NFT Finance with Decentralized Solutions

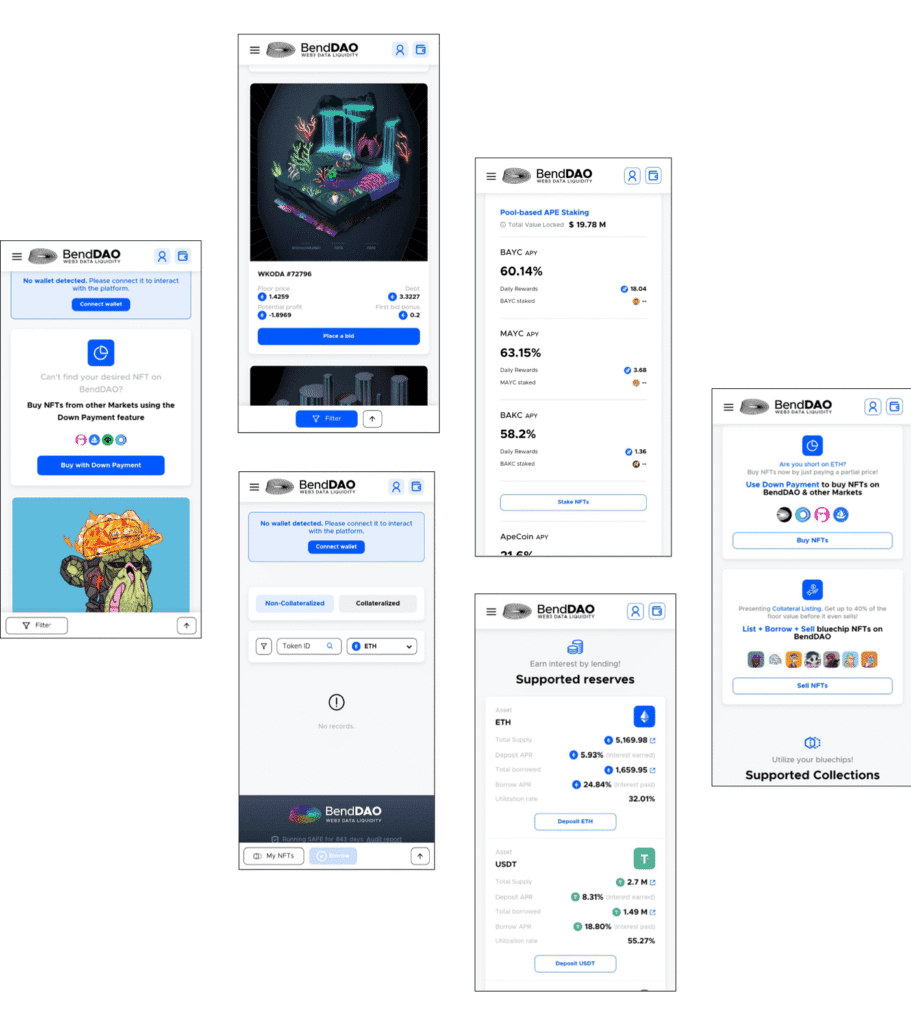

endDAO is a decentralized platform that revolutionizes the NFT finance ecosystem by providing users with the ability to borrow ETH against their NFT assets. The platform offers instant liquidity, flexible loan terms, and a secure liquidation process, allowing users to unlock the value of their NFTs without selling them

Get Started with this product

DBOE enables direct wallet-to-wallet trading, eliminating fund deposits into centralized exchanges. Users retain full control and ownership of assets, ensuring security without reliance on custodial services or intermediaries.

BendDAO provides fast liquidity access by unlocking NFT value instantly. This helps users manage sudden financial needs, especially during volatile markets, without selling or waiting for traditional lending processes.

The platform offers customizable loan durations and interest rates. This flexibility allows users to tailor financial strategies that match their liquidity goals, risk appetite, and repayment capabilities more effectively.

DBOE evolves continuously through user feedback, updates, and audits. This ensures a secure, modern platform that adapts to the growing demands of DeFi and options trading communities.

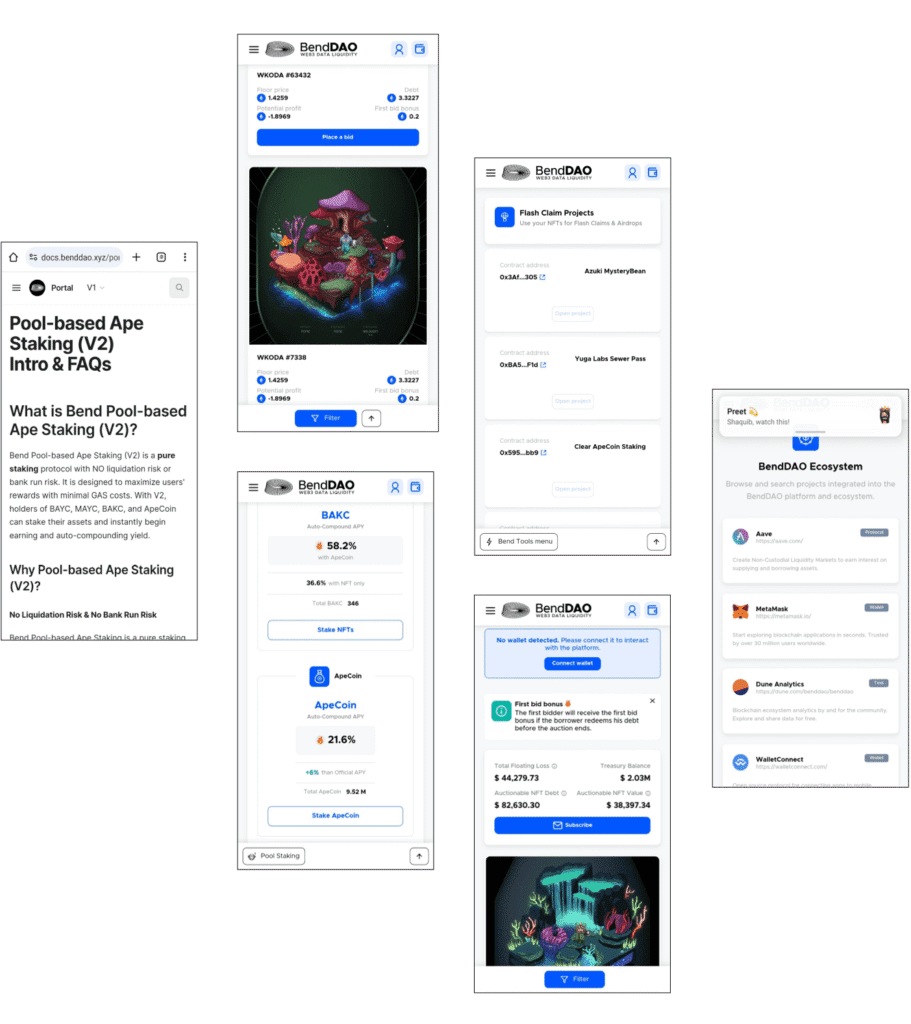

Token holders govern the platform via Decentralized Autonomous Organization (DAO), voting on proposals and shaping future policies to ensure community-driven improvements and platform evolution.

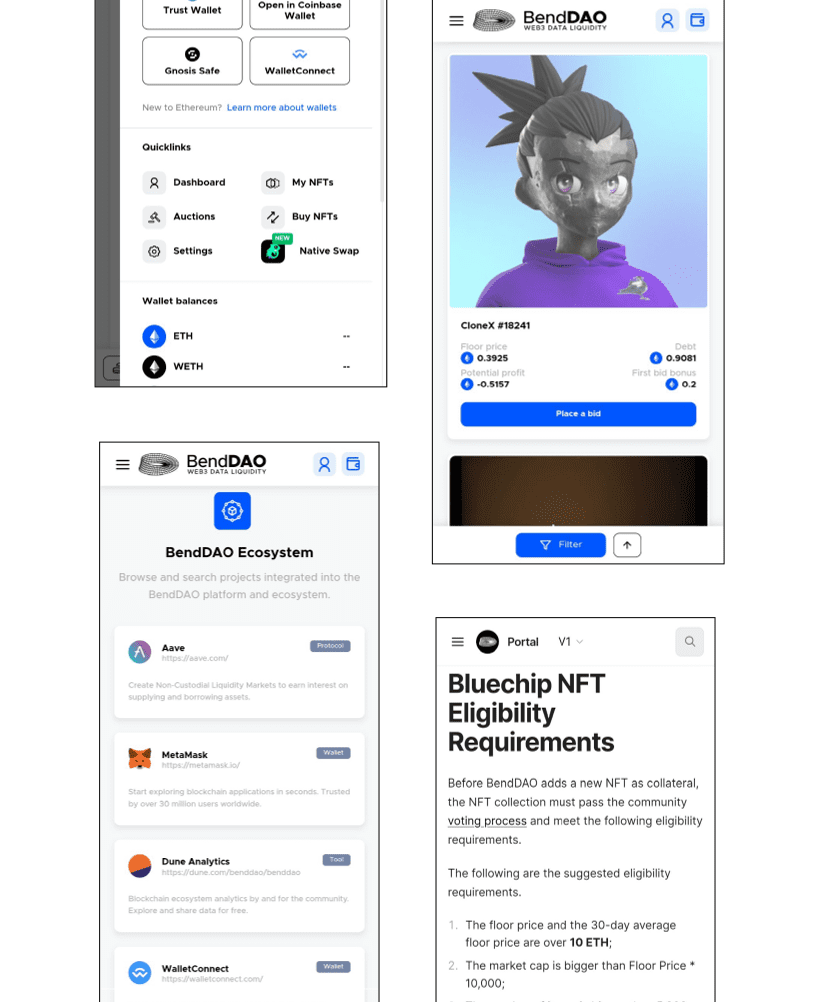

BendDAO connects with top NFT marketplaces, offering seamless asset management. Users can handle loans and NFTs within a single ecosystem, improving convenience and enhancing overall experience and utility.

The platform uses advanced security including multi-signature wallets, encryption, and audits. These measures protect user data and assets, fostering a safe, reliable environment for lending and borrowing activities.

BendDAO provides a clean, intuitive interface for all users. Clear instructions and easy navigation help newcomers and experienced users manage loans and NFTs with minimal friction or learning curve.

The client required the development of a decentralized platform that could seamlessly integrate with popular NFT marketplaces, enabling users to leverage their NFT assets for liquidity. This platform needed to provide NFT-backed loans, offering users immediate access to funds without necessitating the sale of their NFTs. A robust, secure infrastructure was essential to protect user assets and data, ensuring trust and reliability within the NFT community. Efficient liquidity management was crucial to guarantee the availability of funds for borrowers, while maintaining a stable and sustainable financial ecosystem. Additionally, the platform had to cater to both novice and experienced users through a user-friendly interface, ensuring accessibility and ease of use for all participants.

Furthermore, the client emphasized the importance of flexible loan terms, including customizable durations and interest rates to accommodate diverse user needs. A transparent liquidation mechanism for defaulted loans was necessary to uphold platform integrity and user trust. The client also required the incorporation of a community governance model, allowing token holders to participate in decision-making processes and contribute to the platform’s evolution. This democratic approach aimed to foster a sense of ownership and alignment of interests among users, enhancing the overall user experience and ensuring the platform’s long-term success in the competitive NFT finance market.

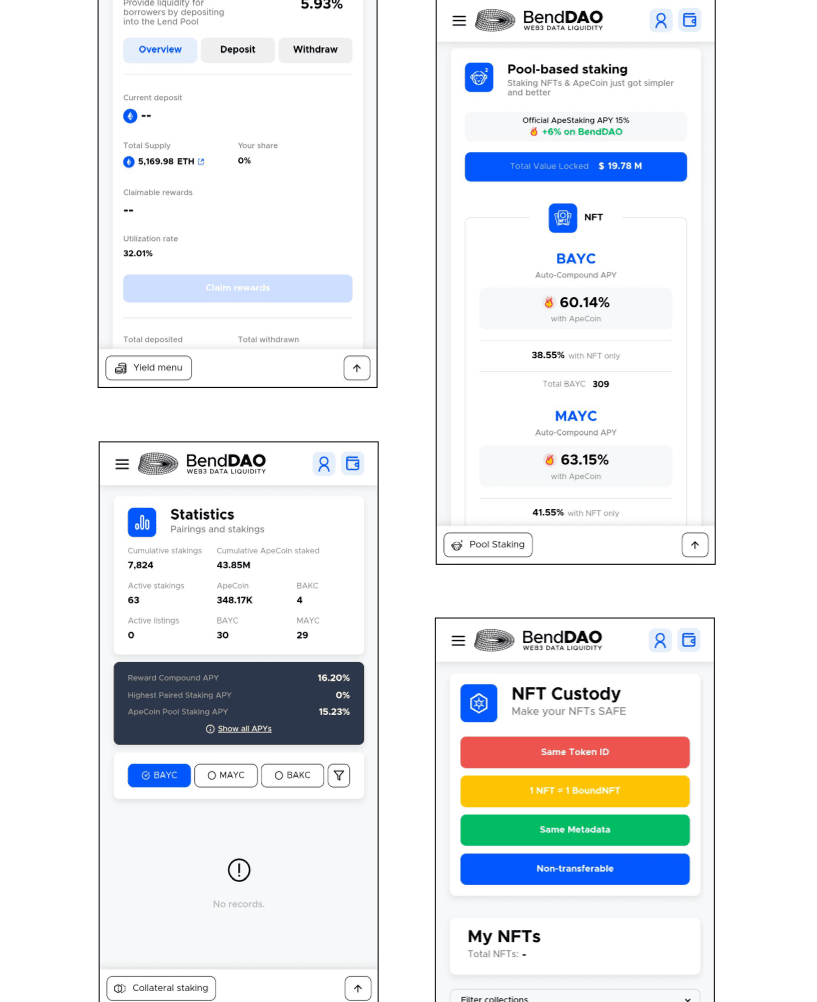

Smart contracts on Ethereum automate NFT-backed loan agreements, ensuring transparency, efficient loan management, and liquidation without intermediaries, improving trust and execution across the decentralized lending platform.

BendDAO uses PoS, letting token holders stake to validate transactions, secure the network, and earn rewards, promoting active engagement and reducing energy consumption compared to Proof of Work systems.

BendDAO operates as a DAO, enabling token holders to propose and vote on changes, ensuring a decentralized, democratic process that aligns platform development with community consensus and participation.

Token holders manage BendDAO policies through a governance framework, promoting decentralized decision-making. This model ensures platform evolution reflects collective user interests and fosters long-term community-driven growth.

PoS strengthens BendDAO’s security by incentivizing honest behavior. Stakers protect against malicious activities, ensuring the integrity of transactions and reinforcing trust in the platform’s operations and governance.

Token holders vote on governance proposals via transparent mechanisms. Majority consensus decides outcomes, empowering the community to shape platform direction and uphold decentralized principles effectively and equitably.

BendDAO rewards users for staking and governance involvement. These incentives drive active participation, reinforce platform stability, and align user contributions with long-term ecosystem sustainability and growth objectives.

PoS boosts scalability by lowering energy use and increasing transaction speed. This efficiency supports user growth, enabling BendDAO to scale sustainably without compromising security or performance.

Visual identity and design elements

Primary font family and usage

Brand colors

#303b4f

#000508

Project Approach BendDAO approached the development of its decentralized platform through a methodical and strategic process. Initially, extensive market research was conducted to identify the burgeoning need for NFT liquidity solutions and to gauge the potential market size. This informed the platform’s design and feature set, ensuring alignment with user expectations and industry trends. Following this, a comprehensive platform architecture was meticulously crafted, focusing on scalability, security, and user experience. Collaborations with leading NFT marketplaces were forged to enable seamless integration, enhancing accessibility and usability for users. Rigorous testing phases were undertaken to validate the platform’s functionality and security measures before its successful deployment on the Ethereum blockchain. Throughout development, a proactive approach to community engagement and feedback integration ensured that BendDAO’s platform met the evolving needs of its users and stakeholders.

Project Results Since its launch, BendDAO has achieved significant milestones in the NFT finance ecosystem. The platform has facilitated millions of dollars in NFT-backed loans, providing users with unprecedented liquidity options without the need to liquidate their valuable NFT assets. BendDAO’s user base has grown steadily, supported by its intuitive interface, transparent governance model, and robust security protocols. The platform’s community governance framework has empowered token holders to actively participate in decision-making processes, fostering a sense of ownership and alignment of interests. These achievements underscore BendDAO’s position as a leading innovator in decentralized finance, demonstrating tangible success in bridging the gap between traditional NFT ownership and DeFi liquidity solutions.

Ensuring robust security for BendDAO was paramount, given its role in handling valuable NFTs and facilitating cryptocurrency transactions. Implementing comprehensive security measures such as encryption protocols, multi-signature wallets, and regular security audits was essential to protect user assets and maintain trust. The challenge lay in continuously evolving security threats and the need to stay ahead with proactive security measures.

Navigating the volatile NFT and cryptocurrency markets presented ongoing challenges for BendDAO. The platform’s ability to provide liquidity against NFT assets required flexibility in loan terms and risk management strategies. Fluctuations in asset prices could impact the collateral value of NFTs, affecting loan-to-value ratios and liquidation processes. BendDAO addressed this challenge through dynamic pricing models and proactive market monitoring, ensuring that borrowers and lenders could navigate market volatility effectively.

Adhering to regulatory standards in Decentralized Finance (DeFi) posed significant challenges for BendDAO. The evolving regulatory landscape required the platform to stay informed about legal developments and adapt its operations to comply with emerging requirements. Ensuring transparency and compliance while preserving the platform’s decentralized nature presented a delicate balance. BendDAO approached this challenge by collaborating with legal experts and regulatory advisors to develop compliance strategies that aligned with its decentralized governance model.

BendDAO utilized diverse technologies for a robust platform.