Securing Crypto & Blockchain Transactions

AML Crypto is a leading technology firm specializing in blockchain analytics and crypto fraud investigations. Their advanced tools are designed to enhance blockchain security by minimizing the risks of fraudulent transactions, asset blocking, and regulatory non-compliance.

Get Started with this product

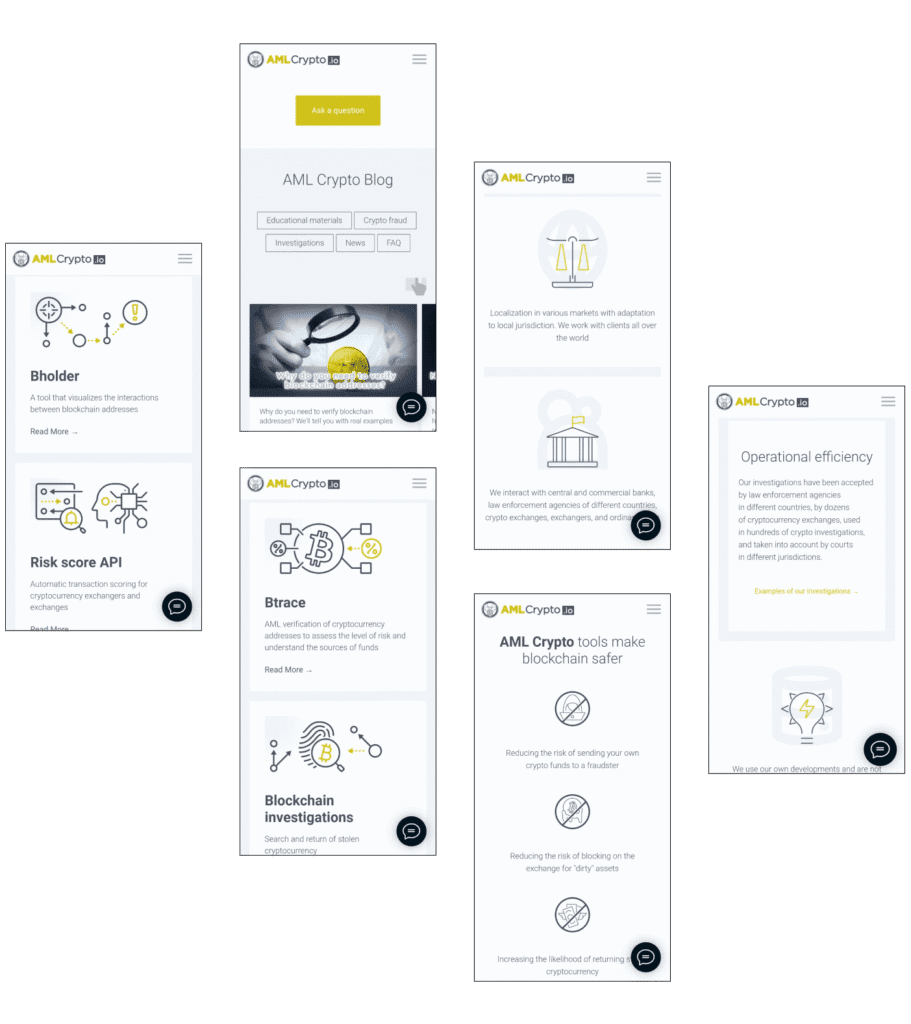

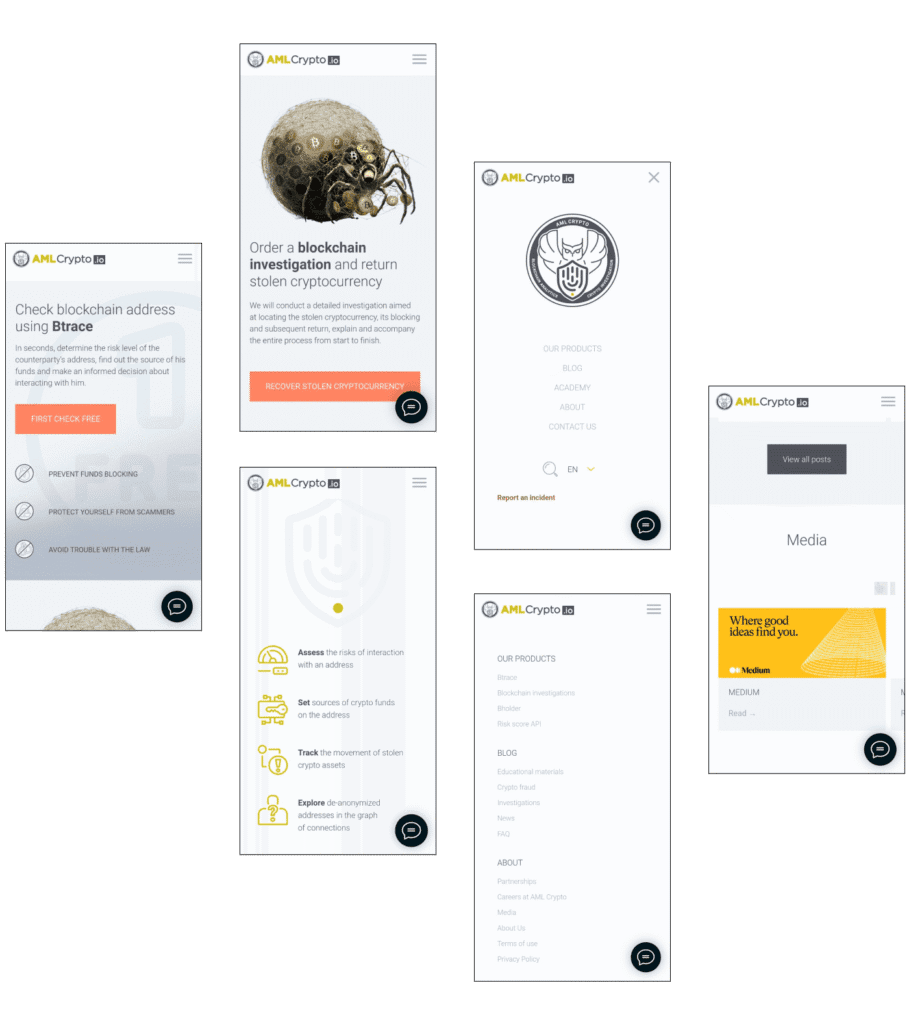

Btrace evaluates cryptocurrency address risks in real-time by tracing fund sources and analyzing transaction history, helping users detect fraudulent addresses and comply with global AML/CFT regulations.

Bholder visualizes blockchain address interactions using graphical maps, simplifying tracking of fund flows and revealing complex transaction patterns to detect suspicious activities during monitoring and investigations.

This tool instantly evaluates transaction risks by analyzing history, address reputation, and AML compliance, enabling quick decisions to prevent fraud and protect cryptocurrency transactions.

Ensures AML Crypto’s tools comply with global AML and CFT regulations like the Travel Rule and 6AMLD, supporting seamless adherence to legal standards and avoiding fines or legal issues.

This service traces and recovers stolen cryptocurrency by analyzing blockchain transactions, tracking funds, and providing detailed reports to support law enforcement and financial institutions in fraud cases.

The Risk Score API automatically assesses cryptocurrency transactions’ risk levels in real-time, helping exchanges and institutions flag high-risk transactions and maintain compliance through seamless platform integration.

Tracks complete cryptocurrency transaction histories across multiple addresses and platforms, aiding investigations, fraud detection, asset recovery, and regulatory compliance with transparent transaction paths.

Tracks complete cryptocurrency transaction histories across multiple addresses and platforms, aiding investigations, fraud detection, asset recovery, and regulatory compliance with transparent transaction paths.

AML Crypto’s clients, including cryptocurrency exchanges, financial institutions, and law enforcement agencies, face significant challenges related to crypto fraud and regulatory compliance. They require sophisticated tools to address these issues effectively. Specifically, clients need robust solutions for assessing the risk associated with cryptocurrency transactions, preventing fraudulent activities, and ensuring compliance with Anti-Money Laundering (AML) and Counter Financing of Terrorism (CFT) regulations. The tools must be capable of real-time risk evaluation, providing detailed insights into transaction histories, and preventing asset blocking due to suspected fraud.

Additionally, clients seek tools that can accurately trace stolen funds and recover them, ensuring minimal disruption to their operations. Integration with existing systems is crucial, as is the ability to provide clear, actionable data that aids in decision-making and regulatory reporting. AML Crypto’s solutions must offer a seamless user experience while meeting high standards of accuracy and reliability, allowing clients to enhance their security measures, mitigate risks, and maintain compliance with evolving financial regulations.

Miners solve complex puzzles using computational power to validate transactions and create blocks, securing the network but consuming significant energy and requiring majority computing control to attack.

Validators create blocks based on the amount of cryptocurrency they stake, reducing energy use and increasing security by making attacks costly due to high required coin ownership.

Stakeholders elect delegates to validate transactions and create blocks, improving scalability and efficiency while maintaining decentralization through community voting and delegate accountability.

Pre-approved, reputable validators produce blocks in permissioned networks, offering high throughput and low energy use by relying on validator identity and reputation instead of computational work.

Participants wait a random time in trusted execution environments, with the shortest wait producing the block, ensuring fairness and energy efficiency without heavy computation.

Nodes vote in phases to reach consensus despite faults or malicious actors, tolerating one-third failures, suited for permissioned blockchains needing high security and fast finality.

Trusted pre-approved nodes validate transactions in private blockchains, balancing fast transaction speeds and security by relying on the reputation of a limited validating network.

Miners allocate unused storage space for block validation, offering an energy-efficient alternative to PoW by using storage capacity instead of computational power to secure the network.

Visual identity and design elements

Primary font family and usage

Brand colors

#1c1c1c

#e9e8c8

Project Approach AML Crypto’s approach to developing its blockchain analytics tools involves a multi-faceted strategy to address the complexities of crypto fraud and regulatory compliance. Initially, the company conducts an extensive analysis of market needs and regulatory requirements to ensure their tools are aligned with the latest standards. This involves collaborating with financial institutions, cryptocurrency exchanges, and law enforcement agencies to gather insights on common challenges and requirements. AML Crypto’s development process includes building robust algorithms for transaction analysis, incorporating advanced machine learning techniques to enhance accuracy, and ensuring that tools like Btrace and Bholder integrate seamlessly with existing systems. The team also focuses on creating user-friendly interfaces and detailed reporting features to aid in decision-making and compliance. Once the tools are developed, AML Crypto undertakes rigorous testing and validation. This includes simulated scenarios and real-world trials to ensure the tools perform effectively under various conditions.

Project Results AML Crypto’s tools have significantly enhanced the security and efficiency of blockchain transactions for their clients. By implementing solutions like Btrace and Bholder, clients have experienced a marked reduction in fraudulent activities and improved compliance with AML and CFT regulations. The Risk Score API has streamlined transaction risk assessment, enabling cryptocurrency exchanges and financial institutions to identify and mitigate risks more effectively. Clients have reported a decrease in asset blocking incidents and a higher success rate in recovering stolen cryptocurrency, thanks to AML Crypto’s advanced tracking and visualization capabilities. The tools have also been instrumental in improving operational workflows for law enforcement agencies and financial institutions. AML Crypto’s solutions have been widely adopted for their accuracy and reliability, leading to positive outcomes in fraud investigations and regulatory compliance.

One of the primary challenges faced by AML Crypto is keeping pace with the rapidly changing regulatory environment surrounding cryptocurrencies and blockchain technology. Governments and financial authorities are continuously updating and introducing new regulations to address issues like money laundering, terrorist financing, and fraud. These changes often come with complex compliance requirements and varying standards across different jurisdictions.

Handling sensitive financial data presents significant privacy and security challenges. AML Crypto’s tools process large volumes of data to detect and prevent fraudulent activities, which involves storing and analyzing potentially sensitive information about transactions and addresses. Ensuring the confidentiality and integrity of this data is crucial, as any breach or misuse could lead to severe legal and reputational consequences.

Developing advanced blockchain analytics tools involves addressing significant technological complexities. AML Crypto’s solutions need to analyze intricate transaction patterns and blockchain interactions, which requires sophisticated algorithms and high-performance computing resources. Integrating these tools with existing systems used by clients, such as cryptocurrency exchanges and financial institutions, poses another challenge. Each client’s infrastructure may vary, necessitating customizations and seamless integration to ensure compatibility and efficiency.

AML Crypto offers tools for secure blockchain transactions, fraud detection, and asset recovery, ensuring compliance and safety.