At our work on blockchain platforms at Nadcab Labs, we’ve witnessed firsthand how decentralized models can up-end legacy infrastructure. From token-based governance to smart contract automation, our team designed systems where thousands of independent contributors shared in value creation. Now, as the concept of a Decentralized Physical Infrastructure Network (DePIN) gains traction, we see the same shift happening, but this time in real-world hardware, services and networks, not just digital protocols. This article unpacks everything you need to know about DePIN: the full-form, how it works, the types, use-cases, market size, risks, governance, tokenomics, and how you can engage.

What Is DePIN?

DePIN stands for Decentralized Physical Infrastructure Network. In simple terms, a DePIN uses blockchain, tokens and smart contracts to coordinate, incentivize and govern physical infrastructure (hardware, nodes, services) in a distributed manner instead of relying solely on centralized corporations. For example, a network of WiFi hotspots, distributed sensors, compute nodes or energy assets can be managed via decentralized rules, with participants rewarded for performance, uptime and contributions to the network.

Key characteristics of a DePIN:

- Participation of physical assets (hardware, nodes) owned/operated by individuals or small entities.

- Tokenized incentives for node contribution, service provision, data-relay, compute or storage.

- A governance layer (often token-based) enabling collective decision-making, rewards, protocol upgrades.

- Transparent ledger-based operations: node metrics, rewards, usage and service agreements on-chain.

- Real-world utility and service delivery: not just token speculation, but actual infrastructure (connectivity, compute, energy, sensing) used by consumers or enterprises.

What is DePIN in crypto?

DePIN in crypto refers to a new wave of blockchain-powered infrastructure networks where communities, not corporations, build and maintain physical systems like wireless networks, storage, computing, or energy grids. It combines real-world assets with decentralized ownership, allowing contributors to earn tokens for providing hardware, bandwidth, or data. This approach removes intermediaries, enhances transparency, and makes infrastructure deployment more efficient and community-driven. DePIN represents the merging of physical and digital economies, where users become stakeholders in the systems they help create, leading to a more open, sustainable, and incentive-aligned infrastructure ecosystem for the Web3 era.

How DePIN Works

Let’s explore typical mechanics of a DePIN from deployment through governance:

Node deployment & contribution

A participant joins by deploying hardware in a location and connecting it to the network. They may stake tokens or meet onboarding criteria.

Verification & proof systems

The network verifies that the node is performing, just like providing coverage, transmitting data, storing files or computing tasks. This often uses proofs like “proof of coverage”, “proof of storage”, “proof of compute”.

Reward/incentive mechanism

Based on verified contribution, nodes receive token rewards. These tokens may represent governance rights, financial rewards, or service access.

Service consumption & fee flows

Consumers (end-users, businesses) pay for the infrastructure service either in tokens or fiat. Fees either go to the node operators or the network treasury, depending on protocol design.

Governance & upgrades

Token-holders propose and vote on network parameters, such as reward emission rates, node requirements, protocol upgrades. The decentralized governance ensures no single operator controls the infrastructure.

Scaling & participation

As more nodes join globally, network coverage improves, service quality increases, and economies of scale kick in. This growth incentivizes more participants.

Transparency & auditability

Because ledger entries (node performance, transactional flows, rewards) are on the blockchain, participants and outsiders can audit performance metrics, enhancing trust and reducing reliance on opaque operators.

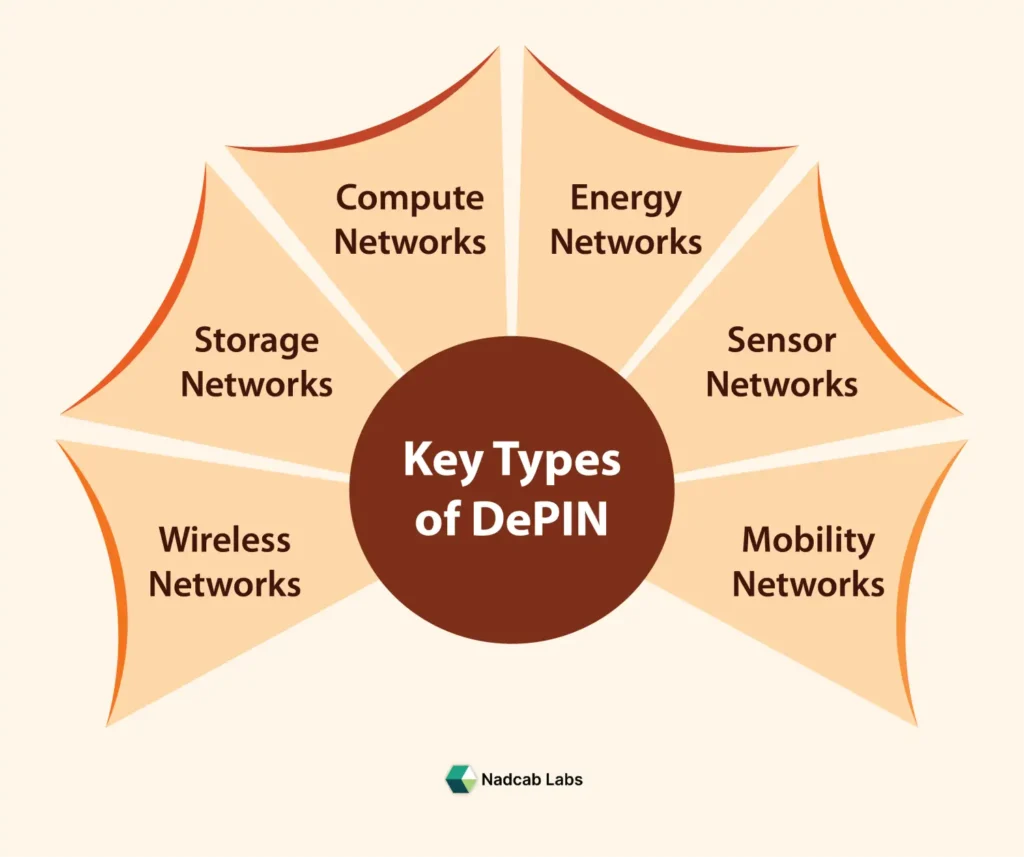

Key Types and Use-Cases of DePIN

Here are the key types of DePIN projects that define the growing decentralized infrastructure ecosystem:

- Wireless Networks (Connectivity DePINs) – These projects create decentralized communication systems, where users provide network coverage through hardware nodes and earn crypto rewards.

Example: Helium Network, offering community-powered wireless connectivity for IoT and 5G devices. - Storage Networks (Data DePINs) – Focused on decentralized file storage and data hosting, ensuring privacy and censorship resistance while rewarding users for providing disk space.

Example: Filecoin and Arweave, enabling secure and permanent decentralized data storage. - Compute Networks (Processing DePINs) – Provide decentralized computing power, allowing developers and AI applications to access affordable and distributed resources.

Example: Render Network and Akash Network, offering GPU and cloud computing through tokenized incentives. - Energy Networks (Power DePINs) – Enable peer-to-peer renewable energy sharing and trading without central control.

Example: EnergyWeb and Power Ledger, which facilitate green energy tokenization and decentralized grid management. - Sensor Networks (IoT DePINs) – Build real-world data networks where individuals deploy sensors to collect and monetize environmental, traffic, or location data.

Example: WeatherXM and DIMO, gathering weather and mobility data from decentralized devices. - Mobility Networks (Transport DePINs) – Focus on decentralizing mobility and logistics by rewarding participants for vehicle data or transportation services.

Example: Peaq Network, powering decentralized mobility and machine economies.

Each type of DePIN project contributes to building a community-owned physical infrastructure, aligning real-world value creation with blockchain based solutions and governance.

Why DePIN Matters

DePIN matters because it represents a major shift in how physical infrastructure is built, owned, and maintained. Instead of relying on large corporations or governments, DePIN empowers individuals and communities to contribute directly to the creation of real-world networks such as connectivity, storage, and energy while earning rewards for their participation. This model promotes fairness, transparency, and efficiency by cutting out intermediaries and redistributing value to those who actually support the network.

Moreover, DePIN bridges the gap between blockchain and the real world, giving crypto tangible utility beyond trading or speculation. It allows users to earn income from their hardware, data, or resources, creating new economic opportunities globally. As industries move toward decentralization, DePIN ensures that infrastructure remains open, inclusive, and community-driven, fueling the future of digital and physical innovation.

DePIN Projects to Explore Worldwide

| Sr. No. | Project | Description |

|---|---|---|

| 1 | Filecoin (FIL) | A decentralised storage network where individuals rent out hard-drive space and earn FIL tokens.[1] |

| 2 | Render Token (RNDR) | A GPU rendering network allowing node-operators to contribute compute power and earn tokens. |

| 3 | Helium (HNT) | A community-powered wireless/IoT network where hotspot owners are rewarded for providing network coverage. |

| 4 | Arweave (AR) | A permanent data storage network (“permaweb”) where nodes store data long-term and earn rewards.[2] |

| 5 | Theta Token (THETA) | A decentralised video streaming and content delivery network where bandwidth contributors earn rewards. |

| 6 | IOTA (MIOTA) | Built on a DAG rather than blockchain, IOTA supports decentralised data exchange and infrastructure for IoT devices. |

| 7 | WiFi Map (WIFI) | A service where users add or validate WiFi hotspots globally and earn $WIFI tokens, creating a decentralised connectivity network. |

| 8 | Akash Network (AKT) | A decentralised cloud-computing marketplace where providers offer compute servers and earn rewards in AKT.[3] |

| 9 | Spheron Network | Provides decentralised cloud compute/storage and tools for deployment, part of the DePIN compute/storage category.[4] |

| 10 | NuNet | A decentralised computing infrastructure project enabling users to lease unused compute resources, targeting AI workloads and DePIN-computing.[5] |

Security Considerations in DePIN

Security lies at the heart of every DePIN (Decentralized Physical Infrastructure Network) project. Since these networks bridge the gap between digital blockchains and real-world physical infrastructure, ensuring security across both domains is a complex but critical challenge. Below are the key security considerations every DePIN participant from node operators to developers and investors must understand.

-

Data Integrity and Authenticity

DePIN networks rely on data collected from decentralized devices such as IoT sensors, storage nodes, or bandwidth providers. Ensuring that this data is accurate and unaltered is crucial.

To maintain data integrity, cryptographic signatures and blockchain immutability are used. However, devices in the field can still be compromised, leading to data falsification or spoofing attacks.

Example: In a decentralized mapping project like Hivemapper, falsified GPS data could distort the accuracy of global maps if not verified through multiple trusted nodes.

-

Device Security and Physical Tampering

Unlike traditional blockchains that operate purely in digital environments, DePIN involves physical devices (hotspots, sensors, antennas, etc.) that can be tampered with or stolen. Attackers could manipulate device firmware or data to falsely claim rewards.

Developers must implement:

- Hardware-level encryption modules (TPM chips or secure enclaves).

- Firmware verification systems that validate device authenticity on startup.

- Periodic audits or reputation systems for devices providing inconsistent data.

-

Network Exploits and Sybil Attacks

Because DePIN networks depend on user participation, they’re vulnerable to Sybil attacks, where a single entity creates multiple fake nodes to manipulate consensus or drain token rewards.

To mitigate this, projects often use:

- Proof-of-Coverage (PoC) or Proof-of-Location (PoL), which requires physical signal verification.

- Staking mechanisms, ensuring malicious actors risk losing collateral for dishonest participation.

-

Smart Contract Vulnerabilities

DePIN protocols operate on smart contracts that handle everything from reward distribution to governance voting. A flaw or exploit in the contract can lead to large-scale losses, similar to the infamous DAO hack of 2016.

Best practices include:

- Multi-layer code audits by independent security firms.

- Use of formal verification tools for contract validation.

- Time-locks and multi-signature wallets for treasury management.

-

Privacy Concerns and Data Leakage

Since DePIN networks often gather physical-world data from environmental metrics to geolocation, privacy is a growing concern. If not properly encrypted, user information could be exposed to unauthorized entities.

Privacy-preserving technologies like Zero-Knowledge Proofs (ZKPs) and Homomorphic Encryption are emerging as solutions to ensure data confidentiality while maintaining transparency.

6. Token Reward Manipulation

DePINs use incentive models to reward participants who contribute resources. Attackers might exploit vulnerabilities in reward distribution algorithms to claim unearned tokens.

Safeguards include:

- Cross-verification of device output.

- Randomized task assignment to prevent pattern-based fraud.

- AI-based anomaly detection to identify suspicious reward patterns.

-

Centralization Risks in Infrastructure

While the goal of DePIN is decentralization, uneven node distribution or dependency on centralized cloud infrastructure can undermine this principle. A few entities controlling most of the compute or storage nodes could manipulate network operations. Decentralization should be reinforced by encouraging geographically distributed participation, open hardware onboarding, and multi-network interoperability to prevent power concentration.

-

Governance Security

As DePIN ecosystems grow, governance shifts to decentralized decision-making through DAOs. Poorly designed voting mechanisms or low participation can make governance vulnerable to manipulation.

Projects are increasingly adopting:

- Quadratic voting to prevent whale dominance.

- Delegated governance with transparent proposal systems.

- On-chain audits to track governance outcomes.

-

Compliance and Regulatory Security

DePIN operates in a gray area where physical operations intersect with blockchain finance. Projects must ensure compliance with data laws (GDPR, CCPA) and telecom or energy regulations, depending on their domain.

Non-compliance can lead to shutdowns or sanctions. Integrating KYC-compliant participation systems and jurisdiction-based restrictions can mitigate risks while maintaining decentralization.

-

Continuous Security Monitoring

Security in DePIN isn’t a one-time task. Networks need continuous monitoring, community-based bug bounty programs, and AI-driven threat detection. This ensures early identification of exploits and rapid response.

Build Your DePIN Infrastructure with Experts!

Partner with Nadcab Labs to launch and optimize your Decentralized Physical Infrastructure Network project with cutting-edge blockchain solutions.

What Are PRNs and DRNs in DePIN?

In the DePIN ecosystem, two major network categories are often discussed:

- PRN – Physical Resource Networks

- DRN – Digital Resource Networks

These represent two complementary layers of the DePIN infrastructure stack, one tied to real-world assets (like hardware and sensors), and the other focused on digital or computational resources.

-

PRNs (Physical Resource Networks)

Definition:

PRNs refer to blockchain-powered networks that manage real-world physical infrastructure. This includes hardware-based systems like wireless networks, sensor grids, renewable energy systems, and decentralized storage setups.

How They Work:

Participants deploy physical devices (routers, antennas, nodes, solar panels, etc.) that contribute to the network’s functionality. In return, they earn crypto tokens for maintaining and expanding the network.

Examples:

- Helium Network – community members install wireless hotspots to provide IoT and 5G coverage.

- Hivemapper – drivers capture real-world imagery using dashcams to build a decentralized map.

- Power Ledger – users share renewable energy through a tokenized, peer-to-peer power network.

Key Insight:

PRNs bridge the physical world with the blockchain, enabling anyone to own and operate parts of infrastructure traditionally dominated by centralized corporations.

-

DRNs (Digital Resource Networks)

Definition:

DRNs handle digital resources such as data storage, cloud computing, content delivery, or AI processing through decentralized networks.

How They Work:

Users contribute computing power, bandwidth, or digital assets and get rewarded in tokens. Instead of physical nodes, DRNs rely on software-based or virtualized resources.

Examples:

- Filecoin – decentralized data storage network.

- Render Network – distributes GPU rendering tasks across global nodes.

- Akash Network – offers decentralized cloud computing for Web3 apps.

Key Insight:

DRNs represent the digital backbone of DePIN handling the computational side of decentralized infrastructure without relying on centralized data centers.

PRNs + DRNs = The Full DePIN Ecosystem

DePIN’s real innovation comes from combining PRNs and DRNs.

Together, they create hybrid ecosystems where physical and digital resources interact seamlessly on blockchain rails.

Example of Integration:

A decentralized drone mapping system could use:

- PRN for operating physical drones and sensors.

- DRN for processing and storing the collected map data on distributed cloud servers.

This hybrid model powers smart cities, autonomous logistics, and community-driven infrastructure, paving the way for a new kind of economy one owned by its users.

Governance in DePIN

Governance distinguishes DePIN from purely technical networks:

- Proposal mechanism: Token-holders submit proposals on protocol changes, node criteria, reward structure.

- Voting model: Voting power may be proportional to tokens held, delegated, or weighted by contribution.

- Treasury oversight: Many DePINs maintain a treasury funded by service fees, used for ecosystem growth, incentives, buybacks.

- Community trust & decentralization: Transparent on-chain governance helps avoid centralized operator dominance.

- Legal/authentic wrapper: Some DePINs incorporate legal frameworks (LLCs, cooperatives) to align with regulation.

- Upgradability: Infrastructure is physical; governance must handle hardware upgrades, node replacements, protocol forks.

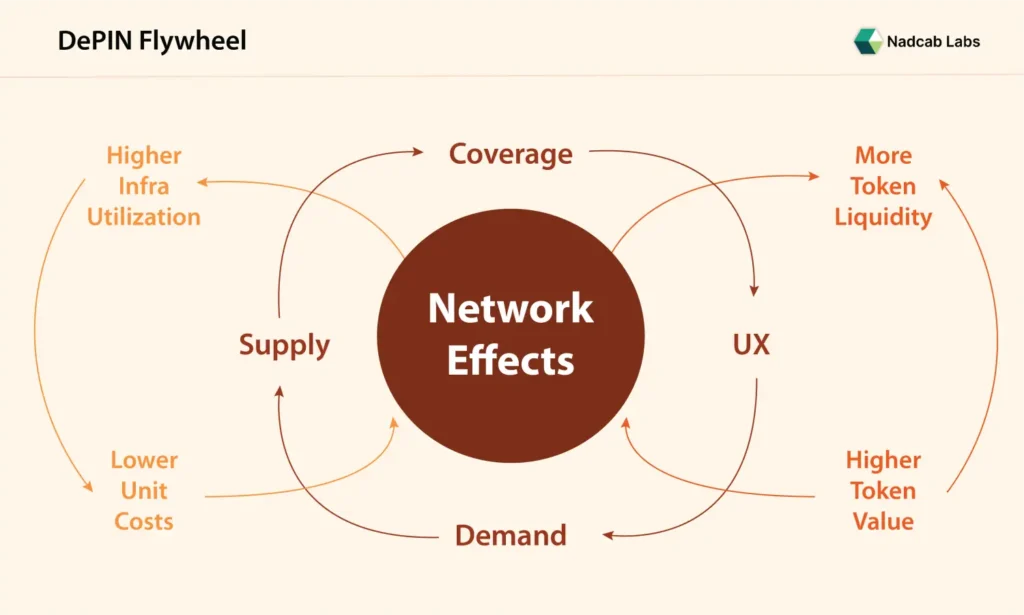

What Is the DePIN Flywheel?

The DePIN Flywheel refers to the self-reinforcing growth cycle that powers DePIN ecosystems, a loop where user participation, infrastructure growth, and token incentives continuously strengthen one another.

It’s similar to a “network effect,” but specifically designed for decentralized physical and digital infrastructure systems.

Market Size, Growth & Future Trends

Credible market data:

- According to Uplatz Blog,[6] the DePIN market has a total addressable market (TAM) of $2.2 trillion, projected to grow to $3.5 trillion by 2028.

- Intel Market Research valued [7] the DePIN solution market at US$ 226 million in 2024, with projections to reach US$ 669 million by 2032 (CAGR 17%).

- The number of early-stage funding deals in DePIN rose by 296% year-over-year; the market cap [8] reportedly reached $20 billion in 2024.

Key growth drivers:

- Surge in IoT devices and edge computing use-cases.

- Demand for connectivity and infrastructure in underserved/rural regions.

- Tokenization of physical assets and shared economy models.

- Integration with AI, 5G/6G, mesh networks and real-world networks.

Emerging trends:

- Ecosystem middleware and hardware-on-ramp kits easing node deployment.

- Partnerships between traditional telecom/energy firms and DePIN networks.

- Legal/regulatory frameworks beginning to adjust for decentralized infrastructure.

- Hybrid models where centralized entities use DePIN layers to expand reach.

Advantages of DePIN

From our experience and industry review, key benefits include:

- Lower barrier to entry for infrastructure participation.

- Decentralized ownership & reward sharing.

- Global reach & inclusion, enabling nodes to be anywhere.

- Transparency and auditability, baked via blockchain.

- Innovation in business models, micro-ISPs, community networks.

- Resilience, fewer central points of failure.

Challenges and Limitations

No model is perfect DePIN has its set of risks:

- Hardware reliability & maintenance issues: Distributed node operators may vary in competence.

- Tokenomics sustainability: Early reward models may not hold long-term if usage doesn’t scale.

- Governance centralization risk: Token-weighted governance may still concentrate power.

- Regulatory uncertainty: Infrastructure sectors (telecom, energy) are heavily regulated and DePIN models may face legal ambiguity.

- Operational complexity: Physical assets, logistics, placement, connectivity all add challenges.

- Adoption lag: Despite promise, infrastructure roll-out takes time; hype may outrun reality.

DePIN vs. Traditional Infrastructure

| Feature | Traditional Infrastructure | DePIN Infrastructure |

|---|---|---|

| Ownership | Centralised companies | Distributed nodes/operators |

| Deployment Time | Long, reliant on large capex | Agile, incremental node additions |

| Cost Model | High capital & operational costs | Shared costs, token incentive model |

| Governance | Board & management driven | Token-holder community governed |

| Transparency | Often opaque | On-chain metrics, open auditing |

| Participation | Limited to firms/operators | Anyone can contribute nodes |

By contrasting, it’s clear why DePIN appeals to the Web3 mindset of community, token-economics and decentralization.

How You Can Participate or Leverage DePIN

If you’re interested in engaging in the DePIN model:

- Research the project: Its hardware requirements, node specs, token incentives.

- Assess tokenomics & governance: Reward models, token supply, governance rights.

- Evaluate hardware/location practicality: Node placement, connectivity, uptime requirements.

- Connect with the community: Many networks have forums (Discord, Telegram) where you can learn and contribute.

- Stay aware of regulatory/environmental issues: Especially for infrastructure assets in regulated sectors.

- Think long-term: Node operators should aim for service uptime, quality, and reliability not just short-term token flips.

Future Outlook

We believe (and industry data supports) that DePIN will continue to grow in importance as the backbone of Web3’s “real-world” layer. We’ll see:

- More middleware and plug-and-play kits reduce the friction for individuals to become node operators.

- Partnerships between centralized providers (telecom, energy, cloud) and community-owned DePIN networks.

- Increased regulatory clarity and legal frameworks for decentralized infrastructure ownership.

- Convergence of DePIN with AI/ML workloads, edge computing, smart cities and sustainable energy networks.

- Token economies of real-world infrastructure are beginning to capture serious value as usage scales.

Why DePIN Is the Future

In a world where decentralization is becoming more than just a buzzword, Decentralized Physical Infrastructure Networks (DePINs) represent a real shift in how infrastructure, governance and value creation can be structured. Whether you are an investor, operator or strategist, understanding DePIN equips you to navigate the future of infrastructure and Web3 more confidently. By mastering not just what DePIN is, but how it works and why it matters, you place yourself at the forefront of this paradigm.

Frequently Asked Question

What regulatory concerns exist for DePINs?

Because DePINs involve real-world infrastructure, concerns include telecommunications regulation, energy grids, data-privacy laws, and token-classification (security vs utility). Compliance frameworks are still evolving.

What does a DePIN contributor actually do?

A contributor to a DePIN deploys or operates physical infrastructure, such as a hotspot, sensor, storage node or compute rig, and links it into a blockchain-based system. They log their activity on-chain, receive verification of the service provided, and earn tokens or rewards accordingly.

How are DePIN tokens valued and used?

Tokens in DePIN networks serve multiple roles: reward issuance, governance participation, staking collateral, and payment for services. Token value is tied to network utility, more coverage, usage, and providers generally boosts token demand.

How is service usage verified in DePIN networks?

Service usage is validated via on-chain proofs tailored to the infrastructure, e.g., Proof of Coverage for wireless networks, Proof of Storage for data networks, or Proof of Compute for GPU nodes. These proofs enable transparent reward distribution and system integrity.

Can DePIN networks generate revenue for end-users?

Yes, users earning tokens by contributing infrastructure can realize revenue, especially when the network grows and tokens gain value. Long-term revenue depends on hardware costs, tokenomics, and network adoption.

What triggers the growth flywheel in a DePIN network?

Growth accelerates when infrastructure deployment increases → coverage or service improves → user demand rises → token usage expands → rewards become more valuable → more contributors join. That self-reinforcing loop is the DePIN flywheel.

What should I check before joining a DePIN project?

Evaluate: hardware requirements and costs, tokenomics and reward mechanics, verification method (proof type), device uptime constraints, governance model, legal/regulatory risks, and community strength.

Is my geographic location important when joining a DePIN?

Yes, Physical infrastructure networks often depend on geographies: hot spots in underserved regions, sensor placement in remote zones or compute nodes where electricity is cheap. Location can affect rewards and network impact.

What hardware or setup do I need to participate in a DePIN?

Hardware needs vary by project, some require a wireless hotspot, others GPU rigs, storage drives, or IoT sensors. Typically you’ll also need a compatible wallet, internet connection, and to register the device with the protocol’s smart contracts.

What differentiates DePIN from typical software-only blockchain projects?

Unlike purely digital projects, DePIN links physical infrastructure (hardware, sensors, energy grids) with blockchain coordination. It demands on-site assets and real-world service provision, not just smart contracts.