✓Key Takeaways

- Collateral liquidation is the automatic process where a borrower’s assets are sold to repay lenders when the loan becomes undercollateralized in DeFi platforms.

- DAOs in the DeFi Space govern many lending protocols, setting liquidation parameters and ensuring transparent, community-driven decision-making.

- Overcollateralization requirements in DeFi typically range from 120% to 150%, providing a safety buffer against market volatility and protecting lenders.

- Smart contracts execute liquidations automatically without human intervention, ensuring speed, fairness, and the elimination of manual errors.

- Price oracles like Chainlink play a critical role in triggering liquidations by providing accurate, tamper resistant real time asset prices.

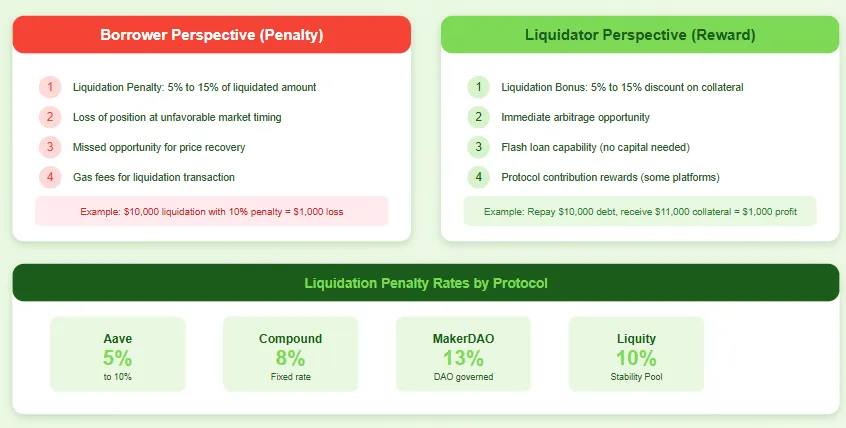

- Liquidation penalties typically range from 5% to 15%, serving as both compensation for liquidators and a deterrent against risky borrowing behavior.

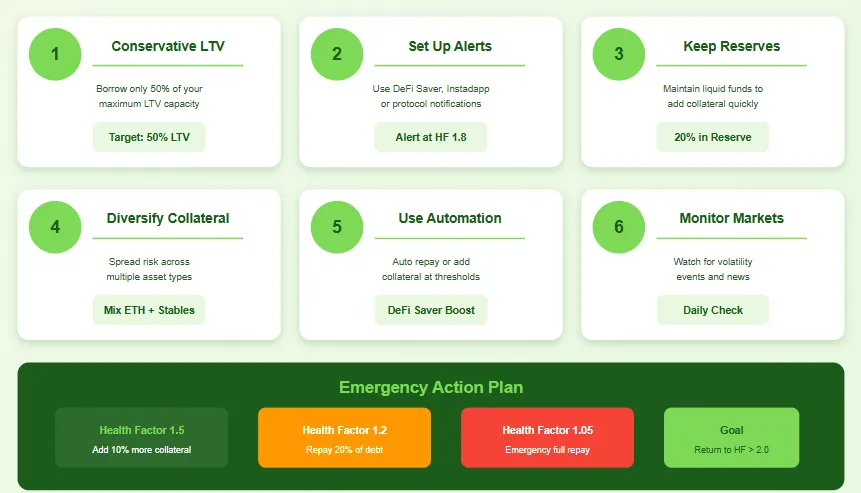

- Maintaining a health factor above 1.5 and setting up price alerts are essential strategies for borrowers to avoid unexpected liquidation events.

- Liquidation bots compete to execute liquidations quickly, earning rewards while maintaining protocol solvency during volatile market conditions.

- Failed or delayed liquidations can result in bad debt accumulation, potentially threatening the entire protocol’s financial stability.

- Understanding the loan-to-value ratio and liquidation threshold for each asset type is crucial for effective risk management in DeFi lending.

Introduction to DeFi Lending and Collateralization

Decentralized Finance, commonly known as DeFi, has revolutionized the traditional financial landscape by eliminating intermediaries and enabling peer-to-peer financial transactions. At the heart of this ecosystem lies DeFi lending, a mechanism that allows users to borrow and lend digital assets without relying on banks or financial institutions. Unlike traditional lending where credit scores and personal information determine loan eligibility, DeFi lending operates on a trustless system powered by blockchain technology and smart contracts.

The concept of collateralization forms the backbone of DeFi lending protocols. Since there is no central authority to verify borrower credibility or enforce loan repayment, borrowers must lock up cryptocurrency assets as collateral to secure their loans. This collateral acts as a guarantee, ensuring lenders that their funds are protected even if the borrower defaults. The value of collateral must typically exceed the loan amount, creating what is known as overcollateralization, a fundamental principle that distinguishes DeFi lending from traditional finance.

DAOs in the DeFi Space have emerged as powerful governance structures that oversee many lending protocols. These decentralized autonomous organizations enable token holders to vote on critical parameters such as interest rates, collateral requirements, and liquidation thresholds. This community-driven approach ensures transparency and adaptability, allowing protocols to respond to market conditions while maintaining the trust of their users.

What Is Collateral Liquidation in DeFi?

Collateral liquidation in DeFi refers to the automatic process of selling a borrower’s pledged assets when the value of their collateral falls below a predetermined threshold relative to their outstanding debt. This mechanism is essential for maintaining the financial health of lending protocols and ensuring that lenders do not suffer losses due to borrower defaults or market downturns. When liquidation occurs, a portion or all of the borrower’s collateral is sold at a discount to repay the outstanding loan amount.

The liquidation process is entirely automated through smart contracts, removing the need for manual intervention or lengthy legal proceedings that characterize traditional loan defaults. This automation ensures that liquidations happen swiftly, often within seconds of the triggering condition being met. The speed and efficiency of this process are crucial in volatile cryptocurrency markets where asset prices can change dramatically within minutes.

Example of Liquidation Scenario

Suppose you deposit 2 ETH worth $4,000 as collateral and borrow $2,500 in stablecoins. Your collateralization ratio is 160%. If ETH price drops to $1,500, your collateral becomes worth $3,000. With a liquidation threshold of 125%, your position (now at 120%) becomes eligible for liquidation. A liquidator can repay part of your debt and claim your ETH at a discount, protecting the protocol from bad debt.

How DeFi Lending Uses Overcollateralization

Overcollateralization is the practice of requiring borrowers to deposit collateral worth more than the amount they wish to borrow. This creates a safety buffer that protects lenders against market volatility and potential defaults. In DeFi, overcollateralization ratios typically range from 120% to 200%, depending on the volatility of the collateral asset and the specific protocol’s risk parameters.

The rationale behind overcollateralization stems from the pseudonymous nature of blockchain transactions. Since protocols cannot verify a borrower’s real-world identity or creditworthiness, they rely on economic incentives to ensure loan repayment. By requiring borrowers to stake more value than they receive, protocols create a financial disincentive for default. Borrowers are motivated to repay their loans to recover their collateral, which is worth more than their debt.

Overcollateralization Ratios by Asset Type

| Asset Category | Typical Collateral Ratio | Maximum LTV | Risk Level |

|---|---|---|---|

| Stablecoins (USDC, DAI) | 110% to 115% | 85% to 90% | Low |

| Major Cryptocurrencies (ETH, BTC) | 130% to 150% | 70% to 80% | Medium |

| Altcoins and DeFi Tokens | 150% to 200% | 50% to 65% | High |

| NFTs and Illiquid Assets | 200% to 300% | 30% to 50% | Very High |

Why Collateral Liquidation Is Necessary in DeFi

The necessity of collateral liquidation in DeFi cannot be overstated. Without this mechanism, lending protocols would be vulnerable to catastrophic losses during market downturns. When asset prices decline sharply, borrowers may find themselves in a position where their debt exceeds the value of their collateral. In traditional finance, such situations are handled through collections, legal action, or write-offs. However, the pseudonymous and borderless nature of DeFi makes such remedies impractical.

Liquidation serves multiple critical functions within the DeFi ecosystem. First, it maintains protocol solvency by ensuring that outstanding loans are always backed by sufficient collateral. Second, it creates market discipline by penalizing excessive risk-taking among borrowers. Third, it provides earning opportunities for liquidators who help maintain system health. Fourth, it builds confidence among lenders who can trust that their deposits are protected even during extreme market conditions.

Protocol Protection

Prevents the accumulation of bad debt that could threaten platform stability

Market Discipline

Encourages responsible borrowing and proper risk management

Lender Confidence

Builds trust by guaranteeing deposit protection during volatility

Role of Smart Contracts in Liquidation

Smart contracts are self-executing programs stored on the blockchain that automatically enforce the terms of an agreement. In the context of DeFi lending, smart contracts manage the entire lifecycle of a loan, from collateral deposit to interest accrual to liquidation. These contracts contain predefined rules that determine when and how liquidation should occur, removing human bias and ensuring consistent application of protocol parameters.

The automation provided by smart contracts offers several advantages over traditional liquidation processes. Speed is perhaps the most significant benefit, as liquidations can be executed within a single block confirmation, typically taking seconds rather than the days or weeks required in traditional finance. Transparency is another key advantage, as all liquidation rules and transactions are publicly visible on the blockchain. This transparency allows users to verify that liquidations are occurring fairly and according to protocol specifications.

Smart contracts also enable complex liquidation mechanisms that would be impractical to implement manually. For example, some protocols implement gradual liquidation, where only a portion of the collateral is sold at a time to minimize market impact. Others use Dutch auction mechanisms to discover optimal liquidation prices. These sophisticated approaches are only possible because smart contracts can execute complex logic reliably and consistently.

How Price Volatility Triggers Liquidation

Cryptocurrency markets are renowned for their volatility, with price swings of 10% to 20% occurring within hours being relatively common. This volatility directly impacts DeFi lending positions because it changes the value of collateral relative to borrowed amounts. When collateral prices fall, the collateralization ratio decreases, potentially pushing positions below the liquidation threshold. Conversely, when collateral prices rise, borrowers gain additional borrowing capacity.

The relationship between volatility and liquidation creates a feedback loop that can amplify market movements. During sharp price declines, many positions may approach liquidation thresholds simultaneously. As these positions are liquidated, additional selling pressure is created, potentially driving prices even lower and triggering more liquidations. This phenomenon, known as a liquidation cascade, was observed during several major market crashes, including the DeFi summer of 2020 and the May 2021 market correction.

Thesis Statement on Volatility Management

“Effective volatility management in DeFi lending requires a multi-layered approach combining conservative collateralization ratios, real-time monitoring systems, and dynamic risk adjustment mechanisms. DAOs in DeFi Space must continuously evaluate and adjust protocol parameters to balance capital efficiency with systemic safety, recognizing that the cost of excessive caution is measured in opportunity loss while the cost of insufficient protection can be protocol failure.”

Loan to Value (LTV) Ratio and Liquidation Thresholds

The Loan to Value ratio is a critical metric in DeFi lending that expresses the relationship between the borrowed amount and the collateral value. Calculated as (Loan Amount / Collateral Value) × 100, the LTV ratio indicates how leveraged a position is. A lower LTV ratio represents a safer position with more buffer against price movements, while a higher LTV ratio indicates greater risk but also higher capital efficiency.

Liquidation thresholds are the predetermined LTV levels at which a position becomes eligible for liquidation. Different assets have different liquidation thresholds based on their volatility profiles and liquidity characteristics. For example, a stablecoin collateralized loan might have a liquidation threshold of 90%, meaning liquidation triggers when the LTV reaches 90%. In contrast, a volatile altcoin might have a liquidation threshold of 65% to account for its greater price uncertainty.

Comparison: LTV vs Liquidation Threshold vs Collateral Ratio

| Parameter | Definition | Formula | Purpose |

|---|---|---|---|

| Loan to Value (LTV) | Ratio of loan amount to collateral value | (Loan / Collateral) × 100 | Measures position leverage |

| Liquidation Threshold | Maximum LTV before liquidation | Protocol defined limit | Triggers the liquidation process |

| Collateral Ratio | Ratio of collateral to loan value | (Collateral / Loan) × 100 | Inverse measure of safety |

| Health Factor | Safety margin indicator | Collateral × Liq. Threshold / Debt | Real-time risk assessment |

Liquidation Process in DeFi Lending Platforms

The liquidation process in DeFi follows a systematic series of steps that ensure fair and efficient resolution of undercollateralized positions. Understanding this process is essential for both borrowers who want to avoid liquidation and liquidators who seek to profit from maintaining protocol health. While specific implementations vary across protocols, the general framework remains consistent.

The DeFi Liquidation Lifecycle

Position Monitoring

Smart contracts continuously monitor all open positions, comparing collateral values against outstanding debts using real-time oracle price feeds.

Threshold Breach Detection

When a position’s health factor drops below 1.0, or LTV exceeds the liquidation threshold, the position becomes eligible for liquidation.

Liquidation Call

External actors (liquidators) identify the eligible position and submit a transaction to initiate the liquidation process.

Debt Repayment

The liquidator repays a portion or all of the borrower’s outstanding debt to the protocol on behalf of the borrower.

Collateral Transfer

In exchange for repaying the debt, the liquidator receives an equivalent value of collateral plus a liquidation bonus, typically 5% to 15%.

Position Update

The borrower’s position is updated to reflect reduced debt and collateral. Any remaining collateral stays in the position.

How Liquidation Protects Lenders

Lenders in DeFi protocols deposit their assets into liquidity pools with the expectation of earning interest. Unlike traditional savings accounts backed by deposit insurance, DeFi deposits are protected primarily through the liquidation mechanism. When borrowers default or become undercollateralized, liquidation ensures that lenders can recover their principal and accrued interest rather than suffering losses.

The protection mechanism works through the overcollateralization buffer. Because borrowers must deposit collateral worth more than their loan, there is always a margin of safety to cover potential value declines. Liquidation triggers before this buffer is exhausted, ensuring that collateral can be sold for enough to fully repay lenders. The liquidation bonus further incentivizes rapid liquidation, reducing the risk that positions become so undercollateralized that full recovery is impossible.

Additionally, many protocols maintain insurance funds or reserve pools funded by a portion of interest payments and liquidation penalties. These reserves serve as a backstop in cases where liquidation proceeds are insufficient to cover outstanding debts, perhaps due to extreme market conditions or oracle failures. DAOs in the DeFi Space often govern these reserve allocations, making decisions about reserve levels and deployment through community voting.

How Liquidation Maintains Platform Liquidity

Platform liquidity refers to the ability of users to withdraw their deposits or execute transactions without significant delays or price impact. Liquidation plays a crucial role in maintaining this liquidity by preventing situations where borrowed assets become locked in insolvent positions. Without liquidation, undercollateralized loans would represent frozen capital that neither the borrower nor lender could access.

When liquidations occur, they release collateral back into the market, increasing available liquidity. Liquidators who acquire collateral at a discount typically sell these assets to realize their profits, adding to market trading volume and price discovery. This recycling of capital through the liquidation process helps maintain the velocity of money within the DeFi ecosystem, ensuring that capital remains productive rather than trapped in failed positions.

Impact of Liquidation on Borrowers

For borrowers, liquidation represents a significant financial event with both immediate and long-term consequences. The immediate impact is the loss of collateral at an unfavorable time, typically during a market downturn when the borrower might have preferred to hold their assets. The liquidation penalty compounds this loss, meaning borrowers lose more value than the simple difference between their debt and collateral.

Consider a practical example: a borrower deposits $10,000 worth of ETH and borrows $7,000 in stablecoins. If the ETH price drops 30%, the collateral becomes worth $7,000 against a $7,000 debt (plus accrued interest). At this point, liquidation may occur. The liquidator repays the debt and receives the collateral plus a 10% bonus. The borrower loses their ETH position and the opportunity to benefit from any price recovery, while still having received the borrowed amount.

Financial Impact Comparison: Liquidated vs Non Liquidated Position

| Scenario Element | Liquidated Position | Self-Managed Position |

|---|---|---|

| Collateral Lost | Debt + Liquidation Penalty | Debt Only (if repaid) |

| Timing Control | None (automatic) | Full control |

| Price Execution | Market price at crisis | Choice of timing |

| Future Opportunity | Lost (position closed) | Retained (can wait for recovery) |

| Additional Fees | 5% to 15% penalty | Standard gas fees only |

Liquidation Penalties and Fees Explained

Liquidation penalties, also known as liquidation bonuses from the liquidator’s perspective, are additional fees charged during the liquidation process. These penalties serve dual purposes: they compensate liquidators for their service in maintaining protocol health, and they deter borrowers from operating at risky collateralization levels. The penalty is typically expressed as a percentage of the liquidated amount, ranging from 5% to 15% depending on the protocol and asset type.

The mechanics of liquidation penalties vary across protocols. In most implementations, the liquidator receives collateral worth more than the debt they repay. For example, if a liquidator repays $1,000 of debt with a 10% liquidation bonus, they receive $1,100 worth of collateral. This $100 profit incentivizes liquidators to monitor positions actively and execute liquidations promptly. Without sufficient incentive, liquidators might not participate, leaving undercollateralized positions unresolved.

Key Parameters Affecting Liquidation Economics

Liquidation Bonus

5% to 15% extra collateral given to liquidators as profit incentive

Close Factor

Maximum percentage of debt that can be liquidated at once (25% to 100%)

Gas Costs

Transaction fees that liquidators must pay, affecting profitability threshold

Protocol Fees

Portion of liquidation proceeds directed to protocol treasury

Risks of Delayed or Failed Liquidation

Delayed or failed liquidations represent one of the most significant risks to DeFi lending protocols. When liquidations do not occur promptly, undercollateralized positions can deteriorate further, potentially becoming insolvent. Insolvency occurs when the collateral value falls below the debt amount, creating bad debt that cannot be fully recovered through liquidation. This bad debt must be absorbed by the protocol, often through insurance funds or socialized losses among lenders.

Several factors can cause liquidation delays or failures. Network congestion may prevent liquidation transactions from being processed quickly, allowing positions to deteriorate during the delay. Extremely volatile market conditions can cause collateral values to fall faster than liquidators can respond. Insufficient liquidator participation, perhaps due to low profitability or technical barriers, can leave positions unliquidated. Oracle failures or manipulation can provide incorrect prices, either preventing justified liquidations or triggering unwarranted ones.

The consequences of systemic liquidation failures can be severe. The March 2020 “Black Thursday” event demonstrated this risk when Ethereum network congestion prevented timely liquidations on MakerDAO, resulting in millions of dollars in bad debt. Such events can undermine user confidence, trigger bank run dynamics as lenders rush to withdraw, and potentially lead to protocol collapse. This is why robust liquidation infrastructure is considered a critical component of any DeFi lending platform.

Importance of Reliable Price Oracles in Liquidation

Price oracles are external data feeds that provide smart contracts with real-world price information. In DeFi lending, oracles determine the value of collateral assets, which directly affects liquidation calculations. The accuracy and reliability of Oracle data are therefore critical to the fair and effective operation of the liquidation mechanism. Incorrect prices can lead to premature liquidations of healthy positions or failure to liquidate truly undercollateralized ones.

Leading oracle solutions like Chainlink, Band Protocol, and Pyth Network employ various mechanisms to ensure data reliability. These include decentralized node networks that aggregate prices from multiple sources, economic incentives for accurate reporting, and reputation systems that penalize nodes providing incorrect data. Time weighted average prices (TWAPs) are often used to smooth out short-term price spikes that might otherwise trigger unnecessary liquidations.

Oracle manipulation remains a persistent threat in DeFi. Attackers may attempt to artificially inflate or deflate reported prices to trigger liquidations or avoid them. Flash loan attacks have been used to manipulate spot prices on decentralized exchanges that serve as oracle sources. This is why sophisticated protocols use multiple oracle sources, implement circuit breakers for extreme price movements, and employ time delays to allow for price verification before triggering liquidations.

Automated vs Manual Liquidation in DeFi

DeFi liquidation can be categorized into automated and manual approaches, each with distinct characteristics and trade-offs. Automated liquidation relies on permissionless smart contract functions that anyone can call when liquidation conditions are met. This approach maximizes speed and accessibility, as any observer can trigger liquidation without special permissions. Manual liquidation, in contrast, might involve governance decisions or designated keepers who must actively monitor and execute liquidations.

Automated vs Manual Liquidation: A Detailed Comparison

| Aspect | Automated Liquidation | Manual Liquidation |

|---|---|---|

| Speed | Milliseconds to seconds | Minutes to hours |

| Accessibility | Open to anyone | Restricted to authorized parties |

| Reliability | Depends on the liquidator’s participation | Depends on keeper availability |

| Flexibility | Fixed rules in the smart contract | Can adapt to circumstances |

| Cost Efficiency | Market-driven optimization | May not optimize for cost |

| Decentralization | Highly decentralized | Centralization risk |

Liquidation Bots and Their Role

Liquidation bots are automated software programs that monitor DeFi lending protocols for undercollateralized positions and execute liquidations when profitable opportunities arise. These bots operate continuously, scanning the blockchain and mempool for positions approaching liquidation thresholds. When they identify an opportunity, they quickly submit transactions to capture the liquidation bonus before competing bots can act.

The sophistication of liquidation bots has increased dramatically since the early days of DeFi. Modern bots employ advanced strategies, including mempool monitoring to identify liquidatable positions before they appear on chain, flash loans to execute liquidations without upfront capital, and MEV (Maximal Extractable Value) techniques to ensure their transactions are prioritized. Some bots even integrate with multiple protocols simultaneously, optimizing their operations across the entire DeFi ecosystem.

The competitive nature of liquidation bot operation benefits protocols by ensuring rapid liquidation execution. However, it also creates challenges. The intense competition can lead to priority gas auctions that increase network congestion and costs. Front-running and sandwich attacks may harm regular users. Despite these issues, liquidation bots remain essential infrastructure for DeFi lending, providing the monitoring and execution capacity that protocols cannot maintain themselves.

Best Practices to Avoid Liquidation for Borrowers

Avoiding liquidation requires proactive risk management and continuous monitoring of your positions. The most effective strategy is maintaining a conservative collateralization ratio well above the minimum required. While protocols might allow 75% LTV, operating at 50% or lower provides a substantial buffer against price volatility. This approach sacrifices some capital efficiency but dramatically reduces liquidation risk.

Essential Strategies for Liquidation Prevention

Monitor Health Factor

Keep your health factor above 1.5 at all times. Set up alerts at 1.8 for early warning and 1.5 for urgent action.

Use Stablecoin Collateral

When possible, use stablecoins as collateral to eliminate price volatility risk from the collateral side.

Diversify Collateral

Spread collateral across multiple assets to reduce exposure to any single asset’s price movements.

Set Up Automation

Use tools like DeFi Saver to automatically add collateral or repay debt when positions approach danger zones.

Keep Reserve Capital

Maintain liquid reserves to add collateral quickly during market downturns without selling at unfavorable prices.

Understand Protocol Rules

Know the exact liquidation thresholds, penalties, and close factors for each asset you use as collateral.

Future of Collateral Liquidation in DeFi Lending

The future of collateral liquidation in DeFi is shaped by ongoing innovations in protocol design, oracle technology, and layer 2 scaling solutions. Several trends are emerging that promise to make liquidation more efficient, fair, and less disruptive to borrowers and markets alike. These advancements represent the continuous evolution of DeFi as it matures from experimental technology to robust financial infrastructure.

Gradual liquidation mechanisms are gaining popularity as an alternative to binary, all-or-nothing approaches. Instead of liquidating large portions of collateral at once, these systems liquidate small amounts continuously as positions deteriorate. This reduces market impact and gives borrowers more time to respond. Protocols like Liquity have pioneered stability pool mechanisms that pre-fund liquidations, ensuring immediate execution without relying on external liquidators.

Cross chain liquidation presents both opportunities and challenges as DeFi expands to multiple blockchains. Positions collateralized with assets on one chain but borrowed on another require sophisticated bridging solutions and unified oracle systems. Layer 2 solutions offer reduced gas costs and faster execution, potentially democratizing liquidation participation beyond well-capitalized MEV searchers. DAOs in DeFi Space will continue to play a crucial role in governing these innovations, balancing protocol safety with user experience improvements.

Integration with DeFi insurance products is another promising direction. Borrowers might purchase liquidation protection that covers their penalty costs or provides automatic collateral top ups. Such products would create additional revenue streams while reducing borrower anxiety and potentially increasing platform adoption. The combination of better risk management tools and more sophisticated liquidation mechanisms points toward a future where DeFi lending can compete with traditional finance on both efficiency and user protection.

Ready to Build Secure DeFi Lending Solutions?

Partner with experts who understand the intricacies of collateral liquidation and DeFi protocol design.

Why Choose Nadcab Labs for DeFi Solutions

With over 8 years of pioneering experience in blockchain technology and decentralized finance, Nadcab Labs has established itself as an authoritative leader in building robust DeFi lending platforms and liquidation systems. Our deep expertise in smart contract architecture, oracle integration, and risk management protocols has enabled us to deliver solutions that protect both lenders and borrowers while maintaining optimal capital efficiency across diverse market conditions.

Our team has successfully implemented liquidation mechanisms for multiple high-value DeFi protocols, designing systems that have withstood extreme market volatility without accumulating bad debt. We understand that effective liquidation infrastructure requires more than just code; it demands comprehensive knowledge of market dynamics, MEV protection strategies, and oracle security. Nadcab Labs brings this holistic expertise to every project, ensuring your DeFi platform operates with institutional-grade reliability.

Whether you are launching a new lending protocol, optimizing existing liquidation parameters, or integrating advanced features like cross-chain collateral management, Nadcab Labs provides end-to-end solutions tailored to your specific requirements. Our track record of working with DAOs in the DeFi Space and understanding governance dynamics enables us to build systems that evolve with community needs while maintaining unwavering security standards. Partner with Nadcab Labs to transform your DeFi vision into a secure, scalable reality.

Frequently Asked Questions

Once your collateral is liquidated in DeFi, the process is irreversible. The smart contract automatically sells your collateral to repay your debt. However, any remaining collateral after covering the debt and liquidation penalty is typically returned to your wallet. To avoid this situation, always monitor your positions and maintain a healthy collateral ratio.

In partial liquidation, only a portion of your collateral is sold to bring your position back to a safe ratio. The remaining collateral stays in your position, and you can continue your loan. Some platforms allow you to add more collateral or repay part of the debt to avoid further liquidation.

Yes, many DeFi protocols allow anyone to become a liquidator. When you successfully liquidate an undercollateralized position, you receive a liquidation bonus or discount on the collateral. This creates economic incentives for third parties to maintain protocol health by participating in the liquidation process.

DeFi liquidations are triggered automatically when your position crosses the liquidation threshold, regardless of how briefly. Even a momentary price drop during high volatility can trigger liquidation before prices recover. This is why maintaining a buffer above the liquidation threshold is crucial.

DeFi liquidations typically happen within seconds to minutes once triggered. The speed depends on network congestion, gas prices, and the activity of liquidation bots. During high market volatility, liquidations can cascade rapidly as many positions become undercollateralized simultaneously.

No, liquidation thresholds vary significantly across platforms and asset types. Each protocol sets its own parameters based on asset volatility, liquidity, and risk assessment. For example, stablecoins often have higher LTV ratios (80% to 90%) while volatile assets may have lower thresholds (50% to 70%).

Many third-party services and DeFi platforms offer health factor alerts via email, Telegram, or Discord. Tools like DefiSaver, Instadapp, and various wallet providers can send notifications when your position approaches danger zones. Setting up multiple alert thresholds is recommended.

A liquidation cascade occurs when multiple liquidations trigger in rapid succession, causing further price drops that liquidate even more positions. This creates a domino effect that can dramatically amplify market crashes. Understanding this risk helps you set safer collateral ratios during volatile periods.

Yes, extremely high gas fees during network congestion can delay liquidations. If gas costs exceed the potential profit for liquidators, they may not execute the liquidation immediately. This can lead to bad debt accumulation in protocols, which is why some platforms have gas compensation mechanisms.

Flash loans enable liquidators to execute liquidations without upfront capital. A liquidator can borrow funds via flash loan, use them to repay the borrower’s debt, receive discounted collateral, sell it for profit, and repay the flash loan, all in a single transaction. This increases liquidation efficiency but can also accelerate cascade events.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.