Decentralized Finance Solutions

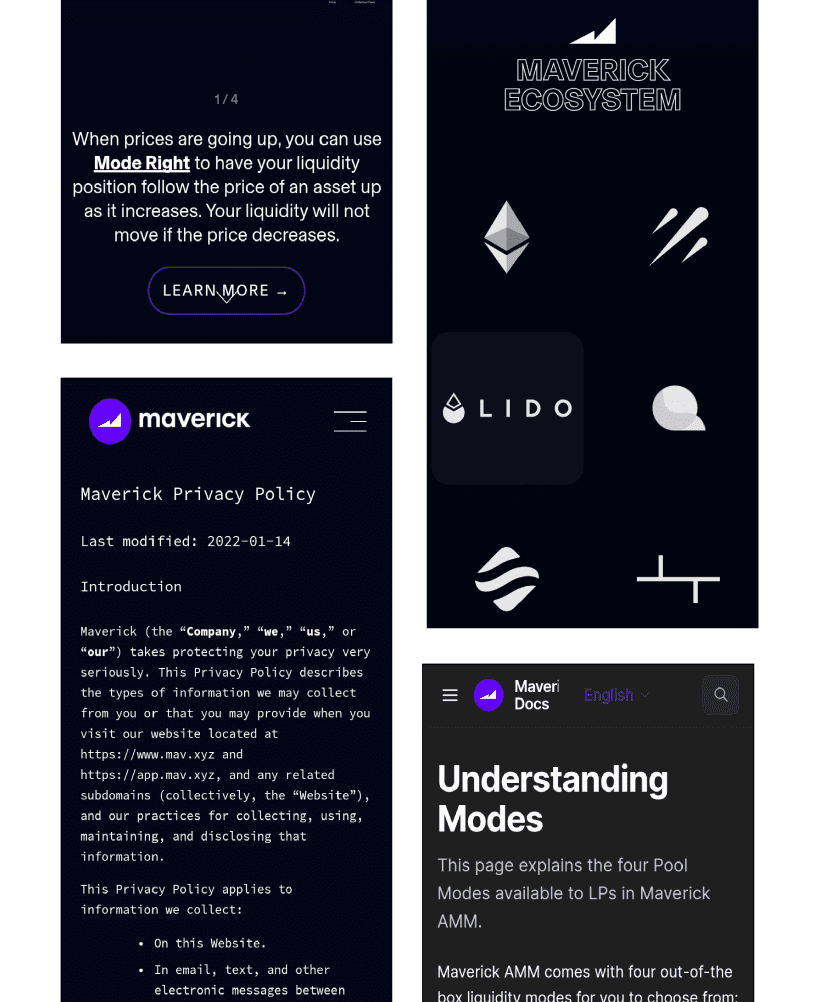

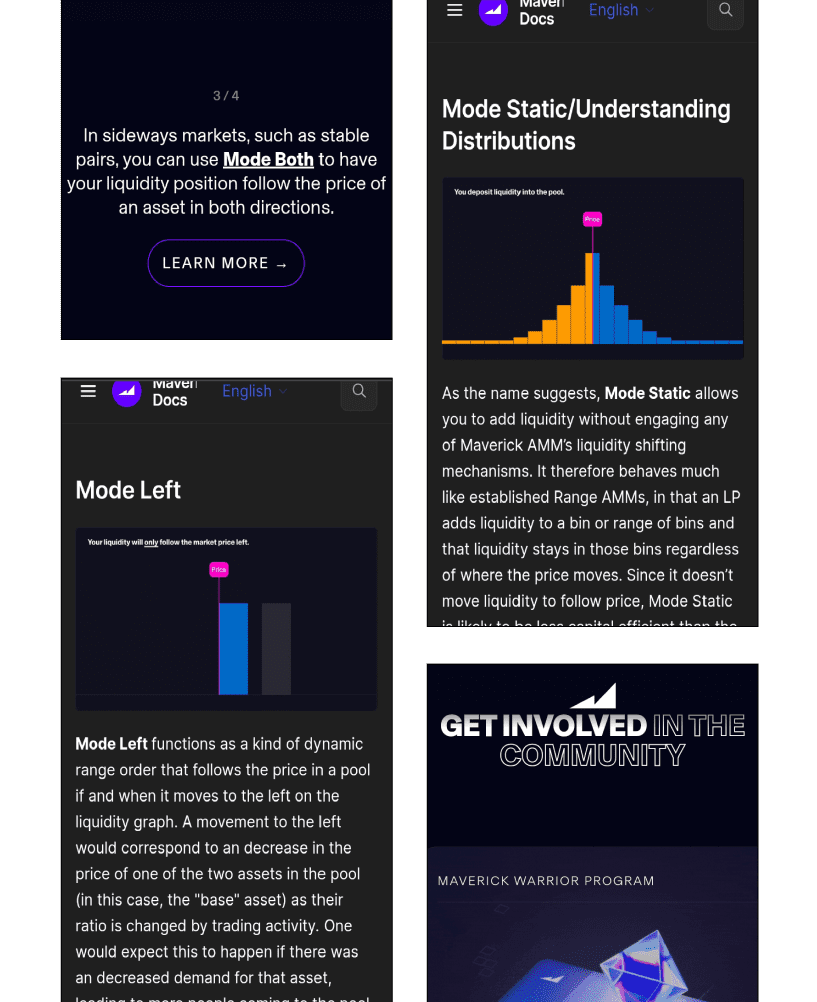

Maverick revolutionizes Decentralized Finance (DeFi) with its pioneering Automated Market Maker (AMM) protocol, focusing on capital efficiency and control. Offering Directional LPing modes—Mode Right, Mode Left, Mode Both, and Mode Static—the platform empowers liquidity providers to optimize asset exposure across varying market conditions.

Get Started with this product

Maverick’s unique liquidity modes—Right, Left, Both, and Static—let LPs adapt to market movements, optimize returns, and reduce impermanent loss. This directional LPing provides unmatched capital control and efficiency in DeFi liquidity provisioning.

By enabling dynamic liquidity alignment with price movements, Maverick’s Directional LPing boosts capital efficiency. LPs can minimize impermanent loss and maximize returns, ensuring profitability in volatile markets through strategic liquidity management.

Maverick’s user-focused resources like the Maverick Guide and FAQs offer step-by-step onboarding and insights. These tools empower users—traders, LPs, and treasuries—to navigate the platform easily and make the most of its innovative DeFi features.

Maverick supports multiple chains like Ethereum and BSC, enabling seamless liquidity deployment. This cross-chain flexibility improves market access and capital efficiency, allowing users to maximize impact across diverse DeFi ecosystems.

Innovative Market Solutions Maverick redefines DeFi with capital-efficient, risk-reducing liquidity management tools. Directional LPing and smart governance offer strategic control, positioning Maverick as a frontrunner in revolutionizing decentralized liquidity infrastructure.

Integrated Analytics Maverick’s analytics dashboard delivers real-time LP data—liquidity use, trade volumes, and trends—helping users refine strategies, boost returns, and make informed decisions based on comprehensive performance metrics.

The Maverick Warrior Program incentivizes user feedback, participation, and collaboration. With rewards and recognition, it nurtures a strong community culture that contributes to platform improvement, growth, and user satisfaction within the Maverick ecosystem.

Maverick evolves continuously through transparent governance and user input. Frequent upgrades enhance scalability, security, and functionality—ensuring it remains a cutting-edge solution for DeFi liquidity management.

Maverick was conceived in response to the escalating demand within decentralized finance (DeFi) for enhanced capital efficiency and control mechanisms. The project’s stakeholders identified a critical gap in existing AMM protocols, which often lacked flexibility in adjusting liquidity positions according to market dynamics. The client envisioned a solution that would empower liquidity providers (LPs) with advanced tools to manage capital effectively across different market conditions, thereby optimizing returns and minimizing risks.

Central to the client’s requirements was the development of Directional LPing, a groundbreaking feature that allows LPs to choose from multiple liquidity modes. Mode Right and Mode Left enable LPs to adjust liquidity positions upward or downward in tandem with asset price movements, ensuring their capital follows market trends without additional exposure to risk during price swings. Mode Both caters to stable pairs, maintaining liquidity stability in sideways markets, while Mode Static supports tailored liquidity distributions for specialized strategies, such as token launchpads. By prioritizing these client requirements, Maverick aims to redefine liquidity management in DeFi, offering a versatile platform that accommodates diverse trading strategies and enhances user participation through intuitive functionalities and community-driven governance.

Maverick empowers its community through decentralized governance. Token holders propose and vote on upgrades, ensuring transparency, inclusivity, and user-driven evolution. This model builds a collaborative ecosystem where stakeholders shape the platform’s development and long-term direction.

Maverick secures its network via PoS, selecting validators based on staked tokens. This energy-efficient mechanism ensures fast, secure transactions while incentivizing honest participation, enhancing scalability, and reducing the environmental footprint compared to Proof of Work.

With DPoS, Maverick improves efficiency by letting token holders elect trusted delegates to validate transactions. This speeds up consensus, enhances decentralization, and encourages community governance through delegated voting and transparent decision-making.

Maverick uses PoA for rapid, reliable consensus via trusted validators. Selected by reputation or authority, these validators ensure efficient processing and strong security, making PoA ideal for private or permissioned blockchain environments.

Maverick leverages PBFT for fast, fault-tolerant consensus among preselected nodes. This ensures rapid finality, resilience against malicious actors, and high throughput, making it ideal for financial systems and DeFi applications demanding consistent performance.

Tendermint powers Maverick with fast, final, and fault-tolerant block validation. Combining PoS with Byzantine Fault Tolerance, it ensures efficient and secure transaction processing—ideal for decentralized apps needing scalability and reliability.

Maverick’s FBA model allows trusted nodes to independently reach consensus via federated voting. It enhances fault tolerance, ensures decentralization, and supports fast transaction processing—perfect for consortiums or applications demanding network integrity and secure decision-making.

Maverick enables PoB by letting users burn tokens, reducing supply, increasing scarcity, and aligning incentives with network value, enhancing security, fostering long-term ecosystem sustainability, and supporting decentralized finance growth.

Visual identity and design elements

Primary font family and usage

Brand colors

#7b23ff

#010101

Maverick approached its development with a meticulous strategy aimed at addressing critical gaps in decentralized finance (DeFi) liquidity management. The project began with thorough market research to understand the needs and pain points of liquidity providers (LPs) in the existing ecosystem. Armed with insights, Maverick prioritized the development of Directional LPing modes—Mode Right, Mode Left, Mode Both, and Mode Static. These modes were designed to offer LPs unprecedented control over their liquidity positions, allowing them to adjust exposure dynamically based on asset price movements. Throughout the development process, Maverick adopted an agile methodology, iterating on features and functionalities based on continuous feedback from the community and rigorous testing. Security audits were conducted at each stage to ensure the platform’s resilience against potential vulnerabilities. The team also focused on user education and support, launching the Maverick Guide and FAQs to facilitate seamless onboarding for traders, liquidity providers, and DAO treasuries.

Since its successful launch, Maverick has made significant strides in transforming DeFi liquidity management. The implementation of Directional LPing has been instrumental in enhancing capital efficiency and reducing impermanent loss for LPs navigating volatile market conditions. This innovation has garnered positive feedback and adoption from a diverse user base, including both experienced DeFi participants and newcomers attracted by the platform’s user-friendly interface and robust feature set. Moreover, Maverick’s decentralized governance model has fostered a strong sense of community ownership and participation. Stakeholders actively engage in governance decisions through voting mechanisms, contributing to the platform’s evolution and ensuring alignment with user interests. As a result, Maverick continues to set industry standards in capital control and user-centric innovation within the evolving landscape of decentralized finance, positioning itself as a leader in the DeFi ecosystem.

One of the primary challenges for Maverick has been achieving widespread market adoption and educating users about the benefits and functionalities of its innovative Directional LPing modes. DeFi users, especially new entrants, may require extensive education to fully understand and leverage these advanced liquidity management tools effectively. Overcoming this challenge involves investing in comprehensive educational resources, community outreach, and targeted marketing campaigns to increase awareness and user engagement.

Ensuring the security and robustness of the Maverick protocol amidst evolving cybersecurity threats remains a critical challenge. As a DeFi platform handling significant volumes of assets, Maverick continuously evaluates and enhances its security measures through rigorous audits, bug bounties, and proactive risk management strategies. Addressing this challenge requires ongoing collaboration with cybersecurity experts and proactive monitoring of emerging threats to maintain user trust and platform integrity.

Scalability is another challenge faced by Maverick, particularly as the platform aims to accommodate growing user demand and transaction volumes without compromising network performance. The team focuses on optimizing smart contracts, enhancing transaction processing speed, and exploring layer 2 scaling solutions to improve scalability while maintaining decentralization and security. Balancing these factors is crucial to meeting user expectations for fast and efficient DeFi services while ensuring the long-term sustainability and resilience of the Maverick ecosystem.

Innovative DeFi platform offering stable yields and flexible asset management for its users.