Key Takeaways

- ERC-20 tokens in smart contracts power over 500,000 fungible tokens on Ethereum, enabling standardized transfers across global financial systems.

- Financial institutions across USA, UK, UAE, and Canada leverage ERC-20 tokens in smart contracts for stablecoins, lending, and cross-border payments.

- DeFi protocols managing $50B+ assets depend on ERC-20 tokens in smart contracts for liquidity pools, yield farming, and decentralized exchanges.

- Real-world asset tokenization using ERC-20 tokens in smart contracts enables fractional ownership of real estate, commodities, and securities.

- Gaming and metaverse platforms integrate ERC-20 tokens in smart contracts for in-game currencies, rewards, and player-owned economies.

- Enterprise SaaS platforms implement ERC-20 tokens in smart contracts for subscription payments, loyalty programs, and API access management.

- Governance systems using ERC-20 tokens in smart contracts enable transparent voting, proposal management, and decentralized decision-making.

- Security audits and regulatory compliance are essential when deploying ERC-20 tokens in smart contracts for enterprise applications.

Understanding ERC-20 Tokens and Their Role in Smart Contracts

ERC-20 tokens in smart contracts represent the foundational standard for fungible digital assets on the Ethereum blockchain. With over eight years of experience building enterprise blockchain solutions across USA, UK, UAE, and Canadian markets, our agency has witnessed ERC-20 become the universal language for programmable value. The standard defines six mandatory functions (totalSupply, balanceOf, transfer, transferFrom, approve, allowance) that ensure interoperability across thousands of applications. Smart contracts implementing ERC-20 automatically handle balance tracking, transfer validation, and approval management, creating trustless systems where token operations execute predictably without intermediaries.

Why ERC-20 Became the Industry Standard for Fungible Tokens

ERC-20 tokens in smart contracts achieved dominance through network effects, tooling maturity, and battle-tested security. Every major exchange, wallet, and DeFi protocol natively supports ERC-20, eliminating integration friction. The standard’s simplicity enables rapid deployment while its consistency ensures predictable behavior. OpenZeppelin’s audited implementations provide secure foundations that enterprises trust for mission-critical applications. This ecosystem advantage means choosing ERC-20 tokens in smart contracts gives immediate access to billions in liquidity and millions of users globally.

Financial Services ERC-20 Tokens for Payments, Lending, and Stablecoins

Stablecoins

- USDC: $25B+ market cap

- USDT: Leading volume

- DAI: Decentralized peg

- Institutional adoption

Lending Protocols

- Collateralized loans

- Variable interest rates

- Liquidation automation

- Cross-chain lending

Payment Systems

- Instant settlements

- Low transaction fees

- Programmable payments

- Global accessibility

Banking and Remittances: Faster Cross-Border Transfers with ERC-20

| Transfer Method | Settlement Time | Average Cost |

|---|---|---|

| Traditional SWIFT | 2-5 business days | $25-50 per transfer |

| ERC-20 Stablecoin | Minutes to hours | $0.50-5 gas fees |

| Layer 2 ERC-20 | Seconds | Under $0.10 |

| Western Union | Minutes to days | 5-10% of amount |

DeFi Ecosystems: ERC-20 Tokens as the Backbone of Decentralized Finance

ERC-20 tokens in smart contracts form the foundation of the $50B+ DeFi ecosystem. Protocols like Uniswap, Aave, and Compound rely entirely on ERC-20 compatibility for token swaps, collateralized lending, and liquidity provision. Enterprises across USA, UK, UAE, and Canada increasingly integrate DeFi primitives into traditional financial products, using ERC-20 tokens in smart contracts to access permissionless liquidity and yield opportunities unavailable in legacy systems.

Market Reality: Uniswap alone has facilitated over $1.5 trillion in ERC-20 token trading volume since launch.

Tokenized Assets: Using ERC-20 for Real-World Asset Representation

| Asset Class | Tokenization Benefit | Market Size |

|---|---|---|

| Real Estate | Fractional ownership | $3.5B tokenized |

| Commodities | 24/7 trading access | $1B+ gold tokens |

| Securities | Automated compliance | Growing rapidly |

| Art and Collectibles | Democratized investing | $500M+ market |

Transform Your Business with ERC-20 Tokens in Smart Contracts

Our blockchain experts design and implement secure ERC-20 tokens in smart contracts tailored to your industry needs. Start your tokenization journey today.

Supply Chain Management: ERC-20 Tokens for Transparency and Tracking

ERC-20 tokens in smart contracts enable supply chain transparency through tokenized inventory tracking and provenance verification. Each product batch can be represented by tokens that transfer between parties as goods move through the supply chain. Smart contracts automatically update ownership records, trigger payments upon delivery confirmation, and maintain immutable audit trails. Major retailers and manufacturers across USA, UK, UAE, and Canada implement these systems for compliance and efficiency.

Fraud Reduction

Faster Settlements

Audit Trail

Healthcare Use Cases: Secure Data Access and Incentivization via ERC-20

ERC-20 tokens in smart contracts transform healthcare data management and patient engagement. Tokens can represent access rights to medical records, with patients controlling who receives tokens to view their data. Healthcare providers across USA, UK, UAE, and Canada use reward tokens to incentivize healthy behaviors, medication adherence, and clinical trial participation. Smart contracts ensure HIPAA-compliant access controls while enabling patients to monetize their anonymized health data for research.

ERC-20 Token Implementation Lifecycle

Requirements Definition

Define token economics, supply mechanics, and business logic requirements for your ERC-20 implementation.

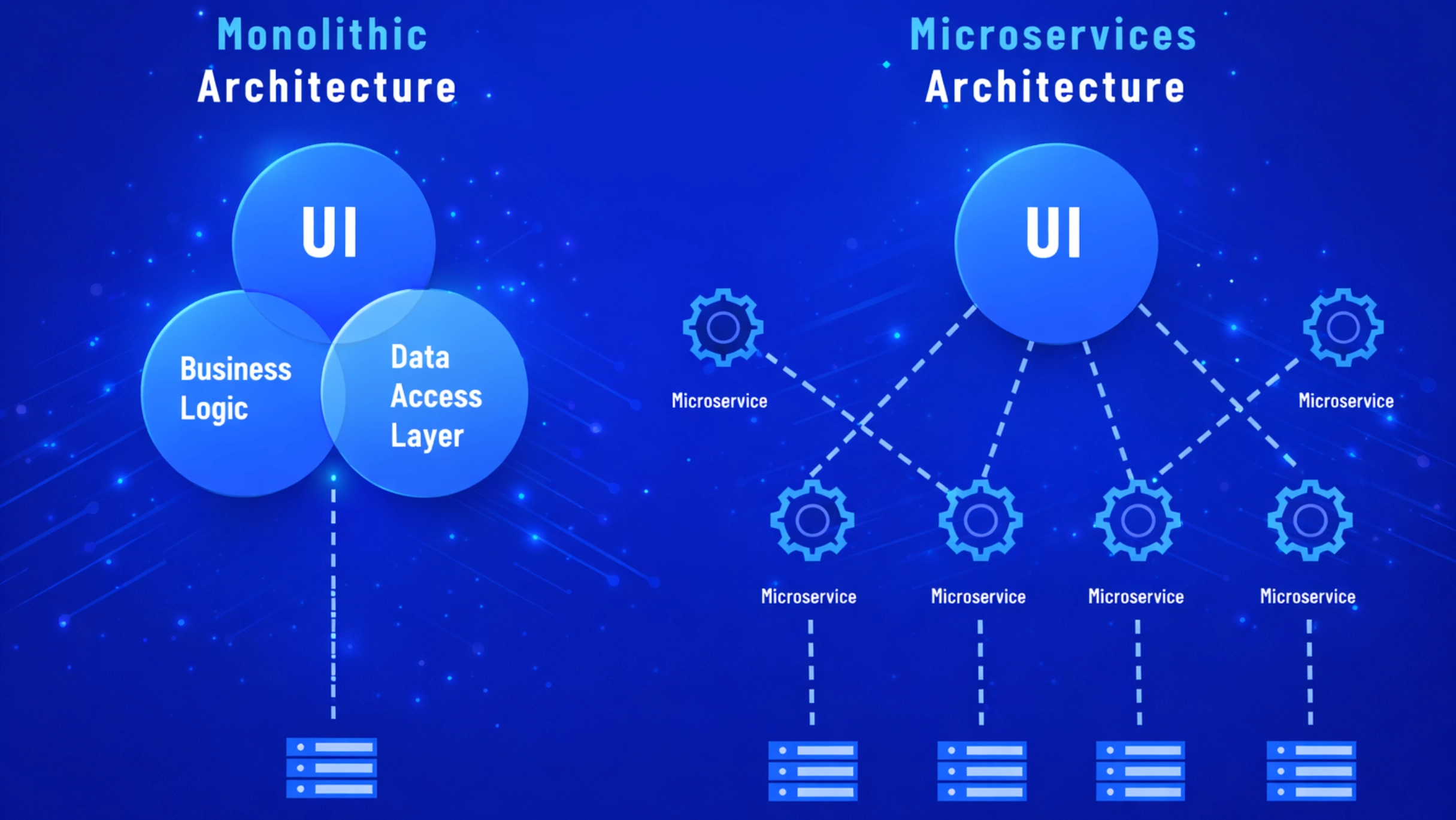

Contract Architecture

Design contract structure including extensions, access controls, and upgrade mechanisms.

Code Implementation

Write Solidity code using OpenZeppelin libraries for secure ERC-20 token functionality.

Testing Suite

Create comprehensive unit and integration tests covering all token functions and edge cases.

Security Audit

Engage professional auditors to review code for vulnerabilities and security issues.

Testnet Deploy

Deploy to testnet for real-world testing with stakeholders and integration partners.

Mainnet Launch

Deploy verified contracts to mainnet with proper documentation and monitoring setup.

Ongoing Monitoring

Monitor contract health, transaction patterns, and security alerts continuously.

Gaming and Metaverse Economies Built on ERC-20 Tokens

ERC-20 tokens in smart contracts power player-owned economies across gaming and metaverse platforms. In-game currencies, reward tokens, and governance assets use ERC-20 for seamless trading on decentralized exchanges. Players can earn, trade, and withdraw tokens with real value. Games like Axie Infinity have processed billions in ERC-20 token transactions, demonstrating the massive potential for blockchain-based gaming economies.

Enterprise and SaaS Platforms Leveraging ERC-20 Smart Contracts

Subscription Tokens

- Automated renewals

- Tiered access levels

- Transferable licenses

- Usage-based billing

API Credits

- Pay-per-call models

- Prepaid packages

- Rate limit management

- Cross-platform use

Loyalty Programs

- Reward accumulation

- Partner redemption

- Engagement incentives

- Referral bonuses

Fundraising and Crowdfunding Models Using ERC-20 Tokens

ERC-20 tokens in smart contracts revolutionize fundraising through programmable token sales and distribution. ICOs, IEOs, and IDOs use ERC-20 for transparent, auditable capital formation. Vesting schedules, cliff periods, and distribution logic execute automatically through smart contracts. Compliant security token offerings in USA, UK, UAE, and Canada leverage ERC-20 extensions for investor whitelisting and transfer restrictions required by securities regulations.[1]

Governance and Voting Systems Enabled by ERC-20 Tokens

| Governance Model | Voting Mechanism | Use Case |

|---|---|---|

| Token-Weighted | 1 token = 1 vote | Protocol parameters |

| Quadratic Voting | Cost increases quadratically | Fair representation |

| Delegation | Vote power transfer | Expert representation |

| Time-Locked | Lock period multiplier | Long-term alignment |

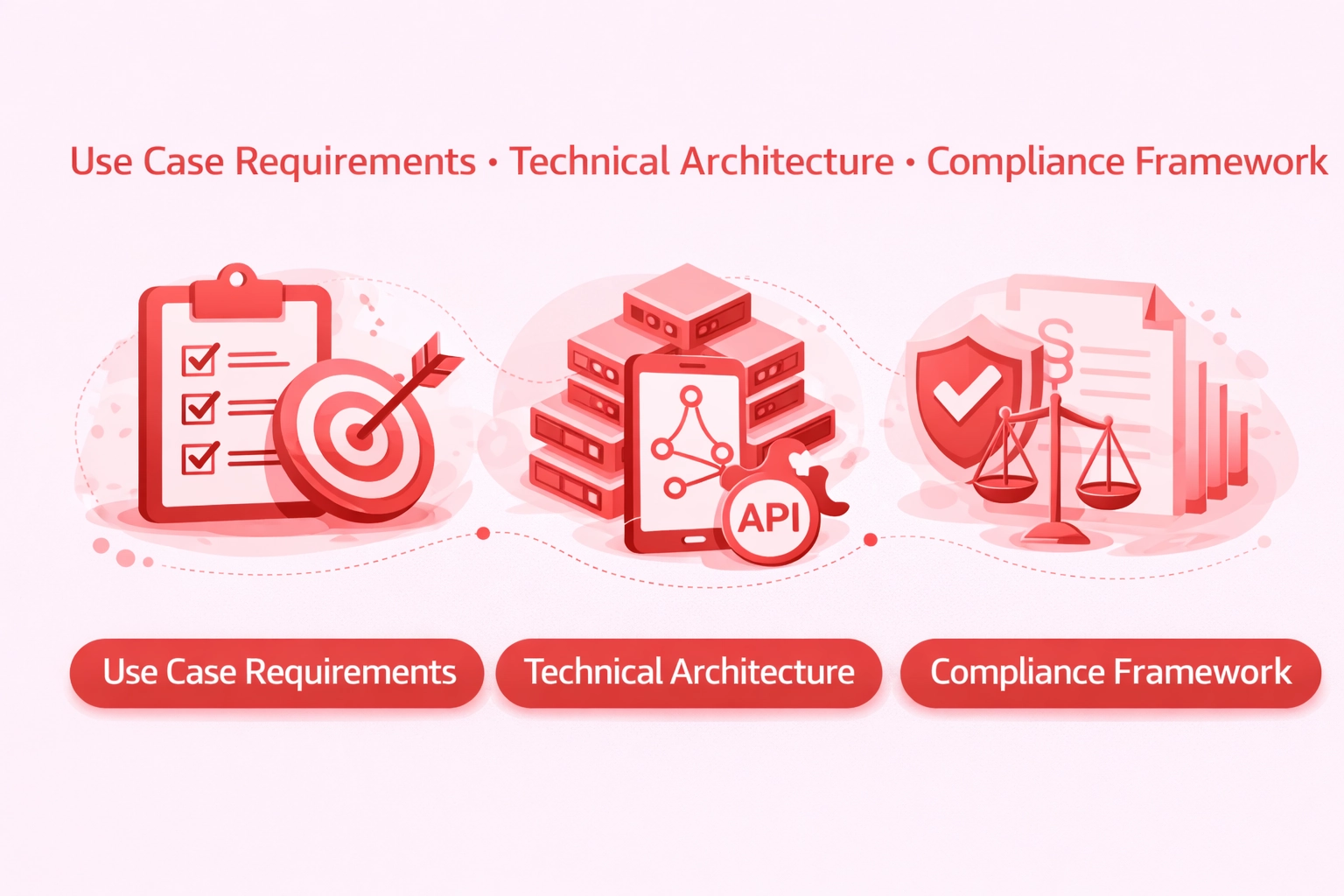

ERC-20 Implementation Selection Criteria

Use Case Requirements

- Token utility defined

- Supply mechanics planned

- Distribution strategy set

- Integration needs mapped

Technical Architecture

- Extension selection

- Upgrade patterns

- Gas optimization

- Security measures

Compliance Framework

- Regulatory classification

- KYC/AML integration

- Geographic restrictions

- Reporting requirements

Security, Compliance, and Regulatory Considerations for ERC-20 Use Cases

Deploying ERC-20 tokens in smart contracts requires rigorous security and compliance measures. Security audits should cover reentrancy vulnerabilities, integer overflow, approval race conditions, and access control weaknesses. Regulatory compliance varies by jurisdiction, with USA SEC guidelines, UK FCA regulations, and UAE VARA requirements each imposing specific obligations. Enterprises must classify tokens correctly as utilities, securities, or payment tokens, implementing appropriate restrictions and reporting mechanisms.

Industry Standards for ERC-20 Token Security

Standard 1: Use OpenZeppelin’s audited ERC-20 implementation as the foundation for all token contracts.

Standard 2: Implement SafeERC20 wrapper for all external token interactions to handle non-compliant tokens.

Standard 3: Require professional security audit before any mainnet deployment handling user funds.

Standard 4: Implement pausability for emergency response capability in case of detected vulnerabilities.

Standard 5: Use multi-signature wallets for administrative functions controlling minting and configuration.

Standard 6: Maintain comprehensive test coverage exceeding 95% including edge cases and attack scenarios.

Future Outlook: How ERC-20 Tokens Will Evolve Across Industries

ERC-20 tokens in smart contracts continue evolving through Layer 2 scaling, cross-chain bridges, and regulatory clarity. Enterprises across USA, UK, UAE, and Canada will increasingly tokenize traditional assets, streamline payments, and build token-gated experiences. Account abstraction will simplify user onboarding, while zero-knowledge proofs enable private token transfers. The convergence of DeFi and traditional finance through compliant ERC-20 implementations will unlock trillions in previously illiquid assets.

With eight years of experience implementing ERC-20 tokens in smart contracts for enterprise clients, our agency sees continued growth in real-world asset tokenization, gaming economies, and enterprise loyalty programs. The standard’s flexibility, ecosystem support, and proven security make it the foundation for the tokenized economy emerging across all industries.

Launch Your ERC-20 Token Solution

Partner with our experienced team to implement secure ERC-20 tokens in smart contracts for your enterprise applications across any industry.

Frequently Asked Questions

ERC-20 tokens in smart contracts are standardized digital assets on Ethereum that follow a common interface for fungible tokens. Smart contracts manage token balances, transfers, and approvals automatically. This standard enables seamless interoperability across wallets, exchanges, and DeFi applications worldwide.

ERC-20 tokens in smart contracts provide businesses with programmable digital assets that automate payments, rewards, and access rights. Enterprises across USA, UK, UAE, and Canada leverage this standard for tokenization, fundraising, and creating efficient financial ecosystems without intermediaries.

es, ERC-20 tokens in smart contracts can represent fractional ownership of real estate, commodities, securities, and other tangible assets. Tokenization enables global investors to access previously illiquid markets while smart contracts automate dividend distributions and compliance checks seamlessly.

DeFi platforms utilize ERC-20 tokens in smart contracts for lending, borrowing, liquidity provision, and yield farming. The standardized interface enables tokens to integrate across multiple protocols, creating composable financial services that operate 24/7 without traditional banking infrastructure.

Security for ERC-20 tokens in smart contracts includes professional audits, access control implementation, reentrancy protection, and proper allowance management. Enterprises must also consider regulatory compliance, KYC integration, and emergency pause mechanisms to protect user assets effectively.

ERC-20 tokens in smart contracts enable decentralized governance where token holders vote on protocol changes, treasury allocations, and strategic decisions. Voting power typically corresponds to token holdings, creating stakeholder-aligned decision-making for DAOs and decentralized organizations.

Financial services, gaming, healthcare, supply chain, and real estate industries benefit significantly from ERC-20 tokens in smart contracts. These sectors leverage tokenization for payments, rewards, asset tracking, and creating new economic models that increase efficiency and transparency.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.