Key Takeaways

- DEX pool fees typically range from 0.01% to 1% per trade and directly impact your crypto trading profits, making fee awareness essential for cost-effective trading strategies.

- Liquidity provider rewards from pool fees create the economic incentive that makes decentralized exchange fees function, rewarding those who supply assets to enable trading.

- The automated market maker (AMM) model determines how fees are calculated, collected, and distributed, with different protocols implementing varying approaches to fee mechanics.

- Understanding the pool fee structure before trading helps minimize costs through strategic platform selection, timing, and trade sizing that accounts for fee impact.

- Yield farming strategies must factor in fee income as a core component of returns, as sustainable yields often depend more on trading fees than token incentives.

- DeFi trading efficiency improves when traders and providers alike understand how fees flow through the system, enabling better decision-making for both roles.

- Crypto liquidity strategies for providers should consider fee tier selection, pool choice, and volume patterns to optimize earnings from liquidity incentives.

- Common mistakes including ignoring fees when calculating profits and underestimating impermanent loss can significantly reduce realized returns for unprepared participants.

Every swap you execute on a decentralized exchange involves fees that flow through an intricate system connecting traders who need liquidity with providers who supply it. These DEX pool fees may seem like small percentages, but they fundamentally shape the economics of decentralized trading, determining profitability for traders and providers alike. Understanding how these fees work, where they go, and how they impact your specific situation empowers you to make smarter decisions whether you are actively trading or providing liquidity to earn passive income.

Introduction to DEX Liquidity Pools

Decentralized exchanges have revolutionized cryptocurrency trading by replacing traditional order books with liquidity pools that enable instant swaps between token pairs. These DEX liquidity pools contain reserves of two or more tokens deposited by liquidity providers, creating the foundation that makes decentralized trading possible. When you execute a trade on a DEX, you are not matching with another trader but rather exchanging with the pool itself, which uses algorithmic pricing to determine exchange rates.

The innovation of liquidity pools solved a fundamental problem that early decentralized exchanges faced: without centralized market makers, how could consistent liquidity exist for token swaps? The answer came through incentivizing regular users to become liquidity providers by sharing trading fees with them. This elegant solution aligned incentives across the ecosystem, creating self-sustaining markets that operate without intermediaries.

Brief Explanation of DEX Liquidity Pools

A DEX liquidity pool functions as a smart contract holding reserves of two tokens in a specific ratio, most commonly 50/50 by value. When traders want to swap one token for another, they interact with this pool, depositing one token and receiving the other based on the automated market maker formula. The pool automatically adjusts prices based on the ratio of reserves, with prices moving up when buying pressure depletes one side and down when selling pressure increases it.

Liquidity providers contribute both tokens in the pool’s required ratio and receive LP tokens representing their share of the total pool. These LP tokens serve as receipts that track ownership and can be redeemed later to withdraw the underlying assets plus any accumulated fees. The system operates continuously and permissionlessly, allowing anyone to trade or provide liquidity at any time without approval from centralized entities.

Importance of Liquidity in Decentralized Exchanges

Liquidity determines the practical usability of any decentralized exchange, directly affecting trade execution quality through slippage and price impact. Deep liquidity means traders can execute larger orders without significantly moving prices, while shallow pools result in worse execution and higher effective costs. The depth of DEX liquidity pools essentially defines the upper limit of efficient trade sizes on any given platform.

From a market quality perspective, liquidity enables accurate price discovery and reduces the profitability of manipulation attempts. Pools with insufficient liquidity become vulnerable to price manipulation through relatively small trades, undermining trust in the platform. This is why platforms invest heavily in liquidity incentives and why fee structures play such a critical role in attracting and retaining the liquidity that makes decentralized exchanges viable. Understanding how automated trading platforms enable seamless token swaps requires appreciating this liquidity foundation.

How Crypto Trading Fees Are Involved in Liquidity Provision

Crypto trading fees serve as the primary mechanism connecting traders who need liquidity with providers who supply it. Every swap generates a fee that flows to liquidity providers as compensation for the capital and risk they contribute to the pool. Without these fees, there would be no economic incentive to provide liquidity, and the entire DEX model would collapse. The fee structure thus sits at the heart of decentralized exchange economics.

The fee percentage and distribution mechanism vary across platforms, but the fundamental principle remains consistent: traders pay for the service of instant liquidity, and providers earn for supplying it. This creates a market-based equilibrium where fee levels that are too high drive traders elsewhere, while fees that are too low fail to attract sufficient liquidity. Finding the right balance represents a key challenge in DEX design.

| Fee Tier | Typical Use Case | Expected Volume | Provider Risk |

|---|---|---|---|

| 0.01% | Stablecoin pairs (USDC-USDT) | Very High | Very Low |

| 0.05% | Correlated pairs (ETH-stETH) | High | Low |

| 0.30% | Standard pairs (ETH-USDC) | Medium | Medium |

| 1.00% | Volatile/exotic pairs | Lower | High |

Trading Principle: The fee you pay as a trader is the reward earned by liquidity providers. Understanding this relationship helps evaluate whether fees are reasonable given current market conditions and available alternatives.

Understanding DEX Pool Fees

A complete understanding of decentralized exchange fees requires examining both how they are structured and how they are calculated within the automated market maker framework. These mechanics determine the actual costs you face as a trader and the returns you can expect as a liquidity provider. The technical details matter because small differences in fee implementation can significantly impact outcomes across many transactions.

Different DEX platforms have developed various approaches to fee structures, from simple fixed percentages to complex dynamic systems that adjust based on market conditions. Knowing these variations helps you select platforms and pools that align with your trading patterns and risk preferences, ultimately improving your results whether trading or providing liquidity.

What Are DEX Pool Fees?

DEX pool fees are charges applied to every trade executed through a decentralized exchange’s liquidity pool system. When you swap tokens on a DEX, a small percentage of your trade value is collected as a fee before the exchange executes. This fee gets added to the pool reserves, increasing the value of LP tokens held by liquidity providers. The mechanism ensures that every trade contributes to compensating those who make trading possible.

Unlike centralized exchange fees that go to the company operating the platform, DEX pool fees flow directly to liquidity providers through transparent smart contract mechanics. Some protocols also allocate a portion of fees to treasury or token buybacks, but the primary recipient remains the providers whose capital enables the trading activity. This direct fee flow creates clear alignment between platform success and provider returns.

Definition of DEX Pool Fees

DEX pool fees can be formally defined as the percentage charge applied to the input token amount during each swap transaction on a decentralized exchange utilizing liquidity pools. This fee is deducted before the automated market maker algorithm calculates the output token amount, meaning traders receive slightly less than they would in a zero-fee scenario. The fee accrues to the liquidity pool, incrementally increasing its total value with each trade.

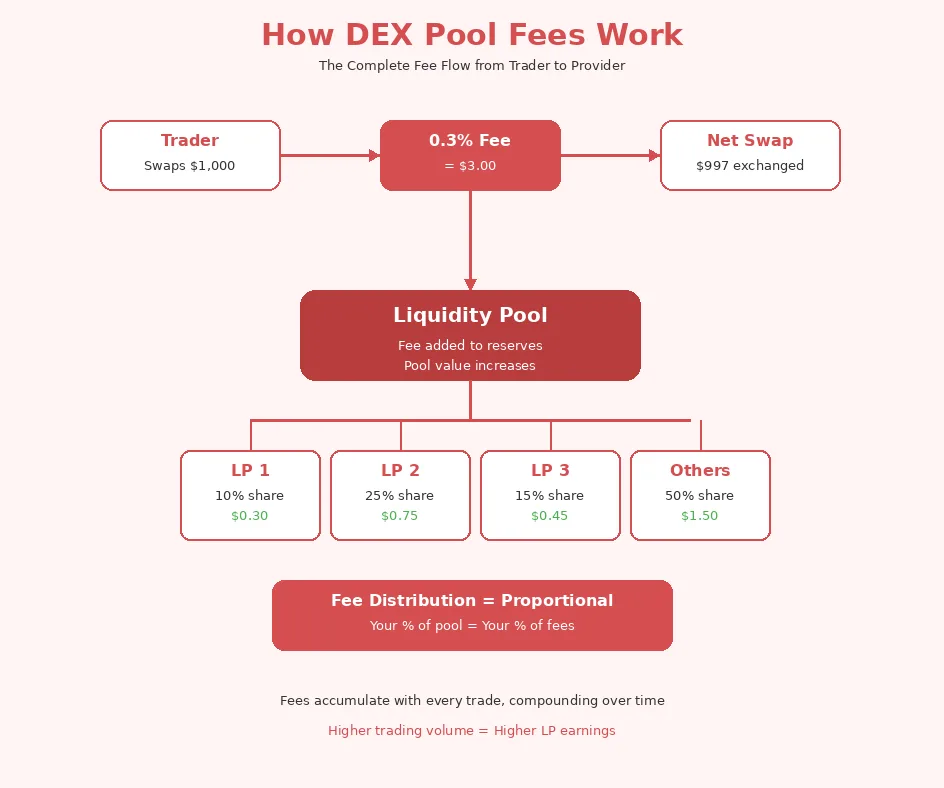

The fee percentage is typically expressed as a decimal or percentage, such as 0.3% or 30 basis points. For a $1,000 trade at 0.3% fee, $3 would be collected as the fee, with the remaining $997 determining the actual swap amount. While individual fees seem small, they accumulate across millions of transactions to create substantial income streams for liquidity providers and protocol treasuries.

Difference Between Fixed Fees and Dynamic Fees

Fixed fees remain constant regardless of market conditions, offering traders predictability but potentially misaligning incentives during extreme volatility or unusual market circumstances. Most early DEX implementations used fixed fee models, with Uniswap v2’s 0.3% fee becoming an industry standard. The simplicity of fixed fees makes them easy to understand and factor into trading calculations.

Dynamic fees automatically adjust based on factors like volatility, liquidity depth, and trading volume, aiming to optimize the fee level for current market conditions. During volatile periods, dynamic fees increase to compensate providers for elevated impermanent loss risk and to discourage potentially destabilizing trades. During calm periods, fees decrease to attract more trading volume. Exploring how adaptive fee mechanisms respond to market conditions reveals the sophistication of modern DEX design.

How Pool Fees Are Calculated

Pool fee calculation follows straightforward arithmetic: the fee percentage multiplied by the input trade amount equals the fee collected. However, the interaction between fees and the automated market maker algorithm creates subtle effects that impact final outcomes. Understanding this complete calculation helps traders accurately predict swap results and liquidity providers estimate their earnings potential.

The fee applies before the AMM formula executes, effectively reducing the amount available for the swap. This sequencing means the fee does not directly reduce your output tokens but rather reduces the input available for exchange calculation. The distinction matters for precise modeling of trade outcomes, especially for larger trades where compounding effects become significant.

Formula for Calculating Fees in Liquidity Pools

The basic fee calculation formula is: Fee Amount = Trade Amount × Fee Percentage. For example, a 1000 USDC swap in a 0.3% fee pool would generate a 3 USDC fee. The net amount entering the swap calculation becomes 997 USDC, which then interacts with the AMM formula to determine output token quantity.

For constant product AMMs, the complete calculation incorporating fees uses the formula: Output Amount = (Reserve_Output × Input_After_Fee) / (Reserve_Input + Input_After_Fee). This formula shows how fees reduce effective input, which in turn reduces output received. The fee accumulates in the pool as additional reserves, slightly improving the position of all LP token holders proportionally.

Role of Automated Market Makers (AMM)

The automated market maker serves as the algorithmic engine that prices trades and executes swaps within liquidity pools. Different AMM designs implement fee mechanics in varying ways, but all share the core function of determining exchange rates based on pool composition. The AMM ensures that fees are collected consistently and that pool reserves update correctly after each transaction.

Popular AMM models include constant product (x*y=k), constant sum, and hybrid approaches that combine elements for specific use cases. Each model has different fee efficiency characteristics, with some designs enabling lower fees for certain trade types while others prioritize capital efficiency or reduced impermanent loss. The choice of AMM model influences both trader costs and provider returns.

Examples of DEX Pool Fee Structures

Uniswap v3 pioneered the multi-tier fee model with 0.01%, 0.05%, 0.3%, and 1% options, allowing liquidity providers to select the tier matching their risk tolerance and expected trading patterns for specific pairs. Curve Finance uses lower fees around 0.04% optimized for stablecoin and similar-asset swaps where impermanent loss is minimal. Balancer allows pool creators to set custom fees within a range, enabling experimentation with different fee levels.

PancakeSwap uses 0.25% fees split between liquidity providers and treasury, demonstrating how protocols can allocate portions of fees to different purposes. SushiSwap implemented 0.3% fees with 0.05% going to protocol revenue and 0.25% to providers. These varying structures reflect different philosophies about balancing trader costs, provider incentives, and protocol sustainability.

Fee Flow Lifecycle: From Trade to Provider Reward

| Stage | Action | Description | Result |

|---|---|---|---|

| 1 | Trade Initiated | Trader submits swap transaction | Trade enters smart contract |

| 2 | Fee Calculated | Contract applies fee percentage | Fee amount determined |

| 3 | AMM Executes | Swap calculated on net amount | Output tokens determined |

| 4 | Fee Retained | Fee added to pool reserves | Pool value increases |

| 5 | LP Value Grows | LP tokens represent higher value | Provider wealth increases |

| 6 | Withdrawal | Provider redeems LP tokens | Original deposit plus fees received |

Impact of Pool Fees on Crypto Trades

Pool fees impact every participant in the DEX ecosystem differently depending on their role and objectives. Traders experience fees as direct costs that reduce profits, while liquidity providers receive fees as income compensating their capital contribution. Understanding both perspectives enables better decision-making regardless of which side of the transaction you occupy, and many DeFi participants engage in both activities.

The magnitude of fee impact varies significantly based on trading frequency, position sizes, and the specific fee structures of chosen platforms. Frequent traders accumulate fees rapidly, making fee optimization crucial to profitability. Occasional traders may find fees relatively insignificant compared to other factors like slippage and market timing. Liquidity providers must balance fee income against impermanent loss and opportunity costs to evaluate true profitability.

Effect on Traders

For traders, DEX pool fees represent a direct reduction in trading profits that compounds across multiple transactions. A trader making 100 trades per month at 0.3% fee loses 30% of their portfolio to fees alone, not counting any trading losses. This mathematical reality makes fee consciousness essential for active traders, particularly those pursuing high-frequency strategies or arbitrage opportunities where margins are thin.

The psychological impact of fees often leads traders to underestimate their true trading costs. Because fees are automatically deducted rather than charged separately, many traders focus on their apparent profits without accounting for the cumulative fee drain. Maintaining detailed records that track fees alongside profits reveals the true cost of trading activity.

How Trading Fees Affect Crypto Trading Profits

Crypto trading fees affect profits through both direct cost reduction and opportunity cost mechanisms. Direct costs are straightforward: every fee dollar paid is a dollar not available for reinvestment or withdrawal. Opportunity costs arise when fees make otherwise profitable trades unprofitable, narrowing the range of viable trading opportunities and forcing traders to wait for larger price movements before executing.

For traders targeting specific profit percentages, fees define minimum required price movements to achieve targets. A trader seeking 2% profit per trade in a 0.3% fee pool must actually achieve 2.6% price movement to cover round-trip fees and hit the target. This fee buffer requirement becomes more significant for shorter-term strategies targeting smaller individual gains.

Strategies to Minimize Fees While Trading on DEX

Minimizing DEX trading fees involves strategic platform selection, timing optimization, and trade structuring. Comparing fee structures across different DEXs for your specific trading pairs reveals potential savings, as different platforms offer varying rates. Using DEX aggregators that automatically route trades through lowest-cost pathways can reduce fees without requiring manual comparison.

Consolidating smaller trades into larger batched transactions reduces the number of fee events while achieving the same net position change. Timing trades during lower network congestion periods reduces gas costs that compound the effective fee burden. For frequent traders, the effort invested in fee optimization often generates better returns than equivalent effort spent on trade selection.

Effect on Liquidity Providers

Liquidity providers experience pool fees as their primary income source, making fee levels and trading volumes the key determinants of their returns. Higher fees per trade generate more income per dollar of liquidity provided, but may reduce trading volume as traders seek cheaper alternatives. Finding pools that balance attractive fees with sufficient volume represents the core challenge of liquidity provision strategy.

The fee income must be weighed against the risks of providing liquidity, particularly impermanent loss that can erode or exceed fee earnings during significant price movements. When dealing with liquidity pool tokens, successful liquidity providers choose pools where expected fee income adequately compensates for the specific risks involved, considering factors like asset volatility, correlation, and historical trading patterns.

How Pool Fees Generate Liquidity Provider Rewards

Liquidity provider rewards accumulate as trading fees are added to pool reserves, incrementally increasing the value backing each LP token. This automatic compounding means providers do not need to actively claim or reinvest their fee earnings; the value simply accrues to their position over time. When providers eventually withdraw, they receive their proportional share of the expanded pool, including all accumulated fees.

The reward generation rate depends on trading volume and fee percentage relative to total pool liquidity. A $10 million pool with $1 million daily volume at 0.3% fees generates $3,000 daily in fee income, translating to approximately 10.95% annualized return before considering impermanent loss. Understanding these calculations helps providers evaluate opportunities realistically. Exploring how yield strategies combine fees with token incentives reveals the complete earning picture.

Influence on Yield Farming and DeFi Trading Strategies

Yield farming strategies heavily depend on fee income as the sustainable component of total returns. While token incentives often grab headlines with high APY figures, these incentives may be temporary or subject to token price depreciation. Fee income derived from actual trading activity provides more predictable, sustainable yields that persist regardless of incentive program changes.

DeFi trading strategies increasingly incorporate fee optimization as a core component. Arbitrageurs factor in fees when calculating profitable opportunities, often finding that apparent price discrepancies become unprofitable after accounting for trading costs. Market makers optimizing yield across multiple venues must understand fee structures to accurately compare expected returns and allocate capital efficiently.

| Platform | Fee Range | Fee Model | Best For |

|---|---|---|---|

| Uniswap v3 | 0.01% – 1% | Multiple tiers | Flexible pair trading |

| Curve Finance | 0.04% | Fixed low | Stablecoin swaps |

| PancakeSwap | 0.25% | Fixed standard | BNB Chain trading |

| Balancer | Custom (0.01% – 10%) | Pool creator defined | Custom pool strategies |

Maximizing Returns in Liquidity Pools

Maximizing returns from liquidity pool participation requires strategic thinking about platform selection, pool choice, and timing. The difference between mediocre and excellent results often comes from attention to these optimization details rather than simply chasing the highest displayed APY. Building effective crypto exchanges demands understanding these same economics from the platform perspective.

Successful liquidity providers treat their positions as investments requiring ongoing evaluation and adjustment. Market conditions change, fee income fluctuates with trading volume, and impermanent loss impacts vary with price movements. Active management typically outperforms set-and-forget approaches, though the required effort must be weighed against potential gains.

Choosing the Right DEX

Choosing the right DEX involves evaluating multiple factors including fee structure, liquidity depth, trading volume, security track record, and available incentive programs. The best choice varies depending on your specific goals, whether you prioritize minimizing trading costs, maximizing provider returns, or accessing specific tokens or features unavailable elsewhere.

Platform reputation and security history deserve particular attention given the irreversible nature of smart contract exploits. Established platforms with long track records and multiple security audits provide greater confidence, even if newer alternatives offer more attractive short-term yields. Balancing return optimization against security considerations defines prudent DEX selection.

Factors Like Fee Structure, Liquidity Depth, and Incentives

Fee structure directly determines your costs as a trader and your income as a provider, making it a primary selection criterion. Lower fees benefit traders but may reduce provider returns unless compensated by higher volume. Multi-tier fee systems allow matching fee levels to specific pair characteristics, enabling optimization for different trading scenarios.

Liquidity depth affects trade execution quality and pool return stability. Deep liquidity means less slippage for traders and more stable APY for providers, as large trades are less likely to dramatically shift pool composition. Liquidity incentives including token rewards and fee boosts can significantly enhance provider returns, though their sustainability and token value trajectories require careful evaluation.

Comparison of Popular DEX Platforms

Uniswap dominates Ethereum DEX volume with its pioneering AMM design, multi-tier fee structure, and concentrated liquidity features that enable capital-efficient provision. Curve Finance specializes in stable asset swaps with extremely low fees optimized for minimal-slippage exchanges between similar tokens. SushiSwap offers cross-chain presence and additional DeFi features beyond basic swaps.

PancakeSwap leads on BNB Smart Chain with lower gas costs attracting price-sensitive traders and yield farmers. Balancer enables custom pool configurations with multiple assets and flexible weights, appealing to sophisticated providers seeking unique strategies. Each platform serves different needs, and many active participants use multiple platforms depending on specific trading requirements.

DEX Platform Selection Criteria

When choosing a DEX platform for trading or liquidity provision, evaluate these essential factors:

- Fee Structure: Compare fee tiers available and select platforms with appropriate rates for your trading pairs

- Liquidity Depth: Ensure sufficient liquidity for your expected trade sizes to minimize slippage costs

- Trading Volume: Higher volume pools generate more fee income for providers and tighter spreads for traders

- Security History: Prioritize platforms with clean security track records and multiple professional audits

- Chain Compatibility: Match platform blockchain to your existing holdings to avoid bridge fees and complexity

- Additional Incentives: Evaluate token rewards and boosted programs while considering sustainability

Strategies to Optimize Fees and Rewards

Optimizing fees and rewards requires active attention to changing market conditions and willingness to adjust positions accordingly. Static strategies that worked yesterday may underperform tomorrow as volumes shift, new incentive programs launch, or market conditions change. Successful participants continuously evaluate their positions against available alternatives.

The optimization approach differs between traders seeking to minimize costs and providers seeking to maximize income, though both benefit from understanding the complete fee ecosystem. Traders focus on finding lowest-cost execution paths, while providers focus on identifying pools with attractive risk-adjusted returns. Both perspectives inform better overall decision-making.

Timing Trades to Reduce Trading Fees

Timing trades strategically can reduce effective costs even when pool fees remain constant, primarily through gas cost optimization. Network congestion varies predictably, with lower fees typically during off-peak hours for major markets. Scheduling non-urgent trades during low-congestion periods reduces the gas component of total trading costs.

For providers, timing entry and exit around volume patterns can impact returns. Entering pools before anticipated high-volume periods captures more fee income, while exiting before expected quiet periods avoids dilution without corresponding earning opportunities. Market events, token launches, and seasonal patterns all create predictable volume fluctuations that informed participants can leverage.

Participating in Pools with High Liquidity Incentives

High liquidity incentive programs offer enhanced returns through additional token distributions beyond base fee income. These programs typically target strategic pools where protocols want to build liquidity depth, offering governance tokens or other rewards to attract and retain providers. Early participation in new incentive programs often captures the highest rates before liquidity dilutes returns.

Evaluating incentive programs requires assessing both the nominal APY and the sustainability of rewards. Programs funded by token inflation may offer high short-term rates that decline as emissions decrease or token values depreciate. Sustainable incentives backed by protocol revenue or with clear long-term funding provide more reliable return expectations.

Understanding Pool Fee Distribution

Pool fee distribution mechanisms vary across protocols, affecting how and when providers realize their earnings. Most AMM designs add fees directly to pool reserves, increasing LP token value automatically without requiring claims. Some protocols separate fee accumulation, requiring providers to actively claim earned fees or stake LP tokens in additional contracts to receive rewards.

The distribution timing and mechanism impact tax treatment and compounding efficiency. Automatic reinvestment through reserve addition compounds continuously but may trigger tax events as income accrues. Separate claiming allows timing control but requires active management and incurs gas costs. Understanding your platform’s specific distribution mechanism enables appropriate strategy alignment.

Provider Insight: The highest advertised APY is not always the best opportunity. Sustainable fee income from consistent trading volume often outperforms temporary high-incentive programs that attract liquidity but generate little actual trading activity.

Common Mistakes to Avoid

Both traders and liquidity providers frequently make avoidable mistakes that significantly impact their results. These errors typically stem from incomplete understanding of fee mechanics, overoptimistic assumptions, or failure to account for all costs and risks. Learning from common mistakes enables better outcomes without requiring the expensive lessons of personal experience. Building automated trading infrastructure requires accounting for all these factors systematically.

Many mistakes involve comparing apples to oranges, whether by ignoring certain cost components or using inappropriate benchmarks. Rigorous accounting that tracks all costs against actual returns reveals true performance and identifies areas for improvement.

Ignoring Pool Fees When Calculating Profits

Many traders calculate profits based on entry and exit prices without accounting for fees paid on both transactions. This oversight creates inflated profit perception that does not match actual results. A trade showing 3% price appreciation with 0.3% round-trip fees actually delivers only 2.4% profit, an 20% reduction from the perceived gain.

Maintaining accurate records that track fees alongside price movements reveals true trading performance. Most portfolio tracking tools can incorporate fee data when properly configured. This discipline enables realistic assessment of strategy profitability and identification of cases where fee optimization could improve results more than trade selection changes.

Not Considering Impermanent Loss

Liquidity providers often focus on attractive APY figures without adequately considering impermanent loss that can reduce or eliminate fee earnings. Impermanent loss occurs when price ratios between pool tokens change, causing the pool position to underperform simply holding the tokens. During significant price movements, this loss can substantially exceed accumulated fee income.

Proper impermanent loss evaluation requires comparing final pool position value against what holding the original tokens would have yielded. Only when fee income exceeds impermanent loss does liquidity provision actually generate positive returns. Pools with volatile, uncorrelated assets carry highest impermanent loss risk, requiring correspondingly higher fee income to remain profitable.

Build Your Own High-Performance DEX with Expert Fee Optimization

Create secure, scalable DEXs with optimized fees to maximize trader and liquidity provider rewards.

Focusing Only on Trading Volume Rather Than Fee Efficiency

High trading volume does not automatically indicate attractive opportunities for either traders or providers. A high-volume pool with low fees may generate less provider income than a moderate-volume pool with higher fees. Similarly, traders may find that high-volume pools have worse effective pricing due to concentrated liquidity elsewhere or suboptimal routing.

Fee efficiency analysis considers fees relative to liquidity and price impact rather than raw volume numbers. A pool generating 0.1% daily fees on liquidity provides better provider returns than one generating 0.05%, regardless of which has higher absolute volume. Traders should compare all-in costs including fees and slippage rather than focusing solely on volume as a quality indicator.

Critical Reminder: Pool fees are just one component of total trading costs. Gas fees, slippage, impermanent loss, and opportunity costs all affect actual returns. Evaluate positions holistically rather than optimizing any single factor in isolation.

Conclusion

DEX liquidity pool fees sit at the center of decentralized exchange economics, creating the incentive structure that connects traders needing liquidity with providers supplying it. Understanding how these fees work, where they flow, and how they impact different participants empowers better decision-making across all DeFi activities. Whether you trade tokens or provide liquidity, fee awareness directly impacts your results.

For traders, fee optimization through platform selection, timing, and trade structuring can meaningfully improve profitability, especially for active participants where fees accumulate across many transactions. For liquidity providers, understanding fee dynamics helps identify pools offering attractive risk-adjusted returns and avoid situations where impermanent loss exceeds fee income.

The evolving landscape of DEX fee models, from fixed structures to dynamic systems that respond to market conditions, continues creating new opportunities and challenges. Participants who maintain current knowledge of fee mechanics and available options position themselves to capture the benefits of decentralized finance while managing associated costs effectively. The fundamental principle remains constant: fees are the price of liquidity, and understanding that price is essential for everyone participating in the DEX ecosystem.

Frequently Asked Questions

DEX liquidity pool fees are charges applied to every trade executed through a decentralized exchange’s automated market maker system. These fees typically range from 0.01% to 1% of the trade value and are distributed to liquidity providers as compensation for supplying the assets that enable trading. The fee structure varies by platform and pool type, with some DEXs offering multiple fee tiers to accommodate different trading pairs and volatility levels.

DEX pool fees directly reduce your trading profits by taking a percentage of each swap you execute on the platform. For active traders making frequent transactions, these fees can accumulate significantly and eat into potential gains. Understanding the fee structure before trading helps you factor these costs into your strategy, whether by choosing lower-fee pools, timing larger trades strategically, or using platforms with competitive fee structures for your specific needs.

Liquidity providers earn from pool fees by receiving a proportional share of all trading fees generated by their contributed liquidity. When traders swap tokens through the pool, the fee collected gets added to the pool reserves, increasing the value of LP tokens held by providers. The earnings accumulate automatically over time, and providers can realize their gains when they withdraw their liquidity, receiving their original deposit plus accumulated fees.

Typical DEX platform fees range from 0.01% for stablecoin pairs to 1% for volatile or exotic token pairs, with 0.3% being the most common standard fee across many popular platforms. Some DEXs like Uniswap v3 offer multiple fee tiers including 0.01%, 0.05%, 0.3%, and 1% to accommodate different trading scenarios. The appropriate fee tier depends on the asset volatility, expected trading volume, and the balance between attracting traders and compensating liquidity providers.

DEX fees can be higher or lower than centralized exchange fees depending on the specific platforms being compared and the trade being executed. While centralized exchanges often advertise lower trading fees around 0.1% to 0.2%, they may charge additional withdrawal fees and require trust in custodial arrangements. DEX trading includes both the pool fee and blockchain gas costs, making the total cost variable and sometimes higher than centralized alternatives, especially on congested networks.

Minimizing DEX trading fees involves selecting pools with lower fee tiers when available, using DEX aggregators that find optimal routing across multiple platforms, trading during periods of lower network congestion to reduce gas costs, and batching smaller trades into larger single transactions when practical. Additionally, comparing fee structures across different DEXs for your specific trading pair can reveal significant savings, as fee policies vary substantially between platforms.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.