hardware can still run a full node and verify transactions independently.

3. When blocks are full, users must compete by paying higher transaction fees. This is similar to paying extra for express shipping when standard delivery slots are all taken.

4. Bitcoin miners play a key role by selecting which transactions go into each block, often prioritizing those with higher fees attached.

5. The block size debate was one of the most heated discussions in Bitcoin’s history, ultimately leading to the creation of Bitcoin Cash in 2017 as a separate cryptocurrency with larger blocks.

6. Segregated Witness (SegWit) was activated in 2017 to increase Bitcoin’s effective throughput without raising the base block size limit.

7. Layer two solutions like the Lightning Network allow thousands of transactions to happen off the main chain and settle later, dramatically reducing congestion on the base layer.

8. Blockchain solution providers like Nadcab Labs help businesses design scalable systems that work alongside Bitcoin’s constraints by building Layer two and custom blockchain architectures.

9. Bitcoin halving events reduce the mining reward roughly every four years, which directly impacts miner revenue and influences how miners approach transaction fee income.

10. Understanding block size is essential for anyone in crypto because it affects transaction speed, cost, decentralization, and long term scalability of the entire Bitcoin network.

What Is Block Size in Bitcoin? A Simple Definition

At its core, Block Size in Bitcoin is the maximum amount of data that a single block on the Bitcoin blockchain can hold. Currently, the base limit is set at 1 MB. Every transaction that people send on the Bitcoin network gets bundled into these blocks, which are then added to the blockchain roughly every 10 minutes.

Imagine a shipping container at a port. The container has a fixed volume, and workers need to decide which packages to load. If there are too many packages for one container, some packages must wait for the next one. Similarly, when Bitcoin transactions exceed the available space in a block, some transactions wait in a queue called the mempool until a future block has room for them.

Why Block Size Matters for Transaction Speed and Fees

Block Size in Bitcoin has a direct impact on two things that every user cares about: how fast a transaction gets confirmed, and how much it costs.

Think of a highway with a limited number of lanes. During off peak hours, cars (transactions) move smoothly and there is no traffic jam. But during rush hour, the same number of lanes cannot handle the surge in traffic. Drivers who want to get through faster can take a toll road (pay a higher fee), while others have to sit in traffic and wait.

When Bitcoin’s network usage is low, transactions are cheap and fast. But during periods of high demand, such as a major price rally or a popular NFT launch, the limited block size means competition for space increases. Users who attach higher fees to their transactions get prioritized by miners, while those with lower fees wait longer.

A Real World Example

Consider a cryptocurrency exchange processing hundreds of user withdrawals at the same time. If the Bitcoin network is congested and blocks are full, the exchange faces a choice: pay higher fees to ensure fast confirmation for customers, or batch transactions and pay a moderate fee but accept slower processing. Many large exchanges now use transaction batching, which combines multiple withdrawals into a single transaction to optimize space usage within a block.

How a Bitcoin Block Is Created and Filled: Step by Step

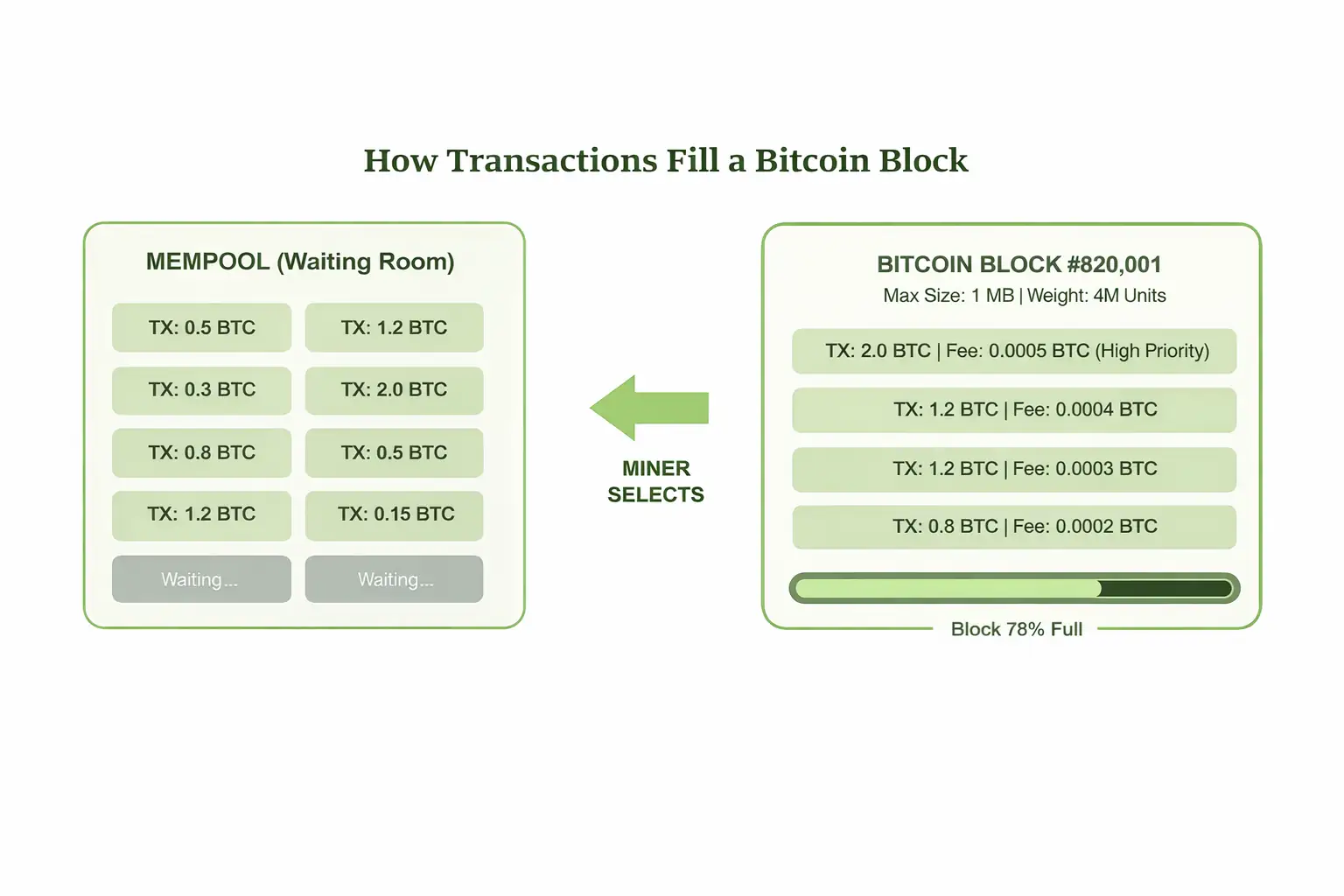

Understanding block size becomes much easier once you see how a Bitcoin block actually gets formed. Here is a simple walkthrough:

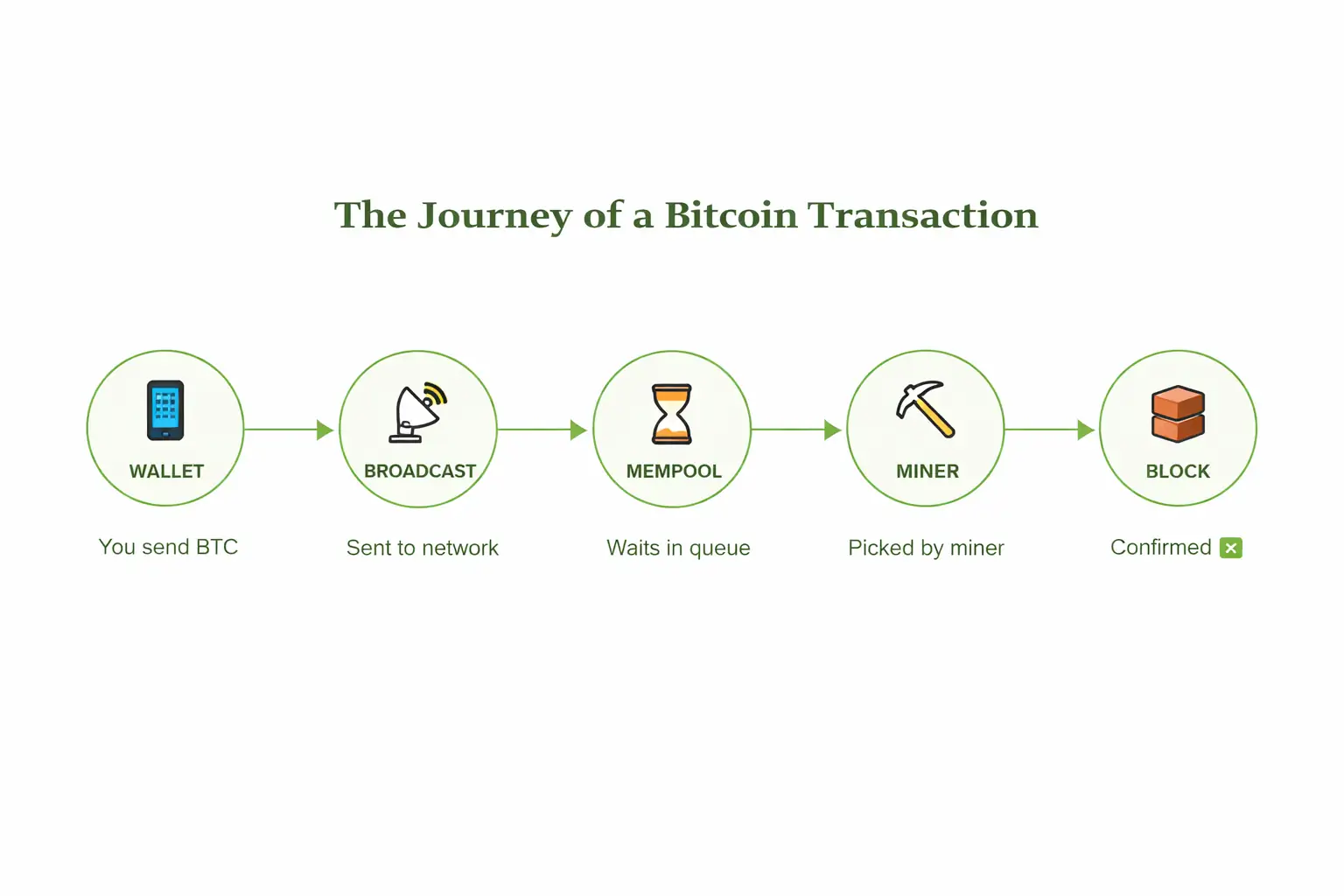

Users Broadcast Transactions

When you send Bitcoin to someone, your wallet broadcasts the transaction to the Bitcoin network. This transaction includes details like the sender address, receiver address, the amount, and the fee you are willing to pay.

Transactions Enter the Mempool

Your transaction lands in the mempool, a collective waiting area shared across all nodes. Thousands of transactions may be sitting here at any given time, each waiting to be picked up by a miner.

Miners Select Transactions

Miners look at the mempool and choose which transactions to include in the next block. They naturally prefer transactions with higher fees because that increases their revenue. The total data of all selected transactions must fit within the block size limit.

Miners Solve the Puzzle

Miners compete to solve a complex mathematical puzzle (proof of work). The first miner to solve it earns the right to add the new block to the blockchain.

Block Is Added to the Blockchain

Once the puzzle is solved, the new block containing the selected transactions is broadcast to the network. Other nodes verify the block, and it becomes a permanent part of the blockchain.

Transactions Are Confirmed

The transactions inside the newly added block are now considered confirmed. Any transactions that did not fit remain in the mempool, waiting for the next block.

What Happens When Bitcoin Blocks Become Full

When every block is packed to its limit, the Bitcoin network enters a state of congestion. This situation creates several noticeable effects for users and businesses:

- Rising Transaction Fees: Users must outbid each other to get their transactions confirmed quickly. During peak congestion periods, fees have historically spiked to over $50 per transaction.

- Longer Confirmation Times: Transactions with low fees may take hours or even days to confirm, as miners keep choosing higher fee transactions first.

- Mempool Backlog: The mempool grows larger, sometimes holding over 100,000 unconfirmed transactions at once.

- User Frustration: New users especially may find the experience confusing and may question why a digital payment system is slower and more expensive than traditional methods during peak times.

This congestion problem is a direct consequence of Block Size in Bitcoin being limited. While this limit exists for good reasons (which we will explore below), it does create real challenges when network demand surges.

How Block Size Impacts Bitcoin Miners

Miners are the backbone of the Bitcoin network. They invest in specialized hardware and consume significant amounts of electricity to validate transactions and secure the blockchain. Block Size in Bitcoin directly affects their operations in several ways.

First, miners earn revenue from two sources: the block reward (newly minted Bitcoin) and transaction fees paid by users. When blocks are full and fees are high, miners earn more from each block. When blocks have plenty of empty space, fee income drops.

Second, the size of blocks affects how quickly miners can propagate (share) newly found blocks across the network. Larger blocks take longer to transmit, which increases the risk of another miner finding a competing block during that time. This is called orphan block risk, and it can result in wasted work and lost rewards.

Third, miners must consider the long term sustainability of their operations. As Bitcoin halving events reduce the block reward over time, transaction fees will become an increasingly important part of miner income. A healthy fee market, driven in part by block space demand, is essential for the security of the network in the decades ahead.

How Block Size Affects Transaction Confirmation Times

On average, a new Bitcoin block is mined approximately every 10 minutes. However, this does not mean every transaction is confirmed within 10 minutes. The actual time depends heavily on block size constraints and network demand.

If you send a transaction during a quiet period on the network, it will likely be included in the very next block, giving you a confirmation within about 10 minutes. But during periods of heavy traffic, your transaction could sit in the mempool for 30 minutes, an hour, or even longer, especially if you set a low fee.

Many wallets and services now offer fee estimation tools that analyze current mempool conditions and suggest an appropriate fee. For example, if you are sending a time sensitive payment, such as paying for a product at checkout, you would choose a higher priority fee. If you are simply moving Bitcoin between your own wallets with no urgency, a lower fee is perfectly fine.

Comparison: Block Size Across Major Cryptocurrencies

Table 1: Block Size and Transaction Throughput Comparison

| Feature | Bitcoin (BTC) | Bitcoin Cash (BCH) | Litecoin (LTC) | Ethereum (ETH) |

|---|---|---|---|---|

| Block Size Limit | 1 MB base (4 MB weight) | 32 MB | 1 MB | Dynamic (gas limit) |

| Average Block Time | ~10 minutes | ~10 minutes | ~2.5 minutes | ~12 seconds |

| Transactions Per Second | ~7 | ~100+ | ~56 | ~15 to 30 |

| Approach to Scaling | Layer two (Lightning) | Larger blocks on chain | Faster blocks | Layer two rollups + sharding |

| Decentralization Level | Very High | Moderate | High | High |

The Bitcoin Block Size Debate: A Brief History

The question of whether to increase Bitcoin’s block size was one of the most intense and divisive debates in the history of cryptocurrency. It split the community, led to personal conflicts among developers, and ultimately created an entirely new cryptocurrency.

In Bitcoin’s earliest days, there was no formal block size limit. Satoshi Nakamoto, Bitcoin’s creator, introduced the 1 MB limit in 2010 as a protective measure against spam attacks that could have overwhelmed the young network. At the time, blocks were nowhere near full, so the limit was not controversial.

By 2015 and 2016, Bitcoin’s growing popularity meant blocks were consistently reaching their 1 MB cap. Transaction fees rose sharply, and confirmation times increased. Two main camps emerged:

- Big Blockers: This group wanted to increase the block size directly (for example, to 2 MB, 8 MB, or even 32 MB). They argued that larger blocks would allow more transactions per block, keeping fees low and throughput high.

- Small Blockers: This group preferred to keep the block size at 1 MB and focus on Layer two solutions like the Lightning Network. They argued that larger blocks would make it harder for ordinary people to run full nodes, threatening Bitcoin’s core value of decentralization.

After years of debate, the small block camp won the argument on the Bitcoin main chain. SegWit was activated in August 2017 as a compromise that improved throughput without raising the base limit. Meanwhile, the big block camp forked Bitcoin to create Bitcoin Cash (BCH) on August 1, 2017, which launched with an 8 MB block size limit that was later raised to 32 MB.

For more in depth reading on how Bitcoin’s protocol works, you can visit the official Bitcoin.org guide on How It Works.

SegWit and the Concept of Block Weight

Segregated Witness, or SegWit, was a major upgrade to the Bitcoin protocol activated in August 2017. Rather than simply increasing the block size, SegWit changed how transaction data is structured and introduced a new concept called block weight.

In simple terms, SegWit separates (segregates) the digital signature data (the “witness”) from the main transaction data. Since signature data often accounts for a large portion of a transaction’s size, this separation allows more transactions to fit inside a block.

With SegWit, Bitcoin moved from measuring blocks purely in bytes (1 MB limit) to measuring them in weight units. The new limit is 4 million weight units per block. In practice, a fully SegWit block can hold roughly 2,700 transactions compared to about 1,650 in a pre SegWit block, effectively increasing capacity by around 60% to 70%.

SegWit also fixed a longstanding issue known as transaction malleability, which paved the way for Layer two solutions like the Lightning Network. Today, a growing percentage of Bitcoin transactions use SegWit addresses, which start with “bc1” instead of the older “1” or “3” prefixes.

Scalability Challenges Related to Block Size in Bitcoin

Even with SegWit, Block Size in Bitcoin remains a fundamental constraint on the network’s scalability. Bitcoin can process roughly 7 transactions per second on its base layer. For comparison, the Visa network handles around 1,700 transactions per second on average and can surge to over 24,000 during peak times.

This gap highlights the scalability challenge that Bitcoin faces. As adoption grows, the demand for block space increases, but the supply remains relatively fixed. The result is periodic congestion, high fees, and slower confirmations.

Several factors make scaling Bitcoin’s base layer particularly challenging:

- Decentralization Concerns: Increasing block size means nodes need more bandwidth, storage, and processing power, which could exclude users in developing countries or those without high end hardware.

- Propagation Delays: Larger blocks take longer to transmit across the global network, increasing the chance of forks and orphaned blocks.

- Security Trade Offs: Any change to Bitcoin’s consensus rules carries risks. The conservative approach favored by the Bitcoin development community reflects the high value placed on security and stability.

This is precisely why the broader blockchain industry has embraced a multi layer approach to scaling. Rather than forcing all activity onto a single layer, developers build secondary networks and protocols that handle high volume activity while using Bitcoin’s base layer as a secure settlement layer.

Layer Two Solutions: The Lightning Network and Beyond

Since directly increasing the Block Size in Bitcoin remains a contentious and risky approach, the community has embraced Layer two solutions as the primary path to scaling. The most prominent of these is the Lightning Network.

The Lightning Network operates on top of Bitcoin’s base layer. It allows users to open payment channels between each other and conduct virtually unlimited transactions off chain. Only the opening and closing of these channels are recorded on the Bitcoin block in blockchain, dramatically reducing the load on the base layer.

How It Works in Simple Terms

Imagine two friends, Alice and Bob, who frequently send small amounts of Bitcoin to each other. Instead of recording each payment on the blockchain (and paying a fee every time), they open a Lightning channel. They can then send payments back and forth instantly, with near zero fees, as many times as they want. When they are done, they close the channel, and only the final balance is settled on the main blockchain.

The Lightning Network is ideal for:

- Small everyday payments (buying coffee, tipping content creators)

- High frequency trading between exchanges

- Micropayments that would be economically unfeasible on the base layer due to fees

- Cross border payments that need to be fast and inexpensive

Other Layer two and scaling approaches include sidechains (like Liquid Network by Blockstream), state channels, and various rollup technologies being explored in the broader blockchain ecosystem. For a wider perspective on scaling technologies across multiple blockchains, the Ethereum.org scaling documentation provides excellent background on how different networks approach similar challenges.

Business and Exchange Relevance of Block Size in Bitcoin

For businesses operating in the cryptocurrency space, Block Size in Bitcoin is not just a technical detail. It is an operational concern that directly affects costs, user experience, and revenue.

Cryptocurrency Exchanges

Exchanges process thousands of deposits and withdrawals daily. During periods of network congestion, withdrawal fees spike, and processing times increase. This leads to customer complaints and support tickets. Exchanges like Coinbase and Binance have adopted strategies such as transaction batching and SegWit integration to optimize their use of block space.

Payment Processors

Companies that accept Bitcoin as payment (like BitPay) must account for confirmation times and fee volatility. Many now offer Lightning Network support to provide instant, low cost payments for merchants and consumers.

Financial Platforms and Custody Services

Institutional custodians managing large amounts of Bitcoin need predictable fee structures for their operations. Understanding block size dynamics helps them time their transactions strategically, consolidating UTXOs (unspent transaction outputs) during low fee periods and avoiding on chain activity during peak congestion.

Benefits of Keeping Block Size Small

It might seem counterintuitive, but there are very strong reasons why many Bitcoin advocates support keeping the block size relatively small:

- Preserving Decentralization: Smaller blocks mean that running a full Bitcoin node requires less bandwidth, storage, and computing power. This allows more people worldwide, including those with modest internet connections, to participate in validating the network.

- Stronger Security: A more decentralized network with many independent nodes is harder to attack or censor. This is arguably Bitcoin’s most important property.

- Faster Block Propagation: Smaller blocks travel across the network more quickly, reducing the likelihood of forks and orphaned blocks.

- Encouraging Innovation: The constraint of limited block space has driven the development of creative solutions like SegWit, the Lightning Network, and various other Layer two technologies.

- Healthy Fee Market: A certain level of scarcity in block space ensures that transaction fees remain meaningful, which is critical for long term miner incentives as block rewards continue to decrease.

Limitations of Keeping Block Size Small

- Higher Fees During Peak Demand: When blocks are full, transaction fees can become prohibitively expensive, especially for small value transfers. In extreme cases, fees have exceeded $60 per transaction.

- Slower On Chain Transactions: Users who cannot afford higher fees may wait hours or days for confirmation, which hurts the user experience.

- Limited On Chain Throughput: At approximately 7 transactions per second, Bitcoin’s base layer alone cannot serve as a global payments system.

- Barrier to New Users: High fees and long wait times during congestion can discourage newcomers from using Bitcoin, potentially slowing adoption.

- Dependence on Layer Two Adoption: The small block approach assumes that Layer two solutions like the Lightning Network will achieve widespread adoption. While progress has been significant, these technologies are still maturing.

Table 2: Pros and Cons of Small vs. Large Block Size in Bitcoin

| Aspect | Small Blocks (1 MB base) | Large Blocks (8 MB to 32 MB+) |

|---|---|---|

| Decentralization | Highly accessible to individual node operators | Requires more powerful hardware and bandwidth |

| Transaction Fees | Higher during congestion | Generally lower due to more space |

| Throughput (TPS) | ~7 on chain (more via Layer two) | ~100+ on chain |

| Node Requirements | Low (can run on a Raspberry Pi) | Higher storage and bandwidth needs |

| Security Model | Strong via decentralization | Potentially fewer validating nodes |

| Scaling Strategy | Layer two (Lightning, sidechains) | On chain scaling |

| Long Term Fee Revenue | Supported by fee market scarcity | Depends on sustained high volume |

Understanding Bitcoin Halving and Its Connection to Block Size

While block size governs how much data fits in a block, Bitcoin halving governs how much new Bitcoin is created with each block. These two concepts are deeply interconnected because they both influence miner economics and, by extension, the security of the network.

What Is Bitcoin Halving? A Simple Analogy

Imagine a gold mine that produces 100 ounces of gold per day. Every four years, the mine owner decides to cut production in half: first to 50 ounces, then to 25, then to 12.5, and so on. Over time, new gold becomes increasingly scarce, which tends to make the existing supply more valuable.

Bitcoin works in a very similar way. Approximately every 210,000 blocks (roughly every four years), the block reward that miners receive for adding a new block to the blockchain is cut in half. This built in scarcity mechanism is one of the key features that gives Bitcoin its store of value properties.

History of Bitcoin Halvings

Table 3: Bitcoin Halving History and Price Impact

| Halving | Date | Reward Before | Reward After | Price at Halving | Peak Price After |

|---|---|---|---|---|---|

| 1st | November 2012 | 50 BTC | 25 BTC | ~$12 | ~$1,100 (2013) |

| 2nd | July 2016 | 25 BTC | 12.5 BTC | ~$650 | ~$19,800 (2017) |

| 3rd | May 2020 | 12.5 BTC | 6.25 BTC | ~$8,600 | ~$69,000 (2021) |

| 4th | April 2024 | 6.25 BTC | 3.125 BTC | ~$64,000 | Still developing |

What Happened to Bitcoin Price After Past Halvings

Historically, Bitcoin has experienced significant price increases in the 12 to 18 months following each halving event. While past performance does not guarantee future results, the pattern is notable. The reduced supply of new Bitcoin entering the market, combined with steady or increasing demand, creates upward price pressure. This dynamic is often described as a supply shock.

After the first halving in 2012, Bitcoin’s price surged from about $12 to over $1,100 within a year. The second halving in 2016 preceded the famous 2017 bull run that pushed Bitcoin near $20,000. The third halving in May 2020 was followed by an extraordinary rally to nearly $69,000 in November 2021.

How Halving Affects Bitcoin Miners

Each halving event directly cuts miner revenue from block rewards in half. This has several important consequences:

- Less Efficient Miners Are Squeezed Out: After a halving, miners with higher electricity costs or older hardware may find it unprofitable to continue. Only the most efficient operations survive.

- Transaction Fees Become More Important: As block rewards shrink, miners rely more on transaction fees to stay profitable. This is where Block Size in Bitcoin becomes especially relevant, because limited block space supports a healthy fee market.

- Hardware Upgrades Accelerate: The pressure of reduced rewards drives miners to invest in newer, more energy efficient mining hardware.

- Network Hash Rate May Temporarily Dip: Right after a halving, some miners may go offline, causing a temporary decrease in total network computing power before difficulty adjusts.

Why Halving Creates Scarcity

Bitcoin’s total supply is capped at 21 million coins. As of now, over 19.8 million have already been mined, leaving fewer than 1.2 million still to be created. With each halving reducing the flow of new Bitcoin, the asset becomes increasingly scarce over time.

This is similar to a company that gradually reduces the number of new shares it issues. As fewer new shares enter the market, each existing share represents a larger piece of the total ownership. In Bitcoin’s case, as fewer new coins are created, each existing Bitcoin becomes proportionally rarer, which many investors believe supports long term value appreciation.

Common Myths About Bitcoin Halving

Reality: Price increases have historically occurred in the months following a halving, not immediately. The actual halving day often sees little price movement, and significant rallies tend to unfold over the following year.

Reality: While halvings do reduce block rewards, the combination of rising Bitcoin prices, improving hardware efficiency, and transaction fee income has historically kept mining viable for well managed operations.

Reality: When the last Bitcoin is mined (estimated around the year 2140), miners will continue to earn transaction fees as compensation for securing the network. This is precisely why a sustainable fee market, supported in part by limited block size, is so important.

Reality: Halvings are entirely predictable because they are coded into Bitcoin’s protocol. They occur every 210,000 blocks, roughly every four years. The approximate date of the next halving can be estimated well in advance.

Reality: Halving affects the entire Bitcoin ecosystem, including investors, traders, businesses, and anyone who holds or transacts in Bitcoin. The supply reduction influences market dynamics, which impacts price, fees, and overall network activity.

Future Outlook for Bitcoin Scalability and Block Size

Looking ahead, the conversation around Block Size in Bitcoin is evolving from a binary “bigger vs. smaller” debate to a more nuanced, multi layered approach to scaling. Several developments are shaping the future:

- Lightning Network Growth: The Lightning Network continues to expand in terms of capacity, channels, and adoption. Major platforms and wallets now support Lightning payments natively.

- Taproot and Future Upgrades: The Taproot upgrade, activated in November 2021, improved privacy, smart contract flexibility, and block space efficiency. Future soft forks may bring additional improvements.

- Sidechains and Federated Models: Projects like the Liquid Network provide fast, confidential transactions for traders and exchanges, offloading volume from the main chain.

- Ordinals and Inscriptions: The emergence of Bitcoin Ordinals (which inscribe data onto individual satoshis) has reignited discussions about block space usage and priorities.

- Institutional Adoption: As more institutions engage with Bitcoin (through ETFs, custody services, and treasury strategies), the demand for efficient, scalable infrastructure will continue to grow.

The consensus within the Bitcoin community appears to lean toward maintaining the base layer as a secure, decentralized settlement layer while building increasingly sophisticated Layer two and sidechain solutions for everyday transactions and specialized use cases.

Conclusion

Block Size in Bitcoin is far more than a technical parameter. It is a fundamental design choice that shapes the speed, cost, decentralization, and security of the entire Bitcoin network. By keeping the base block size limited, Bitcoin preserves its most valuable property: a truly decentralized, censorship resistant monetary network that anyone in the world can verify and participate in.

At the same time, this constraint creates real challenges, including higher fees and slower confirmations during peak demand. The Bitcoin community has responded with innovations like SegWit, the Lightning Network, Taproot, and various sidechain solutions that expand the network’s capacity without sacrificing its core principles.

As Bitcoin continues to mature and institutional adoption accelerates, the interplay between block size, halving events, miner economics, and Layer two solutions will remain central to the network’s evolution. Understanding these dynamics equips you, whether you are a casual user, an investor, a developer, or a business leader, to make informed decisions in the rapidly growing world of blockchain and cryptocurrency.

Frequently Asked Questions

Block Size in Bitcoin is the maximum amount of data (measured in bytes) that a single block on the Bitcoin blockchain can contain. The base limit is 1 MB, although with SegWit the effective capacity can reach up to approximately 4 MB in block weight. This limit determines how many transactions can be included in each block, which is mined roughly every 10 minutes.

Satoshi Nakamoto introduced the 1 MB limit in 2010 to protect the network from spam attacks. Over time, this limit has also become important for preserving decentralization, as it keeps the hardware and bandwidth requirements low enough for ordinary users to run full nodes and validate the blockchain independently.

When blocks are full or nearly full, users compete for limited space by offering higher fees. Miners naturally prioritize transactions with higher fees. During periods of low demand, fees are minimal. During congestion events, fees can spike dramatically, sometimes exceeding $50 per transaction. Think of it as surge pricing when demand outpaces available capacity.

SegWit (Segregated Witness) is a protocol upgrade activated in August 2017 that separates signature data from the main transaction data. This allows more transactions to fit in each block without increasing the base 1 MB limit. It introduced the concept of block weight, with a maximum of 4 million weight units per block, effectively boosting transaction capacity by 60% to 70%.

The Lightning Network is a Layer two solution that operates on top of Bitcoin’s blockchain. It allows users to open payment channels and conduct virtually unlimited transactions off chain with near zero fees and instant settlement. Only the channel opening and closing are recorded on the main blockchain, drastically reducing the demand for block space.

The block size debate was a multi year disagreement within the Bitcoin community about whether to increase the base block size limit. “Big blockers” wanted larger blocks for more on chain throughput, while “small blockers” preferred keeping the limit at 1 MB and scaling through Layer two solutions. The debate culminated in 2017 with the activation of SegWit on Bitcoin and the creation of Bitcoin Cash (BCH) as a fork with larger blocks.

The number of transactions per block varies depending on transaction size and type. A pre SegWit block typically held around 1,650 transactions, while a fully SegWit block can hold approximately 2,700 or more. This translates to roughly 7 transactions per second on the base layer, a figure that Layer two solutions like the Lightning Network can multiply exponentially.

If a block is full and your transaction did not make it in, your transaction stays in the mempool (a waiting area for unconfirmed transactions). It will remain there until a miner includes it in a future block. Transactions with higher fees get picked first. If your fee is too low, you may need to wait a long time or use a feature called Replace By Fee (RBF) to increase your fee and speed things up.

Bitcoin halving cuts the block reward (new BTC created per block) in half roughly every four years. As block rewards decrease, miners rely more heavily on transaction fees to remain profitable. Limited block size ensures there is healthy competition for block space, which supports a sustainable fee market. This dynamic becomes increasingly important with each halving event.

Absolutely. Businesses can use strategies like transaction batching, SegWit addresses, Lightning Network integration, and sidechain solutions to operate efficiently within Bitcoin’s block size constraints. Blockchain solution providers like Nadcab Labs help enterprises architect scalable systems that leverage these technologies, ensuring fast, cost effective operations regardless of base layer congestion.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.