Pendle Finance is a DeFi platform designed to provide users with stable yield management and greater control over their yield-bearing assets. It features innovative yield tokenization, allowing users to split assets into principal and yield components. Pendle optimized Automated Market Maker (AMM) supports yield trading with concentrated liquidity and minimal impermanent loss.

Pendle Finance was developed in response to a growing demand for stable yield management within the volatile DeFi landscape. Clients needed a reliable method to achieve consistent returns on their yield-bearing assets without being subjected to the market’s unpredictable fluctuations. The primary requirement was to create a platform that could tokenize these assets, splitting them into separate yield and principal components. This separation would allow users to manage and control their investments more effectively, providing opportunities to either lock in stable yields or speculate on future yield movements. Additionally, clients sought a system that did not require long lock-up periods, offering flexibility and immediate access to their funds.

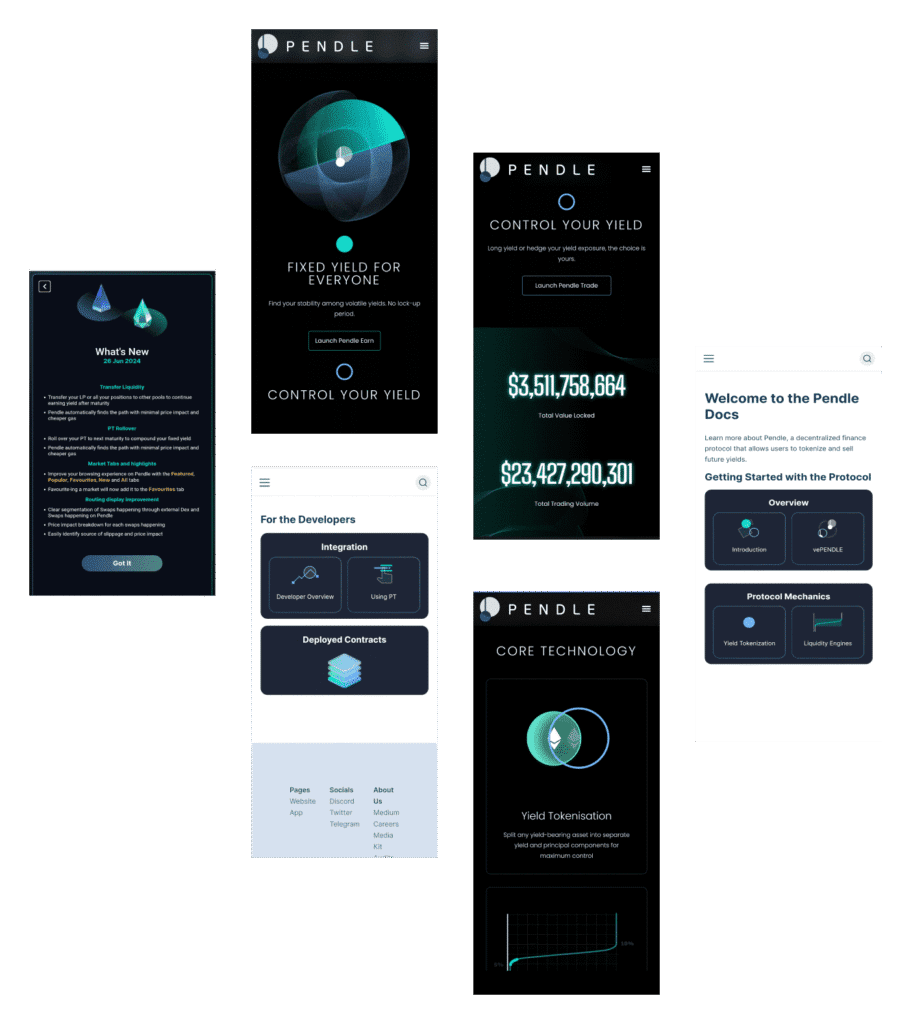

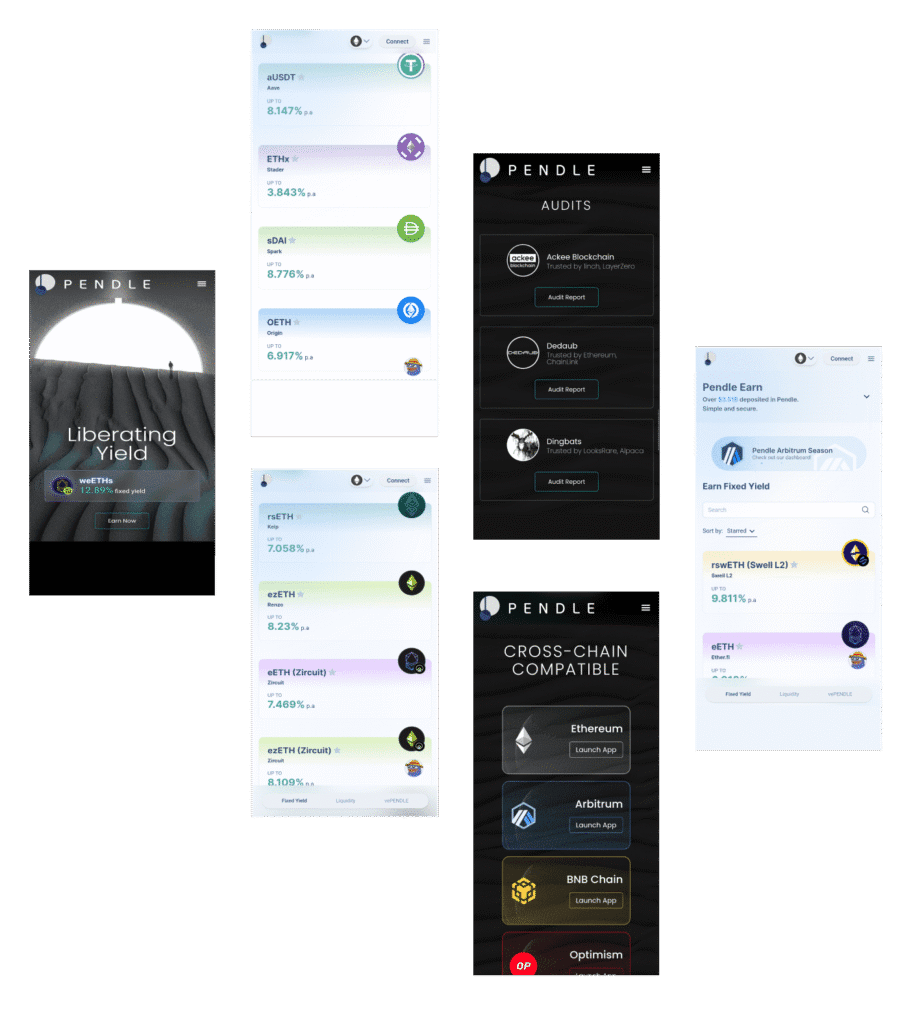

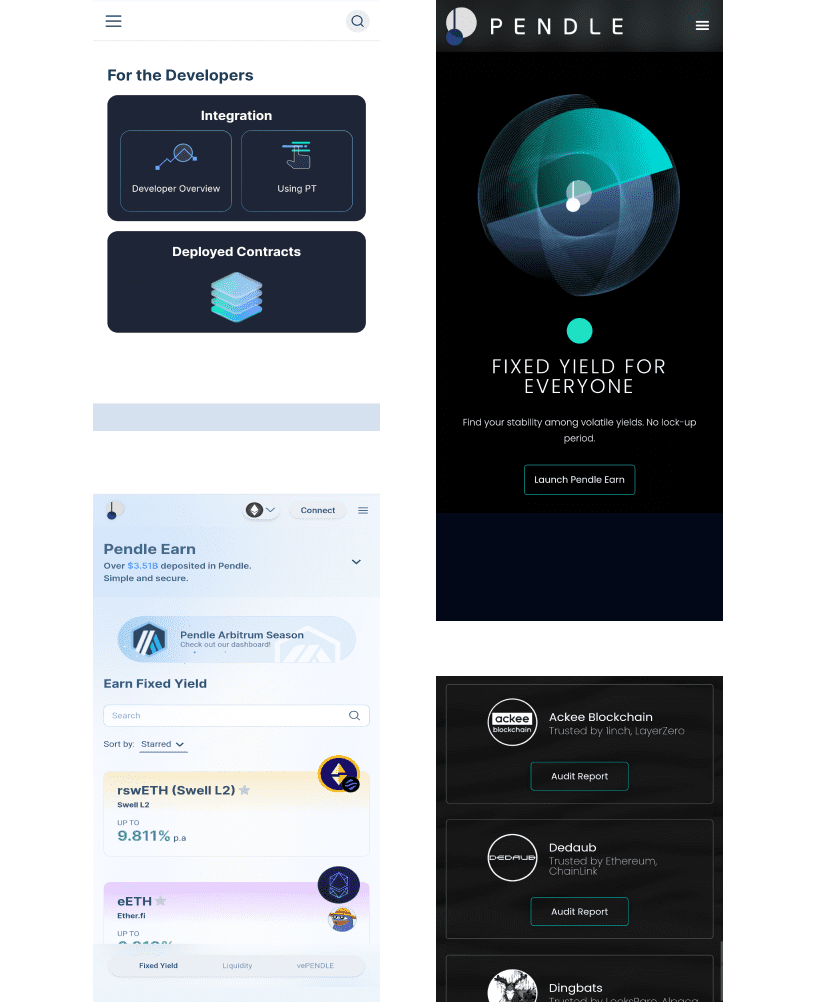

Another crucial requirement was cross-chain compatibility. Clients wanted a platform that could seamlessly operate across multiple blockchain networks, including Ethereum, Arbitrum, BNB Chain and Optimism to maximize accessibility and usability. Furthermore, high standards of security and transparency were non-negotiable, given the increasing number of exploits in the DeFi space. Comprehensive audits by reputable firms were essential to build trust and ensure the integrity of the platform. Finally, users required an easy-to-use, intuitive interface that facilitated straightforward yield management and trading, thereby lowering the barrier to entry for both seasoned DeFi enthusiasts and newcomers.

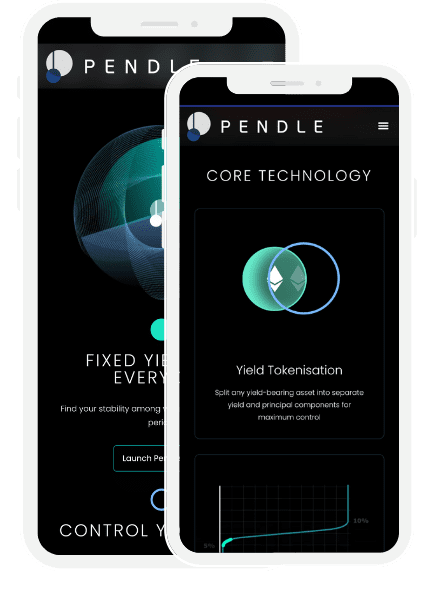

Pendle enables splitting yield-bearing assets into principal and yield tokens. This allows users to lock in returns or speculate on future yields. It enhances flexibility, giving investors more control over their DeFi strategies and risk preferences.

Pendle’s AMM is tailored for yield trading, featuring concentrated liquidity and dual fees. It minimizes impermanent loss, improves capital efficiency, and ensures optimal trading. This design supports confident participation in yield markets with reduced risk and better returns.

vePENDLE lets users lock PENDLE tokens for governance rights and rewards. This encourages community involvement and long-term commitment. Token holders influence protocol decisions while earning incentives, aligning user interests with Pendle’s development and sustainability.

Pendle supports Ethereum, Arbitrum, BNB Chain, and Optimism, enhancing accessibility and interoperability. Users can leverage its features across preferred blockchains, broadening adoption and enabling seamless DeFi yield strategies in a multi-chain environment.

Pendle surpasses $23 billion in total trading volume, indicating active user engagement and liquidity. This robust volume showcases the platform’s efficient infrastructure and its vital role in the broader DeFi trading environment.

Pendle Finance allows users to earn fixed yields without any lock-up periods. This flexibility is ideal for DeFi users who value liquidity, enabling immediate fund access while still benefiting from stable returns. It increases platform attractiveness during market volatility.

Pendle undergoes audits by Ackee Blockchain, Dedaub, and Dingbats, ensuring smart contract safety. These third-party audits reinforce trust, demonstrate transparency, and affirm Pendle’s commitment to maintaining a secure, reliable DeFi platform.

Pendle Finance has a Total Value Locked (TVL) exceeding $3.5 billion, showcasing strong user trust and adoption. A high TVL indicates deep liquidity, reliable yield strategies, and the platform’s growing prominence in the decentralized finance (DeFi) ecosystem.

Ethereum utilizes Proof of Stake (PoS) as part of its consensus mechanism, transitioning from Proof of Work (PoW) to improve scalability and energy efficiency. PoS relies on validators who stake their tokens to secure the network and validate transactions based on their stake.

Arbitrum implements an Optimistic Rollup approach, leveraging Ethereum as its security layer while processing transactions off-chain. This mechanism optimizes transaction throughput and reduces fees by aggregating multiple transactions into a single batch.

BNB Chain employs a Delegated Proof of Stake (DPoS) consensus model, where a set number of elected validators validate transactions and produce blocks. DPoS enhances scalability by prioritizing speed and efficiency in transaction processing.

Optimism utilizes a Rollup-based approach to scale Ethereum’s throughput, batching transactions off-chain and committing them to the main chain periodically. This mechanism reduces costs and speeds up transaction finality while maintaining Ethereum’s security guarantees.

Polygon employs a modified version of Plasma, a Layer 2 scaling solution for Ethereum. It uses a combination of Plasma Chains and Plasma predicates to achieve high transaction throughput while ensuring security through Ethereum’s main chain.

Binance Smart Chain utilizes a Proof of Staked Authority (PoSA) consensus mechanism, combining PoS and Byzantine Fault Tolerance (BFT) consensus. PoSA enhances transaction finality and speeds up block production, optimizing BSC for decentralized applications and DeFi protocols.

PoET is used primarily in permissioned blockchain networks and ensures fair leader election by using a trusted execution environment. In PoET, each node in the network waits for a randomly assigned time before proposing new block.

PoC, also known as Proof of Space, leverages unused hard drive space for mining. Miners write large data sets, called plots, to their drives and when a new block is needed, the system evaluates these plots to find a solution. The more space a miner allocates.

Aa Bb Cc Dd Ee Ff Gg Hh Ii Jj Kk Ll Mm Nn Oo Pp Qq Rr Ss Tt Uu Vv Ww Xx Yy Zz

Pendle Finance approached its development with a comprehensive strategy tailored to meet the precise demands of the decentralized finance (DeFi) landscape. Beginning with thorough market research, Pendle identified critical gaps in existing yield management platforms. The research highlighted a strong market need for solutions that offered stability and flexibility without imposing lengthy lock-up periods on user funds. Armed with these insights, Pendle’s development team embarked on designing and implementing cutting-edge technologies. Central to Pendle’s approach was the creation of a sophisticated yield tokenization protocol. This protocol allows users to split yield-bearing assets into separate principal and yield components. Additionally, Pendle focused on optimizing an Automated Market Maker (AMM) specifically designed for yield trading.

Since its launch, Pendle Finance has achieved remarkable success and recognition within the DeFi community. The platform currently boasts a Total Value Locked (TVL) exceeding $3.5 billion, indicating substantial trust and adoption among users seeking reliable yield management solutions. This impressive TVL underscores Pendle’s effectiveness in providing stability and security in volatile market conditions. Moreover, Pendle has facilitated a total trading volume surpassing $23 billion, highlighting its pivotal role in facilitating efficient and high-volume transactions within the DeFi ecosystem. The platform’s innovative features, such as vePENDLE for governance participation and its cross-chain compatibility, have further enhanced its appeal and utility among decentralized finance enthusiasts.Looking ahead, Pendle remains committed to continuous improvement and innovation.

Managing stable yields in a highly volatile market environment posed a significant challenge for Pendle. The inherent volatility of cryptocurrencies and decentralized financial assets required robust mechanisms to ensure predictable returns for users. Pendle addressed this challenge through innovative yield tokenization and optimized trading strategies to mitigate risks associated with price fluctuations.

Ensuring high levels of security and maintaining user trust were paramount for Pendle. The DeFi sector has been susceptible to exploits and vulnerabilities, necessitating stringent security measures. Pendle underwent rigorous auditing processes by trusted firms like Ackee Blockchain and Dedaub to validate the integrity of its smart contracts and platform infrastructure. Continuous monitoring and proactive security protocols remain critical to safeguarding user assets and maintaining confidence in the platform.

Educating users about the complexities of yield tokenization and DeFi trading presented another challenge. Many potential users were unfamiliar with advanced financial instruments and the risks associated with decentralized platforms. Pendle addressed this challenge by developing intuitive user interfaces and educational resources. Community engagement initiatives, including webinars and tutorials, were also implemented to empower users with knowledge and foster adoption of Pendle’s innovative solutions in yield management.

Innovative DeFi platform offering stable yields and flexible asset management for its users.