Key Takeaways

- Flash loan attack protection in DEX requires layered security approaches combining oracle protection, transaction controls, and smart contract hardening to address multiple attack vectors simultaneously.

- Flash loan attacks in DeFi exploit instant, uncollateralized liquidity to manipulate prices, drain pools, and exploit vulnerable smart contracts within single atomic transactions.

- Time-Weighted Average Price (TWAP) oracles and multi-oracle validation systems significantly reduce price manipulation risks by averaging data across time and sources.

- Decentralized exchange security depends on comprehensive measures including circuit breakers, reentrancy guards, and real-time monitoring to detect and respond to attack attempts.

- DeFi security best practices mandate regular smart contract audits, bug bounty programs, and continuous security enhancements to address evolving attack methodologies.

- Flash loan vulnerability mitigation involves both preventive measures that make attacks economically unfeasible and reactive systems that halt operations during detected anomalies.

- On-chain security mechanisms including block-level trade restrictions and abnormal transaction detection provide essential protection layers for DeFi protocol security.

- Prevent flash loan attacks effectively requires understanding attack patterns, implementing appropriate countermeasures, and maintaining vigilant monitoring of protocol operations.

Flash loan attacks represent one of the most sophisticated and damaging threats facing decentralized exchanges today. These attacks exploit the unique properties of blockchain technology to borrow massive amounts of capital, manipulate markets, and profit from vulnerabilities, all within a single transaction. Understanding and implementing effective flash loan attack protection in DEX platforms has become essential for any protocol seeking to protect users and maintain market integrity.

Understanding Flash Loan Attacks in Decentralized Exchanges

Understanding flash loan attacks in decentralized exchanges requires examining how these sophisticated exploits leverage DeFi’s composability and atomic transaction properties. Unlike traditional financial attacks requiring substantial capital and time, flash loan attacks operate instantaneously with borrowed funds that never leave the blockchain. This unique attack vector demands equally innovative defense mechanisms.

What Are Flash Loan Attacks in DeFi

Flash loan attacks in DeFi are sophisticated exploits that use uncollateralized loans to manipulate protocols and extract value within single blockchain transactions. The attacker borrows substantial funds, executes a series of operations that exploit vulnerabilities, profits from the manipulation, and repays the loan with interest. If any step fails, the entire transaction reverts, making unsuccessful attempts cost only gas fees.

How Instant Liquidity Creates Exploitation Risks

Instant liquidity creates exploitation risks by democratizing access to massive capital for potential attackers. Previously, market manipulation required significant resources; flash loans enable anyone to temporarily control millions in assets. This instant liquidity can overwhelm liquidity pools designed for normal trading volumes, artificially move prices, and exploit any protocol assuming trades occur with genuinely owned capital.

The atomic nature of flash loans means attackers face minimal risk. Failed attacks simply revert with no capital loss beyond gas fees. This asymmetric risk profile encourages experimentation with attack strategies, as successes are extremely profitable while failures cost nearly nothing. Building crypto exchanges that can withstand such attacks requires understanding this fundamental risk asymmetry.

Common Flash Loan Vulnerabilities in DEX Protocols

Common flash loan vulnerabilities in DEX protocols typically involve price oracle dependencies, liquidity pool mechanics, and smart contract reentrancy issues. These vulnerabilities often interconnect, allowing sophisticated attacks to chain multiple exploits together. Understanding how decentralized exchanges implement core trading mechanisms reveals where vulnerabilities commonly emerge.

Price Manipulation Through Liquidity Pools

Price manipulation through liquidity pools occurs when attackers use flash-borrowed capital to execute massive trades that temporarily distort pool ratios and prices. AMM pricing formulas calculate prices based on pool reserves; a large trade can dramatically shift these ratios. If other protocols reference these manipulated prices, attackers can exploit the temporary distortion before the market corrects.

Oracle Manipulation Attacks

Oracle manipulation attacks target the price feeds that DeFi protocols depend on for critical calculations. Many protocols use DEX spot prices as oracles; manipulating these prices propagates false data throughout connected systems. Attackers can trigger unfair liquidations in lending protocols, exploit arbitrage opportunities at manipulated prices, or drain protocol funds through mispriced transactions.

Reentrancy-Based Exploits

Reentrancy-based exploits occur when attackers recursively call vulnerable functions before state updates complete. Combined with flash loans, reentrancy attacks can repeatedly drain funds within a single transaction. Smart contract security for DEX must include robust reentrancy guards to prevent these recursive exploitation patterns that have caused some of DeFi’s largest losses.

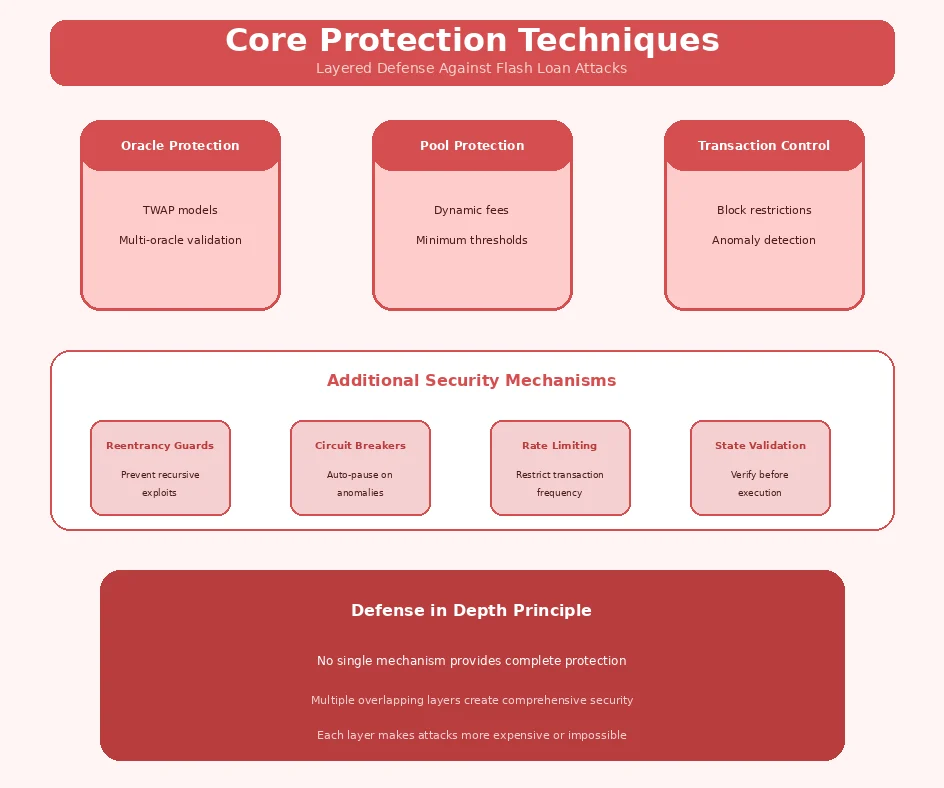

Security Principle: Flash loan protection requires defense in depth. No single mechanism provides complete protection; effective security combines multiple overlapping safeguards that together make attacks economically unfeasible or technically impossible.

Security Challenges Caused by Flash Loan Exploits

Security challenges caused by flash loan exploits extend beyond immediate financial losses to encompass market confidence, user trust, and ecosystem stability. The interconnected nature of DeFi means attacks on one protocol can cascade throughout the ecosystem, affecting platforms that had no direct vulnerabilities themselves.

Impact on Liquidity Providers and Traders

Impact on liquidity providers and traders from flash loan attacks can be severe and immediate. LPs may suffer impermanent loss from manipulated prices, while traders may execute at artificially distorted rates. The sudden nature of attacks means victims often have no opportunity to protect themselves, discovering losses only after attacks complete.

Sudden Price Distortions

Sudden price distortions from flash loan attacks create immediate harm for market participants. Traders may find limit orders executed at unexpected prices, liquidity providers may experience severe impermanent loss, and arbitrage systems may suffer losses from operating on manipulated data. These distortions typically last only moments but can cause permanent financial damage.

Loss of Market Confidence

Loss of market confidence following flash loan attacks affects platforms long after immediate losses are addressed. Users may withdraw liquidity fearing future attacks, traders may avoid platforms with attack histories, and the broader DeFi ecosystem may face skepticism about security. Rebuilding trust requires demonstrating improved security measures and transparent communication.

Protocol-Level Risks in DeFi Ecosystems

Protocol-level risks in DeFi ecosystems from flash loan attacks threaten the composability that makes DeFi valuable. When protocols rely on each other for price data, liquidity, or other services, vulnerabilities can propagate across the ecosystem. DeFi protocol security requires considering not just internal vulnerabilities but also risks from connected protocols.

Cascading Effects Across Interconnected Platforms

Cascading effects across interconnected platforms can multiply attack impact dramatically. A flash loan attack on one DEX can manipulate prices that lending protocols use for collateralization, triggering liquidations across multiple platforms. These cascade effects make isolated security insufficient; platforms must consider their role within the broader DeFi ecosystem.

Flash Loan Attack Types Comparison

| Attack Type | Mechanism | Target | Primary Defense |

|---|---|---|---|

| Price Manipulation | Large trades distort AMM prices | Liquidity pools | TWAP oracles |

| Oracle Manipulation | Exploit price feed dependencies | Oracle-dependent protocols | Multi-oracle validation |

| Reentrancy | Recursive function calls | Vulnerable contracts | Reentrancy guards |

| Governance Attacks | Flash-borrowed voting power | DAO governance | Snapshot voting, timelocks |

Core Techniques for Flash Loan Attack Protection in DEX

Core techniques for flash loan attack protection in DEX encompass multiple defensive layers addressing different attack vectors. Effective DEX security solutions combine preventive mechanisms that make attacks economically unfeasible with reactive systems that detect and halt attacks in progress. This multi-layered approach provides comprehensive protection against sophisticated attack strategies.

Oracle Manipulation Prevention Mechanisms

Oracle manipulation prevention mechanisms form the first critical defense layer against flash loan attacks. Since many attacks depend on manipulating price data that protocols trust, hardening oracle systems significantly reduces attack viability. Understanding how professional exchange platforms implement security mechanisms reveals best practices for oracle protection.

Time-Weighted Average Price (TWAP) Models

Time-Weighted Average Price (TWAP) models calculate asset prices by averaging observations across multiple blocks rather than using instantaneous spot prices. This averaging makes manipulation exponentially more expensive because attackers would need to maintain artificial prices across numerous blocks. TWAP periods typically range from minutes to hours depending on security requirements and acceptable price lag.

TWAP implementation requires balancing security with responsiveness. Longer averaging periods provide stronger manipulation resistance but delay recognition of legitimate price movements. Protocols must configure TWAP parameters based on their specific risk profiles and operational requirements.

Multi-Oracle Price Validation

Multi-oracle price validation requires consensus across multiple independent price sources before accepting data. If an attacker manipulates one oracle source, other sources will report different prices, triggering validation failures that prevent exploit execution. This redundancy significantly increases attack complexity and cost while improving price reliability.

Liquidity Pool Protection Strategies

Liquidity pool protection strategies directly address the AMM mechanisms that attackers target. By making pool manipulation more expensive or detecting abnormal activity, these strategies reduce attack profitability and effectiveness. Flash loan vulnerability mitigation at the pool level provides essential protection for the core trading infrastructure.

Dynamic Fee Adjustment Systems

Dynamic fee adjustment systems increase trading fees when abnormal activity is detected, making attacks more expensive. Sudden large trades, unusual volume patterns, or detected flash loan activity can trigger fee increases that reduce attack profitability. These systems can also implement temporary trade size limits during suspicious periods.

Minimum Liquidity Thresholds

Minimum liquidity thresholds prevent trading when pool reserves fall below safe levels. Attackers often attempt to drain pools or manipulate prices in low-liquidity situations. By enforcing minimum reserves, protocols ensure sufficient depth exists for safe trading operations and make manipulation attempts require larger capital commitments.

Transaction Control and Rate Limiting

Transaction control and rate limiting mechanisms restrict the types and frequency of transactions that can occur, preventing the rapid sequential operations that flash loan attacks require. These on-chain security mechanisms add friction that disrupts attack sequences while maintaining normal user experience.

Block-Level Trade Restrictions

Block-level trade restrictions prevent multiple significant interactions with the same protocol within a single block. Since flash loan attacks must complete within one transaction (and thus one block), spreading required operations across multiple blocks breaks attack atomicity. Attackers would need to maintain positions across blocks, exposing them to market risks.

Abnormal Transaction Detection

Abnormal transaction detection systems identify patterns characteristic of flash loan attacks. Unusually large trades, rapid sequential operations, and interactions with known flash loan providers can trigger protective responses. Real-time detection enables immediate countermeasures before attacks complete successfully.

Flash Loan Attack Prevention Lifecycle

| Phase | Stage | Actions | Mechanisms |

|---|---|---|---|

| 1 | Prevention | Make attacks unfeasible | TWAP, multi-oracle, audits |

| 2 | Detection | Identify attack attempts | Monitoring, anomaly detection |

| 3 | Response | Halt ongoing attacks | Circuit breakers, rate limits |

| 4 | Recovery | Restore normal operations | Price stabilization, LP protection |

| 5 | Analysis | Learn from incidents | Post-mortem, security updates |

Smart Contract Security Measures Against Flash Loan Attacks

Smart contract security measures against flash loan attacks focus on hardening the code that executes protocol logic. Since all DEX operations occur through smart contracts, vulnerabilities at this level can enable catastrophic exploits. Comprehensive smart contract security for DEX requires addressing both common vulnerability patterns and flash-loan-specific attack vectors.

Reentrancy Protection Techniques

Reentrancy protection techniques prevent attackers from exploiting callback mechanisms to recursively drain funds. The infamous DAO hack demonstrated reentrancy’s destructive potential; flash loans amplify this risk by providing capital for sophisticated reentrancy-based attacks. Modern contracts must implement robust protections against this well-known but still dangerous vulnerability.

State Validation Before Execution

State validation before execution follows the checks-effects-interactions pattern: verify conditions, update state, then perform external interactions. This ordering ensures state changes complete before potential reentrancy points, preventing attackers from exploiting outdated state. Combined with explicit reentrancy guards, this pattern provides robust protection against recursive attacks.

Circuit Breaker Mechanisms

Circuit breaker mechanisms automatically halt protocol operations when abnormal conditions are detected. These safety systems prevent attacks from completing even if other defenses fail, providing a critical last line of protection. Effective circuit breakers balance sensitivity (catching attacks) with specificity (avoiding false triggers that disrupt normal operations).

Automatic Trading Pauses During Abnormal Activity

Automatic trading pauses during abnormal activity stop operations when detected patterns suggest attack attempts. Triggers include sudden large price movements, unusual volume spikes, or detected flash loan interactions. While pauses may temporarily inconvenience users, they prevent potentially catastrophic losses from successful attacks.

Security Mechanism Selection Criteria

When implementing flash loan protection, evaluate mechanisms based on:

- Attack Coverage: Which attack vectors does the mechanism address?

- Performance Impact: How does protection affect normal operations?

- Implementation Complexity: Is the mechanism correctly implementable?

- Bypass Difficulty: How easily can attackers circumvent the protection?

- Maintenance Requirements: Does the mechanism need ongoing tuning?

- Integration: How does it interact with other security measures?

Monitoring and Risk Management in DeFi Platforms

Monitoring and risk management in DeFi platforms provide the operational intelligence necessary for effective security. Preventive measures cannot anticipate all attack variations; real-time monitoring and responsive risk management fill gaps by detecting and responding to novel threats as they emerge.

Real-Time Flash Loan Exploit Detection

Real-time flash loan exploit detection systems monitor blockchain activity for patterns indicating attack attempts. These systems analyze transaction characteristics, identify flash loan interactions, and detect unusual trading patterns that may indicate manipulation. Speed is critical; detection must occur fast enough to enable response before attacks complete.

Behavioral Analysis of On-Chain Transactions

Behavioral analysis of on-chain transactions identifies suspicious patterns by comparing activity against normal baselines. Machine learning models can learn typical transaction patterns and flag anomalies that may indicate attacks. This analysis provides early warning even for novel attack strategies that signature-based detection might miss.

Automated Risk Management Frameworks

Automated risk management frameworks enable rapid response to detected threats without requiring manual intervention. These systems can adjust parameters, trigger circuit breakers, and implement protective measures based on real-time risk assessment. DeFi security best practices increasingly emphasize automated response capabilities.

Early Warning Systems for Price Manipulation

Early warning systems for price manipulation alert operators to potential attacks before significant damage occurs. By monitoring price movements across multiple sources and detecting divergence that may indicate manipulation, these systems enable proactive response. Early detection provides crucial time for defensive actions.

Security Notice: Flash loan attacks continue evolving as attackers develop new strategies. No single protection mechanism provides complete security. Platforms must maintain layered defenses, conduct regular security assessments, and stay informed about emerging attack techniques to protect users effectively.

Best Practices for Strengthening Decentralized Exchange Security

Best practices for strengthening decentralized exchange security encompass both technical measures and operational processes. Effective security requires continuous attention rather than one-time implementations. DeFi security best practices evolve as the threat landscape changes, requiring ongoing adaptation and improvement.

Smart Contract Auditing and Verification

Smart contract auditing and verification form the foundation of decentralized exchange security. Professional audits by experienced security firms identify vulnerabilities before deployment, preventing attacks on production systems. Multiple audits from different firms provide comprehensive coverage as each auditor brings unique perspectives and methodologies.

Identifying Flash Loan Vulnerabilities Early

Identifying flash loan vulnerabilities early through comprehensive auditing prevents exploitation in production. Auditors specifically examine oracle dependencies, reentrancy risks, and economic attack vectors that flash loans could exploit. This proactive identification enables fixes before attackers discover and exploit weaknesses.

Continuous Security Enhancements

Continuous security enhancements acknowledge that security is an ongoing process rather than a final state. Regular code reviews, updated security measures, and learning from industry incidents all contribute to improving protection over time. The dynamic nature of DeFi threats demands equally dynamic defensive adaptation.

Start Your Custom DEX Development Today

Build a resilient DEX with advanced flash loan attack safeguards, price integrity controls, and protocol-level security engineered for scale.

Launch Your Exchange Now

Adapting to Evolving DeFi Attack Patterns

Adapting to evolving DeFi attack patterns requires staying informed about new vulnerabilities and attack techniques. Attackers continuously innovate; defenders must match this innovation to maintain effective protection. Industry collaboration, security research participation, and rapid response to new threats all contribute to adaptive security postures.

Security Mechanism Effectiveness

| Mechanism | Protection Level | Implementation | Limitations |

|---|---|---|---|

| TWAP Oracles | High | Medium complexity | Price lag |

| Multi-Oracle | Very High | High complexity | Dependency on sources |

| Circuit Breakers | High | Low complexity | False positives possible |

| Reentrancy Guards | Essential | Low complexity | Only prevents reentrancy |

Security Evolution: As DeFi matures, flash loan protection mechanisms will continue advancing. Emerging approaches including formal verification, AI-powered threat detection, and cross-protocol security coordination will strengthen defenses against increasingly sophisticated attacks.

Flash loan attack protection in DEX represents a critical ongoing challenge requiring comprehensive, layered defensive approaches. The unique properties of flash loans, enabling instant access to massive capital without collateral, create attack possibilities unknown in traditional finance. Effective protection requires combining preventive measures, real-time detection, rapid response capabilities, and continuous security evolution.

Decentralized exchange security against flash loan attacks depends on understanding attack mechanics, implementing appropriate countermeasures, and maintaining vigilant monitoring. No single mechanism provides complete protection; defense in depth combining multiple overlapping safeguards creates resilient systems. As attack techniques evolve, so must defensive capabilities, making security an ongoing commitment rather than a one-time implementation.

Frequently Asked Questions

Flash loan attacks in DeFi exploit the ability to borrow massive amounts of cryptocurrency without collateral within a single transaction. Attackers use this instant liquidity to manipulate prices, drain liquidity pools, or exploit smart contract vulnerabilities. The entire attack occurs atomically, meaning it either completes fully or reverts entirely, leaving no trace if unsuccessful.

Flash loan attacks on DEXs typically follow a pattern: borrow large amounts via flash loan, use the borrowed funds to manipulate prices in liquidity pools or exploit oracle dependencies, profit from the artificial price movement, and repay the loan with interest. All steps execute in a single transaction, making the attack instantaneous and difficult to prevent through traditional security measures.

Flash loan attack protection in DEX encompasses technical mechanisms designed to prevent or mitigate exploitation through flash loans. These protections include time-weighted average price oracles, multi-oracle validation, transaction rate limiting, circuit breakers, and reentrancy guards. Effective protection requires layered security approaches rather than single-point solutions.

DEXs are vulnerable because they operate with publicly visible smart contracts, rely on instantaneous price data that can be manipulated, and allow permissionless interactions that attackers can exploit. The composable nature of DeFi means vulnerabilities in one protocol can affect connected platforms. Additionally, AMM price mechanisms can be temporarily distorted with sufficient capital.

DEX protocols can prevent flash loan attacks through multiple approaches: implementing TWAP oracles that average prices over time, using multiple oracle sources for price validation, adding transaction delays or rate limits, enforcing minimum liquidity thresholds, deploying circuit breakers that pause trading during abnormal activity, and conducting thorough smart contract audits to identify vulnerabilities.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.