ETO marketing services enhance investor liquidity, allowing flexible trading. A lock-in period of one year post-Equity Token Offering Services ensures market stability and investor confidence.

Equity Token Offering Development

Equity Token Offering Services Company enables secure and compliant equity financing by diluting shares to raise capital. The process includes two phases: Private Locked-Up and Public Liquidity. During the lock-in period, stocks can remain non-dilutable, ensuring investor protection. Through structured Equity Token Offering Development (ETOs), tokens are issued via blockchain to global investors for transparent and efficient fundraising.

Projects completed

0

+

Verticals mastered

1

+

Repeat clients

0

%

In client acquisitions

$

0

M

Day to get a result

0

Equity Token Development Services by Industry Experts

Equity Token Design & Structuring

Tokenized Framework Creation

We develop a compliant and investor-ready token structure aligned with your project’s equity and regulatory needs.

Ownership Rights Integration

Our team incorporates dividend, voting, and ownership rights into the token’s structure to reflect true equity.

Secure Architecture Setup

We implement technical safeguards to ensure the token design is secure, scalable, and adaptable across platforms.

Smart Contract Development

Custom ETO Smart Contracts

We create customized smart contracts that handle investor onboarding, token distribution, and lock-up periods.

Audit & Risk Management

All contracts undergo rigorous testing and third-party audits to eliminate vulnerabilities and protect investors.

Compliant Code Deployment

Smart contracts are developed with regulatory and compliance checks built into every core function.

Equity Token Platform Development

Investor-Friendly Dashboards

We build intuitive platforms with real-time investment dashboards for both startups and equity holders.

KYC/AML Integration

Robust identity verification modules ensure only verified and legally allowed investors participate in token sales.

Multi-Wallet Support

Enable users to store, manage, and transact tokens securely through integrated multi-chain wallet solutions.

Regulatory Compliance & Legal Support

Global Legal Expertise

We collaborate with legal partners to help you meet regional and international token issuance requirements.

Jurisdictional Advisory

Get clarity on suitable jurisdictions and token classifications before launch to avoid legal complications.

Documentation Assistance

Our experts help create whitepapers, legal opinions, and all compliance documents needed for your token offering.

ETO Marketing & Outreach Services

Targeted Investor Campaigns

We design tailored marketing strategies to attract institutional and retail investors globally.

Content & PR Distribution

Our team handles content creation, PR releases, and strategic media placements for maximum visibility.

Community Building & Support

We help you build a loyal community around your ETO through social media, forums, and investor education.

Post-Launch Support & Maintenance

Platform Monitoring Tools

We set up tools to monitor your ETO platform performance, detect issues, and ensure 24/7 uptime.

Token Management Services

From burning and vesting to governance updates, we assist in all post-launch token lifecycle events.

Ongoing Technical Assistance

Our developers remain available for bug fixes, security upgrades, and performance enhancements as your project grows.

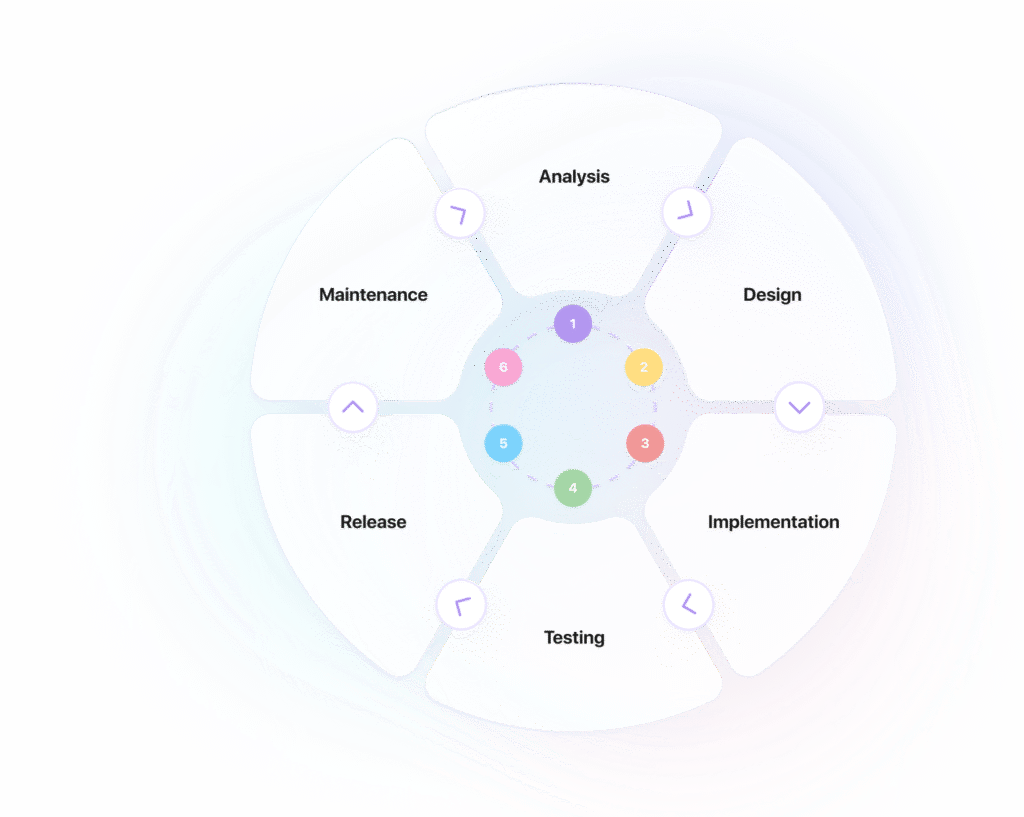

Our ETO Development Process

Step-by-Step Equity Token Offering Development Process

We follow a structured, compliant, and secure approach to Equity Token Offering Development. From planning to post-launch support, our team ensures every stage aligns with your business and regulatory goals.

Strategic Planning & Compliance Review

We begin by understanding your business model, equity structure, and jurisdictional requirements. Our experts align the offering with global regulations to ensure legal compliance and investor confidence from the outset.

Equity Token Architecture Design

Our team designs the equity token framework, including features like dividend rights, vesting, and ownership tracking. Every element is tailored to meet your business objectives while staying technically and legally sound.

Smart Contract Development & Auditing

We develop secure and audited smart contracts that manage token issuance, investor onboarding, KYC/AML compliance, and fund distribution. All contracts are tested rigorously to eliminate security risks and functional errors.

Platform Development & Integration

A custom investment platform is developed with dashboards, wallet support, and real-time analytics. It includes all essential integrations such as compliance modules, identity verification, and seamless user experiences across devices.

Launch, Marketing & Post-Support

After deployment, we help promote your ETO with tailored marketing strategies. We also provide ongoing support for platform upgrades, token management, and community engagement to ensure long-term project success.

Key Features of Equity Token Development

Programmable Equity

Equity Token Offering enables digitized equity tokens, transforming illiquid assets into equity issuance through programmable code, ensuring efficient, automated, and transparent transactions.

Regulatory Compliance

Our ETO developers create SEC-compliant tokens and assist with security laws in your jurisdiction, ensuring adherence to legal frameworks for seamless Equity Token Offering Services.

Liquidity

Secure Wallet

A blockchain-based multi-signature wallet with elliptic curve cryptography secures funds, offering investors robust security in Equity Token Development and safe asset storage.

Global Capital Investment

Equity tokens boost institutional investor trust, expanding Equity Token Offering Services into global capital markets, increasing investment inflow into crypto-based securities.

Greater Market Efficiency

ETO developers ensure technological advancements that enhance investor trust and ETO marketing services, leading to efficient markets and better investment opportunities.

Technologies We Use

Technologies Powering Equity Token Offerings

We leverage advanced technologies such as blockchain, smart contracts, and multi-signature wallets to ensure secure and transparent equity token development. Our platforms are built with integrated KYC/AML systems, elliptic curve cryptography, and compliance tools, offering a robust and scalable foundation for regulated fundraising. Each solution is customized to meet investor expectations and jurisdictional requirements.

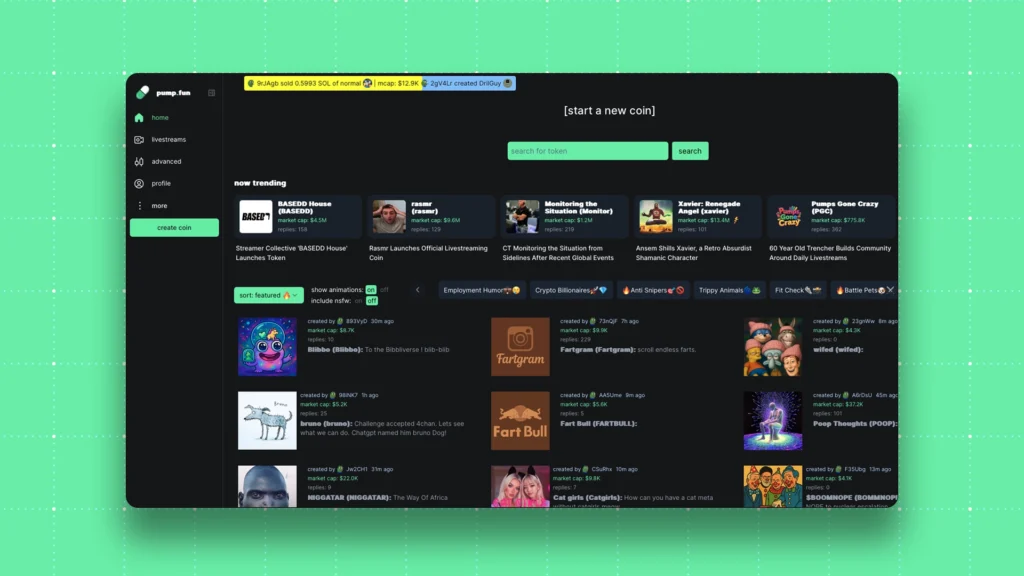

How Businesses Succeed with Our Token Offering Services

Pump.Fun Token Token launch platform

Pump.Fun, accessible at pump.fun, is a decentralized platform designed to offer a unique and engaging experience for users interested in Cryptocurrency Trading and social interaction.

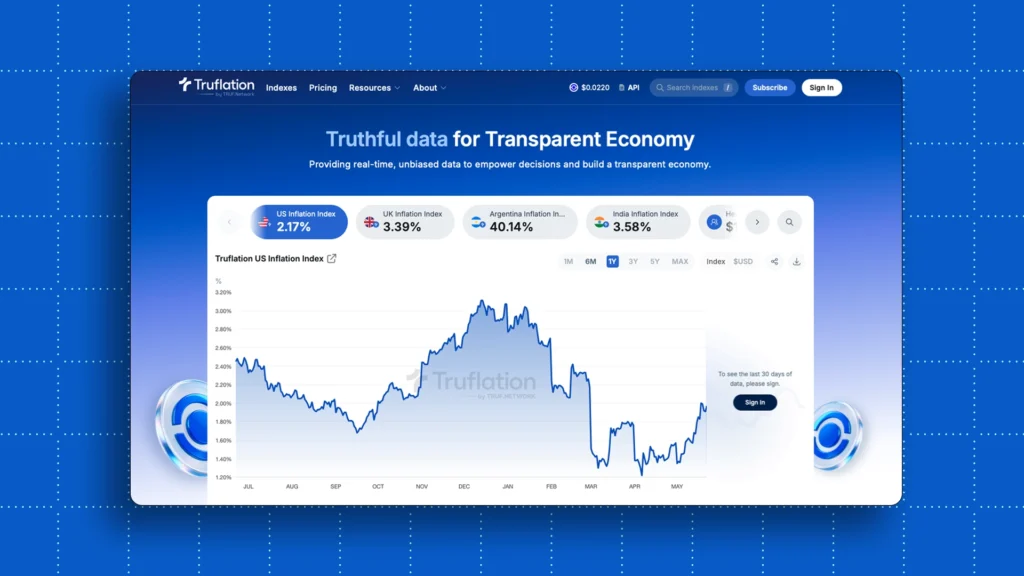

Truflation Development Real-Time Data & Tokenization

Truflation is a decentralized platform focused on tokenizing Real World Assets (RWAs) through transparent, real-time financial data. It aims to bridge traditional finance and decentralized finance (DeFi)

Open Campus launches EDU Chain, the first Layer 2 blockchain for education, introducing a Learn-to-Earn model that rewards learners and builds a decentralized, engaging, and value-driven learning ecosystem.

Key Benefits of Equity Token Offering Development

Automated Dividends

With Equity Token Development, dividends are automatically transferred to investors’ wallets using secure blockchain encryption. This ensures seamless profit distribution and enhances investor confidence.

Voting Rights

Equity token holders, like shareholders, can vote on company decisions. ETO developers integrate transparent governance models, ensuring investors actively participate in shaping the company’s future.

Buyback Rights

With ETO marketing services, companies can buy back shares at market value, regaining ownership from investors while ensuring liquidity and reinforcing investor trust in the equity token ecosystem.

Cash Flow Transparency

The company’s per-token cash flow is stored on a smart contract. Equity Token Development guarantees immutable financial transparency, allowing investors to track earnings with complete trust.

Profit Share Rights

Through Equity Token Offering Services, companies distribute profits as tokens, directly depositing them into investors’ wallets. This fosters trust and incentivizes long-term engagement in business growth.

Holdings in Another Fund

Companies can deposit tokens into funds or custodial services. Equity Token Offering developers ensure efficient fund management, helping hedge risks and optimize financial strategies for long-term growth.

Industries We Empower with Equity Token Offering Development Solutions

Real Estate

We help real estate firms tokenize property assets, allowing fractional ownership and easier global investment access. Our solutions bring liquidity, transparency, and reduced entry barriers to the real estate investment market.

Healthcare & Pharma

Healthcare companies can raise funds through equity token offerings while maintaining regulatory compliance. We support tokenization of intellectual property, R&D funding, and stakeholder management across the healthcare and biotech.

Financial Services

Our ETO solutions enable financial institutions and fintech startups to digitize equity shares, streamline investor onboarding, and simplify cross-border fundraising with smart contracts, compliance features, and secure investor dashboards.

Energy & Infrastructure

We work with renewable energy and infrastructure companies to tokenize project equity. This opens new funding opportunities, enhances project visibility, and allows global investors to participate with lower minimum contributions.

Technology Startups

Tech startups benefit from secure, scalable ETO platforms that offer global investor access without giving up excessive control. Our solutions support fast fundraising while keeping everything transparent and investor-friendly.

Art & Collectibles

Art owners and galleries can tokenize valuable assets through compliant equity tokens. This offers fractional ownership, broader reach, and long-term monetization options while preserving authenticity and investor trust.

Frequently Asked Questions

What are dilutable equity tokens in ETOs?

Dilutable tokens allow phased equity dilution, releasing shares gradually. An ETO development company issues a large number of stocks but sells a portion initially, ensuring structured capital infusion while increasing investor value as the business expands.

How does blockchain enhance ETO security?

Equity Token Development secures transactions using blockchain encryption, multi-signature wallets, and elliptic curve cryptography. ETO developers integrate decentralized security protocols, eliminating intermediaries and ensuring investor asset protection.

How does Equity Token Offering Services work?

An Equity Token Offering Services Company issues equity tokens representing company shares. Investors receive tokens during funding rounds, ensuring strategic share dilution. ETO developers enable compliant, transparent, and automated equity-based fundraising through blockchain.

Why choose an ETO over traditional fundraising?

Equity Token Offering Development provides transparent ownership, global capital investment, and automated equity management. Unlike traditional fundraising, ETOs eliminate intermediaries, reduce costs, ensure liquidity, and offer structured equity dilution.

What are the key benefits of Equity Token Development?

Equity Token Development offers automated dividends, voting rights, profit sharing, buybacks, and cash flow transparency. It enables direct investor-company interaction, eliminating intermediaries while ensuring secure, compliant, and efficient fundraising.

Ready to Launch Your Equity Token Offering?

Build a secure, compliant equity token platform and turn assets into global investment opportunities with our expert team.

Let's Talk!

Blockchain

Blockchain  Apps & Game

Apps & Game  AI & ML

AI & ML  AR & VR

AR & VR  IOT Services

IOT Services  E-commerce

E-commerce  Frontend Developer

Frontend Developer  Backend Developers

Backend Developers  Game Developers

Game Developers  Ecommerce Developer

Ecommerce Developer  Dedicated Developers

Dedicated Developers