DeFi Development Solutions

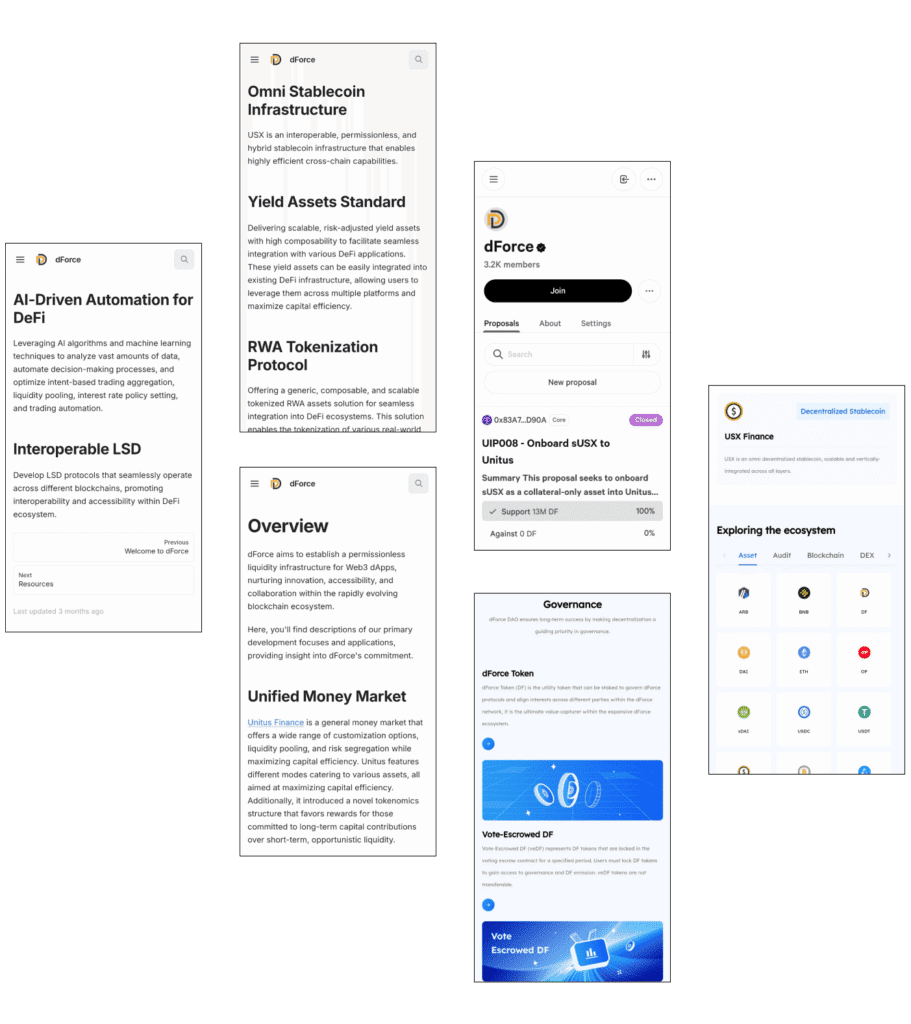

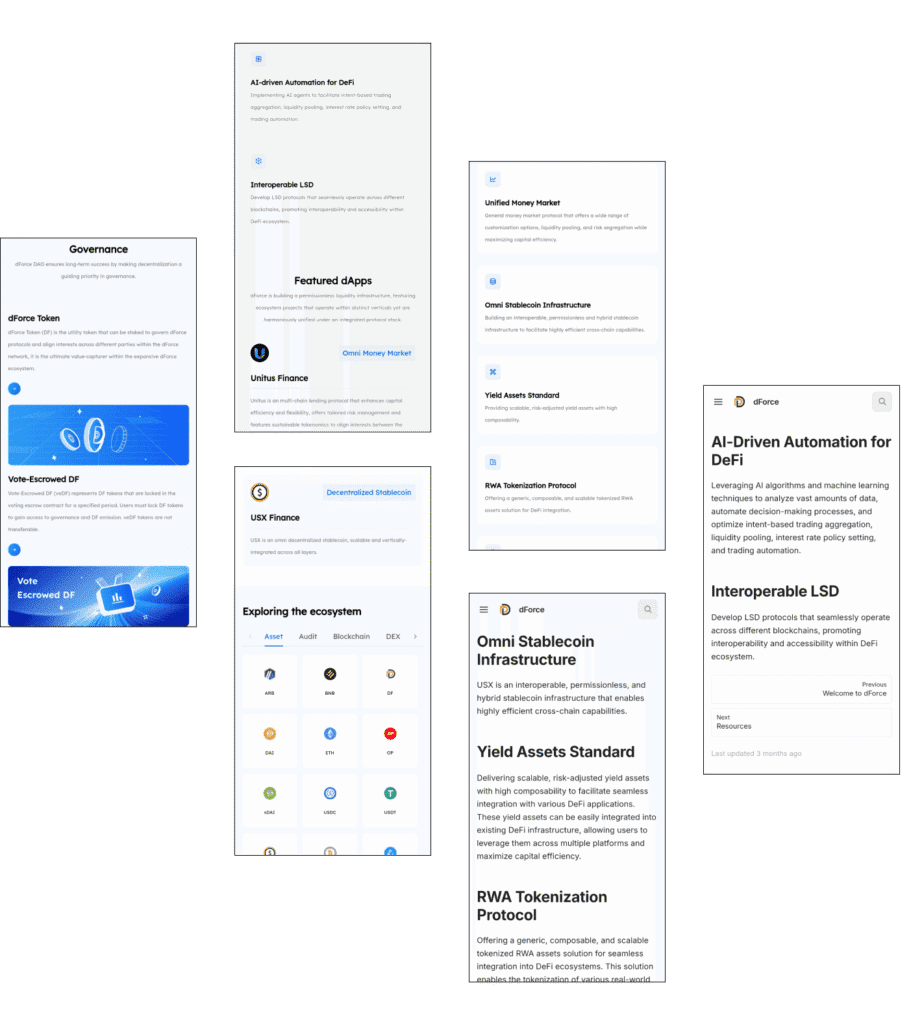

dForce is a prominent DeFi platform focused on creating a permissionless liquidity infrastructure for Web3 applications. It offers a comprehensive suite of protocols, including decentralized stablecoins, money markets, yield tokens, and RWA tokenization. By enhancing liquidity in ecosystems like Bitcoin L2 and decentralized AI, dForce aims to maximize capital efficiency and risk management.

Get Started with this product

dForce enables cross-chain liquid staking, allowing users to earn rewards without locking assets, increasing liquidity, flexibility, and integration across various DeFi platforms through seamless interoperability.

dForce builds a hybrid, permissionless stablecoin system supporting cross-chain operations, enhancing liquidity and utility while promoting open access, efficient transfer, and seamless DeFi integration.

dForce provides risk-adjusted yield assets with high composability, allowing integration into DeFi protocols, enabling diversified passive income strategies and supporting scalable growth within the ecosystem.

dForce tokenizes real-world assets like real estate, offering a composable, scalable solution for DeFi integration, ensuring regulatory compliance and expanding access to traditional investment opportunities.

dForce uses AI to automate trading, liquidity management, and interest rate policies, optimizing DeFi operations with data-driven decisions that enhance efficiency, reduce manual effort, and boost profitability.

dForce delivers customizable money markets with liquidity pooling and risk segregation, enabling flexible lending/borrowing strategies and enhancing DeFi capital efficiency and stability.

dForce offers a permissionless liquidity layer for Web3 dApps, supporting open innovation, seamless integration, and decentralized financial interaction without intermediaries.

dForce features stablecoins, money markets, and yield tokens, ensuring interoperability, liquidity, and innovation across ecosystems like Bitcoin L2 and decentralized AI.

dForce clients require a robust and scalable DeFi Development that integrates various financial instruments into a unified protocol stack. They seek standardized and interoperable solutions for stablecoins, money markets, and yield assets, ensuring efficient and secure cross-chain capabilities. Advanced tools for liquidity management, risk mitigation, and automated trading are essential to maximize returns and streamline operations. Additionally, the platform must provide seamless integration of these tools to create a cohesive and user-friendly experience for its clients.

The ability to tokenize real-world assets (RWA) and integrate them into the DeFi ecosystem is critical. This requires protocols that handle the complexities of asset tokenization, ensuring composability, scalability, and regulatory compliance. Clients expect AI-driven automation to enhance trading strategies, optimize liquidity pools, and manage interest rate policies effectively. Furthermore, a decentralized governance model that allows for community participation and decision-making is vital for the platform’s long-term sustainability and adaptability. Ensuring a secure and transparent environment where investments are protected against vulnerabilities and threats is also crucial. By addressing these requirements, dForce aims to deliver a comprehensive, efficient, and user-friendly DeFi experience that aligns with the evolving needs of its clients.

dForce uses cross-chain consensus to securely validate transactions across multiple blockchains, boosting liquidity and interoperability for seamless access to diverse DeFi services and assets across ecosystems.

dForce employs PoA, where trusted validators confirm transactions quickly based on identity and reputation, enabling fast, efficient processing ideal for secure, low-latency DeFi applications and consortium blockchains.

dForce’s BFT consensus tolerates up to one-third faulty nodes, ensuring network reliability and security even amid malicious activity, maintaining integrity across its decentralized DeFi ecosystem.

dForce combines consensus methods like PoS and BFT, leveraging their strengths for enhanced security, scalability, and throughput, adapting flexibly to diverse DeFi application demands.

dForce uses layered consensus, with different mechanisms like PoS for security and BFT for speed, optimizing both transaction performance and network protection tailored to varied DeFi protocols.

dForce uses federated consensus, where trusted nodes jointly validate transactions, balancing decentralization with efficiency to support secure, scalable DeFi networks handling high transaction volumes.

dForce uses PoS where validators stake tokens to secure the network, offering energy efficiency, strong incentives, and scalability for fast, reliable DeFi transactions.

dForce applies federated consensus with multiple trusted nodes validating transactions, providing efficient, secure, and semi-decentralized processing for high-volume DeFi applications.

Visual identity and design elements

Primary font family and usage

Brand colors

#f6f9ff

#dfecff

Project Approach dForce’s approach to building a comprehensive DeFi infrastructure involves a multi-faceted strategy. First, the platform focused on developing a suite of interoperable protocols, including stablecoins, money markets, and yield assets. This involved creating standardized frameworks that ensure seamless integration across different blockchain networks, enhancing cross-chain capabilities. The development process emphasized security, scalability, and regulatory compliance to build trust and reliability among users. Additionally, dForce prioritized user experience by designing intuitive interfaces and advanced tools for liquidity management, risk mitigation, and automated trading, making DeFi accessible to both novice and experienced users.

To further enhance its ecosystem, dForce incorporated advanced technologies such as AI-driven automation and real-world asset (RWA) tokenization.

Project Results dForce’s strategic approach has yielded significant results, establishing it as a prominent player in the DeFi space. The platform’s interoperable protocols have facilitated seamless cross-chain operations, attracting a diverse user base and enhancing liquidity across multiple blockchain networks. The standardized frameworks and robust security measures have built trust among users, leading to substantial growth in total assets and transaction volumes. As of now, dForce has processed over 991,693 transactions and amassed a total asset value exceeding $151 million, demonstrating its effectiveness and reliability.

The integration of AI-driven automation and RWA tokenization has further bolstered dForce’s ecosystem. AI agents have optimized trading strategies and liquidity management, resulting in higher efficiency and better returns for users. The RWA tokenization protocol has opened new opportunities for investors, allowing them to diversify their portfolios with tokenized physical assets. Moreover, the decentralized governance model has empowered the community, ensuring transparency and inclusivity in decision-making processes.

One of the primary challenges dForce faces is navigating the complex and evolving regulatory landscape for DeFi. Different countries have varying regulations regarding cryptocurrency and decentralized finance, leading to uncertainties and potential legal risks. Compliance with these diverse regulations requires significant resources and constant adaptation. Regulatory scrutiny can impact dForce’s operations, user access, and the implementation of new features.

Security is a paramount concern in the DeFi space, and dForce is no exception. The platform must safeguard against various threats, including smart contract vulnerabilities, hacking attempts, and phishing attacks. Ensuring the security of users’ funds and data is essential to maintaining credibility and trust. Despite rigorous security audits and continuous monitoring, the risk of potential exploits remains.

As dForce grows, scalability becomes a significant challenge. Handling increased transaction volumes and user activity without compromising performance is critical for user experience and platform reliability. High network congestion can lead to slower transaction times and increased fees, which may deter users from engaging with the platform. To address scalability, dForce leverages innovative technologies such as Layer-2 Solutions and optimized consensus mechanisms. Additionally, ongoing research and development efforts focus on enhancing the platform’s infrastructure to support larger-scale operations.

dForce offers DeFi solutions with stablecoins, money markets, yield assets, and AI-driven automation for seamless liquidity and cross-chain integration.