Key Takeaways

- Slippage in DEX occurs when the actual execution price differs from the expected price due to liquidity constraints and market dynamics during transaction processing.

- DEX slippage explained through AMM mechanics shows that pricing formulas automatically adjust rates based on trade size relative to pool reserves.

- Liquidity impact on slippage is significant because smaller pools amplify price changes from individual trades, making low-liquidity pairs more expensive to trade.

- Trading on DEX with large orders requires strategies like order splitting and using aggregators to minimize price impact on DEX trades.

- Crypto trading slippage increases during volatile periods when prices move rapidly between transaction submission and blockchain confirmation.

- Decentralized exchange slippage can be managed through proper slippage tolerance settings that balance execution certainty against price protection.

- Slippage prevention in DeFi involves using tools like Flashbots for MEV protection, monitoring real-time liquidity, and timing trades strategically.

- Understanding why slippage occurs in decentralized exchanges helps traders make informed decisions and set realistic expectations for trade execution.

Slippage represents one of the most important concepts for anyone trading on decentralized exchanges, yet it remains widely misunderstood. Whether you are swapping tokens for the first time or managing substantial DeFi positions, understanding why slippage happens enables better trading decisions and helps avoid costly surprises. This comprehensive guide explores the mechanics behind slippage in DEX, its causes, impacts, and practical strategies for minimizing its effects on your trades.

Understanding Slippage in DEX

Understanding slippage in DEX requires examining how decentralized exchanges fundamentally differ from traditional order book exchanges. Unlike centralized platforms where limit orders wait at specific prices, DEXs using automated market makers execute trades immediately against liquidity pools. This instant execution comes with trade-offs, primarily the relationship between trade size, available liquidity, and resulting price impact.

The concept of slippage affects every DEX trade, though its magnitude varies enormously based on conditions. A $100 swap of ETH for USDC might experience negligible slippage on a major exchange, while a $100,000 swap of an obscure token could see double-digit percentage slippage. Building crypto exchanges that minimize slippage while maintaining decentralization presents ongoing technical challenges that protocols continuously work to address.

What is Slippage in Cryptocurrency Trading?

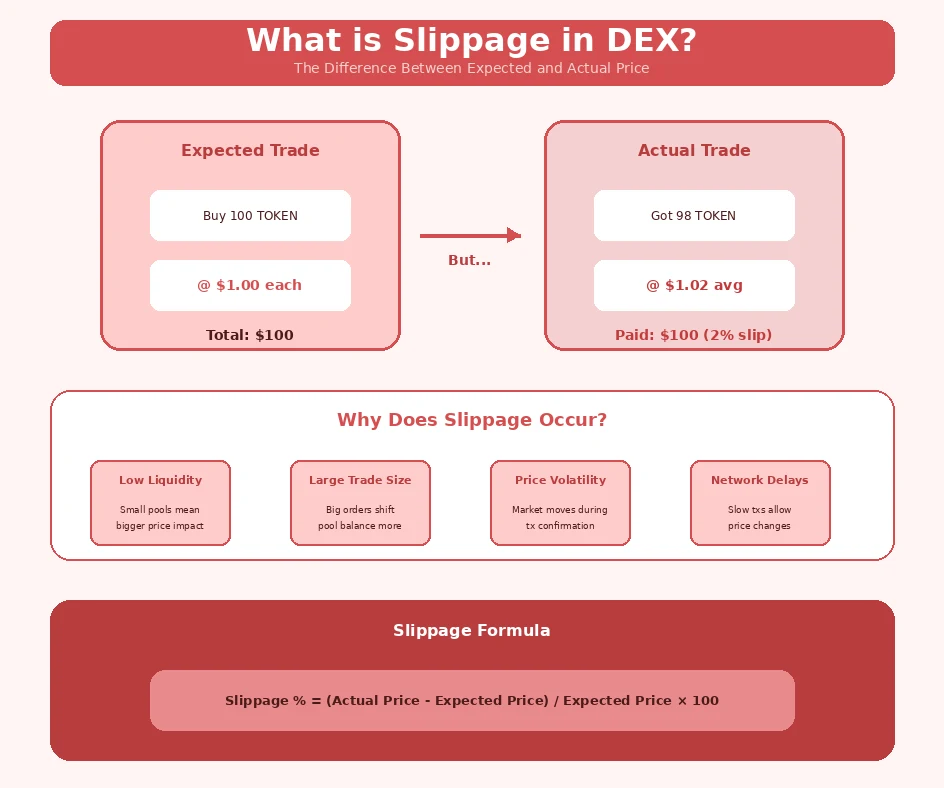

Slippage in cryptocurrency trading is the difference between the price you expect when initiating a trade and the price at which your trade actually executes. This phenomenon occurs in all trading venues but manifests differently in decentralized environments. On a DEX, slippage has two primary components: the predictable price impact from your trade size and unpredictable price changes during transaction confirmation.

The predictable component, often called price impact, results from the mathematical formulas governing AMM pricing. When you trade against a liquidity pool, you are changing the ratio of assets within that pool, which moves the price. Larger trades relative to pool size create larger price impacts. This is fundamentally different from centralized exchanges where your order might fill against multiple limit orders at different price levels.

Difference Between Slippage on CEX and DEX

The difference between slippage on centralized exchanges (CEX) and decentralized exchanges (DEX) stems from their fundamentally different market structures. CEX slippage occurs when market orders consume liquidity across multiple price levels in the order book, while DEX slippage results from the continuous pricing function of AMMs responding to each trade by adjusting pool ratios.

On centralized exchanges, you can often see exact execution prices before trading using limit orders, eliminating slippage entirely for patient traders. DEXs operating through AMMs do not support traditional limit orders, though some protocols now offer similar functionality through additional mechanisms. Understanding how liquidity affects decentralized exchange operations clarifies why these differences matter.

CEX vs DEX Slippage Comparison

| Aspect | Centralized Exchange (CEX) | Decentralized Exchange (DEX) |

|---|---|---|

| Slippage Cause | Order book depth consumption | AMM price curve adjustment |

| Predictability | Visible order book shows depth | Calculable from pool reserves |

| Limit Orders | Native support, zero slippage | Limited or absent in basic AMMs |

| Execution Time | Instant (milliseconds) | Block confirmation (seconds-minutes) |

| MEV Exposure | None (centralized matching) | Front-running risk in mempool |

Causes of Slippage in Decentralized Exchanges

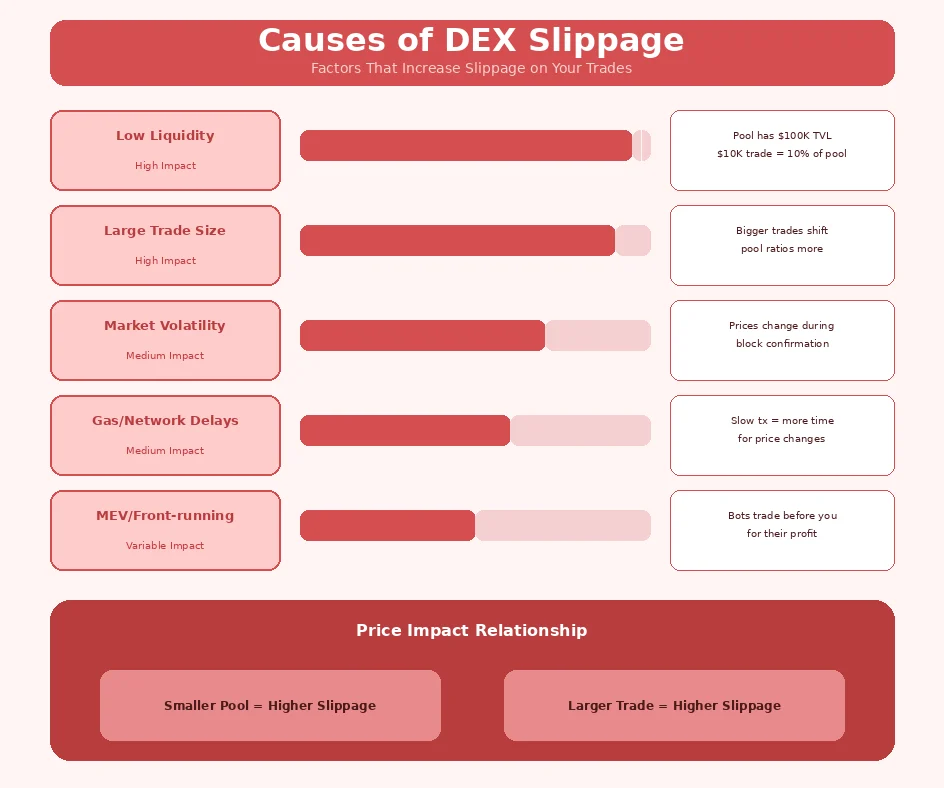

Multiple factors contribute to slippage in decentralized exchanges, often compounding to create worse execution than any single factor would cause alone. Understanding these causes helps traders anticipate slippage and take appropriate measures to minimize its impact. The primary drivers include liquidity levels, trade size, market volatility, and transaction timing.

Low Liquidity and Its Impact on Slippage

Low liquidity represents the most fundamental cause of high slippage on DEXs. The liquidity impact on slippage follows directly from AMM mathematics: when a pool contains less total value, each trade represents a larger percentage of that pool, causing proportionally larger price movements. A $10,000 trade against a $100,000 pool creates much more impact than the same trade against a $10,000,000 pool.

Liquidity concentration further affects slippage dynamics. Uniswap V3 introduced concentrated liquidity where providers can focus capital within specific price ranges, improving capital efficiency but potentially creating gaps with minimal liquidity. Understanding how liquidity pools function on decentralized exchanges provides deeper insight into these dynamics.

Large Trade Size vs Available Pool Liquidity

Large trade size relative to available pool liquidity creates exponentially increasing price impact. The constant product formula used by most AMMs means each incremental unit you purchase costs more than the previous unit. This mathematical property makes large trades disproportionately expensive compared to smaller trades, even when percentage slippage appears moderate.

Consider a pool with $1 million in liquidity: a $1,000 trade might experience 0.1% slippage, while a $100,000 trade could see 5% or more. The relationship is not linear but curves upward as trade size increases. This characteristic makes trading on DEX with large positions particularly challenging without strategies to manage price impact.

Rapid Price Movements and Volatility

Rapid price movements and volatility add unpredictable slippage beyond the calculable price impact. Between when you submit a transaction and when it confirms on-chain, market prices may move significantly. Crypto trading slippage during volatile periods can far exceed the quoted price impact shown at transaction submission, sometimes resulting in dramatically different execution than expected.

Arbitrageurs actively trade to align DEX prices with broader market rates, meaning volatile external prices translate quickly to DEX pool prices. During major market moves, the price when you click swap may differ substantially from the price when your transaction actually executes, potentially triggering your slippage tolerance and causing transaction failure.

Gas Fees and Transaction Delays

Gas fees and transaction delays create indirect slippage by affecting how quickly your trade executes. Lower gas prices mean slower transaction confirmation as miners prioritize higher-paying transactions. During this delay, prices can move, other trades can execute, and your expected execution becomes increasingly uncertain. Paying higher gas for faster execution can actually save money by reducing slippage exposure.

Network congestion amplifies these effects. During high-activity periods when gas prices spike, traders face difficult choices between expensive fast execution and cheaper slow execution with greater slippage risk. Understanding how fee dynamics affect decentralized exchange trading helps navigate these trade-offs.

Trading Principle: Slippage is not a flaw but a fundamental property of AMM-based exchanges. Understanding and planning for slippage is essential for effective DEX trading rather than an inconvenience to avoid entirely.

How Slippage Affects Your Trades on DEX

Understanding how slippage affects your trades on DEX helps set realistic expectations and make informed decisions about when and how to trade. The impact ranges from negligible on small, liquid trades to potentially devastating on large or illiquid transactions. Quantifying slippage exposure before trading enables proper risk assessment.

Price Impact Explained

Price impact on DEX trades represents the predictable price change your trade will cause based on its size and available liquidity. Most DEX interfaces display estimated price impact before trade confirmation, showing what percentage worse your average execution price will be compared to the current market price. This transparency helps traders understand the cost of their trade size.

The price impact calculation derives from the AMM formula. For constant product AMMs, the formula x * y = k means that as you buy token Y with token X, the ratio changes, making each subsequent unit of Y more expensive. The total price impact represents the difference between the starting price and the average price across your entire trade.

Examples of Slippage in Crypto Swaps

Examples of slippage in crypto swaps illustrate how different conditions produce varying outcomes. A $500 ETH to USDC swap on Uniswap might show 0.01% price impact with deep liquidity. The same swap for $50,000 might show 0.3% impact. For an obscure token with only $200,000 in liquidity, even a $5,000 swap could show 5% price impact or more.

Real-world slippage often exceeds quoted price impact when market conditions change during execution. A trader expecting 0.5% slippage based on the quoted price might experience 2% actual slippage if prices move against them during block confirmation. These unpredictable additions make slippage management crucial for significant trades.

Common Trading Scenarios with High Slippage

Common trading scenarios with high slippage include newly launched tokens with minimal liquidity, trading during major market events when volatility spikes, large position entries or exits that exceed comfortable pool capacity, and exotic pairs where liquidity is structurally limited. Recognizing these scenarios helps traders prepare appropriate strategies.

Token launches present extreme slippage environments where early buyers face minimal liquidity and rapidly changing prices. Market crashes create slippage from volatility and increased trading activity competing for block space. Exiting positions in illiquid assets often proves more expensive than anticipated, making entry planning crucial for managing exit costs.

DEX Trade Execution Lifecycle and Slippage Points

| Stage | Action | Slippage Risk | Mitigation |

|---|---|---|---|

| 1 | Price Quote | Shows current pool state | Refresh before confirming |

| 2 | Transaction Signing | Price may have moved | Set appropriate tolerance |

| 3 | Mempool Waiting | Front-running, price changes | Use Flashbots, higher gas |

| 4 | Block Inclusion | Other trades execute first | Priority gas, private txs |

| 5 | Swap Execution | Price impact realized | Split orders, use aggregators |

| 6 | Confirmation | Final execution price known | Review and learn |

Strategies to Reduce Slippage on a DEX

Strategies to reduce slippage on a DEX range from simple setting adjustments to sophisticated trading approaches. Implementing these strategies can significantly improve execution quality, particularly for larger trades where slippage becomes a meaningful cost. The right approach depends on trade size, urgency, and the specific tokens involved.

Using Slippage Tolerance Settings

Using slippage tolerance settings properly protects against excessive slippage while avoiding unnecessary transaction failures. Most DEX interfaces allow setting maximum acceptable slippage as a percentage. If execution price would exceed this tolerance, the transaction fails, returning your tokens minus gas fees. This protection prevents worst-case scenarios but requires thoughtful calibration.

Setting tolerance requires balancing protection against practicality. Too tight (0.1%) and transactions frequently fail during normal volatility, wasting gas. Too loose (10%+) and you accept poor execution. For stable pairs, 0.5-1% often works. For volatile tokens, 2-3% provides reasonable protection while allowing execution. During extremely volatile periods, higher tolerance may be necessary.

Choosing High Liquidity Pools

Choosing high liquidity pools directly reduces slippage by ensuring your trade represents a smaller percentage of total pool assets. Major trading pairs on established DEXs like Uniswap, Curve, or SushiSwap typically offer the deepest liquidity. DEX aggregators automatically route to optimal liquidity, but understanding which pools are deepest helps when trading directly.

For stablecoin swaps, Curve’s specialized pools offer exceptional liquidity with minimal slippage due to pricing curves optimized for similarly-valued assets. For other pairs, checking TVL (Total Value Locked) in specific pools indicates available liquidity. Exploring how farming incentives affect pool liquidity reveals why some pools maintain deeper reserves.

Timing Trades to Avoid Volatile Periods

Timing trades to avoid volatile periods reduces the unpredictable component of slippage. Major news events, economic data releases, and significant market movements create conditions where prices change rapidly between transaction submission and execution. Trading during calmer periods improves execution predictability.

Weekend trading often sees lower volatility and reduced gas prices, though liquidity may also be slightly lower. Avoiding trades immediately following major announcements allows markets to stabilize. For non-urgent trades, patience can significantly improve execution quality by allowing optimal timing rather than reacting to short-term conditions.

Splitting Large Orders into Smaller Trades

Splitting large orders into smaller trades can reduce total slippage by avoiding the exponentially increasing price impact of large single trades. The nonlinear nature of AMM pricing means two $50,000 trades often have less combined slippage than one $100,000 trade. This approach trades execution simplicity for better average prices.

The optimal split strategy depends on trade size, liquidity depth, and gas costs. Splitting increases total gas expense, so the slippage savings must exceed additional gas costs. For very large trades, time-weighted execution across hours or days can minimize market impact while allowing pools to rebalance between trades.

Slippage Management Strategy Selection Criteria

Choose appropriate slippage management strategies based on these factors:

- Trade Size: Larger trades relative to liquidity require more aggressive management

- Token Liquidity: Less liquid pairs need wider tolerance and potentially order splitting

- Market Conditions: Volatile periods require higher tolerance and faster execution

- Urgency: Time-sensitive trades may accept higher slippage for certainty

- Gas Economics: Balance gas costs against slippage savings from split orders

- MEV Exposure: Large visible trades benefit from private transaction methods

Slippage Prevention Tools in DeFi

Slippage prevention in DeFi has evolved with sophisticated tools addressing various slippage sources. From AMM optimizations that improve capital efficiency to MEV protection services that prevent front-running, the ecosystem offers multiple approaches to better execution. Understanding these tools helps traders select appropriate protection for their needs.

Automated Market Makers (AMM) Optimizations

Automated Market Makers have evolved significantly with optimizations reducing slippage for traders. Uniswap V3’s concentrated liquidity allows providers to focus capital in active price ranges, increasing effective liquidity where most trading occurs. Curve’s stableswap algorithm provides superior execution for similarly-priced assets with minimal slippage on large stable swaps.

DEX aggregators like 1inch and Paraswap optimize routes across multiple AMMs, splitting trades to achieve better execution than any single pool could offer. These tools automatically find optimal paths, considering liquidity depth, gas costs, and routing efficiency. Using aggregators has become standard practice for slippage-conscious traders.

Flashbots and Transaction Prioritization

Flashbots and similar services address MEV-related slippage by allowing private transaction submission. Traditional mempool transactions are visible to everyone, enabling front-running where others trade before you to profit from your price impact. Flashbots routes transactions directly to miners privately, eliminating this visibility and preventing sandwich attacks that exploit your trades.

Transaction prioritization through higher gas fees ensures faster inclusion, reducing the window for price changes. During volatile periods, the cost of priority gas often pays for itself through better execution. Many wallets and DEX interfaces now integrate MEV protection, making these tools accessible without technical complexity.

Build Your Low-Slippage DEX with Expert Development

Partner with our DEX development company to create decentralized exchanges optimized for minimal slippage, deep liquidity, and seamless trading experiences.

Monitoring Real-Time DEX Liquidity

Monitoring real-time DEX liquidity helps traders identify optimal execution conditions and avoid surprisingly high slippage. Tools like DEX Screener, DeFi Llama, and individual protocol dashboards display current pool reserves, recent trading activity, and liquidity trends. This information enables informed decisions about when and where to trade.

Understanding liquidity patterns reveals opportunities. Some pools maintain consistent depth while others fluctuate with market conditions or farming incentives. Monitoring helps identify when liquidity is temporarily deeper, creating opportunities for larger trades with lower slippage. Learning about how modern DEX platforms optimize liquidity management provides context for these dynamics.

Slippage Prevention Tools Comparison

| Tool | Slippage Type Addressed | Best For |

|---|---|---|

| DEX Aggregators | Price impact from liquidity | All trades seeking best rates |

| Flashbots | MEV/front-running | Large trades visible in mempool |

| Concentrated Liquidity DEXs | Capital inefficiency | Popular trading pairs |

| Limit Order Protocols | All slippage types | Patient traders |

| TWAP Execution | Large order price impact | Institutional-sized trades |

Risk Warning: Slippage can significantly impact trade outcomes, especially for large orders or illiquid pairs. Always review expected price impact before confirming trades and set appropriate slippage tolerance to protect against unfavorable execution.

Conclusion

Understanding why slippage occurs in decentralized exchanges empowers traders to make informed decisions and implement effective mitigation strategies. Slippage in DEX represents an inherent characteristic of automated market maker design rather than a flaw to be eliminated. The trade-offs between instant execution, decentralization, and price efficiency create conditions where slippage naturally occurs.

Successful DEX trading requires accepting slippage as a cost of decentralized execution while actively managing its magnitude through appropriate strategies. From simple slippage tolerance settings to sophisticated MEV protection and aggregator routing, numerous tools exist to improve execution quality. The key is matching strategies to specific trade characteristics, liquidity conditions, and personal risk tolerance.

As the DeFi ecosystem matures, innovations continue reducing slippage through improved AMM designs, better liquidity incentives, and enhanced execution tools. Traders who understand slippage mechanics and stay current with available tools position themselves for optimal outcomes in an evolving landscape. Whether executing small swaps or managing substantial positions, slippage awareness translates directly to better trading results.

Frequently Asked Questions

Slippage in cryptocurrency trading is the difference between the expected price of a trade and the actual price at which the trade executes. This occurs because market conditions change between when you submit a trade and when it completes on the blockchain. In decentralized exchanges, slippage commonly results from limited liquidity in trading pools and the mathematical pricing formulas used by automated market makers.

Why slippage occurs in decentralized exchanges relates to how AMM pricing works. DEXs use constant product formulas where each trade changes the ratio of tokens in the pool, affecting prices. Larger trades have greater price impact because they shift pool balances more significantly. Low liquidity pools amplify this effect because smaller reserves mean each trade represents a larger percentage of total pool assets.

Normal slippage on DEX trades typically ranges from 0.1% to 1% for popular trading pairs with deep liquidity. Less liquid pairs may experience 2-5% slippage even for moderate trades. During volatile market conditions or for very large orders, slippage can exceed 10%. Most DEX interfaces show expected slippage before trade confirmation, allowing traders to evaluate whether the price impact is acceptable.

Reducing slippage when trading on DEX involves choosing high-liquidity pools, splitting large trades into smaller portions, trading during periods of lower volatility, and using DEX aggregators that route orders optimally across multiple liquidity sources. Setting appropriate slippage tolerance prevents transactions from executing at unacceptable prices while avoiding failed transactions from tolerance settings that are too tight.

Slippage tolerance is the maximum price difference you will accept between the quoted and executed trade price. Setting it too low causes transactions to fail if prices move slightly, while setting it too high exposes you to unfavorable execution. For stable pairs, 0.5-1% tolerance often works. For volatile pairs or low-liquidity tokens, 2-5% may be necessary. Always review the expected output before confirming trades.

Slippage and price impact are related but distinct concepts. Price impact is the predictable price change your trade causes based on its size relative to pool liquidity, visible before execution. Slippage is the difference between expected and actual execution price, which includes price impact plus any price changes occurring while your transaction awaits confirmation. Both factors affect final trade outcomes on DEXs.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.