Key Takeaways

- In 2025, CEXs still dominate with the majority of global spot trading volume, while DEXs have grown to occupy approximately 7-15% of spot volume depending on the quarter, marking significant growth driven by Layer-2 adoption and cross-chain liquidity tools.

- CEXs win on liquidity and trading features, offering deep liquidity, tight spreads, and complex products (futures, options, margin) that institutional participants prefer for large, low-latency orders with minimal slippage.

- DEXs win on custody and control with non-custodial trading where users retain private keys, avoiding exchange insolvency risk and counterparty failure lessons painfully learned from past CEX collapses like FTX.

- Security risks differ by model: CEXs face centralized hack exposure, insider fraud, and insolvency risks (single point of failure), while DEXs face smart contract bugs, oracle manipulation, bridge vulnerabilities, and MEV extraction.

- Approximately $2.2 billion was stolen across hacks and exploits in 2024 (per Chainalysis), underscoring that both custody models carry material security risks requiring careful due diligence from users.

- Regulated CEXs win for compliance and fiat rails, with EU’s MiCA regime (applicable from late 2024) and evolving U.S. enforcement creating clearer frameworks that benefit users wanting AML/KYC protections and consumer recourse.

- DEXs win on innovation and composability, serving as the laboratory for permissionless listing, yield aggregators, automated market makers, and DeFi integrations that regulated CEXs cannot easily match.

- The optimal 2025 strategy is a hybrid approach: use regulated CEXs for trading, fiat conversion, and short-term custody, while keeping long-term holdings in self-custody and using DEXs for DeFi strategies.

- Three tipping points to watch: institutional liquidity improvements on DEXs, regulatory clarity and enforcement trends, and custody/smart contract safety breakthroughs (social recovery wallets, MPC custody, formally verified contracts).

- Neither model fully “wins” in 2025. The healthiest outcome is coexistence where CEXs serve as the backbone for liquidity and institutional flows while DEXs drive innovation for composable finance and user self-custody.

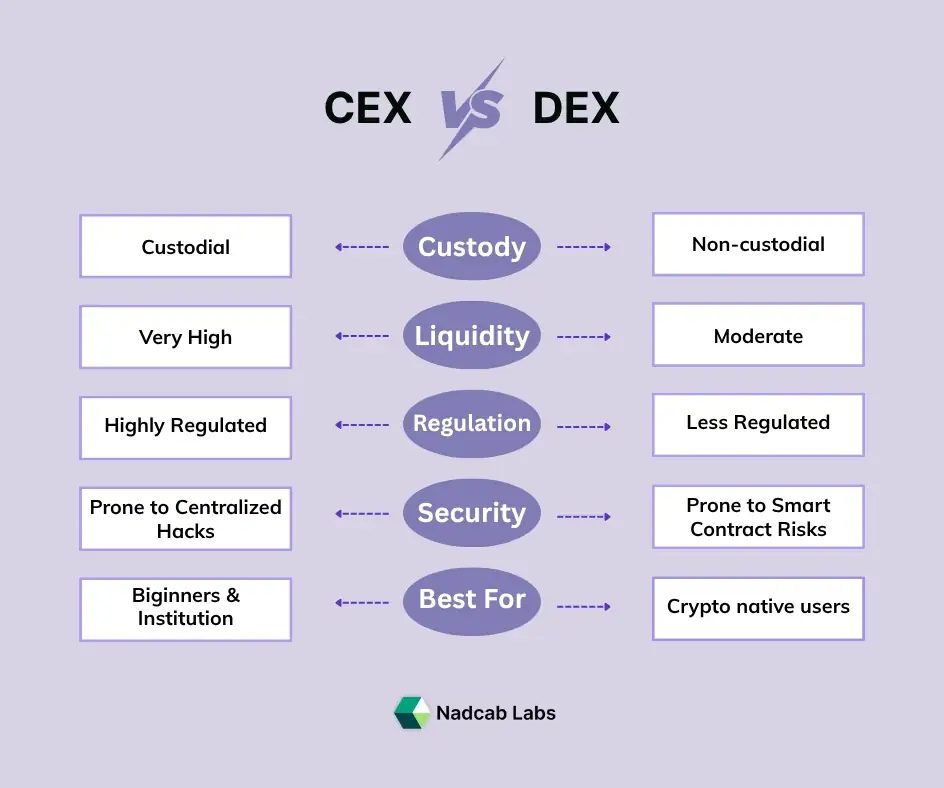

In 2025, the exchange battleground looks less like a boxing match and more like a détente: centralized exchanges (CEXs) still dominate the ring, but decentralized exchanges (DEXs) have quietly built a formidable corner. Investors, builders, and regulators all ask the same question: which model actually wins? The answer is not a one-word verdict; it’s a landscape read, because “winning” depends on what you value: liquidity, control, compliance, innovation, or safety.

Below, let’s walk through the technical differences, the real-world trade-offs, the hard numbers, and what they mean for users and institutions in 2025, with evidence and examples so you can decide which side fits your needs. As the debate over CEX vs DEX grows in 2026, users want a simple, clear explanation of what truly separates centralized and decentralized exchanges.

What Is a Centralized Exchange (CEX)?

Centralized exchanges are the most common crypto trading platforms and are traditional, custodial trading platforms. They hold users’ funds on behalf of customers, run order books (or centralized matching engines), and provide fiat on- and off-ramps, customer support, margin and derivatives trading, and advanced order types. Examples: Binance, Coinbase, Kraken.

What Is a Decentralized Exchange (DEX)?

Decentralized exchanges (DEXs) are non-custodial protocols that execute trades via smart contracts on-chain (AMMs like Uniswap, or on-chain order books). Users keep custody of keys; trades often settle on-chain, enabling composability with other DeFi primitives, examples- Uniswap, PancakeSwap, and Layer-2 DEXs such as Magnet.

Where the numbers stand (short verdict from the data)

These stats form the foundation of today’s CEX vs DEX market share analysis.

- In 2024–2025, CEXs continued to account for the majority of global spot trading volume; DEXs occupied a growing but smaller slice, typically in the single-digit to low-double-digit percentage range of spot volume, depending on the quarter. Multiple market trackers put DEX share roughly between ~7–15% across 2024–2026 reporting windows.

- DEX volumes and TVL (total value locked) have seen strong growth spurts driven by Layer-2 adoption, new AMM designs, and cross-chain liquidity tooling; top DEX volumes reached hundreds of billions in high-activity quarters in 2025.

- Security incidents remain material: 2024 saw billions stolen across hacks and exploits (Chainalysis reported approximately $2.2billion stolen in 2024), underscoring that both custody models face risk, for CEXs from custodial theft/mismanagement and for DEXs from smart-contract exploits and bridge hacks.

These figures tell a story- CEXs still lead on volume and fiat convenience, while DEXs are growing fast and pushing boundaries of self-custody and composability.

Which is better CEX or DEX?

Liquidity & trading features (win: CEX)

CEXs offer deep liquidity, tight spreads, and complex products (futures, options, margin). Institutional participants prefer CEXs because liquidity reduces slippage for large orders. DEX liquidity has improved, Layer-2 aggregators and concentrated liquidity AMMs narrow spreads, but for large, low-latency institutional flows, CEXs usually remain preferable.

Custody & control (win: DEX)

If “not your keys, not your coins” matters to you, DEXs win. Non-custodial trading means users retain control of private keys and, therefore, assets. This avoids exchange insolvency risk and counterparty failure (lessons painfully learned from past CEX collapses). But self-custody brings responsibility: key management, seed phrase security, and the UX friction of on-chain approvals.

Also Read- Evolution of Exchanges – From Mt.Gox to Modern DeFi

CEX vs DEX Security- Which Is Safer in 2026?

- CEX risk- centralized treasure chest, single point of failure for hacks, insider fraud, or mismanagement. Historic collapses (e.g., FTX) and major breaches have shown that catastrophic customer losses are possible.

- DEX risk- smart-contract bugs, oracle manipulation, bridge vulnerabilities, and MEV (miner/validator extractable value). While exploits often target code, many modern DEXs mitigate this with audits, timelocks, and insurance funds. Still, exploits account for large on-chain losses.

Regulation, consumer protection & fiat rails (win- regulated CEXs)

Regulatory clarity has moved forward. The EU’s MiCA regime became applicable and has set licensing and conduct rules for crypto asset service providers, increasing compliance burdens but also raising trust for regulated CEXs operating in Europe. In the US in 2026, the enforcement posture also shifted in several high-profile cases (some SEC suits were dismissed or dropped), creating a more defined but evolving environment. For users wanting fiat rails, AML/KYC protections, and consumer recourse, regulated CEXs currently win.

User experience & accessibility (near tie)

CEXs offer polished UX, 24/7 support, and one-click buys. DEXs historically lagged here, but Layer-2 UX improvements, wallet onboarding refinements, and fiat-to-crypto rails via on-ramps are narrowing the gap, especially for crypto-native users.

Innovation & composability (win: DEX)

If you care about permissionless innovation, novel token economics, automated liquidity, and composable DeFi stacks, DEXs are the laboratory. Smart contracts enable permissionless listing, yield aggregators, and automated market makers that integrate with lending, derivatives, and NFTs. That composability fuels rapid product innovation that regulated CEXs cannot match without major engineering & compliance effort.

Real-world examples that matter

- Uniswap and PancakeSwap– long-standing AMMs with massive on-chain activity. Their upgrades (concentrated liquidity, v3-style features) have materially improved capital efficiency and attracted volume back to DEXs in some quarters.

- Binance and Coinbase– dominant CEX liquidity providers, with broad product stacks (derivatives, staking, custody services). Regulatory challenges over recent years changed their strategies, but legal developments in 2026 showed that regulatory dynamics are still evolving.

- Bridge & Rollup innovations– cross-chain bridges and Layer-2 rollups (optimistic and zk-rollups) have reduced on-chain costs and latency for DEXs, enabling more competitive UX and volume on non-Ethereum chains. This helped DEX’s market share growth in 2024–2026.

CEX vs DEX Safety checklist- What risk do users actually face?

- On CEXs– exchange insolvency, withdrawal freezes, insider fraud, centralized hacks, and regulatory seizure. Choose exchanges with strong custody practices, proof-of-reserves transparency, insurance programs, and clean legal standing. Past waves of breaches and the FTX collapse show that due diligence matters.

- On DEXs– smart-contract bugs, front-running/MEV, oracle manipulation, rug pulls on token listings, and bridge exploitation. Use audited contracts, well-known pools with deep liquidity, and bridge minimization strategies.

Regulation Impact on CEX and DEX

MiCA in Europe (applicable from late 2026) has pushed many service providers toward licensure, transparency, and market-abuse prevention, benefiting users by raising standards for asset-referenced tokens and custodial services. In the U.S., regulatory posture changed in 2026 with significant enforcement shifts and case dismissals that signaled a new approach from agencies. The net effect: better-defined compliance frameworks will favor regulated CEXs for institutional flows, while DEXs will continue to appeal to permissionless innovation, albeit under growing scrutiny (on AML/TF grounds) where intermediaries provide off-ramps or fiat rails.

CEX vs DEX- Which One Should You Use in 2025?

There is no universal winner in 2026. Instead-

- If you’re an institutional trader, high-frequency desk, or need fiat on/off ramps and custody solutions, regulated CEXs mostly win today because of liquidity, compliance, and feature sets.

- If you prioritize control, composability, and permissionless innovation, DEXs win because they let you trade directly from your wallet and integrate with a broader DeFi stack.

- For mainstream retail users who want both convenience and safety, the best choice is a hybrid approach: custody some assets on regulated CEXs for ease of fiat conversion and active trading, while keeping long-term holdings or experimental positions in self-custody and interacting with DEX protocols as needed.

What to watch next- three tipping points that could change the balance

- Institutional liquidity on DEXs– improvements to on-chain order books, concentrated liquidity primitives, and cross-chain settlement could make DEXs viable for large orders with low slippage. If these technologies scale, DEX market share could accelerate materially.

- Regulatory clarity and enforcement– if global regulators require stronger KYC/AML on crypto rails, DEXs that offer permissionless access may face new constraints (or be forced to route users through compliant on-ramps). Conversely, clear rules could encourage more institutional adoption of licensed CEXs.

- Custody & smart-contract safety– breakthroughs in secure custody (social recovery wallets, MPC custody) and formally verified smart contracts could remove two major frictions, security and UX, accelerating DEX adoption.

CEX vs DEX 2025 Analysis

CEX vs DEX in 2025: A Complete Technical & Market Breakdown by Our Exchange Development Experts.

Practical advice for users (actionable takeaways)

- Divide responsibilities– use regulated CEXs for trading, fiat conversion, and custody of short-term capital; use self-custody + DEXs for long-term holdings and DeFi strategies.

- Prioritize audits and on-chain hygiene– for any DEX interaction, prefer audited contracts, look for multi-auditor reports, and use reputable bridges. For CEXs, prefer platforms offering proof-of-reserves, insurance, and a clear regulatory status.

- Keep small balances for day-to-day trading– limit exposure on any single custodian and diversify across custody methods.

- Follow regulatory developments– MiCA and major US enforcement trends materially affect exchange business models and user protections stay informed.

Final Verdict- Who Wins in 2026?

In 2026, the market’s healthiest outcome is coexistence- CEXs continue to be the backbone for liquidity, fiat integration, and institutional flows; DEXs’ development continues to be the innovation engine for composable finance and user custody. Neither model fully “wins” in the absolute sense; the ecosystem wins when both mature, interoperate safely, and give users real choices.

Frequently Asked Questions

In 2026, the fundamental difference is still custody vs control. CEXs manage user funds and trading infrastructure, while DEXs allow users to trade directly from self-custody wallets using smart contracts, without intermediaries.

Neither model is inherently safer.

CEX risks include insolvency, regulatory freezes, and centralized breaches.

DEX risks include smart contract exploits, MEV attacks, and bridge vulnerabilities.

In 2026, safety depends more on platform design, audits, custody standards, and user discipline than on the model itself.

Yes. CEXs continue to dominate global spot and derivatives volume due to deep liquidity, fiat rails, and advanced trading products. However, DEX market share continues to grow steadily, especially on Layer-2 and non-Ethereum ecosystems.

By 2026, DEXs typically account for around 12–20% of global spot trading volume, depending on market conditions. Growth is driven by lower fees, faster Layer-2 settlement, and improved capital efficiency in AMMs and on-chain order books.

Partially. While most institutions still rely on CEXs, on-chain liquidity aggregation, permissioned DeFi pools, and MPC-based custody solutions have made DEXs increasingly viable for institutional experimentation and limited deployment.

DEX protocols themselves remain permissionless and typically do not require KYC.

However, regulated front-ends, fiat on-ramps, and compliant liquidity gateways may enforce KYC depending on jurisdiction and regulatory requirements.

Major risks include:

-

Smart contract bugs

-

MEV and front-running

-

Cross-chain bridge exploits

-

Fake or malicious token listings

-

User errors in transaction signing

By 2026, regulated CEXs operate under clearer global frameworks, improving consumer protection and institutional trust.

DEXs remain largely permissionless but face indirect regulation through compliant interfaces, stablecoin rules, and AML enforcement at fiat entry and exit points.

Beginners still benefit from CEXs due to easier onboarding, customer support, and fiat access.

DEXs are better suited for users comfortable with wallets, self-custody, and DeFi mechanics.

A hybrid strategy is optimal in 2026:

-

Use regulated CEXs for fiat conversion, active trading, and short-term liquidity

-

Use self-custody wallets and DEXs for long-term holdings, DeFi participation, and permissionless innovation

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.