This guide provides an in-depth exploration of the history and evolution of blockchain technology.

The Precursors to Blockchain: Laying the Foundation

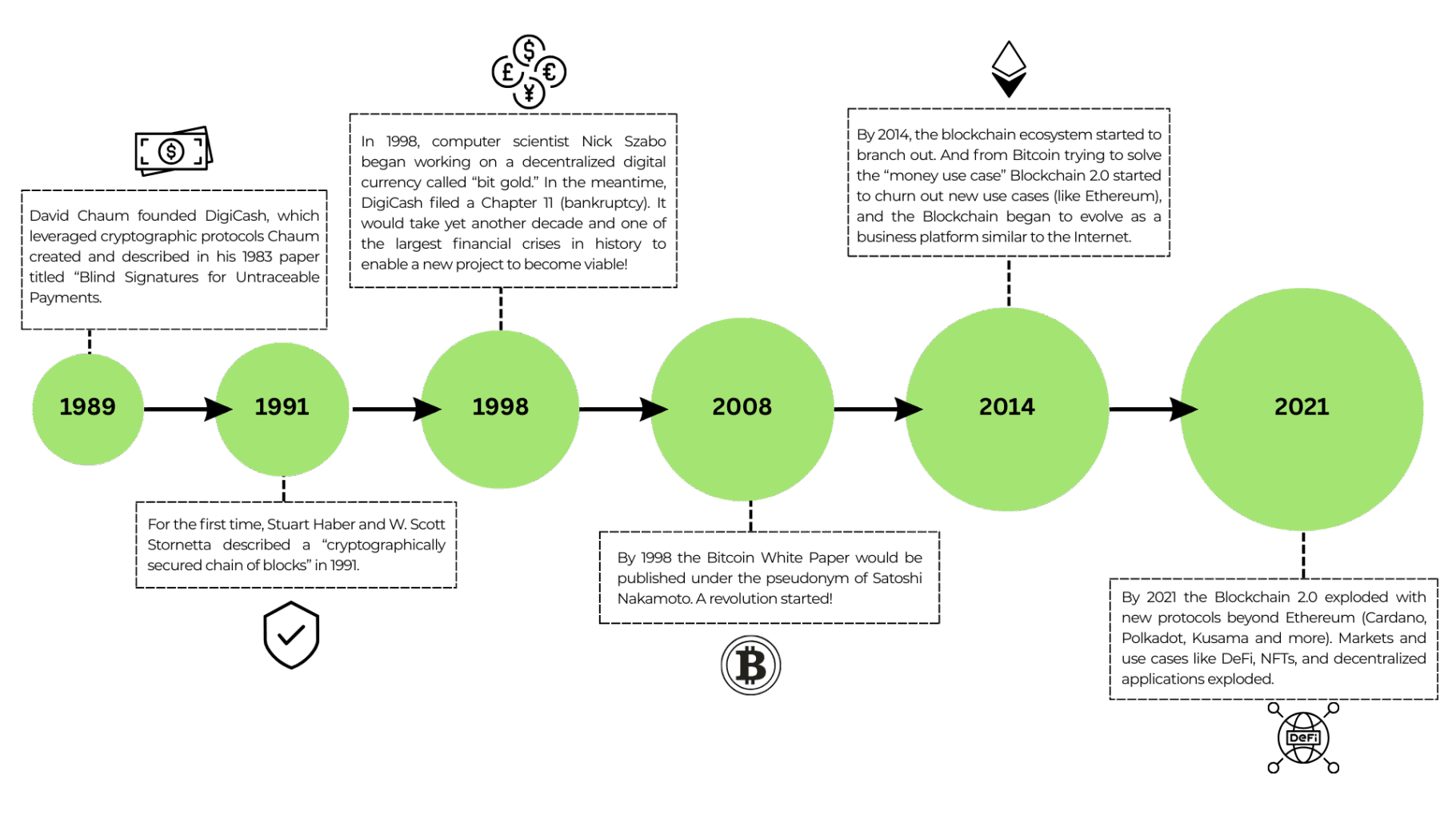

Before the advent of Bitcoin, several technologies and concepts paved the way for blockchain’s creation. Understanding these precursors provides crucial context for appreciating the revolutionary nature of blockchain.

Hash Functions: Cryptographic hash functions are fundamental building blocks. They take an input (data of any size) and produce a fixed-size output, also known as a hash or message digest. Crucially, these functions are:

- Deterministic: The same input always produces the same output.

- One-way: It’s computationally infeasible to reverse the process – to derive the input from the output.

- Collision-resistant: It’s difficult to find two different inputs that produce the same output.

Popular hash functions include SHA-256 (used in Bitcoin) and Keccak-256 (used in Ethereum).

import hashlib

message = “Hello, world!”

hash_object = hashlib.sha256(message.encode())

hex_dig = hash_object.hexdigest()

print(hex_dig)

Merkle Trees: Also known as hash trees, these are data structures used for efficiently summarizing and verifying the integrity of large datasets.

- Data is divided into blocks, and each block is hashed.

- Pairs of hashes are then hashed together, creating parent nodes.

- This process is repeated until a single root hash (the Merkle root) is obtained.

- Any change to a single data block will change the Merkle root, making it easy to detect data tampering.

- Merkle trees allow for selective disclosure or proof of inclusion, enabling verification of specific data elements without needing to download the entire dataset.

Byzantine Fault Tolerance: This area of research deals with distributed systems that must function correctly even when some components fail or act maliciously. The “Byzantine Generals Problem” illustrates the challenge: how can a group of generals, some of whom may be traitors, agree on a common battle plan? Solutions to this problem, such as Practical Byzantine Fault Tolerance (PBFT), were crucial in developing consensus mechanisms for blockchains.

Digital Signatures: Digital signatures use public-key cryptography to ensure the authenticity and integrity of digital messages.

- A sender uses their private key to create a digital signature for a message.

- Anyone with the sender’s public key can verify that the signature is valid and that the message hasn’t been tampered with.

- This provides non-repudiation – the sender cannot deny having sent the message.

B-Money and Bit Gold: These were early attempts at creating digital currencies. While not fully realized, they explored important concepts:

- B-Money (Wei Dai, 1998): Proposed a system where untraceable digital pseudonyms could enforce contracts. It envisioned a distributed database that recorded contractual agreements.

- Bit Gold (Nick Szabo, 2005): Proposed a cryptocurrency based on computationally difficult puzzles. Participants would compete to solve these puzzles, and the solutions would be chained together cryptographically to create a secure record of ownership. Although never fully implemented, Bit Gold introduced concepts like proof-of-work.

The Birth of Bitcoin: A Revolutionary Implementation

Satoshi Nakamoto’s Bitcoin whitepaper, published in 2008, brought together these existing technologies and concepts in a novel and groundbreaking way. Bitcoin wasn’t just another digital currency; it was the first successful implementation of a decentralized, trustless, andcensorship-resistant payment system.

The Bitcoin Whitepaper: Outlined the principles of a peer-to-peer electronic cash system. Key features included:

- Decentralization: No central authority controls the network.

- Proof-of-Work Consensus: Miners compete to solve computationally difficult puzzles to add new blocks to the blockchain. This secures the network and prevents double-spending.

- Blockchain: A public, immutable ledger that records all transactions.

- Cryptographic Security: Uses digital signatures and hash functions to ensure the security and integrity of transactions.

Genesis Block: The first block in the Bitcoin blockchain, mined on January 3, 2009. It contained a hidden message: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks,” a commentary on the financial crisis of the time.

Early Adoption and Growth: In the early years, Bitcoin was primarily used by cypherpunks, early adopters, and those interested in cryptography. The first real-world transaction involved the purchase of two pizzas for 10,000 BTC. As Bitcoin’s value increased, it gained wider attention.

Key Innovations of Bitcoin

- Combining Existing Technologies: Bitcoin’s genius lies not in inventing new technologies, but in cleverly combining existing ones to create a novel system.

- Incentive Mechanism: The block reward (newly minted Bitcoins) incentivizes miners to secure the network.

- Solving the Double-Spending Problem: The blockchain and proof-of-work consensus mechanism prevent the same Bitcoin from being spent multiple times.

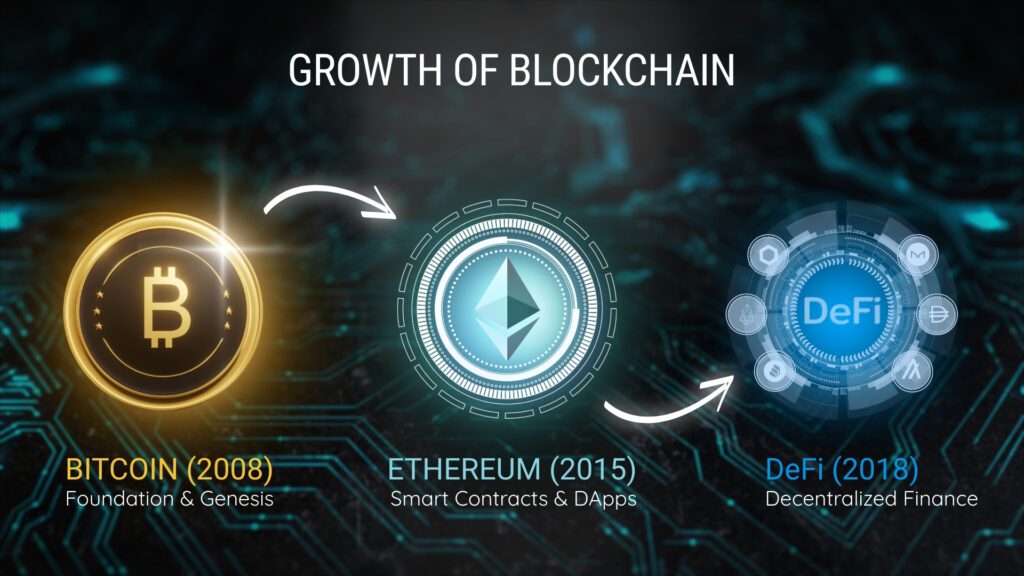

The Rise of Altcoins and Blockchain 2.0

Bitcoin’s success inspired the creation of numerous alternative cryptocurrencies (altcoins) and the exploration of blockchain technology beyond just payments.

Early Altcoins: Many early altcoins were forks of Bitcoin, meaning they copied the Bitcoin codebase and made minor modifications. Examples include Litecoin (faster block times) and Namecoin (decentralized domain name system).

Ethereum: A Programmable Blockchain: Ethereum, launched in 2015, introduced the concept of a Turing-complete smart contract platform.

This allowed developers to build decentralized applications (dApps) on the blockchain.

- Smart Contracts: Self-executing contracts written in code and stored on the blockchain. They automatically enforce the terms of an agreement when certain conditions are met.

- Ethereum Virtual Machine (EVM): A runtime environment that executes smart contracts.

- Gas: A unit of measurement that represents the computational effort required to execute smart contracts.

- ERC-20 Tokens: A standard for creating fungible tokens on the Ethereum blockchain.

Blockchain 2.0: This term refers to the broadening of blockchain applications beyond cryptocurrencies. It includes:

- Decentralized Finance (DeFi): Financial applications built on blockchain technology, such as lending, borrowing, and trading platforms.

- Supply Chain Management: Tracking goods and materials as they move through a supply chain.

- Healthcare: Securely storing and sharing medical records.

- Voting: Creating more transparent and secure voting systems.

- Identity Management: Giving individuals greater control over their digital identities.

Scaling Challenges and Layer-2 Solutions

As blockchain networks grew in popularity, they faced scaling challenges. Bitcoin and Ethereum, in particular, struggled to handle a large number of transactions quickly and efficiently.

Blockchain Trilemma: Often cited is the “Blockchain Trilemma”, which states that a blockchain system can only simultaneously achieve two out of three desirable properties: decentralization, security, and scalability.

Layer-1 Solutions: These involve making changes to the underlying blockchain protocol. Examples include:

- Increasing Block Size: This can increase transaction throughput but may also lead to centralization (larger blocks require more powerful hardware to process).

- Sharding: Dividing the blockchain into smaller, more manageable shards. Each shard can process transactions independently, increasing overall throughput.

- Proof-of-Stake (PoS): A consensus mechanism that replaces proof-of-work. Validators are chosen to create new blocks based on the number of tokens they hold and are willing to “stake” as collateral. PoS is generally more energy-efficient than PoW.

Layer-2 Solutions: These build on top of the existing blockchain to improve scalability without changing the underlying protocol. Examples include:

- Lightning Network (Bitcoin): A payment channel network that allows users to conduct off-chain transactions. Only the opening and closing of channels are recorded on the main blockchain.

- Rollups (Ethereum): Aggregate multiple transactions into a single transaction that is then submitted to the main chain. This significantly reduces transaction fees and increases throughput.

Types of Rollups include:

- Optimistic Rollups: Assume transactions are valid unless proven otherwise.

- Zero-Knowledge Rollups (zk-Rollups): Use cryptographic proofs (SNARKs or STARKs) to guarantee the validity of transactions.

Sidechains: Independent blockchains that are connected to a mainchain (e.g., Bitcoin or Ethereum). They allow for experimentation and can handle transactions more efficiently.

Enterprise Blockchain and Web3

Blockchain technology has also found applications in the enterprise and is playing a key role in the development of Web3.

Enterprise Blockchain: Private or permissioned blockchains designed for use within organizations or consortia.

- Permissioned Networks: Require participants to be authorized before they can join the network.

- Use Cases: Supply chain management, financial services, identity management, and data sharing.

- Examples: Hyperledger Fabric, Corda.

Web3: A decentralized vision of the internet built on blockchain technology. Key principles include:

- Decentralization: Users have more control over their data and online identities.

- Transparency: Blockchain provides a transparent and immutable record of transactions.

- Immutability: Data stored on the blockchain cannot be easily altered.

- Key Technologies: Cryptocurrencies, NFTs, dApps, decentralized autonomous organizations (DAOs).

Non-Fungible Tokens (NFTs): Unique digital assets that represent ownership of items such as artwork, music, or collectibles.

- Use Cases: Digital art, gaming, collectibles, virtual real estate.

- Standards: ERC-721 (Ethereum), ERC-1155 (Ethereum).

Decentralized Autonomous Organizations (DAOs): Organizations governed by code and controlled by their members.

- Use Cases: Investment funds, social networks, and governance of blockchain projects.

The Future of Blockchain: Challenges and Opportunities

Blockchain technology is still evolving, and faces several challenges and opportunities.

Challenges:

- Scalability: Still a major challenge for many blockchain networks.

- Regulation: Lack of clear regulatory frameworks in many jurisdictions.

- Security: Smart contract vulnerabilities and potential for 51% attacks.

- Energy Consumption: Proof-of-work blockchains consume significant amounts of energy (although PoS offers a more sustainable alternative).

- Complexity: Developing and deploying blockchain applications can be complex.

- Interoperability: Lack of interoperability between different blockchain networks.

Opportunities:

- Further Innovation: Continued development of new blockchain technologies and applications.

- Increased Adoption: Wider adoption of blockchain technology by businesses and individuals.

- Financial Inclusion: Providing access to financial services for the unbanked.

- Greater Transparency and Trust: Improving transparency and trust in various industries.

- New Business Models: Creating new business models based on decentralized technologies.

Blockchain’s journey from a theoretical concept to a widely adopted technology has been remarkable. As the technology matures and addresses its current challenges, it promises to revolutionize various industries and reshape the future of the internet.

Blockchain was built on several foundational technologies, including cryptographic hash functions, Merkle trees, Byzantine Fault Tolerance, and digital signatures. Early digital currency concepts like B-Money and Bit Gold also paved the way.

Bitcoin combined existing technologies into a decentralized, trustless, and censorship-resistant payment system. It solved the double-spending problem using proof-of-work and an immutable public ledger.

Scalability, regulatory uncertainty, energy consumption, interoperability between blockchains, and security vulnerabilities in smart contracts remain key challenges.

Layer-1 solutions include sharding and proof-of-stake, while Layer-2 solutions like the Lightning Network and rollups (optimistic and zk-rollups) aim to process transactions more efficiently.

Blockchain promises increased transparency, secure digital identities, decentralized finance (DeFi), NFTs, and DAOs. Together, these innovations form the foundation of Web3, a more user-controlled and decentralized internet.