Key Takeaways

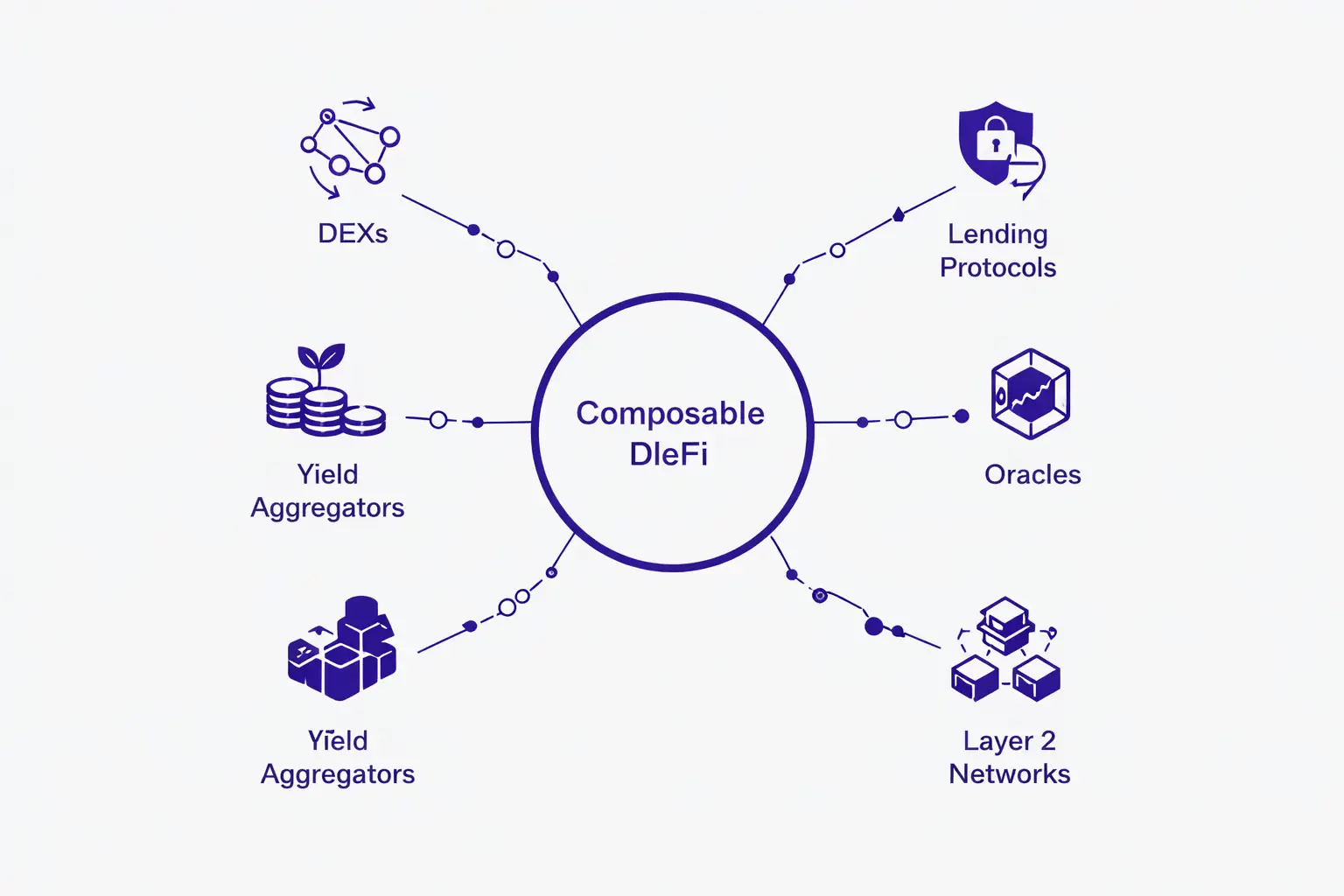

- ▹Composability in DeFi refers to the ability of different protocols and smart contracts to seamlessly integrate and work together, creating a modular financial ecosystem where components can be combined like building blocks.

- ▹DeFi composability enables developers to build on existing protocols without permission, accelerating innovation and reducing development time from months to weeks or even days.

- ▹The “Money Legos” concept illustrates how DeFi protocols can be stacked and combined to create complex financial products, similar to how Lego blocks connect to form intricate structures.

- ▹Smart contracts serve as the foundation for composable DeFi protocols, providing standardized interfaces that allow different applications to communicate and interact automatically.

- ▹While composability and interoperability are related concepts, composability focuses on integration within a single blockchain ecosystem, whereas interoperability emphasizes cross-chain communication.

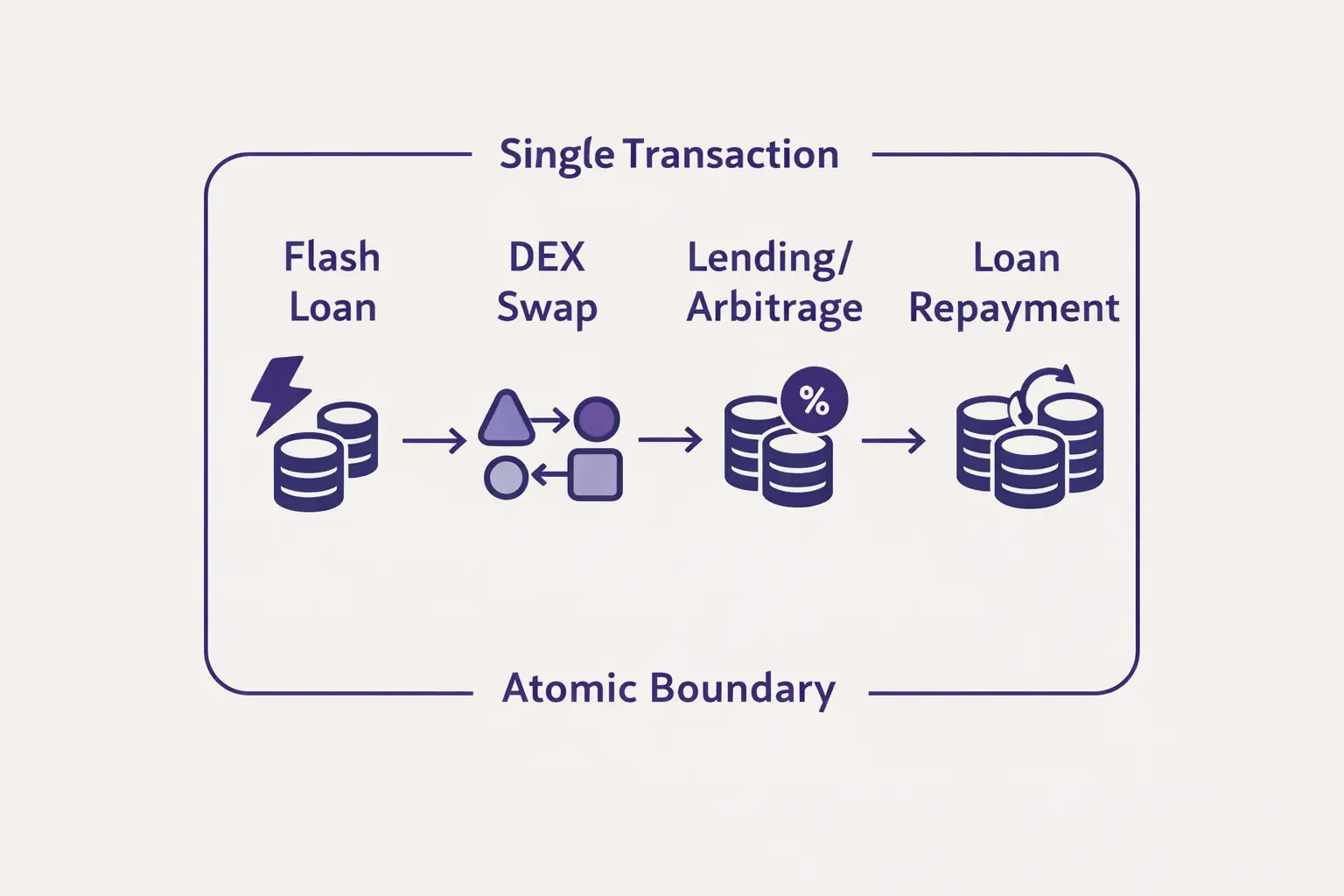

- ▹Real world examples of composability include yield aggregators like Yearn Finance that combine multiple lending protocols, and flash loan arbitrage strategies that leverage multiple DEXs in a single transaction.

- ▹The primary risks of composability include cascading failures where vulnerabilities in one protocol can affect entire ecosystems, and increased complexity that makes security auditing more challenging.

- ▹Layer 2 scaling solutions introduce new composability challenges by fragmenting liquidity and state across different chains, requiring bridge protocols and cross-layer communication mechanisms.

- ▹Modular blockchain architectures are emerging as solutions to enhance composability while maintaining security and scalability, separating concerns like consensus, data availability, and execution.

- ▹The future of composability in DeFi points toward improved cross-chain solutions, enhanced security frameworks, and more sophisticated tooling that will enable even more complex financial innovations.

The decentralized finance landscape has undergone a remarkable transformation over the past few years, evolving from simple token swaps to a sophisticated ecosystem of interconnected financial protocols. At the heart of this evolution lies a powerful concept that distinguishes DeFi from traditional finance: composability. This fundamental characteristic has become the driving force behind unprecedented innovation in the blockchain space, enabling developers to create increasingly complex financial products by building upon existing infrastructure.

Composability in DeFi represents more than just a technical feature; it embodies a philosophical shift in how we conceptualize financial systems. Unlike traditional finance, where institutions operate in silos with proprietary systems and restricted access, DeFi protocols function as open, permissionless building blocks that anyone can access, integrate, and combine. This openness has catalyzed an explosion of creativity, allowing developers to experiment with novel financial mechanisms and users to access sophisticated financial services previously reserved for institutional players.

Understanding composability is essential for anyone looking to grasp the true potential of decentralized finance. Whether you are a developer building the next generation of DeFi applications, an investor seeking to understand market dynamics, or simply a curious observer of the blockchain revolution, recognizing how composability shapes the DeFi ecosystem provides crucial insights into both current capabilities and future possibilities. This comprehensive guide explores every facet of composability, from its technical foundations to its economic implications, offering a detailed roadmap through one of the most transformative concepts in modern finance.

What Does “Composability” Mean in Decentralized Finance?

Composability in decentralized finance refers to the inherent ability of DeFi protocols to seamlessly interact, integrate, and build upon one another without requiring explicit permission or extensive customization. At its core, composability means that different smart contracts and protocols can function as modular components in a larger financial ecosystem, much like Lego bricks that can be assembled in countless configurations to create diverse structures.

The technical foundation of DeFi composability rests on several key principles. First, protocols must expose standardized interfaces that other contracts can reliably call and interact with. These interfaces define how external parties can deposit funds, withdraw assets, query balances, or trigger specific functions. When protocols adhere to common standards like ERC-20 for tokens or established patterns for lending pools, they become inherently more composable because developers can build integrations with confidence that their code will function as expected.

Second, composability requires that protocols maintain open and permissionless access. In traditional finance, integrating with a bank’s API requires lengthy approval processes, legal agreements, and often significant fees. DeFi protocols, by contrast, are accessible to anyone with an internet connection and the technical knowledge to interact with smart contracts. This permissionless nature dramatically lowers the barriers to innovation, enabling developers worldwide to experiment with new combinations and use cases without seeking authorization from protocol creators.

The concept extends beyond simple integration to encompass atomic composability, where multiple protocol interactions can occur within a single blockchain transaction. This means a user can swap tokens on a decentralized exchange, deposit those tokens into a lending protocol, and use the resulting receipt tokens as collateral elsewhere, all in one seamless operation that either fully succeeds or fully reverts. This atomic nature provides powerful guarantees and enables sophisticated strategies that would be impossible in traditional finance.

The Origins of Composability: Lessons from Open-Source Software

The concept of composability in DeFi draws heavily from decades of experience in open-source software development. Long before blockchain emerged, software engineers recognized the value of creating reusable, modular components that could be freely combined to build more complex systems. Libraries, frameworks, and APIs became the building blocks of modern software, enabling developers to stand on the shoulders of giants rather than reinventing wheels.

The Unix philosophy, formulated in the early days of computing, emphasized creating small programs that do one thing well and can be chained together through standard interfaces. This approach proved remarkably successful, with Unix tools becoming foundational to modern computing infrastructure. DeFi protocols embody this same philosophy: each protocol focuses on a specific financial primitive such as lending, exchanging, or providing insurance, and these primitives can be combined to create sophisticated financial products.

The open-source movement demonstrated that when code is freely available for inspection, modification, and integration, innovation accelerates exponentially. Linux, Apache, and countless other open-source projects became industry standards not despite their openness but because of it. Developers could audit code for security vulnerabilities, adapt it to new use cases, and contribute improvements back to the community. DeFi brings this ethos to finance, where protocols are open-source by necessity since smart contracts on public blockchains must be transparent and verifiable.

However, DeFi composability goes beyond traditional open-source software in significant ways. While software libraries provide code that can be copied and modified, DeFi protocols represent live, stateful systems managing real economic value. When developers compose DeFi protocols, they are not just combining code; they are orchestrating interactions between independent economic agents, each with their own liquidity, governance, and risk parameters. This adds layers of complexity and opportunity that distinguish DeFi composability from its software predecessors.

Types of Composability in DeFi (Atomic, Synchronous, Asynchronous)

Composability in DeFi manifests in several distinct forms, each with unique characteristics, advantages, and limitations. Understanding these different types helps clarify both the capabilities and constraints of various DeFi architectures, particularly as the ecosystem expands across multiple blockchains and scaling solutions.

| Composability Type | Definition | Key Characteristics | Use Cases |

|---|---|---|---|

| Atomic Composability | Multiple protocol interactions occur within a single transaction that either fully succeeds or fully reverts | Instant execution, all-or-nothing guarantee, no intermediate states visible | Flash loans, arbitrage strategies, complex swaps, collateral management |

| Synchronous Composability | Protocols interact in real-time with immediate state updates visible across the ecosystem | Real-time state access, immediate settlement, shared execution environment | Price oracles, liquidity aggregation, instant liquidations, automated market makers |

| Asynchronous Composability | Protocols interact across different execution environments or time periods with message passing | Delayed finality, cross-chain messages, eventual consistency, bridge dependencies | Cross-chain swaps, layer 2 interactions, multi-chain yield strategies, bridge protocols |

Atomic Composability represents the gold standard in DeFi integration. When protocols exhibit atomic composability, developers can chain multiple operations together with the guarantee that either all operations succeed or the entire transaction reverts, leaving no partial state changes. This property enables powerful use cases like flash loans, where users can borrow unlimited amounts of capital, use it for arbitrage or other operations, and repay the loan, all within a single transaction block. If the borrower cannot repay, the transaction simply fails and the loan never occurs.

Synchronous Composability extends beyond atomic execution to encompass real-time state visibility and interaction. In synchronously composable systems, when one protocol updates its state, that change is immediately visible and actionable by all other protocols in the same execution environment. This creates a living, breathing financial ecosystem where price changes, liquidity movements, and risk parameters propagate instantly. Ethereum and other monolithic Layer 1 blockchains typically provide strong synchronous composability within their execution environments.

Asynchronous Composability emerges as DeFi expands across multiple chains and scaling solutions. When protocols live in different execution environments, they can no longer interact synchronously. Instead, they must rely on message passing, bridge protocols, and eventual consistency models. A user might initiate a transaction on Ethereum, which triggers actions on Arbitrum or Polygon through bridge messages, with finality occurring only after confirmations on both chains. While this introduces latency and complexity, asynchronous composability is essential for scaling DeFi beyond the throughput limitations of any single blockchain.

Why Composability Is Called the “Money Lego” Concept

The “Money Legos” metaphor has become ubiquitous in DeFi circles, and for good reason. It perfectly captures the modular, stackable nature of composable financial protocols. Just as Lego bricks feature standardized connection points that allow any brick to attach to any other brick, DeFi protocols provide standardized interfaces that enable seamless integration. A child building with Legos doesn’t need to ask permission from the Lego company or negotiate terms; they simply snap pieces together according to their vision. Similarly, a DeFi developer can combine protocols without seeking authorization, creating novel financial products by stacking existing primitives.

The metaphor extends deeper when we consider the creative possibilities. With a limited set of basic Lego bricks, builders can construct an infinite variety of structures, from simple houses to complex mechanical contraptions. The same principle applies to DeFi composability. A handful of fundamental protocols, including decentralized exchanges, lending platforms, stablecoins, and derivative contracts, can be arranged in countless configurations to produce everything from simple yield strategies to sophisticated automated trading systems and risk management frameworks.

Moreover, Legos exhibit what engineers call “emergent complexity,” where simple components combine to create systems far more sophisticated than their individual parts. In DeFi, this emergent property manifests as protocols that leverage multiple underlying primitives to offer functionality that none of the base layers provide independently. Yield aggregators exemplify this perfectly: they automatically allocate capital across multiple lending protocols, rebalancing based on interest rates and risk parameters, creating an optimized yield product that emerges from the composition of simpler lending markets.

However, the Money Legos metaphor also hints at inherent risks. When building tall or complex Lego structures, stability becomes a concern. One weak connection point can cause an entire structure to topple. In DeFi, this translates to systemic risk, where vulnerabilities in one protocol can cascade through an interconnected ecosystem. The same composability that enables innovation also creates pathways for failure propagation, making security and risk management paramount concerns in the DeFi space.

How Smart Contracts Enable Composable DeFi Protocols

Smart contracts serve as the technological bedrock upon which DeFi composability is built. These self-executing programs, deployed on blockchain networks, encode financial logic in transparent, immutable code that anyone can read, audit, and interact with. Unlike traditional financial infrastructure, which relies on proprietary systems and gatekeepers, smart contracts create open, programmable financial rails that enable permissionless composability.

The magic of smart contract composability lies in their standardized interfaces and deterministic execution. When a developer creates a DeFi protocol, they define public functions that external contracts can call. These functions operate according to predefined rules encoded in the contract, ensuring predictable behavior. For example, a lending protocol’s smart contract might expose a “deposit” function that anyone can call to supply assets, a “borrow” function for taking loans, and a “liquidate” function for managing undercollateralized positions. Other protocols can integrate these functions into their own logic, building higher-level functionality on top of this foundation.

Token standards play a crucial role in enabling composability. The ERC-20 standard for fungible tokens on Ethereum created a common language for representing and transferring value. When all tokens adhere to this standard, protocols can integrate with any token without writing custom code for each one. This standardization extends to other token types: ERC-721 for non-fungible tokens, ERC-1155 for multi-token standards, and various other specifications that create common interfaces across the ecosystem.

Developers working with blockchain technology leverage these standards to build increasingly sophisticated composable systems. The DeFi development process involves not just writing smart contracts, but designing them with composability in mind from the outset. This requires careful consideration of interface design, upgrade mechanisms, and interaction patterns that other protocols can reliably depend upon.

Smart contracts also enable composability through their transparency and verifiability. Because contract code is publicly visible on the blockchain, developers can thoroughly understand how a protocol works before integrating it. This transparency eliminates the information asymmetries that plague traditional finance, where proprietary systems operate as black boxes. In DeFi, anyone can audit contract code, verify claimed functionality, and identify potential risks or bugs before committing capital or building integrations.

Composability vs. Interoperability: Key Differences Explained

While composability and interoperability are frequently used interchangeably in blockchain discussions, they represent distinct concepts with important implications for protocol design and ecosystem development. Understanding the nuances between these terms helps clarify the different challenges and opportunities in DeFi architecture.

| Aspect | Composability | Interoperability |

|---|---|---|

| Scope | Integration within a single blockchain or execution environment | Communication and asset transfer across different blockchains |

| Execution Model | Synchronous, atomic transactions within shared state | Asynchronous messaging between independent state machines |

| Latency | Near-instant, typically within a single block | Variable delays based on cross-chain confirmation requirements |

| Trust Assumptions | Shared security model of underlying blockchain | Additional trust in bridge mechanisms and validators |

| Complexity | Simpler integration with direct contract calls | Complex infrastructure requiring bridges and relayers |

| Primary Benefit | Rapid innovation through protocol stacking | Access to liquidity and features across ecosystems |

Composability fundamentally concerns how protocols within the same execution environment can seamlessly integrate and build upon each other. When we discuss composability in the context of Ethereum, for instance, we are talking about how smart contracts deployed on Ethereum can call each other, share state, and execute complex multi-protocol operations within single transactions. This tight integration requires shared infrastructure, including consensus mechanisms, virtual machines, and state storage.

Interoperability, by contrast, addresses the challenge of connecting separate blockchain networks that operate independently with their own consensus rules, virtual machines, and state. Interoperability solutions, such as bridge protocols and cross-chain messaging systems, enable assets and information to flow between different blockchains. However, these solutions typically sacrifice the atomicity and immediacy that characterize composability within a single chain.

The distinction matters because each paradigm enables different capabilities and faces different limitations. Strong composability allows for the sophisticated financial engineering that defines modern DeFi, including flash loans, atomic arbitrage, and complex multi-step strategies. Interoperability, while less powerful in terms of atomic guarantees, expands the total addressable market and liquidity available to DeFi applications by connecting previously isolated ecosystems.

As the DeFi ecosystem evolves, we see increasing efforts to achieve both goals simultaneously. Layer 2 scaling solutions attempt to preserve Ethereum’s composability while improving scalability. Cross-chain protocols work to make interoperability more seamless and secure. The future of DeFi likely involves a spectrum of composability and interoperability, with different applications choosing different trade-offs based on their specific requirements.

Real-World Examples of Composability in DeFi Ecosystems

The true power of DeFi composability becomes evident when examining concrete examples of how protocols combine to create novel financial products and services. These real-world implementations demonstrate not just technical possibility but the practical value that composability delivers to users and developers alike.

Yield Aggregators and Automated Vaults: Platforms like Yearn Finance exemplify composability by automatically moving user funds across multiple lending protocols to optimize returns. When a user deposits USDC into a Yearn vault, the smart contract might allocate funds across Aave, Compound, and other lending markets, continuously rebalancing based on interest rates, gas costs, and risk parameters. This creates a sophisticated yield optimization product that emerges entirely from composing simpler lending primitives.

Flash Loan Arbitrage: Flash loans represent perhaps the most dramatic example of atomic composability. A trader can borrow millions of dollars from Aave, use those funds to exploit price discrepancies across multiple DEXs like Uniswap and SushiSwap, swap tokens back to the original asset, repay the loan with interest, and pocket the profit, all in a single transaction that takes seconds to execute. If any step fails, the entire transaction reverts and the loan never occurred. This zero-risk arbitrage opportunity exists purely because of composable smart contracts.

Collateral Optimization Strategies: Users can deposit ETH into Lido to receive stETH (staked ETH earning staking rewards), deposit that stETH into Aave as collateral, borrow stablecoins against it, and deploy those stablecoins into yield farming strategies. Each step leverages a different protocol, and the combined effect creates leveraged yield positions that would be impossible in traditional finance or without composability.

Decentralized Trading Aggregators: Protocols like 1inch and Matcha aggregate liquidity across dozens of DEXs, automatically routing trades through multiple venues to achieve optimal prices. A single swap might touch Uniswap, Curve, Balancer, and others, with the aggregator’s smart contract orchestrating the entire process. Users benefit from better execution without needing to understand the complexity underlying their trade.

Understanding these real-world applications of decentralized finance helps illustrate how composability transforms theoretical possibilities into practical financial services. Each example demonstrates how the combination of simple, well-designed protocols creates emergent value that exceeds the sum of individual components.

Benefits of Composability for Developers and Users

Composability in DeFi creates a virtuous cycle of innovation that benefits all ecosystem participants. For developers, the ability to build on existing protocols dramatically reduces development time, costs, and technical risks. Rather than implementing lending functionality from scratch, a developer can simply integrate with established protocols like Aave or Compound, leveraging their battle-tested code, accumulated liquidity, and proven security. This allows development teams to focus their limited resources on novel features rather than recreating foundational infrastructure.

The permissionless nature of DeFi composability accelerates the pace of innovation exponentially. In traditional finance, integrating with existing systems requires lengthy negotiations, legal agreements, and technical coordination with multiple parties. In DeFi, a developer can wake up with an idea, write smart contracts that compose existing protocols, and deploy a new product by evening, all without asking anyone’s permission. This removal of gatekeepers democratizes financial innovation, enabling creators from anywhere in the world to contribute to the ecosystem.

For users, composability translates into access to increasingly sophisticated financial products and services. Complex strategies that previously required institutional relationships and significant capital become available to anyone with an internet connection and a wallet. Users can earn yield on their assets, take leveraged positions, hedge risks, and access global liquidity pools, all through composable protocols that handle the complexity behind intuitive interfaces.

Composability also enhances capital efficiency throughout the DeFi ecosystem. When protocols can easily interact, assets can flow to their most productive uses automatically. A token sitting idle in a wallet can be deployed into lending markets, earning yield. That same token, when used as collateral, can support borrowing that enables further productive deployment. This creates multiple layers of utility from the same capital base, increasing overall system efficiency.

Moreover, composability creates network effects that strengthen over time. Each new protocol added to the ecosystem becomes a potential building block for future innovation. As the library of composable primitives grows, the possible combinations expand exponentially, creating an ever-expanding frontier of financial possibility. This network effect helps explain why DeFi has experienced such rapid growth despite the technical challenges and risks inherent in the space.

Composability’s Role in DeFi Innovation and Rapid Experimentation

The experimental culture of DeFi owes much of its vitality to composability. By lowering the barriers to trying new approaches, composability enables rapid iteration and experimentation that would be impossible in traditional financial systems. Developers can launch minimum viable products quickly, gather real-world usage data, and iterate based on actual market feedback rather than theoretical projections.

This experimental approach has led to innovations that redefined what is possible in finance. Automated market makers, pioneered by protocols like Uniswap, emerged from experimentation with constant product formulas in composable smart contracts. Flash loans, initially a somewhat obscure feature of Aave, became a fundamental building block for countless arbitrage and liquidation strategies. Liquidity mining and yield farming emerged organically as protocols experimented with token distribution mechanisms, composing incentive structures with existing DeFi primitives.

The composable nature of DeFi also enables what might be called “financial science” where developers can test hypotheses about market mechanisms, incentive structures, and economic dynamics in live environments with real capital at stake. While this carries risks, it also produces insights that academic research alone cannot provide. The rapid feedback loops created by composable protocols allow the ecosystem to evolve and improve far faster than traditional financial infrastructure.

Furthermore, composability facilitates specialization within the DeFi ecosystem. Rather than every protocol attempting to be a comprehensive financial platform, teams can focus on solving specific problems exceptionally well, knowing that others will compose their work into larger systems. This specialization increases overall quality as teams develop deep expertise in their chosen domains, whether that is lending, exchange mechanisms, derivatives, or any other financial primitive.

Risks and Challenges of Composability in DeFi

While composability drives innovation, it also introduces significant risks that the DeFi community continues to grapple with. The interconnected nature of composable protocols creates systemic dependencies where issues in one protocol can rapidly cascade throughout the ecosystem. This phenomenon, often described as contagion risk, represents one of the most serious challenges facing DeFi.

The complexity created by composability makes comprehensive security analysis extremely challenging. When protocols interact, the attack surface expands beyond what any single protocol audit can cover. Unexpected interactions between protocols can create vulnerabilities that exist only in the composition, not in any individual component. Historical exploits have demonstrated how attackers can exploit these emergent vulnerabilities, draining funds from protocols that appeared secure in isolation.

Oracle manipulation represents another serious risk amplified by composability. When multiple protocols depend on the same price oracles, attackers who can temporarily manipulate oracle prices can exploit many protocols simultaneously. Flash loan attacks often combine oracle manipulation with composability, allowing attackers to borrow large amounts, manipulate markets, trigger cascading liquidations or arbitrage opportunities across multiple protocols, and repay loans, all within a single transaction.

Governance attacks also become more concerning in highly composable ecosystems. If an attacker gains control of one protocol’s governance, they might be able to change parameters or behavior in ways that create vulnerabilities in other protocols that depend on it. This creates a governance attack surface that extends well beyond individual protocol boundaries, requiring careful consideration of governance security throughout the ecosystem.

Liquidity fragmentation poses another challenge as DeFi expands across multiple chains and Layer 2 solutions. While these scaling approaches are necessary for DeFi’s growth, they fracture the composability that makes DeFi powerful. Assets and protocols spread across different execution environments cannot interact with the same atomicity and immediacy as those on a single chain, forcing difficult trade-offs between scalability and composability.

Security Implications: Composability and Smart Contract Risk

Security in composable DeFi systems requires a fundamentally different approach than securing isolated applications. Traditional security audits examine individual smart contracts for vulnerabilities, but in composable systems, the interactions between contracts create an exponentially larger state space that must be considered. A protocol might be perfectly secure in isolation yet become vulnerable when composed with others in unexpected ways.

Reentrancy attacks exemplify how composability creates security challenges. When a contract calls an external contract, it temporarily relinquishes control, creating opportunities for the external contract to call back into the original contract before the first call completes. This can lead to unexpected state changes and fund drainage if not properly guarded against. The famous DAO hack of 2016, which led to Ethereum’s controversial hard fork, exploited a reentrancy vulnerability enabled by contract composition.

Flash loan attacks represent a unique security challenge enabled by atomic composability. Attackers can borrow enormous amounts of capital, manipulate markets across multiple protocols, and extract value, all without risking their own funds. Defending against these attacks requires protocols to consider not just their own security but how their mechanisms might be exploited when combined with vast borrowed capital and complex multi-protocol strategies.

The security challenge extends beyond technical vulnerabilities to include economic attacks. In composable systems, attackers can potentially profit by creating cascading failures across multiple protocols. They might short tokens, trigger liquidations, manipulate prices through DEX trades, and profit from the chaos they create. Defending against these economic attacks requires not just secure code but carefully designed economic mechanisms that remain robust under adversarial conditions.

To address these challenges, the DeFi community has developed various security practices. Formal verification, where contract behavior is mathematically proven to meet specifications, becomes increasingly important for critical protocols. Extensive testing, including simulation of complex multi-protocol interactions, helps identify vulnerabilities before deployment. Bug bounty programs incentivize white hat hackers to discover and report vulnerabilities responsibly. Insurance protocols emerge to pool risk and protect users from exploit losses.

How Layer 1 and Layer 2 Blockchains Affect Composability

The relationship between blockchain scalability and composability presents one of the most significant architectural challenges in DeFi. Layer 1 blockchains like Ethereum provide strong composability guarantees: all protocols share the same execution environment, state changes are synchronous and atomic, and developers can reliably compose contracts knowing they will execute in a single transaction. However, this monolithic architecture faces severe scalability limitations as transaction demand grows.

Layer 2 scaling solutions attempt to address these limitations by moving execution off the main chain while inheriting security from the underlying Layer 1. Solutions like Optimistic Rollups and ZK-Rollups batch many transactions together, settling them on Ethereum as compressed data. This dramatically increases throughput, but it fragments the execution environment. A protocol on Arbitrum cannot directly interact with a protocol on Optimism with the same atomic guarantees that exist within either chain.

This fragmentation creates challenging trade-offs. Within each Layer 2, protocols enjoy the same strong composability they would have on Layer 1, but the overall ecosystem becomes less composable as liquidity and applications spread across multiple environments. Users and developers must choose between the scalability benefits of Layer 2 adoption and the composability advantages of remaining on Layer 1, with no clear universal solution.

Alternative Layer 1 blockchains with higher throughput, such as Solana, Avalanche, and others, take different approaches to the scalability-composability trade-off. Some sacrifice certain decentralization properties to achieve higher transaction throughput while maintaining composability. Others implement different execution models or consensus mechanisms that enable greater scalability without fragmenting the execution environment. Each approach involves trade-offs that developers and users must understand when choosing where to build or deploy capital.

Emerging solutions attempt to restore composability across scaled environments. Shared sequencers aim to coordinate transaction ordering across multiple rollups, enabling some forms of atomic cross-rollup execution. Standardized bridge protocols and messaging layers work to make cross-chain interactions more seamless. The development of these solutions represents an active area of research and experimentation as the DeFi community works to achieve both scalability and composability simultaneously.

Composability in Cross-Chain and Modular DeFi Architectures

As DeFi matures, the ecosystem increasingly recognizes that no single blockchain will capture all activity. The future likely involves a multi-chain landscape where assets and protocols span numerous execution environments. This reality has spurred innovation in cross-chain composability, though achieving it requires fundamentally different technical approaches than single-chain composability.

Cross-chain bridges represent the most established approach to enabling composability across chains. These protocols lock assets on one chain and mint representative tokens on another, allowing users to move value between ecosystems. However, bridges introduce significant security challenges and typically sacrifice the atomic execution properties that make single-chain composability so powerful. A cross-chain transaction might succeed on one chain but fail on another, creating complex failure modes and rollback procedures.

Messaging protocols like LayerZero and Axelar enable more sophisticated cross-chain interactions beyond simple asset transfers. These systems allow smart contracts on different chains to send messages and trigger actions across chain boundaries. While powerful, message-based composability lacks the atomicity of single-chain execution. A protocol on Ethereum cannot know instantly whether its message successfully triggered an action on Avalanche, introducing latency and uncertainty into multi-chain workflows.

Modular blockchain architectures represent another approach to achieving composability at scale. These designs separate blockchain functions like consensus, data availability, and execution into distinct layers that can be optimized independently. Celestia, for instance, provides data availability while allowing various execution environments to settle on top. This modularity enables greater scalability while potentially preserving some composability properties, though the practical implications are still being explored.

Shared security models offer another path forward. When multiple chains share security infrastructure, such as through Ethereum’s upcoming “restaking” mechanisms or Cosmos’s interchain security, they can potentially achieve stronger composability guarantees than fully independent chains. The shared security reduces some risks of cross-chain interactions, though significant technical and economic challenges remain in implementing these systems at scale.

Economic Impact of Composability on DeFi Protocol Growth

Composability fundamentally alters the economics of DeFi protocol development and growth. In traditional software businesses, network effects typically favor incumbents who accumulate users and data, creating moats that protect market position. DeFi composability inverts this dynamic in several ways, creating both opportunities and challenges for protocol developers and investors.

First, composability dramatically reduces the cost of entry for new protocols. Rather than building complete financial stacks from scratch, new entrants can focus on specific innovations while composing with existing infrastructure for everything else. This lowers barriers to entry and accelerates competition, preventing any single protocol from establishing an unassailable monopoly. The ease of forking open-source contracts further intensifies this competitive pressure.

However, composability also creates powerful network effects that benefit established protocols. A protocol with significant integrations becomes increasingly valuable as more applications build on top of it. Liquidity aggregates in widely integrated protocols because users and developers prefer battle-tested, widely composable infrastructure over newer alternatives. This creates a form of “composability moat” where success breeds further success.

The economic models of DeFi protocols must account for composability in their design. Protocols capture value through various mechanisms: transaction fees, governance tokens, protocol-owned liquidity, and participation in the broader ecosystem. Successful protocols balance extracting value from users with maintaining competitiveness against composable alternatives. Too much value extraction drives users to competitors; too little fails to reward protocol stakeholders adequately.

Composability also impacts how protocols think about growth and partnerships. Rather than viewing other protocols as pure competitors, successful projects recognize the value of positive-sum collaboration. Integrations with complementary protocols can drive growth for all parties by expanding the total functionality available to users. This collaborative dynamic distinguishes DeFi from traditional finance, where competitive moats and exclusive partnerships dominate strategic thinking.

The Future of Composability in Decentralized Finance

The future evolution of composability in DeFi will likely follow several parallel tracks, each addressing different aspects of the scalability-composability trade-off while pushing the boundaries of what decentralized financial systems can achieve. Technical innovation, regulatory developments, and market dynamics will all shape how composability develops in the coming years.

On the technical front, improvements in cross-chain communication and shared sequencing could enable new forms of composability that span multiple execution environments while preserving atomic properties. Zero-knowledge proofs may enable privacy-preserving composability, where protocols can interact and verify conditions without revealing sensitive information. Improved formal verification tools will help developers build more secure composable systems, reducing the risks that currently limit mainstream adoption.

Account abstraction represents another frontier that could enhance composability by making smart contract wallets the default user experience. When users interact with DeFi through programmable accounts rather than externally owned accounts, entire new classes of composable applications become possible, including automated trading strategies, sophisticated risk management, and seamless multi-protocol interactions that happen behind simple user interfaces.

Artificial intelligence and machine learning may play increasingly important roles in composable DeFi. AI could help identify optimal compositions of protocols for specific objectives, automatically route transactions across complex protocol graphs, or detect anomalous behaviors that might indicate exploits or attacks. The intersection of AI and composable DeFi represents largely unexplored territory with significant potential.

Regulatory clarity will significantly impact how composability evolves, particularly regarding questions of liability and compliance in composable systems. As regulators develop frameworks for DeFi, protocols will need to navigate requirements around know-your-customer procedures, anti-money laundering compliance, and securities regulation while preserving the permissionless composability that makes DeFi innovative. This balance will require both technical solutions and constructive dialogue between the DeFi community and regulatory authorities.

Looking further ahead, composability may extend beyond financial protocols to encompass broader decentralized systems. Composable identity, reputation, and governance systems could integrate with DeFi protocols to create more sophisticated risk assessment, customized financial products, and community-driven financial services. The vision of fully composable decentralized infrastructure, where everything from finance to social coordination to data storage interoperates seamlessly, remains distant but increasingly plausible.

Explore the Power of Composability in DeFi

Build smarter decentralized applications by leveraging composable protocols that work together seamlessly. Discover how modular DeFi design can accelerate innovation and unlock new financial possibilities.

Expert Insight from Industry Leaders

With over eight years of specialized experience in blockchain development and DeFi protocol design, Nadcab Labs has witnessed firsthand how composability has transformed the decentralized finance landscape from its earliest days to the sophisticated ecosystem we see today. Our team has built and audited numerous composable DeFi protocols, navigating the complex technical and security challenges that arise when multiple smart contracts interact in intricate ways.

Throughout our extensive work in the DeFi space, we have consistently observed that successful composable protocols share several key characteristics: they prioritize security through comprehensive audits and formal verification, they design interfaces with future composability in mind rather than as an afterthought, they maintain clear documentation that enables other developers to integrate confidently, and they engage actively with the broader ecosystem to understand how their protocols are being used and composed.

Our expertise encompasses every aspect of composable DeFi development, from smart contract architecture and security auditing to economic modeling and cross-chain integration. We have helped clients design protocols that safely compose with existing DeFi infrastructure while introducing novel functionality, and we have identified and remediated composability-related vulnerabilities before they could be exploited. This deep technical experience, combined with our commitment to advancing the entire DeFi ecosystem, positions Nadcab Labs as a trusted partner for projects seeking to harness the power of composability while managing its inherent risks.

As DeFi continues evolving toward a multi-chain, highly scalable future, we remain at the forefront of research and development in composability solutions. Our team actively contributes to emerging standards for cross-chain communication, modular blockchain architectures, and security best practices for composable systems. We believe that the future of finance will be built on composable foundations, and we are committed to ensuring that future is both innovative and secure.

Frequently Asked Questions

Unlike traditional APIs that require permission, authentication, and often complex business agreements, DeFi composability is permissionless and operates through transparent smart contracts. Any developer can integrate with any protocol without seeking approval, and all interactions happen on-chain with verifiable execution. Traditional APIs can be changed or restricted by their providers, while DeFi protocols maintain consistent interfaces governed by decentralized communities.

Cross-chain composability is technically possible but faces significant challenges compared to single-chain composability. Bridge protocols and messaging systems enable protocols on different chains to interact, but these interactions lack the atomic execution guarantees of single-chain composability. Transactions across chains introduce latency, additional trust assumptions, and more complex failure modes. However, emerging technologies like shared sequencers and modular blockchain architectures aim to improve cross-chain composability.

Developers maintain composability through careful upgrade mechanisms, comprehensive documentation, and strong communication with integrators. Many protocols use proxy patterns or modular architectures that allow upgrades while preserving external interfaces. Governance processes should consider the impact of changes on dependent protocols. Additionally, maintaining active developer relations and providing migration paths for breaking changes helps preserve the ecosystem of integrations built on top of a protocol.

The primary risks include cascading failures where vulnerabilities in one protocol affect others, oracle manipulation that impacts multiple dependent protocols simultaneously, unexpected interactions between protocols that create novel attack vectors, and governance attacks that could compromise entire ecosystems. Flash loan attacks exemplify how composability enables sophisticated exploits combining multiple protocols. Users should understand the full stack of protocols they interact with and recognize that security is only as strong as the weakest link in the composition.

Gas costs can significantly impact composability because complex multi-protocol transactions consume more computational resources and thus cost more to execute. Developers must balance the desire for rich functionality with gas efficiency. Some optimization strategies include batching operations, using efficient data structures, minimizing storage operations, and implementing gas-aware designs that allow users to choose between comprehensive but expensive operations and simpler but cheaper alternatives. Layer 2 solutions partially address this by reducing transaction costs while preserving composability.

Token standards like ERC-20, ERC-721, and ERC-1155 are fundamental to composability because they provide common interfaces that protocols can reliably interact with. When all tokens follow these standards, protocols can integrate with any token without custom code for each one. This standardization extends beyond basic transfer functions to include allowances, metadata, and other features that enable sophisticated integrations. New standards continue emerging to support novel use cases while maintaining the composability benefits of standardization.

Layer 2 solutions preserve strong composability within each L2 environment but fragment composability across the broader ecosystem. Protocols on Optimism cannot atomically compose with protocols on Arbitrum with the same guarantees as protocols on the same chain. This creates trade-offs where users must choose between the high composability of staying within one ecosystem and the benefits of accessing protocols across multiple L2s. Emerging solutions like shared sequencers and improved bridge protocols aim to restore some cross-L2 composability.

Flash loans are uncollateralized loans that must be borrowed and repaid within a single transaction, made possible by atomic composability. They matter because they enable capital-efficient strategies and arbitrage opportunities while democratizing access to large amounts of capital. Anyone can borrow millions of dollars for a single transaction without collateral, using it to execute complex strategies across multiple protocols. This innovation exists purely because of composability and has spawned entire categories of DeFi strategies and applications.

Users should practice several safety measures: understand the full stack of protocols involved in any transaction, use protocols with thorough audits and established track records, start with small amounts when trying new protocol combinations, monitor for unusual activity or sudden changes in protocol behavior, use hardware wallets for significant holdings, and consider purchasing DeFi insurance for large positions. Additionally, staying informed about security best practices and following announcements from protocols they use helps users respond quickly to any discovered vulnerabilities.

Composability will likely become even more critical as DeFi matures rather than less relevant. While some consolidation may occur with dominant protocols emerging in various categories, the fundamental value proposition of permissionless, modular financial infrastructure remains powerful. Composability enables continuous innovation built on established foundations, prevents monopolization by allowing competitors to leverage existing infrastructure, and creates network effects that benefit the entire ecosystem. As DeFi interfaces with traditional finance and expands to serve broader audiences, composability will enable the customization and specialization necessary to meet diverse needs.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.